Almost all of us have heard about the pound sterling. However, most people's knowledge of it is very superficial - “some kind of English currency.” Few people know where they can pay in pounds, how much this currency costs in rubles, what its history is, and what the banknotes look like. This will be discussed in our article.

Britain - Home of the Pound Sterling

Pound sterling to Russian ruble exchange rate

The British coin remains one of the most expensive in the world. Such an unshakable high position is ensured due to many factors, despite the instability of the global economy as a whole. As of today, the exchange rate of the pound sterling to the Russian ruble has stopped at 95.3 rubles per 1 Pound according to the information tabloids of the Central Bank of the Russian Federation.

Despite the slight weakening of the British currency due to rising prices in the Albion real estate market, demand for the pound is not falling. This trend is also stimulated by a reduction in the trade balance and an increase in employment in the industrial sector.

Modern times

The United Kingdom suspended the gold standard in 1914 to finance its war effort. The country suffered from high inflation during World War I and was forced to significantly devalue England's currency towards the end of the war.

Winston Churchill returned to the gold standard in 1925 at the pre-war rate.

In 1931 Britain abandoned the gold standard and the pound quickly fell. However, after the United States devalued the dollar in 1933, the British currency rose to its highest value.

A significant drop in the value of the English currency with the outbreak of World War II led the British government to peg the value of the pound to the dollar.

GBP exchange rate to major world currencies

The decreasing or increasing rating of the British currency can be traced from the ratio to the money of other countries. The stable high value of the pound is ensured by the efforts of UK banks and the Monetary Policy Committee aimed at maintaining the position of the national currency in the world market. And this work is independent of external economic and political factors.

The current exchange rate of GBP to the main currencies of the world allows you to verify this. So 1 pound sterling costs:

Euro, € (EUR) 1.239

US dollar, $ (USD) 1.413

Swiss franc, Fr (CHF) 1.348

Japanese yen, ? (JPY) 152.8

British denomination money

UK national banks issue money in the following equivalents:

- 5 pounds;

- 10 pounds;

- 20 pounds;

- And 50 pounds.

There are also 1 and 2 pound coins. There are 1, 2, 5 and 10 pence coins in circulation. When making calculations, you can find pence in 20 and 50 monetary units.

From 2021, the Bank of England issued the first polymer banknotes. Money in the UK depicts significant landmarks, prominent political and cultural figures, people of science and, of course, the Queen.

Factors influencing the pound sterling exchange rate

The position of the British currency is ensured by the high level of development of industrial production and the volume of GDP (Great Britain ranks 7th in the world).

Despite membership in the European Union, the British Isle has maintained a stable economy and the autonomy of the national currency. Therefore, the uncertain economic state of the eurozone countries has almost no impact. However, changes in quotes and prices for exchange-traded energy resources and goods may slightly fluctuate the exchange rate of the pound.

Against this background, effective monetary policy and the efforts of English banks are also included in the main factors influencing the exchange rate of the pound sterling.

What are the reasons for the success of the UK economy and the stability of the pound sterling?

From the point of view of fundamental analysis, the British economy is a highly developed post-industrial, 10th economy in the world in terms of GDP:

- Three quarters of GDP are made up of services - banking, insurance, brokerage, consulting; in second place is the highly productive innovative industry.

- The judicial system is the standard in the world (the institution of justices of the peace has existed for more than 600 years), the decisions of which are taken into effect anywhere in the world.

- Free market competition, the presence of a flexible labor market, qualified personnel, medium and small businesses are placed at the forefront (shares of small firms have long been freely traded on the market), the social interests of the population are respected.

- The UK is one of the top five donors to the EU, for example, in 2021 it paid 13 billion pounds sterling to the EU budget, while receiving 4 billion pounds sterling, which was the main reason for Brexit when the UK left the EU.

- The refinancing rate of the Bank of England for commercial banks is one of the lowest in the EU - only 0.75% in pounds, which has a positive effect on the development of small and medium-sized businesses.

- Exports and imports are almost balanced

- exports $839.2 billion (2018). Main partners for 2021 - USA 18.6%, Germany 8.7%, Netherlands 6.9%, France 6.6%, Ireland 6.0%, China 3.6%, Italy 3.1%, Switzerland 3.1%, Belgium 3.1%.

