The grid company of the Center and Volga region Vladimirenergo is a subsidiary of the large organization Rosseti. The company distributes energy resources in the respective region and also accepts payment for the use of these utilities. She interacts with individuals and legal entities, offering favorable terms of cooperation.

To conveniently work with the service, you need to register a personal account of IDGC of Center and Volga Region. Next, you will need to log in, after which clients have access to all functions.

How to register a personal account

Registration of a personal account is carried out online via a PC or smartphone; a prerequisite is that the Internet must be connected. There is no need to visit an office or branch, stand in long lines and waste time.

Registration of a personal account in the service consists of the following stages:

- First of all, you need to go to the official page, for this you can use the link;

- At the top right corner, click on the “Personal Account” button;

- After the form opens, click the “Register” button under the input fields;

- The user will then be redirected to the registration form. In it, he must enter the necessary information - initials, active email address, mobile phone, come up with a password;

- Next, checkboxes are checked to confirm the entered information, and the user also gives permission to process all data;

- Below you will need to enter a verification code, click the “Register” button;

- After all the steps have been completed, you will receive an email with a link; you must use it to activate and complete registration.

It is worth noting! After completing the necessary stages of opening a personal account, the company manager will call the user back, he will explain how to link his own personal account to the registered personal account. To do this, the client presents a Russian passport and enters into an agreement with the company.

Dividends of IDGC of Center and Volga Region (Rosseti CP)

The information presented on this page (hereinafter also referred to as Information) was prepared by DOKHOD specialists (hereinafter also referred to as the Company), is the intellectual property of the Company and is intended for use on the territory of Russia in accordance with Russian legislation. In preparing this Information, materials were used from sources that, in the opinion of Company specialists, are trustworthy. However, such Information is intended solely for informational purposes, does not contain recommendations and, where applicable, is an expression of the private opinion of the Company’s specialists. Despite the care with which the Company's specialists have taken the collection and compilation of Information, the Company does not make any guarantees regarding its accuracy or completeness. The information presented here does not constitute individual investment advice, and the financial instruments mentioned may not be suitable for your investment objectives, risk tolerance, investment horizon or other aspects of your individual investment profile.

No one should under any circumstances consider the Information contained on this page as an offer to enter into an agreement on the securities market or other legally binding action, either on the part of the Company or its specialists. Neither the Company nor their agents or affiliates accept any liability for any damages or expenses arising directly or indirectly from the use of this Information.

The information contained on this page is current at the time of publication. However, the Company has the right to make any changes to it at any time. Distribution, copying, modification, or other use of the Information or any part thereof without the written consent of the Companies is not permitted. The Company, its agents, employees and affiliates may, in some cases, engage in transactions in the securities mentioned in the Information or have relationships with the issuers of those securities. When forming the calculated indicators, the latest official closing prices of the relevant securities available as of the date of publication of the data, provided by the Moscow Exchange, are used.

The results of investing in the past do not determine future income; the state does not guarantee the return on investment in securities. The Company cautions that dealing in securities involves various risks and requires appropriate knowledge and experience.

How to login

Logging into your account in the Rosset service is easy, it takes no more than 5 minutes. Authorization can be carried out on a PC and smartphone.

How to log in to your account:

- You need to go to https://lkk.mrsk-1.ru;

- Afterwards the form will open. Enter your login in the top field;

- Enter the password below;

- Click the “Login to your personal account” button. The full functionality of your personal account will open, in which you can carry out the necessary operations.

How to restore access

Losing your password can lead to login problems in your account. Even if one character is forgotten or entered incorrectly, you will not be able to open an account in the Rosset service.

Note! Before logging in, you should make sure that the Caps Lock key is not turned on. It is also worth checking the type of layout on your PC and smartphone, it should be in English.

If all the conditions are met, but you cannot log into your personal account, then it is better to use login recovery:

- To begin, open the authorization form via the link https://lkk.mrsk-1.ru;

- In the window that opens, you need to select “Recover Password”. The button is located below the fields to fill out;

- Next, a field will appear in front of the user; the email address associated with the account is entered into it;

- Then click the “Recover Password” button;

- A message will be sent to your email containing a link. After clicking on it, the user will be able to change the password, come up with a new one, it is better for him to use a combination of numbers and letters of the Latin alphabet;

- The password is entered in the appropriate field, and “Save” is clicked.

Personal account features

A personal account is a convenient service in which users can carry out various operations online, make payments for the services used, check and monitor readings. All functions are available on PC and smartphone, but an Internet connection is required to use.

