What happens to the money if a broker goes bankrupt or his license is revoked is a question that an increasing number of citizens are asking in connection with the emerging trend of transferring funds from bank deposits to brokerage accounts. Almost all owners of bank deposits have an idea of what will happen to their deposit if the bank goes bankrupt. It’s simple - you need to contact the specified bank for payment of funds in the amount of up to 1.4 million rubles, which will be provided by the Deposit Insurance Agency.

But the situation with brokerage accounts requires clarification. And although the bankruptcy of a broker is an infrequent occurrence, investors have reasons for concern. After all, funds in brokerage accounts are not insured and no compensation is due for them. Therefore, today we will discuss a hypothetical situation, learn precautions, and understand whether bankruptcy of a broker is possible in principle.

Why are brokers closing?

Assessing the latest cases of bankruptcies and exits from the market, one serious pattern could be noticed - all brokers attribute their difficulties to a sharp jump in the franc in the winter and heavy losses in connection with this. Yes, I agree that for this reason FXCM is now selling off, partially, but with questions, I agree with the same reason regarding Alpari UK, there are a number of ambiguities regarding the actions of other companies taking out loans at high interest rates with reference to the same situation, and so on. But bankruptcy six months later, after the news, is, at least, far-fetched.

Of course, we can say that the broker tried to compensate for losses, restructure capital and simply get out of a difficult situation by actively attracting clients, but failed. In fact, I am inclined to think that this was partly the case, however, obviously not 100%.

If we trace the beginning of this story, the first messenger was the Forex Trend, which began to delay the payment of funds at the beginning of the crisis in Russia. The outflow of capital apparently called into question the stability of the company; in addition, as we now see from the news, there was already not enough money for all clients. As a result, traders’ concerns about the stability of the industry were superimposed on the general crisis of the country, and money began to leave other companies. Frank finished off the situation!

In fact, the growth of the franc happened at the right time; it became possible to write off all shortfalls, all delays in payments and the general decline on it. After all, this is a real force majeure, everyone saw it, there should be no complaints. The only surprising thing is that the bankrupts did not declare their losses on a huge scale; on the contrary, they wrote that everything was OK with them.

Note!

But let's return to our topic and talk about what brokers who left clients without money and left the market had in common? Based on these indirect signs, you can trace the trends of your company and think about its stability.

How are investors insured abroad?

Unfortunately, in Russia there is only talk about insuring brokerage accounts. For now, the program is valid only for bank deposits. The practice of recent years shows that revocations of bank licenses occur many times more often than brokerage organizations. But in the latter case, the losses can be much more significant. If people try to keep no more than 1.4 million rubles on deposits, then a brokerage account is used to form capital, which can amount to tens of millions of rubles.

In the USA and European countries there is an asset insurance system:

- USA: up to $500,000, of which cash is limited to $250,000.

- UK: up to £85,000.

- European Union: up to 100,000 euros.

The insurance is valid for residents and non-residents. Therefore, investors from Russia who buy foreign securities through a foreign broker also have the right to use it. Insurance companies are only liable in the event of bankruptcy and fraudulent actions of brokers. If there is a collapse in prices, as a result of which the investor loses a significant part of his capital, then the insurance is not refundable.

Super profitable PA (MMM) accounts on Forex!

Well, I hope everyone knows these stories - thousands of percent of profits on PAMM accounts, a lot of investors, huge investments, a constant flow of clients and even withdrawals of funds to the first lucky ones. However, any requests to monitor accounts on third-party services are completely ignored. No evidence of real profits and trading, only numbers on our own resources and numerous reviews on all specialized sites, where possible.

Then, to deepen the process, portfolios for PAMM investing are created only from the most profitable and titled traders. Profitability percentages are growing, clients are happy. But not for long...

Suddenly, everything ends - delays in payments, strange merged PAMM accounts that were in profit for 2-3 years, unclear explanations from company representatives about what failed liquidity providers, traders, managers, partners, a promise to pay everything tomorrow or in 2 weeks etc. At the same time, the company’s website continues to work properly and accept investments, without notifying future clients that there are difficulties.

