Good afternoon

Today I will analyze the dividend policy. I will tell you about the history of payments and the issuer’s priorities in the matter of distribution of funds. What dividends can shareholders expect in the near future and what is the annual yield that investors should expect when buying securities at today's prices.

In addition, I will show you when you need to buy shares to qualify for dividends, and which broker to choose for trading in the stock market.

And at the end I’ll say a few words about why the issuer’s securities are falling, despite rising profitability.

So, here we go: Magnit dividends 2021.

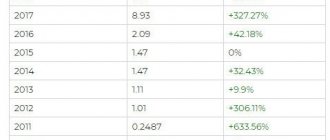

All company dividends for the last 10 years

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | June 23, 2021 | June 25, 2021 | 12M 2020 | 245,31 ₽ | 4,76% | 9 Jul 2021 | |

| 2019 | 5 Jan 2021 | 8 Jan 2021 | 9M 2020 | 245,31 ₽ | 4,26% | 22 Jan 2021 | |

| 2018 | June 17, 2020 | June 19, 2020 | 12M 2019 | 157,00 ₽ | 3,98% | 3 Jul 2020 | |

| 2018 | 8 Jan 2020 | 10 Jan 2020 | 9M 2019 | 147,19 ₽ | 4,3% | 24 Jan 2020 | |

| 2017 | June 11, 2019 | June 14, 2019 | 12M 2018 | 166,78 ₽ | 4,41% | June 28, 2019 | |

| 2016 | 19 Dec 2018 | 21 Dec 2018 | 9M 2018 | 137,38 ₽ | 3,74% | 4 Jan 2019 | |

| 2016 | 4 Jul 2018 | 6 Jul 2018 | 12M 2017 | 135,50 ₽ | 2,93% | July 20, 2018 | |

| 2016 | 13 Sep 2017 | 15 Sep 2017 | 6M 2017 | 115,51 ₽ | 1,08% | 29 Sep 2017 | |

| 2015 | June 21, 2017 | June 23, 2017 | 12M 2016 | 67,41 ₽ | 0,71% | July 7, 2017 | |

| 2015 | 21 Dec 2016 | 23 Dec 2016 | 9M 2016 | 126,12 ₽ | 1,17% | 6 Jan 2017 | |

| 2015 | 21 Sep 2016 | 23 Sep 2016 | 6M 2016 | 84,60 ₽ | 0,79% | 7 Oct 2016 | |

| 2014 | June 15, 2016 | June 17, 2016 | 12M 2015 | 42,30 ₽ | 0,47% | 1 Jul 2016 | |

| 2014 | 5 Jan 2016 | 8 Jan 2016 | 9M 2015 | 179,77 ₽ | 1,58% | 22 Jan 2016 | |

| 2014 | 7 Oct 2015 | 9 Oct 2015 | 6M 2015 | 88,40 ₽ | 0,75% | 23 Oct 2015 | |

| 2013 | June 17, 2015 | June 19, 2015 | 12M 2014 | 132,57 ₽ | 1,15% | 3 Jul 2015 | |

| 2013 | 26 Dec 2014 | 30 Dec 2014 | 9M 2014 | 152,07 ₽ | 1,48% | 13 Jan 2015 | |

| 2012 | 8 Oct 2014 | 10 Oct 2014 | 6M 2014 | 78,3 ₽ | 0,78% | 24 Oct 2014 | |

| 2012 | June 10, 2014 | June 13, 2014 | 12M 2013 | 89,15 ₽ | 0,98% | June 27, 2014 | |

| 2011 | 9 Aug 2013 | 9 Aug 2013 | 6M 2013 | 46,06 ₽ | 0,57% | 23 Aug 2013 | |

| 2011 | April 5, 2013 | April 5, 2013 | 12M 2012 | 55,02 ₽ | 0,91% | April 19, 2013 | |

