If you receive income from your investments, you must pay taxes. In what cases you need to pay taxes and at what rate is determined by the tax code. Chapter 23 of the Tax Code of the Russian Federation is devoted to this. Depending on a number of different factors, tax rules may vary. Taxes can have a significant impact on investment results, so it is advisable to have a good understanding of basic tax rules.

One of the main factors that affects taxes is tax residency . If you spend more than 183 days a year within 12 months in Russia without interruption, then you are a tax resident. If less, then a tax non-resident. The tax rate for residents on most income is 13%, and for non-residents 30%. Therefore, when investing in Russia, it is better to be a tax resident.

Another important factor is who the tax agent - who actually pays the taxes. For some types of income, the tax agent is the financial company through which the investment occurs. They independently calculate the tax base based on the investor’s income and pay tax to the budget. This makes life a lot easier. In other cases, the investor needs to do this himself.

Below we will analyze in detail what taxes an investor pays, what tax rates apply to different types of income, in which cases you will have to pay taxes yourself, and in which cases this is done by a tax agent.

When and how to pay

All individuals, if they receive income, must pay personal income tax - personal income tax. This tax is imposed on all transactions that generated income in any of the accounts - IIS or brokerage. Personal income tax will have to be paid on dividends, coupon payments and the positive difference between the purchase and sale of financial instruments. If at the end of the calendar year the investor did not make a profit, then there is no need to pay tax.

If an investor bought a share at the beginning of the year and by the end of the year it has risen in price, he can sell it and record income. Then he will pay 13% tax on the difference between the income from the sale and the costs of acquisition. But if he is sure that the stock will rise in price and decides not to sell it, then there is no actual income. This means that there is no need to pay tax.

13%

Basic personal income tax rate

Taxation of precious metals (compulsory medical insurance, gold bars and coins)

Taxation of income from precious metals occurs at a rate of 13%. The tax base is calculated as the difference between the amount of income from the sale and the amount of acquisition costs. However, there are differences in taxation depending on the form of the precious metal.

Gold bars upon purchase are subject to a 20% value added tax (VAT is included in the price). You can avoid paying VAT by leaving a gold bar for safekeeping in a bank, but this service is paid. When selling a gold bar, you must pay 13% personal income tax, while previously paid VAT does not reduce the tax base. Coins made of precious metals and unallocated metal accounts are not subject to VAT.

In accordance with clause 17.1 of Article 217 of the Tax Code of the Russian Federation, if precious metals were owned by an individual for more than three years (and there are documents confirming this), then the amount received by the individual from their sale is not subject to personal income tax. In this case, there is also no need to file a tax return.

If the precious metal was owned for less than three years, then tax must be paid. In this case, the amount of income from the sale of precious metals can be reduced by the amount of expenses or take advantage of a property tax deduction in the amount of 250,000 rubles in accordance with Art. 220 Tax Code of the Russian Federation. It is the responsibility of the investor himself to calculate the tax and transfer it to the budget.

How to pay tax on income from shares

Taxes on stock transactions are withheld by the broker.

If the issuing company is registered in Russia, then the investor will pay 13% on income from the purchase and sale of its securities, and the same on dividend income. If the company is foreign, then the investor will pay 13% of the purchase and sale of its securities, but in ruble equivalent, and not in the currency of the transaction.

For example, on July 10, 2021, an investor bought 1 share for $10 at the exchange rate of the Central Bank of the Russian Federation of $1 = 70 rubles. On August 20, 2021, he sold this share for $11 at the rate of the Central Bank of the Russian Federation of $1 = 80 rubles. The investor's tax will be equal to (11x80 - 10x70) * 13% = 14.3 rubles.

How to take risks into account when preparing an investment business plan

An investment business plan would be incomplete and ineffective if it presented the situation only in an ideal and stable form. Market, economic factors, production features and other factors do not make it possible to carry out non-stop activities with the same profit. To draw up a high-quality business plan, it is necessary to consider the possibility of problems in different areas in order to present an image as close to reality as possible. Nowadays, there are many ways to achieve the most objective view of the future of a project in an investment business project.

There are many methods that can be used when creating an investment business plan, but the most popular ones are:

- Integrated sustainability assessment.

- Finding break-even levels.

- Parameter variation method.

- Analysis of the expected effect, taking into account the quantitative characteristics of uncertainty.

Each of the four methods listed above represents the creation of a possible scenario, that is, when developing an investment business plan, a certain situation is considered. It is carefully reproduced in every detail in order to get the most realistic idea of the results and possible prospects of the analyzed actions. It is also important that these actions, even at the stage of developing an investment business plan, make it possible to discard ineffective options that could cause losses, and allow you to develop in advance some measures to counteract harmful events.

Undoubtedly, when developing an investment business plan, it will be preferable to use not one, but all methods at once. If the final results (regardless of each other) are the same, then the acquired information can be considered objective and reliable.

Information about risks obtained during the development of an investment business plan should be used in calculations. Changes are made to the discount rate based on the data received. The amendment itself should be based on three types of risk that are possible in the process of creating a business project:

- Possibility of unreliability of project participants.

- Insurance risk.

- Risk of non-receipt of the project income.

It is worth noting that the amendment is not needed in calculations when the risk associated with it is insured.

