One of Russia's largest retailers, Magnit, is acquiring its competitor, the Dixy retail chain, Magnit announced in a press release on Tuesday.

There are 2,651 convenience stores operating under the Dixie brand in Russia. According to Magnit, the acquired business generates profit - in 2020 it amounted to 281.4 billion rubles. The group of companies includes supermarkets of various formats: “Dixie”, “Kvartal”, “Deshevo”, “Victoria”, “Megamart”, “CASH” and the franchisee “First of all”. Dixy ranks 30th among the largest private companies in Russia according to the Forbes rating.

At the same time, with the acquisition of Dixy, Magnit’s physical presence increases by only a little more than ten percent: Magnit had 21,564 retail outlets at the end of 2021. That is, in terms of revenue (RUB 1.4 trillion over the past year), Magnit looks like a giant next to Dixie.

The owner of Dixy is Mercury Retail Group Ltd, which sold its subsidiary, Tander JSC, 100 percent of the discounter’s shares for 92.4 billion rubles.

Magnit itself was sold by its founder Sergei Galitsky in 2021 for 138 billion rubles. The buyers were VTB Group (received 29.1% of shares), Invest (13.8%), and the remaining shares were diluted between minority shareholders. Their value rose 3.5% on Tuesday after the announcement of the upcoming deal.

Data on the issuer's securities

To make an informed decision about purchasing shares, you need to not only worry about choosing the right moment to buy. You should clearly understand the potential of the acquired assets and understand how you can make money on them.

If the priority is to play to increase quotes, then the main thing is to “dump” shares that have risen in price in time and take profits. In cases where the bet is placed on receiving dividends, you will have to thoroughly study the financial position of the issuer. In practice, this is mainly done by large institutional investors. Ordinary citizens are usually limited to familiarizing themselves with the organization’s annual reports for the last 1–3 years and reading noteworthy analytics.

Before you figure out where to buy Magnit shares, understand what it is. Currently, it is one of the largest chain retailers in the Russian Federation, with 20.86 thousand stores throughout the country. Its revenue for the 1st quarter of 2021 amounted to 376.0 billion rubles, gross profit - 85.2 billion rubles, gross margin - 22.7%.

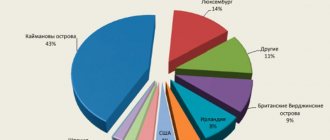

From its founding until 2021, Magnit was owned by Krasnodar businessman Sergey Galitsky. As a result of a high-profile transaction, the holding changed its owner, and now the structure of share ownership looks like this:

- 29.10% – VTB financial group;

- 11.82% – investment company Marathon Group;

- 3% – former owner of the company;

- more than 56% are private investors and legal entities.

Most of the company's securities are freely traded on the stock market. Accordingly, the dynamics of Magnit's share price are subject to the market laws of supply and demand.

Sell while they take it

FMCG market expert Alexander Afinogenov suggests that the meaning of the Mercury Retail group selling its profitable asset can be twofold.

“Either the owners of Dixie have a forecast that the profitability of these stores will not last forever and they need to go into cash while this asset remains attractive. Perhaps they have some calculations that the liquidity of this asset will fall. The basis for such a forecast may be the aggressive offensive of competitors in the “convenience store” format. Fighting for a place in this niche requires investment, which Mercury does not currently have,” he analyzes.

The second version of why Mercury Retail Group decided to sell Dixy may be precisely the search for capital for the development of other projects of the group, which seem to the company to be more promising and in demand.

“The situation inside Dixie itself is quite murky, the management there is constantly changing, and such leapfrog is not good for the trading network. Therefore, getting rid of it means killing two birds with one stone, the second of which is the opportunity to invest the proceeds, for example, in “Bristol” or “Red & White” alcohol markets, “Victoria” supermarkets or in some other assets,” suggests expert.

Dynamics of securities prices

The initial public offering of Magnit shares took place in 2006 on the MICEX (ticker MGNT). The then IPO ended with a quite acceptable result: 18.4% of ordinary shares were sold, the company managed to attract investments for 368.4 million US dollars. The secondary offering in 2009 turned out to be more successful: it was possible to sell more than 51% of the shares in the amount of $369.2 million.

The retailer's securities are included in the main stock indices of the Moscow Exchange: blue chips, broad market, consumer sector and others. It is interesting to trace the dynamics of Magnit shares over the past 5 years. Quotes reached their maximum in August 2015 - then more than 12,275 rubles were given per share. The historical minimum occurred in February 2021 - the security fell in price to 3,160 rubles. It is clear that not all investors managed to make money on the retailer’s shares, but competent traders made good money due to such an impressive rally.

