Author: Olga PLOTONOVA for Yango. pro

Rosneft is the largest borrower on the Russian domestic bond market. But the S&P agency did not raise its rating in February, when it revised all ratings following the increase in the country's rating. Let's look at how this affected Rosneft bonds and why this is important for their buyers.

READ IN THE ARTICLE: ✔ Rosneft remained with BB– ✔ What is S&P dissatisfied with? ✔ What does this all mean? ✔ Large supply of securities ✔ Banks love Rosneft ✔ What to do?

© When using site materials and quoting - a link with a URL is required

Rosneft remained with BB–

International rating agency Standard and Poors (S&P)

(one of the three most authoritative in the world) on February 23, 2018,

upgraded Russia’s sovereign rating

in foreign currency to

investment grade

BBB–.

This means that the agency saw improvements in the economy, and accordingly, the country’s credit obligations - loans, Eurobonds

- became more reliable

As a rule, following a change in a country’s rating in one direction or another, agencies change the ratings of companies. First of all, those associated with the state. On February 27, S&P announced an increase in the credit rating of a number of companies, Gazprom, Russian Railways, and RusHydro to investment grade. But Rosneft retained its previous non-investment rating of BB-

What's wrong with S&P?

S&P analyst Alexander Gryaznov explained that the agency’s decision not to upgrade the rating is due to the fact that Rosneft has a large short-term debt

(2.2 trillion rubles at the end of 2021) and depends on

the refinancing of loans

from local banks.

Rosneft does not want to borrow at high rates and continues to accumulate short-term debt. Banks are not very capable of giving Rosneft as much money as it needs - they are too small, and the state has not provided support for debt refinancing

, which casts doubt on the strength of ties between Rosneft and the state, the agency believes

S&P believes that the government does not interfere too much in the activities of the state-owned company, and Rosneft management has sufficient autonomy, which is also a negative factor for the rating

Finally, S&P is confused by Rosneft's transactions abroad, which have a bad impact on cash flow

companies—acquisition of the Essar Oil refinery in India for $3.9 billion, advance payments in Kurdistan, activities in Venezuela. These transactions, according to analysts, are not operationally profitable for Rosneft at the moment. “There are no signs that Rosneft will moderate its irrational spending,” wrote Sberbank CIB analyst Alex Fak in November 2021. Even sanctions could not stop Rosneft from making foreign purchases, in which it behaves “indiscriminately,” he noted. Fak calculated that since the purchase of TNK-BP in 2013, Rosneft has already spent $22 billion on acquisitions, and invested another $8 billion in Venezuela

True, the rating outlook remains “positive” and reflects the possibility of an increase in Rosneft’s ratings if “the government demonstrates its readiness to provide the company with direct or indirect support in managing liquidity and improving the capital structure,” the agency’s report says

Gift for investment in Rosneft bonds

Maintaining the junk rating was, oddly enough, a gift for investors. “We should take advantage of the fact that Rosneft’s rating was not raised,” says Denis Kuchkin, co-founder of the Yango service.

For most, the rating means reduced investor confidence, increased profitability

(the lower the rating, the more expensive it is to borrow), the security becomes an object of speculation - investors try to quickly buy and sell it just as quickly, but at a higher price.

This all increases the premium (profit) for investors

up to a certain point. The difference in interest rates on bonds of companies with ratings ВВВ– and ВВ– can be 0.7–1.5 percentage points

According to Kuchkin, due to the low rating, Rosneft securities are traded at a premium in terms of yield to comparable securities, for example, Transneft bonds. The premium to them is 0.10–0.15 p.p. per annum

Expert commentary

“We note that many large Russian OSGs (state-related organizations) are subject to international financial sanctions, but do not have similar problems. Some of these OSGs had previously issued infrastructure bonds with government assistance and had access to Sovereign Wealth Fund funds, allowing them to finance large strategic investments. The government did not provide Rosneft with access to such instruments.” “As far as we understand, the government is tolerant of Rosneft’s growing short-term debt, which, given the size of the company, also creates risks for the entire Russian banking system.” “We assess Rosneft’s liquidity indicators as “less than adequate,” which reflects the ratio of liquidity sources to liquidity needs at a level below 1x. Our assessment is mainly driven by the reduction in cash on the company's balance sheet and the accumulation of short-term debt obligations maturing.

