Why is this part of a global trend?

But all emerging market currencies are also becoming cheaper. The best results since the beginning of the year have so far been shown by the Hong Kong dollar and the Thai baht - their nominal rates against the US dollar have remained virtually unchanged since the beginning of the year. The currencies of South Africa, Brazil, Turkey and Argentina are performing worse than the ruble in 2021 (from -13.5 to -50%).

Interestingly, the top three worst-performing currencies in developing countries are exactly the same as last year: the Brazilian real, the Turkish lira and the Argentine peso. The difference is that in 2021 these currencies are falling many times more.

The MSCI Emerging Markets Currency Index, which tracks the performance of 26 currencies against the US dollar, fell 4.6% in 2021 after growing for two years in a row.

All currencies of emerging markets, including the ruble, in 2018 experienced pressure from global trends in the world economy - tightening US monetary policy and trade wars, Anton Pokatovich, chief analyst at BCS Premier, tells RBC.

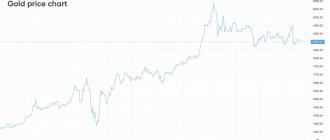

The US Federal Reserve raised rates three times in 2018 and may do so for the fourth time at its December meeting. An increase in rates in the United States, as a rule, leads to a rise in the dollar and a flow of capital from emerging markets to American assets. The Dollar Index (DXY), which measures the dollar's value against major currencies, has strengthened 5.3% this year after falling nearly 10% last year.

“The decline in emerging market currencies is, of course, associated with rising dollar rates and a reduction in the Fed’s balance sheet (the Federal Reserve is actually selling off financial assets purchased during the crisis in order to normalize long-term rates. - RBC). First of all, countries with high levels of short-term dollar debt and low gold and foreign exchange reserves responded to these factors,” notes Tatyana Evdokimova, chief economist at Nordea Bank.

For example, developing countries whose currencies have collapsed by 30-50% in 2021—Turkey and Argentina—are indeed characterized by relatively meager foreign exchange reserves and/or significant levels of dollar debt.

Why do currencies fall differently?

It’s not only and not so much about the Fed’s policy and the strong dollar, The Financial Times points out: emerging markets have developed their own problems that are not directly related to the dollar exchange rate. The strengthening dollar may correlate with stress in emerging markets, but it is not the cause, writes the FT. In turn, Bloomberg lists several stories that influenced emerging markets in 2021:

- trade war between the US and China against the backdrop of a slowing Chinese economy;

- prospects for a settlement on the Korean Peninsula as a result of historic meetings between North Korean leader Kim Jong-un and US President Donald Trump and the President of South Korea;

- the Turkish currency crisis and the economic policies of Recep Tayyip Erdogan;

- escalation of US sanctions against Russia;

- murder of Saudi journalist Jamal Khashoggi;

- the victory of populist candidates in the presidential elections in Brazil and Mexico;

- the International Monetary Fund providing a $56 billion credit line to Argentina;

- Venezuela defaults on foreign debts.

Psychological fall

In early April, the US Treasury published a list of 24 Russian businessmen and officials, as well as 14 Russian companies that were subject to restrictions.

The actions of the US authorities led to a weakening of the Russian currency by more than 8% in just two days (April 9-10). Then the dollar exchange rate exceeded 63 rubles for the first time since December 2021, and the euro exchange rate set the anti-record of the year before last April and exceeded 78 rubles.

“Foreign investors exited ruble assets, contributing to the depreciation of the national currency. They were followed by other market participants, including Russian ones. This behavior was psychological in nature - market participants were afraid that the restrictions had reached large businesses, which had never happened before on such a scale. If you trace the dynamics in the OFZ market, you can see how the exodus of foreign investors from the Russian market occurred,” Yuri Kravchenko, head of the banking and money market analysis department at Veles Capital, said in a conversation with RT.

