Investment greetings, friends! The derivatives market provides an opportunity to earn quite decent money, but at the same time it is much riskier than the stock market. Despite the fact that at first glance it is very simple to work with derivatives, in fact not many traders achieve success here. And if you are the first to learn about what futures are from this article, then it is better for you not to engage in them without completing at least a basic training course. Here I give the basic concepts of futures so that you can understand in general terms how it works. So to speak, for general development. In general, I warned you, let's go.

What is variation margin

So what is variation margin? This is a certain amount credited by the clearing center to the account of a trading participant on the FORTS market based on the results of the daily revaluation of the market value of the asset.

In simple words, variation margin is the financial result from trading until the transaction is closed.

To make it more clear, let’s remember how trading occurs on the stock exchange. Many major exchanges have three trading sessions per day: morning, afternoon and evening.

Based on the results of the morning and afternoon sessions, the results are summed up and income and losses from operations at the current moment are calculated. This process is called clearing (from the English clearing - clearing), i.e. resetting previous financial results to zero based on revaluation to new values.

Thus, variation margin is calculated twice a day - in the morning and in the afternoon. In some cases this happens three times, but not less than once a working day.

All the most important things about futures trading on the Russian market

Futures is a standardized contract for the purchase/sale of an underlying asset at a specific date in the future at a predetermined price.

Futures owe their origins to grain trading, for which the first standardized futures contracts were concluded on the Chicago Board of Trade in 1865. Today, due to the widespread development of financial markets, not only real assets, such as commodities, can act as the underlying asset. raw materials, currencies, stocks and bonds, but also intangible things such as interest rates, inflation rates, volatility indicators, weather, etc.

Russian derivatives market

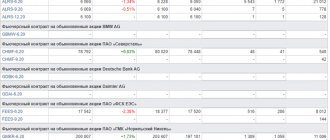

The Russian derivatives market occupies a significant share in the total turnover of the Moscow Exchange. There are approximately 57 assets available for futures trading today. The most liquid contracts are presented on the derivatives market page on the official website of the Moscow Exchange. In fact, more or less active trading is carried out only on these futures, although in addition to them there are a number of contracts that will be covered at the end of the article.

You can view current futures quotes, expiration date and the amount of collateral by clicking on the link corresponding to the underlying asset of interest.

Short names of futures are formed according to the following principle:

[underlying asset identifier]—[execution month].[execution year]

For example: the futures for the dollar/ruble currency pair is named Si-3.18 . Si is the identifier of the dollar/ruble pair, 3 is the month of execution March, 18 is the year of execution 2018.

The short code for the same contract will look like this: SiH8 .

The year of execution here is reduced to one digit of the first digit, and the month is indicated as the Latin letter “H”. The correspondence between months and Latin letters is given in the table.

Thus, a similar contract for a currency pair expiring in June 2021 will have the short code SiM9 .

Specifications for all short codes can also be found on the Moscow Exchange website.

Classification of futures by type and expiration date

Based on the type of execution, futures are divided into two categories:

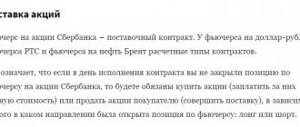

Deliverable - the seller on the expiration date (execution of the contract) delivers the underlying asset to the buyer at the price fixed in the contract. Accordingly, the buyer must pay its full price. On the Russian market, futures for stocks and bonds are deliverable. All other Moscow Exchange contracts that a private investor may encounter are settlement contracts.

Settlement futures - on the expiration date, the parties pay each other the difference between the price of the asset specified in the contract and the market price on the settlement date.

For each underlying asset there can be several futures, differing in expiration date. Most contracts are executed in March, June, September and December - they are called quarterly. The last trading day is the 15th day of the month (if it is a holiday, then the nearest trading day). The execution day is the first trading day after the last day of the Contract.

Important! The exceptions are OFZ futures, for which the settlement date is the 5th day of the month, as well as Brent oil futures. Oil futures change every month. The last trading day is the first working day of the next month, however, in fact, trading on this day is not active due to the fact that oil futures on the international market had already expired by that time. Therefore, if you want to leave a position open, you must close it on the last working day of the current month on the expiring contract and open it on the next futures.