The information above is not a required element for an investment business plan. Some can really be used, but others will not be useful, since (as has been emphasized more than once in this article) everything depends on the scope of the enterprise, the characteristics of production and other factors. Thus, the composition of the investment business plan is determined by local circumstances.

How to pay tax on dividends from foreign shares

If the tax on dividends from Russian shares is paid by the depository or tax agent, then in the case of dividends from American companies, the tax will be withheld by the issuer itself. He will transfer taxes to the American budget for the investor, and the rate at which the tax will be withheld can be 30%.

To prevent an investor from paying tax twice in different countries due to differences in legislation, states enter into agreements that help investors not to overpay. Such a document concluded between Russia and the United States is called the Treaty “On the Avoidance of Double Taxation and the Prevention of Tax Evasion with Respect to Taxes on Income and Capital.” To make it work for the investor's benefit, Form W-8BEN must be completed.

Sample Form W-8BEN that an investor must complete to reduce the dividend tax from 30% to 13%. At the moment, such a form cannot be signed in the Gazprombank Investments service.

This document is valid for three years, and after this period the document will need to be re-signed to continue saving on taxes on US stocks. A completed Form W-8BEN confirms that the investor is a Russian tax resident and reduces the tax on dividends from US shares from 30% to 10%. You will have to pay another 3% of your income to the Russian tax office yourself, because the Russian personal income tax rate is 13% or 15%, respectively.

The investor must independently calculate the tax and transfer 3% of the income on dividends from American shares to the tax office. To do this, you need to fill out and submit a 3-NDFL declaration, and pay the calculated tax by July 15. To pay the tax amount, you can use the “Payment of taxes for individuals” service on the website nalog.ru. The service allows you to both generate a payment document and pay the tax amount online.

To find out what the 3% dividend yield on US stocks would be, you need to request a broker's report. Then you need to convert the amount of income into rubles at the Central Bank exchange rate on the date the funds are credited to the brokerage account. 3% or 5% of this amount must be paid to the budget of the Russian Federation.

The exception to this rule is real estate investment trusts. REIT (Real Estate Investment Trust) are companies that make money by developing, leasing, managing and selling real estate. REITs pay out up to 100% of their profits to investors in the form of dividends before paying income tax in the US, so dividends on their shares will in any case be subject to 30% tax.

If an investor holds foreign shares that are not U.S., then the tax system of the specific country where the issuer is registered must be considered.

For example, the company Rusagro is registered in Cyprus. There is no tax on dividends, and therefore they will go to the investor’s account in full, and he will have to independently pay 13% to the Russian Federation. X5 Retail Group is registered in the Netherlands, and Dutch companies independently withhold 15% tax on dividends. Therefore, the investor will receive dividends minus this tax and will not need to pay anything extra to the Russian budget.

Key differences between investments and regular business

Investment activity is similar to entrepreneurial activity, but has a number of differences. Key differences include:

- timing of profit;

- prospects;

- risks.

As for the payback time, this is essentially the main difference. If in ordinary business bets are placed on quick payback, the faster the entrepreneur makes a profit, the better it will be. And a good activity is considered to be one that begins to generate profit as quickly as possible.

In investing, the right decision is to take a long-term perspective. The longer a company invests, the more profit it will receive. Investments in highly profitable investment projects should be one of the most important areas of the “policy” of any enterprise.

Thus, owning shares of a company throughout its entire life is more profitable than owning shares for a short period. In addition, the enterprise itself in which the investment is made should exist for as long as possible. It is the correct investment strategy that determines whether the investment company will bring income or not, whether it will be stable and expectedly high.

At this point there is a smooth transition to the next category - perspective. An investor must look several years ahead, and not only calculate how much financial profit investing in a particular enterprise will bring him, but consider other types of benefits. Which, as already mentioned, may include: expanding the circle of clients, maintaining profitability, access to new technologies, equipment, etc. How to conduct a preliminary analysis of an investment project can be found at this link -.

At the same time, in ordinary business, although it is important to look ahead, the income that will arrive in the shortest possible time is also important. But the main difference is that in an ordinary business, the only prospect in the future is to obtain financial profit, such things as access to new equipment, intellectual advancement, etc. – is not a goal, but can be a “product”.

As for risks, ordinary business is focused on activities with minimized risks, while investment activities are directed in the opposite direction.

This means that the higher the risks, the greater the profitability of the investment portfolio. But here you need to approach the investment planning stage wisely and calculate everything as much as possible in advance. So that, even with maximum risks, incur minimal losses.

- what is return on investment

- main criteria for assessing the effectiveness of investments

- state and budget investments

- what is investment analysis

How to pay tax on Russian bonds

Coupon income and positive income from the sale and redemption of bonds are taxed at 13%, regardless of the type of bond. Annual income includes not only income from securities trading, but also wages, income from deposits and sales of assets.

You don’t have to pay tax on coupon income if you buy bonds on an IIS and use deduction type B. However, before closing the IIS, the broker does not know what type of deduction the investor has chosen, but the client can indicate it himself. Therefore, brokers can withhold tax on coupons when they are received. If the investor chooses deduction B, when closing the IIS, he will be able to return the amount of personal income tax withheld.

What is investment income?

