Indicators are tools to facilitate technical market analysis.

For the most part, trading in the Forex market is carried out in the direction of the trend. However, to accurately determine market sentiment using charts, it is necessary to collect as much information as possible about the behavior of the value of a particular asset.

In this regard, reversal trend patterns have become very popular, which make it possible to accurately determine the end points of previous trends through mathematical calculations. Every year, new indicators appear for traders, among which everyone can choose the optimal and most accurate option for their trading with a trend reversal, depending on the strategy used.

It is more difficult to choose algorithms for beginners who have not even decided on the style of working in the market. Unfortunately, today there is no universal indicator of a reversal trend. But to start your business, you should pay attention to the standard version of RSI, which is considered the oldest reversal indicator, and then move on to studying new products and from among them choose suitable and preferably the latest indicators to suit your trading style.

Expert Advisors can be used in conjunction with indicators to close transactions in a timely manner. These are trading robots, which are presented in the form of specialized programs that work based on a variety of signals.

2 BEST OPTIONS BROKERS YOU CHOSE!

No verification required! | review | reviews | START TRADE WITH 10$ Deposit from 5$. New broker! | review | reviews | TRY SIGNALS

RECOMMENDED: THEY REMAIN LEADERS ON FOREX!

| Deposit from 0$. TOP2 strategies | TRADING TERMS | review | reviews Deposit 100$. TOP3 TS. TRADING TERMS | review/feedback Deposit from $1. How to get $1500? TRADING TERMS | review/feedback

TOP 8 newest reversal trend indicators without redrawing

TOP 1: Chaos trend reversal indicator (Signal)

In this indicator, a reversal signal shows the breaking of multi-colored lines. They immediately indicate a change in trends. The indicator is not new this year, as it appeared a couple of years ago, but it definitely deserves attention. The peculiarity of this indicator is that the script’s work is viewed in another window. There, in addition to the lines for the signal, a histogram is also displayed, with which you can evaluate the strength of the trend.

To work with such a reversal indicator, you first need to install it on the MT4 platform. It works on a fairly simple principle: the current trend is determined based on the position of the histogram in relation to the zero level. Based on this, traders choose strategies to work with.

Download the updated Chaos trend reversal indicator

Supertrend

This is a hybrid indicator, as it is based on the signals of two fairly well-known products: ATR and CCI. ATR is an average true range indicator that determines the range of minimum and maximum price fluctuations, as well as closing prices. As a result - indicates the current market volatility. CCI is an indicator of the oscillator family. The indicator helps to calculate the oversold and overbought levels of a trading instrument.

When a trend changes, the SuperTrend indicator uses color signaling: green when changing from downward to upward, and red when changing from downward to downward. You can use the SuperTrend indicator when entering the market after its correction. If the indicator changes color to green, you need to wait for the first downward correction and then open trades to buy the asset. And to sell (change color to red), wait for the first upward correction and sell the asset on it.

The SuperTrend indicator also provides a good indication of short-term resistance and support levels. But this factor must be used in trading with great caution. More accurate are the Tenkan and Kijun lines (Ichimoku indicator).

Interpretation of Envelope MT4

This free MT4 indicator gives the following signals:

- Buy when the price reaches the top line

- Sell when the price reaches the bottom line

This MetaTrader 4 indicator can be used by traders:

- Trend

- Breakthrough

Preferred way to use the MT4 indicator:

- The price must close outside the envelopes to understand the trend

- The price must trace its movement in envelopes

- A fence above the upper boundary indicates a bullish trend

- A lower fence on the lower bar indicates a downtrend

Possible trading style: scalping, day trading, swing trading

Possible timeframes: all

Trading platform available: MT4, Webtrader MT4, MT4 Mac, MT5

Smoothed Repulse

A rather exotic indicator that also uses color signaling. It needs research and description, like the Ichimoku indicator did in its time. Based on the few comments from traders, Smoothed Repulse is suitable for scalping, so it is recommended to use it on small timeframes.

Smoothed Repulse indicator on the AUDUSD M15 chart Main signals:

- Buy: open a long position if the indicator line changes color to light green.

- Exit a buy trade: close all orders if the green indicator line changes color to silver during an uptrend.