In total, in April-July, non-residents sold federal loan bonds for 345 billion rubles, and their share of participation in the OFZ market by August 1 decreased by 6.5 percentage points - to 28%. This is stated in the prepared

Ministry of Economic Development

forecast of socio-economic development of Russia.

The second station wave arose in early August after the introduction of a bill into the US Congress proposing to prohibit foreign investors from purchasing Russian government debt, and Russian state banks from transactions in dollars. Note that in 2021 the bill was not adopted.

A few days later, there was a statement from the American authorities about the introduction of new restrictions, the basis for which were unsubstantiated accusations against Moscow of involvement in the poisoning of the ex-employee

Sergei Skripal's GRU

and his daughter Julia.

As a result, on August 10, the US dollar exchange rate on the Moscow Exchange rose above 67 rubles—this value was observed on the trading floor for the first time since August 2021. Just a month later, the national currency reached its minimum value in 2021, when the value of the US dollar exceeded 70 rubles, the euro - 81 rubles.

Yuri Kravchenko believes that the sanctions factor alone led to the Russian currency losing about ten rubles to the dollar. According to the expert, the fair exchange rate is at the level of early April - approximately 57 rubles per dollar.

“It is the sanctions factor that creates a significant risk premium for almost all classes of Russian assets. As a result, the difference between the market exchange rate of the ruble and its fundamental levels increases. Even taking into account the decline in oil prices observed at the end of 2018, we can estimate a fundamentally justified exchange rate of the ruble at around 57-60 to the dollar,” notes Anton Pokatovich.

Loko-invest analysts' opinion

K. Tremasov, head of the analytical department at Loko-invest, points out that the position of the ruble looked surprisingly weak even before the April fall, considering that oil prices rose to 70 USD per barrel. The expert does not believe this is the reason; the national currency has a tendency to strengthen, but there are enough reasons for its decline.

According to Tremasov, the extension of sanctions provoked not just a short-term deviation in the RUB exchange rate, but became the reason for a new long-term UP trend for USDRUB, which will develop at least until the end of 2021.

The situation in Syria does not inspire optimism either. Now, most political scientists are confident that the United States will launch a large-scale military operation, entering into an open conflict with the Russian Federation, which, naturally, increases risks for investors.

Tremasov points out that initially the market reacted logically in response to the news of sanctions, but then panic began. It was caused by the news that the US Congress was considering a draft law that would further tighten sanctions and limit transactions with Russia's national debt.

This is what increased bearish pressure on the price of Federal Loan Bonds (OFZ) and the ruble exchange rate, although the stock market largely recovered from its panicky fall. Although experts do not rule out that the decline in the stock market will continue after the correction.

Tremasov explains his forecast for 2021 regarding the ruble as follows:

- Panic now will lead to excessive selling of the ruble.

- If, against this background, oil remains around 70 USD per 1 barrel, then in 3-6 months, the ruble will return to 60 RUB per 1 USD.

This forecast is valid provided that no new negative factors appear. Well, they may appear if pressure from the United States intensifies. In this case, panic among investors will increase, and this will lead the value of the dollar to 75 rubles or even higher.

April crisis 2021

Many Russian citizens still do not understand the reason for such a sharp fall in the ruble. Therefore, it is worth clarifying the situation. On Friday, April 6, 2021, it became known that the US Treasury Department had imposed sanctions against 4 dozen large Russian businessmen, including government officials and heads of well-known companies.

In particular, the list included O. Daripaska, one of the key shareholders, whose shares immediately fell by 50%, as well as other well-known figures from the “Kremlin list” - K. Shamalov, V. Bogdanov, V. Vekselberg, etc.

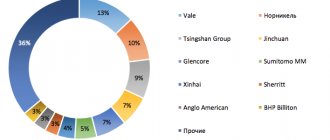

Statistics show that at the opening of the stock market after this news, Russian billionaires instantly lost over 16 billion USD! The greatest losses were suffered by the main shareholder of Norilsk Nickel, V. Potanin, who, according to estimates by the Bloomberg news agency, became poorer by 2.25 billion USD.