S&P rating report

Rosneft NK stock price history for 2021

A bond is a security that confirms the fact that the investor (one participant) has provided the issuer (another participant who issued the bonds) with a loan for a certain period. There are government and corporate bonds. In the first case, the state takes the debt, and in the second - the company. This is why bonds are called debt securities. The state and companies issue them in order to finance their projects or repay existing loans using the funds raised. This costs them much less than taking out a loan from a financial institution. If a bank provides a loan at 20%, then the issuer can pay only 10% on bonds.

Among investors, OFZs - federal loan bonds - are considered an extremely reliable asset, which is quite reasonable. After all, these securities are a debt obligation of the state, or more precisely, of the Ministry of Finance. Their holder receives profit in the form of interest, which is usually paid every six months. Although the yield of the 2021 Russian government bond is small, the coupon payment still exceeds the bank deposit, which is why it is more profitable. OFZ can be purchased by anyone, including professional stock market participants and individuals.

Federal loan bonds according to the type of coupon payments are divided into:

- Papers with a permanent coupon. They are designated OFZ-PD. The coupon value of these bonds is constant throughout the entire period of their circulation.

- With a fixed coupon - OFZ-FD. Their profitability may vary, but is always known in advance. For example, in the first years after issue, the coupon interest may be 7% of the face value, and then the issuer has the opportunity to reduce it to 5%.

- With variable coupon. Payments on OFZ-PK bonds are tied to a specific interest rate, such as RUONIA (Interbank Overnight Lending Rate) or official inflation rates. The yield in this case is calculated as the sum of the RUONIA rate and some coupon rate. Therefore, for such OFZs, only the value of the current coupon is known, and each subsequent coupon is determined based on the average value of RUONIA for the last six months. Consequently, if rates on the financial market rise, then the coupon yield also rises. If rates fall, then profitability decreases.

By face value, OFZs are divided into two types:

- With nominal depreciation - OFZ-AD. The face value of these securities is repaid in installments rather than at one time. The payment schedule is known in advance. The nominal value can be repaid in equal or unequal installments. The periods between payments may be the same or different. It is better to buy such OFZs when there is a need for a gradual return of capital.

- With nominal indexation - OFZ-IN. Now you can choose bonds of this type from two issues: OFZ 52001-IN and OFZ 52002-IN. They have a yield of 2.5%.

The Russian Ministry of Finance also issues so-called OFZ-n people's bonds. They are issued for three years and have a higher rate than ordinary federal loan securities. Now their yield is 8.5%. The peculiarity of this product is that it is not marketable. People's bonds can be purchased only in four banks - Sberbank, VTB, Promsvyazbank, Post Bank. OFZ-n can be sold only to the financial institution from which they were purchased, and only at the purchase price.

Experts note that bonds have risen in price significantly in 2021. This is confirmed by the composite bond market index RUABICP of the Moscow Exchange, calculated using the net price method (excluding cash income, coupons and their capitalization), which has grown by 2.6% since the beginning of the year. The OFZ has a great merit in this. Their total income index reached 11.03%. If nothing changes, then by the end of the year, OFZ owners will be able to receive 15–17% per annum. Therefore, it is worth choosing bonds for investment from this category. For example, OFZ 25083 with a coupon yield of 7.05% and maturity at the end of 2021. At the moment, the bond's price is below par, so part of its total return is a discount.

Both bank deposits and bonds pay interest. Therefore, for an investor, buying a debt paper or opening a bank account is essentially the same process. He has the right to expect regular income from these investments. Only when an investor buys a bond will he immediately provide a loan to a company. If he places money on deposit, he will do it through an intermediary. After all, it is clear that the bank will not just keep money in its accounts. He will lend them to other citizens or companies, but at a higher interest rate than the one he pays to the investor.

In recent years, the deposit rate has been constantly decreasing, while bond yields remain quite high. According to experts, interest payments in rubles on bonds are 1–2.5 percentage points higher than on time bank deposits. If we compare bonds with deposits from which you can withdraw part of the funds or, conversely, replenish them, the yield calculator shows an even greater difference - up to 4 percentage points.

For example, by opening a deposit in Sberbank for 3 years, you can get a maximum of 6.81% per annum, and this is with a deposit size of 700 thousand rubles, taking into account the ban on early withdrawal of funds and capitalization of interest. By purchasing three-year bonds of the same bank, you can get an income of 9.71%. You can sell your portfolio or any part of it without losing the accrued coupon and at any time.