- imports $876.6 billion (2018). The main partners for the same year are Germany 11.6%, USA 10.9%, Netherlands 7.4%, China 6.8%, France 6.4%, Spain 4.9%, Belgium 4.4%

- External debt is $1.6828 trillion. (2017) or 85.3% of GDP. Among the G7 countries it is in 5th place after Japan 253% of GDP, USA 105.4% of GDP, France 97% of GDP.

For more details, see the article: “The UK economy through the eyes of Masterforex-V traders”

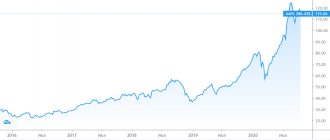

Pound sterling exchange rate dynamics

Among the freely convertible currencies of the world, the pound firmly occupies a leading position and is included in the international payment system Continuous Linked Settlement. This system carries out currency conversion transactions in IMF member countries.

Industrialized countries have gold and foreign exchange reserves, of which British money accounts for more than 5%.

In addition, the dynamics of the pound sterling exchange rate is based on the relationship between market demand and supply based on the results of exchange international currency trading. Now the pound has a “floating exchange rate” index according to the agreement of the IMF countries.

What does the GBP USD exchange rate depend on?

From the point of view of technical analysis, the GBP USD rate is determined by

- Pound and dollar index trends (pound and dollar currency futures are traded on the Chicago Mercantile Exchange CME). The pound and dollar indices are the arithmetic average of correlations for all currency pairs involving them, for example, GBP CHF, EUR USD, GBP AUD, EUR JPY, GBP CAD, EUR NZD, GBP NZD, GBP JPY, EUR CAD, GBP SEK, EUR SEK , GBP NOK, EUR CHF, USD RUB, EUR GBP, EUR AUD, EUR NOK, etc. So,

- if the dollar and pound indices have opposite trends, a bullish or bearish trend will be observed for the GBP USD pair;

- with unidirectional movements of indices, a flat will be visible on the GBP USD pair

- Is the current movement of the pound supported by volumes? trading of major hedge funds and banks of the world.

- If you want to learn to professionally understand the exchange rate of the pound sterling, as well as other world currencies or cryptocurrencies, as well as securities, etc. — come learn from professional traders Masterforex-V using the links at the bottom of the article.

- The Bank of England key rate is 0.25%, compare with the key rates of world central banks:

| Key rates of the Central Banks of the world on Forex currencies | |||||

| A country | Central bank | Currency and its ticker | Key rate of the Central Bank | Date of entry | Financial regulator |

| Australia | RB Australia | Australian dollar (AUD) | 0.1% | 03.11.2020 | ASIC |

| Great Britain | Bank of England | pound sterling (GBP) | 0.1% | 20.03.2020 | FCA |

| Hong Kong | Hong Kong Monetary Authority | Hong Kong dollar (HKD) | 0.86% | 03.2020 | SFC |

| European Union | European Central Bank | euro (EUR) | 0% | 12.03.2020 | MiFID (EU requirements), ACPR and AMF (France), BaFin (Germany), Consob (Italy), CySEC (Cyprus), MFSA (Malta), AFM (Netherlands), FSAEE (Estonia), CMVM (Portugal), FSMA ( Belgium), CNMV (Spain), FCMC (Latvia) |

| Canada | Bank of Canada | Canadian dollar (CAD) | 0.25% | 27.03.2020 | IIROC |

| China | People's Bank of China | Yuan (CNY) | 3.85% | 04.2020 | CSRC, FinCom |

| New Zealand | Reserve Bank of New Zealand | New Zealand dollar (NZD) | 0.25% | 15.03.2020 | FSCL |

| Singapore | Monetary Authority of Singapore | Singapore dollar (SGD) | 1.26% | 01.2020 | M.A.S. |

| USA | US Federal Reserve | US dollar (USD) | 0.25% | 15.03.2020 | NFA, CFTC, SEC |

| Switzerland | National Library of Switzerland | Swiss franc (CHF) | -0.75% | 12.12.2019 | FINMA |

| Japan | Bank of Japan | Japanese yen (JPY) | -0.1% | 16.03.2020 | JFSA |

| Other European currencies | |||||

| Albania | Bank of Albania | Albanian lek (ALL) | 0.5% | 10. 2020 | FSC Albania |

| Belarus | National Library of the Republic of Belarus | Belarusian ruble (BYN) | 7.75% | 01.07.2020 | ARFIN |

| Bulgaria | Bulgarian People's Bank | Bulgarian Lev (BGN) | 0% | 2.01.2020 | FSC Bulgaria |