- Sell: open a short position if the indicator line changes color to orange-red.

- Exit a sell trade: close all sell orders if the orange red line of the indicator changes color to silver during a downtrend.

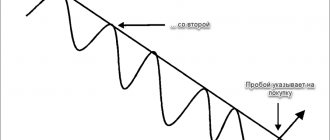

Trend lines auto

This indicator is necessary for constructing trend lines in automatic mode. You can work with the indicator on every time period and any currency pair.

This indicator is capable of performing one more task, in addition to plotting trend lines. It has a sound signal, which is necessary to notify the trader that the price chart has broken through a particular trend line. A separate window also appears, which displays all the information about the output signal and draws an arrow at the place where the signal is generated.

The indicator is set with the parameters shown in the screenshot below.

To change the type of line drawing with this indicator, you must select the “zigzag” settings. It will not be displayed on the chart; its values are necessary for smooth alignment of trend lines based on peaks and valleys.

TEMA

TEMA (Triple Exponential Moving Average) indicator - triple exponential smoothing. It can be used instead of classic moving averages (EMA) to smooth out price data. The TEMA indicator works on the same principle as DEMA (Double Exponential Moving Average) - double smoothing, but with additional processing.

First, DEMA is calculated, then the error of price deviation from DEMA values is calculated. Then the exponential mean error value is added to DEMA to obtain TEMA. Thus, the values of the next indicator smooth out the values of the previous one.

It is well known that the moving average lags slightly behind the price (lags). Therefore, the smaller the gap from the price, the better. And the TEMA indicator shows the upcoming price change earlier than others.

It is worth considering that the delay directly depends on the selected period. And the longer the period, the greater the delay will be. There is an opinion that on short periods the TEMA indicator often gives false signals.

Parabolic SAR

The SAR (Stop And Reverse price) indicator - stop and reversal, indicative price, or simply Parabolic - is designed to determine the tolerances within which price movement is possible. And as a result, stay in the current trend.

That is, Parabolic is designed to determine the stop price and reversal points. Therefore, the indicator draws dotted lines on the instrument charts. If an upward trend prevails in the market, the points will be located under the candles and form a support line. If the trend is downward, the dots will appear above the candles and form a resistance line.

In fact, each SAR marker means the level that the price must reach in order for the trend to reverse. In addition to the direction of the trend, Parabolic also shows its strength to some extent. So, if the current trend accelerates, the distance between the indicator points and the price chart increases. And if the trend fades, the markers approach the current price values.

When trading with Parabolic, it is recommended to use time frames from 1 to 4 hours.

Sale transaction:

- The parabolic has drawn 4 points in a row, which form a descending line - a signal to sell;

- Stop Loss is set above the first point by 3 - 5;

- The transaction is closed when a reverse signal is formed.

For a buy transaction, the opposite conditions are required.

Bill Williams reversal bar indicator

As an indicator of Bill Williams, you can consider its reversal pattern or bar.

A bullish reversal bar always makes a low lower than the previous bar's low and closes above its center point. This indicates that at the very beginning of the bar’s formation, the trend was bearish, but then gradually turned bullish.

The opposite type of bar to a bullish one is a reversal bar of a bearish type. It indicates a new high has formed, and the close occurs at the bottom. That is, initially the trend of movement was bullish, then it became bearish.

Both types of bar must always be located at a great distance from the Alligator indicator. In addition, the angle formed by the price must exceed the size of the angle formed by the Alligator in its mouth. Sell trades will be opened below the low point of the bearish reversal bar, with the stop position placed slightly above its high point.

In a bull market, the opposite rules apply. Buy trades are made at a point above the bear's reversal high, and a stop is placed a short distance from the low point.

These indicators can be used in conjunction with trend strength indicators without redrawing. This should give good trading results.

The indicators that were described in this article are suitable for use only by traders who have extensive experience in trading on the Forex market. Since the work schemes for them are quite complex and require a preliminary analysis of the market situation, which beginners may not be able to cope with. It doesn’t matter who developed the indicator, there is always a risk of making a trade at a loss. Even the authors themselves never profit from using any indicators one hundred percent of the time.

