Dividends on shares of Cherkizovo JSC in 2021 - size and date of closure of the register

Home → Dividends→ Shares of CherkizG-AO - forecast, payment history

A table with the complete history of dividends of the Cherkizovo JSC company, indicating the amount of payment, the date of closure of the register and the forecast:

| Payment, rub. | Registry closing date | Last day of purchase |

| 45.23 (forecast) | October 5, 2021 | 01.10.2021 |

| 134 | April 5, 2021 | 01.04.2021 |

| 48.79 | October 5, 2020 | 01.10.2020 |

| 60.92 | April 7, 2020 | 03.04.2020 |

| 48.79 | October 7, 2019 | 03.10.2019 |

| 101.63 | April 7, 2019 | 03.04.2019 |

| 20.48 | October 8, 2018 | 04.10.2018 |

| 75.07 | April 3, 2018 | 30.03.2018 |

| 59.82 | October 7, 2017 | 04.10.2017 |

| 13.65 | May 1, 2017 | 27.04.2017 |

| 22.75 | May 3, 2016 | 29.04.2016 |

| 22.75 | October 9, 2015 | 07.10.2015 |

| 54.6 | April 17, 2015 | 15.04.2015 |

| 34.44 | November 21, 2014 | 19.11.2014 |

*Note 1: The Moscow Exchange operates on the T+2 trading system. This means that settlements for buying and selling shares occur within 2 business days. Therefore, to be included in the register of shareholders and receive dividends, you must be a shareholder 2 days before the cutoff.

*Note 2: Exact payout date varies by broker and issuer. The predicted nearest date for receipt of dividends to the brokerage account for the CherkizG-ao company: October 18, 2021.

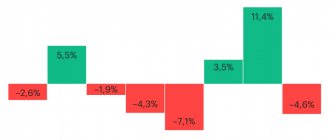

Total dividends of CherkizG-ao shares by year and change in their size compared to the previous year:

| Year | Amount for the year, rub. | Change, % |

| 2021 | 179.23 (forecast) | +63.37% |

| 2020 | 109.71 | -27.06% |

| 2019 | 150.42 | +57.43% |

| 2018 | 95.55 | +30.05% |

| 2017 | 73.47 | +222.95% |

| 2016 | 22.75 | -70.59% |

| 2015 | 77.35 | +124.59% |

| 2014 | 34.44 | n/a |

| Total = 742.92 |

The amount of dividends paid by CherkizG-ao for the entire period is 742.92 rubles.

Average amount for 3 years: 146.5 rubles, for 5 years: 121.7 rubles.

You can buy CherkizG-AO shares with minimal commissions from stock brokers: Finam and BCS. Free deposits and withdrawals. Online registration.

Brief information about the issuer Cherkizovo Group PJSC

| Sector | Food |

| Issuer's full name | Cherkizovo Group PJSC-AO |

| Issuer's name is short | CherkizG-ao |

| Ticker on the stock exchange | GCHE |

| Number of shares in lot | 1 |

| Number of shares | 43 963 773 |

| Free float, % | 3 |

Other companies from the Food sector

| # | Company | Div. profitability for the year, % | The nearest registry closing date | Buy before |

| 1. | Rusagro | 11,85% | 18.09.2021 | 15.09.2021 |

| 2. | NKHP JSC | 4,72% | 27.07.2021 | 23.07.2021 |

| 3. | RusAqua JSC | 3,79% | 27.05.2021 | 25.05.2021 |

| 4. | Beluga a.o. | 2,92% | 26.10.2021 | 22.10.2021 |

Calendar with upcoming and past dividend payments

| Immediate | Past | ||||

| Company Sector | Size, rub. | Registry closing date | Company Sector | Size, rub. | Registry closing date |

| RusAqua JSC Foodstuff | 5 | 27.05.2021 | MDMG-gdr Miscellaneous | 19 ✓ | 25.05.2021 |

| FGC UES JSC Energy | 0.016 | 29.05.2021 | TransK JSC Logistics | 403.88 ✓ | 24.05.2021 |

| SevSt-ao Metals and mining | 46.77 | 01.06.2021 | M.video Retail trade | 38 ✓ | 18.05.2021 |

| Tattel. JSC Telecoms | 0.0393 | 01.06.2021 | PIK JSC Construction | 22.51 ✓ | 17.05.2021 |

| SevSt-ao Metals and mining | 36.27 | 01.06.2021 | PIK JSC Construction | 22.92 ✓ | 17.05.2021 |

| GMKNorNik Metals and mining | 1021.2 | 01.06.2021 | Moscow Exchange Finance and Banking | 9.45 ✓ | 14.05.2021 |

| MOESK Energy | 0.0493 | 01.06.2021 | Sberbank Finance and Banking | 18.7 ✓ | 12.05.2021 |