Investment income is the result obtained from an investment. This may be financial or other type of profit.

For example, gaining access to new technologies, expanding the customer base that will use the company’s services or buy a manufactured product. In short, investment income is the income generated from a company's investment activities.

Investment activity is an enterprise’s investment in production and other areas of its resources (financial or other, for example, intellectual, provision of equipment, etc.) to obtain maximum profit.

In this case, profit can be considered both the receipt of financial income and:

- conquering new markets;

- gaining access to new technologies, knowledge, equipment;

- maintaining the level of production profitability;

- expanding the circle of clients;

- gaining competitive advantages and other types of profit.

How to pay tax on Eurobonds

The broker will withhold the tax on these securities himself. The tax will be calculated in rubles. It is charged on coupon income, positive income from the sale and redemption of bonds. In addition, an increase in the exchange rate between the date of purchase of the security and the date of its sale may lead to an increase in the tax amount.

For example, an investor bought a Eurobond for $1,000 at a ruble rate of 70 to $1 and sold it for $1,000, but at a ruble rate of 80 to $1. The tax in this case will be (80,000 -70,000) * 13% = 1,300 rubles.

How to calculate return on investment

A number of formulas are used to calculate investment income. When calculating profitability, you need to remember that you cannot use only one criterion and be based only on them. To compile a more accurate picture of the return on invested capital, all formulas are used and the strategy of generally possible prospects and changes in the market and economy is calculated.

Current income

To calculate current income (can be used to calculate monthly income), a simple formula is used:

D = P – W

where D is income for the selected period;

P – receipts for this period (for example, for a month);

Z is the costs incurred during the period.

For example, you need to calculate the company's income for January 2021. Receipts this month amount to 150 thousand rubles, expenses for January are 97 thousand rubles.

D = 150 000 – 97 000

Investment income for January 2021 will be 53 thousand rubles.

Net income

To calculate investment return, the basic formula can be considered net income:

BH = ∑D – K

BH is actually net income itself.

∑D – the amount of income for all periods of the project (several time periods are determined in each project);

K is capital investments, those that were made from the very beginning.

The net income formula allows you to evaluate the whole picture and find out the profit for the entire investment period. But this formula does not paint a clear picture. Since it should be taken into account that over time money is subject to inflation and the amount that was initially contributed at the end of the project may have a completely different value.

To more accurately reflect the situation, a different formula is used taking into account the discount factor.

Calculation of the discount factor

Formula for calculating the discount factor:

a = 1 / (1 + E)

where, a is actually the required coefficient;

E is the discount rate or discount rate for a certain time interval during which the income was received.

Discounted income

Formula for calculating net present value (NPV):

NPV = ∑ (P-Z)*a – ∑K*a

where, P is revenue for a certain period (income itself);

Z – current costs for this period;

K – capital investments for a certain period;

a is the discount factor calculated earlier.

The main thing when using the formula is to remember that all components belong to the same period.

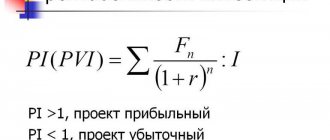

Profitability index

The return on investment index is calculated to understand whether investments in a project can be covered based on current income. ID is calculated using the formula:

ID = ∑(P – Z)*a / ∑K*a

where, ID is the profitability index;

P – receipts for a specific period;

Z – costs for a specific period;

a – discount factor;

K – capital investments.

The result of the calculations is a number close to one. The more it is 1, the more effective the project.

Average and internal rates of return

The average rate of return ARR, also known as the average rate of return, allows you to calculate the average annual income that can be received from the implementation of an investment project. The calculation of the internal rate of return of an investment project is calculated using the following formula:

ARR = ∑ BH / NW*N

where, BH is net income;

SZ – the sum of all costs (investments);

N – number of all billing periods.

The internal rate of return of an investment project (IRR) is calculated using the following formula:

VND = ∑ (P-Z) / (1+Evn)

where, P is the result achieved over a certain period;

Z – costs for the same period;

Evn – internal discount rate.

Get back 52,000 rubles: tax deductions on IIS

Owners of IIS have the right to benefits from the state - receiving tax deductions. They come in two types:

- Type A tax deduction

is a deduction from the amount contributed to the IIS for the calendar year. The tax office returns this money to a bank account, and the maximum deduction amount is 52,000 rubles. They can be used in any way you like. For example, reinvest - invest again in exchange-traded instruments. How to get a type A deduction online on the tax office website - read our step-by-step instructions. This deduction is suitable for investors who have official income on which tax is withheld and paid to the Russian budget at a rate of 13%. - Tax deduction type B

- exemption from personal income tax on income from an IIS. Such a deduction is received upon closing an IIS if the account has been open for more than three years. The investor will receive the entire amount of income without tax withholding. This option is suitable for investors who do not have official income.

For deposits

This may sound sad to some, but it is also necessary to pay income tax on the income received from the deposit. True, there is one small but very important subtlety in this matter: you will have to pay tax only on income received from a deposit of more than 1 million rubles. That is, if the amount in the deposit account does not exceed 1 million rubles. and amounts to, for example, 800 thousand rubles, you will not have to pay tax on the interest received.

It should be noted that this measure will only take effect in 2021 and you don’t have to worry about it for now.

