Dividend policy

On July 21, 2021, MMC adopted the Regulations on Dividend Policy, which is based on the following principles:

- legality;

- maintaining a balance between the interests of shareholders and the company’s development goals;

- transparency of charges.

Norilsk Nickel has established an annual payment; provided that a stable financial condition is maintained, interim dividends are paid. The final decision is made by the Board of Directors at the annual general meeting, recommendations on the amount of payments are considered by the Budget Committee.

The source of payments is the net profit of Norilsk Nickel after taxation according to IFRS. The percentage of profits allocated for payments to shareholders is not fixed (but if available, the figure is at least 30%). The final payment of dividends depends on operating profit and the current debt load. Focus on the ratio of net profit and EBITDA:

- <1,8 – 60%;

- 1.8-2.2 – 30–60% (taking into account the cyclical nature of the metals market);

- >2,2 – 30%.

It is important for MMC to maintain a high level of creditworthiness and respect the rights of shareholders. The method of receiving Norilsk Nickel dividends for 2021 - to a bank account or by postal transfer - is chosen by the shareholder independently. Current information on the dividend policy is posted on the website nornik.ru.

All company dividends for the last 10 years

Dividend payments from Norilsk Nickel are stable, the dividend strike is 10 years. MMC is the leader in dividend yield in the industry.

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | May 28, 2021 | June 1, 2021 | 12M 2020 | 1 021,22 ₽ | 3,73% | June 15, 2021 | |

| 2019 | 22 Dec 2020 | 24 Dec 2020 | 9M 2020 | 623,35 ₽ | 2,62% | 7 Jan 2021 | |

| 2018 | May 21, 2020 | May 25, 2020 | 12M 2019 | 557,2 ₽ | 2,47% | June 8, 2020 | |

| 2018 | 25 Dec 2019 | 27 Dec 2019 | 9M 2019 | 604,09 ₽ | 3,04% | 10 Jan 2020 | |

| 2017 | 3 Oct 2019 | 7 Oct 2019 | 6M 2019 | 883,93 ₽ | 5,32% | 21 Oct 2019 | |

| 2017 | June 19, 2019 | June 21, 2019 | 12M 2018 | 792,52 ₽ | 5,33% | 5 Jul 2019 | |

| 2016 | 27 Sep 2018 | 1 Oct 2018 | 6M 2018 | 776,02 ₽ | 6,56% | 15 Oct 2018 | |

| 2016 | 13 Jul 2018 | July 17, 2018 | 12M 2017 | 607,98 ₽ | 5,33% | July 31, 2018 | |

| 2016 | 17 Oct 2017 | 19 Oct 2017 | 6M 2017 | 224,20 ₽ | 2,09% | 2 Nov 2017 | |

| 2015 | June 21, 2017 | June 23, 2017 | 12M 2016 | 446,10 ₽ | 5,38% | July 7, 2017 | |

| 2015 | 26 Dec 2016 | 28 Dec 2016 | 9M 2016 | 444,25 ₽ | 4,35% | 11 Jan 2017 | |

| 2014 | June 17, 2016 | June 21, 2016 | 12M 2015 | 230,14 ₽ | 2,72% | 5 Jul 2016 | |

| 2014 | 28 Dec 2015 | 30 Dec 2015 | 9M 2015 | 321,95 ₽ | 3,44% | 13 Jan 2016 | |

| 2014 | 23 Sep 2015 | 25 Sep 2015 | 6M 2015 | 305,07 ₽ | 2,99% | 9 Oct 2015 | |

| 2013 | May 21, 2015 | May 25, 2015 | 12M 2014 | 670,04 ₽ | 6,56% | June 8, 2015 | |

| 2013 | 18 Dec 2014 | 22 Dec 2014 | 9M 2014 | 762,34 ₽ | 8,29% | 5 Jan 2015 | |

| 2012 | June 11, 2014 | June 17, 2014 | 12M 2013 | 248,48 ₽ | 3,58% | 1 Jul 2014 | |