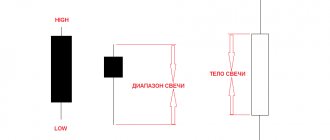

Heikin (Heiken) Ashi

Heikin Ashi is a useful indicator of the price oscillator family. To determine the trend and its strength, the indicator uses Heikin Ashi values instead of the “net price”. This is an additional signal line that is used to achieve the following purposes:

- Use it as a signal line at intersections with the oscillator.

- To smooth values and filter out some false signals, since oscillator values are prone to rapid fluctuations (nervousness) against the background of a natural lag.

Heikin Ashi is developed on the basis of ordinary Japanese candles, but the method of constructing candles itself is unusual. And visually, the opening and closing points of Heikin Ashi candles do not always correspond to the same points on the charts of “classic” Japanese candles.

The opening price of a Heikin Ashi candle (HA candle) is the smoothed value of quote fluctuations in the range between the opening and closing of the previous HA candle. Thus, the opening and closing prices are first added and then divided by 2. The indicated prices are taken from the previous HA candle.

The closing prices of an HA candle are the average of all indicators of a regular candle. That is, this is the minimum, maximum, as well as the opening and closing prices of the timeframe. Divide them by 4 and get the closing price of the HA candle.

The maximum price is obtained by comparing the parameters of the maximum of a regular Japanese candle with the opening and closing prices of an HA candle. The minimum price is obtained by comparing the minimum of a regular candle with the opening and closing prices of an HA candle. To make it more informative, HA candles are colored differently than regular Japanese candles. When analyzing, you need to take into account the shadows of candles.

With Heikin Ashi, trend reversals are easy to recognize. To do this, you need to draw a trend line and highlight the rollbacks in the trend. The lower shadow indicates where to set Stop-Loss. And Take Profit is usually set around the support/resistance level

Bollinger Bands

Bollinger Bands are an indicator that helps assess market volatility. They allow you to determine not only the direction of the trend, but also volatility, as well as the range of fluctuations. That is, the direction of the trend and the nature of trading.

The indicator consists of three main lines. The middle line is the moving average (MA). The outer bands are also MA, but they are displayed taking into account the deviation.

The distance between Bollinger Bands depends on the nature of price behavior. If market volatility increases, the corridor expands. And when market volatility falls, the corridor narrows.

The most common is trading using the price crossing the center line of the indicator. When the price crosses the moving average from below to above, buy trades are opened. And if from top to bottom, a sell transaction is opened.

Another trading method is buying on reversals. Considering that the extreme lines are support and resistance levels, trades are opened when the price pushes away from one of them and goes to the opposite one.

When price touches the lower Bollinger Band and then reverses, long positions are entered. In a situation when the price touches the upper border of the indicator and turns down, short positions are opened.

It is not recommended to use this instrument in markets with low liquidity.

Combined reversal analysis schemes

Standard tools have been studied for a long time, tested in many variants, and only non-standard solutions can provide any advantage. The availability of programming tools allows you to combine several analysis methods in one indicator with virtually no loss of accuracy. In addition, it is possible to get rid of many indicators on the working screen - the trend reversal indicator recommended below can be found for free on the Internet. Signals are processed according to a standard scheme.

Click the button to go through a step-by-step guide to trend reversal indicators and master these tools in a few simple steps Explore »

Non-standard VisualMACD indicator.

An assessment of the reversal potential is necessarily included in complex technical tools, such as the Forex Eye indicator, which, in addition to clear trading signals, calculates possible target levels for movement in both directions.

General trading scheme using the Forex Eye indicator.

MACD

The MACD indicator (MACD) - Moving Average Convergence and Divergence can be translated as “Convergence and divergence of moving averages.” It is used in technical analysis to evaluate and predict price fluctuations in markets.

It is used to check the strength and direction of a trend, as well as to determine reversal points. It belongs to the family of oscillators, and is essentially an improved version of two moving averages.

The MACD indicator is built on the basis of two lines - solid (main) and dotted (signal), which is usually of a brighter color.

The main line is built based on two average fluctuations in the exchange rate of the instrument being traded. It is more mobile and reacts quite quickly to price changes in a short period of time. The signal line reacts much more slowly to price fluctuations, but covers a longer time interval.