Now in 2020-2021 it is profitable to buy bonds with longer maturities, since bank rates will most likely decrease. And as you know, the yield of debt securities strongly depends on the Central Bank rate. But it should be remembered that investments in bonds, unlike deposits, are not protected by the state. If the Central Bank revokes the license of a bank, the Deposit Insurance Agency will return up to 1.4 million rubles to the deposit owner, but security holders do not have this opportunity.

The risks of investing in bonds can be managed through a broadly diversified investment portfolio. Since high-yield corporate and municipal securities are somewhat inferior to deposits in terms of risk level, you should not ignore those assets that are guaranteed by the state itself.

We are talking about federal loan bonds (OFZ). In terms of risk level, they are even more reliable than deposits. Therefore, when you need to distribute capital between several types of securities in order to assemble a portfolio with a good monthly income and minimal risk, it is better to buy bonds issued by the state, along with corporate bonds of the largest companies.

Bonds have the following advantages compared to a bank deposit:

- High profitability. Given comparable investment periods, debt securities can bring much higher returns than the most attractive deposit rates. Of course, everything depends on the reliability of the issuer and the risk of default on the bonds, but in many cases the bank's securities have a higher yield to maturity than the rates on a deposit with the same bank.

- Liquidity. Bonds can be quickly bought or sold at the average market value while maintaining the interest accumulated during the period of ownership. It will not be possible to withdraw your money and close your bank deposit without losing interest.

- Wide choose. There are many types of bonds. Consequently, the investor has the opportunity to assemble his own investment portfolio, optimal in terms of profitability and risk.

One of the disadvantages is that bonds are a rather complex investment instrument. To understand it, you will need certain knowledge and practice. In addition, a private person cannot independently participate in trading on the stock exchange. To do this, he will need an intermediary - a broker, with whom he should enter into an agreement for the provision of services.

The easiest way is through a foreign broker. Interactive Brokers and Exante provide access to a full range of US bonds, including municipal and corporate bonds.

A Russian broker can also provide access to Western markets, but this opportunity is only available to qualified investors.

To confirm this status, you need to own securities worth at least 6,000,000 rubles, have at least 2 years of experience working with exchange-traded assets, or receive an economics education from one of the accredited universities. For details on trading foreign bonds, please contact your broker's technical support.

Large offer of Rosneft bonds

There is a large supply of Rosneft securities on the market - after the introduction of sanctions, it cannot borrow on Western markets and is forced to raise funds from local investors. Since the beginning of the year alone, the company has conducted three placements. At the beginning of February, it attracted 50 billion rubles with a yield of 7.64% and a coupon of 7.5%. At the beginning of March - another 20 billion rubles, but the coupon was already 7.3%. And there was another small placement at the end of March, but its volume was less than 3 billion rubles - Rosneft did it in the expectation that it would receive a lot of securities under the offer, but this did not happen.

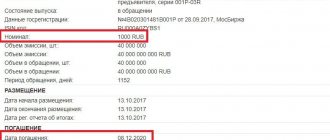

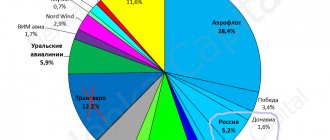

Today there are 7 classic bond issues

Rosneft for 90 billion rubles and 39 issues of exchange-traded bonds for 2 trillion 871 billion rubles. In 2021 alone, it is estimated that the company borrowed about 1 trillion rubles.

Rosneft is known for its loans, which greatly influenced the Russian money market. On December 11, 2014, the company conducted a private placement of bonds

— collected 625 billion rubles in an hour among a limited number of banks.

After this, “Black Tuesday”

(December 16), when the dollar at auction reached 80 rubles, the euro reached 100 rubles.

Market participants were afraid that the company would buy up all the currency. Later it became known that she borrowed from the Central Bank, completing the transaction through the FC Otkritie bank. At the end of January 2015, Rosneft again raised 600 billion rubles in an “opaque” way. All these actions of the company coincided with periods of repayment of foreign currency loans

abroad.

According to S&P analysts, it is now unlikely that such a scenario will repeat itself, since the Bank of Russia has practically reduced to zero the possibility of lending to Rosneft through a currency repo.

