Cryptocurrency

Cryptocurrency is a relatively young asset characterized by high volatility. You can make money on it using:

- mining;

- cloud mining;

- investments.

Each method has its pros, cons and expected income.

Read more: how to make money on cryptocurrency?

1) Mining

It is recommended to invest 100,000 rubles in video cards. It is no longer profitable to mine cryptocurrency on processors, and ASIC miners are expensive and quickly become obsolete.

Then you need to decide on the mining target. Let’s immediately discard coins from the top ten of the coinmarketcap rating. The complexity of their mining is so great that video cards do not even cover the cost of electricity.

A good option is the Beam coin. At the end of September 2021, it costs $1,459. Powered by the Beam Hash II algorithm, for which no ASIC devices have been created.

To create a simple mining farm you will need:

- Frame made of wood or metal. It costs a penny: getting wooden blocks and fastening them together is not a problem.

- Motherboard. The main requirement is the number of GPU connectors (at least 4). The average price is 5,000 rubles.

- Raisers (splitters). Provide an extended connection between the video card and the motherboard. Without them, the cards will be close to each other, causing overheating. Price - 500 rubles.

- Video cards are the basis of the farm. GeForce GTX is suitable for Zcash mining. The cost of one is approximately 30,000 rubles. With a budget of 100,000 rubles, you can afford 3 pieces.

- Power unit. Any one whose power exceeds 500 W will do. The average price is 4000 rubles.

- Personal Computer. A simple processor and 4-6 GB of RAM are enough. Most people have a computer, so we don’t include it in the calculations.

The total cost of the assembled farm is 99,500 rubles. We will calculate the payback using the cryptocalc calculator. Let’s round the price of 1 kilowatt of electricity to 6 rubles (about 9 cents). Power consumption, according to the whattomine website, will be 390 W.

Important: the likelihood of finding a block with such capacity on your own is low, so you will have to connect to the pool and give it a portion of the profit (about 1%).

Over the course of a year, the farm will allow you to earn 21,087 rubles (at the dollar exchange rate of 63.85 rubles). Return on investment is about 5 years. Unfortunately, with three video cards this is the best mining option. We can only hope for the growth of cryptocurrency.

Important: profits can either increase or decrease. Its size depends on the rate of the crypt and the complexity of its mining.

Read more: what is cryptocurrency mining?

2) Cloud mining

Suitable for those who do not want to understand the technical structure of farms or endure the constant hum of fans at home.

Its essence is this: you rent computing power, and the management company maintains it and pays electricity bills. Profit is credited to your account in your personal account, from where it can be withdrawn to any cryptocurrency wallet.

Important: there are many HYIPs on the network positioning themselves as cloud mining services. If you are offered more than 6-10% per month, then with a 99% probability we can say that this is a pyramid.

Proven cloud mining services:

- Hashflare;

- CCG;

- Genesis-mining.

The first one has temporarily suspended the sale of contracts, so you will have to choose between the remaining two.

Genesis-mining offers to rent equipment for mining Bitcoin and Dash for 1 year; other cryptocurrencies are currently unavailable. CCG has both annual and perpetual contracts (for BTC, BCH and ZEC). The cost of the latter is not much higher, so it is recommended to take them.

100,000 rubles - 1,566 dollars. Here is the calculation of profitability when renting capacity for bitcoin mining on the CCG company website:

The calculations do not take into account the fees that CCG charges for services. It is 0.00017 dollars per 1 Gh/s per day. If you rent 13,160 Gh, you will have to pay the company $2.23 daily. In total, per day you will receive not 4.28 dollars of net profit, but 2.05. The return on investment will be 764 days. This suggests that it is pointless to take out annual contracts: you will go into the red.

It can be seen that cloud mining does not currently bring tangible profits. Investors can only make money when the cryptocurrency rate increases. Renting computing equipment is suitable for crypto enthusiasts who believe in the inevitable growth of assets.

3) Investments

Investing in cryptocurrency is the most interesting option today. If you invest 100,000 rubles, then in the long term the crypto shows stable growth, and the high volatility characteristic of a young market allows you to increase the amount of your capital many times over.

