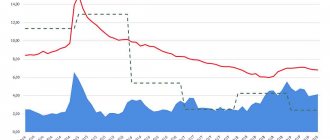

Today, Russians want to earn more than what bank deposits can provide, but at the same time they are not ready to take much risk. The optimal investment option in this case is an individual investment account with VTB. You can manage assets in an investment account yourself or by transferring authority to a manager. The main advantages of VTB for private investors are the reliability of the bank itself and favorable tariffs.

Promotions for training from Tinkoff

Open an account

General conditions of cooperation with VTB

Any individual who has reached the age of majority can sign an agreement with a broker. Moreover, an individual investment account at VTB, as in another office of a broker or management company, is opened exclusively for citizens of the Russian Federation.

Other conditions include:

- settlements on IIS are carried out only in Russian rubles;

- annual limit on balance replenishment – 1 million rubles;

- To receive tax benefits, at least 3 years must pass from the date of opening the account. If money is partially or completely withdrawn, the IIS is automatically closed, but at VTB you can withdraw accrued dividend income to a bank account;

- funds or assets placed on IIS are not subject to DIA insurance.

Important: Brokerage services are not provided in every VTB operating office. You can find out which branch you need to contact through a single call center 8-800-33-324-24.

The broker does not set a minimum entry threshold - you can start trading with any amount. This allows you to enter the market even with small capital.

Let's summarize: what are the benefits of a VTB individual investment account?

IIS from VTB is a modern and profitable financial instrument for both a person with small savings and a large investor. In addition to consistently high and reliable returns, it provides a unique tax deduction scheme. Thirteen percent of the annual investment or complete exemption from personal income tax after 3 years of using the account is an obvious advantage of the program.

VTB provides everyone with a wide variety of strategies and fund packages. All that remains is to choose the best option for yourself, open an investment account and start earning money.

Tariffs valid for 2021

This year, the VTB broker is providing clients with several tariff plans.

"My online":

- The fee for carrying out financial transactions by a broker, including when purchasing currency on an individual investment account at VTB (on the Main Market financial platform) is 0.05% of the total turnover*.

- Storing assets, conducting settlement transactions - no commission.

- Submitting trading and non-trading orders to a broker (at a service branch or by telephone) – 150 rubles. for each** application.

"Investor standard":

- Standard bank commission*,** 0.0413%.

- With the package the fee will be 0.03455%.

- With the Privilege package the commission is 0.03776%.

"Professional standard":

- The standard commission is calculated based on the total volume of funds in circulation. For individual investment insurance – up to 1 million rubles, the fee will be 0.0472%.

- Within packages or “Privilege” the most favorable tariff is 0.04248%.

* Exceptions: OFZ-N, mutual funds, transactions with short-term securities with a circulation period on the financial market of up to 7 days.** Except for applications for OFZ-N.

The VTB depository fee will be 150 rubles. per month. This is the base rate; if an investor purchases bank shares, the tariff is reduced to 105 rubles. If there is no movement on assets, no payment is charged.

DEPO accounts account for all securities - documentary and non-documentary, emission and non-equity, foreign and Russian.

Through IIS, transactions are carried out on behalf of the owner, but by a broker. Since unqualified investors are prohibited from independently trading in the stock market.

The exception is the presence of large capital, however, this does not apply to IIS, with a limit of 1 million rubles.

UK products

The company offers tools for various tasks: preserving capital from inflation, creating pension savings, increasing passive income. I'll look at the main ones.

Mutual funds

A mutual fund invests the funds of shareholders (unit holders) in a diversified portfolio of assets (stocks, bonds, currencies, precious metals, real estate) for a certain fee (commission).

The management company uses conservative strategies with minimal risk (Unit Fund of bonds "Treasury"), aggressive (Unit Fund "VTB - Consumer Sector Fund", Prospective Investment Fund), moderate strategies (Unit Fund "Balanced").

DU

With trust management, a team of analysts, risk managers, managers and lawyers develops an individual investment strategy for selected assets, supports the client with analytics, and generates reporting. The management company provides access to premium tools.

More

For experienced investors, VTB Capital offers investments in exchange-traded funds (ETFs). Unlike conventional mutual funds, the profitability of investments depends on the success of trading on the stock exchange. Exchange-traded mutual funds show greater profitability, but the degree of risk also increases.

Closed-end venture capital funds (high risk). The validity period of the instrument is 5-10 years, but the fund is closed only after the return of the invested funds with a premium. The management company invests money in the purchase of LLC shares and shares of young companies.

The risk of such investments is maximum, since there is a high probability that the project will fail, but it pays off with potentially unlimited profitability.

For wealthy clients, the management company develops an individual portfolio of assets based on an analysis of their financial goals and risk appetite (recommended entry threshold is 15 million rubles).

Real estate funds invest shareholders' funds in real estate. The profitability of a portfolio investment consists of rent and growth in market prices for real estate. The investor is freed from the need to directly manage the object and monitor its condition, which significantly saves the shareholder’s time.

VTB Capital Management Company manages pension savings. The purpose of a non-state pension fund is to invest funds in order to increase the savings of a future pensioner (in excess of real inflation).

For institutional investors, VTB Capital offers management services for funds of non-state pension funds, insurance and investment companies, and legal entities.

Opening an account in the office

When contacting a bank operating branch, you need to have with you:

- Russian Federation passport.

- SNILS.

- TIN number or original certificate.