This scheme is as old as time and is codenamed “MMM”. Financial pyramids are built quickly and live successfully until they gain critical weight and people begin to withdraw their deposits. Of course, its principle does not allow paying money to everyone, because part of it went to profit. At this moment, the company quickly liquidates itself, without the possibility for the client to return the money.

Conclusion : super profitable PAMM accounts, in large quantities, without evidence or drawdowns - a reason to think that not everything is pure.

What criteria should you use to choose a broker?

Finding a stock exchange intermediary is now easy: almost all major banks are engaged in brokerage activities. In Russia, these include the well-known Sberbank, VTB 24 and Gazprombank. You can use the services of another organization, but before concluding an agreement, be sure to check whether it has the appropriate license. Information about companies authorized to represent the interests of clients on the stock exchange is publicly available on the website of the Central Bank. If the company you like is on this list, you can trust it with your assets.

The number of companies that provide individuals with the opportunity to buy and sell shares on the stock market is increasing every day. In this regard, the importance of choosing a competent intermediary also increases: beginners should take this stage seriously. The principle of operation of all such companies is the same, but there are several criteria by which you can choose the best option:

- Reliability.

- Cost of services.

- Ease of collaboration.

Each of these points will be discussed in more detail below.

Reliability

It is unlikely that this indicator can be considered truly objective, since any company may one day go bankrupt. However, firms that are market leaders go bankrupt much less often than small young organizations.

Two main characteristics will help you assess whether a broker is a major player: the number of clients and transaction turnover. It is better to opt for one of the companies with the highest performance.

Here are a few more characteristics that will help determine the reliability of the intermediary:

- Time of existence of the company. The most resistant to negative conditions are those firms that have been operating in the market for more than eight years. You can find out how long the organization you are interested in has been engaged in financial activities on the website of the Federal Service for Financial Markets. To do this, simply enter the name of the broker in the search bar and find the date the license was issued.

- List of exchanges with which the company has the right to work. You can find it on the MICEX website.

- The number of active clients who are currently purchasing shares through your chosen broker. This information is also available on the MICEX website.

- Transparency of work schemes. It will be a good sign if information about the managers and owners of the organization, as well as current financial reports, is publicly available.

- Account insurance. Find out whether your funds will be insured and what the reimbursement amount will be. The maximum amount of payments in case of bankruptcy of a broker is 50 thousand dollars. In general, this procedure is similar to insurance of deposits of individuals.

- Reviews from other investors. Find out how satisfied the clients who previously worked or continue to work with this company were with the services provided.

Cost of services

When planning a long-term cooperation with a broker, it is important to pay attention to the size of the commission charged. If, for example, the commission is 1% of profit, then over 10 years the return on your investment will decrease by 10%. Typically, financial institutions offer several tariff plans to choose from, the terms of which vary depending on the volume of transactions, trading style and exchange sector. Some plans provide fixed payments, others - in the form of a percentage, which will be smaller the larger the amount of a particular transaction.

An option is possible in which you transfer the agreed amount to the broker monthly, and it will remain unchanged both in the complete absence of financial transactions and in the case of a large number of transactions. Such conditions are extremely beneficial for large investors who constantly work on the stock exchange: for them, the fixed amount will always be less than a percentage.

Before opening an account with the chosen company, carefully read the tariff description from start to finish. With a quick study, you may not notice any additional conditions, for example, an increased account maintenance fee if there is no activity for a certain period.

Ease of collaboration

It is important that you do not experience any discomfort when working with a broker. Therefore, it would be a good idea to pay attention to such factors as ease of access and communication with the intermediary.

To evaluate a specific company based on these two criteria, pay attention to the following interaction features:

- Number and location of offices. Perhaps the company has only one representative office, and it is located on the other side of the city. In this situation, you will not have the opportunity to personally contact specialists to resolve important issues relating to your finances.

- Simplicity of the account opening procedure.

- Opportunities for working with the stock exchange online. Since the purchase and sale of shares occurs mainly on the Internet, when choosing an intermediary, it is necessary to evaluate the functionality of its website. Check whether your personal account receives information about changes in the investment portfolio and financial reports on recent transactions. It is desirable that all document flow can be carried out remotely.

- Speed of technical support. It’s good if, when problems arise, you quickly receive recommendations for solving them.

- List of additional services: information, analytics, financial advice, etc.