BUY/SELL CURRENCY IS PROFITABLE!!!

Are there any prerequisites for devaluation in 2021?

Russia is in a difficult economic situation and the population justifiably has a question about whether to expect a devaluation of the ruble in 2021. The precondition for the unrest was a decline in GDP, despite the fact that its growth was predicted, while retail trade did not move towards positive dynamics.

Imports of goods have decreased greatly and their growth is not expected in the near future. The imposed sanctions significantly complicate the work of the country's economy, and if everything continues further, this could indeed lead to the devaluation of the Russian monetary unit.

This economic phenomenon will be significantly affected by inflation and the state’s inability to repay its own debts.

Within the framework of this issue, it is worth mentioning that devaluation can be both open and hidden. In the open form of the phenomenon, the Central Bank officially makes a statement and makes a complete replacement of money. At the same time, credit rates are updated and depreciated bills are withdrawn.

Of course, experts do not expect devaluation in this form, but in a hidden form it is possible, in which case it will be possible to observe a decrease in the value of the currency, but without removing it from circulation. As a result of this financial policy, the standard of living becomes more expensive, which can already be observed today.

It is impossible to say with 100% certainty that the country will face a similar path of development. Oil prices began to rise and positive economic growth dynamics became noticeable. The devaluation will be significantly affected by inflation and financial shortages, but so far there is no talk of this. The first indicator is expected to remain at the level of 5%, and there are still enough reserve funds in the budget.

There is little cause for concern, the currency has stabilized on the market, and all problems are so far being resolved through the reserve fund, and sanctions have not weakened their impact on the country’s economy.

What does the Central Bank say?

Hidden devaluation could already be observed in 2014-2015, when you had to pay 70 rubles for one dollar. Today, Central Bank analysts cannot give promising forecasts, but they put forward their own theses on this issue.

Not long ago he announced a prediction according to which there would be no open devaluation. On the contrary, economic observers expect an increase in economic growth by 5% and advise forgetting about the past fall of the Russian currency.

If oil prices continue to rise, this will be a good help for Russia. Despite the fact that the reserve fund is not able to constantly ensure stability for the country, the state has directed all efforts to ensure that devaluation does not occur.

The largest depreciation rates in 1992-2014

The free exchange rate of the ruble was introduced in Russia on July 1, 1992 by the statement of the Central Bank of the Russian Federation “On the official exchange rate of the ruble.” Immediately after this, the Bank of Russia equalized the official exchange rate of the US dollar with the exchange rate (in effect since November 1991), raising it from 56 kopecks to 125 rubles (an increase of 222 times).

In the 1990s, a daily fall of the ruble against the dollar by 10% or more was recorded 21 times, by 20% or more – six times. The biggest drop in history was Black Tuesday on October 11, 1994. In one day, the dollar exchange rate increased by 38.58% - from 2833 to 3926 rubles. According to the findings of the State Commission to investigate the causes of the sharp destabilization of the financial market, the collapse of the ruble occurred against the backdrop of a general crisis in the economy. It was noted that some commercial banks carried out speculative foreign exchange transactions aimed at artificially increasing the dollar exchange rate. As a result of “Black Tuesday”, the Chairman of the Central Bank of the Russian Federation Viktor Gerashchenko and acting. O. Minister of Finance Sergei Dubinin. However, such a large-scale fall in the ruble turned out to be short-lived; already on October 14, the dollar exchange rate was 2,994 rubles.

The last time in the 1990s, large exchange rate fluctuations were noted after the default in 1998. So, on September 4, the official ruble exchange rate was lowered from 13.46 rubles. up to 16.99 rub. per dollar (a fall of 26%), and after a short-term growth on September 10-15, another collapse followed: from 9.61 rubles. up to 12.45 rub. (29.5%).