A future with a shorter maturity is called near-term. Accordingly, a future with a longer term will be called distant relative to it. As a rule, the most active trading is carried out on futures with the nearest expiration date.

The value of a futures contract is a reflection of the market's expectations about the price of the underlying asset on the expiration date. That is, if the market expects the underlying asset to rise, the futures will trade at a higher price than the asset itself. And if market expectations are negative, then futures quotes will be lower than prices on the spot market.

If a distant futures trades higher than a nearby futures or spot market, it is said to be in contango. If the opposite situation occurs, when the distant futures turn out to be cheaper, then the futures are said to be trading in a state of backwardation. The difference between the futures price and the price of the underlying asset is called the basis, which is positive in the case of contango and negative in the case of backwardation.

For most assets, the most common relationship between the futures price and the underlying asset is contango. Theoretically, the fair price of a futures contract is calculated using the formula:

Pfutures = Pspot* (1 + R * ( T / 365)), where

Pfutures and Pspot are the futures price and the price on the spot market, respectively,

R is the risk-free interest rate,

T is the period until the expiration of the contract.

The logic is that the seller of a futures contract has an alternative: sell the underlying asset right now and place the proceeds, for example, in ordinary OFZs. Then, over the same period, he will be able to receive a small risk-free return. The positive basis should compensate him for this income for the period before expiration. Thus, the distant futures will cost more than prices on the spot market (more expensive than the near futures), but as the expiration date approaches, the spread between them will narrow.

Example: consider futures contracts for 10 shares of Lukoil LKOH-3.18 and LKOH-6.18 with expiration dates in March and June, respectively. The company's share price is currently 3,747 rubles. The near futures LKOH-3.18 is trading at a price of RUB 37,626, which is equivalent to a share price of RUB 3,762.6. The positive basis is 25.6 rubles. or 0.7% of the share price. For long-distance futures LKOH-6.18 at a price of RUB 38,400. for the contract the basis will be 103 rubles. or 2.7% of the share price.

The state of backwardation in the Russian market is typical for assets for which there is strong bearish sentiment. Also common is backwardation for stock futures closest to the dividend cut-off date. The dividend gap is factored into futures quotes by investors.

Example: for ordinary shares of Sberbank, the cutoff for dividends usually occurs until mid-June. The March futures SBRF-3.18 is currently trading at a price of 27,866 rubles, while the futures SBRF-6.18 and SBRF-9.18 are trading in backwardation at prices of 27,491 and 27,597 rubles. respectively. The negative basis of distant futures to the near one is -375 rubles. (-1.4%) and -269 rub. (-1%) and lays down the future dividend gap.

Futures trading

Strategies for using futures in trading fall into three broad categories: speculation, hedging and arbitrage.

1) Speculative transactions with futures

The most popular futures for speculation are contracts for the RTS index (Ri) and a contract for the dollar/ruble pair (Si). In trading jargon, they are also called “Rishka” and “Sishka”. These futures have the greatest liquidity and high trading volumes, which allows them to be traded both on a medium-term horizon and intraday. Day traders tend to favor the contract that has higher trading volumes and volatility during the current period.

Slightly less popular, but nevertheless actively traded, are futures for oil (BR), the euro/ruble pair (EU) and the Moscow Exchange index (MX and MM - “mini”). Among stocks, there is good liquidity for active speculation in Sberbank (SR) and Gazprom (GZ) futures.

There are a number of things to consider when trading futures.

Guarantee provision (GS). Since the actual settlement of futures occurs on the expiration date, each contract is provided with a collateral (GB) - an amount that is blocked in the account of the person who entered into the contract directly on the day of the transaction. Such a mechanism is necessary to ensure that bidders fulfill their obligations under the contract. For clients, the advantage of this scheme is that it actually becomes possible to trade with large free leverage, since the GO amount is significantly less than the contract value.

Not only cash, but also securities in a brokerage account can act as collateral for a futures position.

The amount of the collateral changes every day depending on the volatility and value of the contract. At the same time, if you are in an open position and the GO increases, then there is a risk that the amount in your account may not be enough to secure the position. The level of the current GO can be viewed on the specific futures page on the Moscow Exchange website.

