When planning investments in bonds, stocks or other financial instruments, we always assess the potential risks. These risks may be associated, first of all, with the inability of the issuer to pay off its obligations to us in the future.

Of course, not every investor has the necessary knowledge and skills to independently analyze the solvency of a particular organization. Yes, this is not necessary, because there are specialized rating agencies to provide such information.

Credit rating agency

A rating agency is a company that evaluates the solvency of financial institutions, the quality of asset management, corporate management and the timeliness of settlement of obligations.

The most famous and popular product of rating agencies is a credit rating. The indicator is calculated both for an individual company and for the state as a whole and expresses an assessment of solvency. Contents Hide

- Credit rating agency

- International rating agencies

- National rating agency

- Major rating agencies

- Credit rating agency

- Russian rating agencies

- Difference between global and national rankings

- Are rating agencies objective?

- Minimum requirements for rating agencies

- How can a private investor use information from rating agencies?

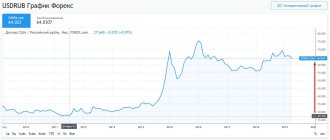

Why A-

ACRA analysts write that Russia’s credit rating is maintained at the A- level due to the low level of the country’s public debt and its stable structure. ACRA noted Russia's effective monetary policy and its coordination with the fiscal policy.

The rating is pressured, in particular, by low economic growth potential, limited export diversification, opacity of government obligations towards a number of public sector companies, and weak institutions.

ACRA analysts also mentioned the threat of sanctions that would limit the influx of investment, technological cooperation and trade with potential foreign partners. The assignment of a sovereign rating will not affect the existing ratings of Russian issuers on the national scale, notes an ACRA representative.

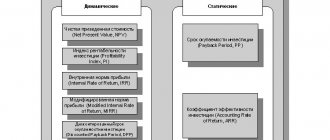

In the basic model for assigning a rating, ACRA takes into account 16 parameters related to macroeconomics, government finances, external position and institutions. The weight of each block is 25, 30, 22.5 and 22.5%, respectively. In the ACRA model, the highest weight is assigned to the indicator “state debt burden” - 19.5%, followed by political stability and quality of public administration (8.4% each). This approach differs from the methods of Western rating agencies, where institutional strength is given greater weight.

International rating agencies

International rating agencies play a strategic role in the global economy. Their assessment activities shape the degree of trust in banking structures, the attractiveness of individual companies or entire states for investors, and increase or decrease the chances of receiving a loan.

Despite the enormous influence on the global economy, each rating agency was initially created and operates as a commercial structure. The main goal of such organizations is profit, regardless of whether they operate on an international or national scale. This fact is the main reason for doubts about the objectivity of rating agencies.

What is a rating score and what does it mean. Rating scales

There are international assessment standards and, in addition to them, our own national ones. Or related to the activities of the agency itself, which is less common, since it does not have the property of universality. The international system consists of assigning a letter rating code, the values of which are given in the table:

| Rating | Decoding |

| AAA, AAA- | Very high degree of creditworthiness. There are practically no grounds for terminating the bank's activities. In the second case, the situation is just as good, but there are some negative aspects, which, however, practically do not affect the chances of returning the invested funds. |

| A+, AA-, AA, AA+ | Overall high degree of creditworthiness. Excellent performance indicators of the bank, indicating high chances of returning funds to creditors. There is a certain degree of imperfection (the fewer A’s and the more minuses, the more pronounced it is). |

| A-, A | High degree of creditworthiness. The bank is still on the list of one of the best credit institutions. The bottom step is for a credit institution to be included in the lists of central banks for the possibility of placing Nostro and Loro accounts of other credit institutions and other operations. |

| BBB-, BBB, BBB+ | Relatively high degree of creditworthiness. The probability of returning funds to creditors is high. There are negative factors, some difficulties which, however, have little effect on the final creditworthiness. |

