Price today: 1 207.9500 USD +23.5000

- Recalculate:

- in dollars

- in rubles

- In Euro

- in hryvnia

- in tenge

Conversion into other currencies is carried out according to the cross rate of the Central Bank of the Russian Federation as of May 26, 2021. Unit: troy ounce, category: non-ferrous metals. Source: New York Mercantile Exchange

The latest data from the New York Mercantile Exchange

Right now, platinum costs an average of $1,210.0500 on the exchange.

Data from the exchange was received at 16:00 Moscow time. These statistics are updated every hour.

Show price fluctuation graph for 24 hours

Show statistics

:

- for the last

- year

- month

- a week

- for 2021

- in 3 years

- during all this time

The supply shortage will remain in the platinum market

Platinum is used in catalysts in diesel car engines to reduce carbon emissions. Demand for platinum is expected to rise in the coming years as governments around the world impose stricter emissions limits in an attempt to slow climate change.

The precious metal is mainly mined in South Africa and Russia, as well as in Zimbabwe, Canada and the USA. Production was cut last year at the start of the COVID-19 pandemic, reducing supply as demand from manufacturers increased.

The recovery in global output strengthened at the start of the second quarter, according to Markit Economics. Monthly Manufacturing Purchasing Managers' Index (PMI) data showed output expanded at its fastest pace in more than a decade as new orders rose at its strongest pace in nearly 11 years. JPMorgan's global manufacturing PMI rose to 55.8 in April, its highest level since April 2010. A reading above 50 indicates increased activity.

The auto industry has recovered quickly from the COVID-19-induced downturn in 2021, with the platinum market facing its largest ever supply deficit of 932,000 ounces, according to the World Platinum Investment Council. While total demand from the auto, industrial and jewelry sectors together fell by 569,000 ounces last year, down 7% from 2021, mining output was down 20% and recycling was down 10%. resulting in a decline in total supply of 1.4 million ounces, or 17%.

With COVID-19 vaccination programs expanding and allowing the economy to return to normal, the board forecasts that platinum demand will rise by approximately 254,000 ounces, or 3%, to 7.99 million ounces in 2021 and supply will increase by about 17%, or 1.1 million, to 7.9 million. This would result in a shortage of about 60,000 ounces of platinum, putting the market in deficit for the third year in a row.

In the mainland China jewelry market (the world's largest market), in-store platinum jewelry sales growth jumped 79.6% year-on-year in the first quarter of 2021. In Hong Kong and Macau, growth was 62.8% year on year. Analysts at Heraeus note that with platinum prices trending higher, sales could rise even further if consumers view jewelry as a good investment.

Research is also underway on the use of platinum in lithium-air and lithium-sulfur batteries for electric vehicles to improve their performance.

Trading Value

If the purchase of a mining company requires the redemption of a block of shares, then futures are used to purchase gold directly. A futures, as you already know, is a delivery contract that contains a product, its volume, timing and price. This agreement is concluded between the buyer and the seller, and the execution is regulated by the exchange.

In Russia, you can buy gold futures through FORTS, a platform for transactions with futures and options of the Russian Trading System (RTS). This is an integral part of the Moscow Exchange, MICEX.

To access this site, you will need to enter into a service agreement with a broker who has access to this market. After which, you can give him an order to buy back a certain security, or trade yourself, through the Quik terminal.

When examining a specific contract, you should pay attention to the following indicators:

- The underlying asset of a futures contract is refined bullion.

- The volume of the contract, that is, one lot, is equal to one troy ounce.

- The futures price is indicated in US dollars per troy ounce.

- Final settlements under a futures contract are made on the date of its execution.

- The execution months for futures contracts on the Moscow Exchange are December, September, June and March.

- The minimum amount of contract security is six percent.

- The settlement date of a futures contract is the fifteenth day of the month and year of its settlement.

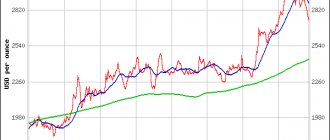

Platinum price rises to six-year high

The spot price of platinum rose above $1,300 an ounce on February 15 for the first time since September 2014 in response to ongoing supply shortages and optimism about rising demand.

Platinum price chart

The price of platinum increased by 13% by the end of 2021, to 1,072.12 USD per ounce. On January 11, it retreated to 1,035.56 USD per ounce, and then rose to its February high. On March 4, the price reached 1,129.55 USD per ounce. Since then it has been growing, and in May it remained in the range of 1,200-1,255 USD per ounce.

Bullish flows into the platinum and palladium spot market in early May were the highest since July 2021, according to analysts at French bank Societe Generale.

So what are the platinum price forecasts for the rest of 2021 and next year?

When did it all go wrong?

Platinum enjoyed extraordinary success in the 2000s. It was one of the commodities of the decade, from a low of about $400 an ounce in 2001 to a high of $2,285 an ounce in 2008. The platinum metal fell along with all other assets in 2008, but rose again to nearly $2,000 an ounce in 2011, and has been in an endless decline ever since.

