Content

- Gold and inflation

- Gold production and consumption

- Gold price and risk-free return

- Current situation in the gold market

- The role of gold for the Russian economy

Anton Tabakh, Managing Director for Macroeconomic Analysis and Forecasting, Expert RA

Anton Prokudin, leading methodologist at Expert RA

Gold and other precious metals have always been safe haven assets for investors in times of crisis. And the new crisis caused by the COVID-19 epidemic is accompanied by rising gold prices. The world's central banks and simply large banks have intensified their purchases of gold against the backdrop of rising risks and lower interest rates in both developed and developing countries. At the same time, the price of gold has been growing over the past 1.5 years; before that, it was stably quoted at $1,100–1,300 per ounce.

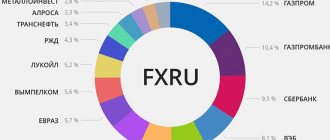

For Russia, the price of gold is an important macroeconomic factor: firstly, the gold mining industry plays an important role in the trade balance and mineral extraction tax (although it is significantly inferior to the oil and gas industry). Secondly, Russian international reserves have a higher share of gold than the average of countries that do not issue reserve currencies, that is, those that need reserves as protection against potential sanctions. In recent years, this has contributed to the revaluation of reserves, but if prices fall, there is a threat of a double hit - both in revenues and in reserves.

Gold production has been steadily increasing, and demand for it from regular sources peaked 20 years ago, so the market balance is tilting towards a surplus of gold. The increase in gold prices in 2000–2011 was not accompanied by an increase in constant demand; on the contrary, it even decreased. Variable (investment) demand has pushed up gold prices, especially since 2006, and it is thanks to it that the price of gold remains high today. The reason for the high investment demand lies in the dynamics of real interest rates, which have been declining in recent years and are moving into negative territory in 2020.

As economies recover and Western central bank monetary policies normalize, variable demand for gold will reverse and the price may decline significantly, but normalization may take a longer period than in previous cycles. Against this background, the likelihood of continued high gold prices in the medium term is very high, as is the possibility of accumulation of risks for investors and central banks.

At the same time, along with gold, other precious metals also act as a hedge against inflation. Buying the cheapest of them (currently platinum) will protect the investor from unnecessary losses over a long time horizon.

Basel III: the global financial revolution

On March 29 of this year, Basel III, developed by the Basel Committee on Banking Supervision, came into force, returning gold to its historical significance. In short, about 40 years ago, the same committee abolished the gold backing of the dollar, making US currency and Treasury obligations virtually the only valuable instrument in the world. How and why this happened is a long and dark story. Gold was simply turned from a universal equivalent into a market commodity, like oil or cotton. In bank reserves, gold can now be accounted for only at half its value, which means that it is unprofitable to purchase and store it, since it is possible to issue loans and money into circulation only at half its market value.

Despite this, today it is the US Central Bank that has the largest official gold reserves in the world - 8,133 tons. For example, Germany, second on the list, has more than two times less gold - 3,369 tons. Russia, with all of last year’s increase, ultimately has 2,119 tons of gold in its reserves. So, Basel III says that from now on gold is a full participant in group 1 of assets, equal to the dollar.

This means that the interest of states, banks and private investors in it should also increase. For example, instead of dubious dollars and treasury bonds of other countries, countries can store their entire funds in real, shiny, highly liquid bullion. In our own vaults, under full control, and not increasing the influence of other countries through demand for their currency and securities.

Experts explain the long-term decline in the value of the metal (from approximately 2012 to 2021) precisely by the global game in the market, through which prices were artificially lowered in order to buy large volumes at a low price - after all, the entry into force of Basel III was known already in 2011.

Gold and inflation

Gold (along with silver) has been the main means of payment for hundreds of years and circulated in the form of coins in the economies of most countries of the world. In the 19th and early 20th centuries, gold and silver were in circulation in parallel with paper money issued by private banks, and in 1944–1971, the gold exchange standard (Bretton Woods system) was in force in the world, when central banks had US dollars in reserves, and The US gold reserves provided dollars. After 1971, gold ceased to be used as collateral by Western countries, and the era of fiat money began.

