08/31/2019 1 194 1 Reading time: 6 min. Rating:

Author

: Konstantin Bely

And again about investments. Today we’ll look at a concept that every investor should know. After reading this publication, you will learn what a ticker is , what tickers there are for stocks, futures, indices, currencies, oil, gold and other commodities, what they mean, and other useful information related to this concept. So, first things first.

What is glued futures for?

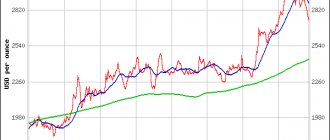

To clearly demonstrate this problem, I will show several examples of completely different futures contracts. Let’s say the chart of the December and March 6E currency futures contracts (EURUSD)

Or look at this chart of the March RTS futures contract:

One gets the feeling that this is some kind of completely illiquid instrument that is of no interest to anyone. And suddenly, starting from December 14, interest appeared in it and the volume increased sharply. In fact, RTS index futures are the most liquid instrument in the Russian futures market. And there is nothing surprising in the fact that the volume appeared in exactly these numbers, since on December 15, expiration occurred, and we switched to a new contract.

And, as I wrote at the very beginning of the article, for those who analyze higher time frames, such charts are a very big problem. There are several ways to solve this:

- Look at the underlying asset. For example, if this is a futures for a stock, then the chart is the stock, index, etc.

- View spot chart. So, if we are talking about currency futures, then the chart of the underlying asset can be viewed on Forex.

- View the stitched futures chart.

The first two options may be suitable for analytical forecasts, but not for trading. For example, a momentum stock behaves completely differently from a futures. And there is no need to talk about the over-the-counter Forex market at all, because quotes can vary significantly from one broker to another.

The most preferable and compromise option is to build a glued futures chart. It is such a schedule that will allow us to obtain the most objective information. But it should be noted that this method is not 100% effective, due to the fact that it will not be possible to perfectly glue two charts of different contracts “back to back”. I’ll tell you why this happens below.

Methods for gluing futures contracts

I have heard of at least two main gluing methods, but I am sure that there are many more, since there is no clear and correct method.

The simplest method is overlap. Its essence is that we wait for the expiration date (last day of circulation) of the current contract and superimpose the schedule of the nearest contract on it. But this method gives a very large error. This happens because trading on the next contract begins even when trading on the current futures has not yet ended. If you are familiar with such concepts as contango and backwardation, then you will understand what we are talking about. But let’s not (yet) go into the jungle of the derivatives market and futures trading. As a result of such gluing, we will see large gaps on the chart caused by price differences.

There are also more complex methods, such as the "Panama" (which takes its name from the Panama Canal and its locks). This method allows you to get a smoother price chart. Its essence lies in the fact that at the moment of changing the contract, the price difference between the two contracts is calculated. And each bar of both contracts decreases by the amount of this difference.

But again, I don’t want to “fill my head” with information that is not so important for us, because we will not waste time and glue futures together ourselves. Certain programs and services will do all the work for us. Our task will be to simply use ready-made information. And that’s exactly what I’ll tell you about now.

Use in practice

Futures can be used as a trading instrument for hedging risks, the analyst says. To do this, it is necessary to sell futures for the amount of the cryptocurrency portfolio in order to level out the risk of its possible drawdown, advises Viktor Pershikov. According to him, the financial results from the sale of futures will cover the loss from the decline in the portfolio. The 8848 Invest analyst does not recommend using futures as an independent and only tool for making money.

“Trying to buy and sell futures while trading actively often makes less sense than a properly constructed investment portfolio hedged by futures,” he explained.

Where can I view stitched futures charts for free?

Now we come to the most interesting part. Below I will share with you several online services and programs with which you can view stitched futures charts completely free of charge.

Stitched currency futures charts

In one of my articles on the topic of exchange volume, I already wrote that for currency futures, we will look for data on the CME Chicago Mercantile Exchange. By the way, most of the programs and services will be the same as in the article to which I provided a link.

Thinkorswim trading terminal

In my opinion, the best solution for traders of all stripes. In this program you will find absolutely all charts of the American stock market (NYSE, NASDAQ, CME...). There are both stitched charts and contract charts. And the most interesting thing is that it is completely free! This is the program you can see in my weekly video reviews.

TradingView.com service

An excellent site with very great possibilities. I strongly recommend using it in your trading activities.

But the free account has some limitations, namely: quotes are broadcast with a delay, and time frames below the daily one are not available.