There is one more detail that should not be forgotten. If the deposit rate exceeds the key rate of the Central Bank of the Russian Federation by five or more points, then the tax rate will already be 35%. Considering the size of the key rate (6.25-6.5%), we can safely assume that deposits with such a yield are not found in our country. Therefore, only a very rare “lucky” person will have to pay tax at this rate.

The situation is similar for foreign currency deposits. To the delight of all investors, no tax will be charged on exchange rate differences, regardless of its impact on the amount. The return on the deposit is calculated daily, minimizing the error of currency rate fluctuations. The 35% rate applies to those deposits where the current rate exceeds the key rate by 9 points. Considering the size of deposit rates in foreign currency, a personal income tax of 35% can be considered something bordering on fantasy.

Investment tax deduction for sellers of long-term securities

There is an investment tax deduction for those who sell securities that have been owned for at least three years. This benefit is called a deduction in the amount of a positive financial result, the difference between income and expenses on transactions with securities. A positive financial result obtained from the sale or redemption of securities is exempt from personal income tax.

In this case, the following conditions must be met:

- securities must be traded on the Moscow or St. Petersburg stock exchange, and shares of open-end mutual investment funds must be managed by Russian companies;

- securities must be acquired no earlier than January 1, 2014 and be owned by the investor for at least three full years;

- The amount of income exempt from personal income tax is determined by the formula: number of years of ownership x 3 million rubles.

That is, if an investor held securities in his portfolio for 3 years, the maximum amount of his investment deduction will be 9 million rubles.

Taxation of mutual funds

Mutual funds are classified as securities, so their taxation is very similar to securities. The obligation to pay tax arises upon the disposal (redemption or sale) of shares owned by the investor. In this case, the shareholder’s income may be reduced by expenses associated with the sale, acquisition and storage of shares, including discounts and allowances.

UIF - mutual investment fund

Thus, personal income tax is charged if the amount from the sale or redemption of shares exceeds the amount of expenses. When redeeming shares, the management company is a tax agent, that is, it makes the calculations itself, withholds tax and transfers it to the budget. The tax rate is 13% for residents and 30% for non-residents. In this case, transactions of exchange of shares of one mutual fund for shares of another mutual fund within one management company are not subject to taxation.

Rare mutual funds pay income to their shareholders (for example, rental real estate mutual funds). This income is taxed at a rate of 13% (and 30% for non-residents) and is withheld by the management company.

Benefit for long-term ownership of securities of companies from the innovative sector of the economy

If an investor decides to invest in securities of the high-tech sector of the economy, he can take advantage of the LDV-RII benefit. It implies a complete exemption from personal income tax for income from trading operations on such securities.

There are only three conditions: the shares must be purchased no earlier than January 1, 2015, be in continuous ownership for at least 1 year, and be included in the List of High-Tech Sector Securities.

List of securities of the high-tech sector, income from which is exempt from personal income tax.

There is a way to use the Type B tax deduction and the long-term holding benefit to save even more: after 3 years, you can not sell securities in an IIS, but transfer them to a regular brokerage account and close the IIS. In this case, the date of purchase of the asset does not change, but on a regular brokerage account the benefit will already be in effect.

Methods for determining actual financial indicators

The following methods are needed to determine your own benefit and understand whether it is worthwhile to engage in a specific investment in a project. Using the above formulas, you can calculate the approximate profitability of the project at the very beginning. But even if the metrics are promising, periodically calculating fresh metrics will help keep the project under control.

To identify actual indicators, you can use the already described formulas for NPV, ID and IRR. But there are also a number of additional ones.

Estimated rate of return

To determine the success of an investment project, the calculated rate of return (RRP) method is well suited. It allows you to calculate how much the amount of investment in the project has changed over a certain time period.

RNP = SGP / PKZ * 100%

where, AGP is the average annual profit;

PKZ – initial capital costs.

Another version of the formula with minor changes:

RNP = SGP / SKZ * 100%

where, AMC is the average capital cost.

NPV

Net present value (NPV) is calculated using the formula:

NPV = ∑ З*(1/(1+E)) + ∑ BH*(1/(1+E))

where, Z – investment costs;

E – discount rate;

BH – net income for the period of use of the project.

All indicators are taken for a certain step of the billing period. If the indicator is positive, the project will meet expectations and be profitable, moreover, the higher the indicator, the more profitable the business.

Profitability

Calculating the profitability of the project (RP) allows you to determine the feasibility of the undertaking. Calculating it using the formula, the result is an indicator close to one; the higher it is 1, the more profitable the investment.

RP = ∑ BH / (1+E) / ∑ 1/(1+E))

where, BH is the net income for a certain calculation step, and the amount of BH is the income for the entire period of use of the project;

E is the discount rate.

Using all the given formulas, you can calculate the profit received from the investment project. In addition, find out at the very beginning how profitable and expedient this idea will be.

Studying with a professor: how to calculate the profitability of an investment project

When and how does a broker pay tax?

The broker himself calculates and withholds tax from the balance of money in the investor's brokerage account. The broker will do this during January of the year following the year of receipt of income. If at the end of the tax period there is not enough money in the investor's brokerage account for the broker to withhold the entire amount, he will also have to pay the tax himself. This must be done no later than December 1 of the year following the year in which the income was received. In this case, you do not need to fill out a declaration - the tax amount will automatically appear in your personal account in your nalog.ru account.