| 2011 | 30 Oct 2013 | 1 Nov 2013 | 9M 2013 | 220,70 ₽ | 4,39% | 15 Nov 2013 | |

| 2010 | April 30, 2013 | April 30, 2013 | 12M 2012 | 400,83 ₽ | 7,77% | May 14, 2013 | |

| 2009 | May 24, 2012 | May 24, 2012 | 12M 2011 | 196,00 ₽ | 4% | June 7, 2012 | |

| 2007 | May 16, 2011 | May 16, 2011 | 12M 2010 | 180,00 ₽ | 2,51% | May 30, 2011 | |

| 2007 | May 21, 2010 | May 21, 2010 | 12M 2009 | 210,00 ₽ | 4,22% | June 4, 2010 | |

| 2006 | May 26, 2008 | May 26, 2008 | 12M 2007 | 112,00 ₽ | 1,63% | June 9, 2008 |

Norilsk Nickel announced dividends for 2021 and buyback

The Board of Directors of PJSC MMC Norilsk Nickel supported management’s proposal to minimize dividends for 2021, the company’s press release states.

The total reduced dividend payout was calculated as 50% of 2021 free cash flow. Accordingly, the final dividend recommendation was 50% of last year's consolidated IFRS free cash flow (50% of approximately $6.6 billion ) less interim dividends paid for the first 9 months of 2021 in the amount of approximately $1.2 billion.

The Board of Directors recommends that shareholders approve the payment of final dividends for 2021 in the amount of 1,021.22 . per one ordinary share. In total, it is recommended to allocate about 161.6 billion rubles to pay dividends.

Thus, at the current price of Norilsk Nickel shares is 24,400 rubles. dividend yield can be almost 4,2%.

The closing date of the register for receiving dividends is June 1, 2021. If you want to receive dividends, then the last day to purchase the company's securities is May 28.

The final decision on the payment of dividends will be made at the shareholders meeting, which will take place on May 19, 2021.

Bayback

The company also reports that its main shareholders, Interros, RUSAL and Crispian, have reached a preliminary agreement to support the buyback of Norilsk Nickel shares in the amount of up to $2 billion by the end of 2021 and to bring this issue to the board of directors.

The press release notes that the purpose of the buyback is to support the company's market capitalization. The main shareholders consider it expedient to carry it out in a situation of underestimation of the fundamental value of shares, as well as in order to create conditions for launching a long-term incentive program for the company's employees. It is planned to allocate 0.5% of the authorized capital to the long-term incentive program for the company's employees.

Norilsk Nickel shares reacted to the news with a sharp increase, approaching the level of 24,500 rubles. and adding 2.2%.

If we assume that the buyback will begin, for example, from the beginning of May, then taking into account the remaining working days, the average daily volume of purchases of MMC shares could be about 900 million rubles. in a day. The share of buybacks in the average daily trading turnover over the past year could reach about 7.8%. This is a high indicator, which means buyback can have a noticeable impact on quotes.

Despite the lower dividend, the news about the buyback is positive for MMC shares. The potential for further growth remains, especially in the scenario of implementing a plan to restore production at damaged mines.

Chairman of the Board of Directors of Norilsk Nickel Gareth Penny: “The Board of Directors welcomes the achievement of an agreement by major shareholders on such fundamental issues as cash payments to shareholders. We regard this as a serious step in the interests of maintaining the financial stability of Norilsk Nickel in the active phase of the new investment cycle. Carrying out a share buyback in a situation where their price is under pressure is a traditional tool to maintain their investment attractiveness. We believe that the difficulties the company has recently encountered are temporary and believe that the proposal to consider a buyback is made in a timely manner.”

Comment from RUSAL

RUSAL is satisfied with the decision of the Board of Directors of MMC, according to the aluminum company’s website. At the moment, this was the best option, taking into account all the features of the period, and we are glad that the opinions of the council members coincided, the message says.

Despite the fact that Norilsk Nickel's largest shareholders maintain different approaches to certain development issues.