View full calendar for 2021 »

7 Best Dividend Stocks for 2021

| # | Company | Sector | Dividend yield for the year, % | The nearest registry closing date | Buy before |

| 1. | Surgnfgz-p | Oil Gas | 16,84% | 20.07.2021 | 16.07.2021 |

| 2. | iMMTSB JSC | Miscellaneous | 15,24% | 09.06.2021 | 07.06.2021 |

| 3. | Unipro JSC | Energy | 15,08% | 22.06.2021 | 18.06.2021 |

| 4. | ALROSA JSC | Metals and mining | 14,99% | 04.07.2021 | 30.06.2021 |

| 5. | NLMK JSC | Metals and mining | 14,91% | 09.06.2021 | 07.06.2021 |

| 6. | Rusagro | Food | 11,85% | 18.09.2021 | 15.09.2021 |

| 7. | MMK | Metals and mining | 11,80% | 17.06.2021 | 15.06.2021 |

View the full company rating for 2021 »

Interesting read:

- How to buy shares as a private person;

- How to start trading on the stock exchange from scratch;

- How to buy securities;

- Investment portfolio - what is it;

- How to save money for shares and live on dividends;

- How to buy Gazprom shares as a private individual;

- Formula for calculating stock returns;

- Investing in shares - what you need to know;

← Return to main catalog

Cherkizovo Group announces financial results for the first quarter of 2021

Cherkizovo Group (MOEX: GCHE), Russia's largest vertically integrated producer of meat products, announces unaudited consolidated IFRS financial results for the first quarter of 2021.

Key financial indicators of the first quarter:

• Revenue increased by 10.4% compared to the same period last year - to 33.3 billion rubles.

• Gross profit increased by 29.7% year-on-year to RUB 11.0 billion.

• Adjusted EBITDA* decreased by 8.6% year-on-year to RUB 4.6 billion. Adjusted EBITDA margin fell 280 basis points to 13.7%.

• The Group’s net profit amounted to 6.5 billion rubles compared to 3.0 billion rubles in the first quarter of 2021. Adjusted net profit** increased by 44.5% and amounted to 1.8 billion rubles compared to 1.3 billion rubles a year earlier.

Key corporate events for the first quarter

• On February 15, the Group reached a preliminary agreement to purchase the meat processing enterprise Pit-Product LLC (Pit Product brand) from the Finnish Atria Group. The deal allows Cherkizovo to increase its share of the sausage market in the Northwestern Federal District, one of the key regions for the company. The transaction was closed on April 30, and the results of the acquired asset will be reported in the Meat Processing segment.

• On March 3, the Company announced the launch of sales of a new product - meat snacks under the growing Cherkizovo Premium brand. This product category is becoming increasingly in demand among Russian consumers, demonstrating double-digit growth.

• On March 25, the General Meeting of Shareholders approved the payment of dividends in the amount of RUB 134.00 per share in addition to the interim dividend in the amount of RUB 48.79 per share announced in August 2021.

Major corporate events after the reporting period

On April 22, at the Extraordinary Meeting of Shareholders, the quantitative composition of the Board of Directors was changed from 7 to 9, and new members of the Board of Directors were elected - Emin Mammadov, who currently holds the position of Deputy General Director of the Group, and Elliot Jones, who returned to the Board of Directors after annual break.

Comment by the Company’s General Director Sergei Mikhailov:

“Despite the overall slight decrease in sales in physical terms, in the first quarter of 2021 Cherkizovo Group showed an increase in revenue and net profit. The increase in these indicators was due to an increase in the average selling price of products in all segments of our business, which in turn is associated with the further expansion of sales of products with high added value. This was especially noticeable in the Chicken segment, which accounts for more than 70% of the Group’s sales. Sales volumes of products under our flagship brand Petelinka remain stable, sales of our other brand, Chicken Kingdom, are growing.