Technical analysis: "Magnet"

Technical analysis: "Magnet"

In the fall of 2015, the price breaks out of the growing trend. A falling channel has formed. From the lower limit to 8000 rubles. the paper rebounded, and at the beginning of August 2021 they broke through the upper border of the channel. Until the end of last year, the bulls held 10,000 rubles. At the beginning of this year there was a strong sales impulse up to RUB 9,500. with continued reduction to 8500 rub. In the summer the price began to rise. In August they hit 10,000 rubles, but again they could not pass 11,000 rubles. A sharp decline passes through all supports. Now the price may well reach 7,000 rubles.

In the second half of 2015 and the beginning of 2021 there will be a downward channel. In mid-2021 there will be an inverted head and shoulders. The figure was opened up, and the price exited the falling channel. They hit 10,000 rubles, but it was not possible to develop growth. Trade went sideways. At the beginning of 2017, a downward trend formed. Double support test for 8700 rub. The security came out of a falling trend and formed a growing trend in the summer. Rally in August up to 11,000 rubles. with double top. The figure was revealed downwards. Acceleration of the decline in October with a breakdown of the support of 8,500 rubles. The last bar hints at continued decline.

The August rally brought the price to 10,900 rubles. The double top opens sharply downwards and the bottom of the pattern becomes resistance. The decline in the channel is unfolding. In the second half of October, the decline accelerates with exit from the channel downwards. Around 8000 rub. attempt at rebounds and vague consolidation (looks like a bear flag). It is opened downwards. Maybe there will be attempts to curb sales at RUR 7,500. In case of failure, the decline will continue to 7,000 rubles.

Trading idea: Aeroflot

The paper grew for two years, from the level of 40 rubles. and up to 220 rub. Two growing trends on the daily chart. After the breakdown 200 rub. down at the end of August, the security was no longer able to resume growth within the annual growing trend. Throughout October, the price was kept at support at 180 rubles. The bulls made rebounds, but they were stopped in the zone of 185 - 187 rubles. As a result, trading in a side channel, which in the long term looks like a rectangle, is a continuation figure. In this case – continuation of the decline. Strengthening moments - the price has already exited the growing trend, and the descending line of local highs on rebounds within the October sideways trend. In the middle of yesterday's trading there was a sharp acceleration of the decline to support at 180 rubles. Until the end of the day – consolidation at this level. All previous contacts were in an acute form, now the situation is different. It is quite possible that this is preparation for a support breakthrough. In case of a successful breakout, a new falling wave may begin. We do not recommend opening positions at the beginning of trading.

Trading plan for opening a short position:

1. Sale in the zone 179 rubles,

2. Take profit: zone 160 rub. and below. To protect profits, it is advisable to use trailing stops,

3. Stop loss: 184.2 rub.

4. The signal is valid as long as the price is below the level of 182 rubles.

What do quotes depend on?

Although the company is still continuing to transform its business model, positive changes are already visible: the average bill has increased, the cost of manufactured goods has decreased, and the efficiency of existing retail outlets has increased. The forecasts for the holding's profits are also favorable. All this had a positive impact on the dynamics of Magnit shares: their value for January - April 2021 varied from 3,445.50 rubles. up to 3690.00 rub. However, the volatility of the paper is high: today it can cost 2,705.00 rubles, and tomorrow it can be 15% cheaper.

The above means that this asset is of interest, first of all, to aggressive players. Moreover, you can make money both from rising and falling prices. Magnit's share price today is 3,705.50 rubles, profitability forecasts are 12.86%, the expected dynamics of quotations are positive. In anticipation of the payment of dividends in the amount of 157 rubles. analysts advise buying the stock per share.

Positive factors.

It is impossible to increase profits without changing your strategy. This happened in the third quarter of 2021 and was announced officially. It is expected that the new strategy will help reverse the current situation, increase the company's profitability and ensure stock growth.

Shares of the public joint stock company "Magnit" can be purchased and sold on the Moscow Exchange, ordinary share (MGNT)

Another positive factor is the expansion of retail space. Although each square meter of area brings Magnit significantly less compared to X5 Retail Group (almost 65 thousand rubles for a competitor versus just over 50 thousand rubles for Magnit), this only means that there is huge potential for growth.

