Dividend policy of Rosseti

Until 2021, Rosseti paid 10% of profits according to RAS. But in 2021, the company suffered a loss under RAS, so at the end of the year it was decided not to pay dividends. As at the end of 2021, then Rosset also came out at a loss.

At the end of 2021, a new dividend policy was adopted. Now Rosseti will allocate 50% of profits under RAS or IFRS for payments on preferred shares - depending on which comes out more.

In this case, the following will be deducted from the dividend base:

- expenses from revaluation of financial investments and investments;

- share of profit from payment for technical connection to the power supply system;

- share of profits allocated for investment and development in accordance with the corporation's budget.

As a result, it is very difficult to calculate or at least predict the approximate base for dividends. Therefore, it is also impossible to determine exactly how much the payment will be.

Common shares usually pay out much less than preferred shares. Therefore, investors are mainly interested in Rosseti preferred shares.

Rosset usually pays dividends once a year – at the end of the year. But the possibility of paying interim dividends is provided. As a matter of fact, interim dividends will be paid in 2021 – based on the results of the 1st quarter of 2021.

By the way, in 2021 only interim payments were made, and there were no annual payments. A repetition of the situation is not excluded.

Rosseti cannot agree on payments to shareholders for 2021

According to Kommersant, the top management of the state power grid holding Rosseti does not intend to return profits to shareholders at the end of 2020. The company explains this by a significant increase in the debt burden of the subsidiary Federal Grid Company in connection with the financing of work on the electrification of the Eastern polygon for JSC Russian Railways. The issue of refusal to pay will be considered on May 24 at the board of directors of the state holding. But this position has not yet been agreed upon with the Federal Property Management Agency, which has not yet sent its directive to state representatives on the council.

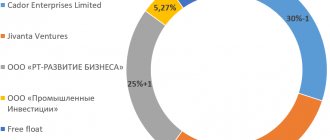

A scandal is brewing in the board of directors of Rosseti. According to Kommersant, the top management of Rosseti proposes to refuse to pay dividends based on the results of 2021; the issue will be considered at the board of directors of the state-controlled state holding (88.04% of the Federal Property Management Agency) on Monday, May 24. At the same time, the company’s position has not yet been agreed upon with the Federal Property Management Agency and the Ministry of Finance. In particular, the Federal Property Management Agency has not yet prepared a directive for state representatives on the board of directors.

According to Kommersant, the department believes that the state holding should pay dividends at least at the minimum level, and the Ministry of Finance insists on paying “at least 10 billion rubles,” although initially it traditionally demanded half of the net profit according to IFRS (it amounted to 61.2 billion rubles in 2021).

Thus, it is unclear how board members will ultimately vote. The annual meeting of Rosseti shareholders is scheduled for June 30.

The Ministry of Energy and Rosseti declined to comment; the Ministry of Finance and the Federal Property Management Agency did not respond to Kommersant.

Rosseti must allocate at least 50% of net profit for dividends, but minus non-cash income and expenses, financial support for subsidiaries and fees for technical connection. Until 2016, the state holding made minimal payments on preferred shares or did not pay dividends at all. For the first time, Rosseti paid dividends on ordinary and preferred shares for 2016, giving shareholders 3.8 billion rubles, but for 2021 and 2021 they again avoided payments, explaining this by paper losses under RAS, and instead accrued interim dividends for the first quarter of the next of the year. However, in 2021, the company paid the largest dividends in history - 23 billion rubles, which amounted to 17% of net profit under RAS or 22% under IFRS.

Now the reason for the intention of the top management of Rosseti to refuse payments to shareholders is the high cost of creating electrical networks for the expansion of the Eastern test site.

At the same time, in fact, it will not be the state holding itself that will be responsible for financing the construction and the construction itself, but the Federal Grid Company (FSK) controlled by it, which manages the main power lines. Rosseti accumulates payments from its subsidiaries - FGC (the most profitable) and interregional distribution companies (IDGC). At the same time, FSK, as Kommersant’s interlocutors clarify, is ready to pay shareholders about 20 billion rubles. for 2021.