| BB-, BB, BB+ | Average degree of creditworthiness. There are quite pronounced problems, but the bank is working normally. It can still, under certain conditions, be recommended for depositors and creditors. |

| B-, B, B+ | The degree of creditworthiness is slightly below average. Everything is the same as in the previous rating, but the degree of the bank’s problems is somewhat more pronounced. |

| SSS-, SSS, SSS+ | The degree of creditworthiness is below average. There are quite pronounced problems with the functioning of credit institutions. The bank is still able to service its obligations, however, under certain circumstances or a significantly changed market environment, there is some risk of a default state and bankruptcy of the bank. |

| SS-, SS, SS+ | Low degree of creditworthiness. More pronounced problems than in the previous case. The risk of defaults and non-payments is quite significant. |

| C | Unacceptably low degree of creditworthiness. Almost pre-default state. The bank may still have a chance, but the probability of bankruptcy is very high. |

| D | Bankruptcy procedure |

As already mentioned above, in addition to the international scale, there may be your own options. In addition, the Big Three agencies also use slightly different assessment options, which, however, are based on the same principles and generally coincide with each other.

National rating agency

In the Russian Federation today there are 4 accredited rating agencies. The National Rating Agency (hereinafter referred to as NRA) is considered one of the leading agencies of the Russian Federation. Despite the fact that the NRA has been operating since 2002, it was included by the Bank of Russia in the register of credit rating agencies only in 2021. Over the 14 years of operation, the company has come a long way. From a rating project in an experimental format, the organization has grown into an independent business project with a high level of efficiency and profitability.

TOP – 30 analytical agencies

| No. | Name | Turnover, million rubles | Among clients | Year of creation |

| 1 | AGT Communications Network | 1100 | Beeline, TTK, MegaFon | 2001 |

| 2 | ROME | 870,9 | IBM, Bayer, Boiron | 1993 |

| 3 | P.H.D. | 797,8 | Audi, Bayer, Volkswagen | 2006 |

| 4 | Realweb | 610 | Aeroflot, re:Store, HH.ru | 1998 |

| 5 | Mindshare | 601,3 | National Geographic Society, TWD, Trends Brands | 1997 |

| 6 | OMD OM Group | 572 | Lipton, Mango, Baltika | 1997 |

| 7 | iMARS | 542,8 | Russian Railways, Aeroexpress, Rosneft | 2001 |

| 8 | Initiative | 539,7 | Lego, Bonduelle, Tele2 | 2005 |

| 9 | VBI | 480,5 | Avilon, Yauza Motors, Lukoil | 2012 |

| 10 | PRIOR | 449,1 | Panasonic, Metabo, OK | 1993 |

| 11 | TBWA\Group Moscow | 440,4 | Airbnb, S7, Vichy, Beeline | 1998 |

| 12 | Artox Media Digital Group | 357,1 | SaveTime, residential complex Malakhovsky Kvartal, Dymov | 2007 |

| 13 | Main Target Group | 328 | Golden Lady Group, Ministry of Tourism of Cuba, National | 2001 |

| 14 | SLAVA | 269,5 | Mistral, Wimm-Bill-Dann, Nissan | 2011 |

| 15 | Ambitica | 265,5 | Mazda, Ford, MUZ | 2007 |

| 16 | MOTIVE agency & production | 216 | Russian Railways, Sollers, Transmash holding | 2005 |

| 17 | UPSIDE | 207,6 | Xiaomi, Sportown, CALZEDONIA | 2018 |

| 18 | Deluxe Interactive Moscow | 147,6 | Gazpromneft, Polaroid, Bacardi | 2007 |