All metals, whether base or precious, have had a tough time since 2011. But what really impacted platinum was the Volkswagen diesel scandal in 2015. After all, platinum is mainly used in catalytic converters for diesel engines, and more than half of annual demand came from the automotive industry.

If you remember, the scandal was that Volkswagen, which had long claimed low emissions from its diesel engines, cheated on tests in the US. By installing a “damper”—software designed to pass regulatory laboratory tests—it simulated the emissions levels of about 580,000 vehicles sold between 2006 and 2015. During real driving, emissions were several times higher than permissible limits. A change in attitude towards diesel cars followed, and platinum suffered the most.

Since then, the precious metal has traded just below $1,000 an ounce. Then, during the coronavirus scare in March, platinum crashed to a low of $560. Over the summer, the precious metal managed to lift gold, palladium and silver above $1,000 an ounce before returning to today's value of $870.

Analysts' Opinion: Could Platinum Prices Reach New Highs?

Will the platinum market continue to grow this year given the expected supply shortage? Analysts at Dutch bank ABN AMRO are optimistic about the prospects for platinum prices, noting in a recent analysis that not only will demand for catalysts in diesel engines increase, but the transition to fuel cell vehicles will further boost demand for platinum.

According to their forecast, by the end of 2021 the price of platinum will return to 1300 USD per ounce, and then during 2022 it will grow and reach 1400 USD per ounce by December. Analysts at Australian bank ANZ are more cautious, expecting the price of platinum to rise back above $1,300 an ounce by 2022, but forecast it will fall to $1,250 an ounce by the end of June 2022.

Platinum price forecast for 2021-2022

Heraeus analysts expect further tightening of carbon emissions standards to increase platinum consumption in Europe. The European Commission is planning the next level of emissions standards for heavy vehicles. The proposal is expected to be submitted in November 2021.

Analysts said: “This will require additional processing to comply, which means higher cost and likely more PGM [platinum group metal] ... Additional processing required may include a second diesel oxidation catalyst or a passive nitric oxide absorber catalyst. Both will require additional platinum along with some palladium.”

“While this should have a positive impact on demand for platinum group metals, higher costs for diesel vehicles will allow alternative powertrains to compete on price.”

But in the short term, the price of platinum may decline before rising further: “Further downward price fluctuations are possible as the price seasonally tends to fall in the second half of the year.”

Futures RTS.

The RTS exchange is gaining increasing popularity in the stock market. What is this connected with? Traders get the opportunity to trade a large number of assets - stocks, bonds and their derivatives. Both legal entities and individuals can act as market participants. And most importantly, access to the RTS is open even to non-residents of the Russian Federation. It is very important. Thanks to the stable operation of the exchange, the prices of a wide variety of financial assets are effectively regulated.

The RTS Index is the main indicator of the Russian stock market. It is calculated in dollars, based on the value of the 50 largest Russian companies (Lukoil, GAZPROM, Sberbank, etc.). Accordingly, trading futures on the RTS index is an investor’s prediction of the value of the RTS index in the future. The advantages of this instrument are its high liquidity, relatively low costs and a long trading session (usually from 10 to 23.50 Moscow time). For example, the daily trading turnover in RTS index futures exceeds the turnover of the entire stock market by 2 times.

An important advantage of RTS index futures is that the investor does not need to deposit the full amount of the contract, only 10-15% is enough (the so-called guarantee collateral for RTS index futures), and the loss or profit will be calculated as if he had deposited the full amount .

You might be interested in reading the breakdown of futures codes.

There are many ways to trade RTS index futures, but the two most common are:

• intraday trading. In intraday trading, results are recorded after the trading session closes at the end of the day.

• Scalping. Strategy for dynamic, operational traders. Positions in scalping are closed immediately after the trader senses the slightest preconditions for a market turn or stop. Here's an example. A contract was purchased, within thirty seconds its value increased, freezing in the future. It’s not worth taking risks - the position needs to be closed as soon as possible.

Let's summarize briefly about the RTS exchange:

- firstly, the opportunity to make good money;

— secondly, you can choose one or more of the available instruments (not all exchanges have such a great selection);

— thirdly, the RTS is available to everyone, including non-residents of the Russian Federation;

— fourthly, market liquidity is very high;

— fifthly, all trading tools are accessible and easy to use;

— sixthly, the trader is given additional opportunities to insure risks.

A huge advantage of transactions with futures is the ability to work while making minimum payments - margin collateral. All you need to do is pay 10% of the price specified in the contract. Another undeniable advantage is the ability to trade futures without using broker assets.

Trading futures on the RTS is an excellent chance to manage your capital profitably. If you structure your trade correctly, you can increase the profitability of your transactions significantly. Another thing is that the risks are increasing. But you have to put up with this.