The list of available functions of your personal account includes:

- Formation and submission of an application for technological connection;

- In your personal account you can pay your electricity bills online. This makes it much easier to use, everything can be done at home, there is no need to go to a terminal, bank or branch, where you often have to stand in long lines;

- Users can view the history of payment transactions and spent resources. All this will help calculate average energy costs and allow you to better plan subsequent payments and their amounts. In LC you can view receipts electronically, but if necessary, they can be printed;

- Customers can check their electricity consumption readings from the meter and on the website. This will help establish the correctness of the readings, and also prevent possible overpayments or debts;

- In the LC you can fill out and send an application for redistribution of maximum power;

- The user can fill out and send an application for the transfer of electrical network facilities.

Dividends on shares of IDGC CP JSC in 2021 - size and register closure date

Home → Dividends→ Shares of IDGC CPU - forecast, payment history

A table with the complete history of dividends of the company IDGC TsP JSC indicating the amount of payment, the date of closure of the register and the forecast:

| Payment, rub. | Registry closing date | Last day of purchase |

| 0.0259262 | June 15, 2021 | 11.06.2021 |

| 0.0163 | January 14, 2020 | 10.01.2020 |

| 0.0407 | June 25, 2019 | 21.06.2019 |

| 0.0402 | June 12, 2018 | 07.06.2018 |

| 0.0118 | June 16, 2017 | 14.06.2017 |

| 0.0083636 | June 27, 2016 | 23.06.2016 |

| 0.0031 | June 29, 2015 | 25.06.2015 |

| 0.00563 | July 11, 2014 | 09.07.2014 |

| 0.00425 | May 8, 2013 | 08.05.2013 |

| 0.0028 | May 14, 2012 | 14.05.2012 |

| 0.0012511 | May 6, 2011 | 06.05.2011 |

*Note 1: The Moscow Exchange operates on the T+2 trading system. This means that settlements for buying and selling shares occur within 2 business days. Therefore, to be included in the register of shareholders and receive dividends, you must be a shareholder 2 days before the cutoff.

*Note 2: Exact payout date varies by broker and issuer. The predicted nearest date for receipt of dividends to the brokerage account for IDGC CP: June 28, 2021.

Total dividends of IDGC CPU shares by year and change in their size compared to the previous year:

| Year | Amount for the year, rub. | Change, % |

| 2021 | 0.0259262 (forecast) | +59.06% |

| 2020 | 0.0163 | -59.95% |

| 2019 | 0.0407 | +1.24% |

| 2018 | 0.0402 | +240.68% |

| 2017 | 0.0118 | +41.09% |

| 2016 | 0.0083636 | +169.79% |

| 2015 | 0.0031 | -44.94% |

| 2014 | 0.00563 | +32.47% |

| 2013 | 0.00425 | +51.79% |

| 2012 | 0.0028 | +123.8% |

| 2011 | 0.0012511 | n/a |

| Total = 0.1603209 |

The amount of dividends paid by IDGC CP for the entire period is 0.1603209 rubles.

Average amount for 3 years: 0.028 rubles, for 5 years: 0.027 rubles.

DSI indicator: 0.86.

You can buy IDGC CPU shares with minimal commissions from stock brokers: Finam and BCS. Free deposits and withdrawals. Online registration.

Brief information about the issuer PJSC Interregional Distribution Grid Company of Center and Volga Region

| Sector | Energy |

| Issuer's full name | PJSC Interregional Distribution Grid Company of Center and Volga Region |

| Issuer's name is short | IDGC CPU |

| Ticker on the stock exchange | MRKP |

| Number of shares in lot | 10000 |

| Number of shares | 112 697 817 043 |

| TIN | 5260200000 |

| Free float, % | 27 |

Other companies from the Energy sector

| # | Company | Div. profitability for the year, % | The nearest registry closing date | Buy before |

| 1. | Unipro JSC | 15,08% | 22.06.2021 | 18.06.2021 |

| 2. | RyazEnSb | 10,10% | 03.06.2021 | 01.06.2021 |

| 3. | Lenenerg-p | 10,05% | 29.06.2021 | 25.06.2021 |

| 4. | TGK-1 | 9,48% | 07.07.2021 | 05.07.2021 |

| 5. | IDGC Center | 8,78% | 11.06.2021 | 09.06.2021 |

Calendar with upcoming and past dividend payments

| Immediate | Past | ||||

| Company Sector | Size, rub. | Registry closing date | Company Sector | Size, rub. | Registry closing date |

| RusAqua JSC Foodstuff | 5 | 27.05.2021 | MDMG-gdr Miscellaneous | 19 ✓ | 25.05.2021 |

| FGC UES JSC Energy | 0.016 | 29.05.2021 | TransK JSC Logistics | 403.88 ✓ | 24.05.2021 |

| SevSt-ao Metals and mining | 46.77 | 01.06.2021 | M.video Retail trade | 38 ✓ | 18.05.2021 |

| Tattel. JSC Telecoms | 0.0393 | 01.06.2021 | PIK JSC Construction | 22.51 ✓ | 17.05.2021 |

| SevSt-ao Metals and mining | 36.27 | 01.06.2021 | PIK JSC Construction | 22.92 ✓ | 17.05.2021 |

| GMKNorNik Metals and mining | 1021.2 | 01.06.2021 | Moscow Exchange Finance and Banking | 9.45 ✓ | 14.05.2021 |

| MOESK Energy | 0.0493 | 01.06.2021 | Sberbank Finance and Banking | 18.7 ✓ | 12.05.2021 |