| Bosnia and Herzegovina | Central Bank of BiH | Convertible Mark (BAM) | 2.88% | 02.2020 | Central Bank of BiH |

| Hungary | National Library of Hungary | Hungarian forint (HUF) | 0.6% | 02.2020 | HFSA Hungary |

| Gibraltar | Treasury of Gibraltar | Gibraltar pound(GIP) | 0.25% | 05.2020 | Treasury of Gibraltar |

| Denmark | National Bank of Denmark | Danish krone (DKK) | -0.6% | 09.2020 | DFSA Denmark |

| Iceland | Central Bank of Iceland | Icelandic krona (ISK) | 2.75% | 03.2020 | FSA Iceland |

| Moldova | National Bank of Moldova | Moldovan leu (MDL) | 2.65% | 06.11.2020 | Licensing Chamber |

| Norway | Norwegian Bank | Norwegian krone (NOK) | 0% | 7.05.2020 | NFSA |

| Poland | National Bank of Poland | Polish zloty (PLN) | 0.1% | 07.2020 | PFSA/KNF |

| Russia | Bank of Russia | Russian ruble (RUB) | 4.25% | 08.2020 | Bank of Russia (until 2013, Federal Financial Markets Service) |

| Romania | National Bank of Romania | Romanian leu (RON) | 1.5% | 05.08.2020 | A.S.F. |

| North Macedonia | People's Bank of the Republic of North Macedonia | Macedonian dinar (MKD) | 2% | 05.2020 | National Library of Macedonia |

| Serbia | People's Bank of Serbia | Serbian dinar (RSD) | 1.25% | 11.2020 | National Library of Serbia |

| Ukraine | National Bank of Ukraine | Ukrainian hryvnia (UAH) | 6% | 12.06.2020 | NCCPF |

| Croatia | Croatian People's Bank | Croatian kuna (HRK) | 2.5% | 09.2020 | HANFA |

| Czech | National Bank of the Czech Republic | Czech crown (CZK) | 0.25% | 11.2020 | CNB |

| Sweden | Bank of Sweden | Swedish krona (SEK) | 0% | 12.02.2020 | (FSA Sweden) |

| Forex currencies in Asia | |||||

| Azerbaijan | Central Bank of the Azerbaijan Republic | Azerbaijani manat (AZN) | 7% | 19.06.2020 | MBA |

| Armenia | Central Bank of the Republic of Armenia | Armenian dram (AMD) | 4.25% | 15.09.2020 | Ministry of Finance |

| Afghanistan | Yes Afghanistan Bank | Afghan Afghani (AFN) | 15% | 03.2020 | Yes Afghanistan Bank |

| Bangladesh | Bangladesh Bank | Bangladeshi Taka (BDT) | 6% | 03.2020 | Bangladesh Bank |

| Bahrain | Central Bank of Bahrain | Bahraini Dinar (BHD) | 1% | 03.2020 | Central Bank of Bahrain |

| Brunei | Brunei Monetary Authority | Brunei dollar (BND) | 5.5% | 03.2020 | UDOB |

| Butane | Royal Monetary Authority of Bhutan | Ngultrum (BTN) | 7.04% | 03.2020 | HLC Bhutan |

| Vietnam | GB of Vietnam | Vietnamese dong (VND) | 5% | 03.2020 | SSC |

| Georgia | National Library of Georgia | Georgian lari (GEL) | 8% | 09.2020 | National Library of Georgia |

| Israel | Bank of Israel | Israeli shekel (ILS) | 0.1% | 05.2020 | ISA |

| India | Reserve Bank of India | Indian Rupee (INR) | 4% | 05.2020 | SEBI |

| Indonesia | Bank Indonesia | Indonesian rupiah (IDR) | 3.75% | 11.2020 | Bappebti |

| Jordan | Central Bank of Jordan | Jordanian dinar (JOD) | 2.5% | 03.2020 | Central Bank of Jordan |

| Iraq | Central Bank of Iraq | Iraqi dinar (IQD) | 4% | 03.2020 | Central Bank of Iraq |

| Iran | Central Bank of the Islamic Republic of Iran | Iranian rial (IRR) | 18% | 03.2020 | Central Bank of Iran |

| Yemen | Central Bank of Yemen | Yemeni rial (YER) | 27% | 03.2020 | Central Bank of Yemen |