RTS are now officially recognized, and they best characterize the Russian stock market. With the help of RTS futures, you can effectively hedge the risks of investing in certain securities. RTS futures can be used by anyone, both small and large investors. This instrument is considered one of the most reliable in world trade.

You may be interested in the article Foreign Exchange or Stock Market.

Long-term Platinum forecast for 2021-2030: how the price trend will develop

Long-term platinum price forecasts indicate that the price of platinum may continue to rise.

The Wallet Investor website predicts that the price of platinum will fall from $1,235 per ounce in early June to $1,215.83 per ounce by the end of 2021.

Platinum forecast for the year

But the service expects the price to recover in 2022 and reach $1,318.32 per ounce in September 2022, fall to $1,275.70 by December 2022, but rise to $1,406.84 per ounce in May 2023.

In addition, Wallet Investor predicts that the metal's maximum price will reach $1,455.77 per ounce by December 2024, $1,535.46 per ounce by December 2025, and $1,643.64 per ounce by May 2026.

Gov Capital forecasts platinum prices at $1,250.63/oz at the end of 2021, $1,708.58/oz at the end of 2022 and $3,391.28/oz at the end of 2025.

Coin Price Forecast's long-term forecasts are very optimistic. The website estimates the price will reach $1,407 per ounce by the end of 2021, $1,785 by the end of 2022, $2,782 by the end of 2025 and an average of $3,883 per ounce in December 2030.

Platinum price forecasts for 2021-2030.

Trackable value

In general, aurum is a fairly stable asset. It is perfect for trading for both experienced investors and novice traders. You can view regular quotes for this material on the main page of our portal, or using the Investing.Com service.

The gold futures price chart reflects the price for one troy ounce of this commodity. When analyzing the chart, a rather high price period is visible in October – November 2021. Forecasts for the near future indicate a certain calm in the gold market. After which, the resumption of standard production in the spring will affect the price. In which direction - based on volumes.

FAQ

Is Platinum a Better Investment Option than Gold or Silver?

Expectations of rising inflation in 2021 are likely to support investment interest in precious metals, including platinum, as a hedge. Platinum has so far outperformed gold in 2021, and this trend is expected to continue.

Will platinum become more expensive?

Investment banks such as ABN AMRO and ANZ expect the price of platinum to rise in 2022 due to rising demand from the auto industry and ongoing supply shortages.

How much will platinum be worth in 10 years?

The most optimistic forecasts suggest that the price of platinum could exceed USD 4,000 per ounce by the end of 2031.

This will depend on whether a large-scale transition to fuel cell vehicles takes place, as plans to phase out fossil fuels will reduce demand for catalysts for diesel car engines.

Is Platinum a Good Investment in 2021?

Whether you should invest in platinum or another precious or industrial metal depends on the composition of your investment portfolio and your attitude to risk. You should research the platinum market before investing and only trade with money you can afford to lose.

0

Author of the publication

offline for 10 months

What will the course be in the future? Should you buy platinum now?

Given the current price and opportunity, investing in platinum can be a great way to diversify your portfolio. The price is volatile - the precious metal has many industrial uses.

Now platinum is a very attractive asset. In recent years, it has become increasingly cheaper compared to other precious metals. This metal is used not only in the automotive industry, but also in the jewelry industry. Below is the forecast for 2021:

| Months | Open | Min-Max | Closed | Meas.,% | Total,% |

| 2021 | |||||

| Mar | 1193 | 1110-1234 | 1171 | -1.8% | -1.8% |

| Apr | 1171 | 1078-1192 | 1135 | -3.1% | -4.9% |

| May | 1135 | 1135-1265 | 1205 | 6.2% | 1.0% |

| Jun | 1205 | 1145-1265 | 1205 | 0.0% | 1.0% |

| Jul | 1205 | 1186-1310 | 1248 | 3.6% | 4.6% |

| Aug | 1248 | 1248-1391 | 1325 | 6.2% | 11.1% |

| Sep | 1325 | 1325-1477 | 1407 | 6.2% | 17.9% |

| Oct | 1407 | 1254-1407 | 1320 | -6.2% | 10.6% |

| But I | 1320 | 1208-1336 | 1272 | -3.6% | 6.6% |

| Dec | 1272 | 1231-1361 | 1296 | 1.9% | 8.6% |

Source: Longforecast.com

Once the coronavirus crisis is over, metal will be able to catch up. As the global economy recovers, demand for cars will increase. The precious metal will only benefit from this - demand for it in the automotive industry will increase significantly. And in the future, you can sell platinum very profitably.

As the economy recovers, the demand for platinum jewelry will also increase. In China, the largest market for platinum jewelry, the metal has great potential for growth in the coming years. Finally, now that the white metal has become much cheaper than gold, more and more investors will become interested in investing in platinum. Be sure to create a free demo account at LiteForex! You'll be kept up to date with forecast commodity prices, and the user-friendly interface will help if you decide to start investing and trading.