Polymetal dividends in 2021

The Board of Directors of Polymetal recommended paying $0.89 per share of the company as final dividends for 2020.

The closing date of the register of shareholders is May 7, 2021, therefore, taking into account the T+2 trading mode, the last day for purchasing for dividends is May 5. On May 6, shares can already be sold - you will be included in the company's shareholder register.

At the same time, the dividend payment date itself is set for May 28. Dividends can be paid in rubles or dollars. If dividends are paid in rubles, the exchange rate for them will be determined on May 14.

Polymetal shares are traded on the Moscow Exchange under the ticker POLY.

The current price of Polymetal shares is 1,633 rubles. If we recalculate dividends at the current rate, the payment in rubles will be 67.24 rubles, which gives a dividend yield of about 4.11%.

Also in 2021, Polymetal will pay dividends based on the results of the 1st half of 2021. The profitability of this payment will depend on the company's profits this year. But given that the price of gold has fallen to $1,776 per ounce, and the cost of gold production will once again increase, I do not think that the dividends will be as large. For example, analysts at Income predict dividends at 44.88 rubles per share.

Results of 2021

2020 was a successful year for Polymetal, as for all other gold miners.

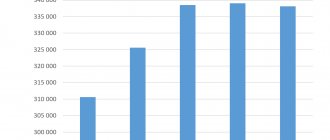

Thus, gold production increased to 1,402 tons compared to 1,316 tons a year earlier. The average selling price of gold increased from $1,411 per ounce to $1,792. Add the fall in the ruble exchange rate and you get a significant increase in revenue.

And here’s another interesting article: Review of “eternal portfolios” TRUR, TUSD and TEUR from Tinkoff Investments

Revenue increased to 206.7 billion rubles (145.2 billion rubles in 2019), net profit almost doubled, to 78.3 billion rubles against 37.9 billion rubles in 2021.

The cost of gold mining has increased to $874 per ounce ($866 a year earlier), but is still quite low and gives a good margin (one ounce is mined for $866 and sold for $1,792). Polymetal's net profitability is 37.9%.

Earnings per share (EPS) rose to $166.6 ($80.6 in 2021).

In general, all the prerequisites for good dividends are there.

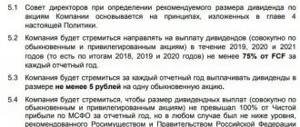

Dividend policy

In 2021, Polymetal adopted a new dividend policy. Firstly, dividends will be paid twice a year (based on half-year results). The payment will be 50% of adjusted net profit for the half year, provided that the net debt/adjusted EBITDA ratio is less than 2.5 (currently 0.82).

Secondly, the final dividend (for the 2nd half of the year) can be increased to 100% of FCF, provided that FCF is more than 50% of adjusted net profit and no necessary expenses arise.

Thirdly, the company will refuse special dividends (previously the Board of Directors could recommend paying retained earnings at the end of the year).

Buy shares of Polymetal Polymetal Int

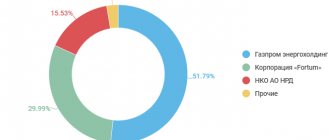

Purchasing Polymetal shares makes it possible to get a “piece” of the Russian metallurgical company, which is a leader in silver production and ranks third in gold mining. Shares of Polymetal International plc are traded on the Moscow, Kazakhstan and London stock exchanges and are included in the MICEX index.

Issuer Description

- Polymetal is a domestic metallurgical enterprise that mines minerals and conducts geological exploration in five regions of Russia - Karelia, Magadan Region, Khabarovsk Territory, Sverdlovsk Region and Chukotka, as well as in Kazakhstan.

- The IPO was held in 2007 on the London Stock Exchange, RTS and MICEX. In 2010, Polymetal International Plc, a holding company for Polymetal OJSC, was registered on the island of Jersey in the UK.

- Polymetal mines silver, gold and copper (in the near future it plans to mine platinum group metals in Karelia).

There are various factors for the rise and fall of stocks. Their price strongly depends on the market situation, external conditions, dynamics, and the emergence of new deposits. Also, the cost of securities depends on:

- Status of quarterly and annual reports.