| Kazakhstan | National Bank of the Republic of Kazakhstan | Kazakhstan tenge (KZT) | 12% | 17.03.2020 | AFSA |

| Cambodia | National Bank of Cambodia | Cambodian riel (KHR) | 1.46% | 03.2020 | National Library of Cambodia |

| Qatar | Central Bank of Qatar | Qatari rial (QAR) | 2.5% | 06.2020 | Central Bank of Qatar |

| Kyrgyzstan | National Bank of the Kyrgyz Republic | Kyrgyzstani som (KGS) | 5% | 01.2020 | National Library of Kyrgyzstan |

| DPRK | Central Bank of the DPRK | North Korean won (KPW) | n.d. | n.d. | Central Bank of the DPRK |

| The Republic of Korea | Bank of South Korea | won (KRW) | 0.75% | 16.03.2020 | FSC |

| Kuwait | Central Bank of Kuwait | Kuwaiti Dinar (KWD) | 1.5% | 16.03.2020 | Central Bank of Kuwait |

| Laos | Bank of Lao PDR | Laotian kip (LAK) | 4% | 03.2020 | Bank Lao PDR |

| Lebanon | Bank of Lebanon | Lebanese pound (LBP) | 6.75% | 03.2020 | Bank of Lebanon |

| Malaysia | Bank Negara Malaysia | Malaysian ringgit (MYR) | 2.5% | 03.2020 | Bank Negara Malaysia |

| Macau | Macau Currency Authority | Macau pataca (MOP) | 0.86% | 03.2020 | UDOM |

| Mongolia | Bank of Mongolia | Mongolian tugrik (MNT) | 6% | 11.2020 | Financial Regulatory Committee of Mongolia |

| Myanmar | Central Bank of Myanmar | Myanmar Kyat (MMK) | 10% | 03.2020 | Central Bank of Myanmar |

| Nepal | Nepal Rastra Bank | Nepalese rupee (NPR) | 5.5% | 03.2020 | Nepal Rastra Bank |

| UAE | Central Bank of the UAE | UAE dirham (AED) | 1.5% | 03.2020 | Dubai FSA |

| Oman | Central Bank of Oman | Omani rial (OMR) | 2.15% | 03.2020 | CMA |

| Pakistan | State Bank of Pakistan | Pakistani rupee (PKR) | 12.25% | 05.2020 | GB of Pakistan |

| Saudi Arabia | ADO SA | Saudi Riyal (SAR) | 1% | 03.2020 | CMA |

| Syria | Central Bank of Syria | Syrian pound (SYP) | 0% | 03.2020 | Central Bank of Syria |

| Tajikistan | National Bank of Tajikistan | Tajikistani somoni (TJS) | 11.75% | 04.2020 | National Library of Tajikistan |

| Thailand | Bank of Thailand | Thai baht (THB) | 1.25% | 05.02.2020 | Bank of Thailand |

| Taiwan | Central Bank of the Republic of China (Taiwan) | Taiwan dollar (TWD) | 1.13% | 07.2020 | Central Bank of the Republic of China (Taiwan) |

| Turkmenistan | Central Bank of Turkmenistan | Turkmen manat (TMT) | 5% | 01.2020 | Central Bank of Turkmenistan |

| Türkiye | Central Bank of Turkey | Turkish lira (TRY) | 10.25% | 24.09.2020 | C.M.B. |

| Uzbekistan | Central Bank of Uzbekistan | Uzbek som (UZS) | 15% | 04.2020 | Central Bank of the Republic of Uzbekistan |

| Philippines | Central Bank of the Philippines | Philippine Peso (USD) | 4.5% | 11.2020 | Central Bank of the Philippines |

| Sri Lanka | Central Bank of Sri Lanka | Sri Lankan rupee (LKR) | 7.5% | 03.2020 | Central Bank of Sri Lanka |

| Official Forex Currencies in Africa | |||||

| Algeria | Bank of Algiers | Algerian dinar (DZD) | 3.75% | 03.2020 | EFSA |

| Angola | National Library of Angola | Angolan Kwanzaa (AOA) | 15.5% | 05.2020 | National Library of Angola |

| Benin | Central Banks of West African States | West African franc (XOF) | 4.5% | 05.2020 | Central Bank ZAG |

| Botswana | Bank of Botswana | Botswana Pula (BWP) | 4.25% | 05.2020 | Bank of Botswana |