Unfortunately, not all investments are successful. Some coins drop to zero and the developers stop supporting them: a scam occurs. To reduce the risk of losing funds, you need to create a cryptocurrency portfolio.

The portfolio should include:

- Oldest, most famous coins (30%): Bitcoin, Litecoin. The likelihood that these coins will depreciate approaches zero. They are the flagships of the market. Even people who are far from crypto know about Bitcoin.

- Cryptocurrencies - application platforms (30%): Ethereum, EOS, Lisk. They have growth potential due to their use in everyday life. In addition, Ethereum is the second largest currency in the world by capitalization.

- Coins that generate passive income (20%): NEO, Ontology. For storing them you will receive GAS tokens.

- Stablecoins (5%): Tether USD, PAX USD. Their exchange rate is tied to the dollar exchange rate. They are needed to protect your portfolio from market declines and position averaging.

- Privacy coins (10%) : Monero, Zcash. They adhere to the original philosophy of the cryptocurrency world - decentralization and anonymity. There is always a demand for them.

- Exchange tokens (5%) : Binance Coin, Huobi Token. They bring real benefits to their holders: they reduce commissions when trading on the exchange, they allow you to participate in IEOs and Airdrops.

One of the cryptocurrency portfolio options:

| Cryptocurrency | Portfolio share, % | Price for 1 coin, rub.* | Investment amount, rub. | Number of coins in the portfolio |

| Bitcoin | 30 | 638012 | 30000 | 0.04683039 |

| Ethereum | 20 | 13567 | 20000 | 1,47 |

| EOS | 10 | 251,53 | 10000 | 39,65 |

| NEO | 10 | 586,64 | 10000 | 17,02 |

| Ontology | 10 | 50,67 | 10000 | 197,12 |

| Monero | 10 | 4589 | 10000 | 2,17 |

| Tether USD | 5 | 64,26 | 5000 | 77,73 |

| Binance Coin | 5 | 1328,05 | 5000 | 3,78 |

*price is indicated as of September 22, 2019

Stocks and bods market

To invest 100,000 rubles in securities , the first thing you need to do is enter into an agreement with a broker. One hundred thousand rubles is enough to open an account in any Russian company. When choosing an organization, there are several factors to consider:

- the amount of commission for completing a transaction;

- depository fee;

- account servicing conditions;

- reliability of the company.

The latter is a fundamental factor. Your funds will not be lost even if the broker goes bankrupt, but choosing it wisely will help you avoid paperwork and wasted time.

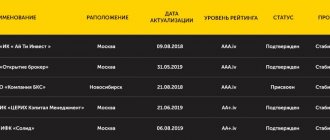

Reliability is determined by the National Rating Agency. According to him, the list of the best Russian brokers looks like this:

The investor must enter into an agreement and replenish the account with a certain amount. After which he gets access to the terminal (Quick or MetaTrader) and can make transactions. The main financial instruments are stocks, bonds and ETFs.

Important: depending on the preferences and strategy of the investor, instruments can be combined with each other, creating a diversified portfolio. It is not necessary to invest all your money in one type of paper.

1) Bonds

Bonds are conservative securities. They are like a promissory note: the investor gives money to the company, and it undertakes to return it with interest.

Despite the relative safety, there are also risks in bonds. They are associated with the bankruptcy of the issuer: if the company that issued the paper stops paying its debts, then it will have to part with the money.

In order to reduce the likelihood of losing funds, it is necessary to distribute them between two types of bonds:

- corporate;

- state

The first ones are issued by companies and offer an increased percentage. The latter are created by countries or their subjects. Earnings from such securities are less, but they are considered the most reliable.

Important: when investing in bonds, the main thing is not to forget that profit is formed from two parts. This is the coupon income and the difference between the purchase and sale prices (if you decide to sell the security before the maturity date). The first part is predetermined, but the size of the second is unpredictable.