| 2010 | July 27, 2012 | July 27, 2012 | 6M 2012 | 21,15 ₽ | 0,52% | 10 Aug 2012 | |

| 2009 | April 13, 2012 | April 13, 2012 | 3M 2012 | 5,18 ₽ | 0,14% | April 27, 2012 | |

| 2008 | April 13, 2012 | April 13, 2012 | 12M 2011 | 18,26 ₽ | 0,5% | April 27, 2012 | |

| -1 | May 6, 2011 | May 6, 2011 | 3M 2011 | 4,67 ₽ | 0,13% | May 20, 2011 | |

| -1 | May 6, 2011 | May 6, 2011 | 12M 2010 | 6,57 ₽ | 0,18% | May 20, 2011 | |

| -1 | May 7, 2010 | May 7, 2010 | 12M 2009 | 10,06 ₽ | 0,43% | May 21, 2010 | |

| -1 | May 8, 2009 | May 8, 2009 | 12M 2008 | 1,46 ₽ | 0,13% | May 22, 2009 | |

| -1 | May 8, 2009 | May 8, 2009 | 3M 2009 | 4,76 ₽ | 0,44% | May 22, 2009 |

General impressions of Magnit Investor Day on September 26-27, 2021

I'll try to summarize the main points.

Comments from the scene can be read here

26.09.2018, 15:15

Investor Day Magnit. Day 1

Today is Magnit Investor Day in Moscow. I'll try to broadcast it. Transferred to the AGM and... Read more

27.09.2018, 11:18

Magnit Investor Day. Day 2

2nd day. A trip to… Read more

Here are the audio recordings.

Strategy report.

https://yadi.sk/d/PqRYEmADcLxN9w

Answers to questions, my questions at 27 minutes and somewhere at the very end a question about “cannibalism”.

https://yadi.sk/d/4R6AAPzraNefaQ

I’ll tell you right away what the negative aspects were:

1. Transformation is not a quick and thorough process. According to the results of the 3rd quarter or the 4th there will be “quick wins”, but we need another whole year. This is not suitable for everyone.

How the breakthrough will be achieved was described in great detail during the event and today during shopping trips.

2. The purchase of SIA, as it seemed to me, is de facto a foregone conclusion, there are no free distributors, and the transformation of “cosmetics” is one of the growth points. The pharmacy business, although with a low margin, “magnetizes” buyers, as shown by experimental points. There will be many pharmacies (in all “cosmetics” + hypermarkets and “family” ones), we need our own supply channel.

3. We have a poor country, without economic growth, with demographic problems. It’s difficult in this environment, this is not growing Vietnam or Brazil.

How did everything go?

Arrived at the Four Seasons. One of the first.

At a glance, there were about fifty industry analysts, plus a hundred representatives of funds, many foreigners.

I was standing drinking coffee, the guys came up, introduced themselves, they recognized me.

Literally a minute later Paul Foley came up to us.

Note: According to Magnit, the board of directors considers “close interaction with management during the transformation phase to be extremely important” and considers it necessary to “involve” the deputy chairman of the board of directors, Paul Michael Foley, in strategic advice and support for Olga Naumova “in her transition to a new position " Paul Foley is the founder and managing partner of Foley Retail Consulting GmbH in Europe. Paul currently sits on the board of directors of the Hippo hypermarket chain in Belarus, VOLI supermarkets in Montenegro and AHT Cooling Systems in Austria. www.rbc.ru/business/22/06/2018/5b2c14719a794750659a9dea

He asked how things were going, what he was interested in, and for about half an hour we talked closely.

The guys asked him several interesting questions.

A true industry professional. He asked if we know how long a cucumber lives? He told me a lot about positive changes

I say now is a good time to enter, we believe in transformation. Do you know Peter Lynch? He says he heard about this one.

I showed him the article and photographs.