The broker himself will calculate and withhold income taxes if the investor decides to withdraw money from the brokerage account to his bank account. The money will be debited from the brokerage account in rubles.

Don't miss important collections

The user with this email is not registered

Consent to the processing of personal data

Acting freely, of his own will and in his own interest, as well as confirming his legal capacity, an individual gives his consent to VTB Bank (PJSC) (hereinafter referred to as the Bank), located at the address: St. Petersburg, Degtyarny Lane, 11, letter A, to process your personal data under the following conditions:

- This Consent is given to the processing of personal data, both without the use of automation tools and with their use.

- Consent is given to the processing of the following personal data of mine: personal data that is not special or biometric: last name, first name, patronymic; E-mail address.

When do you have to pay taxes yourself?

The investor needs to independently calculate the income from the purchase and sale of currency and pay personal income tax before July 15 of the year following the one in which the investor received the declared income.

The base tax rate is 13%, but if during the year an investor earned more than 5 million rubles in total, not only on the stock exchange, then all income above this amount will be taxed at a rate of 15%. The investor will have to pay not 3%, but 5% of the dividend income of American companies independently to the Russian tax office, regardless of whether the W-8BEN form is signed or not.

Summary table: who and when to pay taxes on investments

Taxation of bank deposits

Income from bank deposits is taxed if the interest rate on the deposit exceeds the refinancing rate increased by 5%. For example, if the refinancing rate is 7%, then income will be taxed if the interest on the deposit is more than 12%. Income is taxed at a rate of 35%, but only on that part that exceeds the refinancing rate increased by 5%.

Example: you invested 100,000 rubles for 1 year on a bank deposit with a rate of 15%. Your income will be 15,000 rubles. Of this amount, 3,000 rubles will be taxed, and the tax will be equal to 1,050 rubles.

Deposits in foreign currency are taxed if the interest rate on the deposit exceeds 9%. The tax is paid at a rate of 35% and also only on the excess.

To calculate the tax, the interest rate on the deposit, which is specified in the agreement, and the refinancing rate in effect at the time of conclusion of the agreement are taken into account. From 2021, the refinancing rate is equal to the key rate.

The tax agent is the bank, that is, the bank itself will calculate the amount of tax and withhold it, and the client will receive income minus the tax.

In practice, bank deposits with interest rates that exceed the amounts specified in the law are rare. Therefore, in most cases, the income of investors is not taxed.

How to choose a bank deposit

Distribution of net profit

The amount of net profit remaining at the disposal of the company is distributed by the enterprise independently. The areas for using net profit can be very diverse. Funds are formed from its funds - savings, consumption, reserves.

The accumulation fund is used mainly for the development of the company in technical terms - new assets and technologies are acquired, research and development are financed, projects are developed and other activities are carried out. The consumption fund pays dividends to shareholders, non-production bonuses to employees, material assistance and other social projects.

Reserve funds are formed to cover unforeseen expenses associated with natural disasters or those of a production nature. For example, they create a reserve for doubtful debts to stabilize the financial condition of the company in the event of overdue debts from debtors.

Calculation of net income

To calculate net income, it is important to determine the potential income of the enterprise and its accurate calculations of expenses. Income is a very important indicator, because precisely according to it,

you can calculate the value stated in the purchase offer. To find out, you need to subtract the total number of expenses from your total income. The higher the difference between them, the better. Net income is an additional product and part of national income.

Net operating income is a company's income for the year. The balance sheet of the enterprise consists of the property, minus the costs of its maintenance (from renting it out or from using it by other persons).

The pure product, in capitalism, appears as a type of surplus product with surplus value. According to Karl Marx, net income is a by-product of the exploitation of workers. Profit and rent are the two main forms of money that appeared as a result of the redistribution of the net income of capitalist society.

The second term on the right-hand sides of equations 5.1 and 5.2 shows the present value of the investor's future net income when he implements the project in question.

If the present value of future investment income is lower than investment expenses (NPV [p.111] Estimate the investor's net income if after 2 months the stock prices turn out to be equal to 90 110 100 110 105, respectively, and the futures price of the index increases to 222. [p.163]

Find the investor's net income in six months if, 0.3 years after the current moment, risk-free interest rates increase to 10%. [p.166]

Investor's net income [p.317]

For example, in the methodological recommendations there is no mention of the criteria for economic efficiency, or that the construction of indicators of the economic efficiency of investments should be focused on net profit. For most economists this has long been an axiom. But without a detailed explanation of the problem of the efficiency criterion in the educational process, it is impossible to understand the essence of deducting the amount of advanced equity capital from the final flow of real cash, reflecting the net income of the investor to assess the efficiency of share capital. Therefore, in the book, for the reader who is encountering this most important problem of the theory of determining efficiency for the first time, it is very important to present it in as much detail as possible. [p.16]

Investor's net income [p.188]

The NPV value shows the investor’s net income received by him for Glet and expressed in money of the same value, i.e. cost at the start of the project. [p.190]