- Providing training materials. Some financial organizations give their clients access to a database of free video lessons and articles that help them gain a deeper understanding of the topic of stock trading.

Analyze the companies you like using these criteria, study the reviews, and you can easily choose the broker with whom cooperation will be the most pleasant and profitable.

Customer profit per month

I can’t say that this point 100% applies to companies that do not feel very confident, but this PR move has always raised a lot of questions in me. I'm talking about brokers' monthly reports, which were very popular last year, showing how much their clients earned and lost over the past 30 days.

A. Winning was almost always greater than losing.

B. The amounts indicated in the report for all companies directly went off scale in the millions.

B. There was no evidence of the reliability of these figures.

This is a real PR move, designed to ensure that this information cannot be verified. But newcomers to Forex have that same urge of greed: “Wow, what money, I want that too!”

Conclusion : if your broker uses advertising techniques that cannot be verified, he may do the same in other matters.

Broker bankruptcy action plan

The client's assets held in the brokerage account are not the property of the broker and are separate from the intermediary's own accounts. I repeat once again, if the license is revoked, nothing will happen to the shares, nor to the bonds.

In accordance with Bank of Russia Regulation No. 481-P dated July 27, 2015, a professional participant in the securities market, in the event of cancellation of a license, must do the following:

- stop your professional activity for which your license is revoked;

- ensure the safety of funds, securities, and other property of the client and the integrity of records of rights to this property;

- notify customers within 3 days of license revocation;

- invite clients to provide instructions on how to return property within a specified period;

- in accordance with the instructions of clients, return all property belonging to them;

- if the client has not responded to the notification, provide NSD with a list of such clients within 30 days after the deadline.

An approximate plan of action for an investor in case of bankruptcy / revocation of a license is as follows:

- After receiving notice of bankruptcy or revocation of a license from a brokerage organization, the client must open a brokerage and depository account in another that has a license from the Bank of Russia.

- Instruct the old broker to transfer assets to the new one.

- Order a report on the status of a brokerage account with the name, quantity and purchase price of securities.

- Instruct the new broker to transfer assets and provide him with the report received from the old intermediary.

Violation of this order is possible only in the event of criminal actions of a brokerage organization, when it takes all assets offshore and returns nothing. Therefore, the main advice is to open accounts with the largest and oldest companies that have long been professional participants in the stock market in Russia. The easiest way is to look at the top 25 ratings on the Moscow Exchange and choose from it.

02.11.2019

695

How to choose a broker on the stock market for a beginner and open an account to form an investment portfolio

Criteria for selecting and assessing the conditions of brokerage companies.

An abundance of advertising or its sudden disappearance

Remember how much advertising MMCIS and Forex Trend had. On all fronts and sites, there were huge numbers of these banners with PAMM accounts and TOP5, TOP20 indices. Large sites, small, one-page ones, advertising on TV, in the subway, only rave reviews in ratings and always first places. Your own rebate service, your own service with reviews, your own specialized forums, your own awards and exhibitions, borders on the street and movie stars in commercials.

All this costs incredible money! Colossal!

Even the largest Western brokers, the pillars of exchange and over-the-counter trading, cannot afford this. So where does the money for such advertising campaigns come from? That's right, this is clients' money, which is scrolled and overlapped only within the company.

And so, when ALL this advertising disappears at once, you have to think about the fact that nothing has actually changed with the broker, the offers are still the same, but he no longer wants to attract attention to himself, or is no longer able to. This is a sure sign that it’s time to run and withdraw the money, at least partially. Although, it’s better to just notice this aggressive marketing in advance and not fall for it.

Conclusion : Now, probably, not everyone remembers MMM, but the development of events there followed the same scenario.

All residents of the country considered Lenya Golubkov almost a member of the family. If your broker is visible from everywhere, including emails and telephones, think about where he gets the funds for such promotions.

Let's sum it up

What do our calculations tell us? Taking into account costs, the effectiveness of the trading strategy should be higher, and the lower the stop loss value, the greater the impact of costs on the results:

- for a long-term strategy with a stop loss size of 250 points, it is enough to open 56 profitable trades out of 100 to earn 10%;

- for a medium-term strategy – 58 profitable trades out of 100.

- for scalping – 68 profitable trades out of 100.