During the 2000s, there were no sharp (more than 10%) jumps in the ruble exchange rate. For example, during the global financial crisis, the ruble fell in value against the dollar by 35% (from 27.3 rubles to 36.7 rubles), but this took two and a half months (from November 2008 to February 2009). Until 2014, no serious daily rate jumps were recorded.

The situation with the ruble

At the moment, things are not going very well for the domestic currency. Since 2014, the ruble has been falling steadily. Despite the fact that there were extremely dangerous moments, at the moment the domestic currency has more or less stabilized. However, for how long? At the moment, one United States dollar costs as much as 67 rubles. It is worth recognizing that this situation is extremely negative.

Previously, the government of the Russian Federation confidently stated that soon the domestic currency would be able to fully rehabilitate itself and withstand the full onslaught of sanctions from the United States of America and the European Union. It is worth admitting that they somehow withstood the onslaught. However, at what cost?

Many world and domestic experts say that at the moment the economy of the Russian Federation can only be considered stable for Western countries. This is due to the fact that no matter how many sanctions they use, the Russian economy is still standing. However, they do not understand that the population of the Russian Federation itself, which receives low salaries, suffers from this. In addition, the updated bill on the pension system of the Russian Federation, which is so strongly criticized by the local population, will soon come into force.

What needs to happen for the dollar to fall to 50 rubles?

So, can the dollar fall to 50 rubles? A competent specialist will most likely joke about such a question: “What kind of question? Of course... it can! But when and under what circumstances I would like to find out myself.”

In my opinion, some global event, like the ones below:

- the Russian economy will suddenly begin to grow at the same rate as China;

- the dollar will cease to exist as the world's reserve currency;

- The US will “unilaterally forgive” its sanctions;

I hope you can determine for yourself how likely such events are.

How is the history of the ruble different?

Analysts have already noted that in addition to the general dynamics of emerging market currencies, the ruble exchange rate is influenced by oil prices and geopolitics.

But if previously the rise/fall of oil prices correlated with the rise/fall of the ruble exchange rate, now the factor of sanctions has come to the fore. A factor specific to Russia in the form of sanctions risks was predominant this year, says Pokatovich. “The ratio of the contribution to the weakening of the ruble from trends that apply to all currencies of emerging markets and specific factors is about 30 to 70%,” the expert estimated.

The main factor in the dynamics of the ruble in 2021 was sanctions, confirms Tatyana Evdokimova. They remain the main risk factor for next year, she adds.

In addition to the tightening policy of the US Federal Reserve and sanctions, purchases of currency by the Ministry of Finance within the framework of the budget rule contributed to the weakening of the ruble in 2021, noted Raiffeisenbank macroanalyst Stanislav Murashov. “All this year, the Ministry of Finance continued to buy foreign currency, which affected the weakening of the ruble, as did sanctions and the expectation of their tightening. Until the end of the year, the Ministry of Finance suspended foreign currency purchases, the ruble stabilized a little,” Murashov said. In 2021, the influence of sanctions rhetoric will continue, plus the resumption of interventions by the Ministry of Finance in the open market will have a fundamentally negative impact, the expert predicts.

Currency risks for the ruble remain

At the same time, the risks of investing in the ruble have not disappeared.

Dollar income in Russia depends on the dynamics of oil prices by approximately 60%. This is already enough to make the assets of some countries in Central and South-Eastern Europe look more attractive. The smaller interest rate difference, within 1-2%, is compensated by much lower currency risks. For the ruble, one of the key risk factors remains the possibility of new economic sanctions from the United States, which completely prohibit investing in the Russian debt market.

The US Treasury Department has already received instructions to prepare the appropriate regulatory framework by March 2018. Need I say that if such sanctions come into force, carry trade operations will be immediately stopped and a massive outflow of capital will begin?

The risks for the ruble are not limited to sanctions alone. In addition to them and the fall in oil prices, risk factors are the situation with North Korea, Ukraine, as well as the future presidential elections in Russia.