A sample bondholder portfolio should look like this:

| Bond name | Bond type | Nominal value, rub. | Price of securities on the stock exchange, rub.* | Annual return, % | Number of securities in the portfolio |

| OFZ 25083 | State | 1000 | 1009,4 | 6,63 | 25 |

| OFZ 26217 | State | 1000 | 1017,1 | 6,59 | 25 |

| VEB PBO-001R012 | Corporate | 1000 | 1030,03 | 8,85 | 10 |

| Promsvyazbank BO-08 | Corporate | 1000 | 1054,48 | 9,2 | 10 |

| Alfa-Bank 002Р-02 | Corporate | 1000 | 1036,12 | 8,84 | 10 |

| Solid-Leasing-BO-001R-01 | Corporate | 1000 | 1001 | 14,12 | 10 |

| MigCredit-BO-01MS | Corporate | 1000 | 1021 | 15,57 | 7 |

The total investment amount will be 99,027.2 rubles. The average return on the compiled portfolio is 8.963%. In a year you will be able to earn 8875 rubles in net profit.

2) ETF

For diversification, you can invest 100,000 rubles in an ETF. ETFs are securities of investment funds. They include hundreds of companies, which allows the investor not to think about diversifying his assets.

There are two classifications of funds:

- by currency (ruble or foreign money);

- by asset type (stocks, commodities and bonds).

There are 16 ETFs traded on the Moscow Exchange from two providers: FinEx and ITI Funds.

Average ETF returns over the past year are:

- shares - 1.4%;

- bonds - 11.1%;

- gold - 18.83%.

The low profitability of the stock fund is caused by the negative situation on the world market. Don't get hung up on low numbers. In the long term, stock ETFs are the most profitable.

Economists advise not to neglect gold ETFs and keep at least 10% of your capital in it. The remaining funds can be distributed at your discretion: for example, 50/50 between stocks and bonds.

ETF quotes on the Moscow Exchange 09/22/2019

Those who invested 100 thousand rubles last year as follows received:

- 1883 rubles from gold ETF;

- 4995 rubles with bond ETF;

- 630 rubles from share funds.

The total profit was 7,508 rubles or 7.5% of the initial capital.

3) Promotions

You can invest 100,000 rubles in shares. Stocks are high-risk securities. The investor buys a certain share in the authorized capital of the enterprise and becomes a full co-owner of the business.

Based on the type of profit received, shares are usually divided into two categories:

- height;

- dividend.

In growth bets, the bet is made on the increase in the price of the paper. Most often, shares of young, undervalued companies fall into this category, but sometimes well-known companies also add value.

Blue chip stocks are considered dividend-bearing. These are large-cap companies that consistently share profits with their investors.

Forbes magazine analyzed the Russian stock market and compiled a table of returns on domestic stocks over the past year:

The first lines of the rating belong to oil and gas companies. Some of them made it possible to earn more than 60% of net profit, which is considered an excellent indicator in the securities market.

Important: this table should not be regarded as a guide to action. It is not a fact that companies that showed good results last year will be able to maintain the bar.

You cannot invest all your money in one industry. If the price of oil falls, you may lose a decent portion of your capital. It is recommended to distribute funds between these shares:

- Tatneft (privileged);

- Novatek;

- Alrosa;

- Surgutneftegaz;

- Severstal;

- NorNickel;

- Rostelecom;

- NLMK.

The formed portfolio performs two functions. Firstly, it allows you to get a high profit from dividends at the expense of Tatneft, Severstal and Surgutneftegaz. Secondly, it distributes money across different industries: oil, gas, diamonds, metalworking and the IT sector.

It is impossible to predict stock quotes, but the average dividend yield of the portfolio will be 14.375% or 14,375 rubles .

Of course, if firms do not reconsider their fund distribution policies.

How to invest your savings so that they make a profit - TOP 5 “golden” rules of investing

Before deciding where to invest 200 thousand rubles or a larger amount, you need to improve your level of financial literacy. Otherwise, you will not be able to make a profit from your investment.

- Clearly define your investment goal What do you want from an investment? Quickly increase capital by 1.5-2 times, protect savings from inflation or ensure a comfortable old age? Each financial goal has its own tools.