| Burundi | Bank of the Republic of Burundi | Burundian franc (BIF) | 5.25% | 05.2020 | Bank of the Republic of Burundi |

| Guinea | Central Bank of the Republic of Guinea | Guinean franc (GNF) | 11% | 05.2020 | Central Bank of the Republic of Guinea |

| Egypt | Central Bank of Egypt | Egyptian pound (EGP) | 12.25% | 16.01.2020 | COSOB |

| Zambia | Bank of Zambia | Zambian kwacha (ZMW) | 11.5% | 05.2020 | SEC |

| Cameroon | Bank of Central African States | Central African franc (XAF) | 3.25% | 05.2020 | B GCA |

| Kenya | Central Bank of Kenya | Kenyan shilling (KES) | 7% | 05.2020 | Central Bank of Kenya |

| Congo | Central Bank of Congo | Congolese franc (CDF) | 7.5% | 05.2020 | Central Bank of Congo |

| Libya | Central Bank of Libya | Libyan dinar (LYD) | 3.32% | 05.2020 | Central Bank of Libya |

| Mauritius | Bank of Mauritius | Mauritian rupee (MUR) | 2,85% | 05.2020 | Bank of Mauritius |

| Mauritania | Central Bank of Mauritania | Mauritanian ouguiya (MRU) | 6.5% | 05.2020 | Central Bank of Mauritania |

| Madagascar | Central Bank of Madagascar | Malagasy Ariary (MGA) | 9.5% | 05.2020 | Central Bank of Madagascar |

| Morocco | Bank al-Maghrib | Moroccan Dirham (USD) | 2.25% | 03.2020 | AMMC |

| Mozambique | Bank of Mozambique | Mozambican metical (MZN) | 11.25% | 03.2020 | Bank of Mozambique |

| Namibia | Bank of Namibia | Namibian dollar (NAD) | — | 05.2020 | Bank of Namibia |

| Nigeria | Central Bank of Nigeria | Nigerian Naira (NGN) | 13.5% | 05.2020 | SEC Nigeria |

| Rwanda | National Library of Rwanda | Rwandan franc (RWF) | 05.2020 | National Library of Rwanda | |

| Seychelles | Central Bank of Seychelles | Seychelles rupee (SCR) | 5% | 05.2020 | FSA (SC) |

| Somalia | Central Bank of Somalia | Somali shilling (SOS) | — | 05.2020 | Central Bank of Somalia |

| Sudan | Central Bank of Sudan | Sudanese pound (SDG) | 16.5% | 05.2020 | Central Bank of Sudan |

| Tanzania | Bank of Tanzania | Tanzanian shilling (TZS) | 5% | 05.2020 | CMSA |

| Tunisia | Central Bank of Tunisia | Tunisian dinar (TND) | 7.75% | 02. 2020 | Central Bank of Tunisia |

| Uganda | Bank of Uganda | Ugandan shilling (UGX) | 8% | 05.2020 | Bank of Uganda |

| Ethiopia | National Bank of Ethiopia | Ethiopian birr (ETB) | 5.21% | 05.2020 | National Bank of Ethiopia |

| South Africa | South African Reserve Bank | South African rand (ZAR) | 3.5% | 07.2020 | FSCA |

| Forex currencies in Latin America | |||||

| Argentina | Central Bank of Argentina | Argentine Peso (ARS) | 36% | 11.2020 | CNV |

| Bahamas | Central Bank of the Bahamas | Bahamian dollar (BSD) | 4% | 04.2020 | SCB |

| Belize | Central Bank of Belize | Belize dollar (BZD) | 2.3% | 04.2020 | IFSC |

| Bermuda | Parole Bermuda | Bermudian dollar (BMD) | 0% | 04.2020 | B.M.A. |

| Bolivia | Central Bank of Bolivia | Boliviano (BOB) | 2.79% | 03.2020 | ASFI |

| Brazil | Central Bank of Brazil | Brazilian real (BRL) | 2% | 11.2020 | CVM |

| Venezuela | Central Bank of Venezuela | Sovereign Bolivar (VES) | 38.76% | 09.2020 | Central Bank of Venezuela |

| Haiti | Bank of the Republic of Haiti | Haitian gourde (HTG) | 22% | 04.2020 | Bank of Haiti |

| Honduras | Central Bank of Honduras | Honduran Lempira (HNL) | 4.5% | 04.2020 | Central Bank of Honduras |

