Where to invest 5,000 rubles to get a capital of 1 million in 10 years? Review of real estate investment opportunities for people with low incomes

Hello, this is Andrey Merkulov.

If you ask any person if he wants to create passive income, everyone will answer positively. Everyone dreams of the life of a rentier, when money falls into the account by itself, and you don’t have to go to work every day to receive it. But few people do anything to achieve this. More often than not, dreams remain dreams. And not everyone has millionaire relatives who leave a fortune as an inheritance.

Most people have to rely on their own strength. At the same time, many simply do not understand where to start, everyone is afraid of making a mistake, many have nothing to invest... There are a lot of circumstances and excuses that prevent you from starting to do something... And there is also a large set of all sorts of harmful attitudes that ultimately lead us to the conclusion: “ It’s not for me now.” The only problem is that this “now” stretches out for years. Every time the situation seems inappropriate to do something for your future. And when a person realizes that he can no longer work, and he has no (or insufficient) sources of other income to maintain his usual standard of living, it turns out that it is too late to do anything.

On the other hand, even small (but competent and regular) actions over a long investment horizon can help create an impressive fortune. And there are many examples of this in history.

Regular replenishment

The amount considered in this material still has significant merit. 5 thousand rubles is money that you can regularly add to your “investment fund”, even if your salary is not the highest. If you set a goal, you can replenish the same deposit with capitalization monthly - and in just a year you will collect an impressive amount, which will bring much more significant interest for the same year. Perhaps this is the key aspect of building serious and reliable profitability by operating five thousand assets.

Books and knowledge

Knowledge is power, and one cannot but agree with this. Only a well-read, intelligent and comprehensively developed person can have a large, stable income. Investing 5,000 rubles in your education may turn out to be one of the wisest decisions of your life.

We recommend watching the video below:

What exactly to invest capital in is up to you to decide. An amount of 5,000 rubles is enough to take courses in design and photography, learn to work in 1C, pay for a semester of training at a language school, or take training in the basics of entrepreneurship. Investing in your education is investing in your successful future.

Aggressive speculation

The relative insignificance of the amount carries with it another potential opportunity - the free use of money in high-risk manipulations. This is not savings for several years, it is a significant, but not a large part of the average salary - and therefore, with such funds you can go all-in. This, of course, is not about gambling (this should be avoided in principle, the chances of winning at roulette are completely ephemeral), but about aggressive trading. For example, buying a currency with high leverage - if you get it right, you can literally increase your starting capital several times in one transaction. An attractive deal, but the level of risk fully corresponds to the potential profitability. And here, in no case should you rely on blind luck. Luck, of course, will be required, but without specific knowledge and good instincts, such operations are tantamount to throwing money in the trash.

PAMM accounts

PAMM accounts are trust management of funds. Only those who have never gotten entangled in the World Wide Web are unfamiliar with the topic of making money on Forex.

An undoubted advantage of PAMM accounts for an investor is the opportunity not to trade on their own, but to entrust this difficult task to a professional.

The investor receives an additional process from the funds entrusted to him.

More articles on the topic:

PAMM account managers can help investors earn a tidy sum of money, however, Forex is an unstable structure with a high level of risk.

An investor should be fully aware that he may lose all of his money when he decides to place it in a trust.

Reselling things on Aliexpress

Aliexpress is a platform that everyone has heard of. This Chinese online store can rightfully be called the largest in the world, and the variety of products makes it attractive to all segments of the population.

The most popular items for resale include accessories, clothing and inexpensive gadgets. You can earn substantial money on Aliexpress by organizing the sales process through social networks, for example, Vkontakte.

Reselling things on Aliexpress is profitable, but it takes a very long time, because in addition to the fact that it is necessary to organize a group on a social network, fill it with participants, make advertising, the investor is also required to debug the logistics process.

So, you can make money on the Internet by investing only 5,000 rubles. You should evaluate what you are capable of and what percentage you would like to receive from the money invested. Of course, highly profitable projects are always associated with risk, but if you invest money at a low interest rate, or organize your own small business, the risk is significantly reduced.

Lend on Web Money

The Web Money electronic service allows you not only to store currency, but also to make good money on it. Its own debt service makes the resource similar to an investment project.

If you decide to lend using this e-wallet, then remember:

- you do not know the person to whom you are lending;

- the risk that he will not return the money is very high;

- Registration in a debt service is an extremely long and tedious process.

In the project's debt service, you can review borrowers' applications, and if you do not find suitable conditions, create your own application.

The interest rate at which you can give a loan is quite high, and if you are not afraid to take risks, you can try to play in the Web Money debt service with amounts that are comfortable for you.