Trading using the MACD indicator is based on the intersections of the Main and Signal lines. So, in the case when the Home falls below the Signal (dashed) line, this is a signal to sell. And in the case when the Main rises above the Signal line, this is a signal to buy. Also, the moments when the Home crosses the zero line down or up are used as sell/buy signals.

Example: we buy when the histogram columns begin to go below the zero line and then close above the moving average. The trade is closed when the histogram columns cross the average in the opposite direction. A sell transaction requires the opposite conditions.

On hourly timeframes (and less), the MACD indicator gives a lot of false positives. It is recommended to use it on daily charts or higher.

Average Directional Movement MT4 Index Review

The MetaTrader 4 ADX indicator can be used by traders:

- Trend

- Breakthrough

The preferred way to use the average directional movement index trend indicator is:

- The ADX curve must go beyond 25 to alert us to a trend.

- The trend is given by the intersection of +DI & -DI

+ DI is higher -DI is uptrend

-DI above + DI downtrend

A trend can end in two cases

- ADX returns below 40

- ADX reaches 50

Possible trading style with the average directional movement index: scalping / day trading / swing trading

Possible units of time in the average directional movement index: all

Available trading platform: MT4 / Webtrader MT4 / MT4 Mac / MT5

TRIX

The TRIX indicator (TRIple eXponential average) - Triple Exponential Average, is an overbought and oversold oscillator. It differs from MA in that it produces fewer false signals.

When calculating, TRIX excludes values with shorter periods than the indicator period, thereby smoothing the resulting line and excluding short-term market fluctuations from it. As a result, during trading it allows you not to make unnecessary movements.

The TRIX indicator is displayed in a separate terminal window and consists of a line and level 0. If the TRIX line is located above zero, the market is in an upward trend. And if below the trend falls. If the TRIX line is above level 0 and continues to rise, the uptrend is intensifying, and if it is below 0 and continues to fall, the downward trend is intensifying.

TRIX is an impulse indicator, so it is recommended to use it during pronounced trend movements. During a flat period, TRIX can produce quite a lot of false signals. That is, if the TRIX line fluctuates near the zero mark for a long time, this usually indicates uncertainty in the market. At such moments it is better not to take active actions. It's better to analyze.

For a sell transaction:

- The TRIX line broke through the zero mark from top to bottom;

- Stop Loss is set 3-5 points above the local extreme;

- When there is an opposite signal, we close the deal.

A buy transaction requires the opposite conditions.

Trend strength indicators: TOP 7 best of the best!

Good afternoon, dear traders! Today we’ll talk about a concept that is familiar to each of you without exception - a trend! What it is, how to determine its direction, what it is like - all these are the basics, which are not interesting to us within the framework of this article! What will we talk about then? About the most important characteristic in our opinion – the strength of the trend! This is something that any stock speculator who wants to play and win should know and be able to identify!

Trend strength

is the degree of its duration and stability. It is determined by assessing the volume of transactions, volatility, ascension / descent, thanks to which it is possible to analyze the real intentions of bulls and bears.

Experienced traders rarely trust solely the visual perception of a trend, since the mood of sellers and buyers changes very quickly. In order to decide to open a position, you need not only to detect the emergence of a new trend, but also to evaluate its strength. If you enter the market after catching a strong movement, you can get an excellent profit. The chain of dependencies is as follows: the stronger the trend, the longer it will last, the more difficult it is to reverse it in the opposite direction, the smaller the rollbacks and the more you can earn.

You can determine the strength of a new price movement in 3 ways: Using a trend line.

trend line

Through support/resistance.

support lines

Using trend strength indicators.

bears indicator

The first method is very easy to use, and its readings are quite accurate. First, you need to extend the trend line along two or three highs (for a bear market) or lows (for a bull market). Secondly, evaluate the angle of inclination. Third, analyze the price movement. Conclusion: if the angle is close to 45% and the candles (bars) “stretch” towards the line, then we have a strong trend! The second method is also quite accurate and easy to use. In order to determine the strength of the upward movement, you need to: draw resistance and support levels,

support lines

evaluate how the price behaved around them. For a bull market: if the price approached resistance, rolled back, and then broke through, then the trend is strong. If the resistance line is not broken after two or three attempts, then it is weak! A breakout movement is usually formed by 3-5 candles. For a bear market, the situation is the same: if the price dropped to the support level, then made a rollback, and then broke through it, then we can talk about the strength of the bears. If the breakdown does not occur within 2-3 movements, then it is a sign of weakness.

