Investment greetings, friends! An unexpected question: do you like to eat delicious food? I love it. Especially if the food is grown using PhosAgro fertilizers! And it probably tastes even better if you have shares of this holding in your portfolio. After all, the total payment of PhosAgro dividends in 2021 will be about 123 rubles, plus another 109 rubles are predicted to be paid at the end of 2021 - a total of approximately 232 rubles. This allows you to get a dividend yield of 9.79% at current quotes. Given the potential growth of the company's shares, the acquisition of PhosAgro could be a good investment.

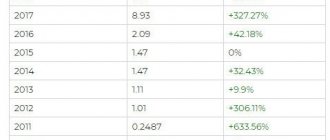

All company dividends for the last 10 years

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | 1 Jul 2021 | 5 Jul 2021 | 3M 2021 | 105 ₽ | 2,42% | 19 Jul 2021 | |

| 2019 | June 3, 2021 | June 7, 2021 | 12M 2020 | 63 ₽ | 1,45% | June 21, 2021 | |

| 2019 | 23 Dec 2020 | 25 Dec 2020 | 9M 2020 | 123 ₽ | 3,76% | 8 Jan 2021 | |

| 2019 | 13 Oct 2020 | 15 Oct 2020 | 6M 2020 | 33 ₽ | 1,17% | 29 Oct 2020 | |

| 2019 | 2 Jul 2020 | 6 Jul 2020 | 3M 2020 | 78 ₽ | 2,97% | 20 Jul 2020 | |

| 2018 | May 29, 2020 | June 2, 2020 | 12M 2019 | 18 ₽ | 0,65% | June 16, 2020 | |

| 2018 | 31 Jan 2020 | 4 Feb 2020 | NP | 48 ₽ | 1,94% | 18 Feb 2020 | |

| 2018 | 11 Oct 2019 | 15 Oct 2019 | NP | 54 ₽ | 2,16% | 29 Oct 2019 | |

| 2017 | 8 Jul 2019 | 10 Jul 2019 | NP | 72 ₽ | 2,88% | July 24, 2019 | |

| 2017 | June 6, 2019 | June 10, 2019 | 12M 2018 | 51 ₽ | 2,08% | June 24, 2019 | |

| 2017 | 31 Jan 2019 | 4 Feb 2019 | NP | 72 ₽ | 2,79% | 18 Feb 2019 | |

| 2017 | 10 Oct 2018 | 12 Oct 2018 | NP | 45 ₽ | 1,81% | 26 Oct 2018 | |

| 2016 | July 19, 2018 | July 23, 2018 | NP | 24 ₽ | 1,03% | 6 Aug 2018 | |

| 2016 | June 7, 2018 | June 13, 2018 | 12M 2017 | 15 ₽ | 0,65% | June 27, 2018 | |

| 2016 | March 7, 2018 | March 12, 2018 | NP | 21 ₽ | 0,84% | March 26, 2018 | |

| 2016 | 11 Oct 2017 | 13 Oct 2017 | NP | 24 ₽ | 1,01% | 27 Oct 2017 | |

| 2015 | 13 Jul 2017 | July 17, 2017 | NP | 21 ₽ | 0,89% | July 31, 2017 | |

| 2015 | June 8, 2017 | June 13, 2017 | 12M 2016 | 30 ₽ | 1,33% | June 27, 2017 | |

| 2015 | 25 Jan 2017 | 27 Jan 2017 | NP | 39 ₽ | 1,38% | 10 Feb 2017 | |

| 2015 | 12 Oct 2016 | 14 Oct 2016 | NP | 33 ₽ | 1,35% | 28 Oct 2016 | |

| 2014 | 8 Aug 2016 | 10 Aug 2016 | NP | 63 ₽ | 2,32% | 24 Aug 2016 | |

| 2014 | June 8, 2016 | June 11, 2016 | 12M 2015 | 57 ₽ | 2,02% | June 24, 2016 | |

| 2014 | 22 Jan 2016 | 26 Jan 2016 | NP | 63 ₽ | 2,2% | 9 Feb 2016 | |

| 2014 | 14 Oct 2015 | 17 Oct 2015 | NP | 57 ₽ | 2,28% | 30 Oct 2015 | |

| 2013 | July 22, 2015 | July 25, 2015 | NP | 48 ₽ | 2,04% | 7 Aug 2015 | |

| 2013 | June 17, 2015 | June 19, 2015 | NP | 15 ₽ | 0,73% | 3 Jul 2015 | |

| 2012 | 6 Jan 2015 | 11 Jan 2015 | 9M 2014 | 20 ₽ | 1,08% | 23 Jan 2015 | |

| 2012 | 25 Sep 2014 | 29 Sep 2014 | 6M 2014 | 25 ₽ | 1,87% | 13 Oct 2014 | |

| 2012 | June 20, 2014 | June 24, 2014 | 12M 2013 | 19,3 ₽ | 1,56% | 8 Jul 2014 | |