Variation margin. The intermediate result on open futures positions is summarized every day and credited to the account of trading participants in the form of variation margin. It is calculated as the difference between the closing price of the current trading day and the price at which the transaction was concluded (or the closing price of the previous day, if the transaction was concluded earlier). Variation margin is credited to the trading participant's account if it is positive, and debited if it is negative.

Example: On March 1, an investor opened a short position on the RTS index at a price of RUB 130,000. The closing price was RUB 128,050. At the end of the day, a variation margin in the amount of 130,000 - 128,500 = 1,500 rubles was credited to the investor's account. The next day the price dropped further and at the end of the day amounted to 126,340 rubles. At the end of this day, 128,500 - 126,340 = 2,160 rubles were credited to the account. The total profit at that time was 3,660 rubles. The next day, quotes began to rise, and the investor closed the deal at a price of 127,200 rubles. On the last day, the variation margin was negative and equaled 126,340 - 127,200 = -860 rubles. In total, the investor earned 2,800 rubles from the transaction. for one contract.

The advantage of such a mechanism for a trader is that when a position moves towards profit, the accrued variation margin can be immediately used as a margin, that is, it becomes possible to increase a profitable position or open an additional position on other instruments. The other side of the coin is the fact that if you do this too aggressively, if the price reverses or the required GO amount increases, there may not be enough funds in the account to cover the collateral, which will lead to a requirement to replenish the account or the forced closure of part of the positions (margin-call), which is often unprofitable.

Evening trading session. It is worth considering that futures are traded not only during the main trading session from 10:00 to 18:45 Moscow time, but also in the evening session from 19:00 to 23:45 Moscow time, the financial result of which counts towards the next trading day. The evening trading session allows participants in the derivatives market to quickly react to changes in the situation on Western trading floors, as well as to play on corporate news on Russian shares published after closing.

In addition to technical features, there are also market nuances when trading futures. A future is always a trailing instrument relative to the underlying asset. For example, oil futures are dependent on similar contracts on the CME Chicago Exchange, so the order book on it is practically uninformative. Stock futures depend on the quotes of the corresponding securities, so it is more convenient to track many technical signals on the spot market.

A special feature of Si futures trading is that the leading instrument is the USDRUB_TOM currency pair, which in turn correlates with oil prices. For trading, it makes sense to monitor signals for both the currency pair and oil. In addition to this, scalpers also use the order book of the USDRUB_TOD currency pair (settled today).

Futures on the RTS index depend on both the MICEX index and the USD/RUB exchange rate, so from the point of view of intermarket analysis it is an even more complex instrument for trading.

2) Hedging

Hedging involves opening two oppositely directed transactions on the underlying asset and its futures in order to insure against changes in the value of the asset in a direction unfavorable for the investor.

Example 1: an investor has 1000 ordinary shares of Sberbank in his account, which he does not plan to sell in the near future. In the short term, there is a high risk of price declines. To hedge against this risk, the investor sells 10 SBRF futures, which correspond to a similar number of Sberbank shares. Thus, the current value of the portfolio is fixed, and the decrease in the value of shares will be compensated by the variation margin on the futures. Once the risk of such a decline has passed, the investor will be able to close the futures position without loss to the overall portfolio value, while making a small profit due to the collapse of the contango. The position in shares remains untouched, which is sometimes important for tax purposes.

Example 2: an investor likes Gazprom shares to purchase at current prices, but there are no available funds at the moment - they will appear only in a month. To hedge against price increases during this period, an investor can purchase a futures contract for the corresponding number of shares with an expiration date closest to the desired date. To do this, he does not need to have the entire amount in his account, but only the size of the GO. Thus, when the price of shares rises, the profit on the futures compensates the investor for purchasing securities at a less favorable price.

3) Arbitration

In addition to direct hedging, futures allow you to bet on the narrowing or widening of spreads between two related assets. These can be futures for shares of JSC and AP of the same company or near and far futures contracts for the same asset. Arbitration strategies are based on such transactions, which allow you to make money on the temporary decorrelation of assets.