The company’s financial results in the first quarter were also positively impacted by the restoration of traffic in the food service channel after the lifting of restrictions on visiting public catering establishments introduced in connection with the spread of coronavirus infection, as well as additional supplies of products from a recently acquired asset in Efremovo, Tula region. We believe that sales in this channel will return to pre-pandemic levels in the coming months and will continue to grow in the future, remaining one of the main sources of revenue growth for the Group in the future.

In the first quarter, the company's EBITDA decreased, which was primarily due to results in the Pork and Meat Processing segments. The indicator was negatively affected by the increase in production costs, which began in mid-2020, and in January-March 2021 became systemic. In particular, we see a continued increase in the cost of oilseeds, primarily soybean meal.

The overall increase in production costs was partially offset by government support measures: in particular, the establishment of an export duty on grains made it possible to reduce their costs in the first quarter. However, the cumulative rise in prices for other components, including packaging and vitamins, in the future, in our opinion, will continue to put pressure on rising costs, which may force the industry to raise selling prices. Taking advantage of its vertically integrated business model, Cherkizovo Group sought to contain prices for its products during the first quarter. The company is still trying to maintain an optimal balance that allows it to maintain an acceptable level of profitability in the current difficult macroeconomic conditions without compromising the interests of consumers.”

Financial indicators

| million rubles | 1Q 2021 | 1Q 2020 | y-o-y, % |

| Revenue | 33 291 | 30 164 | 10,4% |

| Net change in fair value of bio assets | 4 715 | 1 441 | 227,2% |

| Net revaluation of unsold crops | (1 189) | (369) | 222,2% |

| Gross profit | 10 958 | 8 449 | 29,7% |

| Gross profit margin | 32,9% | 28,0% | 4.9 p.p. |

| Operating expenses, net | (3 800) | (4 032) | -5,8% |

| Share of adjusted EBITDA of joint ventures and associates | 95 | 227 | -58,1% |

| Adjusted operating profit 1 | 2 399 | 2 909 | -17,5% |

| Operating profit margin | 7,2% | 9,6% | -2.4 p.p. |

| Adjusted EBITDA 1 | 4 563 | 4 994 | -8,6% |

| Adjusted EBITDA margin | 13,7% | 16,6% | -2.8 p.p. |

| Profit before tax | 6 543 | 3 118 | 109,8% |

| Net profit | 6 544 | 3 005 | 117,8% |

| Adjusted Net Income 1 | 1 828 | 1 265 | 44,5% |

| Net operating cash flow | 2 089 | 1 363 | 53,3% |

| Net debt 1 | 65 513 | 62 185 | 5,4% |

1In accordance with the Group's accounting methodology, adjusted operating income, adjusted EBITDA and adjusted net income (*,**,***,****) do not include the net change in the fair value of biological assets and certain other items

Revenue

At the end of the first quarter of 2021, the Group’s revenue increased by 10.4% year-on-year and amounted to 33.3 billion rubles compared to 30.2 billion rubles a year earlier. The growth in revenue is due to rising prices for products from various segments of the Company, especially in the largest Chicken segment. We have been steadily increasing sales of our branded products on the Russian market; Sales in the foodservice industry began to recover.

Gross profit

In the first quarter of 2021, gross profit increased by 29.7% year-on-year to RUB 11.0 billion, compared to RUB 8.4 billion a year earlier. Gross profit margin increased to 32.9% versus 28.0% in the same period last year.

Operating expenses

Operating expenses decreased by 5.8% year-on-year to RUB 3.8 billion compared to RUB 4.0 billion in the first quarter of 2021 due to the implementation of cost reduction measures throughout the Company. The share of operating expenses in revenue decreased to 11.4% versus 13.4% a year earlier.

Adjusted operating income

Adjusted operating profit decreased by 17.5% to RUB 2.4 billion compared to RUB 2.9 billion in the same period last year. Adjusted operating profit does not include the net change in the fair value of biological assets of the Group's segments (by RUB 4.7 billion) and joint ventures (by RUB 1 million).