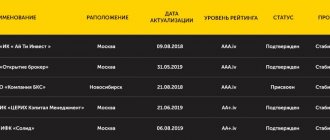

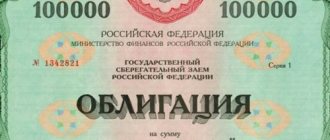

Bond selection

Here are the options:

- Finex Eurobonds of Russian issuers (FXRU). The fund invests in Eurobonds of Russian issuers - the country's leading companies. The fund's commission is 0.5%. This is the lowest commission for similar funds in Russia.

- Region — Moscow Exchange Government Bond Index 1–3 years (SUGB). The fund invests in Russian government bonds with a maturity of 1–3 years (short bonds). The fund's commission is 0.8%.

Both Eurobonds and Russian government bonds carry almost equal risk. However, you must understand that if global markets fall, these bonds will also fall in value, albeit not for long. Although these funds invest money in bonds with investment grades, this does not save them from selling off in the event of a crisis - investors move money into government bonds of developed countries. Only these bonds rise when markets and economies fall.

For our investor, I would choose the Finex Eurobonds of Russian Issuers (FXRU) fund and buy its lots for 1000 ₽ (20%).

Portfolio structure

Based on the portrait of our investor and his goals, I propose the following portfolio structure:

1. Tool categories:

- shares - 70%;

- bonds - 20%;

- gold - 10%.

If you want to be an aggressive investor, then the allocation to stocks can be 80-90%. And for a conservative investor, the share of bonds should be higher - 40–50%. Additionally, if you have an investment horizon of less than 10 years, even for a moderate portfolio you should reduce the exposure to stocks. For example, if you want to invest for 7 years, a moderate investor's portfolio should include no more than 50% of stocks and no less than 40% of bonds.

2. Distribution of assets by region:

- USA - 50%;

- Europe - 20%;

- Asia - 15%;

- developing countries - 10%;

- Russia - 5%.

Everything here is individual. I suggest this structure for investing in stocks. If you don't like the US market, but prefer Asia or Russia, you can change shares in your portfolio.

In the Russian market, it is not easy to exactly follow this distribution when investing 5,000 rubles. But here the fact of proper diversification is more important, and not the exact shares.

Investing in Internet projects

Comfortable conditions for doing business have been created in the vastness of the virtual network. Many web portals offer unlimited opportunities for investing in various business projects. Website development or purchasing ready-made online resources is a modern investment direction that is in demand in the investment market.

However, if you consider that you only have 5,000 rubles to invest, you shouldn’t count on getting a good deal on a good website. Moreover, this amount is quite enough to create your own Internet portal. It is worth understanding that in the absence of special skills, it will be difficult to independently develop a website from scratch, and additional funds may be needed to attract specialists.

Fund selection

The most difficult thing when choosing funds for the conditions described above is that the amount to invest is small, and there should not be many funds in the portfolio. Ideally there should be three of them, if possible.

I deliberately exclude investing in:

- Individual shares. To do this, you need to have a good knowledge of fundamental analysis and be able to search for and select companies.

- Separate bonds. They also require constant monitoring of the condition of the issuing companies.

- Mutual investment funds (UIFs). It is mutual funds, not BPIFs (exchange-traded mutual funds). Because mutual funds charge huge commissions for their services and, in most cases, lose to stock market indices. Therefore, we will invest specifically in indices.

The best option for investing in equities around the world is global equity funds. Unfortunately, in Russia there is only one such fund that is available to unqualified investors - FinEx Global equity UCITS ETF (FXRW). It is not the cheapest (commission 1.36%), but one of the most affordable - one share can be bought on the exchange for only 1.2 rubles.

For qualified investors, foreign funds are available, which are much cheaper in terms of commissions. For example, the Vanguard Total World Stock (VT) global equity fund charges a fee of just 0.08%. It consists of 54% shares of companies from the United States, 36% of developed countries other than the United States, and 10% of companies from developing countries. Therefore, another piece of advice is to become qualified investors faster.

Read on topic: Instructions: how to become a qualified investor to buy foreign shares

So, if you buy FXRW, your investment in the stock will be distributed globally as follows:

- USA - 37%;

- Japan - 20%;

- UK - 15%;

- Australia - 9%;

- other countries - 18%.

The structure of the fund does not quite correspond to the desired structure for our investor. But, as I wrote above, the main thing is the presence of diversification, not shares. To invest 5,000 rubles per month, I would buy this fund for 3,500 rubles (70% of the investment amount).

If you'd like to spread out your investments more precisely by region, here's a list of some of the funds I've selected based on their fees:

- USA - Tinkoff S&P 500 (TSPX) or VTB - American Companies Stock Fund (VTBA). Commissions are 0.79% and 0.81% respectively. Both funds invest in the S&P500 index (an index of the 500 largest US companies).

- Europe - Alpha_Cap Europe 600 (AKEU). Commission - 1.1%.

- Asia - no funds to choose from. Russian companies offer only mutual funds investing in China. The cheapest is FinEx China UCITS ETF (FXCN).