26.07.2018, 07:15

Lynching of Magnet

Peter Lynch, in his books Outmaneuver Wall Street and The Peter Lynch Method, writes a lot about how ordinary investors can achieve success and show results significantly higher than those of the guys at investment firms. He strongly recommends paying attention not to crowd sentiment, analyst recommendations and profit forecasts, but to ... Read more

But before I was a bear, I showed him old notes and photos of Magnit. I say Magnit was very bad and expensive, now everything is changing, Galitsky didn’t follow it then.

He says “ you are completely wrong ,” look at the whole story, Sergei created a business from scratch, etc.

Then I showed him old photos. That's how bad the store was and that's how they opened opposite each other. He says now we are opening everything smartly. I pointed out the air conditioner in my post - it’s very important.

What do you think about buying Dixie? He replies, “You said it, I didn’t say it,” and laughs.

He told a lot more things and didn’t run away. I was shocked by the openness, as if there was something to compare with.

Can I have a photo for our investor community?

He says of course. “Wow Alyonka! My Russian wife says this is the smell of her childhood!”

Next is the event itself.

Paul said the photo was Maria Sharapova.

You can listen to everything that was said in the recording.

The presentation, which I photographed for some reason, is at the link.

Magnit-Transformation-Strategy_CMD_26Sep2018_final1

Analysts asked questions of an academic nature, few of them, as it turned out, go to stores. But they are all immersed in Excel and paper.

This is certainly better than gambling addiction, but it is clearly not investing in real assets or buying a share in a company. That is, shareholders care about other things. Although I could be wrong.

That is, in half an hour no one asked questions about SIA, about 14%, about M&A, about dividends.

I had to ask them))

I was amazed by Alexey Krivoshapko from Prosperity, this is such an advanced “Maxim Orlovsky”, a very cool guy, they get the essence.

As for the reaction in the media, there are two points.

I had my laptop open and Interfax’s response was delayed by about 10 minutes.

But when they wrote “Magnit wants to close hypermarkets,” it was very strange. Not close, but reformat.

Then they wrote “investors didn’t like” the new strategy - but on the contrary, everything was clear and to the point, no lip service or sweet promises. Even I understood everything! ))

There were also comprehensive comments on SIA. The fall of Magnit on this is simply insane, because the transaction will be for a small amount, and the capitalization is simply melting.

I think it's sold by the Oppenheimer Fund.

During the break I approached Olga Naumova, let’s take a photo for our investor community.

She says, “I’ll call you now, we have a special person for this.” But he didn’t come up, and Medzhid from Alyonka helped out. She says okay, let's take pictures.

Here is a photo for memory.

This is not a manager, this is a tank, she will crush everyone and will do as she promises - that’s the impression. He has no doubts, he can, he knows, he does.

I didn’t go to the Tretyakov Gallery, probably foreigners were interested there.

In the morning everyone gathered, three buses. I hit the first one. Olga Naumova went with us.

They brought it to the beautiful ideal Magnit, redesign 2.1 (by 2020 everyone will be like this, and those that won’t will be closed or “moved”).

There was nothing to dig into, unlike Krasnoyarsk, there was a better assortment and prices. Says 7000 positions. It was 5000.

The increase in this particular store is +55% after the redesign! There were 1200 buyers, now there are 1700.

Everyone asked questions about the work of the store.

As I said at the investor day, I am not an expert, I trust the implementation of the strategy to a professional, therefore, where and how they put the greens and peaches, let them decide, and why they put something on the shelves that way is not interesting to me. There were a lot of scary articles in newspapers about “promo”—Olga Naumova has a different opinion. And who should you trust?

I asked her directly: “Is this by any chance a Potemkin Magnet?” Too good."

She literally answered, “I’m not the right person to take you around Potemkin stores.”

While everyone was listening to her about the appearance of meat and a coffee machine, I walked over and conducted several mini-interviews with local customers.

