Who is a maker, how to define it and who can be called a maker - it is useful for a potential player on the Forex exchange to learn about this if he wants to make money on financial transactions.

Market Makers - History

The term market maker (market - market, maker - producer, creator), meaning an obligatory element of the market as a provider of liquidity, began to be used in the 1980s, when transactions were carried out through telephone calls. Then, with the development of information technology, trading platforms on the Internet began to appear. And these days, a market maker is an artificial intelligence that, with the help of a mathematical algorithm, facilitates the uninterrupted flow of transactions and thereby ensures instant liquidity. Automated programs are capable of processing up to a million orders simultaneously, which is certainly an impossible result for a human.

What obstacles may arise for the beneficiary?

Unfortunately, not everyone can become beneficiaries. When trying to register yourself as such a person, some obstacles may arise. You will not be able to register yourself as a beneficiary if:

- the business has existed for less than three months or has been operating in this direction for no more than 90 days;

- Previously, there were situations with non-fulfillment of certain financial obligations, as well as lost court proceedings on this issue;

- there is no property for collateral or it is under arrest;

- the requested monetary amount exceeds the final annual balance.

Guarantors are often interested in experience in carrying out such work. It is advisable to provide them with the positive results of conducting such activities in large organizations. The solution process can take a long time. This is due to the desire to minimize risks for the client and the performer.

What is the difference between a market maker and a broker?

Many traders use the term “broker” when talking about any company that provides intermediary services in trading. However, this is not true. A broker is an intermediary between investors or traders and the market. In this case, the broker’s earnings consist of the commission and spread and depend not on the successful execution of orders, but on their total number.

Nowadays, brokers are no longer people, as they used to be, but electronic systems operating via the Internet. The modern system for providing brokerage services is called ECN (Electronic Communication Network). ECN brokers use special software to collect their clients' orders and then send them to a common electronic database, where counter orders are selected and executed.

If a company is not engaged in placing orders on the market, but executes them independently, then we are talking about a market maker company.

Admiral Markets is a broker. Investment firms operating under the Admiral Markets brand are leading providers of online trading services and offer investment services for Forex and CFD (contract for difference) trading on indices, metals, energies, stocks, bonds and cryptocurrencies.

Market Makers - Categories

Liquidity providers can be divided into two categories - first and second level players. Market makers of the first level are considered to be the largest commercial banks, which are united in a group called Tier 1. Sometimes they are also called institutional market makers (IMMs).

They are the ones who enter into cooperation with exchanges, enter into agreements and assume obligations to maintain the turnover of assets and maintain a balance between supply and demand.

In addition to commercial banks, such providers include organizations that create movement in the market using interest rates and foreign exchange interventions. These include large banks, dealing centers, brokerage companies, large funds and individuals who own significant capital.

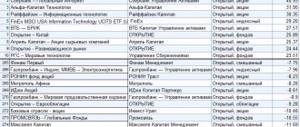

The figure below shows the largest market makers, which are first-level market makers or, as they are also called DPM - Designated Primary Market Maker (translated from English - designated primary market maker):

Second-tier market makers include intermediaries who facilitate the entry of private traders and smaller brokers into the market. They operate their own liquidity, but can also borrow funds from Tier 1 liquidity providers if necessary.

Unlike ordinary traders, market makers analyze the market, focusing on orders such as Take Profit, Stop Loss, and pending orders.

If we are talking about categories of market makers, it is definitely worth mentioning exchange players who belong to the category of speculative market makers. These are market participants who own such large amounts of capital (for example, small banks, private investors) that when they conduct transactions, a price impulse is formed.

We also need to say something separately about market takers. By analogy with market makers who make price, that is, make a price or quote, market takers accept or take the price (take price). In turn, market takers can only enter into transactions with market makers.

It is often found that the buying or selling rates differ between different market makers. This may be the result of dealing centers making their own adjustments as they are second-tier liquidity providers.

Section 2. General provisions

2.1. The Agreement defines the terms of use of the Information, the rights and obligations of the User arising when gaining access to the Information and Information services through the Site.

The composition of the Information available on the Website is determined by the Company at its sole discretion, taking into account the requirements of laws, regulations of the Bank of Russia and other regulations of the Russian Federation.

The procedure and conditions for obtaining free access to Information through the Site are determined by the Agreement. The procedure and conditions for access to Information services and use of Information are determined by the Agreement, as well as agreements concluded between the Company and Users.