Example. You can invest half a million rubles in your business to buy an apartment in 1-2 years. The second option is to divide the amount into several parts, and then purchase securities, precious metals and shares in a mutual fund. Then in 15-20 years you will have a good pension that does not depend on the state.

- Don't put all your eggs in one basket Smart investors never invest in one direction. After all, in this case there is a risk of losing all your money. When deciding where to invest 500,000 rubles, it is better to distribute the funds into at least 2-3 areas. The larger the amount, the more diverse your investment portfolio should be.

- Invest in areas that you are good at. This is the main rule of Warren Buffett, one of the richest people in the world. To make a profit, you need to understand the market in detail. For example, it is better for art historians to invest in collectible objects, for engineers - in technology companies, and for IT specialists - in cryptocurrency and IT startups.

- Do not refuse the help of professionals Financial consultants, trustees, appraisers and other experienced market players know where to invest 300,000 rubles, five hundred and even a million. They usually offer clear and profitable instruments: shares, PAMM accounts, ETF funds. For beginners who want to earn a lot of money, it is better to start investing with these methods.

- Constantly learn If you want to know in a month where to invest 300,000 rubles, start educating yourself right now. After reading this article, check out professional investing literature.

Advice. To get started, we recommend reading books about the basics of investing: B. Graham “The Intelligent Investor”, V. Savenok “Create Your Personal Capital”. There is a large list of literature in the publication on investing for beginners.

Precious metals

Precious metals have always been considered the safest way to invest money. Investments in them allow you not to worry about the safety of funds during a crisis, but they can bring income only over the long term.

You can invest 100,000 rubles in:

- ingots;

- impersonal metal account;

- investment coins.

Jewelry with such capital is not worth considering. The copies presented in chain stores have no aesthetic value, and collectible items are very expensive.

Payment systems that do not have withdrawal limits

As can be seen from the previous table Wiki Masterforex-V, withdrawal limits are not set in Google Pay, Apple Pay, Samsung Pay, Shopify, Eleksnet, Moment, Money online, Perfect Money, Prostir, Alipay, Robokassa, Altyn Asyr, Unified Cashier, Cloudpayments , ePaymants, Paymaster, Payu, Frisbee 24, Payanyway, Pay pro, PayOnline, ATF24, RBK Money, Fondy, Interkassa, Rapida.

The limits of payment systems can vary quite significantly. But there is a general rule: for users who have not passed the verification procedure, the limits are usually lower. However, there may be no restrictions for verified users.

Hype

HYIP is a highly profitable investment project. It can bring more to its investors than any other financial instrument.

It is worth understanding that hype projects do not engage in real activities. Payments are made from proceeds from new depositors. In other words, hype is a financial pyramid.

There is no need to fear this word like fire. Many people know how to make money from HYIPs and get much more from them than from their main job.

For those who are thinking about where to invest 100,000 rubles, we have created our own hype monitoring:

19.02.2020

Investment projects 0 2 053

Roy Cash Club Review

Roy Club is a new way to earn money on the Prizm cryptocurrency with a yield of up to 30% per month.

07.01.2020

Investment projects 0 2 012

Review of Prizm Space Bot - making money on the Prizm cryptocurrency

Reviews and review of Prizm Space Bot. How to use it to earn up to 27% per month?

30.09.2019

Investment projects 11 1,347

Review of the legendary Wise Deposit

Review and reviews of Wise Deposit. I added the stable project Weiss Deposit to my portfolio. Endless passive income through a loop. Deposit bonus +6%.

13.08.2019

Investment projects 11 2 948

Review of ITN Group Ltd. My investment and review of the project.

Overview of the ITN Group company. Why is it worth investing in itn.ltd? How much can you earn? My reviews.

Drawing conclusions

An income of 20,000 rubles a month is not very much money. This amount may seem huge only for those who live on a salary. No matter how valuable an employee you are, the company owners will not pay employees such a large sum.

To become a wealthy person, you need to adhere to these simple rules:

- Work hard and a lot, but only for yourself, and not for “uncle”;

- Immediately invest 50% of your income in developing your business;

- Hire employees, since one person cannot physically do all the work;

- Build the structure so that each department has its own leader.