breakout of level and trend

The third method of assessing strength is the most popular among traders and occupies one of the main places in technical market analysis. We are, of course, talking about the use of indicators that show the strength of a trend, that is, tools that graphically or in percentage terms indicate the stability of price movements. As practice shows, this method is the most accurate and convenient to use. Analysis based on the trend line and resistance/support is associated with subjectivity in the interpretation of signals. The use of indicators does not have this drawback.

It is unlikely to be possible to say exactly how many such indicators exist. The differences between them are sensitivity, graphical display, type, applicability on different timeframes. But the basis is the same mathematical functions, which we will discuss in more detail.

Mathematics and functions

Technical analysis of markets is based on psychology and mathematics. The first argues that traders are ordinary people who will act in the same way in similar situations. Mathematics offers tools for numerically and graphically displaying their intentions. Mathematical functions in various combinations form the basis of any indicator. Tools for determining trend strength typically use weighted averages of price. The average price is determined taking into account the volume of transactions. This is the most accurate characteristic, which is not significantly influenced by the timeframe. The dependence is as follows: if the average transaction price is higher than the price for the previous period, then there is an upward movement in the market; if it goes the opposite way, then there is a downward movement (the market is bearish). An indicator of strength is the range of change: the higher, the stronger the trend. The mathematical function of the moving average is used to construct the graph. Numerical and graphical indicators of trend strength indicators are nothing more than the difference between the weighted average price of the current period and the past, which is multiplied by the volume of transactions. Or in other words, the cumulative increase (decrease) in the monetary volume of trading operations.

Initial data of indicators

Each market participant selects a trading strategy “for themselves”! Selects a timeframe, trading instrument (stocks, futures, options, currency pairs, etc.) and analysis tools (indicators, indices, etc.).

Before you start using the indicator to determine the strength of a trend, you need to set the following parameters:

method by which the moving average will be constructed: simple, exponential, smoothed, linearly weighted; the number of periods that will be taken into account in the calculation; method for determining sensitivity; time periods for which data is checked.

Which ones to install should be decided by the trader himself based on the playing style, timeframe and indicator.

TOP 7 best

Professionals recommend using several indicators simultaneously. We have collected for you the 7 best tools for analyzing trend strength that will help you significantly increase your deposit:

Average DX (ADX) (for scalping). CPM_3_CurrentPair (trend strength in percentage). Bears Power and Bulls Power. Aroon (without recutting). SMA. IVAR. Ichimoku trend indicator.

Now let’s look at each of them in detail: features, how to find exit/exit points, analyze the strength of the trend.

Average DX (ADX): predicts the future!

Features: for any timeframe, oscillator, without drawing on the price chart.

adx indicator

In our rating of the best indicators for determining the strength of a trend, ADX deservedly takes an honorable first place. After all, it is able to predict the strength of a barely emerging movement, that is, it works ahead of the curve and does not follow the price, which is extremely important for finding an entry point into the market.

Graphically, the ADX oscillator is represented by three lines: the ADX line, and two lines +DMI and –DMI. They are located between levels 0 and 100. Most of the time they fluctuate in the range from 10 to 50. If the ADX line drops to level 20 and below, this indicates that the market is flat. The higher the main line of the oscillator, the stronger the price movement. The range from 40 to 100 indicates the strength of the trend, continuation of movement or a breakthrough of the psychological level of support or resistance.

The strength of the Average Directional Movement Index is that it can be used on absolutely any time frame: from intraday trading to investing. The signal to open a position is a breakdown of level 40 by the main line; to close, a decline below this level. It is better to avoid entering the market if ADX has not broken through the 40 mark, but has only touched it. This is a clear sign of trend weakness and possible consolidation.

CPM 3 Current Pair: successful upgrade!

Features: reflects trend strength in percentages or points, redesigned from the classic CurrencyPowerMeter.