Adjusted EBITDA

Adjusted EBITDA decreased by 8.6% year-on-year to RUB 4.6 billion. Revenue growth was offset by increased costs in various segments due to increased feed costs and increases in most cost components overall. Adjusted EBITDA margin decreased to 13.7% versus 16.6% a year earlier (down 280 basis points).

Interest expenses

Net interest expenses for the first quarter of 2021 decreased to RUB 0.8 billion compared to RUB 1.1 billion in the same period last year due to the refinancing of the debt portfolio at lower interest rates and an increase in the share of subsidized loans.

Net profit

The Group's net profit for the first quarter of 2021 increased by 117.8% year-on-year and amounted to RUB 6.5 billion compared to RUB 3.0 billion in the first quarter of 2021. Net profit margin increased to 19.7% compared to 10.0% a year earlier.

Adjusted net profit increased by 44.5% and amounted to 1.8 billion rubles compared to 1.3 billion rubles for the same period last year. Adjusted net profit margin reached 5.5%, up from 4.2% a year earlier.

Cash flow

Operating cash flow increased by 53.3% to RUB 2.1 billion compared to RUB 1.4 billion in the first quarter of 2021 due to lower inventories.

Capital Expenditures and Debt

In the first quarter of 2021, the Group's capital investments in fixed assets and their maintenance increased by 81.5% year-on-year and amounted to RUB 3.4 billion. The Group’s main current project is the construction of an oil extraction plant.

As of March 31, 2021, net debt**** was at 65.5 billion rubles compared to 62.2 billion rubles in the first quarter of last year. Total debt as of March 31, 2021 decreased to 73.4 billion rubles compared to 73.6 billion rubles a year earlier. As of the end of the first quarter of 2021, long-term debt amounted to RUB 42.7 billion, or 58% of the Group's debt portfolio. The effective cost of debt***** as of March 31, 2021 was 5.1%. In the first quarter of 2021, the share of subsidized loans and credit lines in the Group’s debt portfolio amounted to 49% (in the first quarter of 2021 - 25%).

Subsidies

The total amount of government subsidies received in cash to compensate for interest expenses was 29 million rubles, which is 76.2% less than the same period last year.

Net change in fair value of biological assets

The net change in the fair value of biological assets is due to increases in the value of poultry products and market hogs.

Segments

| Segments | Volume of sales | Change y-o-y, % | Revenue 2 | Change y-o-y, % | ||

| 3 months 2021, thousand tons | 3 months 2021, thousand tons | 3 months 2021, million rubles | 3 months 2021, million rubles | |||

| Chicken | 169,2 | 174,7 | -3,1% | 20 930 | 17 720 | 18,1% |

| Turkey 3 | 10,7 | 9,9 | 8,3% | 1 971 | 1 681 | 17,3% |

| Pig farming | 31,9 | 47,9 | -33,4% | 4 961 | 5 585 | -11,2% |

| Meat processing | 26,3 | 25,4 | 3,6% | 5 261 | 4 835 | 8,8% |

| Samson 4 | 7,3 | 5,9 | 22,4% | 1 530 | 1 162 | 31,7% |

2 Revenue to external customers

3 Sales volumes and revenues presented in the Turkey section refer to turkey sales by the Cherkizovo Trading House

4 Sales volumes refer to sales of the associated company Samson-Food Products

Chicken segment

Total sales in the first quarter of 2021 decreased by 3.1% to 169.2 thousand tons (in the first quarter of 2021 - 174.7 thousand tons). The average selling price increased by 22% compared to the previous year and amounted to 126.0 rubles/kg. Revenue growth was driven by an increase in the average selling price due to increased sales volumes of Chicken Kingdom brand products, as well as a recovery in sales in the catering industry. Under the influence of these factors, segment revenue increased by 18.1% and reached 20.9 billion rubles (in the first quarter of 2021 - 17.7 billion rubles).

The net change in the fair value of biological assets amounted to RUB 1.9 billion compared to RUB 0.8 billion a year earlier.

Gross profit increased by 17.5% year-on-year to RUB 6.1 billion (RUB 5.2 billion in the first quarter of 2021) as a result of improved pricing conditions and increased sales of Chicken Kingdom brand products. The growth was partially offset by an increase in production costs. The segment's gross margin remained virtually unchanged at 28.5%.