- The owner of the company does not have to deal with every employee;

- If you have managed to establish stable work, you can hire a manager and go about your business.

When your business is at the peak of development and prosperity, you can think about opening another business. In simple words, constantly create assets, that is, something that can bring you profit. With competent experienced management, you will know exactly where to earn 200,000 in a day. And this is not the limit. Some companies generate tens of millions in revenue per year. Remember that life is movement, so you can’t sit in one place. You should not waste your energy and time on enriching others. Work only for yourself and you will definitely succeed.

Forex

Forex is an international currency market. You can make money on it in two ways:

- trading;

- PAMM accounts.

Each method implies a different approach to working and choosing a broker. Let's look at them in a little more detail.

1) Trading

Access to the market is provided by intermediaries - brokers or dealers. To avoid problems, it is better to use the services of companies with an official license from the Central Bank of the Russian Federation. At the moment, only four legal entities have received it:

- Alfa-Forex;

- VTB-Forex;

- PSB-Forex;

- Finam-Forex.

The minimum transaction amount is 1000 currency units. One hundred thousand rubles is enough to purchase any lot.

Important: Forex trading is carried out with leverage. If a trader does not know how to predict market movements, then the risk of losing the deposit is close to 100%.

The possible profit from trading is impossible to calculate. It depends entirely on the abilities of the trader and his experience. The average trader’s earnings are 5-10% of the deposit amount. Some can “work miracles” and increase the initial capital tenfold in 1 month.

Important: about 15% of stock speculators trade in profit. The rest receive losses. To be among the “lucky ones”, you need to spend time studying literature on technical, fundamental analysis and the psychology of crowd behavior.

2) PAMM accounts

PAMM accounts are created for those who do not understand anything about trading. Transactions are made by another trader, for which he takes part of the profit (usually from 40 to 60%).

Russian legislation prohibits brokers from having PAMM accounts. Those wishing to invest 100,000 rubles in them will have to enter into an agreement with other organizations. The following companies have proven themselves well:

- Alpari;

- Roboforex;

- InstaForex.

You cannot trust money to the first trader you come across. You will need to analyze the account history and evaluate its trading strategy. It is customary to distinguish 2 types of accounts:

- aggressive;

- conservative.

Important: sometimes managers declare an aggressively conservative way of trading. To simplify things, we will classify such traders as the first category.

The difference between the accounts is as follows: aggressive ones bring the investor an income of hundreds and thousands of percent, but there is a high risk that the trader will reset the deposit. The income from conservative ones is less, but the risks are proportionally reduced.

Since Forex itself is a risky instrument, it is recommended to give 80% of the deposit to conservative managers and 20% to aggressive ones.

Each dealer has hundreds of PAMM accounts. A brief analysis shows that the average annual profitability of conservative ones is 27%, and aggressive ones are about 700%.

Important: as in any market, a manager's past transactions do not guarantee future profits.

Those who distributed money in the recommended proportion last year received 21,600 and 140,000 rubles in profit, respectively. The final profit is 161,600 rubles or 161.6% of the initial capital.

Some dealers offer to invest in pre-formed PAMM portfolios. They include several dozen accounts and free the investor from manual diversification of assets.

Examples of PAMM portfolios on Alpari and their profitability over the past year:

- Euro_Team - 68.6%;

- Russian Rockets 777 - 57.7%;

- American World - 74.2%;

- Grow Up - minus 7.2%;

- Prophet Portfolio S - minus 3.3%.

The average income from the formed portfolios is 38% per annum.

Don't speculate

The task is not to take on excessive risks, leverage and not to speculate if there is no experience and knowledge of trading. Portfolio rebalancing - changing the structure, selling/purchasing new assets is required, but not more than once every six months.

In the current portfolio approach, there is no need to do things like: we bought a couple of assets, they rose in price, we need to take profits, or, on the contrary, we sell during a drawdown.

We work for the long term, so we plan the process for ten years; any changes in the portfolio should be made no more than once every six months. There's plenty of that.