This unusual indicator is very convenient to use and easy to understand. The fact is that, unlike others, it shows the strength of movement as a percentage (or points). But that is not all! Visually, CPM 3 CurrentPair consists of two color scales.

CPM 3 Current Pair

One narrower one reflects the situation on lower timeframes, the other wider one reflects the situation on higher timeframes! It is very comfortable! The indicator shows not only the strength, but also the direction of the trend, which is also a significant advantage.

Bears Power and Bulls Power: Trusted Classics!

Features: best used in pairs, oscillators, visually – histograms.

These are actually two separate indicators! Bears Power is needed to analyze the strength of a downward trend, and Bulls Power is needed for an upward trend. True, they are advised to be used simultaneously, because the data from one graph confirms the data from the other!

Bear Strength and Bull Strength are indicators developed by trading genius Alexander Elder. They are the opposite of each other. It is based on an exponential moving average (EMA) with a period of 13 and price extremes. The difference between the maximum price and EMA characterizes the strength of the bulls. The difference between the minimum price and the EMA is the strength of the bears.

The histogram of indicators is plotted relative to level 0. When the bulls are strong, Bulls Power is located above zero, when they are weak - below. If the bears dominate the market, then Bears Power is located below level 0. If the bulls seize the initiative, then it is higher. It is best to use them in conjunction with a moving average, which will confirm the signals of the indicators and indicate the direction of the trend.

The best time to enter is characterized by: an upward movement of the EMA; Bears Power is rising and approaching zero, but not yet there; Bulls Power is growing and is above the zero line; presence of bull divergence. It is better not to open a position if the Bears' Strength is already in the positive zone.

bear signal

It is worth closing a position if: EMA decreases; The Bulls' power is approaching the negative zone;

As you can see, everything is quite simple. The main thing is that the indicator readings do not contradict each other.

Aroon - the early light of dawn without redrawing!

Features: the oscillator, without redrawing, reflects the strength of the trend and predicts price reversals, suitable for any timeframe.

Every trader has technical analysis tools that he prefers to use. And it's not strange! So each indicator is reflected in its own way. Many of them draw lines directly on the price chart, others display the results of the analysis below it. These are called “no redraw” indicators.

The most convenient among the tools without redrawing is Aroon. He has earned the commitment of an army of traders. Designed by Indian American. The name was given by the author. Translated from Sanskrit, Aroon means “early light of dawn.” This name very accurately reflects the essence of the instrument. Indeed, in addition to the ability to reflect the strength of a trend, it is able to “predict” a new movement, even at its “dawn”.

The indicator is represented by two lines: Aroon up (blue) and Aroon down (red), which reflect the number of time intervals between the appearance of price extremes. It follows from this that the only significant parameter that a trader must set before applying it is the settlement period. The default value of the parameter is 14. If trading is carried out on daily candles, then you do not need to change it. If the trader is going to trade intraday, then the value should be changed to 25.

Significant levels for Aroon are 30, 50 and 70, upon crossing which it will give signals to open a position.

aroon

Possible options for the location of the red line:

between 70 and 100 – a strong upward trend;

between 50 and 70 – a high probability of a strong upward movement;

between 30 and 50 – a weak trend.

from 0 to 30 – consolidation.

Possible options for blue:

between 70 and 100 – strong downward trend;

between 50 and 70 – high potential for a strong downward movement;

between 30 and 50 – a weak trend.

from 0 to 30 - price consolidation.

The Arun indicator is easy to use; its signals are very accurate and timely. The possibility of a signal delay exists only when there is a sharp price change. But this is a weakness of any indicator.

SMA: everything ingenious is simple!

Features: trend indicator, dampens market “noise”.

SMA is a simple moving average. We talked about the principles of calculation earlier. If other indicators use average indicators in combination with other parameters in their calculations, then SMA operates directly on price values. The trader decides which price to use, but most often the closing data is chosen.

In addition, before use, you need to set the calculation period. This means that you need to select the number of values over which the average will be calculated. This affects the sensitivity of the indicator. The longer the period, the less the indicator reacts to price changes. Conversely, a shorter period gives greater sensitivity.

SMA neutralizes momentary decisions of sellers and buyers. It reflects only general sentiments, which allows you to make decisions based on the real situation that has developed in the market.