Another factor is the variety of stores. Magnit does not stop at simple retail outlets within walking distance. It brings into operation hypermarkets, cosmetic stores and other points of sale.

Where and how to buy Magnit shares as an individual

There are no technical difficulties for purchasing the company's securities. To buy Magnit shares, an individual needs:

- enter into an agreement with a broker (both IIS and a regular brokerage account are suitable);

- transfer money to a newly opened account;

- submit an application to purchase a package of securities;

- receive annual dividends on Magnit shares. In 2021, their next payment is expected on June 19.

As you can see, there is nothing complicated here.

Sequence of actions when buying shares

Before making a decision to purchase an asset, you need to find out its current quotes. This can be done on online news and financial resources:

- ru – Moscow Exchange portal, to view quotes just enter the security ticker MGNT in the search bar;

- interfax.ru, rbc.ru, ru.investing.com, smart-lab.ru, stocknavigator.ru - sites allow you not only to find out quotes, but also to obtain forecasts from leading analysts regarding changes in their value in the future.

To buy Magnit shares, an individual should use the help of his broker. You can purchase securities from him at the exchange price, as well as on credit (if you trade with leverage).

Purchasing with simplified identification

If you don’t want to open a brokerage account, you can use another method: buy assets through your personal account at a bank or using an electronic wallet. In this case the client:

- selects a security, fills out an application for its purchase;

- enters a code from SMS confirming the intention to make a transaction;

- transfers money from a bank card or electronic wallet;

- receives a transaction report to the specified email address.

With this method of purchasing shares, the commission will be higher than in the case of purchasing assets through a broker. But the transaction can be completed in a few clicks, and you don’t have to go anywhere.

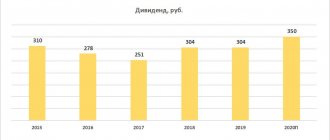

Dividend payment

Traditionally, Magnit paid dividends on its shares quarterly. No deviation from the rules is expected in 2021. In past periods, dividend yield varied from 3 to 5% per annum, now they are talking about 4%. However, due to regular payments, there is stable demand for the company’s securities. However, significant volatility in asset prices can negate the entire profit from dividends.

Those who still decide to purchase Magnit shares should study the dividend payment schedule. In 2021, the closure of the register of shareholders will occur on June 17 and October 13, therefore, you need to buy the holding’s securities before these dates.

Will one of the largest Russian retailers, Magnit, be able to regain its former power?

Retailer Magnit presented its strategy for 2021–2025. It provides that in 2021, an additional driver of revenue growth should be accelerated expansion. Magnit plans to build an ecosystem around the brand, its basis will be the chain’s stores and a single platform for online orders. The supermarket, later than its competitors, began to develop the trend of moving online. And whether he will be able to catch up with them in principle remains a big question.

Business turnaround

The Magnit retail chain has long been the leader in the industry in terms of financial results and market capitalization. At the end of 2017, for example, Magnit took second place in the Forbes ranking of the largest private companies, second only to Lukoil.

.

But a record drop in performance soon followed. And in the winter of 2018, the founder of the Magnit network, Sergei Galitsky

sold most of his shares

to the VTB group

. Among the reasons for what was happening was the fact that the management of Magnit was unable to quickly adapt to the changes taking place in life.

As senior consumer analyst

Victor Dima

, many of the Magnit stores that have opened recently resembled general stores from the 1990s. Meanwhile, the consumer has changed a lot, and ideas about what retail should look like have changed.

According to him, competitors have caught on to this trend, and the same X5 has improved its appearance and product range. Then experts said that Magnit was awaiting a new stage in its development.

New leaders

VTB Bank has the largest stake in PJSC Magnit

- 17.28%.

The investment structures of Alexander Vinokurov

have 13.8%. The remaining shares are either owned by minority shareholders or are in free circulation on the stock exchange.

Jan Dunning was appointed President of Magnit in February 2021

, who previously successfully led Lenta.

Jan Dunning came to Russia in early 2000 and began working as sales director at Metro Cash & Carry. It should be noted that he fit perfectly into Russian life. During the conflict of shareholders in Lenta in 2010 in St. Petersburg (one appointed Sergei Yushchenko

, the other - Jan Dunning), the latter, as reported by the media, personally participated in the seizure of the Lenta office and broke into the office of CEO Sergei Yushchenko . The attackers were serious and used tear gas and smoke bombs. True, as a well-mannered European, Dunning later apologized to journalists for what they had to see. But he nevertheless took the place of general director.