| Grenada | Eastern Caribbean Central Bank | East Caribbean dollar (XCD) | 0.25% | 04.2020 | Eastern Caribbean Central Bank |

| Dominican Republic | Central Bank of the DR | Dominican Peso (DOP) | 3% | 09.2020 | DFSU |

| Colombia | Bank of the Republic | Colombian peso (COP) | 1.75% | 11.2020 | Bank of the Republic |

| Costa Rica | Central Bank of Costa Rica | Costa Rican colon (CRC) | 2.79% | 03.2020 | SUGEVAL |

| Cuba | Central Bank of Cuba | Cuban Peso (CUP) | 2.25% | 01.2020 | Central Bank of Cuba |

| Mexico | Bank of Mexico | Mexican Peso (MXN) | 4.25% | 11.2020 | CNBV |

| Nicaragua | Central Bank of Nicaragua | Nicaraguan Cordoba (NIO) | 7.2% | 04.2020 | SIBOIF |

| Panama | NB of Panama | Panamanian Balboa (PAB) | 1.36% | 04.2020 | NB of Panama |

| Paraguay | Central Bank of Paraguay | Paraguayan Guarani (PYG) | 1.25% | 04.2020 | Central Bank of Paraguay |

| Peru | RB Peru | Peruvian salt (PEN) | 0.25% | 11.2020 | SBS, SMV |

| Uruguay | Central Bank of Uruguay | Uruguayan peso (UYU) | 9.25% | 11.2020 | Central Bank of Uruguay |

| Chile | Central Bank of Chile | Chilean peso (CLP) | 1.75% | 30.01.2020 | SBIF |

| Jamaica | Bank of Jamaica | Jamaican dollar (JMD) | 0.5% | 03.2020 | FSC Jamaica |

Currency exchange in the UK

If necessary, currency exchange in the UK is possible in banks that are open from 9 am to 3.30 pm daily. The offices of large banks are also open on Saturdays. There are also many exchange offices at airports, train stations, and hotels, where currency transactions are carried out around the clock.

You can use some post offices and ATMs, which are widespread throughout the country. However, banks will offer the most favorable rate, plus a small commission - 0.5% -1%. All operations are carried out with a passport. Visa, MasterCard, American Express cards, as well as credit cards and traveler's checks are used.

Recommended brokers for trading exchange rates on the forex market

Before you start trading in the financial markets, you first need to open a trading account (deposit) with a reliable Forex broker. To help traders, the Masterforex-V Academy has developed an independent rating of Forex brokers, which includes more than 30 criteria, for example:

- the ability to trade on stock, futures, cryptocurrency, commodity exchanges, etc.

- sizes of spreads and swaps;

- availability of licenses from financial regulators;

- possibility of hedging or scalping;

- availability of PAMM and LAMM accounts;

- availability of STP, NDD, ECN accounts;

Below are selected just 12 “best forex brokers” of the major league (out of more than 400 brokers present on the market).

| № | Broker name, year founded | Financial instruments | Licenses from financial regulators | ||||

| Currencies | Goods | Stock market | Cryptocurrencies | PAMM | |||

| Major League | |||||||

| 1. | NordFX (2008) | + | + | + | + | + | CySEC, MiFID |

| 2. | Swissquote (1996) | + | + | + | + | — | FINMA, FCA, SFC, Dubai FSA |

| 3. | Dukascopy (1998) | + | + | + | — | — | FINMA, FCMC |

| 4. | Alpari (1998) | + | + | + | + | + | ARFIN |

| 5. | FxPro (2006) | + | + | + | — | — | FCA, CySEC, FSB, Dubai FSA, BaFin, ACPR, CNMV |

| 6. | Interactive Brokers (1977) | + | + | + | — | — | NFA, CFTC, FCA, IIROC |

| 7. | Oanda (1996) | + | + | + | — | — | NFA, CFTC, FCA, IIROC, MAS, ASIC |

| 8. | FXCM (1999) | + | + | + | + | — | FCA, BaFin, ACPR, AMF, Dubai FSA ,SFC, ISA, ASIC, FSB |

| 9. | Saxo Bank (1992) | + | + | + | — | — | Danish FSA, Consob, CNB, ASIC, MAS, FINMA, JFSA, SFC Hong Kong |