2.2. The agreement is a public offer in accordance with Art. 437 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). The Agreement is published on the Site and comes into force from the moment of publication.

The user who has started using the Site is considered to have confirmed his agreement with the terms of the Agreement in the manner prescribed by clause 3 of Art. 434 Civil Code of the Russian Federation.

2.3 In accordance with the legislation of the Russian Federation and concluded agreements, the Company is the copyright holder of the Information, including, but not limited to, Exchange information, Indices and other Derivative information posted on the Site.

How does a market maker work?

What do liquidity providers do? They are entrusted with the responsibility to purchase and sell assets according to the set ask and bid prices, even in cases where the market situation is not in their favor. This is due to an agreement concluded with the exchange, where the conditions stipulate a period during which the market maker is obliged to maintain the difference between the ask and bid prices, while receiving a certain reward. At the same time, the market maker is obliged to execute the order at his own expense if there is no counter order. That is, he becomes a kind of custodian of assets until there is someone willing to purchase them.

Due to the fact that the market maker can view current orders, he will be the first to know if there is an overweight in the bearish or bullish direction. Then he takes measures to reduce imbalances and prevent large spikes in volatility. At the same time, the ability to quickly convert trading instruments into cash equivalent and back is supported.

For maintaining the market price of a trading instrument within the boundaries of a predetermined spread, the market maker receives significant discounts on commission fees for a place on the trading floor, and profit is formed due to the difference between the purchase and sale prices (the so-called dealing spread).

Naturally, the exchange is interested in the liquidity of the assets traded on it, but competition between liquidity providers is also necessary, therefore the presence of several market makers on one trading platform is recognized and approved. Thanks to this, the cost of transactions decreases, the speed of their execution increases, and more transparent pricing is formed.

If the rules of the exchange contain a clause stating that a transaction is recognized as legal only if it was carried out with the participation of a market maker, this significantly increases its significance and influence.

Section 9. Final Provisions

9.1 Any disputes related to the conclusion, amendment, execution or termination of this Agreement shall be resolved in accordance with the legislation of the Russian Federation.

9.2 The Company has the right to make changes to the terms of the Agreement by publishing a new version of the Agreement on the Website. The corresponding changes come into force from the moment the new version of the Agreement is published on the Website.

9.3 The User is obliged to periodically review the text of the Agreement in order to study the latest changes made to it. By continuing to use the Site after the relevant changes come into force, the User expresses his agreement with the terms of the Agreement in the new edition.

Market Makers - Main Tasks

The main tasks of market makers:

- Maintaining a sufficient level of liquidity for the declared instrument during the trading session;

- Accumulation of orders within the traded instrument;

- Search and comparison of the best price offers;

- Fixing offers in the order book (a set of sell and buy orders in real time) and taking them into account;

- Order execution;

- Performing duties as a mediator;

- The fastest possible provision of information about current quotes to other exchange players;

As has been mentioned more than once, one of the main tasks of liquidity providers is to keep the market value of an asset within a narrow range. What is it for? This contributes to an increase in concluded transactions, and accordingly, the profit from the spread increases. If significant price fluctuations occur, this will result in losses. Therefore, market makers act against the direction of the trend, that is, they open short positions when the trend is up and vice versa - they open long positions when the market is falling. This ensures a two-way quote.

Such actions lead to slight shifts in quotes, but the market maker has the right to do so.

Who is the Beneficial Owner?

A beneficial owner is a person who has direct influence over the company, whether or not he or she is considered to have a formal record of the corporation's operations.

That is, if the premises in which the office is located is your property, and you rent it out, then you will be the beneficial owner.

How does a market maker make money?

Important information that market makers have is data from orders received from clients. What about this data? This includes such important parameters as the values of Stop Loss and Take Profit orders, as well as the values of pending orders. Having this data at its disposal, the Forex market maker knows in which areas the largest number of certain orders accumulate. And this, in turn, allows him to manipulate the price (the greater the number of clients with whom the market maker works, the greater his influence on the market).

It is known that in order to make money on the stock exchange, you need to be able to correctly predict large price movements and timely open positions in their direction. Imagine that you could control the price movement, then all you would have to do is open a buy position and then move the price up. Or vice versa - open a sell position and move the price down. Of course, such large-scale price movements cannot be carried out by any market maker in the world. But in order to provoke a major price movement, sometimes a very small impulse from the market maker is enough.