Over the past centuries, the United States and other countries have experienced inflationary spikes due to wars and various economic disasters, but usually reverted back to a fixed rate against gold. At the same time, the stability of the banking system depended on the presence of sufficient reserves of specie in reserves: in the second half of the 19th century, the normal ratio between gold and issued bank notes was 15%. Therefore, the barometer of the health of the financial system was the ratio between the money supply or GDP 1 and the stock of gold (and sometimes silver) in banks. Nowadays, such accurate reporting is not maintained, so you can start from the ratio of GDP or money supply to all gold mined in the world. Considering that the volume of money supply in developed countries, using the example of the United States, is usually 60% of GDP, the reserve ratio to GDP would be 9%.

Chart 1 clearly shows that the cost of all mined gold (and silver) 2 compared to GDP was high in the 1930s (after Roosevelt artificially increased the price of gold), at the turn of the 1970s and 1980s (due to soaring inflation and losses confidence in currencies after the abolition of the Bretton Woods system in 1971) and this year against the backdrop of a pandemic and crisis. In quiet times, the valuation of all gold and silver mined falls to 5% of GDP, as it did in the late 1960s and 1990s.

If we look at the US economy since 1900 and the level of inflation in it, it becomes obvious that after the abolition of the Bretton Woods system, high inflation accompanied the rise in the price of gold, but the high price of gold is now observed against the backdrop of low inflation. Therefore, the reason for the price increase is likely to be not only high inflation. During the period of the gold or gold exchange standard in the United States, high inflation was perceived as a temporary phenomenon, followed by a rollback of prices, and only in the 1950s it became clear that inflation could be permanent, which is why the phenomenon of rising gold prices with an inflationary surge until the middle of the 20th century century was not observed.

The prices of silver and other metals are not as closely linked to investment cycles, so their high prices may not coincide with gold's peaks. For comparison, Chart 3 shows the prices of silver, platinum and palladium relative to inflation in the United States. It can be clearly seen that silver was at its peak in 1980, palladium in 2000 and 2020, and platinum prices are more relaxed and were expensive in 1980 and 2008-2010.

When choosing between precious metals today, we can say with confidence that:

- gold is expensive by historical standards;

- palladium is the most expensive of the precious metals, and its price has the prospect of falling sharply;

- platinum is the cheapest of these metals,

Therefore, it is now more profitable for investors to choose platinum rather than gold as a protective asset. Prices for all of the precious metals listed rise over a long time horizon along with inflation, so they are equally suitable for protecting savings from inflation.

How does the size of gold reserves affect the country's economy?

At first glance, one might think that all states are in a hurry to acquire gold, at any cost; however, in reality the opposite is true. Gold used to be a unique reserve asset for states and citizens due to its unique chemical characteristics that made it incapable of reacting with other elements, including acids, making it a reliable store of value.

However, this situation changed in the twentieth century. All countries and their central banks or treasuries now hold significant amounts of reserves in the form of a diversified portfolio of currencies, foreign government bonds and precious metals.

Most published studies and articles focus primarily on the volume of gold held by governments, without addressing the ratio of the amount of gold to total reserves. The volume of gold reserves in comparison to the total reserves of countries reflects the political and economic interests of the authorities and the position of the state in the international arena. Below we present a study of two groups of countries. The first group consists of those countries that continue to increase their gold reserves; the second group is countries that are reducing their gold reserves.

Gold standard era

Without going too far into history, let's look back to 1694, when the Bank of England established a gold standard system in which banknotes were exchanged for gold on demand. This system was adopted throughout the world and remained the basis for an effective economic system for more than two centuries.

Under the gold standard, the value of any currency was fixed in gold, which meant a fixed exchange rate between currencies. The gold standard system put great pressure on large and small countries alike. On the larger countries' side, absolute rising inflation for more than two centuries has caused people to doubt the ability of central banks to back their banknotes in gold; this led to speculators selling currencies in order to exchange them for gold. As a result of such speculative actions, the volumes of gold in central banks began to be depleted, most notably in the Bank of England. On the other hand, smaller countries have been forced to raise their interest rates when foreign rates rise; otherwise they suffered serious losses. The massive sell-off of domestic currency prompted a turn to gold reserves or to the sale of domestic currency and the purchase of foreign currency in an environment of high interest rates.

