She requires to buy drug to treat male sexual function problems within the local pharmacy in Kansas on the web Cialis naturally. With great discount… This Canadian Pharmacy with a team of experienced and Licensed Pharmacists. buy cialis black Interaction with medicinal substances Contraindicated combination with drugs containing any organic nitrates (nitroglycerin, isosorbide dinitrate, isosorbide Mononitrate) multicolor-ed.com Against the background of these substances, the activity of Cialis black increases, which can cause adverse consequences. Greetings!

The market offers many investment instruments, the use of which will allow you to save and increase your investments. Sberbank Eurobonds are a mutual fund that offers a good alternative to conventional foreign currency deposits. These are debt securities denominated in a foreign currency (usually US dollars). Another name for them is Eurobonds.

Data about the Sberbank – Eurobonds fund

| Name | Open investment fund RFI "Sberbank - Eurobonds" |

| ticker isin | RU000A0JU054 |

| registration number | 2569 |

| registration date | March 26, 2013 |

| type | open |

| strategy | bonds |

| risk | short |

| commission | 2% for ownership of units from 0 to 180 days 1% for ownership of units from 181 to 731 days 0% for ownership of units over 731 days |

| Total return for 3 years | 15,88 % |

| minimum initial deposit | 1 thousand rub. |

| subsequent installments (from what amount) | from 1 thousand rub. |

| number of shareholders | not indicated |

| minimum investment period | absent |

| purchase online | There is |

| early withdrawal | There is |

Pawnshop squeezed

Corporations have to pay more than the government

It is worth noting that the reduction in the key rate affects not only bonds, but also a competing source of financing - bank loans. In recent years, the total volume of bonds issued by Russian non-financial organizations is equivalent to 24–25% of corporate loans to legal entities, or 7.25% of GDP. And it seems that no one expects the situation to change. “The market for ruble corporate bonds is growing at a rate of 12–15 percent annually and now amounts to about 14.5 trillion rubles. The maturation of the Russian financial system, lower inflation and the ability to plan for several years ahead have led to a significant development of the local debt market. Nevertheless, it is several times smaller than the direct bank lending market, which remains the main resource for obtaining funding for private corporations in Russia,” explains Dmitry Dorofeev.

It is interesting that the relatively small size of our debt market looks much more solid when compared with similar indicators for European countries. Thus, in Germany (according to Expert calculations based on international statistics), the volume of the debt market at the end of 2021 amounted to about 7% of the volume of corporate loans, for the Czech Republic - 10%. A higher indicator for Russia may indicate both less availability of bank lending, less development of financial markets, and a greater share of large enterprises in the Russian economy. They are more likely to resort to issuing bonds to raise financing than smaller companies. If we compare the volume of debt securities issued by non-financial organizations, then for Germany it is 5.42% of GDP, for the Czech Republic - 4.56% of GDP: Europe is more inclined towards bank financing. But the problem is that our bank financing, even if we consider lending by banks to each other, does not reach half of GDP, while in the Czech Republic it is 52%, in Germany - 80%, not to mention countries such as the UK or Denmark (133 and 160% of GDP respectively).

Russian bond market (as of July 1, 2021)

An important point is the cost of raising financing through bond issues: for all but the largest companies it is still high. As mentioned above, small companies and newcomers to the debt market have to pay a premium. “Large, high-quality borrowers can now borrow on the Eurobond market at a rate of 2.5–3 percent in dollars for five to seven years, while second- and third-tier companies would have to pay 4–7 percent in dollars to place Eurobonds for five years, depending on credit quality,” says Dmitry Dorofeev. “At the same time, the market remains closed to small borrowers with EBITDA of less than $100 million, who cannot borrow the minimum appropriate amount of $300 million.”

It is worth mentioning separately the Central Bank’s Lombard list, namely its reduction. It now, in addition to a number of state and municipal securities, includes securities of 76 non-credit organizations, 18 banks and mortgage-backed bonds from 19 issuers. At the beginning of 2018 there were 80, 34 and 42, respectively. The reduction is due not only to stricter requirements, but also to a general decrease in the number of banks as a result of the cleanup. “The presence of a Eurobond issue on the Lombard list is always an advantage, since an investor can always receive funding from the Central Bank of the Russian Federation through a number of first- and second-tier banks. The advantage of this option was clearly visible at the end of 2014 in conditions of increased turbulence in the market, recalls Dmitry Dorofeev. “But since then the banking system has been operating in conditions of excess foreign exchange liquidity, and the option is no longer so important.”