1. One woman said that she really likes the changes, everything is clean and beautiful and the staff has become better.

2. Another said negatively, “It’s become like everywhere else,” I don’t like it now, there are no cheap goods. Yes, it was dirty and boxes were lying around, but why do I need Magnit now, in the neighboring Billa the prices are better and there are more goods. And I came for a cheap cola.

We need to go there in a couple of months.

She spent a long time telling the story that this store had 640 meters of total area. And trading 350.

They took it and made a radical rearrangement, kicked out the sublease, and there was 440 meters of retail space.

This is a redesign 2.0 with compaction.

Redesign of basic 1.0 under Galitsky, it’s just new signs, painted walls, light, low current.

And 2.0 and the more advanced 2.1 are almost the target beautiful store.

He says, “I promise you that we will redo and finish everything.”

I asked, “Magnit’s revenue has been falling per meter for many years,” what will you do? Consolidate sales.

There used to be a store for the poor. It will be “for the whole family.”

There was no marketing. All marketing is “watermelon for 5 rubles.” Collect the toy in a mug. Or some kind of star wars. Nobody does that.

We will go on TV. Change your image. We are preparing a brand book. Matryoshka?

She spoke a lot about personnel, about taking into account local specifics, how this will happen.

Private label and umbrella brands. There will be a new strategy in this direction in January.

We do a third of private labels ourselves. Agroblock unique cucumbers, tomatoes, champignons. Big mushroom.

This store is redesign 2.0. He is good. But there will be 3.0

Next is Magnit Cosmetic. There will be pharmacies, goods for children, goods for animals, and cosmetics.

This is a growth point. For now, investors will have to go not for cosmetics, but for motherwort.

So everything is simple here - if they remake Mangits and Cosmetics, like the standards they looked at, then it will be a very cool network.

All. But waiting takes time. More than I wanted.

It has been said that these pilots show a mind-blowing effect on revenue growth.

Overall, I liked the event and Olga Naumova was very open to the head of the top chip.

When will dividends be paid in 2021?

The most current data by date is in the table above.

The date of fixing the register of participants applying to receive dividend payments on Magnit securities for the 2021 reporting year is set for June 14, 2019.

Since the Moscow Exchange operates in the “T + 2” mode (trading day + 2 business days), in order to receive dividends you must be listed as the owner of the securities as of the close of trading on the cutoff day for dividend payments - 06/11/2019.

Estimated date for closing the register to record participants entitled to receive dividends based on the results of 9 months. 2021, will be set for December 20-25, 2021.

The period for receipt of funds to investors' accounts can be up to 25 business days.

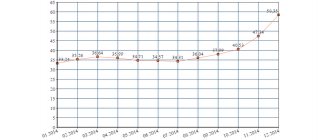

Stock return

If we take the value of Magnit shares equal to 3,700 rubles, then the LTM (Last Twelve Months) yield, reflecting dividend flows over the last 12 months, has the following indicators: (137.38 + 166.78)/3700 = 8.22% excluding taxes or 7.15% including personal income tax withholding.

Now I will consider future profitability, taking into account forecast indicators for 9 months. 2021 In this case, the following result is obtained: (100 + 166.78)/3700 = 7.21% excluding taxes or 6.27% taking into account personal income tax withholding,

How to buy shares and receive dividends

Magnit's ordinary shares are listed on the Moscow Exchange. Therefore, to purchase securities, it is better to contact one of the Russian brokers.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here you can get acquainted with the best representatives of Russian brokerage. These are large companies with high reliability, excellent service and reasonable commissions.

Warning about Forex and BO

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Forex is an over-the-counter market that primarily trades currency pairs. It has nothing to do with the stock market, and you cannot purchase securities there.

Binary options are services that allow you to place online bets on movements in asset prices over a certain period of time. Such offices are analogues of online casinos and have nothing to do with real trading.

PJSC "Magnit" Annual General Meeting of Shareholders June 10, 2021 ISIN RU000A0JKQU8

© 2021 IC VELES Capital LLC.