| 2011 | 4 Sep 2013 | 6 Sep 2013 | NP | 15,45 ₽ | 1,65% | 20 Sep 2013 | |

| 2011 | April 22, 2013 | April 22, 2013 | 12M 2012 | 19,9 ₽ | 1,59% | May 6, 2013 | |

| 2010 | 23 Nov 2012 | 23 Nov 2012 | 9M 2012 | 25 ₽ | 1,84% | 7 Dec 2012 | |

| -1 | 22 Aug 2012 | 22 Aug 2012 | 6M 2012 | 38 ₽ | 2,92% | 5 Sep 2012 | |

| -1 | April 18, 2012 | April 18, 2012 | 12M 2011 | 32,5 ₽ | 3,37% | May 2, 2012 | |

| -1 | 26 Oct 2011 | 26 Oct 2011 | 9M 2011 | 25 ₽ | 0,22% | 9 Nov 2011 | |

| -1 | April 4, 2011 | April 4, 2011 | 3M 2011 | 31,035 ₽ | April 18, 2011 | ||

| -1 | April 4, 2011 | April 4, 2011 | 12M 2010 | 209,7 ₽ | April 18, 2011 |

About PhosAgro

PhosAgro was founded in 2001. It received the status of a public company in 2011 – its depositary receipts were placed on the London Stock Exchange. In 2021, PhosAgro shares were listed on the Moscow Exchange for the first time.

The company produces:

- mineral fertilizers;

- high-grade phosphate raw materials - apatite concentrate;

- feed phosphates;

- monocalcium phosphate;

- nepheline concentrate;

- ammonia and its derivatives.

In total, PhosAgro produces 39 brands of fertilizers and plans to expand this line to 50 in 2025. The company supplies more than 9 million tons of fertilizers annually to 100 countries around the world.

PhosAgro is a vertically integrated holding. The company carries out a full cycle of work - from the extraction of phosphate raw materials to the production of finished products. It also has its own logistics companies and even its own research institute, where various research is carried out in the field of production and processing of mineral fertilizers.

This is a classic cyclical company with a mature business, predictable and gradual earnings growth and stable cash flows. Moreover, it pays dividends quarterly.

In general, almost a quasi-bond.

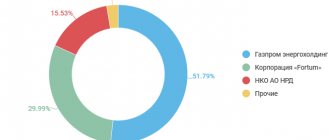

PhosAgro is almost entirely owned by private individuals:

- 24.85% and 18.81% of the shares belong to the Cyprus funds Adorabella Limited and Chlodwig Enterprises Limited, respectively, the ultimate beneficiary of which is the head of PhosAgro, Andrey Guryev;

- 20.98% of the shares belong to the rector of St. Petersburg State University Vladimir Litvinenko;

- 4.82% of the shares are owned by Andrei Guryev’s wife Evgenia;

- 4.51% of shares belong to PhosAgro board member Igor Antoshin.

The remaining shares (26.03%) are in free float. They can be bought on the Moscow Exchange or on the LSE (in the form of GDRs).

PhosAgro ticker on the stock exchange is PHOR.

When will dividends be paid in 2021?

The registration date for the receipt of dividends by PhosAgro shareholders is set for 10/15/2019.

However, to receive dividends, the investor must purchase shares before the close of trading on October 11, 2019. This procedure is due to the fact that the Moscow Exchange adheres to the “T+2” scheme (trading day + two business days). This number is also called the cut-off date for dividend payments.

The period for receipt of funds to shareholders' accounts ranges from 1 to 4 weeks after the closure of the register of participants.

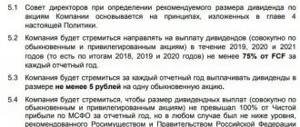

Dividend policy

In September 2021, PhosAgro adopted a new dividend policy. In accordance with it, dividends will be paid from free cash flow (FCF), and not from net profit, as was previously the case.

And here is another interesting article: What is sukuk, how is it issued and what is its profitability

Exactly how much FCF will be allocated for dividends depends on the net debt/EBITDA ratio:

- less than 1 – the company will distribute 75% of the FCF;

- from 1 to 1.5 – 50-70% of FCF will be allocated for dividends;

- above 1.5 – less than 50% FCF.

The minimum dividend amount is set at 50% of adjusted net profit. Paid quarterly:

- in February-March - intermediate for 9 months of the previous year;

- in June - totals for the previous year;

- in July – for the 1st quarter of the current year;

- in November – for the 1st half of the current year.