It is more difficult for companies listed on the first level to get on the pawnshop list; for others, it is already more difficult. “Currently, the Lombard list includes 755 bond issues, and the Central Bank is consistently tightening the rules for getting on the list. Today, companies in the non-financial non-state sector occupy no more than a third of the entire list in terms of volume,” says Alexander Zhulyaev. — From January 1, 2021, for bonds of legal entities - residents of the Russian Federation, bonds of constituent entities of the Russian Federation and bonds of municipalities, the minimum level of credit rating of the issue (issuer) is set at A+(RU)/ruA+ according to the classification of credit rating agencies ACRA / Expert RA " For debt securities issued by legal entities - non-residents of the Russian Federation, the minimum level of issue credit rating is BB/Ba2. When including these securities in the Lombard list, in addition to ratings, the conditions of their placement and circulation, as well as other material circumstances, are taken into account.”

Supporters of the development of the debt market constantly point out that the pawnshop list must be seriously expanded - otherwise our debt market will continue to fluctuate around several percent of GDP, and a significant part of companies will be cut off from long-term financing (bonds can be much longer than loans, up to to “eternal” bonds). In particular, the founder of the Rusal Group of Companies and the Volnoe Delo Foundation, Oleg Deripaska, : “Our economy is underfunded three times: GDP is 109 trillion rubles, and credit is 62 trillion. All we have left is credit: we have no bonds or IPOs, this is some kind of stone age. The country has no other problem than the development of the debt market” (see “Banks and the economy are moving further apart”, “Expert” No. 37 for 2021). But the Central Bank considers these arguments insignificant against the backdrop of its struggle for stability.

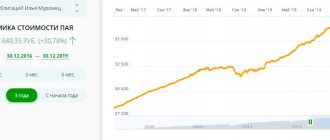

Dynamics of share value and NAV

The value of the Sberbank - Eurobonds share has grown significantly over the past three years - by 13%, while the value of net assets has decreased by more than a third. The reason for this could be a decrease in investor confidence in the fund. The cost of a share on average is approximately 2.3 thousand rubles.

Issuers in price

The beginning of September was marked by a record-breaking cheap placement of Norilsk Nickel Eurobonds: the company borrowed $550 million at 2.55% with demand four times greater than supply. This is a record low rate on dollar corporate bonds in Russian history. According to Sberbank chief analyst Mikhail Matovnikov , the reason that the best Russian borrowers can afford such rates is the interest in them on foreign markets. Veon (VimpelCom), Sovcombank Leasing and Leasing placed their issues; VEB, RRDB, VSMPO-Avisma, VIS-Holding, as well as some regions - Tomsk region and Bashkiria are preparing to occupy. Among small companies, Samara supplier of electrical products LLC Elektroapparat will offer its bonds in the coming days. For the most part, companies enter the debt market to refinance existing loans or more expensive loans.

But in general, although the market for initial placements somewhat revived in the summer, companies are not rushing to the bond market. At the same time, the demand for new issues remains - and this is what explains the rush to placements and record low rates.

As Freedom Finance bond trader Alexander Zhulyaev , the division of bonds into echelons is very arbitrary and there are no accurate statistics, but now everyone has prospects, including not only the second and third echelons, but also bonds of the HDO sector (high-yield bonds). “This is mainly determined by high demand from investors, caused by the flow of funds from banks to the stock market due to low deposit rates. It is high demand that makes rates attractive for almost all groups of issuers, regardless of the size of the issue and credit quality. The vast majority of initial placements take place at lower rates than the organizers planned,” says Alexander Zhulyaev.

True, this does not concern VDO; for them, bonds are still an expensive pleasure. “Now more and more issuers are entering the market with bond issues of a billion rubles or even several hundred million. Anton Zatolokin, head of the market analysis department at Otkritie Broker . — For small market newcomers, rates are still at the double-digit mark and are probably noticeably lower than bank loans with a comparable term. For issuers familiar to the market, the gap is insignificant, but bonds are still by their nature a more expensive tool for attracting financing than a bank loan.”

Associate Professor of the Department of “Regulation of the Activities of Financial Institutions” of the Faculty of Finance and Banking of the Russian Presidential Academy of National Economy and Public Administration Yuri Tverdokhleb adds that while the VDO market is now characterized by issue volumes of 100 million rubles, and the traditional bond market is at least 2.5–3 billion rubles, To attract a wider range of investors, the issue volume must be at least five billion.

Advantages and disadvantages

Advantages of investing in the Sberbank Eurobond Fund:

- reliability. The fund works with trusted issuers. The likelihood that they will go bankrupt all at once is extremely low;

- investors can receive daily reports on the fund's profitability and independently predict the situation based on quarterly and annual reports;

- information can be obtained at any time via the Internet;

- obtaining returns exceeding the rates of bank deposits in US dollars.