In order to determine the strength of the trend, you need to draw two vertical lines on the chart: through the current candle and the twentieth to the left of it. Now determine the price values at the points where the moving average intersects the vertical lines. Subtract the less from the greater. Let's call this number variable "A".

sma

After which comes the most difficult moment - determining the reference value of this parameter for a given type of trading instrument (currency pair, stock, option, etc.). This will have to be done experimentally. That is, you need to make several such “measurements” over different periods and calculate the normal value (variable B).

Next we compare A and B. If A is greater than B, then there is a strong trend in the market, if the values are close or equal, then the price movement is weak (a reversal is possible) or flat.

The only significant disadvantage of a simple moving average is that all price values are equal in importance. Many traders discourage this because they believe that older prices should be less significant! The exponential average does not have this drawback.

IVAR: complex algorithms - simple results!

Features: an indicator based on variation indices, without drawing, determines only the strength of the trend, but not the direction.

In order to understand the essence of the algorithm with which the indicator is calculated, you need to have an idea of what a “fractal time function” is. But understanding the essence is not necessary for its effective use, so we will not go into details, but will immediately talk about using this technical analysis tool.

IVAR does not plot prices on the chart. The data is displayed in a separate window. Before starting work, you only set the power to which two will be raised to calculate the variation index (default 5) and the number of bars in the current timeframe (default 1000).

ivar indicator

The indicator chart is a line that fluctuates around the 0.5 level. If it is below it, then the trend is strong, if above it is weak, most likely the market has entered a flat. During periods when the line is as close as possible to a significant level, it is better not to open a position; this is a situation of uncertainty.

Since IVAR does not allow you to determine the direction of the trend, it is recommended to use it with other analysis tools to achieve maximum results. For example, it works well in tandem with the Rubicon indicator.

Ichimoku Kinko Hyo – Japanese quality for market analysis!

Features: trend indicator, used independently without additional analytical tools.

This is not just an indicator that allows you to determine the strength of a trend, it makes it possible to comprehensively assess the current market situation for a specific trading instrument. It draws prices quite heavily on the chart, so it will not appeal to traders who prefer indicators without drawing.

By installing Ichimoku on the chart, a market participant will see:

Fast line (Tenkan-sen).

Slow line (Kijun-sen).

The candle's closing line, which is adjusted by the period set to calculate the slow line (usually 26).

The Ichimoku Cloud, which consists of a shaded area and support and resistance lines (Senkou Span A and Senkou Span B).

Ichimoku indicator

And now first things first!

The fast average and slow average allow you to assess the current position in the market and find points for entry and exit. A signal to buy an asset – the fast line crosses the slow line from bottom to top. When the opposite happens, a cross from top to bottom is a signal to sell. The closing line is needed to determine the long-term trend in the market.

The strength of the trend is determined using the cloud. Its color depends on which line is on top: Senkou Span A or Senkou Span B. If B is located above, then the cloud will turn orange, if A - pink or blue, depending on the trading terminal! Orange color is an indicator of a bearish market, pink (blue) is an indicator of a bullish market. Signs of a weak trend are that the cloud is very thin and the price is near it or has broken through it. A trend reversal is possible. When candles (bars) are located inside the cloud, this indicates a flat. A sign of a strong trend is an expanding cloud, from which the price chart moves away.

The Ichimoku indicator is complex only at first glance. If you study it, it will become a powerful weapon for a trader in the difficult field of stock trading.

Conclusion

A strong trend is a goldmine for every trader. Indicators of trend strength help determine the direction and “seriousness” of an emerging movement. The invaluable experience and practice of many generations of stock speculators has given us a rich toolkit for analyzing the market and its most important components. The choice is so wide that every trader can choose an indicator “to suit his taste”: with or without graphics, a chart or a scale with percentages. It's up to you to decide what to use! The main indicator of the correct choice of analysis tool is a steadily growing deposit.