How FSK can sharply increase debt for the sake of investment in BAM

The cost of the project for the construction of electrical networks for the expansion of the Eastern test site is tentatively estimated at 185 billion rubles, of which 122 billion rubles. FSK plans to borrow, which will significantly increase the company's debt burden (currently the debt/EBITDA ratio is 1.48). But this is not an argument for the Ministry of Finance on the issue of dividends, Kommersant’s interlocutors clarify. As measures to support FSK, the allocation of state subsidies was discussed (including through Rosseti transferring dividends to the budget and returning them back to the company in the form of a subsidy), attracting funds from the National Welfare Fund, and including the costs of financing construction in the tariff for electricity transmission services through the networks of the United National electrical networks. No decision has been made at this time.

If FSK finances the project through a loan, the company’s net debt/EBITDA ratio will approach 2 in 2021 and will remain approximately at this level until construction is completed, Vladimir Sklyar from VTB Capital calculated.

Interest on the loan will be, according to his estimates, about 3 billion rubles, which could reduce the company's dividends by about 7% from the reference level, taking into account the current dividend policy. At the same time, the company's free cash flow will remain significantly negative in the first two years of the project, he emphasizes.

Tatiana Dyatel

Rosseti dividends in 2021

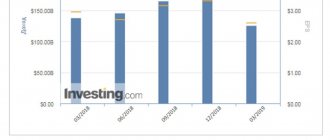

At the end of the 1st quarter of 2021, Rosseti's revenue amounted to 265.5 billion rubles, profit according to IFRS - 40.8 billion rubles, and according to RAS - 40.17 billion. On this news, energy quotes increased. The fact is that at the end of 2021, the company made a loss under RAS of 11.5 billion rubles and decided not to pay dividends (at the same time, according to IFRS, a profit of 124.7 billion rubles was made - that’s what “different measurement systems” means).

Here’s another interesting article: Quiz “What do you know about dividends?”

In order to “rehabilitate itself” to shareholders who have not received dividends for two years, and at the same time to show that everything is fine, Rosset decided to pay interim dividends.

As a result, owners of ordinary shares will receive 0.02443 rubles per share, and holders of preferred shares - 0.07997 rubles. With a price of an ordinary share of 1,385 rubles, the yield is 1.76%, and of a preferred share - 4.74% with a share price of 1,688 rubles.

The dividend cut-off date is July 8. To receive dividends, due to the T+2 trading mode and taking into account the holidays, shares must be purchased before July 4th.

Dividend assessment of subsidiaries and affiliates of PJSC Rosseti - a look at September 2021

Hi all!

All Rosseti subsidiaries reported for the 2nd half of 2021, which allows us to draw some intermediate conclusions and try to estimate dividend payments for 2021. Here is a post based on the results of the reports for the 1st quarter of 2021.

21.05.2018, 21:35

Rosseti's subsidiaries – view as of May 2018

The reports of subsidiaries and affiliates of PJSC Rosseti for the 1st quarter of 2021 have been released. I don’t see the point in analyzing each company, because... Elvis did this beautifully in his reviews. I will only draw attention to some, in my opinion, fundamental points. As the first reports were released to IDGC, a rather sharp increase in both revenue from electricity transmission and ... Read more

To evaluate dividend payments, it is necessary to evaluate the company's net profit and those possible adjustments that turn it into a dividend base. Below I will write how I did it for each of the companies.

I would like to note something common to all: from May to September, each daughter company made several adjustments to investment programs for consideration by the Ministry of Energy. In some of the companies this resulted in a significant change in expected dividends. I really hope that the adjustments made in August and September were the last ones this year - investment programs must be approved by November 1, 2018.

So, in order:

FSK

This is exactly the company whose dividend base has changed significantly due to IP adjustments. For efficiency, I had to write a separate post.

23.08.2018, 13:16

Estimation of dividends of PJSC FGC for 2021: view as of August 2018

Hi all! I decided not to wait for the release of all reports of Rosseti’s subsidiaries under IFRS for the first half of 2021 and make a separate post about the assessment of FSK’s dividend yield, especially since it has changed significantly. The previous calculation was in May 2021 in this entry and was about 2.5 ... Read more

Lenenergo

This is the only company that has not yet adopted a new dividend policy! This is also the only company for which my forecasts and calculations of dividends for 2021 (of course, only in terms of the usual) did not agree with their actual payment and I could not establish the reason for such a discrepancy - in all others, where there were even minor differences, I have to do this managed!

The company categorically does not explain the principle of payment, does not provide calculations of the dividend base, citing precisely the lack of an approved new methodology.

In addition, according to the new methodology, the indicators of the subsidiary company - SPBES - should be included in the calculations - but they are not disclosed anywhere (unlike Tyvaenergo and EESC), at least I couldn’t find them.