Flaws:

- imposition of additional services. If you invest in a Eurobond mutual fund in an authorized branch of Sberbank, you may encounter attempts by staff to impose additional services on you. To do this, they often resort to half-truths and deception. Apparently they get generous bonuses for this. However, if you invest online, you will be spared these inconveniences;

- not the highest return. In lesser-known funds it is often higher. However, the risk of losing your money there is much greater.

OFZ: there is room to grow

The volume of government bond issues is growing faster than corporate bonds.

The most recent available statistics do not inspire much encouragement. The volume of corporate bond placements (including bank bonds) on the Moscow Exchange decreased from 231 billion rubles in July to 130 billion in August. At the same time, the volume of government bond placements, including Central Bank securities, increased from 930 billion rubles to 1 trillion rubles. At the same time, the OFZ yield increased from 5.56% at the end of July to 5.85% as of September 9. Following them, corporate bonds included in the first-level listing had to grow from 5.97 to 5.96%; for other corporate bonds, yields increased even more.

However, further analysts' forecasts inspire some hope. “Now the yield on the OFZ index (RGBI) reaches 5.8 percent, which is 1.5 percentage points higher than the key rate. Even if the Central Bank no longer lowers the key rate, this is a lot. We can expect that with the gradual normalization of expectations for the ruble, the yield on short-term OFZs will stabilize in the range of 4.0–4.5 percent, and on the far segment of the OFZ curve - in the range of 5.5–6.0 percent, says Finam Group analyst Alexey Kovalev. — The first ruble corporate tier (bonds with ratings close to Russian sovereign) will be traded with a spread of 50–80 basis points to the OFZ curve. The remaining echelons have premiums starting from 100 basis points.”

Corporations prefer to borrow in rubles

The chief portfolio manager of Aton-Management Management Company, Konstantin Svyatny , in turn, notes that OFZ yields increased over the summer along the entire curve, the slope of the curve is the maximum since 2014. “The yield to maturity of even relatively short three- to four-year OFZs fluctuates around five percent per annum, which makes them attractive to local investors, and a reduction in geopolitical risks can attract non-residents to the market, who have been gradually reducing their market share,” he says. — Rates on deposits in banks from the top 10 fell to a historical low by the end of August, the maximum rate in Sberbank is 3.8 percent per annum in rubles. In these conditions, the increased OFZ rates are becoming interesting for individuals, even taking into account the introduction of the tax in 2021. If investors return to actively investing in the OFZ market, then with a certain time lag the influx of funds will resume in the corporate bond market.” At the same time, Mr. Svyatny fears that if sanctions risks remain on the agenda, then the growth in OFZ yields may continue and volatility will increase. And the corporate bond market will most likely remain inactive, prices will decline, and there will be few initial placements. The August statistics tell us precisely about the decline in companies' interest in new placements.

Alternatives

In addition to Sberbank, among mutual funds investing in Eurobonds, I would highlight these:

- VTB;

- Alfa Capital;

- Opening.

| Name | Total return for 3 years | commissions |

| "Sberbank - Eurobonds" | 15,88 % | 2% for ownership of units from 0 to 180 days 1% for ownership of units from 181 to 731 days 0% for ownership of units over 731 days |

| VTB | 37,30 % | up to 180 days – 2%, up to 365 days – 1.5%, over a year – 1% |

| Alfa Capital | 20,63 % | up to 180 days – 2% up to 365 days – 1% more than a year – 0% |

| Opening | 3,04 % |

|

These are mutual funds of large and reliable banks, so the risks on such Eurobonds will be as low as in Sberbank.

Investment conditions

For investors wishing to invest in the SBCB ETF, the following conditions apply:

- investment amount – from 1 share (as of March 7, a share cost 1004.5 rubles, but it will gradually increase);

- management fee – no more than 0.8% per year, charged at the end of the year;

- premiums for purchases and discounts for redemptions are not provided;

- order execution is instantaneous, trading mode is T0.

For the purchase of a share of the SBCB mutual fund, a standard broker commission is charged, which depends on the tariff you choose and the purchase volume.

When selling a share for a profit, you will need to pay income tax of 13% on the profit received. For example, if you bought a share for 1005 rubles and sold it for 1200, you must pay 15 rubles in tax on the 115 you received.

But there are at least two ways to avoid paying tax:

- hold the shares for more than 3 years - then for each year of ownership you can count on an investment deduction in the amount of 3 million rubles;

- open an IIS and use a tax deduction type B - on income.