6. Modern art movements

Art is a unique world where a lot of money circulates. Access to the market of antique works and creations of famous masters is closed to ordinary investors. You will need to invest much more than one hundred thousand rubles.

The solution is to buy paintings by novice artists. Proper selection of an investment object allows you to earn from 80 to 500% per annum. Gallerist Rebecca Wilson has compiled a list of attractive artists with inexpensive works. Here are a few in which you can invest 100,000 rubles:

- Ben Gooding, USA. Studied at the Cambridge School of Art. His canvases feature unusual patterns. The price of paintings starts from 1 thousand dollars.

- Claire Price, UK. He writes in the style of abstract art. Despite her young age, she managed to receive a prestigious award in the field of art - Acme Jessica Wilkies. The cost of paintings starts from 1 thousand dollars.

- Michael Covello, USA. Studied at Cornell University. The canvases depict intricate geometric shapes and color images. Sells paintings in the range from 650 to 3 thousand dollars.

One of Ben Gooding's paintings

You need to look for paintings by artists at online auctions. Some of them have profiles on specialized sites. On saatchiart you can contact Ben Gooding and commission work from him.

The advantages of investing in contemporary art are:

- protection against inflation;

- additional diversification of your portfolio;

- good profitability.

Minuses:

- Long-term investment. You can count on profit only after a few years.

- Risk of property damage. No one is safe from fire or flood. Paintings damaged in them will cease to interest collectors.

- Low liquidity. You won't be able to sell a painting quickly. You will have to find a fellow art connoisseur, negotiate a price with him and finalize the deal. Sometimes this process takes years.

Interesting: the price of a painting is greatly influenced by the popularity of the artist. The paintings of the Russian author Oleg Dou were sold for a thousand dollars until his work appeared on the cover of a London magazine. After this, the price of his creations instantly soared 6-7 times

Semiprecious stones

The first option is to invest 200,000 rubles to earn money. Semi-precious stones are stones that do not reach the “precious” level in price due to their prevalence, unattractive appearance, or lack of strength. However, they are widely used in industry and jewelry, so the demand for them is constantly growing.

The term “semi-precious” is used only in the CIS. Scientists gemologists around the world call such minerals jewelry or jewelry-ornamental.

They are usually divided into two classes:

The higher the class, the higher the price of the mineral. Also, the cost depends on the purity, size and mechanical strength of the stone:

| Name of the stone | price, rub. |

| agate | from 800 |

| aventurine | from 500 |

| turquoise | from 1600 |

| pomegranate | from 900 |

| nephritis | from 1700 |

| tourmaline | from 1000 |

| chalcedony | from 700 |

| tanzanite | from 700 |

Features of the jewelry stone market are long-term investments and low liquidity. Minerals are specific products, so finding a buyer may take several months.

Examples of semi-precious stones

Important: it is recommended to buy large stones. Their prices are higher and they rise in price faster. It’s better to invest 200,000 rubles in one or two rare minerals than to waste money and buy small change.

If you invest 200,000 rubles, the return on investment cannot be predicted, but data for the last 26 years is encouraging:

- white opal - the price has increased 14 times;

- red tourmaline - 30 times;

- green tourmaline - 67 times;

- blue aquamarine - 6 times.

You can buy stones:

- In the Internet. The buyer has two options: use the services of specialized companies or take a closer look at the offers on the pages of online stores. There are also auctions, but they sell rare minerals with prices of several thousand dollars.

- Offline. People from small towns will have to be content with the shops of local jewelers. Residents of Moscow, St. Petersburg and Yekaterinburg can visit exhibitions, although they are held only a few times a year.

Important: do not take a large batch for the first time. Buy 1-2 stones and take them for examination to check the quality. It’s better to pay a couple of thousand and sleep well than to find out when selling that your stones are useless pieces of glass.

Mutual funds

Mutual Fund is a financial instrument for people without experience. There is no need to compile a portfolio or revise it; this is handled by the management company. You just need to purchase a share and receive passive income.