In its pure form, arbitrage transactions are opened when spreads widen in the short term and are closed when they return to normal. These are almost risk-free transactions in which the profit from each transaction is small, but its probability is very high. For the average private investor, this is an inaccessible niche, since here you need to have a very significant advantage in speed - discrepancies exist for a very short time and are immediately eliminated by the trading algorithms of professional arbitrageurs.

However, a private investor may well bet on a change in the spread between JSC and AP shares of the same company or take advantage of the inefficiency between near and far futures in the medium term. At the same time, when selling futures, you can receive additional income in the form of a positive basis in contango.

Example: the spread between the shares of Sberbank JSC and AP in the fall of 2021 was close to historical minimum values and at the moment reached 1.15. In order to play on its expansion, one could buy ordinary shares of Sberbank on the spot market and at the same time sell futures for preferred securities of Sberbank. When quotes grew, the “common” would outperform the preferred ones and the profit from a long position would cover the loss from a short one with a small profit on top. In addition, a positive contango basis would be additional income.

Classification of futures by underlying asset

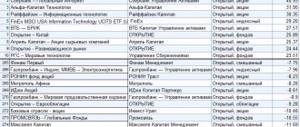

Stock futures

For March 2021, futures for 22 shares of Russian and 5 shares of German companies are available on the Moscow Exchange. German companies include ordinary shares of BMW, Deutsche Bank, Daimler, Siemens and preferred shares of Volkswagen. In practice, they are not popular, and trading on these futures is almost never conducted.

Among Russian companies there are securities from the first and second echelons. There are 5 different expiration (execution) dates available for Sberbank and Gazprom, 4 for Rosneft and Lukoil, 3 for Tatneft-AO, and 2 for all others. All futures for shares of Russian companies are deliverable.

Bond futures

Among the bonds are futures for federal loan bonds, the underlying asset for which is securities maturing in 2, 4, 6, 10 and 15 years. For each category, there are short-term and long-term futures with maximum maturity periods of three and six months, respectively.

Bond futures allow you to hedge your position in bonds, as well as make a leveraged bet on the rise or fall of the OFZ. Just like stock contracts, they are deliverable.

Index futures

Available for trading are futures on the RTS index, two futures on the MICEX index, a contract on the Russian market volatility index and a less popular futures on the blue chip index. The advantage of contracts for the RTS and MICEX indices is that it becomes possible to play the market as a whole, and not on individual shares. For the MICEX index, a “mini” contract option is separately provided, which is cheaper and more accessible for trading due to lower GO and commission costs.

Futures on the RVI volatility index are, in essence, a speculative instrument that allows you to bet on an increase or decrease in volatility. The principle of calculating this index is based on the volatility of actual prices of options on the RTS Index. In this case, the nearest and subsequent options (only quarterly or monthly series) with a period until expiration of more than 30 days are used.

Currency futures

Eleven currency pairs are available for trading. In addition to those presented on the main page of the Moscow Exchange derivatives market, there is an even less liquid futures for the dollar/Turkish lira (UTRY) pair. Currency futures are settlement contracts.

Commodity futures

The most popular commodity futures contract is the Brent crude oil contract (BR). 12 contracts are available for trading based on expiration dates in monthly increments. In addition to oil, gold, silver, copper, platinum, palladium and raw sugar are available as underlying assets.

Interest rate futures

MosPrime (MP) bet contract. MosPrime Rate is an independent indicative rate for providing ruble loans (deposits) on the Moscow money market. This indicator is formed by the National Financial Association on the basis of rates for granting ruble loans (deposits) announced by leading banks in the Russian money market to first-class financial institutions with terms of “overnight”, 1 week, 2 weeks, 1, 2, 3 and 6 months.

RUONIA (RR) rate contract. The indicative weighted ruble overnight deposit rate of the Russian interbank market RUONIA (Ruble OverNight Index Average) reflects the assessment of the cost of unsecured borrowing by banks with minimal credit risk. The rate is calculated by the Bank of Russia.

Open an account

BCS Broker

Where does variation margin come from?

The market value of contracts changes several times during the day. For example, the government made an important statement: the exchange rate fell or, conversely, soared. Accordingly, the price of currency futures also changed. As a result of clearing, a certain difference is formed, which represents the profit or loss of the trading participant.