Previous

Product opportunity cost

Next

Investing in gold 2021 – options, features, prospects

I recommend reading:

- Cruscotto currency strength indicator - instructions for use

- Currency Power Meter

- Currency Slope Strength (CSS) indicator for…

- Spread indicators for MT4

- Indicators 3 MA Cross w alert v2 and v4

- Forex volatility indicators

- Time indicators until the candle closes for MT4

- Signal indicators for entering the market

- Large time frame in Forex and BO: indicators and strategies

- Indicators for gold for the Meta Trader terminal

- The best indicators of chart highs and lows

- Bill Williams indicators - fractals, alligator and others

- Ozymandias indicator for finding a trend

RSI

RSI (Relative Strength Index) indicator - The Relative Strength Index is an oscillator that follows the price and fluctuates in the range from 0 to 100. At first, its 14-period version was used, later 9 and 25-period indicators became popular.

It is important to remember that the shorter the calculation period, the more sensitive the RSI indicator becomes and produces more false signals. So you need to be careful when setting it up.

TS with RSI is based on searching for divergences (discrepancies), in which the price forms a new high, but the indicator fails to exceed its previous high. With such discrepancies, we can say that there is a high probability of a price reversal. If the RSI subsequently falls below the last trough, then the so-called The “failed swing” ends and indicates an imminent price reversal.

To open sell trades:

- The RSI broke through the overbought level (70) from top to bottom.

- We sell on the next candle after the breakdown.

- We set the Trailing Stop to the level of the local maximum price that preceded the opening of the transaction. That is, Stop Loss will automatically follow the price at a certain distance.

- We set Take Profit 2.5 times further (in points) than Stop Loss.

- If a reverse signal has formed, but Take Profit or Stop Loss has not yet triggered, we close the deal manually.

Buy transactions require the opposite conditions.

Stochastic Oscillator

Stochasticity is a goal, an assumption, an accident. This is a process whose behavior is not defined, and its subsequent state can be either predicted or random.

The Stochastic Oscillator is compared to a certain indicator of price speed. It shows the ratio of the closing price of the current period to the maximum or minimum for a specific period. That is, its main purpose is to determine trends and price turns, their changes by tracking the distribution of closing prices in an extreme series of market highs and lows. Stochastic values range from 1 to 100.

Experts divide the Stochastic indicator into 3 types:

- Fast Stochastic (pure %K) is determined by diagnosing its values for lack of smoothing using an averaging method. It is used quite rarely because it is too variable in itself.

- Slow Stochastic (slow %K) - values smoothed by the averaging method.

- Full Stochastic (universal) is the most flexible and advanced. Is the average of the oscillator types listed above. Sometimes it may coincide with their meanings.

The Stochastic Oscillator consists of two lines: the main (%K) and the signal (%D). Typically %D is a moving average of %K. The main line is shown as a solid line, and the signal line as a dotted line.

Most often, Stochastic is used to search for divergences and analyze trends. If the Stochastic value rises above 80%, the market is in the overbought zone. And if it drops below 20%, the market is in the oversold zone.

To open buy trades:

- Both Stochastic lines entered the oversold zone.

- The lines intersected in this area.

- The oscillator broke through the oversold level from bottom to top.

- We buy on the next candle, after the breakdown.

- We set the Trailing Stop to the level of the local maximum price that preceded the opening of the transaction. That is, Stop Loss will automatically follow the price at a certain distance.

- We set Take Profit 2.5 times further (in points) than Stop Loss.

- If a reverse signal has formed, but Take Profit or Stop Loss has not yet triggered, we close the deal manually.

Sell transactions require the opposite conditions.

Signals for transactions

When used in conjunction with the short Force Index and other trend-following indicators, its effectiveness can be significantly increased. For example, when using any other trend-following indicator to identify an uptrend, the best buying points can be found when the two-day moving average from the Force Index is falling. When another trend indicator shows a downward trend, the rising two-day moving average from the Force Index will indicate the best time to decide to sell.

To find a short-term pullback within a rising trend, wait for the Force Index's two-day exponential moving average to move into negative territory. This point, which is likely to be a local minimum of the medium-term trend, is ideal for buying.

You can place a pending buy order just above the high of the candle, at which the 2-day moving average from the Force Index went into the negative zone in the presence of a strong uptrend. In this case, you will be protected in case prices fall because your order will not be filled, on the other hand, if, as expected, the uptrend continues, the order will be filled and you will have a position in the direction of the strong uptrend.