Licenses of a professional participant in the securities market, issued by the Federal Financial Markets Service of Russia on October 14, 2003, for carrying out depositary activities No. 077-06549-000100, for carrying out dealer activities No. 077-06541-010000, for carrying out brokerage activities No. 077-06527-100000, for carrying out securities management activities No. 077-06545-001000. LLC "IC VELES Capital" provides agent services for the issuance, redemption and exchange of investment shares of mutual funds of LLC "UK VELES Management".

Information disclosure of IC VELES Capital LLC.

Disclosure of information of UK VELES Management LLC. UK VELES Management LLC. License to carry out activities for managing investment funds, mutual investment funds and non-state pension funds No. 21-000-1-00656 dated September 15, 2009, issued by the Federal Financial Markets Service of Russia, without limitation of validity period. License of a professional participant in the securities market to carry out securities management activities No. 045-14068-001000 dated October 25, 2021, issued by the Central Bank of the Russian Federation (Bank of Russia), without limitation of validity period.) Before purchasing investment units of mutual investment funds, obtain detailed information about mutual funds investment funds managed by UK VELES Management LLC and familiarize yourself with the rules, as well as other documents provided for by the Federal Law of November 29, 2001 N 156-FZ “On Investment Funds” and other regulations of the federal executive body for the securities market, including information about the places where applications for the acquisition, redemption and exchange of investment shares are accepted, can be found at the address: Moscow, Krasnopresnenskaya embankment, 12, no. 7, fl. 5, room 514, by phone: + or on the Internet at: www.veles-management.ru. Information that must be published in accordance with the rules of trust management of mutual investment funds is published in the “Appendix to the Bulletin of the Federal Service for Financial Markets”. The value of investment units may either increase or decrease. Past investment performance does not determine future returns. The state does not guarantee the return on investment in mutual funds. Before purchasing an investment share, you should carefully read the rules of trust management of the fund. The rules of trust management of mutual investment funds managed by the Limited Liability Company "Management Company VELES Management" provide for premiums to the estimated value of investment shares when issuing them and discounts to the estimated value of shares when they are redeemed. Please note that charging discounts and surcharges reduces the return on investment in investment units of mutual funds. Open-end mutual investment fund of market financial instruments "VELES - Global". The rules for trust management of the fund were registered by the Central Bank of the Russian Federation (Bank of Russia) on July 25, 2021 under No. 3784. Open-end mutual investment fund of market financial instruments "VELES - Currency". The rules for trust management of the fund were registered by the Central Bank of the Russian Federation (Bank of Russia) on July 25, 2021 under No. 3782. Open-end mutual investment fund of market financial instruments "VELES - Conservative". The rules for trust management of the fund were registered by the Central Bank of the Russian Federation (Bank of Russia) on July 25, 2021 under No. 3783.

Investor Caution. The information presented on the site is not an offer, proposal or guide to action and does not imply an attempt to induce you to engage in a particular transaction or operation with securities and financial instruments. The given profitability indicators do not determine the future profitability of investments and the effectiveness of any transactions and (or) operations; The performance of one's past investment activities does not determine an investor's future returns. Financial terminology used on the site is intended to clarify investment conditions and may not coincide with the concepts and definitions given in the legislation. The information presented on the site does not constitute individual investment advice, and the financial instruments or transactions mentioned therein may not correspond to your investment profile and investment objectives (expectations). Determining whether a financial instrument or transaction suits your interests, investment goals, investment horizon and level of acceptable risk is your task. IC VELES Capital LLC is not responsible for possible losses in case of transactions or investments in financial instruments mentioned in this information, and does not recommend using this information as the only source of information when making an investment decision.

Reviews

Use, copying and distribution of site materials is permitted in accordance with the Creative Commons Attribution 4.0 licensing rules. International license, and is only possible with a link to the site.