Important: the rating does not guarantee that mutual funds will earn the same amount next year. It is designed to evaluate the past performance and competence of managers.

The average yield of top mutual funds is 26.5% per annum.

The cost of a share in VTB and Sberbank is 1000 rubles. You will have to pay 50,000 for a share in other funds. Based on this, we will form a portfolio:

- BKS Precious Metals - 50,000;

- VTB Oil and Gas Sector Fund - 10,000;

- Sberbank Natural Resources - 10,000;

- VTB Moscow Exchange Index - 10000;

- VTB Share Fund - 10,000.

Important: 50,000 rubles were given to BCS, since their fund invests in the most stable asset - precious metals.

Please note that mutual funds charge a commission of 1% when replenishing your account. It turns out that not 100,000, but 99,000 rubles will be in work.

The potential return of the formed portfolio is 26.87%. In 1 year it will bring 26,601 rubles . If an investor wants to sell shares, he will have to pay:

- The withdrawal fee is 1% of the amount (1256 rubles).

- Profit tax - 13% (3458 rubles).

You will have 120887 on hand. The final profit is 20.88% of the initial capital.

Startups

There are crowdinvesting platforms for investing in startups. You can invest 100,000 rubles in one of four sites:

- StarTrack;

- Alpha Stream;

- Penenza;

- SberCredo.

Each of them conducts a thorough analysis of projects before placing them, but even this cannot mitigate the risks. According to statistics, every tenth startup goes bankrupt and stops paying off debts.

The differences are as follows:

- An approach to diversification of funds . In StarTrack, SberCredo and Penenza, investors choose companies to invest in. Alpha Stream takes care of this. Platform specialists form a portfolio of several dozen companies and distribute money equally between them.

- Minimum deposit amount . StarTrack - 100 thousand rubles, Penenza - 5 thousand, Alfa Stream and SberCredo - 10 thousand. It turns out that when investing on the StarTrack site, the investor does not have the opportunity to distribute funds.

- Return on investment. The average profit in Penenza is 26% per annum, in Alfa Stream - 20%. Startrack does not advertise investor returns, but according to reviews from the network, it is approximately 23%. It’s too early to talk about SberCredo: the platform appeared quite recently and has not had time to show itself in action. But Sberbank analysts claim that investors can receive from 16 to 22% per annum.

Investors can go two ways. Entrust all funds to the giant of the Russian crowdinvesting industry - the StarTrack platform, or distribute them equally between Penenza, SberCredo and Alfa Potok. The second option is preferable.

The expected average return is 20.76%. In 1 year, 100 thousand rubles will turn into 120,760.

Important: you must pay 13% tax on profits. After this, the investor will have in his hands not 120,760, but 118,061 rubles.

Real estate company

If you open your own real estate agency, you will understand how to earn 200,000 rubles in a week literally out of thin air.

Realtors receive 2% from each transaction. When a potential client is made aware of this, he easily agrees to pay such a commission because he believes that it is a small thing. In fact, this is quite a lot of money. Nowadays, apartments cost about 3 million rubles, respectively, a realtor is paid approximately 60 thousand rubles from each transaction. Professionals can carry out 3-5 transactions per week. So do the math. In fact, no serious work needs to be done. The realtor draws up the contract and takes a turn at the registration chamber. For this he receives good money. Typically, such a company employs 3 people. They receive a certain percentage of the transaction. As a rule, this is 100 thousand rubles per month.

Bank deposit

The most conservative way to invest. The investor knows in advance when and how much he will receive. In addition, the money is insured by a government agency. They will be paid anyway.

The rule “the lower the risk, the lower the interest” works here too. Banks accept rubles at 7% per annum with the official inflation rate of 5%. Making a million takes a lot of time and patience.

1) Ruble deposit

The average interest rate in Russia is 7%. When choosing a deposit, you should give preference to accounts with monthly interest capitalization. Let's calculate profitability based on these data:

| Investment term | Account amount | Interest |

| 5 years | 141 769,81 | 41 769,81 |

| 10 years | 200 965,83 | 100 965,83 |

| 15 years | 284 894 | 184 894 |

| 20 years | 403 872,64 | 303 872,64 |

Over 20 years, the initial deposit will increase by 303.8%. The effective interest rate will be 15.19% per annum. However, the calculations do not take into account inflation, which makes serious adjustments to them.

