VTB dividend policy

Based on the results of the financial year, the net profit of VTB JSC is calculated. The issue of dividend payment is resolved at the general summer meeting.

Nominee owners of securities receive dividends through a trustee after ten days. Other asset holders - after 25 days. No cash amounts will be paid. Income is credited to a brokerage account or transferred to a bank account, the details of which were specified in the agreement for brokerage and depository services.

VTB JSC pays from net income from 20 to 80% of funds as dividends. The yield on the bank's securities does not exceed 4% per year. The average dividend yield in recent years has been around 2%.

According to the charter, a joint stock company has 3 types of shares:

- privileged of the first type;

- privileged of the second type;

- ordinary shares.

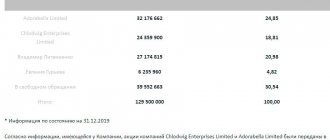

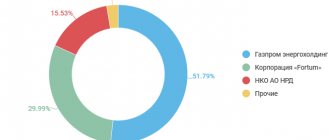

The Ministry of Finance owns the first type of preferred shares. The second type of preferred shares belongs to the DIA (Deposit Insurance Agency). Ordinary shares in the amount of 70% belong to the Federal Property Management Agency. The remaining shares are owned by different investors.

Bank stock return

The average return over the last 3 years for JSC is 3%, for AP is 3.4%. VTB securities are often called undervalued and have good potential. But statistics show that they fall in price much more often than they rise: since January of this year, their value has decreased by 30%.

At the same time, VTB’s own profit figures exceeded the most positive estimates, which will certainly affect dividends for 2019: it is expected that the yield on the securities will range from 6.4 to 8.9%.

All VTB dividends for the last 10 years

Let me take a closer look at the amount of dividends paid by the company since 2008. For clarity, I present a table of profitability for VTB ordinary shares.

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | June 18, 2021 | June 22, 2021 | 12M 2020 | 0,00139939 ₽ | 2,92% | 6 Jul 2021 | |

| 2018 | 1 Oct 2020 | 5 Oct 2020 | 12M 2019 | 0,00077 ₽ | 2,25% | 19 Oct 2020 | |

| 2017 | 12 Nov 2019 | 14 Nov 2019 | NP | 0,00018 ₽ | 0,38% | 28 Nov 2019 | |

| 2016 | June 20, 2019 | June 24, 2019 | 12M 2018 | 0,0011 ₽ | 2,72% | 8 Jul 2019 | |

| 2015 | May 31, 2018 | June 4, 2018 | 12M 2017 | 0,00345 ₽ | 6,92% | June 18, 2018 | |

| 2014 | May 4, 2017 | May 10, 2017 | 12M 2016 | 0,00117 ₽ | 1,74% | May 24, 2017 | |

| 2013 | June 30, 2016 | 4 Jul 2016 | 12M 2015 | 0,00117 ₽ | 1,72% | July 18, 2016 | |

| 2012 | 2 Jul 2015 | 6 Jul 2015 | 12M 2014 | 0,00117 ₽ | 1,51% | July 20, 2015 | |

| 2011 | June 27, 2014 | 1 Jul 2014 | 12M 2013 | 0,00116 ₽ | 2,75% | 15 Jul 2014 | |

| 2010 | May 13, 2013 | May 13, 2013 | 12M 2012 | 0,00143 ₽ | 2,99% | May 27, 2013 | |

| 2009 | April 26, 2012 | April 26, 2012 | 12M 2011 | 0,00088 ₽ | 1,39% | May 10, 2012 | |

| 2008 | April 21, 2011 | April 21, 2011 | 12M 2010 | 0,00058 ₽ | 0,63% | May 5, 2011 | |

| 2007 | April 16, 2010 | April 16, 2010 | 12M 2009 | 0,00058 ₽ | 0,69% | April 30, 2010 | |

| 2006 | May 13, 2009 | May 13, 2009 | 12M 2008 | 0,000447 ₽ | 1,05% | May 27, 2009 | |

| -1 | May 7, 2008 | May 7, 2008 | 12M 2007 | 0,00134 ₽ | 1,42% | May 21, 2008 |

Dividends in 2021

In 2021, the bank actually made a trick with its ears. More precisely, not the bank itself, but its main shareholder - the state. The government persistently recommended that the bank increase reserves and allocate no more than 10% of net profit under IFRS to dividends.

The final decision will be made at the shareholders' meeting on September 3, 2021, but given who has the majority of votes, I don't think there will be any surprises.

In such a situation, the bank will distribute approximately 19.5-20.1 billion rubles of profit, which gives a dividend size of 0.0074-0.0077 kopecks per share. At the current VTB share price of 0.03672 rubles, this gives a dividend yield of about 2% per annum.

Let me remind you that previously the management planned to allocate 50% of net profit to dividends - the dividend yield at that time reached, according to various calculations, 12-15% per annum. On this news, VTB shares grew by leaps and bounds before the coronavirus crisis. Now, it looks like we will go into another protracted tailspin.

VTB shares are traded on the Moscow Exchange under the ticker VTBR. One lot contains 10,000 shares. The minimum purchase amount at current prices is 3,672 rubles.

How to buy VTB shares and receive dividends

To purchase securities, you must open a brokerage account. This can be done from representatives of the MSE (Moscow Stock Exchange) - licensed brokers.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

The list of the best brokers includes the following companies: ZerichCapital, VTB 24, BCS, Aton, Alfa Bank, Promsvyazbank, Otkritie broker, Sberbank.

Warning about Forex and BO

Forex and BO are in no way connected with company securities. There are no regulators here.

Shares can only be purchased through brokers who are licensed by the Central Bank.

State-owned companies may be given a deferment of dividend payments for up to six months

Over the past few days, the government has been discussing an anti-crisis plan, which, in particular, includes a clause on the possible postponement of dividend payments for state-owned enterprises for a period of three to six months.

Whether we are talking about dividends in general, or only about payments due to the state on its shares, is not specified in the material.

At the moment, there is no final list of anti-crisis measures, which means that it will be supplemented and clarified over time.

According to some media reports, by March 18, the government will announce a list of economic and administrative measures that will be taken to combat the coronavirus and the consequences of this pandemic. These measures were partially announced by Prime Minister Mikhail Mishustin during the Coordination Council. At the same time, he clarified that these measures will be only initial steps. Among the announced measures is the creation of an anti-crisis fund in the amount of three hundred billion in national currency, which will be used to support the domestic economy and ordinary Russians.

In addition, Vedomosti journalists suggest that businesses will be granted tax holidays. First of all, this will affect travel companies and enterprises in the air transportation sector. Other industries are also discussed. Regarding small and medium-sized businesses, officials can provide them with a quarterly deferment in paying taxes.

How much does a newcomer earn per month in investing with VTB?

It is impossible to specifically answer the question of how much they earn from VTB investments. One month is too short a period, even for an average calculation of earnings. You may not even earn anything, and this will be within the normal range; a year is much more indicative.

Interest-free loan for the first investment portfolio

Apply for a VTB credit card with an interest-free period and large cashback for all categories of purchases and transfers! A great start into the world of investment! You can view and apply here