There are no additional fees or commissions for the SBCB ETF.

Newbie

If you have decided to consider purchasing securities for the first time or are thinking about Eurobonds as an alternative to foreign currency deposits, then first it is better to thoroughly study the equipment. I will describe the main points below.

What is a mutual fund and why is it needed?

Mutual funds accumulate funds from numerous private investors and invest the received amounts on more favorable terms than if the participants invested them separately. They are a good replacement for bank deposits. Moreover, this method of investing is becoming increasingly popular.

The income from such investments can be much higher than from a regular bank deposit. And such investing is also less risky than investing in securities on your own. After all, the fund's property is managed by specialized companies. They acquire different assets, thereby reducing the risks of investors.

Advantages and disadvantages of mutual funds

Advantages of mutual funds:

Investing in mutual funds has many advantages for investors:

- a small minimum amount to enter. Often 1 thousand rubles is enough;

- all data about fund managers is always publicly available, and clients can communicate with them;

- strictly controlled by the state;

- the property of the management company is separated from that transferred to it for trust management;

- taxes are paid only when the share is redeemed;

- public availability. Anyone can invest in mutual funds.

Flaws:

- inability to make investment decisions. They rest entirely on the shoulders of the management company;

- the success of investments depends on the management company;

- unpredictable profitability;

- mandatory payment of personal income tax;

- it takes a lot of time to repay the share. This may take about 15 days;

- dependence of the profitability of mutual funds on crises and defaults. During an economic downturn, the value of shares also decreases.

Risks

The main risk lies in the possibility of issuers failing to fulfill their payment obligations. To lose money, the issuers of the Eurobonds that make up the mutual fund must go bankrupt.

What affects the risk level of a mutual fund

Unfortunately, there is no guarantee that the fund's clients will receive income. Here's what determines whether they make or lose money:

- management company experience,

- understanding of processes occurring in the economy,

- season,

- a crisis,

- Exchange Rates.

What can be done to reduce risks

To reduce risks, invest not in one, but in several mutual funds. Diversification of an investment portfolio can significantly reduce the risk of losing money in investing and thereby increases the likelihood of making money.

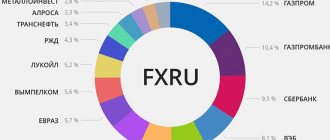

Asset composition

The full asset structure is disclosed on the official website of the VTBU mutual fund (https://www.vtbcapital-am.ru/products/bpif/vtbfcresb/structure/). Currently, the fund’s portfolio includes Eurobonds of the following companies:

- Rosneft;

- SCF Capital;

- Evraz;

- Rusal;

- VEB;

- Sibur;

- MMK;

- STLC;

- Alrosa;

- Pole;

- Lukoil;

- VTB;

- VEON;

- Alfa Bank;

- Severstal;

- Bank of Moscow;

- Gas Finance and a number of others.

And here’s another interesting article: Review of the new mutual fund SBGB from Sberbank: fund for the Moscow Exchange government bond index

In total, VBTU contains 23 Eurobonds, the weight of each is from 3% to 7%. The average weight is 4.17%, the median is 3.64%.

Diversification by industry looks like this:

The purpose of the investment policy of the management company is to ensure that changes in the settlement price of a VTBU share correspond to changes in the quantitative indicators of the Moscow Exchange Index of Corporate Russian Eurobonds (RUCEU) stock exchange index. At the same time, the management company makes an adjustment for liquidity - the original index has 60 positions (and VTBU - 23). So this BPIF cannot be called a complete equivalent of the index.

Measures taken by KBF UA LLC to ensure the fulfillment of the operator’s duties when processing personal data

Measures necessary and sufficient to ensure that KBF UA LLC fulfills the operator’s obligations provided for by the legislation of the Russian Federation in the field of personal data include:

1) appointment of a person responsible for organizing the processing of personal data at KBF UA LLC; 2) adoption of local regulations and other documents in the field of processing and protection of personal data; 3) obtaining consents of personal data subjects for the processing of their personal data, except for cases provided for by the legislation of the Russian Federation; 4) ensuring separate storage of personal data and their material media, the processing of which is carried out for different purposes and which contain different categories of personal data; 5) storage of physical media of personal data in compliance with conditions that ensure the safety of personal data and exclude unauthorized access to them; 6) carrying out internal control of compliance of PD processing with the Federal Law “On PD” and the regulatory legal acts adopted in accordance with it, requirements for the protection of PD, this Policy, local regulations of KBF UA LLC; 7) other measures provided for by the legislation of the Russian Federation in the field of personal data.