Important: the real return on deposits does not exceed 2%. It turns out that in 20 years, your 303,872 rubles in interest will buy the same amount as 49,132 now.

2) Currency deposit

Banks offer their clients to open an account in dollars or euros. Exotic currencies are rare, so there is no point in considering them.

The peculiarity of deposits in foreign currency is their dependence on exchange rate fluctuations. The investor may receive additional profits or incur losses.

Important: Russian investors should not worry. History shows that the ruble is constantly becoming cheaper relative to other currencies.

The main reason for the strengthening of the currency is low inflation in Western countries.

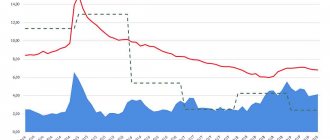

It can be seen that over the past 20 years the dollar has lost only 53% in value. The Russian currency depreciated by 592% over the same period. Conclusion: over the long term, dollar deposits perform better than ruble deposits.

100,000 rubles - 1,566 dollars. The average interest rate on foreign currency deposits in Russia is 2% per annum. To invest with maximum benefit, select a deposit with monthly interest capitalization.

| Investment term | Account amount | Interest |

| 5 years | 1730,57 | 164,57 |

| 10 years | 1912,41 | 346,41 |

| 15 years | 2113,38 | 547,38 |

| 20 years | 2335,48 | 769,48 |

Create an airbag

Before you invest anywhere, you need to make sure that you have a financial cushion that can cover your family’s expenses for 3 to 6 months. A safety net is necessary in a situation where there is no stable source of income. In order not to withdraw money from investments, funds for needs must be at hand. The best option is a bank deposit.

In addition, if there are loans, they must be repaid immediately. These are additional investments that can be used to purchase shares or other instruments. In general, it is difficult to work with investments and pay off the loan at the same time.

Antiques

You should not invest in dishes, furniture and figurines. Now prices have dropped noticeably and it will not be possible to recoup your investment soon. In addition, worthy antiques are expensive, and mass-produced pieces have no collector's value.

However, there are several options where to invest 100,000 rubles:

- Soviet posters. Posters from the Second World War are especially prized. You can buy them at auctions and in specialized online stores. The price starts from several thousand rubles.

- Old or limited edition books. The works of Russian classics and poets are popular among collectors.

- Items from the late USSR. For us this is rubbish, but for foreigners it is a rarity. Soviet items on ebay are in great demand.

Interesting video with examples of old Soviet items sold on ebay in 2021:

Business Investments

Your own business opens up endless opportunities for profit. You can invest one hundred thousand rubles in different ways:

- Create your own production . Of course, there is no talk of opening a plant. But it’s possible to organize a home mini-bakery or pizzeria with this money.

- Get into trading . Reselling goods will never go out of style. It is enough to buy something cheaper and sell it more expensive. The main source of products is China. It is best to implement it via the Internet; renting a room will eat up a good half of the budget.

- To provide services. It doesn’t matter what it will be: a cleaning company, legal advice or an agency for organizing holidays. The main thing is that the company generates income.

Important: according to statistics, 7 out of 10 Russian entrepreneurs fail. To avoid problems, try not to use loans and start a business with free money.

Investment rules

You can have a lot of really good ideas on where to invest your money, but just a couple of wrong actions can make you bankrupt. That is why some nuances should be taken into account.

Before you make a contribution, you need to develop a business plan. It should contain the following items:

- over what period of time how much profit do you plan to receive;

- all existing risks; when considering types of investment, we indicated general risks, but you need to consider a specific direction of earnings and analyze it from all sides;

- the ability to withdraw money at any time - the amount of risk also depends on this.

If you are not sure about the correctness of your choice, do not invest the entire amount at once, but divide it into parts and invest each differently. Also, always take into account legal restrictions; they are one of the biggest barriers to novice investors.