Home / Credit ratings of banks / Rating agencies, rating scales / National Rating Agency

The National Rating Agency (NRA) has been operating since 2000 and is one of the leading independent rating agencies in Russia. Currently, NRA's clients based on assigned contact ratings are more than 200 legal entities. More than 800 companies and banks participate in other NRA information projects, the materials of which are regularly published in the media, on the agency’s website and social networks.

NRA ratings are officially recognized by the Central Bank of the Russian Federation, Vnesheconombank, the Federal Financial Markets Service, the State Corporation Russian Nanotechnology Corporation (RUSNANO), the Ministry of Agriculture of the Russian Federation, the Agency for Mortgage and Housing Lending (AHML), the RTS and MICEX stock exchanges, the National Association of Stock Market Participants (NAUFOR ), the National Stock Association (NFA), the National League of Managers (NLU), the Association of Russian Banks (ARB).

From July 14, 2021, in accordance with the law, the Central Bank switched to using only ratings from ACRA and Expert RA agencies and did not stop using NRA ratings.

| See also: rating scale for MFOs |

National Rating Agency - rating scale of credit ratings of Russian banks

National scale

| Meaning | Short description | Full description |

| AAA | The level of credit risk is assessed as low | The level of credit risk is assessed as low, the financial statements are characterized by very high values of key financial indicators. The investment strategy and policy are diversified and balanced, the reputation is characterized by the highest degree of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as the highest possible. |

| AA+ | The level of credit risk is assessed as low | The level of credit risk is assessed as not high, the main financial ratios and indicators have high values. Reputation is characterized by a very high degree of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as very high. |

| A.A. | The level of credit risk is assessed as low | The level of credit risk is assessed as not high, the main financial ratios and indicators have high values. Reputation is characterized by a very high degree of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as very high. |

| RM2 | High level of risk management quality | |

| AA- | The level of credit risk is assessed as low | The level of credit risk is assessed as not high, the main financial ratios and indicators have high values. Reputation is characterized by a very high degree of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as very high. |

| A+ | The level of credit risk is assessed as insignificant | The level of credit risk is assessed as insignificant, the main financial ratios have adequate values. Reputation is characterized by a high level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as high. |

| A | The level of credit risk is assessed as insignificant | The level of credit risk is assessed as insignificant, the main financial ratios have adequate values. Reputation is characterized by a high level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as high. |

| A- | The level of credit risk is assessed as insignificant | The level of credit risk is assessed as insignificant, the main financial ratios have adequate values. Reputation is characterized by a high level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as high. |

| BBB+ | The level of credit risk is assessed as moderate | The level of credit risk is assessed as moderate, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as adequate. |

| BBB | The level of credit risk is assessed as moderate | The level of credit risk is assessed as moderate, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as adequate. |

| BBB- | The level of credit risk is assessed as moderate | The level of credit risk is assessed as moderate, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of clients and counterparties. The ability to fulfill obligations in a timely and complete manner is assessed as adequate. |

| BB+ | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased, the main financial ratios are within acceptable limits. Reputation is characterized by a certain level of trust on the part of a narrow circle of clients and counterparties. The ability to timely and fully fulfill obligations is moderately sensitive to the impact of adverse factors and is assessed as adequate in the short term. |

| BB | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased, the main financial ratios are within acceptable limits. Reputation is characterized by a certain level of trust on the part of a narrow circle of clients and counterparties. The ability to timely and fully fulfill obligations is moderately sensitive to the impact of adverse factors and is assessed as adequate in the short term. |

| BB- | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased, the main financial ratios are within acceptable limits. Reputation is characterized by a certain level of trust on the part of a narrow circle of clients and counterparties. The ability to timely and fully fulfill obligations is moderately sensitive to the impact of adverse factors and is assessed as adequate in the short term. |

| B+ | The level of credit risk is assessed as moderate in the short term | The level of credit risk is assessed as moderate in the short term, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of a limited number of clients and counterparties. The ability to timely and fully fulfill obligations is sensitive to the impact of adverse factors and is assessed as doubtful. |

| B | The level of credit risk is assessed as moderate in the short term | The level of credit risk is assessed as moderate in the short term, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of a limited number of clients and counterparties. The ability to timely and fully fulfill obligations is sensitive to the impact of adverse factors and is assessed as doubtful. |

| B- | The level of credit risk is assessed as moderate in the short term | The level of credit risk is assessed as moderate in the short term, the main financial ratios meet the requirements for them. Reputation is characterized by a moderate level of trust on the part of a limited number of clients and counterparties. The ability to timely and fully fulfill obligations is sensitive to the impact of adverse factors and is assessed as doubtful. |

| CC+ | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased. There is exposure to adverse factors, the probability of failure to fulfill obligations is assessed as high. |

| CC | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased. There is exposure to adverse factors, the probability of failure to fulfill obligations is assessed as high. |

| CC- | The level of credit risk is assessed as increased | The level of credit risk is assessed as increased. There is exposure to adverse factors, the probability of failure to fulfill obligations is assessed as high. |

| C+ | The level of credit risk is assessed as high | The level of credit risk is assessed as high, cases of failure to fulfill part of current obligations, technical defaults. The probability of non-fulfillment of obligations is assessed as very high. |

| C | The level of credit risk is assessed as high | The level of credit risk is assessed as high, cases of failure to fulfill part of current obligations, technical defaults. The probability of non-fulfillment of obligations is assessed as very high. |

| C- | The level of credit risk is assessed as high | The level of credit risk is assessed as high, cases of failure to fulfill part of current obligations, technical defaults. The probability of non-fulfillment of obligations is assessed as very high. |