To create this momentum, market makers first trend in the direction they want and then act in the opposite direction. Thus, when the market maker makes a profit, the rest of the participants in the transaction are losers, some to a greater extent, and others to a lesser extent.

Section 8. Submitting Complaints

8.1 A user who believes that any information materials posted on the Site violate his rights and legitimate interests must send a corresponding complaint to the Company’s email address

8.2 The Company considers complaints that meet the specified requirements:

8.2.1 The complaint contains the applicant’s name, surname and patronymic/name, location and actual address, contact information.

8.2.2 The complaint contains a detailed description of the alleged violation of the User's rights.

8.2.3 The complaint contains contact information for sending a response: email address and telephone number.

8.2.4 The complaint contains consent to the processing of personal data (for the applicant - an individual).

Complaints that do not meet the specified requirements are not considered by the Company.

8.3 Complaints are considered by the Company no later than 30 calendar days from the date of receipt of the complaint to the Company’s email address specified in clause 8.1 of this section of the Agreement.

How does a market maker work on the stock exchange?

As defined by the US Securities and Exchange Commission, a market maker is a company that is willing to buy or sell shares on its own behalf on an ongoing basis at a publicly stated price. It assumes the risk of acquiring and storing securities of a particular organization in its accounts. The goal is to organize trade in these assets, the reward for which will be the difference between the purchase and sale prices. This difference is called the dealing spread and is the fee charged by the market maker for providing liquidity.

It is important to know that the exchange and the market maker are different legal entities that have a contractual relationship with each other, and their interests do not coincide. For its part, the market maker in the securities market undertakes to keep orders within a certain price corridor with pre-agreed spread boundaries. In return, the exchange provides trading space and discounts on commissions.

If you don't feel ready to move on to trading live markets yet, try your hand at a secure demo account from Admiral Markets.

Click the banner below and start trading risk-free today!

Who is a Forex market maker

How do Forex market makers work? Market makers on Forex are direct participants in transactions, that is, they act as both sellers and buyers. As a rule, these are large banks that are ready at any time to sell to a client either the currency they have or the currency of another client who has opened a sell order. By acting in this way, the market maker of the Forex market maintains the required level of liquidity. In doing so, they take on the risk of volatility. But due to the spread and huge volumes of transactions, this risk is covered by the profitability of the transactions. The activities of market makers in the Forex market can be compared with the activities of exchange offices, only very large ones.

Despite the fact that the Forex market is decentralized, all its participants are connected with each other in one way or another. Regular traders trade with the help of intermediaries, brokerage companies and market makers. If the broker is unable to provide the required amount of currency in order to complete an exchange transaction, he turns to market makers - liquidity providers. Or, in other words, it brings client orders to the interbank market. Orders can also be issued to liquidity providers if brokers do not want to risk their own money.

Of course, market makers in the foreign exchange market can incur losses if they choose the wrong position. But these losses are covered by large volumes of transactions and a huge number of clients.

The influence of market makers in the Forex market is somewhat different from that in the stock market due to the large difference in the total volume of transactions. Indeed, in any economic sector, even a not very popular one, the amount of circulating currency is significantly greater than the number of company shares.

Thus, there are two reasons why Forex brokers cannot be liquidity providers without the help of larger entities. The first is the huge volume of transactions. And the second is leverage. If on the stock market the leverage level is on average 1:4, then on Forex it reaches 1:1000.

The ideal trading platform for Forex trading is MetaTrader 5! And a unique plugin with many additional functions and technical indicators MetaTrader Supreme Edition will help you bring your trading skills to perfection!

Click on the banner below and download MetaTrader Supreme Edition completely free of charge!

A current example of who's who

If you create an order on the market that matches the parameters of the existing offers, you will get a market order executed. Here, the liquidity of the asset will be taken from trading, therefore, the role of a taker is performed. When a position is opened with a price that is not in the order book, additional demand is introduced into the market and liquidity increases. The deal will be delayed. Because of this, the order book always contains only offers from makers, awaiting immediate acceptance by taker traders.

A good example with a fragment of an improvised Depth of Market:

- Elena sells 1 ETH for $95.25;

- Sergey offers 1 ETH for $94.75;

- Alice buys 1 ETH for $94.15;

- Denis purchases 1 ETH for $93.85.