- Level of development of competitors.

- Speculative actions of large investors.

Follow market quotes using charts, study news feeds, rely on financial indicators and market news to figure out whether it is worth buying or selling securities. You can also listen to the recommendations of brokers for this. Proposals that offer good fundamentals usually deserve increased attention: increased net income and revenue, improved profitability, reduced or no debt obligations, etc.

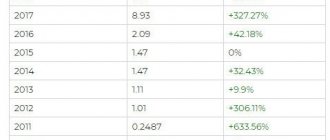

Dividend payments by ticker JE00B6T5S470

Dividends are the share of profits that the issuer distributes among shareholders. Since 2021, the company has been paying dividends twice a year.

If you intend to invest or are already doing so, follow up-to-date information and, before making a transaction, delve into the nuances and understand whether this or that option is worthy of attention. On the website of the financial supermarket banki.ru, you can not only study detailed information about investments, study forecasts, but also choose a broker, view dividend schedules and buy the selected product online.

Polymetal. Record results

Polymetal published preliminary financial results for the second half of the year and the full year 2020.

Key indicators for the second half of the year:

— Revenue: $1,730 million (+33% y/y; +52% p/p) — Adjusted EBITDA: $1,070 million (+59% y/y; +73% p/p) — Adjusted net profit: $705 million (+ 114% y/y; +85% p/p) — FCF: $555 million (2 times growth y/y; 10 times growth p/p) — Net debt/EBITDA: 0.8x (1.4x at the end 2021)

Comment by Dmitry Puchkarev, BCS World of Investments:

“Polymetal published strong financial results that were in line with expectations. The report's impact on quotes may be neutral. The strong dynamics of key financial indicators is due to rising prices for gold and silver in the second half of the year. The dividends noted in the press release correspond to the company's updated dividend policy.

The most important point in Polymetal's case remains gold prices. At the beginning of 2021, the price of the precious metal is declining, which may put pressure on the financial performance of the first half of the year. At the moment, there are no obvious reasons for the rise in gold prices, so Polymetal shares may lag behind market dynamics in the medium term. At the same time, the securities remain interesting as a protective asset for diversifying an investment portfolio.”

Polymetal Chief Executive Officer Vitaly Nesis:

“Polymetal delivered record profits in 2021 amid a challenging global environment. Strong financial results, favorable metals price conditions and consistently low costs contributed to significant increases in cash flow and dividends, as well as significant reductions in debt levels. We have achieved zero fatal injuries and minimized the impact of the coronavirus pandemic on our employees, communities and operations.”

More details

Revenue for 2021 increased by 28% and amounted to $2,865 million. Average selling prices of gold and silver were in line with market dynamics and increased by 27%. Gold sales totaled 1,392 thousand ounces, up 2% year-on-year, while silver sales decreased 13% to 19.3 million ounces, in line with production trends. Polymetal's revenue in the second half of the year amounted to $1,730 million (+33% y/y; +52% h/p).

The Group's cash costs for 2021 were $638 per gold equivalent ounce, down 3% year-on-year, 2% below the lower end of cost guidance of $650-700 per ounce. The decrease occurred as a result of the weakening of the Russian ruble and the Kazakh tenge, which offset additional costs associated with the coronavirus pandemic and an increase in mineral extraction tax payments against the backdrop of an increase in metal prices.

Total cash costs in 2021 were virtually unchanged from 2021 at $874/GE oz, up 1% from last year but remaining within the $850-900/GE oz forecast for 2021 due to higher volumes of stripping work and renewal of the mining equipment fleet against the backdrop of high metal prices.

Adjusted EBITDA for the year increased by 57%, reaching a record value of $1,686 million, driven by higher production volumes, higher metal prices and lower costs. Adjusted EBITDA margin increased by 11 percentage points. and reached an absolute maximum of 59% (48% in 2021). Adjusted EBITDA for the second half of the year amounted to 1,070 million (+59% y/y; +73% h/p).