What is investment 2. What is meant by investment 3. What is real investment and capital investment 4. What are the main goals of investment in an enterprise. 5. What constitutes the minimum required volume of investment 6. What factors must be taken into account at the initial stage of the financial and economic assessment of the project 7. What are the costs of lost opportunities when assessing investments 8. What is meant by the financial and economic efficiency of an investment project 9. Why is quantitative assessment of the effectiveness of investment projects 10. Name the criteria used to assess the effectiveness of investment projects. 11. What hypothesis underlies all methods used for assessing efficiency 12. What indicators are used as the financial result of the project 13. What does operating cash flow consist of 14. What is the investor’s net income 15. What causes the need for discounting 16. How is it calculated and what shows net present value 17. At what NPV is an investment project considered effective 18. What does cash inflow consist of 19. What does cash outflow consist of [p.216]

In this case, the tax on the investor’s net income will be higher than in example 1 for a company that always maintains the first status. [p.350]

Expected optimal net income of the investor L/", reduced to the zero (base) point in time. [p.54]

Within the framework of the investor behavior model, a comparative analysis of the old and new profit taxation systems for newly formed enterprises was carried out. As comparison indicators, we considered the level of investment, which characterizes the moment the investor arrives, expected tax revenues to the consolidated budget, the expected net income of the investor, and the expected tax burden on the created enterprise with optimal behavior of the investor. Calculations of these indicators, carried out on conditionally real data, revealed that for investment projects with a high share of the active part of fixed assets, the new profit tax system is significantly better than the old one in terms of these indicators. True, the difference between the new and old system decreases with increasing project volatility. [p.86]

If the accumulated amount of net income is the sum of positive and negative components during the entire life of the project and turns out to be negative, then this indicates that the project is unprofitable, i.e. characterizes the inability of the project to fully reimburse investment costs and the inability of the project to provide at least the minimum rent for the investor. [p.98]

An important point when using discounted valuation is to compare the total net income with the total investment costs so that the investor can determine the possible overall level of return on invested capital. [p.98]

Example. It is necessary to evaluate a modern office building with full ownership, occupied by the parent company. The building was leased for 25 years with the possibility of reviewing the rent every 5 years with an initial payment of $100,000 per year. An analysis of recent sales shows that investors expect a risk-adjusted net return of 5%. The acquisition cost is determined based on the ratio [p.350]

Investment institutions also provide certain guarantees for investors. Before allowing securities for sale, the exchange, investment company or fund must verify the reliability of the securities and its sellers. The procedure for including securities on a list for sale is called listing. Each exchange has strict rules for admitting securities to trading and its own guarantees to clients, while the criteria for selecting securities may be the volume of net income, the value of assets, and the size of the issue of securities. An important prerequisite for assessing the quality of securities is an objective assessment of the financial condition and activity of the issuer. [p.230]

The NPV shows the investor's net gains or net losses as a result of placing money in a project compared to keeping the money in a bank. If 4T >Q, then the project will generate more income than the cost of capital. If the cost of capital is NTC, it is therefore more profitable to leave the money in the bank. The project is neither profitable nor unprofitable if NPV = 0. [p.595]

Another component of the organization's own funds is reserve capital. Reserve capital is the insurance capital of an organization, intended to compensate for losses and to pay income to investors or creditors if there is not enough net profit for these purposes. In organizations of different forms of ownership and types of activity, the formation of reserve capital can be mandatory or voluntary. To account for changes in reserve capital, account 82 Reserve capital is used. The processes of formation and use of equity capital and all its components are discussed in more detail in Chapter 4 of the textbook. [p.168]

Return on investment from the investors' perspective. When carrying out analytical calculations from the position of investors, i.e. individuals and legal entities providing the enterprise with capital on a long-term basis, the composition of the initial indicators changes somewhat. The total income of investors (shareholders and lenders) is the net profit and the amount of interest payable. This total return can be compared either to total assets or to long-term capital, in the first case a ratio known as return on assets (ROA) is calculated, in the second - return on invested capital (ROI). [p.383]

The critical assumption in this approach is that k0 is constant regardless of the level of leverage. The market capitalizes the value of the company as a whole; as a result, the ratio of debt to equity does not play a big role. The greater use of supposedly “cheaper” debt is balanced by an increase in the required return on equity, ke. Thus, the weighted average of ke and kj remains constant at all leverage levels. If a firm increases its level of leverage, its degree of risk also increases and investors increase their required level of return in direct proportion to the increase in their debt-to-equity ratio. As long as kj remains constant, ke is a constant linear function of the debt-to-equity ratio. Since a firm's cost of capital, , cannot be changed by changing leverage, according to operating net income theory, there is no optimal capital structure. [p.476]

Listing is the inclusion of securities in the quotation list of the exchange, i.e. admitting them to trading. Listing is the most important procedure of exchange trading. Many companies seek to include issued securities in exchange lists of stock assets. - The prestige of listed securities is higher, which increases investor interest in them. Regular publication of stock exchange reports in the mass and business press makes it possible to better inform security owners about changes in prices and profitability of shares, attracts new buyers, and increases the liquidity of listed securities. The benefits of official recognition of securities compensate for the costs associated with the payment of registration and periodic fees (to maintain the list of securities in proper condition), as well as the need for public disclosure of information about the status of the company. Each exchange has strict rules for admitting securities to trading and provides guarantees to clients. The criteria for selecting securities may be the volume of net income, the value of assets and the size of the securities issue. [p.46]