“As one of the largest shareholders of Norilsk Nickel, RUSAL is interested in the growth of the company’s value and its technological and organizational development. We will always defend the interests of the company and its shareholders. In addition, the main shareholders agreed that in the current situation with MMC share prices, a necessary step to maintain the investment attractiveness of the shares and respect the interests of minority shareholders is to carry out a buyback,” emphasized Deputy General Director of RUSAL Maxim Poletaev.

BCS World of Investments

What dividends will be paid in 2021?

On June 10, 2019, the annual general meeting of shareholders of Norilsk Nickel was held, and on June 21, persons entitled to dividends were determined. Shareholders will be paid 125.4 billion rubles. (66.2% of net profit), RUB 792.52 per share. (yield 5.74%). At first glance, the profitability is low, but you need to consider the indicator at the end of the year.

The next dividends are planned to be paid in the fall of 2021 (closing of the register on October 1). One share will cost 796.31 rubles. (5.06%). The total payment at the end of the year will be 1,588.82 rubles, a yield of 10.8% (the maximum for the last 4 years). The amount of payments is indicated taking into account taxes withheld from shareholders in accordance with the legislation of the Russian Federation.

When will dividends be paid in 2021?

Payment to professional securities market players (asset managers, brokers, etc.) occurs within 10 days after the registry is closed. The remaining holders of Norilsk Nickel securities receive payments within 25 days. It is convenient to track accruals and the payment calendar in your free personal account on the official website nornik.ru.

Persons who purchased shares before June 19, 2021 (trading is conducted in T+2 mode) have the right to receive the next Norilsk Nickel dividends. To receive autumn payments, you must purchase shares before September 27 inclusive.

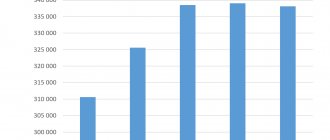

Stock return

The profitability of mining and metals industry securities is affected not only by dividends, but also by price fluctuations. Norilsk Nickel shares are flying higher and higher. Based on the results of trading on the Moscow Exchange on June 28, 2021, the cost of one share was 14,308 rubles, since the beginning of the year +28.73%. The maximum over the last 52 weeks was recorded at 14,868 rubles, the minimum was 10,174.

Factors that positively influence the share price and the amount of dividends of Norilsk Nickel:

- growth in quotations of non-ferrous metals on commodity markets;

- increased demand for MMC products due to growing demand for electric vehicles;

- good production (increased output of main types of products, modernization) and financial results at the end of 2018;

- increasing the efficiency of the production chain through the introduction of digital technologies;

- partnership with BASF (obtaining exclusive access to nickel and cobalt supplies).

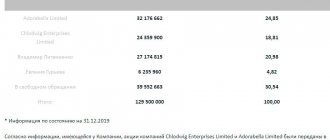

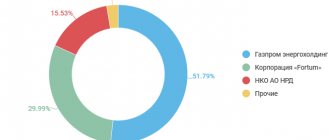

The conflict of the main shareholders has a negative impact. Vladimir Potanin (30.4%, Interros) is interested in the development of the company, which will lead to a reduction in dividends. Oleg Deripaska (27.8%) is against: he needs funds to service the debt to RUSAL.

The agreement reached expires in 2022. Another bad signal for investors is the active purchase by the majority shareholders of securities from the minority shareholders of Norilsk Nickel in order to increase their share. The risk of stock volatility increases.

Norilsk Nickel's prospects for the future

The growth of Norilsk Nickel quotes in 2021, as I already wrote, was associated with an increase in the price of palladium and copper. Palladium is primarily used in diesel engines, and demand has been driven by stricter environmental regulations in this area. Palladium and copper were in short supply, which served as a price driver.

For comparison, I superimposed the price of palladium on the chart of Norilsk Nickel shares - the blue chart. I think everything is clear and without unnecessary comments.