View full calendar for 2021 »

7 Best Dividend Stocks for 2021

| # | Company | Sector | Dividend yield for the year, % | The nearest registry closing date | Buy before |

| 1. | Surgnfgz-p | Oil Gas | 16,84% | 20.07.2021 | 16.07.2021 |

| 2. | iMMTSB JSC | Miscellaneous | 15,24% | 09.06.2021 | 07.06.2021 |

| 3. | Unipro JSC | Energy | 15,08% | 22.06.2021 | 18.06.2021 |

| 4. | ALROSA JSC | Metals and mining | 14,99% | 04.07.2021 | 30.06.2021 |

| 5. | NLMK JSC | Metals and mining | 14,91% | 09.06.2021 | 07.06.2021 |

| 6. | Rusagro | Food | 11,85% | 18.09.2021 | 15.09.2021 |

| 7. | MMK | Metals and mining | 11,80% | 17.06.2021 | 15.06.2021 |

View the full company rating for 2021 »

Interesting read:

- How to purchase shares for an individual;

- Trading on the stock exchange for beginners;

- ETF funds - what they are and how to buy;

- Investment portfolio;

- How can you live on dividends?

- How to buy Gazprom shares for an individual;

- What is the average return of stocks;

- Investments in shares;

← Return to main catalog

Technical support

The official page provides technical support for customers; it will help solve problems that may arise while using services, making checks, payments and other operations. Operators will help you find a solution in any difficult situation.

For all questions, for consultation, as well as for submitting an application via telephone, you can call the 24-hour telephone number and tell the operator what exactly you need - 8-800-220-02-20.

The site has a company email address that is intended to assist customers. You should write down an appeal, a letter indicating a problem or suggestion in a special form. And then you can send it, and after a short period of time the client will receive an answer by email from the company’s managers. The application form is available at https://www.mrsk-1.ru/service/feedback.

The following two tabs change content below.

- about the author

- The last notes

Nikita Averin

In 2021 he graduated from the Federal State Budgetary Educational Institution of Higher Education “Saratov State Technical University named after. Gagarina Yu.A.", Saratov, in the field of preparation "Informatics and Computer Science". Currently I am the administrator of the site kabinet-lichnyj.ru. (Author's page)

Which IDGC is worth investing in?

What is it, which ones are there and where do they work?

IDGCs are interregional distribution grid companies. The main activity of IDGC is the transmission of electricity from generating companies to sales organizations. Roughly speaking, transportation of electricity.

Learn more about the electricity market: “How the electricity market works in Russia”

There are currently 8 public IDGCs operating in Russia: IDGC of Volga, IDGC of Center and Volga Region, IDGC of the South, IDGC of Center, IDGC of the North-West, IDGC of the Urals, IDGC of Siberia and IDGC of the North Caucasus.

From the point of view of attractiveness for investors, IDGCs differ quite greatly from each other. We will try to choose the best investment option.

Note: Among the public subsidiaries of Rosseti, the securities of Lenenergo, MOESK, Kubanenergo, TRK, and Dagestan Energy Sales Company are also traded on the market.

Debts

Let's start our consideration of IDGCs with the size of the debt load. Since the activities of distribution companies are strategically important for the country as a whole, large debts are unlikely to cause bankruptcy of companies, because the state cannot allow the population to lose electricity, but interest payments on loans can “eat up” a significant part of the net profit, which will reduce potential dividends.

IDGC of Volga has the lowest indicator both in absolute terms and in terms of Net debt/EBITDA. The absence of significant financial expenses on loans increases the company's dividend potential. In terms of debts, IDGC of CPU and IDGC of the Urals look good.

The situation is much worse for IDGC of the South and IDGC of Siberia, which spend a significant portion of their profits on loan servicing costs. Moreover, both companies' debt burden in absolute terms has been increasing recently.

Nevertheless, for IDGC of Siberia the situation may improve in the future - the company’s investment program included raising borrowed funds until 2021, when the company raised 5.3 billion rubles. There are no plans to attract loans to finance the investment program in 2021.

IDGC of the South took a different route - the company is raising capital to pay off debts through an additional issue of shares. The result of the placement will be visible from the report for the second quarter of 2021. The company is expected to raise about 2 billion rubles. from the parent Rosseti. The additional issue involves the placement of 19,963.6 million shares, which corresponds to 28.9% of the capital. Dilution will negatively impact Earnings per Share (EPS). In addition, the expected volume of borrowing is only about 8% of net debt, so we cannot yet count on a significant reduction in the debt burden.