Revaluation occurs only if the position is not closed. Thus, based on the clearing results, the trader, having considered that the price has reached a peak and there is a high probability of further decline, has the right to take a profit. Then the variation margin goes into accumulated income, and the position is closed.

Initial terminal setup

The MICEX offers trading in oil futures, which is considered a classic market product and a popular online trading tool. A settlement contract for Brent oil has been launched and is actively developing on the Moscow Exchange. Futures volumes were among the top three on the market. Traders profit from price changes and implement various trading tactics.

Before trading, you need a configured Quik 7 terminal, which displays assets and helps you comfortably both buy futures and close a position on a contract.

Using the platform you can simultaneously:

- keep track of multiple securities;

- make purchases and sales;

- create an investment portfolio.

Setting up Quik 7 for futures trading follows the same principle as for stock section instruments.

To trade on the platform you need 2 tabs:

- one - for conducting operations;

- the second is to study the movement and determine the range of transactions with the highest income.

Setup begins with selecting the instruments for which information is required for trading operations. To ensure that the platform shows only the necessary information and does not download unnecessary information, the flow of quotes only for futures contracts is selected. In the program menu, you need to go to the “System” tab, then - “Order data”, then - “Quote flow”.

Selected lists are marked with checkmarks, Indexes can be added, and the selection is confirmed with the “Yes” key.

To further configure the platform, you need to take the following steps:

Create “Current trading” and add futures transactions that are of interest to the table. To do this, select “Create window” in the menu, and in it – “Current trading”.- Find the FORTS futures list in the available instruments, which displays contract codes. In the “Column Headings” field, select the required indicators and confirm. After these actions, a table appears with futures quotes; securities with the greatest liquidity (Brent - BR futures, RTS index futures, Sberbank shares, etc.) are displayed in the top.

- You should display the columns “% change from close”, “Last trade price”, “Turnover in money”, “Buyer’s GO” and “Number of open positions”. Confirm with the “Yes” button to complete the formation of the “Current Trading” table, which should be placed in the upper left corner of the workspace.

- The next step is the formation of a book of quotes, which is created by right-clicking on the required futures in the “Current Trading” table and selecting the menu item with the icon of 2 mutually directed arrows. It is better to place the glass of quotes for a trading instrument to the right of “Current trading”.

- Next, display the chart of the required futures. Perform an action using the right mouse button to select the desired contract and the context menu item “Price and Volume Chart”. A chart of the required futures appears, which should be placed to the right of the order book.

- It is necessary to fix the “Current trading”, the book of quotations and the chart, so that when you left-click on a futures in the table, the book of quotations and the chart will change automatically. To do this, click the anchor icon in the “Current Trading” table (located in the upper right corner). Afterwards there are similar icons in the order book and on the chart.

- The next step is to create a “News” table, because understanding the news background is necessary regardless of the chosen trading instrument. Create a table by selecting the “Create window” menu, in which place a checkmark next to the “News” item. As a result, a news feed window will appear, which displays operational information during the trading day.

Difference with stock market

The main difference from exchange trading in primary assets (for example, shares) is that when the market value of shares changes, money will not be added to the trader’s account. For example, on Monday I bought a share for 7,500 rubles. ($100 or 2,900 UAH). On Wednesday, this share already costs 8,250 rubles. ($110 or 3,190 UAH), but until I sell it, I will not receive any income.

In the derivatives market, everything happens differently: the amount in the account changes several times during the day. On the next trading day, the countdown begins with the value at the time of the last clearing.

How does the futures price depend on the price of the underlying asset?

It is clear that the price of the underlying asset itself, which underlies the futures, changes. This is the market. Along with the price of the underlying asset itself, the price of derivative instruments, including futures and options, also changes.

Most of the time, the futures price differs from the price of the underlying asset - up or down. Why? The price of the underlying asset is the price set right now. The futures price is the price expected at the futures expiration date.

For example, if investors expect that the price of an underlying asset, for example, shares of Sberbank, will increase, say, from 250 to 300 rubles, then they will actively buy futures for it - after all, if the share price is 300 rubles, they will be able to buy it for 250 rubles in expiration date. Therefore, the futures will rise. The situation when the futures price is higher than the price of the underlying asset is called contango .