Net income for 2021 was a record $1,086 million ($483 million in 2021), with core earnings per share of $2.30 ($1.02 per share in 2021) driven by higher operating income. Adjusted net income increased by 82% to $1,072 million ($586 million in 2021). Adjusted net profit for the second half of the year reached 705 million (+114% y/y; +85% hy/p).

Net debt decreased to $1,351 million ($1,479 million at 31 December 2019) and the ratio to adjusted EBITDA was 0.80x (1.38x in 2021), significantly below the Group's target of 1.5x.

In 2021, the company generated significant free cash flow of $610 million ($256 million in 2021) driven by net cash inflow from operating activities of $1,192 million ($696 million in 2021).

Dividends

According to the updated dividend policy, the Board of Directors proposed to pay a final dividend of $0.89 per share (about $419 million). This includes $0.74 per share, representing 50% of H2 2021 adjusted net income, and an additional discretionary dividend of $0.15 per share, increasing the declared dividend to a maximum payout of 100% of free cash flow. for 2021 against the background of a stable financial position and excellent operating results of the Company. This brings the total amount of dividends declared for the period to $608 million ($385 million in 2021) or $1.29 per share, up 57% from $0.82 per share in 2019.

Forecast for 2021

The Company confirms its current production guidance of 1.5 and 1.6 million gold equivalent ounces for 2021 and 2022. respectively. Production will be higher in the second half of the year due to the seasonality factor.

Cash costs in 2021 are expected to average $700-$750/GE oz., with total cash costs expected to average $925-$975/GE oz. The projected increase in costs compared to 2021 is due to the strengthening of the ruble and the Kazakh tenge, higher diesel prices in the Russian market, as well as wage growth in the mining industry exceeding consumer price growth, and the impact of measures related to the coronavirus pandemic.

The priority remains to deliver projects on time. The Company is willing to incur reasonable additional costs to avoid falling behind schedule. Actual costs will depend on movements in ruble/US dollar exchange rates and oil prices.

BCS World of Investments

Taxation of Polymetal dividends

The Polymetal company is registered on the island. Jersey, offshore. Consequently, the company itself does not pay tax on dividends, i.e. you will receive the full amount.

And here’s another interesting article: LSR dividends in 2021

However, we live in Russia and must pay tax on dividends as tax residents of our country at a rate of 13%. It will be necessary to declare tax at a rate of 13% in terms of rubles on the date of actual receipt of taxes into the account and taking into account the date of payment of dividends.

If you want to avoid difficulties with declaring Polymetal dividends, it is better to sell shares shortly before the cutoff (i.e. before May 7, 2021), and then buy them back after the dividend gap.

True, in the course of such a feint with your ears, you will lose the right to the benefit for long-term share ownership (LDW).

So decide for yourself - LDV or tax declaration according to all the rules.

Overall, I think Polymetal is an interesting stock if you want to hedge against stock market declines, as it has a negative beta (due to gold moving counter to the stock). But as a hedge, it is still better to take gold - in the form of an ETF, since additional risks are added to the shares of gold miners, in addition to changes in the price of the precious metal, for example, corporate conflicts (see the “case” of Petropavlovsk). In addition, there is a certain problem with dividends.

Will you buy Polymetal for dividends?

- Better to take ETF 100%, 2 votes

2 votes 100%2 votes - 100% of all votes

- Yes, sure! 0%, 0 votes

0 votes

0 votes - 0% of all votes

- I'd rather go and buy Polyus 0%, 0 votes

0 votes

0 votes - 0% of all votes

- I will buy, but not for the sake of dividends 0%, 0 votes

0 votes

0 votes - 0% of all votes

- Will buy and sell before dividends 0%, 0 votes

0 votes

0 votes - 0% of all votes

- Bought and holding 0%, 0 votes

0 votes

0 votes - 0% of all votes

- And I shortened it! 0%, 0 votes

0 votes

0 votes - 0% of all votes

Total votes: 2

17.04.2021

So I prefer either Polyus shares or gold. But this is my opinion, and it is not necessarily correct. What do you think about Polymetal's dividends in 2021? Write in the comments! Good luck, and may the money be with you!

Rate this article

[Total votes: 5 Average rating: 5]