| 19 | Serviceplan | 146,8 | BMW, Cherkizovo, Metro | 2013 |

| 20 | AdWatchIsobar | 140 | VTB, Danone, Materia Medica | 2014 |

| 21 | Pro-Vision Communications | 138,6 | Parker, Nivea, Lego | 1998 |

| 22 | IQ Marketing | 133,9 | X5, OK, Agreement | 2001 |

| 23 | Terralife | 126,1 | Polaris, ORSAY, Moskvarium | 2011 |

| 24 | i.com | 120 | Baltika, Suzuki, Freedom Finance | 2010 |

| 25 | Netpeak | 90,3 | Mircli, Redmond, LG | 2006 |

| 26 | DADA Agency | 83,3 | Raffaello, X5, Nivea | 2013 |

| 27 | FPR | 67,3 | Facial Place, Ginza Project, Abrau | 2002 |

| 28 | IndexBox | 25,3 | Knauf, Rusnano, Siemens | 2007 |

| 29 | RADAR Advertising | 18,9 | Baltika, VTB, Gazpromneft | 2007 |

| 30 | OLYMPIA | 10,2 | Red Bull, OSTIN, Studio 54 | 2015 |

You can learn more about the work of the agency you are interested in in our catalogue.

Major rating agencies

The most authoritative rating agencies are the so-called ones, including Fitch Ratings, Moody's, and Standard & Poor's. It is estimated that their reports account for approximately 95% of the entire international market for valuation services. It is these companies that assign credit ratings to the most popular companies and states among investors. In fact, such opportunities give the main rating agencies to influence the economic and political situation on the world stage. Decisions made on credit ratings are often used as a lever of political pressure and are biased.

What is a bank credit rating

In short, this is the level of its solvency. It reflects the ability to conduct transactions and pay money to creditors and depositors. Since the condition of the bank is characterized by many details (their number is determined by a huge number of parameters), a standard credit rating scale has been developed for ease of comparison. From it you can judge the position of the bank, and if it is bad, then how bad it is.

To avoid confusion, all scales are generally standardized. A credit rating is designated by the letters “A”, “B”, “C”, “D” with pluses and minuses, as well as their combinations.

Even the smallest detail can affect solvency. Therefore, when calculating the rating, credit institutions are assessed according to a large number of criteria. Specialized systems for determining solvency have been developed to take into account all the details that may influence the auditors' conclusions. Assessing and assigning a credit rating is usually a very lengthy process.

Credit rating agency

Credit rating agencies are involved in calculating the creditworthiness of individual banking institutions. As a rule, research is initiated by credit institutions on a paid, commercial basis. The assigned rating can be long-term or short-term in nature and depends on the timing of the financial institution's borrowings.

When compiling such ratings, several different approaches are used. As a rule, we are talking about comparing a number of financial indicators. There are also more complex schemes, according to which each criterion receives a certain specific weight, and the final score is summed up as a total number of points.

How reliable are bank credit ratings?

Every investor should be careful when interpreting credit ratings. And there are a number of reasons for this.

- The analysis is done according to a standard scheme. External and internal factors, political and economic aspects, and market conditions are not taken into account.

- The analysis is not carried out constantly, but at certain intervals. Sometimes a bank that is in fact in a pre-default state can have good credit ratings. And formally the agency has nothing to do with it. It's just not time to update the rating yet.

- A credit rating is not the only indicator of a bank’s condition, but only one of many.

- Having a rating from a credit institution simplifies the work of money market participants. And yet this parameter is nothing more than an expert opinion. Investors should make decisions about cooperation independently, thoughtfully, taking into account many other factors.

Russian rating agencies

There are four national rating agencies in Russia that have been accredited by the Central Bank of the Russian Federation:

- ACRA

- "Expert RA"

- National Rating Agency (NRA)

- “National Credit Ratings” (NCR), created by the RBC media holding

It is worth noting that the rating agencies “National Rating Agency” (NRA) and “National Credit Ratings” (NCR) received accreditation from the Central Bank of the Russian Federation on September 12, 2021, receiving the right to assign credit ratings.

Difference between global and national rankings

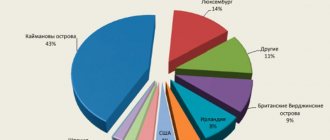

In independent Russia there has always been an objective need to create independent rating agencies. The reason is that international agencies do not have the opportunity to give individual Russian companies a rating higher than that of the state as a whole.