If investors expect the price of the underlying asset to drop, for example, after a dividend gap or a bad report, then they sell overly expensive futures. As a result, the futures price is lower than the price of the underlying asset - this is backwardation .

Another pattern in the futures market: the closer to the expiration date, the smaller the difference between the price of the future and the underlying asset. Reason: each subsequent buyer (or seller) will receive a smaller profit. Therefore, on the last day of trading, the price of the futures and the underlying asset are usually approximately equal.

Where is variation margin used?

As we already know, variation margin is used in the FORTS derivatives market when revaluing the value of futures contracts.

The variation margin size can be seen on the trading terminal. The trading participant has the right to use the profit to open new positions before the time of clearing settlement, and withdrawal of amounts is possible only when the current position is closed.

Taxation of futures

Income derived from futures trading is taxed at the standard rate:

- 13% for individuals;

- 20% for legal entities;

- 35% for non-residents of the Russian Federation.

For example, if you, as an individual, received 25,000 rubles in income as a result of speculation on futures, then you need to pay 3,250 rubles in tax on them, and the final earnings will be 21,750 rubles.

If at the end of the year you received a loss, then you can carry it over to the next year, reducing your tax base for the next year. For example, some Vasya lost 25 thousand rubles on investments in 2021, and in 2021 he earned as much as 75 thousand. He must pay 9,750 rubles, but he reduces the tax base by carrying forward losses from previous years: 75,000 – 25,000 = 50,000. And he pays 13% of 50,000, i.e. 6,500 rubles.

Important: the financial results of the FORTS derivatives market (futures and options) and the stock market (stocks, bonds, funds) do not add up. If you earned 15 thousand on the fund, but lost 10 thousand on the fixed-term term, then the results are not balanced. But 10 thousand losses can be carried forward to next year.

So, a futures is a futures contract, obligatory for execution by the persons who entered into it. In accordance with it, one party undertakes to sell and the other to buy the underlying asset at a pre-agreed price. The underlying asset can be securities, commodities or volatility. The parameters of each future are standardized and described in the specification. The trader can only review the contract and determine for himself whether the conditions are suitable for him. Futures are speculation, not investment, and new investors should avoid them. Good luck, and may the money be with you!

Rate this article

[Total votes: 2 Average rating: 5]

What should the variation margin be?

We remember that most transactions on the exchange are made using leverage, which exceeds the futures price by tens or hundreds of times. The leverage can reach 1:500.

Variation margin is a broker’s risk control tool when providing a loan to a trader. Its size must be no less than the amount of the transaction guarantee, which is deposited by the trader into his personal account when opening a position.

If a negative margin has resulted in the account being depleted, a situation called a Margin Call occurs. When the trader replenishes the account, further trading is possible. If the account has not been replenished, the broker closes the position.

Thus, by increasing the collateral, you can reduce the amount of leverage, and also have a “reserve” in case of negative developments in which the variation margin will be negative for a certain period.

Where and how can you buy options

This type of instruments is available on the MICEX , and on the CBOE (Chicago Board Options Exchange), and on other trading platforms around the world. However, it is impossible to directly register on the site and start trading. All operations are done through a broker who has access to the relevant exchange.

That is, the process looks like this:

- Find a broker who has access to the relevant exchanges.

- Register with him, open an account and top it up.

- Download the software.

- You start trading.

BCS one of the best brokers for beginners . It has a lot of tariffs, this will come in handy later when you reach a trajectory of sustainable growth. At all tariffs, it gives access to the MICEX derivatives market; the conditions for the starting tariff are given in the table below.

BKS | ||

| Minimum deposit | from 30,000 rub. | |

| Transaction fee | At the “Investor” tariff – 0.1% of the transaction amount | On the “Investor PRO” tariff – 0.035% of the transaction amount, with a deposit amount of 900,000 rubles or more |

| Additional charges | If the account has less than 30,000 rubles. 300 rub./month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, Maintaining a Depo account is free. Deposit/withdrawal of rubles - free | |

| Account maintenance cost | 0 rub./month . on the “Investor” tariff, on other tariffs, funds are debited only if there was activity on the account this month. | 299 rub./month . on the “Investor PRO” tariff, if there were no transactions in the month - free |