The ruble may lose its investment attractiveness

According to survey results, foreign funds that have invested about $15 billion in Russian OFZs will lose interest in ruble assets in 2021 and will begin to close their investments, selling off Russian currency and curtailing carry-trade operations.

The main reasons for possible capital flight from Russia are the low price of oil, the expansion of economic sanctions and an increase in the Fed interest rate.

Let us remember that thanks to the tough policy of the Bank of Russia, the ruble has become the favorite currency of speculators. Receiving loans in dollars and euros at an interest rate of approximately 1% per annum, banks and funds buy ruble OFZs, the yield of which is 7.5% and higher. At the same time, a stable or even strengthening ruble makes it possible to withdraw them back after some time, receiving a very high foreign exchange profit by world standards.

However, as the Central Bank of the Russian Federation lowers the interest rate, and the Federal Reserve, on the contrary, raises it, the difference in interest rates decreases, making investments in ruble assets less attractive.

Following the September meeting, the Fed clearly indicated that it would increase dollar borrowing costs in December and predicted a threefold tightening of monetary policy in 2021. In addition, the Federal Reserve has begun to shrink its balance sheet, reducing the excess dollar liquidity that flooded the markets after the crisis in 2008. Along with this, the Bank of Russia reduced the key rate to 8.5% per annum, which is the minimum for three years, and also stated that another rate reduction is possible in the coming quarters.

Statements by officials

No one doubts the reasons for the fall of the ruble in 2021, but it is interesting how officials behave against this background. After the opening of the MICEX on April 10 and 11, the state apparatus tried in every possible way to contain panic through verbal interventions. For example, Mrs. Nabiullina openly spoke out: “There is no reason to panic. The Central Bank of the Russian Federation has a wide range of tools that allows it to stabilize the situation in the foreign exchange market and prevent a crisis. At the moment, we do not see factors that require us to respond immediately, but we are keeping the situation under control and are ready at any time to move on to applying systemic measures to stop panic sales if they continue.”

At the same time, A. Dvorkovich said: “Last time, when the Russian Federation was hit with sanctions and provoked a fall in oil prices, we without any difficulties found tools and methods to stabilize the situation. You can rest assured that if necessary, the search for the necessary tools will be successful this time too.”

It is also interesting to listen to the statement of M. Oreshkin, who holds the post of head of the Ministry of Economic Development: “We are now seeing high volatility in the market. But this is completely normal in view of the floating exchange rate of the national currency, which took the main blow due to the collapse of investor expectations. But there is no real threat, and the crisis that has broken out will make it possible to evaluate how effective measures the Central Bank has developed over the past couple of years to curb the consequences of panic.”

“Import substitution”: so far the word has only been invented

In the period 2014-2017, Russian industry maintained its dependence on imports at approximately the same level, studies by the Gaidar Institute show.

The first measurements were made before the devaluation, in April 2014. Then, about 40% of enterprises declared a critical dependence on imports: the impossibility of refusing to purchase imported equipment, raw materials and materials at any price increase. In December 2014, after the devaluation, when an increase in import prices became inevitable, and imports themselves fell by almost a third, 40% of Russian enterprises were still not ready to give up imports. Only 22% of enterprises declared their independence from imports in terms of machinery and equipment, and 33% in terms of raw materials. This situation forced researchers to turn in 2015 to the reasons hindering import substitution. The main barrier is the lack of Russian equipment and raw materials, of any quality: in January 2015, 62% of enterprises answered this way. In second place is the low quality of domestic analogues: 35% of respondents. The next three years of observations showed that there were no significant positive changes in the production of new equipment and raw materials in Russia. Quite the contrary. In three years the situation has changed for the worse. In June 2021, 69% of enterprises already complained about the lack of Russian equipment and raw materials, and 37% complained about the low quality of Russian products. The third most important obstacle to import substitution was insufficient support from the authorities: in 2015 this was complained about in 18% of cases, in 2017 - in 10%.