Separately, it is worth mentioning IDGC of the North Caucasus. The company has been consistently increasing losses over the past 3 years, and gross profit and EBITDA are also negative. Due to constant losses, the company does not pay dividends. From the point of view of attractiveness for investors, this IDGC is not of interest in the current conditions, and will not be considered in the future.

Favorites: IDGC of Volga, IDGC of CPU, IDGC of the Urals Outsiders: IDGC of the South, IDGC of Siberia

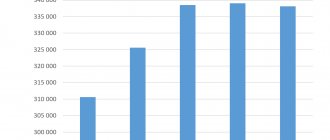

Net profit

Among distribution companies, only 5 companies generated sustainable profits over the past 3 years. The best results in 2018 were demonstrated by IDGC of Center and Volga Region; IDGC of Volga and IDGC of Center closed the year with noticeable profits.

In terms of Net Profitability (EPS/P), the leaders are IDGC of Central Asia, IDGC of Volga and IDGC of Center. IDGC of Volga's ratio has been declining over the past three years, which is due to an increase in quotations without a significant increase in profits. The same is true for IDGC of CPU in 2021.

IDGC of the North-West looks worse due to a loss in 2021 and IDGC of the South with a loss in 2021.

The net profit of IDGC of the South in 2021 was affected by the payment of fines and penalties in favor of FGC UES, the Astrakhan Sales Company and the settlement of legal disputes with energy sales companies, which were of a one-time nature. It should also be noted that in 2019, the additional issue of the distribution company will have a negative impact on the EPS/P indicator.

The negative financial result of IDGC SZ is associated with the bankruptcy of a large client - the Arkhangelsk Sales Company. Energy supply companies pay distribution companies (IDGCs) for transmitting electricity. Since several sales companies have gone bankrupt in recent years, some IDGCs had to create reserves for receivables from these organizations, which led to large one-time expenses that were reflected in net profit. In recent years, this has affected IDGC of the Urals (2018), IDGC SZ (2017), IDGC of Siberia (2018), IDGC Central Plant (2017).

Separately, it is worth mentioning IDGC of the Urals, which in 2021 experienced the bankruptcy of 3 sales companies in its area of operation: Chelyabenergosbyt, Roskommunenergo and NUESK. The total amount of their debt is about 5 billion rubles. The creation of reserves led to a significant decrease in the net profit of IDGC of Urals in 2021. However, after the resolution of this situation in the distribution company’s operating area, there are expectations for the restoration of the company’s financial results in 2021 in the absence of such write-offs.

An important factor is Rosseti's intention to change the distribution of cross-subsidies between users of regional and backbone networks. Cross-subsidization means that lower residential tariffs are partially paid by industrial consumers. The essence of the project is to reduce IDGC tariffs for small and medium-sized businesses, while increasing electricity payments to large consumers connected to the main networks of FGC UES.

According to Deputy General Director of Rosseti Pavel Grebtsov, this measure could lead to a reduction in IDGC tariffs by an average of 6%. Large losses will be suffered by those distribution companies in whose areas of operation large industrial enterprises are concentrated. These are IDGC of Siberia, IDGC SZ and IDGC of Center. FGC UES, which manages the backbone networks, can benefit from such a measure.

Favorites: IDGC of CPU, IDGC of Volga, IDGC of Center Outsiders: IDGC of Siberia, IDGC of the South

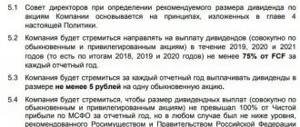

Dividends

Like almost all companies in the electric power sector of the Russian Federation, IDGCs provide value to shareholders mainly through the payment of dividends. The dividend policy of Rosseti and its subsidiaries is uniform and assumes 50% of net profit from the larger amount, depending on the IFRS or RAS standard after adjustments.

At the end of 2021, the highest dividend yield - 14% - was provided by IDGC of Volga, slightly less - by IDGC of Central Asia. Among the outsiders are IDGC of Siberia and IDGC of the Urals.

A significant reduction in dividends of IDGC of Urals is associated with a drop in net profit in 2021. In the absence of such one-time write-offs in 2019, dividend yield may begin to recover.

It is difficult to expect pronounced positive dynamics for IDGC of Siberia, given the high debt burden and a significant share of unreliable accounts receivable.

Favorites: IDGC of Volga, IDGC CP Outsiders: IDGC of Siberia

Investment program

The investment program has a significant impact on the net profit of IDGCs, and, consequently, on their dividends. To maintain electrical networks in good condition and expand power supply coverage, distribution companies spend large sums on capital expenditures.