Now you can clearly see for yourself that the more active the trading strategy and the smaller the stop loss size, the greater the impact financial costs have on the effectiveness of the trading strategy.

Incomprehensible withdrawal conditions and delays

Unfortunately, delays in withdrawals appear even when the broker’s restructuring has already begun. At this moment, only those who assessed the situation in advance and managed to submit an application for withdrawal before others can be lucky. Rumors spread quickly, and the abrupt departure of customers from the company actually blocks its work.

But the strange conditions for withdrawing funds should at least warn you. For example, a sharp increase in the commission for withdrawal, a departure from the usual and stable electronic payment system, additional deductions, strange conversion rates, delays in terms of the need to contact support, and in general other obvious earnings in this matter on the client. All this should gently hint to you that things are not going well for the broker if he is ready to profit from a client who, of course, will not come to the company again after this.

Conclusion : we carefully monitor the withdrawal conditions and withdraw profits from time to time, checking the honesty of the company and responding to changes in the conditions for receiving funds.

Who is a broker and what functions does it perform?

Anyone who has been even slightly interested in trading on the stock exchange knows that transactions there are not concluded directly, but through brokers. In addition to them, there are other professional players in the financial market, such as dealers, depositories and market makers. Beginners often confuse these concepts and cannot figure out what the functions of a broker are and how they differ from other participants.

The standard definition of the word “broker” is: an intermediary who provides a service to secure a transaction and receives financial compensation for this. Brokers connect buyers and sellers in a variety of industries. For example, business brokers specialize in mergers or acquisitions of small firms by larger ones. They find business owners buyers who want to buy them. There are also credit brokers who help people in need of a loan obtain a loan on the most favorable terms.

It is worth talking in more detail about the peculiarities of the work of stock brokers. Their demand is explained by the fact that individuals are not allowed to independently enter into transactions on the stock exchange, buying and selling securities. Only specialized companies can be trading participants.

The client of such a company can be either an ordinary person or an organization. Their interaction occurs according to the following scheme: the client opens a trading account and submits requests for the purchase/sale of shares, and the broker transmits these requests to the exchange and finds suitable counterparties.

Brokers do not invest their own funds in the purchase of securities: their main task is to work with client orders. Profit from intermediary activities is provided by the commissions that the company receives for concluding transactions. To work as a broker, you must obtain an appropriate license from the Central Bank of the Russian Federation.

Bonuses and promotions or money for free!

And now we come to the point that is the most important in this article. What we clearly show is the broker’s imminent capitulation – this is the distribution of money for free!

This step is sometimes the apotheosis of point 3, when all possibilities have already been exhausted and only the most intractable traders remain to be attracted. Or it is simply a gradual increase in attractive promotions, which go as far as returning part of the lost funds, sometimes in an amount equal to half the deposit. If your broker offers such a promotion, ask yourself where the money is coming from? The answer is already somewhere above.

On a forum thread, one of our participants reminded me of an illustrative story about how MMCIS, which had sunk into oblivion, offered $50 for free. The essence of the promotion was that you needed to open an account of $100, after which the company added its $50 to it and you could immediately withdraw this money without trading. For new clients. Just a fair of generosity and a siren signal that it’s time to take your money!

Of course, many companies offer bonuses, but they should not be absurd - 100%-200% to your account after replenishment, free money just like that, refunds of lost funds, to some extent even your own rebates - this is also strange (isn’t it better just reduce spreads).

Here I would also include promotions to lower the minimum deposit threshold, opening a PAMM with a very small own investment or even without it. Bonuses from the “Bring your family” series, when it is clear to everyone that the same trader will be trading, just on his wife’s account. A large number of different sweepstakes and competitions with real prizes are also questionable. One every 6-12 months is understandable, advertising expenses, but there shouldn’t be a large number of them, so it won’t be like in point 3.

Conclusion : if the list of promotions and competitions of your broker is significantly larger than all others, you are offered huge amounts of money for free, even as bonuses, the conditions for receiving and using these funds are veiled, unclear or completely absent - this is a sure sign that the company is ready to do anything to attract real new money.

The consequences of this are clear.

Which broker is best for a beginner? A specific case with calculations.

General selection of tariffs for me from the best brokers in Russia

What's next?