During World War I, the gold standard system was suspended in all countries except the United States. After the end of the war, many countries found themselves saddled with debt and hyperinflation. At the same time, the banking sector was the most affected, as many banks faced insolvency. By the end of World War I, central banks made significant efforts to restore the gold standard system. Despite the fact that during the war large sums of money were printed that were not backed by gold reserves, states could restore the gold standard system. However, the post-war period did not prove stable in the monetary sphere, and many countries, including Great Britain, refused to restore this system.

In the absence of political and ideological support for the gold standard system, central banks began to reevaluate their policies, especially after the global Great Depression era in the 1930s. Significant changes to the monetary system were carried out by US President Franklin Roosevelt.

Countries with increasing gold reserves

USA

Once the markets crashed in 1929, Britain abandoned the gold standard as the pound began to float and be determined by market forces due to frequent attacks by speculators. States stopped believing in the gold standard system, and one after another abandoned it.

The United States has taken new measures to save itself from the global crisis. One measure was to raise interest rates, which had been below 20%, in order to quell speculation on the dollar. As the government began to put pressure on the Fed, the Open Market Committee was created, which was responsible for increasing the supply of money by reducing interest rates on government and corporate bonds. Ultimately, the Fed and the government realized they were not on the right track and had to change it. They realized that gold was the basis of their previous fiscal policy and nothing could be changed without a complete revision of this system, and therefore the end of the gold standard.

By the beginning of Roosevelt's presidency, shifting the gold standard was a priority. It didn't take too long to recognize that abandoning the gold standard would be key to recovery from the Great Depression. In short, Roosevelt decided to let the dollar float against gold, driving its value to a low level.

The hardships of World War II were unbearable, so all countries eventually decided to abandon the gold standard system as it became unprofitable. In 1944, before the end of the war, major nations signed the Bretton Woods Agreement, which pegged currency prices to the dollar rather than gold.

However, the US dollar had to be exchanged for gold on demand, and gold was valued at $38 per ounce. In 1971, President Richard Nixon decided to end the gold standard system and replace it with a petrodollar system. From this date onwards, interest rates replaced gold and became the mainstay of fiscal policy.

By that time, gold was outside the Fed's fiscal policy; although its importance as a reserve asset has not diminished for the Secretary of the Treasury. According to the World Gold Council, the United States tops the list of countries with the largest gold reserves. It turns out that the United States owns 8133.5 tons of gold (about 12 billion dollars), which is 74% of the total reserves held in the treasury. The Treasury has been responsible for storing gold in secure vaults since January 31, 1934, in three locations: Denver, Fort Knox and West Point. The United States ranks fourth on the list of largest gold producers with 209 tons per year.

If we look at the issue of percentage of gold reserves to total reserves, then no other country has such a high percentage of gold reserves as Tajikistan and even the US is in second place in this list. Here the question may arise: what does this mean? a) The United States, as the producer of the dominant currency in the world, does not need a large number of foreign currencies, b) gold has an inverse relationship to the dollar, which means that as the demand for gold from the Treasury increases, the price of gold will rise, and the US dollar will depreciate. In other words, a weaker dollar will improve the economy and increase the value of stored gold.

European countries use the euro

Like the dollar, the euro is considered one of the pillars of the world economy. Although the European Central Bank stores 26% of its reserves in gold (504 tons), each country in the EU has its own treasury, storing its gold separately. The formula “sell the euro – buy gold as a reserve” is a common policy in the Eurozone countries. In second place among the countries holding the largest volumes of gold is Germany, owning 3,377 tons of gold, representing 68.7% of the total reserves; Italy follows with 2,451 tons, representing 67.8% of total reserves. Although Cyprus only has 33 tons of gold, it accounts for 64.1% of its total reserves; France - 2435 tons, 63.8% of total reserves, the Netherlands - 612 tons, 63.9% of total reserves, Portugal - 382 tons, 59.1% of total reserves and Austria - 280 tons, 45% of total reserves.