Nevertheless, during the crisis, a small import substitution did occur. However, 2021 showed a decrease in the scale of import substitution in enterprise purchases to the lowest level in all three years of monitoring - imports began to grow again as soon as the ruble exchange rate stabilized. At the end of 2021, 7% of companies reported a reduction or complete elimination of the physical share of imports in purchases of machinery and equipment. As for imported raw materials and materials, only 8% of enterprises were able to refuse them by the fourth quarter of 2021.

Why were the successes so modest? Experts from the Gaidar Institute believe that the main reason is the dependence of Russian industry on imports that has formed over previous years. When purchasing foreign equipment, enterprises were forced to switch to imported components and raw materials: partly because Russia does not produce raw materials of adequate quality. But first of all, because foreign manufacturers, as a rule, try to offer complex deliveries in order to tie the buyer to their products at all stages of its use.

However, experts from the Gaidar Institute emphasize that the decrease in the volume of import substitution is also a consequence of the strengthening of the ruble in 2021.

“Our economy, in most cases, has failed to effectively take advantage of the opportunities provided by the weakening of the national currency,” says Nikolai Kashcheev.

— These periods could be used for at least some structural reforms. Since such periods are partly favorable due to the weakening of external competition. But each time the devaluation was just an excuse to reap its rather random fruits and continue doing business as usual. Then the devaluation effect was lost, and our economy again relied on oil.” But maybe something will change next time and a new round of ruble depreciation will still bring the long-awaited effect? Maybe our economy will be able to carry out import substitution of some goods and increase the export of others?

Latest news from the Ministry of Finance regarding the collapse of the ruble in 2021

Currently, the Ministry of Finance is trying to destroy all these ties unfavorable for the Russian currency in every possible way, but at the moment this is extremely difficult to achieve. Despite this, the department is confident that the goal will soon be achieved. It is also noted that next year, the rise or fall in the cost of oil will not in any way affect the exchange rate of the national currency.

As for Western sanctions, despite the fact that the country is currently slowly emerging from the crisis provoked by Western sanctions, it is too early to talk about stability. There are also not many reasons for concern, the currency has recently stabilized, and all problems are so far being resolved through the reserve fund.

The collapse of the ruble in April. The ruble collapsed due to new sanctions

Both the currency and stock markets of the Russian Federation demonstrated an extremely negative reaction to the new sanctions imposed by the US Ministry of Finance against individuals and companies from the Russian Federation. In April 2021, the currency fell sharply against the euro and dollar, the expert clarifies. The maximum trading was recorded against the backdrop of statements by US President Donald Trump that if Russia begins to shoot down US missiles in Syria, it will be faced with new and intelligent weapons. The dollar then rose to 65.06 rubles, and this was the maximum since November 2016. The euro, in turn, rose to a value of 80.5 - the highest since March 2016

Arithmetic of the ruble carry trade for dummies

Meanwhile, pressure on the assets and securities of emerging economies is beginning to increase. The largest US exchange-traded fund investing in EM debt and currencies has seen a steady outflow of funds since July. During this time, clients demanded back $1.2 billion, forcing the fund to close positions.

It is very likely that demand will continue to fall due to the gradual withdrawal of global players from EM securities and geopolitical negativity towards Russia. This means that the ruble may soon lose its attractiveness for carry trades.

The real interest rate in Russia is one of the highest in the world. It is 5.3% per annum - this is exactly how much the key rate of the Central Bank of the Russian Federation exceeds the inflation rate. The Federal Reserve's interest rate is slightly lower than the rate of price growth, so in the United States the real interest rate is negative.

At the moment, the difference between the real interest rates of the Central Bank of the Russian Federation and the US Federal Reserve is 5.85 percentage points. If this difference drops to 3.5 percentage points, investments in Russian assets will lose their attractiveness.

In other words, for carry speculators to leave the ruble, the Bank of Russia does not even have to lower its rate. It is enough for the Fed to increase its interest rate five times, and inflation in Russia accelerates to 4.4%.