An assessment of the industry in which the issuer operates involves, first of all, studying the stage of its life cycle and the expected time frame for being in this stage. The investor's income on shares is ensured by two main results: a) an increase in the market value of the share (the main factor here is capital gain per share) b) the amount of dividends on shares (determined mainly by the amount of the issuer's net profit). The most stable growth of capital and net profit is typical, as a rule, for companies in those industries that are in the early stages of their life cycle. Foreign experience shows that the highest return on shares is provided by companies operating in knowledge-intensive industries. However, the shares of such companies are also the most risky - these companies are called venture capital (or risky) companies. Among other factors that determine the investment qualities of shares of companies in various industries, when assessing the place assigned to the industry in the structural restructuring of the country's economy, special attention should be paid to the average level of profitability of enterprises in the industry, as well as the level of taxation of their income (profit). The last two factors can serve as a criterion for assessing the possible level of dividends on shares. When assessing the investment qualities of companies in individual industries, you can use the methodology for determining the investment attractiveness of economic sectors, discussed earlier. [p.311]

Typically, the investor's annual income is at least 150 thousand Canadian dollars, and his net personal capital is more than 1 million Canadian dollars [p.175]

An indicator that is determined by dividing the company's net income for a certain period by the company's own (share) capital at the start date of this period. The latest return on equity data tells an investor how effectively their money is being used. [p.153]

The company's net income for a certain period is divided by the company's share capital (equity) at the beginning of the same period. Return on equity tells an investor how effectively their money is performing. [p.154]

Federal and local tax laws play a critical role in setting securities market prices because, of course, what matters to investors is after-tax returns, not before-tax returns. Accordingly, before making any investment decision, the investor must determine the possible amount of tax payments. Their amount is not the same for all securities in a given investor's portfolio; it may be 0% if some securities are exempt from taxation (for example, securities issued by states and localities). Tax payments can exceed 40% for corporate bonds when both federal and local taxes are taken into account. After determining the amount of tax payments, the investor can assess the net income and risk of the security. A smart investment decision can then be made. [p.338]

Call and put options will not be sold for less than their intrinsic value, as sophisticated investors will take advantage of this. If an option is worth less than its intrinsic value, then investors can earn instant returns without risk. For example, if the stock price is 150 and the call option is selling for 40, i.e., 10 less than its intrinsic value (which is 50), then investors will simultaneously buy the options, exercise them, and sell the shares received from the seller of the option. They will spend 140 on each option, including the strike price, and in exchange for each share sold, they will receive 150. As a result, their net risk-free return will be 10 from one option. Therefore, the call option will not be worth less than 50 when the stock price is 150. [p.648]

Including - net profit - depreciation - increase in working capital - interest on loans - return of investment loan - guaranteed investor income [p.36]

If the NPV is negative, the investor will return the invested capital (if the net profit is positive), but with less interest than he would receive at the bank. If the amount of net income accumulated over the entire life of the object is negative, this indicates that the project is unprofitable, i.e. its inability to recoup invested funds, let alone pay even minimum dividends to potential investors. [p.32]

If IR = 1, future net profit is equal to investment, i.e. the investor's income will be zero. When IR > 1, the project is absolutely effective and should be accepted at IR [p.41]

ROA = Return to Investors / Assets = (Net Return to Common Stockholders + Interest Payable) / Assets. [p.219]

This column is one of the most important and informative for investors and analysts. It shows the ratio of stock price and net income per share. The stock price is the exchange rate at the close of the stock exchange on the day preceding the publication of the table. In the stock exchange report it is given in column 10. [p.210]

From a financial point of view, the investment process includes the creation of a production (or other) facility, which consists of the accumulation of capital (new funds), and the consistent receipt of income by this production facility and the investor. These processes occur sequentially, and for a certain period of time in parallel (if the return on investment begins before the completion of the investment process). Flows of investment funds and flows of return (with interest) payments have different distributions over time. Therefore, from the investor’s point of view, it is advisable to designate them in the form of indicators of investment expenses and net income. [p.305]

In December 1995, the British Venture Capital Association published preliminary end-1994 net investor returns for independent UK venture capital funds that raised funds for investment between 1980 and 1990. These data show that the average internal rate of return (IRR) was 12.1% per year. However, this average figure masks significant differences in the performance of individual funds, which range from losses to gains of over 30% per year (on a compounded basis). The top half of the funds had an average pre-tax return (IRR) of 18.8% per year, the top quarter of the funds 24.2% per year. These returns exceed those that can be obtained from other categories of assets at acceptable levels of risk and liquidity. The income of funds financing the repurchase of shares by company managers (MBO) exceeded the income of funds specializing in investing in the initial stages of project development. [p.68]

Estimate the investor's net income if after 1 month. share prices will be equal to 20.50 30t20 25.10 42.00 37.75 28.50, respectively, and the futures index value will increase to 321. [p.162]

The values of lines 4-10 characterize the economic feasibility of the joint-stock company’s activities for founders and investors. They accumulate information on such important indicators as net income (profit remaining at the disposal of the enterprise after paying taxes, deductions, fees, loan payments) and its distribution according to areas of use, including dividend payments. Particularly interesting for private investors is the analysis of dividend per share, share price, interest income per share to [p.101]