European countries take the position that it is necessary to have large volumes of gold reserves in relation to their total volume (commodities, currencies, etc.). If there were a gold standard system in the world economy today, countries would hold as much gold reserves as needed to control their currency and economy.

The sad lesson of Venezuela

The authorities of Venezuela, one of the leading oil-producing countries, were determined to pursue illiberal, anti-Western policies by abandoning the dollar. As a result, they held 64.8% of their reserves in the form of gold rather than foreign currencies; Only 187.5 tons of gold were stored, which was the lowest level in the last three decades. In December 2009, the Central Bank of Venezuela decided to carry out a “reorganization of gold reserves.” A 10-year plan was drawn up to increase gold reserves, but they did not announce how much the increase would be; Moreover, the financial crisis was still in full swing at that time, confidence in the US dollar had decreased, so in Venezuela that year was called the “year of gold.” In fact, the plan led to some success, as gold reserves increased from 355 to 365 tons by 2011; however, this policy did not last long. The country faces a major crisis in 2021, necessitating the sale of two-thirds of its gold reserves at a lower price than in 2010.

As a result, most of the gold purchased after the “reorganization” in 2009 was sold at a loss, and the economic situation in Venezuela worsened significantly.

Tajikistan

It may seem surprising, but Tajikistan, one of the poorest countries in the world with 30% of the population below the poverty line, stores 81% of its total reserves in gold, which puts the country at the top of the list, even above the United States. This 81% represents only 14.4 tons.

The country's GDP was $7.8 billion in 2021 as the economy is largely dependent on agricultural and metal exports. The country's income mainly depends on the labor force emigrating to Russia and the export of products to neighboring countries such as Russia, Turkey, Kazakhstan and Afghanistan.

Countries with declining gold reserves

Great Britain

However, some developed economies have a different view on gold. Unlike the rest of Europe, the UK has a different policy regarding gold. On 7 May 1999, the UK decided to sell most of its gold reserves at short notice, replacing them with a basket of currencies, including a new currency (the euro). UK gold reserves have fallen from 590 tonnes in 1999 to 310 tonnes currently, representing just 8.6% of the UK's total reserves.

This decision was made following new amendments made by the Bank of England. In the mid-1990s. Policies were introduced to reduce high levels of unemployment and price volatility, which led to a sharp fall in UK exports. Great Britain decided to reduce its gold reserves by 2/3, however, the kingdom still ranks 17th in the list of countries with large amounts of gold reserves.

Commonwealth Kingdom Countries

Canada and New Zealand followed the UK, but more decisively. The gold standard was adopted by Canada on June 14, 1853, and in 1999 the Bank of Canada decided to sell all of its gold reserves. The economic reasons that led Canada and New Zealand to dump all of their gold reserves remain unclear.

Australia is a country with a strong economy, largely focused on mining, representing only 6% of its total reserves. Australian gold reserves have increased slightly from 79.7 tonnes in 1999 to 79.85 tonnes in 2021. Commonwealth countries are among the richest gold mining countries as they account for the majority of gold mined. Australia is the world's second largest gold producer, producing 270 tonnes per year, Canada is fifth with 170 tonnes, and South Africa is seventh with 140 tonnes per year.

Sino-Russian axis

China became the last country to join the gold standard system at the beginning of the 20th century. China ranks fifth in gold production with 1,842 tons of gold; they represent only 2.6% in relation to total gold and foreign exchange reserves, which makes it similar to other countries that are reducing their gold reserves.

Following China is Russia, which stores only 1,645 tons, representing 16% of its total reserves; however, there are doubts about the accuracy of the statistics for both countries.

Gold is a very popular commodity in retail jewelry in China and Russia; these countries are considered the cheapest markets to buy gold. China ranked first among gold sellers with 455 tons, and Russia came in third with 250 tons per year.