It seems that the list of brokers has been significantly reduced, but it is still not clear who to choose.

Also important is customer service and maximum availability, which includes a free hotline and the ability to resolve any issue very quickly over the phone. All four have no problems with telephone availability.

Which means, I repeat, there is no ideal broker.

Each person will have their own ideal broker. And even if you are a beginner, the selection criteria will be the same as for an experienced trader. If it is present on the Moscow Exchange, then it is already reliable.

And I give you the following recommendations:

- You can choose one of the four brokers who remained with us after my subjective selection.

- After determining your personal plan for developing yourself as a trader on the stock exchange, you can choose the optimal plan from any of these brokers. You don't need to go to their office to do this. You can find out by calling a financial advisor.

You don't have to stop with the first broker you call. Don't be lazy to call all four. And, having compared the optimal offer on paper, choose a suitable broker.

For example, I now trade only futures on the Derivatives Market of the Moscow Exchange, then:

- I don't need the stock market

- I don't need the foreign exchange market

- But I need charts of Stock and Foreign Exchange market instruments for analysis!

- I don't need any paid analytics or paid consulting

- What is important to me is very powerful remote telephone support with employees who understand perfectly the problem that I can clumsily explain.

- It is important for me to get through to the broker very quickly, and not like the Sberbank broker (you can hang on the wire for hours).

- Fast withdrawal of money to the card is important to me

- It is important for me to quickly receive money as a deposit to a brokerage account

- I don't care about any programs or mobile applications. Grabs Quik.

This all, as you understand, concerns the Derivatives Market. The question may arise: “Which broker to choose for trading on the Stock market?” To do this, we slightly change the phrases in the questions posed and, using the same scheme that will be below, we look for the answer for ourselves. It's simple!

So, let's go look for the best one for me from this four! Let's calculate the commission when trading 1 futures contract, and then 20 futures contracts.

Since brokers’ websites are crazy about tariffs: everything is confusing and somehow incomprehensible, I started calling our four brokers.

I started calling the Otkritie broker’s toll-free number from about two o’clock in the afternoon Moscow time and never got through. The answering machine always says that all operators are busy.

Okay, busy so busy.

I called the broker Finam. I got through right away and asked for the tariffs I was interested in to meet my requirements to be sent to me by email.

In a couple of minutes, they found me a tariff for futures with a fee of 0.45 rubles per contract. True, there is a subscription fee for maintaining an account of 177 rubles per month.

I called the Otkritie broker again and the answering machine reported that all the specialists were busy.

I'm calling the BCS broker. I called right away. She clarified my understanding of the tariffs to ensure they were correct and chose the optimal one for myself.

I have pre-selected the “Investor” tariff for now.

I call the Otkritie broker again. Another answering machine.

Broker Otkritie is dropped from the list for the title of best broker in Russia.

Moreover, on the website I found such information on the tariffs I was interested in. The “Universal” tariff for trading futures contracts is 0.74 rubles. And this is already more expensive than the Finam broker.

I say to the Otkritie broker: “Come on, goodbye!”

According to Kit Finance everything is very clear. I didn't even have to call. All the information is very simple on the website and without complicated tariffs.

So, we have chosen more or less suitable tariffs for trading only futures on the Derivatives Market of the Moscow Exchange with the best brokers in the country.

It seems that they are all good and profitable. But this is only at first glance.

We choose a specific tariff for trading on the stock exchange from the best brokers in Russia

In order to choose the best tariff, and therefore the broker, we need to determine such a trading parameter as the number of transactions per month.

In my case, this is usually no more than 30 (even with a reserve, I take the number) transactions per month. But to choose a tariff, you need to multiply this figure by two.

Why do you need to multiply by two?

The answer is simple. Because we open any transaction and pay a commission. And then we close this deal and again pay a commission to the broker.

This means that my parameter “Number of transactions per month” is 60.

We consider the benefits of the Kit-Universal tariff of the Kit-Finance broker for my trading.

0.65*60*1=39 rubles is the entire commission to the broker for trading one futures.

0.65*60*20=780 rubles is the entire commission to the broker for trading in each of 30 open and then closed transactions with 20 futures contracts.

But!