The appraisal activities of Russian companies are much cheaper. In addition, their assessment is considered more objective, since it takes into account the specifics of business in the Russian Federation. The services of domestic RAs, in particular, are in demand among companies that do not even plan to develop international markets.

AK&M NEWS AGENCY.

Certificate of the Russian Federation Press Committee on registration of mass media N 03139 dated January 15, 1996.AK&M was founded in 1990 as a closed joint stock company (CJSC AK&M) and since its inception has been one of the most famous and influential information and analytical agencies. The main specialization is economic information.

AK&M website on the Internet – www.akm.ru

— has been a leading information portal in the field of economics and finance for many years.

Since 2001, AK&M has been an organization authorized by the Federal Financial Markets Service of Russia to disclose information on the securities market

.

Within the framework of these powers, the agency has created and maintained the Information Disclosure System on the securities market - DISCLOSURE.

The system accumulates all current information about issuing companies registered in Russia, including quarterly reports and significant events of issuers, information on securities issues, lists of affiliates and other information.

AK&M is represented on the economic information market with a number of its own information and analytical products.

Information products:

- operational news feed “AK&M-Online News”;

- information retrieval system "DataCapital";

- "Stock Newsletter".

Disclosure of information on the securities market (www.disclosure.ru):

- disclosure of information in the AK&M News Feed;

- disclosure of information on the Internet Page;

- live feed of essential facts;

- reporting of issuing companies.

Analytical products and services:

- bulletin “Sectors of the Russian economy: production, finance, securities”;

- “Mergers and Acquisitions Market” newsletter;

- custom analytical studies;

- stock indices.

Ratings

(since 2005, the activities of the AK&M information agency in the field of ratings construction have been continued

by AK&M Rating Agency CJSC

):

- bank ratings;

- enterprise ratings;

- bond ratings;

- depository ratings;

- ratings of management companies;

- ratings of investment companies;

- regional ratings;

- service agent ratings;

- various rankings;

- Study of the relative creditworthiness of the constituent entities of the Russian Federation.

Professional conferences, forums, round tables:

The agency's information and analytical products are used in their work by more than a thousand organizations and enterprises, including the Administration of the President of the Russian Federation, the Government Office of the Russian Federation, Committees of the State Duma and the Federation Council of the Federal Assembly of the Russian Federation, the Ministry of Economic Development of the Russian Federation, the Ministry of Finance of the Russian Federation, the Central Bank of the Russian Federation, the Russian Federal Property Fund, Federal Tax Service, Federal Customs Service, leading Russian banks and enterprises, investment companies and funds, insurance and management organizations, consulting and valuation structures.

AK&M has been cooperating successfully with the media for a long time. Central and regional periodical newspapers and magazines actively quote news and publish thematic materials prepared by agency specialists. AK&M news covering corporate events is constantly published by such well-known newspapers as Vedomosti, Kommersant, RBC Daily, Expert, Dengi, Securities Market, Banking Business, and BDM magazines. Banks and the business world”, as well as Internet portals: “Gazeta.ru”, “Polit.ru”, “Lenta.ru”, “Rambler.ru”, Cbonds, RBC and many others. AK&M information is quite widely cited by regional media.

Interested parties abroad have the opportunity to receive AK&M information about the Russian stock market and corporate events both through the English version of the www.akm.ru server and through partner agencies.

The AK&M Agency carried out extensive explanatory work in order to create a positive attitude towards information disclosure processes among Russian companies issuing securities. Its result was a significant expansion of data sets on Russian companies, as well as the formation of stable partnerships with a significant number of companies representing all sectors of the Russian economy.

AK&M is developing rapidly, expanding the scope of its services and constantly improving the quality of its information and analytical products.