Operating expenses amounted to 7.6% of revenue versus 10.3% a year earlier. Operating profit increased by 35.0% to RUB 4.5 billion compared to RUB 3.3 billion in the first quarter of 2021. Operating margin reached 20.9% compared to 18.3% in the same period last year.

Adjusted EBITDA increased by 3.7% YoY to RUB 3.5 billion, while Adjusted EBITDA margin decreased from 18.4% to 16.2%.

Pork segment

The segment's sales volumes to third parties for the first quarter of 2021 decreased by 33.4% year-on-year and amounted to 31.9 thousand tons (in the first quarter of 2021 - 47.9 thousand tons). At the same time, sales of live pigs decreased to minimum values, sales of carcasses decreased accordingly, and sales of individual parts of carcasses increased by 15%, amounting to 8.1 thousand tons. The average selling price of live pigs increased by 29% year-on-year to RUB 100.7/kg compared to RUB 78.3/kg a year earlier; the average selling price of carcasses increased by 24%, averaging 150.7 rubles/kg, and the average selling price of individual parts of carcasses increased by 7% to 222.9 rubles/kg. Segment revenue from external customers decreased year-on-year by 11.2% to RUB 5.0 billion compared to RUB 5.6 billion in the first quarter of 2021. The segment's total revenue increased by 3.5% to RUB 7.5 billion; inter-segment revenue increased by 52.2% YoY.

The net change in the fair value of biological assets amounted to 2.3 billion rubles, while a year earlier it was at the level of 0.2 billion rubles.

Gross profit increased by 83.3% to RUB 3.9 billion, compared to RUB 2.1 billion in the first quarter of 2021, as revenue growth offset higher costs and an increase in the net change in fair value of biological assets. The segment's gross margin increased to 52.0% compared to 29.4% a year earlier.

Operating profit amounted to RUB 3.8 billion compared to RUB 1.9 billion in the first quarter of 2021. The segment's operating profitability increased to 50.9% versus 25.8% a year earlier.

Adjusted EBITDA remained unchanged and amounted to RUB 2.2 billion. Adjusted EBITDA margin was 29.1%, down from 30.9% a year earlier.

Meat processing segment

The segment's sales volumes to third parties in the first quarter of 2021 increased by 3.6% year-on-year to 26.3 thousand tons (in the first quarter of 2021 - 25.4 thousand tons) due to expanded sales of sausages and ham under the " Cherkizovo" and "Cherkizovo Premium". The average selling price increased by 5% year-on-year to RUB 199.8/kg (in the first quarter of 2021: RUB 190.3/kg). Under the influence of these factors, segment revenue increased by 8.8% and reached 5.3 billion rubles compared to 4.8 billion rubles for the same period last year.

Gross profit decreased by 64.2% to RUB 0.3 billion compared to RUB 0.8 billion in the first quarter of 2021 due to the fact that prices for the main component, meat, increased significantly year-on-year. Gross margin fell to 5.2% from 15.9% a year earlier.

Operating expenses increased by 15.6% year-on-year and amounted to 18.0% of revenue (17.0% in the first quarter of 2020).

The operating loss increased from RUB 0.1 billion in the first quarter of 2021 to RUB 0.7 billion.

Adjusted EBITDA reached a negative value of RUB 0.4 billion compared to a positive result of RUB 0.1 billion in the first quarter of 2021.

Results of joint ventures and associates

The Group's significant investments in joint ventures and associates include: a 50% stake in the Tambov Turkey joint venture, which specializes in the production of turkey meat products and was established by the Company together with partner and shareholder Grupo Corporativo Fuertes, as well as a 75% stake in Samson - food products", a manufacturer of meat products in St. Petersburg.

The overall result of the Group's consolidated EBITDA from significant joint ventures and associates was RUB 95 million compared to RUB 227 million a year earlier.

Development prospects

The macroeconomic situation in Russia, which began to deteriorate in 2020 amid the spread of COVID-19, continues to cause concern among food market participants. Contrary to expectations, the cost of components for food production, including oilseeds, packaging products and mineral fertilizers, currently continues to rise. This has a negative impact on costs, forcing manufacturers to adjust product prices, which can negatively affect consumer demand given that the real incomes of a significant part of the population remain low. In this regard, the importance of government programs for targeted social support for citizens and the creation of fair mechanisms for regulating prices for essential products is increasing.