Final words

Gold reserves are a popular topic and there are many questions associated with it. For example, is there a connection between gold trading, gold reserves and the gold rate. What is the impact of the gold price on gold held by states? And the most important question: what will be the consequences of depleting the extraction of this metal? In general, we can summarize the main ideas of this topic as follows:

Although gold has never lost its importance as a store of value, its role in the modern economy has now changed. Its history began with a simple coin, then gold evolved into a backing medium for banknotes, and is now an important part of government reserves, being a useful element in traditional fields (jewelry and store of value), including the medical and automobile industries. Moreover, the relationship between banks and gold also changed from one historical period to another.

We can divide countries in relation to the gold reserve system into three types: a) The US and the Eurozone hold the most sought-after currencies and have no choice but to hold their reserves in gold and give very little room to the less desirable currencies. It must be kept in mind that the United States is the second largest producer of gold; b) advanced economies such as the Commonwealth countries are treating gold differently by liquidating their reserves, followed by other developed economies such as Japan and Switzerland; c) developing economies such as Russia, China and India are adopting the same policies as countries from the second group, which was the inevitable result of economic stagnation.

Venezuela is a prime example of a failed policy in which the country defied international monetary systems and funneled all its oil revenues into gold. This was one of the reasons that caused a major crisis in the country in 2015, resulting in most of the gold reserve being sold at a low price in 2021.

Gold production and consumption

Gold production grew over the centuries along with the need for money, but even after the abolition of its circulation in the world, the attitude towards this product as a means of saving remained (the logic of Gresham’s law is clearly visible here), so gold production continued to grow and is at a record level according to the results of 2019.

Gold production, as will be shown below, completely covers the needs of industry. The second constant source of gold is scrap. Mining volumes are also increasing, rising from 20 million ounces in the early 1990s to 40 million ounces in recent years. In 2019, the supply of gold from permanent sources (mining and scrap) amounted to 150 million ounces per year.

If prices remain at $1,000–2,000, production volumes will remain at the current level or even increase, since the average production cost is much lower. The cost of gold production has risen substantially in line with the price over the past 20 years. At the same time, at the end of the 1990s it is clear that when the price of gold falls, the cost of production also falls due to the cessation of production at costly deposits.

Costs of $700 in recent years clearly indicate a large margin for a decline in the price of gold. The offer will remain high even at $700.

The constant demand for gold consists of its industrial consumption: mainly jewelry production, also the electronics industry, coin production. Industrial consumption of gold grew until the late 1990s amid a decline in its real price. Maximum demand was 120 million ounces per year. Further, consumption decreased due to rising prices. A decline was also observed in the late 1970s with surges in gold prices. It is obvious that gold prices can only receive support from industry at values of $400–1,000.

The market balance consists of the constant supply of gold minus its industrial consumption. Investment demand and demand from central banks can have either a negative or a positive balance and are therefore ignored in Chart 7.

The balance sheet shows that low gold prices in the late 1990s were accompanied by a lack of production, and since 2006 there has been a constant surplus of gold on the market amid high prices. Investment demand and demand from central banks was negative in the 1990s, and in the last 10 years it has been absorbing 40-60 million ounces per year. When investor interest shifts to other investments, the price of gold could fall quite sharply in the direction of $500-800 per ounce, where supply will decrease and demand will increase.

Gold price and risk-free return

Investment demand for gold is associated primarily with economic conditions, namely with real interest rates on government debt. In the absence of the opportunity to obtain a positive risk-free return, investors turn to a protective asset (gold). So historically, when real yields are very low, which happens in two combinations of yields and inflation, gold prices have risen. With a stable yield situation, gold was not in demand.

High gold prices are associated with the situation in financial markets, which do not allow investors to earn returns above the inflation rate, which leads to the flow of funds into protective assets (primarily gold). At the same time, gold production far exceeds constant demand at current prices, and a change in central bank policies to a more stringent one will lead to a flow of investors back from protective assets to risky ones. The price of gold will drop significantly.