Most likely, this schedule will continue for future payments.

You can learn more about PhosAgro’s dividend policy at the following link: https://www.phosagro.ru/upload/docs/Dividend_policy_statement.pdf.

Stock return

To begin with, I will calculate the profitability relative to the 3rd quarter of 2019. The base value is taken as the price of 2,500 rubles for one ordinary PhosAgro paper.

So it turns out:

54 / 2500 = 2.16% excluding tax costs or 1.88% including personal income tax withholding.

Now I will calculate the annual dividend yield on PhosAgro securities for the last 12 months (LTM yield), taking into account already known payments:

(72 + 54 + 72 + 54) / 2,500 = 10.1% excluding tax costs or 8.77% including personal income tax withholding.

For example, in 2021, only 105 rubles were paid. / paper, which at current prices would be a yield of 3.65%, taking into account taxes.

A little about PhosAgro

PhosAgro is a vertically integrated company (that is, a full-cycle company that does everything with its products - from production to sale), a world leader in the production of phosphate raw materials and phosphate-containing fertilizers. If you are eating bread right now, then the wheat from which it is made was most likely grown with the help of PhosAgro fertilizers.

The company has three main areas of activity - the production of phosphate products, nitrogen fertilizers (mainly urea) and apatites. How much these goods cost can be found on the stock exchange. The more expensive urea and apatite, the greater PhosAgro’s revenue.

In addition, almost 75% of products are exported. Therefore, the more expensive the dollar, the better for the company - the more revenue in rubles.

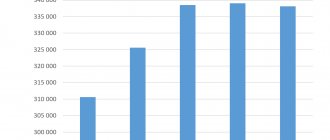

Year after year, the company’s financial indicators are increasing – there are prospects.

Thus, at the end of 2021, the holding’s revenue amounted to 233.4 billion rubles.

Net profit compared to last year (i.e. 2021 - let me remind you, we are analyzing the report for 2021) increased three times, which is also a plus.

Free cash flow also increased compared to last year.

But FCF is not so interesting to us, since in accordance with the dividend policy the company pays up to 50% of profit under IFRS, which amounted to 22.2 billion rubles in 2021.

How to buy shares and receive dividends

PhosAgro securities are listed on the Moscow Exchange. The surest way to acquire them is to open a brokerage account with one of the large licensed Russian companies providing services for private investors.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Above you can see a list of leading brokerage firms. These are large brokers with good ratings and excellent reliability. They all provide a high level of trading services and have competitive commissions.

Warning about Forex and BO

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Binary options are a pure play kitchen where players bet that the price of an asset will go up or down at certain intervals. In such offices it is impossible to make real transactions to purchase securities of Russian issuers.

Forex is an international over-the-counter market where currency pairs are primarily traded. There is also no opportunity to acquire ownership rights to assets listed on stock exchanges; therefore, there are no dividends.

What's up with dividends for 2021: size, how much and when to buy

In June, PhosAgro will pay dividends from retained earnings for 2018. The dividend will be 51 rubles per ordinary share and 17 rubles per GDR. A total of 6.6 billion rubles will be allocated for payments.

At current prices (2,457 rubles per share), the yield is only 2.07%. But keep in mind that this is only part of the dividends. To receive them, you need to buy shares before June 6 - today, alas, is the last day. The register of shareholders closes on June 10.

But the second payment is just around the corner. Already in July, PhosAgro will pay 72 rubles per share and 24 per GDR as dividends from retained earnings as of March 31, 2021. Here the cut-off for dividends is July 8, and the register itself closes on July 10.

At the current price, the payout yield is 2.9%.

Thus, by purchasing shares at their current price, you can already earn 123 rubles in dividends in July, or 5% yield. I agree, a little, but that’s not all.

According to forecasts, another 43.24 rubles may be paid on November 12, and in February next year the company may pay 66.25 rubles. Total earnings - 232 rubles. Now it’s more interesting.

And here’s another interesting article: VTB Bank dividends in 2021: lower and lower

PhosAgro shares are traded on the Moscow Exchange under the ticker PHOR. You can buy them through any broker, for example, Tinkoff Investments. The stock is traded in lots. One lot contains one share.

PhosAgro pays dividends within 1-2 months. The money is usually deposited into a brokerage account, but some brokers transfer it to a regular bank account.

Upon receipt of a dividend, income tax will be withheld. That is, by purchasing one share of PhosAgro, you will earn not 51 rubles in dividends, but only 44.37, and not 72 rubles, but 62.64. Usually the broker himself withholds the tax, but sometimes the investor needs to do this.

So, will you buy PhosAgro for dividends? Write in the comments, good luck, and may the money be with you!

Rate this article

[Total votes: Average rating: ]