| Leverage | Calculated for each share, within the range of 1 to 2 – 1 to 5 | |

| Margin call | Calculated based on the risk for each security | |

| Trading terminals | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | |

| Available markets for trading | Foreign exchange, stock, commodity markets, it is possible to connect US platforms (Nyse and Nasdaq) - $1/month | |

| License | TSB RF | |

| Open an account in BCS | Open an account in BCS | |

Calculation formula

To calculate, you can apply the formula using the minimum price step given above. However, this calculation applies only to currency futures. If the contract value is expressed in rubles, then the formula is quite simple and looks like:

\[ Вм=(Ц1-Ц0)*n, where: \]

\( Ц1 \) – price at the time of calculation;

\( Ц0 \) – price at the time of previous clearing;

\( N \) – number of contracts.

In the following examples, we will look at calculating the variation margin for both positive and negative developments.

Why and when to calculate variation margin

So, the variation margin is the amount by which the value of assets is revalued. This reassessment is done daily, and sometimes several times a day. Why is this needed?

The amount in the trader’s account consists of two components:

- Warranty provision.

- Available funds.

Both the first and second components can change. Only the guarantee needs to be increased independently, using your own funds or accumulated income from other positions, and the amount of available funds depends on the market. If you receive a significant marginal profit, it can be transferred to accumulated income, after which the available funds in the account are reset to zero.

Considering that most transactions are carried out using leverage, using revaluation, the exchange at the end of the day forms a balance for each participant, calculated taking into account the current situation. This allows you to assess and minimize the risks of non-repayment of loans.

As for traders, the current “current” amount of marginal profit makes it possible to quickly close a position at the right time and withdraw the profit, turning it into your income.

Understanding the terminology

Making money on various options involves using specific terminology. Let's look at the most common concepts:

- A call is a contract, the buyer of which can purchase the underlying asset (BA) in the future at a previously fixed price. It does not matter what the cost of BA will be at expiration.

- Put - its buyer receives the right to sell the BA at a pre-agreed price. The second party does not have the opportunity to refuse to purchase the underlying asset.

- Strike – the cost of the BA at which the asset can be bought or sold at expiration. On the options board there is a whole series of strikes for everyone. Depending on them, the cost of the contract and the likelihood of receiving income change.

- Volume – position size, measured in the number of contracts.

- Open Interest – shows the number of open contracts. At the moment of “entry” of new players, deals are concluded between sellers and buyers, and OI increases. Depending on further actions, it can either fall or rise.

| Seller (subscriber) | Buyer | Open Interest | Direction |

| New | New | +1 + 1 = 2 | OI is growing |

| New | The current buyer has left the market (sold) | +1 — 1 = 0 | OI remains the same |

| A former subscriber buys and exits the market | New | -1 + 1 = 0 | OI does not change |

| Exit | Exit | -1 — 1 = -2 | Open Interest is declining |

- Pro-trading levels - near them the forces of sellers and buyers are temporarily equalized. The chart is moving in a narrow price range; the trade breakdown indicates a more likely direction of movement in the future. Some trading systems are built on this phenomenon. I will tell you more about trading methods later in a post about options analysis and strategies.

- Premium is the amount paid to the seller when purchasing an option contract. This is a kind of payment for the risk that the holder of the right will not use it in the future and will not purchase BA from the subscriber. The premium remains with the seller even if the buyer does not exercise the option to purchase the underlying asset. In the case of margined contracts, the subscriber does not receive a premium to the account immediately; instead, an amount equal to the margin is blocked for both parties to the transaction.

- Expiration date is the time when settlement occurs between the parties. If actual delivery of BA is provided, the buyer can exercise the right to purchase it. More often than not, everything is limited to adjusting the account balances of the subscriber and buyer of the option contract. The specification indicates the expiration day, the process takes place from 18:45 to 19:05 Moscow time, this period is reserved for evening clearing (it is extended by 5 minutes on expiration days).

There are other “narrow” terms used when working with these tools. Very soon I will publish an article on how to trade options and, as part of it, I will explain a number of expressions that are used directly in trading.

Advantages and disadvantages

Let's look at the positive aspects first:

- The main advantage of variation margin is that income is accrued until the asset is sold.