Conscious trend

The expected series of transformations followed. For example, the development of digital transformation and online sales. Magnit management stated that online sales and the click&collect service (that is, ordering goods online with the option to pick them up in the store) are planned to be launched in 2021. Pilot projects for the delivery of goods from their stores together with partners appeared in Krasnodar (delivery service for food and non-food products from Magnit supermarkets together with the Broniboy company). In Moscow, the retailer's partner has become the iGooods delivery service.

On this topic

3082

Sobyanin approved the layout project for one of the largest transport hub “Vykhino”

The Vykhino transport hub will actually become the new south-eastern station of Moscow. The planning project provides for a comprehensive reconstruction of the transport hub with the construction of capital facilities with a total area of more than 121 thousand square meters.

And last spring, the retailer announced in its annual report that it could take the first steps in developing online sales in 2021. Last fall, Magnit began its first project in the online retail segment by launching an online pharmacy. For now, self-pickup is operating from more than 100 points in Moscow and the Moscow region, where about 5 thousand items of pharmaceutical products, cosmetics, etc. are presented. Based on the online pharmacy, the chain expects to develop a model for its own delivery of products.

The first results of pilot projects in e-commerce (sale of everyday goods on the Internet) were also summed up. Despite the short period of operation, the company already fulfills about 7 thousand orders per day, while the number of orders is actively growing - by an average of 25% every week.

According to Magnit, the majority of orders are made by buyers who have not previously visited offline stores.

But Magnit began developing this area later than its competitors. Thus, X5 launched an online store of the Perekrestok supermarket in Moscow back in 2021, and in St. Petersburg in 2021. Another project of the retailer is express delivery from Pyaterochka stores.

X5 Retail

became the largest company in the online food retail segment on the Russian market at the end of 2021.

Magnit still lags behind competitors in the development of its own e-grocery direction, but is aware of the trend towards moving online and may begin to catch up with its competitors in the near future. As Jan Dunning explained, Magnit is too big a business to make a complete turnaround in one year. According to him, you cannot change course too quickly, otherwise you may lose what is good that you have now.

This may be true, and a well-thought-out strategy will begin to bear fruit in the future. But, as the media noted, some aspects of the company’s activities look alarming today.

Thus, compared to the times of Galitsky, Magnit PJSC and Tander JSC, which manage the network, began to sue twice as often. Under Galitsky - 1380 times in 2016 and 1426 times in 2017. Under the new management - 2,523 times in 2018, 2,758 times in 2019 and 1,985 times in the first half of 2020. Most often, PJSC Magnit and JSC Tander are sued by counterparties. The claims relate to the retailer’s failure to pay for waste management services and its failure to fulfill obligations under energy supply and lease agreements.

Supervisory authorities also have complaints against Magnit. In 2018–2020, 4,024 violations were identified, an average of 118 per month (under Galitsky, almost two times less). First of all, we are talking about non-compliance with fire safety rules. In addition, such violations were recorded as failure to disinfect stores during the coronavirus pandemic, lack of sanitary clothing and information about vaccinations for employees, failure to comply with restrictions on the tobacco trade, and the presence of expired products on the shelves.

But most importantly, net profit fell from 24 to 10 billion rubles

, that is, it decreased several times compared to the Galitsky period. The course towards optimization led primarily to a reduction in the salaries of ordinary personnel.

It should be noted that we are talking about a company with state participation. And the top management of Magnit, when it comes to their own salaries, behaves similarly to the heads of many state-owned companies. So, a few months after Galitsky’s departure, at a difficult moment, it was planned to spend over 16.5 billion rubles

for payments to the new top management team.

At the same time, the new managers became minority co-owners. Dunning currently owns 170 thousand shares. Now one share is trading for about 4.8 thousand rubles, which is about 800 million rubles. He has already increased his share three times. Jyrki Talvitie became a minority co-owner of Magnit

, who served as a member of the board of Magnit for just over a year, and during this time was able to receive 478 shares.

He is now listed as an advisor to the company. Vladimir Sorokin

and

Elena Milinova

, who also did not serve long on the board of Magnit, became minority shareholders But they had about 37 thousand and 14 thousand shares in their hands, respectively.

Yes, Jan Dunning successfully led Lenta. During his reign, the network reached the all-Russian level, held an IPO and significantly increased its capitalization. Will Magnit be able to catch up and overtake its competitors? There are still big doubts about this.