In addition, if we take their new individual entrepreneur and directly calculate the dividend base, without even taking into account the indicators of SPBES, then the calculated value is not enough to pay the statutory 10% on preferred shares.

Apparently this is the reason for the delay in the adoption of the new dividend policy... it is most likely being finalized for a specific case).

As for the profit for 2021... I will not excite the minds of readers in this post - I’ll just take the figure that the company itself plans (data in the individual entrepreneur dated 09/04/2018)... especially since 3 months ago I wrote a large note on this topic.

18.06.2018, 15:21

PJSC Lenenergo: record year 2021, and what next?

Good day everyone! On June 15, 2018 (including T+2), the cutoff for dividends for 2021 passed. From this point on, the company’s financial results for 2021 are a thing of the past - the time has come to try to predict and evaluate the company’s financial prospects in 2018 and beyond - because in the future they will entirely determine the price... Read more

Fundamentally, nothing has changed - the main intrigue lies in the speed of return of the accumulated smoothing and the replacement of profits from TP with profits from electricity transmission. The latter must be said based on the results of the first half of the year. Electricity transmission efficiency indicator at maximum.

The company itself expects net profit under RAS of 9.57 billion rubles.

and the volume of total dividend payments is 1.73 billion rubles. — I’ll take these numbers, although taking into account the indicators for the 2nd quarter, I admit that it may be a little better.

IDGC CPU

The company shows simply phenomenal financial results. Net profit and sales profit are growing quarter by quarter. To be honest, I didn’t expect such dynamics, I thought that there would be a way out to a certain plateau (and it inevitably will be) - but not yet! What's the matter? What is the reason for such fantastic results?

The answer, it seems to me, is in this sign

The company receives tariff debts from the regions - smoothing is being returned and at a fairly good pace. According to my data, the volume of tariff debts to MSRK CP at the beginning of the year was ~ 12 billion rubles.

Considering this dynamics, when assessing dividends, I believe that by the end of the year the company will be able to earn no less than in the first half of 2021, i.e.

State of emergency 2021 RAS ~ 13.7,

State of emergency 2021 IFRS ~14

Such an increase in private equity so far more than covers the increase in investment costs, in terms of the impact on the dividend base

IDGC of Volga

This is where we are approaching a certain plateau! The company stopped receiving accumulated smoothing in 2021 - most likely the return of tariff debts was the reason for the sharp increase in indicators starting in 2015.

In addition, many were confused by the adjustments in reporting under RAS related to the gratuitous receipt of property.

The result now is:

- This figure is not taken into account in the net profit under RAS for the half year (it is reflected through deferred income, which will be written off simultaneously with depreciation on this property)

- This figure is included in the net profit under IFRS for the half year - i.e. the state of emergency is overstated by a one-time component

In connection with the above, I calculate profit as LTM (2nd half of 2018 = 2nd half of 2017):

State of emergency RAS 2021 = 4.85 billion rubles.

PE IFRS 2021 = 6.2 billion rubles.

It is also worth noting that in the latest IP adjustment, the company proposes to use, among other things, profits from previous years as a source of financing for the IP (instead of profits from the transfer of electricity), which somewhat improves the dividend base compared to previous IP projects.

IDGC of the South

Things can get very, very interesting here.

The company has a huge tariff debt of ~ 7.6 billion rubles (including 4 - Rostovenergo, 1 - Astrakhanenergo). So, among other things, the return of this smoothing has begun: 1.2 billion rubles are expected in 2021, and 1.3 billion rubles in 2021.

As for additional issues, on the agenda (information dated 09/05/2018) so far there is only an additional issue of 1.4 billion rubles. There is no talk at all about any other numbers. And there will hardly be an additional increase of 1.4 billion this year - most likely next year... there are no directives on this yet.

The figure for the possible creation of reserves for the debts of sales companies, announced at the AGM, in the amount of 1 billion rubles has so far been confirmed... but in the second half of 2021 the balance of other income and expenses was generally 1.3 billion rubles!

Taking into account the above, and also taking into account the fact that in both 2021 and 2017 the profit according to RAS for the second half of the year was significantly higher than the profit for the first half of the year, I will conservatively calculate that in the second half of 2021 they will earn the same amount as in the first... i.e. state of emergency 2018 = 1.9 billion rubles.