An additional negative factor this year was the decision of the Central Bank of the Russian Federation to increase the key rate, which increased the cost of loans for businesses. However, this will not have an impact on the implementation of both current and planned future investment projects of the Company in a number of Russian regions.

During 2021, we expect sales in the food service channel to recover to pre-pandemic levels. We continue to see prospects for increasing the Group's revenue in this channel. The acquisition in 2021 of the Compass Foods enterprise in the Tula region, specializing in the production of products for McDonald's, and the launch of a line for the production of beef burgers in the Kaliningrad region allowed the Company to prepare for further growth in food consumption outside the home.

Another focus of the Group’s development is to increase the share of highly processed products. As part of this strategy, in 2021 the company acquired two modern meat processing plants of Pit-Product LLC in the Leningrad region. This transaction will allow Cherkizovo to significantly strengthen its position in sales of sausages on the large market of the North-Western Federal District. The company views M&A as a tool for further development in all business segments along with organic growth. The Group also continues to take steps to strengthen its vertical integration, exemplified by the construction of its own oil extraction plant in the Lipetsk region.

Is it worth taking Cherkizovo shares?

The group released a very controversial report on the results of 2021. Thus, revenue increased by 19.6% to 120.1 billion rubles due to rising prices and increased sales, especially in the poultry segment (it accounts for 59% of revenue).

But at the same time, operating profit decreased by 34% to 10.2 billion rubles, and net profit by 43.8% to 6.9 billion rubles.

Reasons for the drop in profits:

- revaluation of bio-assets;

- increased costs for various needs;

- increase in loan servicing costs;

- increase in the cost of raw materials.

As a result, despite impressive revenue growth, the company actually earned less than the previous year. And since dividends are paid from net profit, it is natural to assume that their size will decrease.

In addition, the high debt burden, which Cherkizovo has not yet been able to reduce for several years in a row, may also affect the size of dividends in the future.

Therefore, in my opinion, it is not worth taking Cherkizovo shares solely for dividends. The stock has a low dividend yield and the potential for lower payouts in the future.

But Cherkizovo can be included in a portfolio as a growth stock. Causes:

- performance indicators are growing;

- sales volumes are also growing;

- revenue is also growing;

- the investment cycle has passed, and all free cash flow will be directed to dividends;

- a fairly low P/E ratio of 7.19 (for comparison, Beluga Group has 21, Coca-Cola 28.75, Kraft Heinz 17).

And here’s another interesting article: Bashneft dividends in 2021: indeed, a broken tower

Thus, whether you need Cherkizovo shares or not, decide for yourself. As a dividend stock, in my opinion, it should not be included in the portfolio. But the Group's business itself is stable, growing, and the shares have growth potential. Besides, people will always want to eat. GCHE has no other significant competitors on the Moscow Exchange, so Cherkizovo should be considered as a growth stock. What do you think about Cherkizovo shares? Write in the comments, good luck, and may the money be with you!

Rate this article

[Total votes: 1 Average rating: 5]

Cherkizovo dividends for 2021

The new dividend is immediately huge and from a growing asset!

https://www.e-disclosure.ru/portal/event.aspx?EventId=ECFQmqS5AEONl62Gvs2BNA-BB

Moscow, Russia – February 14, 2021 – Cherkizovo Group (MOEX: GCHE), Russia’s largest vertically integrated producer of meat products, announces the decisions of the Board of Directors adopted at its meeting on February 13, 2021. During the meeting, the Board of Directors of PJSC Cherkizovo Group (hereinafter referred to as the “Company”): • Took into account the reports of the Chairmen of the Audit Committee, the Personnel and Remuneration Committee and the Investment and Strategic Planning Committee. • Took note of the Company’s financial results for 2021. • Approved changes to the Company’s annual budget for 2021. • Approved the work results (KPI performance ratios) of each of the subcommittees under the Investment and Strategic Planning Committee of the Board of Directors for the 2018-2019 corporate year. • Approved the results of the performance of the General Director’s KPIs for 2021. • Approved key performance indicators (KPIs) for members of the Company’s Management Board for 2021. • Approved the results of the implementation of the Medium-term incentive program approved at the meeting of the Board of Directors on February 28, 2021. • Convened the annual general meeting of shareholders on March 27, 2021 (AGM) and approved its agenda. • Set March 2, 2021 as the date for determining those eligible to participate in the AGM. • Approved the text and form of the message to shareholders about the AGM and the list of information provided to shareholders. • Preliminarily approved the Company’s Annual Report for 2021. • Approved the recommendations of the AGM on the distribution of the Company’s net profit based on the results of the 2021 reporting year by paying dividends in the amount of 101 rubles 63 kopecks per ordinary share . He recommended setting the date on which persons entitled to receive dividends are determined: April 7, 2021.