A cost method of accounting in which investments in other companies are recorded at cost. In the income statement, the investor's income from investments is reflected only to the extent that they are actually transferred by the capital receiving company from the net income accumulated from the date of acquisition of these investments. [p.208]

The existence of important spillover effects results in private firms' investment in R&D being insufficient from a national perspective. This point of view is not purely theoretical. As many studies have shown, investment in R&D produces high returns for investors and even higher returns for society. A recently published economic survey showed that private firms have an average return on investment in innovation ranging from 20 to 30%, while public firms

Taking into account the problematic implementation of the pre-emptive right to assets, investors were absolutely right when they turned to the mechanism of redemption funds to streamline the redemption process. The analyst must determine whether the relevant provision in the preferred stock agreement is simply a recognition of their pre-emptive rights, or whether it is a direct obligation of the issuer. A buyer of 4 1/2% preferred shares of Leveland Liffs Iron, relying on a redemption fund to which 15% of consolidated net income was paid annually, could buy these shares in 1961 with a yield of 5/4%> when long-term government bonds were earning 3. 85% per year, and in 1975, when Treasury bonds were earning 8 3/g% B per year, redeem them at a price of 101/2- [p.506]

There are two possible answers to this question. The first answer is that financial analysis involves costs. This means that financial analysis will not be performed consistently on all securities. As a result, the prices of all securities will not reflect their intrinsic value all the time. Opportunities for discrepancies between the price and intrinsic value of a security may arise from time to time, thereby providing the opportunity to obtain additional benefits from financial analysis. This means that investors should only undertake financial analysis when the associated incremental benefits outweigh the incremental costs.” Ultimately, in a highly competitive market, prices will be fairly close to intrinsic value, so only highly trained analysts will benefit from using financial analysis to find mispriced securities. In this regard, the market will be almost (though not absolutely) efficient. Sophisticated investors will be able to achieve unusually high total returns, but given the costs of collecting, processing information and executing trades, their net return will no longer be extremely high. [p.800]

Net return received on the test set (NETRET) using the simplest one-period trading strategy (excluding transaction costs). Based on the network's earnings forecast for the next time interval, the investor takes a long or short position in Philips shares and closes it 15 minutes later. Then the next network forecast will again tell him whether to take a long or short position, which will be closed in 30 minutes, etc. The resulting net result can serve as a measure of forecast accuracy, taking into account direction and absolute magnitude. [p.133]

ALLNET provides better results than regression in terms of MSE and net income estimates. However, this does not indicate its qualitative superiority in forecasting over the linear model. Further than 3 days of trading, both regression and ALLNET predicted values less than 0.5, i.e. negative returns, so our investor would have to remain short the entire time. [p.133]

Investments in microfinance organizations (MFOs)

Private investors have the right to invest money only in one type of MFO - microfinance companies (MFC). And only a significant amount - no less than 1.5 million rubles. From the text “Microfinance organizations: how do MCCs differ from IFCs” you can find out why such restrictions on investments were introduced.

You must pay personal income tax on income from investments in microfinance organizations.

Vladimir invested 1.5 million rubles in the IFC and at the end of the year earned 225,000 rubles. Of these, personal income tax will be withheld: 225,000 × 13% = 29,250 rubles.

Who pays

: calculates and holds MFOs.

Unallocated metal accounts (OMS)

This is also a type of bank deposit, but it does not count money, but grams of gold, silver or other precious metal. When you open such a deposit, you buy metal from the bank, and when you want to close it, you sell it back to the bank. At the same time, you will not be given the bars themselves; your account will simply contain a certain number of grams of silver, gold, platinum or palladium. If the price of the metal rises, you will receive income.

Unallocated metal accounts are not taken into account when calculating the total income on other bank accounts and deposits.

No need to pay income tax

, if your account is three years old or more.

You have to pay

, if the account was closed earlier than three years after opening. Personal income tax is charged on the difference between the purchase and sale prices of precious metal.

When closing the compulsory medical insurance, you have the right to withdraw the deposit in the form of bullion. But in this case you will have to pay an additional VAT of 20%

on the price of the metal.

Who pays:

calculates and holds the bank.

Current or interest income

Current income is the money an investor receives as a result of owning a particular financial instrument.

In the vast majority of cases, when it comes to current income, it means cash.

The corresponding receipts are usually periodic.

We will deal with current income by placing money in a savings account, expecting to receive interest income, buying shares that provide us with dividends, receiving rent for renting out real estate.

The benefit from investing in financial instruments that offer current (interest) income is determined by its size.

Investing in bonds with a return of 10% annually is more profitable than placing funds in a deposit with an 8% annual rate.

In practice, current income is not the only factor to consider when making investment decisions.

The assessment of expected capital gains is often decisive.

Bonds

The average yield of the bond market from the middle of the last century to 2021 is approximately 2% per annum. But again this is due to the high interest rates that were observed in the 20th century and the beginning of this century.

If we take data over the last decade, the real yield of bonds fluctuates between 1-1.5% per annum. And it goes down every year.

Related Article: 700-Year Global Fall in Interest Rates and Bond Yields