Current situation in the gold market

In 2021, the economic crisis caused by the COVID-19 pandemic has moved gold into the category of the main investment hedging assets. The high level of uncertainty and extra-loose monetary policies of the central banks of developed countries have exerted serious upward pressure on the level of gold prices, in some currencies the price of gold has reached record levels. According to the results of the first half of the year, the yield of gold at 17% exceeded the yield of all major global assets - the NASDAQ, S&P500 indices, American treasury bonds, not to mention oil.

In the first half of 2021, there was a drop in demand for physical gold (including coins and bars) by 6% compared to the first half of 2021. Demand from the electronics industry fell by 14%, and from the dental sector by 30%. Demand for jewelry fell by 39% in the first half of the year due to restrictions on economic activity. Central banks also reduced demand for gold - by 39% compared to the first half of 2019.

Gold supply also fell by 6% in the first half of 2021 due to a drop in production due to lockdowns and restrictions on economic activity.

First of all, the rise in the price of gold ensured a significant increase in flows into gold ETFs. In the first quarter, capital inflows into gold ETFs amounted to 16.6%; in the second quarter, the growth rate accelerated to 27%.

In the second quarter of 2021, rising gold prices supported an increasing level of uncertainty - the likelihood of a V-recession fell with the spread of coronavirus, and U- and W-variants of recession became more likely. Central banks of developed and a significant part of developing countries expanded their easing monetary policy measures: in addition to the almost traditional quantitative easing, programs for the purchase of corporate assets were announced. In addition, rising gold prices in the first quarter played a role.

In the third quarter, growth in inflows into gold ETFs slowed to 14.5%, likely due to the slowdown in gold price growth at the end of the third quarter. Despite the slowdown in price growth, the main factors that ensured the rise in gold prices in the first half of the year remain: uncertainty regarding the COVID-19 pandemic, soft policies of central banks. In addition, a supporting factor for gold prices was the Federal Reserve's statement about the possibility of inflation exceeding the 2% target without retaliatory action.

Factors influencing the price of gold

What influences the price of another asset we are interested in? In addition to dependence on the dollar, the price of gold is also affected by:

- Investor behavior. Interest and active purchase of the precious metal (demand) cause its price to rise.

- Reduction or increase in gold mining.

- Natural factors (cataclysms, natural disasters).

- Political and economic crises.

- Activity of state banks. By increasing their gold and foreign exchange reserves, financial institutions accumulate gold, thereby creating favorable conditions for its growth.

- Psychological factor. Rumors about a rise or fall in price often affect the overall situation, provoking the purchase or, conversely, sale of metal.

- Dependence on other currencies or assets (oil, Australian dollar, franc, etc.).

- Use of gold. The rise in prices is influenced not only by investors and financial units, but also by the population, which cyclically buys gold jewelry. In addition, gold is used in dentistry, pharmacology, nuclear research, and for soldering various metals.

There are other, less significant reasons.

The role of gold for the Russian economy

Export

Russia is a net exporter of gold, and in 2019–2020 gold exports increased both in quantity and in value terms. In 2021, gold exports increased more than seven times in physical volume and more than eight times in value terms compared to 2018. The main buyer was Great Britain - the country bought gold for $5.33 billion out of $5.75 billion sold. A number of experts attribute the record demand for gold to uncertainty regarding Brexit. However, it should be remembered that the UK is the largest financial center, so a significant part of the flows can pass through it in transit.

Since the second quarter of 2021, gold exports have increased again - peak exports in April amounted to 42.5 tons, during April - June Russia exported approximately 24 tons of gold per month. The increase in gold exports in April 2021, which made it possible to at least slightly compensate for the fall in total exports of the Russian Federation, is associated with three main factors.

- In April 2021, the rules for exporting gold abroad changed in Russia: gold mining and refining companies were given the right to obtain general (and not one-time) licenses for exporting gold abroad. Previously, it was supposed to sell gold to banks lending companies, and the banks, in turn, had similar general licenses. Gold mining and refining companies could previously obtain one-time licenses to export gold, but this was associated with significant additional costs.