IDGC SZ

We took part and asked questions in the teleconference of IDGC SZ, as part of the disclosure of results for the 1st half of the year. Management expectations have become more optimistic compared to what was announced at the AGM

09.06.2018, 11:33

AGM IDGC of the North-West 2018

The second AGM in St. Petersburg. This meeting was not at the Expoforum, but in principle it was not that far away. The country's chief analyst for IDGC was present! I managed to take a photo with him. Spoiler alert, the next AGM photo will be even cooler. It can also be said that the handouts were excellent. Denis gave me his... Read more

According to RAS, the emergency situation is expected at the level of 2 billion rubles, according to IFRS - 2.2 billion rubles. Previously they expected 1.5 billion.

The total debt smoothing is ~5 billion rubles. Of the large ones, 1 billion for Novgorodenergo and 586 million for Pskovenergo are expected to be returned this year. All regions have return schedules and are actively defending their rights in the courts!

There are large volumes of technical support, work on which is still behind schedule (weather, repairs) but will intensify in the second half of the year.

For calculations, I take their data, announced at the teleconference, but I consider them somewhat conservative - they do not take into account possible TP...

Here is the profit structure for the next 2 years in individual entrepreneurs from 09/06/2018

Over the past six months, they have already earned more than 1 billion precisely from the transmission of electricity; there has never been such a thing as a TP! I think what they voiced is more like profit from the transmission of electricity, everything they earn from the TP will be a bonus! But as I already said, I think according to their data.

MOESK

Everything is simple here - I focus on management forecasts:

Moscow. 24 August. INTERFAX - PJSC MOESK (MOEX: MSRS) expects to receive a net profit under RAS this year of 6.5-7 billion rubles, a company representative said at a telephone conference. “The growth will be related to tariff regulation,” he explained. The fact is that this year the increase in the required gross revenue (GRR) of the company reached almost 5 billion rubles. In addition, this year, unlike last year, MOESK does not expect write-offs of reserves for accounts receivable.

IDGC of URAL

In order to reach a positive dividend base, in the second half of 2021 the company must earn (without revaluation of the Lenenergo stake) ~ 1.4 billion rubles. Whether she is capable of doing this is hard for me to say. The management itself does not believe in this - I will take their opinion as a basis.

IDGC of Center, Kubanenergo, IDGC of Siberia

- the profit is taken from their IPR,

shopping mall

- I think they will earn the same as in the first half of the year.

The result looks like this

Good luck to all!

How and where to buy Rosseti shares

Both types of Rosseti shares are traded on the Moscow Exchange. Ordinary shares – under the ticker RSTI, preferred shares – RSTIP.

Bidding is carried out in lots. One lot contains 1000 company shares. Consequently, the minimum purchase amount for common shares at the current quote is 1,385 rubles, and for preferred shares – 1,688 rubles.

The purchase of shares is carried out through any Russian broker that provides access to the Moscow Exchange. The list can be viewed here.

To purchase, you just need to select the desired stock by ticker through the web terminal or trading platform, select the number of lots and click “Buy”.

Is it worth taking Rosseti shares?

The company is now in a rather difficult economic situation. Profits are moving back and forth, energy prices are rising, and the FAS does not allow tariffs to be increased.

It is possible that at the end of 2021 a loss will be made, and shareholders will be left with only interim dividends, as in 2018 and 2017.

Rosseti's quotes, by the way, have already gone down. A positive report and quarterly dividends alone are not enough to convince shareholders that everything is fine with the company. Despite the fact that Rosseti shares are already trading at historical lows, some experts do not rule out a drop in quotes by another 35-40%, literally to 1.1-1.2 rubles for both types of shares.

And here’s another interesting article: 10 rules for collecting a balanced portfolio

Receiving payments from the company's subsidiaries will not change the situation. In accordance with the dividend policy, income from investment activities is not taken into account when calculating the dividend base.

So I would not buy Rosseti shares for dividends just yet, especially since after the dividends are paid there will be a gap when the quotes fall even more. I will wait for the release of at least a six-month report - and only then can I think about the future of the company. If the positive dynamics continue, then you can take a closer look at the shares. And so - in my opinion, it is better to pay attention to one of the “daughters” of Rosseti. For example, MRSK CPU. The company recently paid dividends and is now worth less. But this is just my opinion - you may think differently. Write in the comments if anything. Good luck, and may the money be with you!

Rate this article

[Total votes: Average rating: ]