Year by year decline.

But this is a record payment.

Add to calendar

This review should not be considered or relied upon as individual investment advice. ALENKA CAPITAL does not carry out investment consulting activities and is not an investment adviser. Despite the fact that this material was prepared with the utmost care, ALENKA CAPITAL and Marlamov E.T. cannot guarantee the accuracy and completeness of the information included in the review. ALENKA CAPITAL and Marlamov E.T. are not liable for damages from the use of information contained in this review

How to buy Cherkizovo shares

To purchase Cherkizovo shares (as well as any other securities), you need to open a brokerage account with any Russian broker, for example, Tinkoff, Sberbank or BCS.

Then you need to fund your account, download a trading program or use the web interface to find the right stock. Cherkizovo stock ticker is GCHE. The minimum purchase volume is 1 lot, one share per lot.

Now the Cherkizovo share costs 1974.5 rubles, therefore, this is the minimum purchase amount.

Cherkizovo is going to raise more than $200 million on the stock exchange

Photo: iStock

Cherkizovo Group will again try to conduct a secondary public offering (SPO) on the Moscow Exchange. Investors will be offered to buy shares of the company and the founder's family.

Plans to hold an SPO are stated in a statement from the Cherkizovo group. The placement will consist of two components, primary and secondary. As part of the primary, investors are going to be offered 6.6% of treasury shares owned by the company itself, as well as new securities issued after the offering. Some of the new securities will be able to be purchased by current shareholders of Cherkizovo at the SPO price.

From the primary component, Cherkizovo expects to receive about $200 million. The funds may be used to pay off debt obligations and potential acquisitions, the company clarifies. In the second round, shares will be sold by existing shareholders of Cherkizovo. The Mikhailov family, which currently controls the company, will retain strategic control of the company and a majority stake. Cherkizovo CEO Sergei Mikhailov noted that the SPO will be “the company’s first step to relaunch on public markets.”

Sergey Mikhailov

Chapter "Cherkizovo"

“Since we first considered a re-IPO, the company has not only maintained but strengthened its leading position in the market. <…> Over the years, we have invested heavily in developing the production of high value-added products, modernizing production plants, distribution channels, sales and marketing activities, and bringing them to international standards.”

Now the sons of the founder of Cherkizovo, Sergei and Evgeniy Mikhailov, each own 26.3% of the company. Another 15.1% belongs to LM Family Trust, 14.4% to Lidia Mikhailova, 8% to the Spanish Grupo Fuertes (Cherkizovo’s partner in the turkey production joint venture in Tambov), 6.6% to treasury shares. Other company employees own 0.9% of the shares.

Read also

Year of business: everything is not as bad as it seems. Research Inc. and Tinkoff Business

As a result of the placement of shares, their share of free float will be at least 25%. Currently, 2.4% of shares are in free float.

Cherkizovo already tried to carry out an SPO in April last year - then the company was going to raise more than $300. Both the Mikhailov family and the company itself planned to sell the securities on the Moscow Exchange. The placement was postponed “to a more favorable time,” citing market volatility.

Cherkizovo Group is one of the largest meat producers in the country. It owns the brands Petelinka, Pava-Pava, Chicken Kingdom, Cherkizovo and others. The company was founded in 1993 by Igor Babaev and members of his family. Now the group manages 8 poultry production complexes, 16 pig farms, 6 meat processing plants, 9 feed mills, elevators and more than 290 thousand hectares of agricultural land. The group's revenue in 2018 amounted to 102.6 billion rubles.

Subscribe to our channel on Telegram: @incnews