- With correct calculation and positive market dynamics, the account owner can make a large profit.

However, there are also disadvantages:

- If the value of the contract falls, then the negative margin will be debited from the account until the money runs out. The trader is forced to replenish the account, otherwise the exchange will forcefully close the position, and the investor will receive a loss.

- It is impossible to influence the price of futures. Therefore, margin trading is hardly suitable for beginners: operations in the derivatives market require knowledge and experience.

What are futures and how do they work?

A futures contract (in English “futures”) is a derivative financial instrument (or derivative), upon the conclusion of which the buyer has an obligation to purchase the underlying asset at a price specified in the contract after a certain time, and the seller, accordingly, has the obligation to sell it.

In simple terms, what a futures is is a contract under which one party undertakes to sell an underlying asset to another at a pre-agreed price within a specific time frame.

The underlying asset can be a stock, a commodity (for example, oil, gas, wheat, meat), an interest rate, or even another derivative.

To explain the essence of futures, I will give the following example.

Imagine that you are a farmer. You planted an entire field of wheat in the spring and hope to sell the crop for $40 a bushel in the fall. However, according to all forecasts, the summer will be good, there will be a lot of harvest, and the price of wheat may fall to $30 per bushel. And you have already factored in a price of $40 in your calculations.

So you go to a miller you know and say, “This fall I’ll sell you 1,000 bushels of wheat for $40 each. If I don't keep my word, I pay a fine. If you don’t hold back and buy, you pay a fine. Is it coming?

Miller agrees. It’s good for him: in the fall he will definitely receive the required number of bushels of wheat and will be able to process it into flour. And good for you - in the fall you will receive your $40,000, even if wheat costs $10 a bushel. And if someone breaks their word, they will pay a fine.

This is roughly how futures work, with the only difference being that the contracts on the exchange are standardized and the parties do not negotiate directly, but only use the tools provided. What I described above is a special case of a futures - a forward contract. Forwards, like futures, are derivatives, but do not have standardization and are concluded in the over-the-counter section.

Futures are traded on the futures exchange. In addition to futures, there are also options on the futures market. They work in much the same way, but the buyer (or seller) of the option can choose not to exercise their obligations without any penalty. The seller (or buyer) of a futures contract cannot refuse the transaction.

Another example of futures that will help you understand how these derivatives market instruments work.

Let's say you bought Lukoil shares and expect them to grow (this is called “buy long”, “open a long position”). At the time of purchase, Lukoil shares cost, for example, 6,700 rubles. But then the coronavirus appears, and quotes begin to fall. You can hedge your risks by selling futures.

Now, if Lukoil shares continue to fall, then you will receive variation margin (more on that later), and if the futures reaches expiration, you will take the profit. For example, Lukoil fell to 6,000 rubles, and you earned 700 rubles by selling futures. Thus, you have fully compensated your costs: if you decide to cash out, you will get all your 6,700 rubles back.

But more often futures are used not for hedging, but for generating additional income. To put it simply: if a trader anticipates an increase in the price of an asset, then he pays back the futures; if there is a decrease, then he sells.

In general, futures are a rather complex financial instrument, and it is impossible to cover all the points in one material. Therefore, further I will speak in a simplified manner and only about those futures that are available on the derivatives section of the Moscow Exchange.

In general, the futures market is huge - according to some estimates, the capitalization of the derivatives market reaches 1.2 quadrillion US dollars, and futures occupy about 20% of it (. For comparison, the global real estate market is estimated at 217 trillion dollars, and shares at 73 trillion. Here's an infographic for the impressions: https://money.visualcapitalist.com/worlds-money-markets-one-visualization-2017/.

Example of use and calculation

Let's assume that a trader has an account with an amount of 75,000 rubles. ($1,000 or 29,000 UAH) at the moment. According to forecasts, in the coming days it is planned to increase the price of futures for shares of company N. The price of one share at the time of the transaction is 3,750 rubles. ($50 or 1,450 UAH). The contract includes 100 shares for a total amount of RUB 375,000. ($5,000 or 145,000 UAH).

To purchase a futures, a guarantee of 15% of the contract value is required, i.e. RUB 56,250 ($750 or 21,750 UAH) (5000*15%).