Bonds of NK Rosneft region 05 - price, rate and description

There are several types of bonds with the OFZ ticker, starting in 1995.

The main typology of OFZ is as follows:

- Federal loan bonds with a variable coupon or OFZ-PK. These securities began to be issued in 1995, and after the default of 1998, the issue was suspended. The coupon was paid once every six months. The value of the coupon rate changed and was determined by the weighted average yield on government short-term bonds over the last 4 sessions (trading). At the end of 2014, the issue of these bonds was resumed.

- Federal loan bonds with constant income or OFZ-PD. They began issuing them in 1998. The coupon was paid once a year and was fixed for the entire circulation period.

- Federal fixed income bonds OFZ-FD. They began issuing them in 1999. They were issued to owners of state bonds and OFZ-PK, frozen in 1998. The circulation period is 4-5 years. The coupon was paid quarterly. The rate decreased annually from 30% in the first year to 10% at the end of the term.

- Federal loan bonds with OFZ-AD debt amortization. Periodic repayment of the principal amount of the debt.

- Federal loan bonds with indexed par value OFZ-IN. Issued since 2015. The nominal value of the bonds is indexed monthly for the coming month in accordance with the consumer price index for goods and services in the Russian Federation.

Based on the type of coupon payments, all OFZs can be divided into 4 groups:

- with constant coupon payments that do not change throughout the entire validity period of the security;

- with a variable when the issuer, i.e. the state can “link” the percentage of payments to inflation for a certain period;

- a zero-coupon bond, when no interest payments are made, but the price of placing the bonds among investors is significantly lower than the par value (usually by 20 or even 30%);

- with an indexed coupon, which is indexed, for example, by the amount of inflation, or when the coupon is “tied” to the price of oil.

"People's bonds", like other bonds, have their advantages compared to other types of investment instruments. These advantages include, first of all:

- Reliability, since the guarantor that the debt and interest on it will be paid on time and in full is the state, its state budget, and gold and foreign exchange reserves.

- Liquidity. OFZ is the most liquid security, since it can always be bought or sold. Moreover, this can be done not only where there is a free market - on the stock exchange, but to private or legal entities (in the form of a civil purchase/sale agreement).

- The interest income of OFZ with constant income is 7-8% per annum, despite its small value, it is still 10-20% higher than interest on bank deposits.

- Ease of ownership, use and disposal. It can be stored both in paper form, for example, in a safe deposit box, and electronically - in the form of digital records in the National Depository Center. You can manage your bond portfolio remotely using special programs and applications that every bank or broker operating in financial markets has.

In addition, OFZ as a financial asset can be inherited or given as a gift.

OFZs, like many similar securities, provide good opportunities to earn money. The most attractive thing is the constant, guaranteed payment of the coupon rate or interest.

The interest income received can be reinvested or invested every 6 months in:

- to purchase new bonds, increasing your interest income;

- in the acquisition of shares of highly reliable issuers (companies) to receive income from the growth in the value of shares and dividend payments received on them;

- accumulation on bank deposits.

The nominal OFZ interest rate or its coupon income is expressed in % per annum. However, in reality there is a concept called the “effective interest rate”. This rate takes into account the fact that interest earned on income in the first year is reinvested in the second year, etc.

Those. capitalization of investments occurs through the accrual of interest on interest. This rate is calculated using the well-known compound interest formula.

Expert commentary: banks love Rosneft

The demand for papers is even greater. This is evidenced by the fact that in early February the company was going to place securities

for 15 billion rubles, and placed it for 50 billion rubles.

“In the next two to three months, investor demand

will concentrate in Rosneft bonds,” says Kuchkin. “Naturally, investors are now trying to speculate on the paper and sell it at a higher price.” However, this situation will last no more than a quarter. Gradually, the spreads (difference in yield) on Rosneft bonds and other first-tier securities will narrow.

Why? Firstly, a new offer of ruble bonds from the oil company is not expected. Secondly, there is a liquidity surplus among banks in the market - at the beginning of 2021 it was estimated at 3.5 trillion rubles. Liquidity surplus

means that banks have too much money and they need to put it somewhere. And considering that it was formed largely by banks undergoing rehabilitation, which received very cheap government funds (at almost 0% per annum), buying bonds with a yield of 7.5% looks very attractive for them.