When the procedure for registering an investment account with VTB is completed, the investor will be given:

- One copy of the application form and all applications.

- Notification of the opening of a personal IIS, as well as an extract with personal details.

- An unnamed plastic card with a secret PIN code for it.

- A special scratch card on which the login and password for the IIS are hidden under the coating.

Alternatives

If you have trust only in government agencies, I recommend Sberbank Asset Management. The company ranks first in the market of open mutual funds and has received state licenses. The disadvantage of the organization is commissions up to 7%. With long-term investments, they eat up a significant part of the investor's profit.

For those who are focused on capital growth, I suggest. Investments in mutual funds provide returns of up to 80% over a three-year period. Investments are available through the mobile application.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

How to become an investor online

If an individual is already a client of a banking institution, an account can be opened via the Internet using the VTB Online personal account.

Step-by-step instruction:

- go to your profile on the website https://online.vtb.ru;

- go to the block dedicated to investments;

- click on the “open brokerage account” button;

- check the correctness of your personal data and click “Everything is correct” or make changes by clicking on the “Data has changed” button.

Next, following the system prompts, the bank client can independently open an IIS via the Internet. After this, the brokerage account will be displayed in your personal account in the “Savings” section, next to savings accounts and deposits.

Additional proof of identity is not required because when a credit or debit card is issued, the individual is already authorized.

A master account and a current account are opened automatically. Documents are signed by entering a secret code from SMS messages.

What is IIS and their classification

IIS is an account for transactions with securities on the stock exchange, but no one can guarantee that transactions with them will be profitable. My readers know that trading in the markets without brokers is impossible, and a completely logical question arises: is it possible to open an individual investment account without a brokerage account. In fact, both IIS and brokerage are the same accounts, and only one of them is enough to work. But the brokerage has more options, both in the amount and in the list of supported currencies.

IIS is one of the ways to diversify your investments.

Speaking about the main types of accounts, I will note the following:

- standard (available since 2015);

- for trust management.

A qualified investor is familiar with such concepts, but for a beginner it is important to learn in advance all the features of the IIS tax policy in order to save money on costs and get more profit.

How to deposit money into an IIS: all methods

You can deposit funds into your personal account through your online account as follows:

- in the main menu, go to the “Savings” block and click on the brokerage investment account;

- on the page where the details are displayed, select the “Top up” option;

- indicate the replenishment amount, financial platform (for example, Main Market or Derivatives Market, etc.).

The transfer is made from a current or master account, which must first be topped up:

- Through a mini-office or ATM, depositing money on the card.

- Through the cashier-operator of VTB Bank.

- Interbank transfer from a card account or current account in another banking institution in the Russian Federation.

IIS is replenished without additional fees, regardless of the amount. But if the transfer is made through a third-party bank, they may charge their own fee.

For example, Sberbank will withhold 1-3%, and there are no commissions when sending money from Post-Bank accounts.

Insurance of investment accounts

No one will offer you protection against losses! But there is a certain nuance in the case of working with IIS. It’s convenient that you can invest online and receive not only insurance, but a tax deduction in the amount of 13% of the investment amount, but not more than 52 thousand rubles per year. In this case, the account must be open for at least 3 years. I recommend once again studying the features of taxation of investments in order to evaluate all the pros and cons of this activity. When you open a bank deposit, the state guarantees you a return of up to 1.4 million rubles if the bank goes bankrupt. But when you decide to buy a government or other bond, there is no such guarantee. That’s why you always weigh everything carefully to eliminate even minimal risks.

Are VTB broker clients entitled to a tax deduction?

Tax benefits are available to all IIS owners, regardless of through which broker or management company the account was opened.

Documents for tax deductions under IIS at VTB are standard:

- copy of the agreement;

- documentary evidence of replenishment;

- 3NDFL is submitted to the tax office located at the place of registration.

The conditions for obtaining a tax deduction for an individual investment account at VTB depend on the type: A or B. You will learn more about this topic from this article.

Real reviews

There are plenty of reviews online about the work of the VTB management company, left by both clients and employees. Often they contradict each other.

Clients

Most reviews about the work of VTB Capital Asset Management are positive; clients note the reliability of the organization, the ease of use of the “My Investments” mobile application, and the profitability of investments in mutual funds. Negative reviews indicate low quality of service in some offices and managerial mistakes.

Employees

Employees of the VTB Capital Asset Management organization point out reasonable salaries and friendly staff. However, in some offices, working conditions and the attitude of managers, overtime and non-payment of bonuses negate the positive aspects of working at VTB.

Expert opinion about the My Investments project

VTB has a high rating and a good reputation, as it has been operating since 2003; moreover, it is a government agency with all the necessary licenses. By the way, the independent rating agency Expert A awarded it the highest reliability rating (A++).

Most experts approve of VTB My Investments, noting the convenient service in the application, low commissions and good offers from the bank’s analysts. Experts include limitations on the list of available tools as negative points; Most issues are resolved only in the bank.

Having carefully studied the reviews about how much you can earn on VTB investments, we came to the conclusion that there is no certain amount of profit. Yes, you can make an income, but you will have to learn to control yourself (so as not to sell everything out of panic), study the financial market and be interested in its news, understand that it is impossible to get rich quickly. Here you cannot act as in a situation with a “open and forget” deposit; you will have to analyze and act, and then your investment will bring profit.

Interesting article

VTB Investments - do you need to pay taxes on dividends?