In its work, the AK&M information agency uses the latest technologies in the areas of collecting, processing and disseminating information.

Today, the AK&M news agency maintains a high reputation as a producer of high-quality information services and a leader in the economic information market.

______________________________

If you are interested in our products and services, you can send an APPLICATION to the agency. Immediately after receiving the Application, specialists from the relevant department of the AK&M information agency will contact you.

Regarding subscription questions, you can also consult with the employees of the AK&M commercial department by calling +7 (495) 916-71-51 or sending a message by E-mail: [email protected] .

Are rating agencies objective?

Each rating agency is a commercial organization that seeks to maximize its own profit. This feature of RA prevents them from being completely objective. In recent years, there have been frequent cases of explicit or hidden corporate orders with specific objectives: to make a competitor’s rating worse, and a specific company better. Money buys very serious reports. A striking example of this statement is the crisis of 2008-2009, when a whole group of corporations with impeccable ratings found themselves on the verge of ruin.

Minimum requirements for rating agencies

- Providing reliable and objective information based on historical data. The rating is subject to periodic review, and the methodology is changed every three years.

- Independence. The ratings are free from economic pressure and political interference.

- International access and openness.

- A rating agency needs a sufficient number of staff to organize the analytical process with objective results.

- Rating agencies are officially recognized by regulatory authorities and the professional community.

People know better

Assigning a rating at level A- is a fundamentally correct decision, says Skolkovo-NES professor Oleg Shibanov. Russia is a net creditor to the rest of the world, it has a large trade surplus and a significant budget surplus, the economist lists. It's "underweighted by the big agencies," he believes. It is difficult to imagine that Russia will not be able to pay off its creditors over the next five years, Shibanov explains.

“I’m not surprised that the Russian agency is giving a higher rating,” says Natalia Orlova, chief economist at Alfa Bank. “The Russian agency looks from the inside, based on development scenarios, while international agencies look more at comparable indicators of different countries.” In addition, global investors may have some priorities, while Russian ones may have others, Orlova adds.

Level A- is more justified in relation to Russia than ratings from international agencies, senior economist at Oxford Economics Evgenia Sleptsova told RBC. Even taking into account all the risks of a political nature and risks not related to the macro-financial situation, Russia’s sovereign risk remains low, she is sure.

How can a private investor use information from rating agencies?

The reputation of rating agencies was seriously damaged after the 2008 crisis. It turned out that companies with impeccable ratings are capable of bursting like soap bubbles. For this reason, even the results of the Big Three reports should not be taken as the ultimate truth.

Moreover, the credit rating itself has never been and will not be a recommendation to buy or sell any assets. Ratings show only one characteristic - the level of creditworthiness of individual companies or states. And even companies and states with an AAA rating are susceptible to such a phenomenon as default. The difference is that among companies with a AAA rating, cases of bankruptcy will be isolated, while among companies with lower rates, bankruptcy will occur much more often.

Better than "three"

ACRA's rating is two to three notches higher than the ratings assigned to Russia by foreign agencies. Currently, the country's rating according to S&P is BBB-, according to Moody's - at a level corresponding to BBB-. Fitch rated Russia higher than other global agencies and did not lower Russia's rating to the “junk” BB category; now it is at the BBB level. Thus, the rating from ACRA is two notches higher than the rating from Fitch and three notches from S&P and Moody's.

Russia already had a rating of category A. According to the Chinese agency Dagong (the latest rating was in 2021, Dagong’s accreditation was revoked in 2021), it is at level A with a stable forecast, that is, even higher than according to ACRA. The Japanese rating agency JCR last raised the Russian rating in 2021 - to BBB-. The same rating is from the German Scope.

ACRA is the first Russian rating agency to assess the creditworthiness of Russia. The first and so far the only sovereign issuer, besides Russia, to receive an assessment from ACRA was Switzerland (AAA). ACRA's competitors - Expert RA, NKR and NRA agencies - have not yet assigned a sovereign rating to Russia.