According to S&P estimates, this year banks undergoing reorganization by the Bank of Russia will receive about 1 trillion rubles. Rosneft is a great opportunity to invest this money. “Now among players with great liquidity there is competition in the market for stable borrowers, and if Rosneft were to offer bonds worth 200 billion rubles, the market would buy everything,” says Kuchkin

Accordingly, the demand for paper will increase, while it is possible that large investor banks will purchase large issues for transactions with the Central Bank or to hold on their balance sheets until they receive a coupon income or an offer, then a shortage of Rosneft bonds will form for small investors, and it may be sold so much above par that the effective yield on sale begins to decline.

New taxes on bonds in 2021. What is important to know

As I said, federal bonds can have a fixed or time-varying coupon. Government bonds with a constant coupon have a predetermined rate that remains unchanged throughout the entire circulation period of the instrument. Such bonds are extremely relevant now, since the Central Bank of the Russian Federation has repeatedly spoken about the imminent resumption of the process of reducing market rates.

Federal loan securities with variable coupons change their yield several times during their circulation period. Its indicators are tied to the RUONIA index (Ruble Overnight Index Average), and it, in turn, strongly correlates with the key rate of the Central Bank of the Russian Federation. This type of bond is well suited for individuals, since there is no need to delve into economic processes and predict the dynamics of rates.

There is also such a type of federal loan securities as zero-coupon bonds. But private investors and individuals practically do not own such instruments, and few new bonds of this type are being issued today.

The face value of a federal loan bond may be amortized or indexed. In the first case, part of the nominal value is returned to the investor along with regular payments. In the indexation option, the nominal component of the bond is tied to inflation indicators. If the Ministry of Finance in 2021 issued OFZ-IN with a denomination of 1,000 rubles, and inflation for the reporting year (2018) was recorded at around 5%, then in 2021 its denomination will already be 1,050 rubles.

Specific types of federal loan instruments have their pros and cons. I'll tell you about the general positive aspects. If you compare the rates of OFZ and deposits, it becomes clear that the profitability of the former is higher. In addition, the level of reliability of bonds is higher.

Bonds can be bought and sold on the secondary market without loss of return for the period. I’ll make a reservation that this point does not apply to people’s OFZs, which were actively offered for purchase to individuals through state banks.

State bonds have few downsides, although I note that they are far below corporate bonds in terms of profitability.

Bonds in a general definition are special debt securities that are issued (issued) by a company or state in order to attract money from investors (creditors). They are needed to implement some investment projects, as well as to cover the state budget deficit.

The person who bought the bonds is the debt holder or creditor. For the fact that he purchased bonds, i.e. has actually lent money to the person who issued the bond, the issuer is obligated to pay interest on the debt. Plus at the end of the term - the entire principal debt.

Generally, interest is paid on a bond over the life of the bond. Interest is paid periodically - every month, quarter or once a year. Upon expiration of the bond, the creditor receives from the debtor the entire amount of the debt and interest for the entire period of the bond.

Until recently, bonds were issued only in paper form. For example, “OFZ - People’s” still have a paper format in order to expand access for individuals to this debt investment instrument.

Currently, most securities, including government and corporate bonds, are electronic. Those. all characteristics and parameters of the security are encoded with a special digital code.

Since the issuer of OFZ is the state (directly represented by the Ministry of Finance of the Russian Federation and the Central Bank of the Russian Federation), by distributing these debt securities, it pursues its specific goals. This:

- replenishment of the state budget by attracting money from private investors;

- obtaining funds for the purchase of foreign currency;

- creating conditions under which the base of retail investors expands at the expense of individuals. Thus, the state, in addition to borrowing money, involves a considerable part of ordinary people in the investment process, expanding its social support base.

In addition, the government's issue of bonds is often associated with the task of increasing the money supply in the country's economy, but without using the issue of unsecured money (non-inflationary issue).

Large offer and low rating - “buy” recommendation

High demand and high supply mean that Rosneft bonds can be bought on the market and will not have to pay a premium for low liquidity, which can “kill” all profitability.

Yango recommends paying attention to Rosneft securities, but buying them as long as these two factors remain in effect - a large supply on the market and a low rating. At the same time, private investors should pay attention to issues placed after January 1, 2017

year, since these issues have a favorable

tax regime

- their

coupons are not subject to personal income tax

, which, as you might guess, increases the investor’s income compared to similar issues whose coupons are subject to

personal income tax

.

TOP ↑