| 10. | FOREX.com (1999) | + | + | + | + | — | NFA, CFTC, FCA, ASIC, JSDA, MAS, SFC |

| 11. | FIBO Group (1998) | + | + | + | + | + | CySEC |

| 12. | FINAM FOREX (1994) | + | — | — | — | — | Bank of Russia |

| Second League | |||||||

| 13. | Forex Club (1997) | + | + | + | + | — | ARFIN |

| 14. | TeleTrade (Teletrade) (1994) | + | + | + | + | — | ARFIN |

| 15. | ActivTrades (2001) | + | + | + | + | — | FCA, SCB |

| 16 | FreshForex (Fresh Forex) (2004) | + | + | + | + | — | — |

| 17. | eToro (eToro) (2007) | + | + | + | + | — | ASIC, FCA, CySEC |

| 18. | FortFS (2010) | + | + | + | + | + | IFSC Belize |

| 19. | (2011) | + | + | + | + | — | ASIC, IFSC, CySEC |

| 20. | BCS Forex (2004) | + | + | + | + | — | — |

| 21. | GKFX (2009) | + | + | + | + | — | FCA, JFSA, DMCC, BaFin, AMF, AFM, Consob, CNMV, , CNB, NBS |

| 22. | NPBFX (Nefteprombank) (2016) | + | + | + | + | — | — |

| 23. | Admiral Markets (2001) | + | + | + | + | — | ASIC, FCA, EFSA, CySEC |

| 24. | Grand Capital (Grand Capital) (2006) | + | + | + | + | + | — |

| 25. | RoboForex (Roboforex) (2009) | + | + | + | + | + | CySEC, IFSC Belize |

| 26. | FinmaxFX (2018) | + | + | + | + | — | CROFR, VFSC Vanuatu |

| 27. | FXOpen (2005) | + | + | + | + | — | FCA |

| 28. | Forex Optimum Group Limited (2009) | + | + | + | — | — | — |

| 29. | EXNESS (Exness) (2008) | + | + | + | + | — | FSA Seychelles |

| 30. | HYCM (1989) | + | + | + | + | — | FCA, CySEC, CIMA, Dubai FSA |

| 31. | Alfa Forex (Alfa Bank) (2003) | + | — | — | — | — | Bank of Russia |

| 32. | Forex4you (Forex fo you) (2007) | + | + | + | + | — | FSC BVI |

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V.

Origin of English currency

Sterling is the oldest European currency that is still in use today. The origins of the English currency have a rich history. The first silver coin was introduced in 775. Money was minted from silver, and exactly 240 coins came out of 1 pound of the highest standard metal. Since then, 1 pound sterling has been the constant national currency of Foggy Albion.

Subsequently, there were coins of various denominations made of gold, silver, copper, tin and other metals: sovereign, guinea, shilling, penny. In 1971, the decimal system was adopted and all money was replaced by one coin - the penny, and 1 pound became equal to 100 pence.

Advice from Sravni.ru: The British pound is not as widespread in the CIS as the euro or dollar, but this does not stop the currency from being a reliable instrument for preserving capital and a stable way to invest in times of crisis. On the international Forex currency exchange, pairs involving the British pound are considered one of the most volatile, highly liquid and promising.

The story of one pound

A pound sterling is equal to 100 pence. The name of the currency itself originated in the 12th century. At that time, the phrase “pound sterling” meant “a pound of pure silver” and was a monetary measure.

Historians have found that in 1300, silver pennies with stars engraved on them were called sterling.

In 1694, the English bank began to produce its own banknotes, and the name of the currency became quite official and generally accepted.

Since 1971, the British pound, to which sterling is added only in official documents, has been equated to the decimal monetary system.

Scotland and Ireland issue pounds with their own design, but equal in value to the British currency. Sometimes there are difficulties with paying with such money in England and Wales.

Notes

- Inflation, Office for National Statistics

- Pound sterling, Pound unit of weight // Encyclopaedia Britannica

- Liah Greenfeld. The Spirit of Capitalism. Nationalism and Economic Growth. - Harvard University Press, 2001. ISBN 9780674012394, - p.34

- Cornelius Luke, 2005, p. 80.

- Coins from the United Kingdom - Numista

- Royal Mint website, Legal Tender Guidelines section

- What is legal tender? (English). Bank of England

. - Scottish and Northern Ireland banknotes (English). www.bankofengland.co.uk

. Access date: February 28, 2021. - Bank of England criticized for losing track of £50bn of banknotes. the Guardian

(4 December 2020). Access date: February 28, 2021. - Hanna Ziady, CNN Business.