Rights of PD subjects

PD subjects have the right to:

1) complete information about their personal data processed by KBF UA LLC; 2) access to their personal data, including the right to receive a copy of any record containing their personal data, except for cases provided for by federal law; 3) clarification of their personal data, their blocking or destruction if the personal data is incomplete, outdated, inaccurate, illegally obtained or is not necessary for the stated purpose of processing; 4) withdrawal of consent to PD processing; 5) taking measures provided by law to protect their rights; 6) exercise of other rights provided for by the legislation of the Russian Federation.

General provisions

Policy for the processing of personal data in the Limited Liability Company "QBiF Asset Management"

Asset Management" (hereinafter referred to as the Policy) defines the basic principles, goals, conditions and methods of processing personal data, lists of subjects and personal data processed in the Limited Liability Company "QBEF Asset Management" (hereinafter referred to as KBF UA LLC), the functions of LLC " KBF UA" when processing personal data, the rights of personal data subjects, as well as the requirements for the protection of personal data implemented by KBF UA LLC.

The policy was developed taking into account the requirements of the Constitution of the Russian Federation, legislative and other regulatory legal acts of the Russian Federation in the field of personal data.

Profitability

Sberbank can set both fixed and floating interest rates on assets. Eurobond holders receive profit either once every six months or once every 12 months.

Today, the yield on the issuer's securities averages 2-7% per annum. This allows you not only to save money and avoid inflation, but also to increase savings, especially if you make a long-term investment.

So, today the yield on Eurobonds with a maturity of 3 years is 4.7%, but the return on assets with a validity period of 7 years is 5.8% per annum.

Eurobond selection parameters

The choice of a specific security depends on the investment strategy and goals of the individual buyer. For long-term passive investing (that is, without making transactions with securities during their validity period), Eurobonds for a period of 5 years or more, issued by the Ministry of Finance, are suitable. They will bring a stable income with virtually no risk of loss.

If a more active strategy is assumed, then it is worth determining a profitable bond according to the following parameters:

- Reliability of the issuer . Corporate securities are more profitable, but also carry higher risks. You can reduce the likelihood of losses by choosing a stable issuer (for example, a bank with state participation or the oil and gas industry, which is regularly subsidized from the budget even in unfavorable market conditions). To determine reliability, you can use the ratings of specialized agencies (for example, STLC has a credit rating of BB+ from Fitch with a “Positive” outlook (https://www.gtlk.ru/investors/ratings/); Rosneft has a BBB- with a “Stable” outlook » from S&P (https://www.rosneft.ru/Investors/instruments/Ratings/)).

- Liquidity level. Possibility of quick sale without loss in price from the face value (as a rule, this is possible during the first half of the validity period, when the future buyer will have the opportunity to receive a significant coupon income). https://bcs-express.ru/novosti-i-analitika/likvidnye-evroobligatsii-na-mosbirzhe. The most liquid bonds:

- Availability of depreciation . This is the repayment of the face value in installments on the date of payment of each coupon (a kind of analogue of a loan repayment schedule). Such a tool will enable the investor to respond more flexibly to changes in market conditions, transferring part of the invested funds into more profitable or less risky instruments. For example, STLC Eurobonds (RU000A0JY023) have amortization with a payment frequency of 91 days; from government bonds – for 10-year ones (XS0114288789).

- Taxation. Personal income tax is not levied on income from government Eurobonds. For corporate bonds, a tax of 13% on the increase in market value (upon sale) plus 13% on the coupon income may be levied.

- Profitability. The coupon rate is inversely proportional to the level of risk. Based on your investment strategy, it is worth finding the optimal balance between income and the possibility of losses.

- Possibility of default by the issuer in the event of a decrease in equity capital. This parameter is provided for by the release conditions. If such a possibility is provided, then the issuing organization has the right to write off debts in the event of bankruptcy.

How it works

Eurobonds - Eurobonds - are issued by issuers who receive a loan for business development, conducting current projects, and developing new tasks.

Depositors-investors buy bonds from a company, from the state. Established payments under the debt document occur 1-2 times a year. The price of the security is set by the market - not less than $1,000. The amount of payments is determined by the company selling the bonds. At the end of the contract, the borrower repays the loan in full.

Important! Companies trade in lots containing 100-200 securities. The final amount will be 100-200 thousand US dollars.

The average term of Eurobonds is 10 years. Some companies take out loans for 20-40 years.

Eurobonds are placed on the securities exchange, where today large Russian companies, VTB, Lukoil, and Gazprom participate.