- On April 1, 2021, the Central Bank of the Russian Federation announced the suspension of gold purchases to fill gold and foreign exchange reserves. In fact, purchase volume has declined since the start of 2021. The policy of the Central Bank of the Russian Federation regarding the accumulation of gold and foreign exchange reserves will be discussed in more detail in the next section.

- At the end of March 2021, amid the uncertainty associated with the COVID-19 pandemic, concerns arose in the market regarding a physical shortage of gold on the New York Mercantile Exchange (COMEX). Concerns were triggered by an increase in the number of deliverable contracts, as well as an increased difference between the prices of futures on the American exchange and spot contracts in Europe.

The share of gold in the total exports of the Russian Federation is relatively small and until the end of 2019 amounted to a fraction of a percent. For comparison: the share of crude oil exports in total Russian exports until 2021 was about 30% (in the second quarter of 2021 it decreased to 20% due to falling oil prices). However, at the end of 2019 and in the second quarter of 2020, there was a significant increase in connection with the events described above; the share of gold in exports in the second quarter of 2021 increased to almost 7%.

It is likely that a similar share of gold in Russian exports will remain against the backdrop of relatively high gold prices and low oil prices, as well as uncertainty due to the COVID-19 pandemic.

Tax revenues from gold mining

Gold mining is subject to natural resource extraction tax (MET). Mineral extraction tax is a direct federal tax, so its changes are reflected in the revenue side of the federal budget. In general, the tax rate for gold is 6%, the tax base is the cost of the extracted mineral (concentrate or other semi-product containing gold).

In recent years, the cost of mined gold has remained at approximately the same level, despite fluctuations in the amount of the product mined, similarly, the amount of mineral extraction tax paid has remained at the same level - in the amount of about 4–4.5% (the percentage below 6 is due to cases of special taxation). For example, in 2021, Russian gold mining produced 747 billion rubles worth of product, which brought 34 billion rubles of mineral extraction tax to the treasury.

The share of taxes on gold mining occupies a small part of the revenues of the federal budget of the Russian Federation. For example, in 2021, the share of the mineral extraction tax on gold was about 0.56%, while almost 96% was the tax on the extraction of crude oil and natural gas. Despite the relatively constant absolute amount of mineral extraction tax paid for gold, the share of this tax in federal budget revenues has been declining over the past few years.

It is likely that based on the results of 2021, it will be possible to observe an increase in the share of gold taxes in the budget due to the increase in the cost of this precious metal and a decrease in oil prices.

Among the Russian regions for gold mining, one can distinguish the Republic of Sakha (Yakutia), Krasnoyarsk, Khabarovsk and Transbaikal territories, Amur, Irkutsk and Magadan regions, as well as Chukotka Autonomous Okrug. Together, these regions produce almost 90% of Russian gold in value terms.

The leader in the value of mined gold in 2021 (as in the previous few years) was the Krasnoyarsk Territory, where gold was mined for 160 billion rubles in value terms.

In accordance with accrued taxes, gold is the central natural resource for the Khabarovsk Territory, as well as the Amur and Magadan regions.

Table 1. Share of mineral extraction tax for gold in the total accrued mineral extraction tax by region, 2021

| Region | Mineral extraction tax for gold, billion rubles. | Mineral extraction tax for the region as a whole, billion rubles. | Share of mineral extraction tax for gold in the mineral extraction tax for the region as a whole, % |

| The Republic of Sakha (Yakutia) | 3,87 | 144,14 | 3 |

| Krasnoyarsk region | 9,29 | 273,62 | 3 |

| Khabarovsk region | 2,92 | 3,94 | 74 |

| Amur region | 2,19 | 2,55 | 86 |

| Irkutsk region | 2,72 | 173,42 | 2 |

| Magadan Region | 3,66 | 5,14 | 71 |

| Transbaikal region | 2,21 | 43,07 | 5 |

| Chukotka Autonomous Okrug | 3,22 | 15,10 | 21 |

Source: calculated based on Federal Tax Service data

Another source of federal budget revenue is taxes on jewelry manufacturers.