Broker Kit-Finance has a clause in the tariff that if the total commission for a month does not exceed 200 rubles, then they will charge the missing amount from the brokerage account.

The total amount of commissions from the Kit-Finance broker when I trade 1 futures per month will be a maximum of 200 rubles. When trading 20 futures, the commission will be 780 rubles.

We consider the benefits of the “Day” tariff of the Finam broker for my trading.

This tariff includes a mandatory subscription fee for maintaining an account. It is 177 rubles.

For a transaction of one futures contract, the commission is 0.45 rubles.

What happens then?

(0.45*60)*1+177=204 rubles. When trading 1 futures.

(0.45*60)*20+177=717 rubles when trading 20 futures.

Already 4 rubles more than the Kit-Finance broker when trading 1 futures. And when trading 20 futures, it is 780-717 = 67 rubles cheaper.

But again, here it is better to look at your dynamics of the number of entries for about a month.

I took 30 entries with a reserve. In fact, I have fewer entries. You can clearly see which of these two brokers is better from this table. In my calculations, I take trading 1 futures.

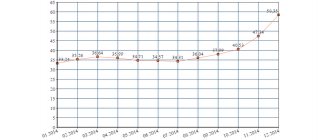

| number of transactions per month | Calculation of commission at broker Finam | Total commission amount for broker Finam | number of transactions per month | Calculation of commission at broker Kit-Finance | Total commission amount for the Kit-Finance broker |

| 5+5 | (10*0,45)+177 | 181,5 | 5+5 | 0,65*10 | 200 |

| 10+10 | (20*0,45)+177 | 186 | 10+10 | 0,65*20 | 200 |

| 20+20 | (40*0,45)+177 | 195 | 20+20 | 0,65*40 | 200 |

| 30+30 | (60*0,45)+177 | 204 | 30+30 | 0,65*60 | 200 |

| 40+40 | (80*0,45)+177 | 213 | 40+40 | 0,65*80 | 200 |

| 50+50 | (100*0,45)+177 | 222 | 50+50 | 0,65*100 | 200 |

Let's analyze the chain of tariffs from the BCS broker for my trading.

The BCS broker has three interesting tariffs for me when trading futures on the Moscow Exchange. If Finam only liked one tariff out of all the tariffs, Kit-Finance has only one tariff, then the BCS broker has many of them. But interesting three:

- Tariff "Trader"

- Tariff "Investor"

- Tariff "InvestorPro"

Analysis of the “Trader” tariff of the BCS broker

Let’s look at the “Trader” tariff of the BCS broker. Let's look at the extract from the official website of BCS according to the tariff:

The total amount of commissions to the broker is:

(1*60)*1+199=259 rubles when trading 1 futures

(1*60)*20+199=1399 rubles when trading 20 futures

Let's look at the extract from the official website of BCS for the "Investor" tariff:

Analysis of the “Investor” tariff of the BCS broker

Important! Here you need to look not only at the amount of commissions per month for 30+30 transactions. Otherwise, it will be more difficult to understand whether the tariff is beneficial for me or not?

We calculate the total amount of commissions to the BCS broker:

3*60*1=180 rubles - with the number of transactions 30+30 per month when trading 1 futures

3*60*20=3,600 rubles when trading 30+30 per month when trading 20 futures

3*40*1=120 rubles with the number of transactions 20+20 per month when trading 1 futures

3*40*20=2400 rubles with the number of transactions 20+20 per month when trading 20 futures

3*16*1=48 rubles with the number of transactions 8+8 per month when trading 1 futures

3*16*20=960 rubles with the number of transactions 8+8 per month when trading 20 futures.

Important! I usually have about 8 transactions per month. But the figure of 960 rubles is higher than the figure of the broker Kit-Finance (780 rubles) and Finam (540 rubles)

Analysis of the "InvestorPro" tariff of the BCS broker

The huge subscription fee immediately catches your eye. And if your brokerage account is up to 900,000 rubles, then the commission for one futures contract will be as much as 5 rubles. And even if you have 5 million-10 million rubles in your account, you still spend a lot on commissions. I think I will make a more detailed comparison in a separate article, but for now this tariff loses in the ranking of the optimal tariff for futures trading.

(5*60)*1+299=599 rubles. With my number of transactions per month being 30+30, the commission turns out to be super cosmic even when trading 1 futures.