Alexey appears on the crypto exchange, agreeing to buy an Ethereum coin for $95.50. When he places such an order, his transaction will be executed immediately, since there are Sergey and Elena on the market, whose offers fully comply with the conditions. is a taker here .

If another trader wants to buy ethereum for $94.50, then the trading terminal system will place his order between Alice and Sergey, since no one is offering the crypto coin at the set price yet. This pending order speculator will increase the liquidity of the virtual currency and play the role of a maker .

Market makers and myths about them

The very name “market maker” (literally from English - making the market) evokes the idea that he can dictate his terms on the market. One gets the feeling that everything is in his hands: liquidity and transaction parameters. It seems that Forex market makers have access to some insider information and can exchange it, which gives them the opportunity to organize untimely triggering of placed stop orders, massive slippages and other situations that are unpleasant for “ordinary” traders.

Beginners or unsuccessful traders are most prone to such suspicions, for whom it is always easier to blame someone else for their own failures, absolving themselves of responsibility for their failures. It is known that most Forex traders trade at a loss. Naturally, it is very convenient to think that this money goes into the hands of liquidity providers.

Also, many people think that market makers can widen spreads to increase their own profit. But that's not true. The size of the spread depends on the sell and buy orders. Caring for their profits, market makers maintain the functioning of the market, where many traders and dealers maintain a fair exchange rate using various orders.

Most often, market makers are accused of being able to move quotes in the direction where the largest volumes of sales or purchases are planned. The higher the turnover, the greater the profit. Naturally, market makers will not act to their detriment, but on large movements in quotes, all participants, including traders, make a profit.

Oddly enough, market makers have the maximum income when the market is in equilibrium and in a calm state. Frequent breaking of support and resistance levels is undesirable for them; they prefer to receive a stable income from the spread.

If market makers did not intervene, every time new major players or economic news appeared in the market, complete chaos would reign. But when liquidity providers are in place, price volatility and risk are reduced, so traders can be confident that the prices they are offered are fair.

Of course, everyone understands that market makers can actually influence market quotes, but these capabilities are very limited and can only be used to adjust and balance quotes so that price jumps are minimal. The main area of influence of market makers is people; liquidity providers influence traders by creating market sentiment and pushing them to make transactions in the right direction.

Market makers are large market participants who have the ability to manipulate quotes. However, they are always opposed by competitors - banks, funds, brokers and dealers, and as a result their positions balance each other.

If a market maker abuses quotes in his favor, then other market participants will instantly figure him out and, moreover, competitors will immediately take advantage of the current situation and lure his clients to their side.

The liquidity provider found to have acted dishonestly will then be fined and, in the most severe cases, may even be debarred from operating. Naturally, such a risk is absolutely unjustified, especially considering that market makers receive stable and continuous income through the spread.

If we talk about the most popular myths about market makers, then there are three leaders, let's look at them further:

— The vast majority of transactions that are concluded on trading platforms are initiated by market makers

Many traders are sure that this is actually the case. But, as we have already mentioned, as the position grows, the risks also increase, and the chances of closing the position with a profit are significantly reduced. According to statistics, market makers open approximately 10-15% of transactions from the total number, while this amount is clearly not enough to form the market value of an asset.

— Market makers are hunting for stop losses of ordinary traders.

Unfortunately, many traders, especially unsuccessful ones, are accustomed to thinking that broken stops are the work of market makers. But, although market makers know the parameters of these orders, they are not their main goal due to their small sizes and large price spread. Therefore, market makers only artificially create supply and demand, thereby provoking traders to open transactions in the desired direction.

— Large market makers are actively buying currency and are in collusion with each other.

Of course this is not true. What are Forex market makers? Forex market makers are organizations competing with each other, and, in addition, associations of financial organizations for the purpose of manipulation for profit are punishable by law.

Although the market maker appears to be a very stable and important figure, he may also find himself in the unenviable position of another, larger liquidity provider. In addition, force majeure situations and financial crises cannot be ruled out.

Naturally, there are scammers in this area. But these are, as a rule, small offices opened specifically for such dishonest earnings and have nothing to do with true market makers.

It is definitely worth mentioning that there is a system of incentives for liquidity providers from official trading platforms, which allow market makers to reduce or completely eliminate their positions before important trading events. When Forex market makers close their trades, the market becomes chaotic and prices are likely to jump in any direction.