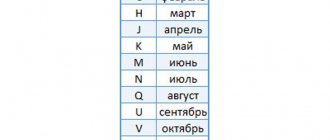

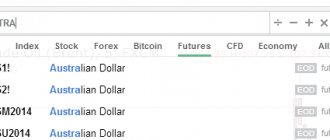

There is also one small nuance: in the field with the contract ticker you need to type E6 (B6, A6, N6...), instead of the usual 6E, 6B... The stitched chart on this service is under the ticker E61! (for other contracts there will be a different letter accordingly).

Website ClusterDelta.com

The site ClusterDelta is widely known in the narrow circles of BCA people. On this site you will also find charts of major futures, updated in real time.

The maximum time frame of the chart that can be displayed is daily. Accordingly, the historical data for analysis will not be so extensive, about 9 months.

Stitched charts of RTS index futures and other FORTS derivatives market contracts

Those who have traded or are trading on the Russian derivatives market FORTS know how big a problem it is to find a schedule for Russian futures futures, and in particular, for futures on the RTS index (Ri). I will give several links to several resources that solve this problem.

Website ru-ticker.com

In my opinion, the best information portal in the segment of the Russian stock market. I recommend adding it to your bookmarks. Like most similar services, there are paid and free accounts, but to solve our problem, a free account will be enough.

In order to find the charts we need, in the site menu we look for the “Help” - “Glued futures charts” item.

Finam brokerage company website

Also a very useful site for those who trade on the Russian stock market. One of the best online chart broadcasting services.

Here is the direct link. If it doesn’t work, then go to finam.ru, then in the main menu and select the “graphics” item.

Website MFD.ru

I came across this site quite by accident when I was googling material for an article. Quite an interesting information and analytical portal. I recommend it for reference. Here is also a direct link to the RTS index. Or go to the website mfd.ru in the “Quotes” section. There we select the market that interests us. The choice is very extensive. There are Forex, FORTS, world indices, etc.

That's all for me. Let's summarize. From this article you learned about what “gluing” futures contracts is and what it is used for. I also shared several useful links to free programs and services with which you can view stitched futures charts for various instruments of both Russian and other markets. If you think that I undeservedly overlooked some site and did not talk about it, then be sure to write about it in the comments.

Thank you for your attention. Don't forget to subscribe to blog updates.

Good luck in trading!

Best regards, Vadim Atroshchenko

What is a ticker?

A ticker is a unique short designation for an asset traded on an exchange. Stocks, bonds, futures, options, stock indices, ETFs, currencies, cryptocurrencies, commodities (oil, metals), etc. have their own tickers. Tickers also designate companies whose securities are traded on an exchange. Moreover, the same company can have different tickers on different exchanges and on the same exchange for different assets.

Tickers, as a rule, consist of 1-6 capital Latin letters, most often there are tickers of 3-5 characters, some tickers may have a digital designation. Often tickers are somehow related to the company name: they repeat the first letters of the name or an abbreviation, but this is not necessarily the case. They can also repeat the name of the brand produced by the company, the type of activity of the company, the object of study, etc. There can be a lot of options.

For example:

- SBER - ticker symbol of Sberbank of Russia;

- LKOH - Lukoil ticker;

- UTEL — Ukrtelecom ticker;

- MSFT - Microsoft ticker;

- IBM - IBM ticker;

- KO - Coca-Cola ticker;

- 6502 - Toshiba ticker.

The name "ticker" comes from the name of the telegraph device "Ticker Tape Machine", which received information about stock quotes and printed it on a narrow telegraph tape. This device was invented and put into operation back in 1869.

Interesting fact: the expression “read the tape,” which is now actively used in relation to social networks, originally meant receiving and reading stock quotes on a ticker tape. The ability to read and understand the stock market tape in a time when there were no computers and charts was the most valuable skill of a trader.

There are 20 one-letter tickers. They were originally assigned to the largest companies, since speed was very important when receiving quotes by telegraph, and one letter was printed faster than several.

For example:

- F - Ford Motor Company ticker;

- V — ticker symbol of Visa Inc.

The term "ticker" is not used everywhere. For example, in the UK the stock symbol is called EPIC (Exchange Price Information Computer); in Russian, British tickers are called “epiki”.

In Russia, the word “code” is often used instead of “ticker”: “trading code”, “instrument code”, “issuer code”, “stock code”.

In the USA, the concept of “ticker” is used quite actively (Ticker Symbol), but along with it you can also find the concept of Stock Symbol (“stock symbol”, “stock symbol”).