(5*60)*20+199=6199 rubles. With my number of transactions per month being 30+30, the commission turns out to be super-super cosmic when trading 20 futures.

Conclusion according to three tariffs of the BCS broker

- According to the “Trader” tariff, the total commission per month is 259 rubles with a subscription fee for 30+30 transactions per month when trading 1 futures

- According to the “Investor” tariff, the total commission per month is 180 rubles without a subscription fee for 30+30 transactions per month when trading 1 futures

- According to the InvestorPro tariff, the total commission per month is 599 rubles with a subscription fee for 30+30 transactions per month when trading 1 futures

But we won’t trade one futures all our lives. While we are learning, we are trading one futures. And when we learn, we will trade 20 futures. despite the fact that I took 20 futures into account for futures with GO for approximately 5,000 rubles.

In some transactions out of these 20 settlements, the commission will be less, since the number of futures will be less due to the large GO.

5.5. Unstable trade

I specifically made this point separately, because... At the moment, there are a lot of specific precedents that do not fall under, but are very similar to, incorrect operation of a broker. By unstable trading, I mean frequent shutdowns of terminals and disconnections, cancellations of transactions without explanation or with references to liquidity providers, which cannot be discussed due to “incredible secrecy,” the appearance of fines for lack of trading, which reset the deposit during the vacation. And also trade shoulders, of enormous size!

Often inexperienced traders also attribute the presence of negative slippage on ECN accounts, as well as the cancellation of transactions in cheating trading. Such claims need to be studied separately, delving into the essence. It is difficult to recognize them at a quick glance, because... a good company can be drawn into endless dialogues for the purpose of, for example, blackmail.

Conclusions : carefully read reviews and complaints about brokers. Among them there may be very useful information for you.

So, if you have carefully read this article, the next step I advise is to go and check your broker for clauses that may lead to imminent bankruptcy. Hiding your head in the sand is the style of an unreasonable trader, because... you have to pay too much money. Therefore, so as not to be offended later, do not be lazy to do your little research. Bankruptcies on Forex have become almost commonplace for us, so protect yourself in advance.

You can also find information about the broker in various ratings with reviews, I recommend this one:

The article is presented in issue 95 of ForTrader.org magazine

Discuss on the forum

- How to determine that a broker will soon go bankrupt?

How are your money and securities protected at the broker?

According to the law, clients' assets (cash and securities) are separated from the broker's property and cannot be subject to collection for the broker's debts. Shares and other securities of clients are kept in a securities account at the depository, and funds are kept in a separate account.

Clients’ funds transferred by them to the broker for making transactions with securities and (or) concluding agreements that are derivative financial instruments, as well as funds received by the broker under such transactions and (or) such agreements that were made (concluded) by the broker on the basis agreements with clients must be in a separate bank account (accounts) opened by a broker in a credit institution (special brokerage account). The broker is required to keep records of each client's funds held in a special brokerage account(s) and report to the client. Client funds held in a special brokerage account(s) cannot be recovered for the broker's obligations. The broker does not have the right to credit his own funds to a special brokerage account (accounts), except in cases of returning them to the client and/or providing a loan to the client in the manner prescribed by this article.

All client securities are subject to accounting. The main link in this system is the National Settlement Depository (NSD) - a non-bank credit organization that performs the functions of centralized storage of securities and has the status of the central depository of Russia.

In addition to NSD, there are other depositories whose services brokers use. The depository must have a license to carry out depository activities issued by the Central Bank of the Russian Federation. It may be a completely separate legal entity that is not related to the broker, but often the broker has a depositary license along with a brokerage license.

By law, the depository does not have the right to perform any actions with the client’s securities without his instructions.

The broker's depository keeps direct records of clients' rights to securities. In turn, he has a nominal holder deposit account opened with NSD. All securities of the broker's clients are stored there without indicating the final owner. In the event of bankruptcy, the securities remain in the depository and do not disappear anywhere.

There are also registrars in the system - licensed professional financial market participants who keep records of the issuer's shareholder register in order for shareholders to exercise their rights.

Such an accounting system allows you to work with securities very quickly in the modern world, where hundreds of thousands of transactions with the Central Bank take place in one day.