£50 billion in UK banknotes is 'missing.'

Nobody has an explanation (undefined)

.

CNN

. Access date: February 28, 2021. - In the UK, for the first time in 300 years, coins were issued with an error

- Mix-up at Royal Mint creates dateless 20p pieces worth £50

- Information about the undated 20p coin

- "British Royal Mint - Legal Tender Guidelines" (unspecified)

(inaccessible link). Access date: February 15, 2012. Archived December 17, 2008. - The Daily Telegraph (unspecified)

.

Sterling surges to 14-year high

. Access date: January 24, 2007. Archived August 24, 2011.

VAT refund

The term Tax Free refers to the process of refunding VAT included in the price of a purchased product or service provided.

Not all commercial enterprises operate under the Tax Free scheme in the UK. You can find out about the possibility of VAT refund from their employees.

Cash registers of stores participating in the Tax Free system print a VAT refund form automatically when payment is made using a bank card issued outside the European Union.

When leaving the United Kingdom, the foreigner must show the customs officer the goods in their packaging and the completed form above. The tax will be returned after consideration of the application to the card specified in the form.

In the UK, Tax Free programs are operated by two operators:

- Global Blue will refund VAT if a single receipt shows a purchase of goods exceeding £30;

- Tax Free Worldwide refunds tax on amounts in one check starting from £50.

The pound as the main international reserve currency

A reserve currency is a national currency that is recognized throughout the world and accumulated as a foreign exchange reserve by the central banks of other countries. It is designed to perform the function of supporting the local currency. Typically, one country uses several reserve currencies, which are selected from the most stable and least susceptible to inflation.

You should know that the IMF has coined another term - world reserve currencies. In order for the monetary unit of a certain state to receive this status, the fund considers the following criteria:

- the degree of stability of the financial situation in the country;

- level of development of the state's economy.

The pound sterling has had the status of the main reserve currency for 300 years. But after the abolition of the gold standard, the dollar and euro became the leaders.

The interest on the pound in general reserves has increased in recent years. In addition, according to financial analysts, the UK currency has good prospects. This forecast is justified by the instability of the US dollar.

However, taking into account only this factor does not reflect the real situation with the pound sterling. In June 2021, due to fears of a “hard Brexit,” the currency of the United Kingdom dropped to a minimum—during one trading session, the pound was trading at $1.2514.

Etymology of name and designation

The British currency has a compound name. Usually only the pound is used, alternatively the British pound can be called, in order to indicate accurately. History dates the year 775 as the year the sterling appeared. These were small silver coins, which, among 240 pieces, made up a full pound, a measure of weight in the Anglo-Saxon lands. So it turns out that when paying for goods and services, pounds of silver sterling were transferred. In everyday life, the phrase has been reduced to two words. The Normans, who conquered England, left the definition for the monetary unit, but divided it into 20 shillings, with each of them weighing 12 pence. Later in history, the prefix sterling returned.

Pence has been used since the advent of proper money in English history and in the modern division of the pound sterling. However, its weight and share most of the time were calculated using the 12-digit system, which resulted in 240 coins in one measure. The now familiar and integral decimal division system became quite problematic in Great Britain only in the second mid-twentieth century.

Like any modern currency, there is a symbol for the pound sterling. To determine amounts calculated in pounds, the symbol ₤ or even its simplified but equivalent version £ is used. The symbol is based on the letter L, which is part of the abbreviation LSD (labra, solidi, denarii). Initially, this is how the division of English monetary units took place according to established rules that have been preserved since the times of the Roman Empire. Libra is a unit of weight.

Otherwise, the English pound sterling is denoted by the letter code GBP (ISO 4217 826), which means Great Britain Pound. Other designations you may sometimes see, such as UKP, are not official. Mostly in the share market and accompanying analyst reports, you can see the designation GBp (GBX), which determines the specified amount in pence.

Exchange rate regime

See also: Exchange Rate Regime

Currently, the UK uses a freely floating exchange rate regime. The criterion for the effectiveness of exchange rate policy (exchange rate anchor) is inflation indicators.

| Market rate | |

| Google Finance (…/GBP): | RUB USD EUR JPY CHF |

| XE.com (…/GBP): | RUB USD EUR JPY CHF |

| OANDA.com (…/GBP): | RUB USD EUR JPY CHF |