However, already in 2021, palladium fell in price by almost 25%, nickel by 10%, and copper by 12%. The fall in the cost of non-ferrous metals is caused both by market oversaturation and, naturally, by the crisis. Now people are much less interested in cars than in bread, milk and toilet paper.

At the same time, significant drops in prices in rubles were avoided due to the weakening of the national currency. If the ruble continues to fall more than prices for non-ferrous metals, then Norilsk Nickel will not feel losses.

This, by the way, can be seen in the graph above. Despite the reduction in palladium prices, Norilsk Nickel quotes are still going up.

As for nickel itself, it has growth potential in 2020-2021. It is actively used in the production of electric vehicles (about 50 kg of nickel is consumed for one such car).

Today, electric cars make up approximately 1% of the total vehicle fleet, and the increase in the number of electric cars is 30-50% per year. So an increase in demand for nickel is more than likely. And this will lead to a swing in quotes.

Thus, from the point of view of income, everything is in order at Norilsk Nickel. There are no special prerequisites for a serious decrease in profitability even during a crisis - on the contrary, new prospects are opening up for the company, which must be used wisely.

And here’s another interesting article: Central Telegraph dividends in 2020: a record again!

Another thing is that two mastodons continue to fight for control over the company - Deripaska and Potanin. Which of them will be able to take over is a big question, but this person will determine the entire future of the company. And it may not suit all shareholders.

In addition, the showdown could directly affect Norilsk Nickel's business - and this is not good at all.

You also need to take into account the high price of one Norilsk Nickel share. This can be a stopping factor for a novice investor.

Will you buy Norilsk Nickel shares for dividends in 2020?

- Yes, definitely 52%, 42 votes

42 votes 52%42 votes - 52% of all votes

- Already bought and keep 30%, 24 votes

24 votes 30%

24 votes - 30% of all votes

- Yes, but only after the 14% gap, 11 votes

11 votes 14%

11 votes - 14% of all votes

- No 5%, 4 votes

4 votes 5%

4 votes - 5% of all votes

Total votes: 81

13.05.2020

But in general, Norilsk Nickel remains one of the few dividend chips on the Russian stock market that did not lose value amid the crisis and did not reduce, but even increased its dividends. Good raw material base, excellent management, powerful infrastructure - what else is needed? A split would not hurt to increase the liquidity of the shares - and in general everything will be fine. I think that then Norilsk Nickel shares will appear in the portfolios of almost all shareholders, like Sberbank, Lukoil and Gazprom. Good luck, and may the dividends be with you!

Rate this article

[Total votes: Average rating: ]

How to buy shares and receive dividends

Individuals do not have independent access to exchange trading; they have to act through a broker. The process looks like this:

- Choose a broker.

- Enter into a contract.

- Top up your account.

- Buy shares of MMC (ticker GMKN).

- Wait for Norilsk Nickel dividends to arrive in your account. The payment is cleared of personal income tax: the account will receive not 792.25 rubles, but 689.25, it is also worth taking into account the commissions of the exchange and broker.

Best brokers

When choosing a broker to purchase Norilsk Nickel shares, you need to pay attention to the presence of a license and admission to trading on the Moscow Exchange, reputation and the percentage of analytical forecasts that have come true.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Warning about Forex and BO

I recommend purchasing Norilsk Nickel securities only with the help of a professional broker. Forex and binary options have nothing to do with the real stock market; it is impossible to purchase mining and metallurgy shares in this way and make money on dividends or price fluctuations.

This is analogous to gambling; there is a high probability of losing all invested funds.

A nuance with the price of shares

And everything would be fine, but there is a small nuance with the share price. As you can see, Norilsk Nickel's share price is five figures. This means that an investor with a small capital, when purchasing such a stock, risks making a serious bias in his portfolio towards non-ferrous metallurgy.

For example, if the total portfolio size is only 100,000 rubles or so, then when purchasing even 1 Norilsk Nickel share, the distortion will be more than 20%. In my opinion, this is quite risky.

So I advise you to take a closer look at a company only if you have a large enough capital so that buying shares fits into your investment strategy.