Therefore, one of the most important recommendations for any trader is not to trade immediately before major economic events, as even the largest market participants try to take a break from trading during this period.

Needed or not?

Novice market participants taking their first steps in trading often do not realize how important a role market makers play on the stock exchange. Let's assume that all such intermediaries have disappeared and the trading platform is left to its own devices. What does this mean?

Trading in low-liquidity stocks will be paralyzed. Trading with first- and second-tier chips will become very difficult. Why?

The liquidity that market makers bring to the exchange will disappear. Simply put, from now on every trader will be forced to wait until a buyer is found for the submitted order.

For example, the Russian stock market is not very liquid. Consequently, such waiting times can be significant. If traders are still able to trade shares of Sberbank or Novatek, then working with securities even at the level of Bashneft, Uralkali, Mostotrest, UWC and the like will become extremely difficult.

In addition, without market makers, difficulties will arise in situations of significant price fluctuations of an asset. Let's assume that Aeroflot stock quotes went up sharply when positive news came out from the company's management. A large number of traders will want to buy this chip. But there will be a shortage of sellers. Moreover, current holders of Aeroflot shares will begin to dump and refuse to part with securities at current market prices.

The mirror situation with the general sale of a particular asset threatens to turn into even bigger problems. The financial market will lose stability, which will scare off conservative investors.

To summarize, we note that the absence of market makers on the exchange will bring obvious difficulties:

- traders will “hang” for a long time in the quotation books, waiting for the opportunity to make a deal;

- you will have to overpay when buying a popular asset;

- There will be a risk of losing a significant part of your capital due to rapid drawdowns in quotes.

Thus, the services provided by such market participants are important and in demand. It is impossible to imagine modern financial platforms without them.

How to understand that there is a market maker in front of you

As has been mentioned several times in this article, traders can open orders in the direction they need. Therefore, every trader who wants to better navigate the market needs to be able to determine the moments when liquidity providers make purchases. Experienced traders are able to recognize certain signals that indicate that market makers are involved in a trade.

One of these signals is the formation of a flat due to a decrease in interest in trading. The appearance of short-term flat areas in a trend is called an accumulation period. Typically, such periods are formed in connection with the closure of European and American trading sessions. But sometimes it is obvious that the interest of trading participants in a certain trading instrument still remains, but at the same time a flat is observed. In this case, we can assume that the market maker has entered the game.

When a liquidity provider is identified, other trading participants can use a trading method where orders are placed in two directions at some distance from the boundaries formed by the flat.

About us: Admiral Markets

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

Section 3. Procedure and conditions for access to Information.

3.1 In accordance with clause 1, part 3, art. 6 of the Federal Law of July 27, 2006 No. 149-FZ “On Information, Information Technologies and Information Protection” The Company determines the procedure and conditions for the User’s access to the Information posted on the Site.

3.2 The Company provides free of charge access to Exchange information, Indices and other Derivative information to be posted on the Site in accordance with the requirements of laws, regulations of the Bank of Russia, and other regulations of the Russian Federation. Exchange information, Indices and other Derivative information may be used under the conditions established by section 4 of this Agreement.

3.3 All Indices are calculated by the Company using methods published on the Site. The values of additional parameters used in calculating the Indices (coefficients, tariffs) are disclosed on the Site in the public domain.

3.4 Exchange information, as well as any Materials posted on the Site, are not advertising and cannot be regarded as recommendations or offers aimed at encouraging the User to enter into contracts with any exchange commodities (instruments) admitted to organized trading held in commodity sections and the derivatives market section of the Company.

3.5 Information posted on the Site may contain links to third party sites. When following hyperlinks posted on the Site to information resources external to the Site, the User leaves the Site. The Company is not responsible for the unreliability of information posted on information resources external to the Site, as well as for untimely updating and update of the relevant information in their composition.

3.6 The Company does not act as a representative of third parties specified in clause 3.5 of this section of the Agreement. The placement of these links is for informational purposes only and should not be construed as advice, advertising of products, recommendations, or offers sold by any third parties.

3.7 The provision of Information services to the User is carried out on the basis of an agreement for the provision of Information services concluded between the User and the Company. The procedure and conditions for providing access to Information provided in accordance with the agreement for the provision of Information services are determined by the specified agreement.