| D | Bankruptcy proceedings have begun | Bankruptcy proceedings have begun. |

| suspended | The rating is temporarily suspended. | |

| withdrawn | The rating has been withdrawn. |

National scale, forecast

| Meaning | Short description | Full description |

| positive | Positive outlook | Expected change in the bank's creditworthiness and financial condition in the long term (over six months) |

| stable | Stable forecast | Expected change in the bank's creditworthiness and financial condition in the long term (over six months) |

| negative | Negative Outlook | Expected change in the bank's creditworthiness and financial condition in the long term (over six months) |

| waiting list | There is a high probability that the rating will be revised in the near future (within the next few months). | |

| waiting list: positive outlook | There is a high probability that the rating will be revised in the near future (within the next few months). The organization maintains its rating at the current level, however, in the near future, positive changes or events related to their activities may allow the rating to be increased by one or more positions. | |

| waiting list: uncertain prognosis | There is a high probability that the rating will be revised in the near future (within the next few months). The organization is in the process of deep internal changes that significantly affect the basic premises of the business and the prospects for its development. Typically, such a forecast is associated with certain events that have a significant impact on the company's activities, the impact of which will become clear at some point in time in the future. In fact, although the rating is not currently suspended, any rating action by the agency is possible in the near future, including an upgrade or downgrade of one or more notches, a change in outlook, a rating suspension, or a permanent rating withdrawal. | |

| waiting list: negative outlook | There is a high probability that the rating will be revised in the near future (within the next few months). An organization, while maintaining its current rating, in the very near future may experience the impact of negative factors, both financial and non-financial, which may give the agency reason to lower the rating by one or more scale steps. | |

| waiting list: rating suspension | There is a high probability that the rating will be revised in the near future (within the next few months). The agency assumes that there are significant changes in the activities and financial condition of the organization that the NRA is aware of, with a lack of information that would allow it to confidently assess the impact of such changes on the reliability/creditworthiness of the company. As a rule, in order to renew or revise a rating when it is suspended, the agency requires additional information from the company or bank or a period of time during which there will be greater certainty about the financial position and stability of the company. From the moment such organizations are placed on the Waiting List until subsequent decisions by the agency, the organization is considered not to have an NRA rating, and cannot use a previously assigned rating to confirm its creditworthiness or reliability in transactions or negotiations with third parties. | |

| — | There is no forecast. | |

| withdrawn | The rating has been withdrawn. |

Internal structure of S&P Global

As S&P Global points out on its website https://www.spglobal.com/en/, it provides its users with a cosmic 135 billion data points in real time for making operational business decisions. In fact, there are at least 20 agency indicators per inhabitant of the Earth.

S&P Global Market Intelligence collects global data and processes it statistically thanks to its unique technology platform. Online, it posts information about financial markets, research, news, etc.

Based on the information received, S&P Global Indices develops corporate-owned indices, incl. the famous Dow Jones and S&P 500. It is the world's largest provider of indices and analytical data.

S&P Global Platts focuses on processing indicators for the commodity sector of the global economy.

S&P Global Ratings compiles short-term and long-term credit ratings of issuers: for debt obligations of countries, regions, municipalities, economic sectors, and individual organizations.

Bank reliability ratings (1)

- Non-fulfillment of payments

- Cash register activity

- Cash activity (among banks)

- Box office activity (new leaders)

- Cash activity (banks are new leaders)

- The most attractive banks

- The most attractive banks - 2

- Public deposits (dependency)

- Deposits from the population (growth)

- Profitability

- Unprofitability

- Profitability - Impact on Capital

- Unprofitability - impact on capital

- Violation of regulations

- Client account activity

- Client account activity (new leaders)

Why is it better to save in foreign currency than in rubles?

First you need to figure out why dollars and euros are better than wooden rubles? And is it better?

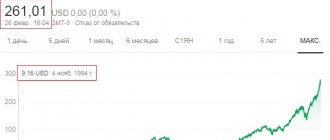

- Foreign currency is more stable than the Russian ruble. This fact is confirmed by the graph of the Russian ruble to dollar exchange rate over the past 10 years. It shows that the ruble has weakened more than three times over this period. The same situation is observed in relation to the currencies of other developed countries - the euro, the pound.

- The currency is less susceptible to inflation. In Russia, for the entire period since the beginning of the 90s, the inflation rate has averaged 10% (according to the Central Bank). Moreover, official indicators do not always reflect the real state of affairs, which in fact is somewhat worse. It turns out that people who store their funds in rubles lose 10% of their savings every year. Investing in foreign currency can significantly reduce losses, since inflation in many Western countries is lower by an order of magnitude.

- World currencies are accepted always and everywhere. When a default or other difficult situation occurs, when the stability of the ruble causes concern, everyone runs to banks for dollars or euros. You can protect yourself in advance from such developments by having savings in foreign currency.

Bank reliability ratings (2)

- Activity of non-resident accounts

- Activity of non-resident accounts (new leaders)

- Loro account activity

- Loro account activity (new leaders)

- Loan portfolio share

- Loan portfolio share (new leaders)

- Overdue loans

- Overdue loans (increase)

- Loan provisions

- Loan provisions (growth)

- Indicator of movement and changes in authorized capital

- Indicator of movement and changes in authorized capital - reduction

- Shareholder assistance

- Share of assets in the form of cash balances

- Share of assets in the form of cash balances (among banks)

Country ceilings

- For bonds and other debt obligations in foreign and national currencies

The country ceiling is the highest possible rating and is set for bonds and notes denominated in foreign currency for each country in which there are companies with agency ratings.

- For ratings of bank deposits in foreign and national currencies

Similarly, a ceiling is set for bank deposits made in foreign currency for each country in which ratings are assigned. The country ceiling also uses a long-term scale.