- Developing countries. There are no such funds either. But you can buy separately a Chinese stock fund (see above) and a Russian stock fund - the VTB Moscow Exchange Index Fund (VTBX). This is the cheapest available mutual fund and ETF in Russia.

The commissions of all these funds are taken into account in their cost, that is, these amounts do not need to be paid separately.

Equity funds are just one part of a portfolio. It is considered aggressive (stocks are always aggressive), so we balance the portfolio with bonds. Not all bonds are conservative, so you need to choose investment-grade bond funds.

Option 3. Bank deposit

Conservative investment option. The risk of losing your funds tends to zero, but the profitability leaves much to be desired . The amount of profit is known in advance; you can open an account in foreign currency, rubles or precious metals. All this together attracts investors.

To compare conditions in different organizations, you need to use the website banki.ru.

Ruble deposit

The best deposit for an investor is with monthly interest capitalization and a maximum rate. It would be nice to be able to withdraw money at any time.

The average interest rate in the country (according to the website banki.ru) is 7%.

Important: deposits in large banks will give a profit of 4-5%. It is better to focus on small commercial organizations.

With a one-time account replenishment of 5,000 rubles, the investor’s profit will be:

| Investment term | Account amount |

| 5 years | 7088,62 |

| 10 years | 10 048,34 |

| 15 years | 14 244,77 |

| 20 years | 20 193,71 |

| 25 years | 28 629,04 |

After 10 years, the amount in the account will double, and after 25 years, 6 times. For a profit that allows you to accumulate a substantial capital, the amount of five thousand rubles will not be enough.

With a monthly investment of 5,000 rubles:

| Investment term | Account amount | Interest |

| 5 years | 360 060,85 | 60 060,85 |

| 10 years | 870 433,45 | 270 433,45 |

| 15 years | 1 593 986,66 | 693 986,66 |

| 20 years | 2 619 712,89 | 1 419 712,89 |

| 25 years | 4 074 088,76 | 2 574 088,76 |

In just 10 years, the account balance will approach 1 million rubles, and after 25 years it will increase to 4 million, most of which will be interest. If you start investing at 35, you can ensure a comfortable retirement, and if you think about it earlier, you will be able to create an impressive capital at a relatively young age.

Currency deposit

You can open a deposit in almost any foreign currency, but this is in theory. In practice, only a small part of banks allows their clients to store funds in “exotic” currencies.

Organizations prefer to work with proven dollars and euros. For investors, deposits in euros are unprofitable: the average interest rate on them is only 0.4%. The profit on dollar deposits is higher - 2.5% per annum.

In addition to interest income, it is worth considering exchange rate differences. For example, just remember 2014: those who kept funds in dollars additionally earned about 50% in ruble equivalent.

With a one-time replenishment of a foreign currency deposit of 5,000 rubles ($75), the investor’s income will look like this:

| Investment term | Account amount |

| 5 years | 84,98 |

| 10 years | 96,26 |

| 15 years | 109,07 |

| 20 years | 123,57 |

| 25 years | 140,01 |

With a monthly deposit of $75:

| Investment term | Account amount | Interest |

| 5 years | 4 798,05 | 298,05 |

| 10 years | 10 234,04 | 1 234,04 |

| 15 years | 16 393,12 | 2 893,12 |

| 20 years | 23 371,34 | 5 371,34 |

| 25 years | 31 278,44 | 8 778,44 |

Because of the low interest rate, after 25 years the account will only have $31,278, of which most ($22,500) is not interest but savings. 31,278 dollars is 2,083,400 rubles. It turns out that the final return on a foreign currency deposit is 2 times lower than on a ruble deposit.

It is impossible to take into account exchange rate differences: not a single expert will say how much a dollar will cost in 25 years. The ruble may strengthen, then yields will fall even more. If the ruble falls, the investor will receive a higher profit.

Anonymized metal account

An impersonal metal account (UMA) allows the owner of bullion not to think about their storage and transportation. All you have to do is come to the bank, select the appropriate metal and pay for the purchase.

Banks offer to open an account in the following precious metals:

- silver;

- gold;

- platinum;

- palladium.

Metal quotes can be found on the official website of the organization. At the moment, Sberbank sells them at the following prices:

- gold - 3356 rubles;

- silver - 38.03 rubles;

- platinum - 1936 rubles;

- palladium - 3337 rubles.

The return on a deposit is difficult to predict; it depends on many factors: global metal consumption, production level, demand.

Important: Compulsory medical insurance is only suitable for long-term investments. The difference between the purchase and sale prices of metal in a bank is about 9%. If the investor wants to sell it soon after acquisition, he will lose this amount.

It is best to invest 5,000 rubles . You can buy 1.5 grams of gold or 131.5 grams of silver. Over the past year, the cost of metals has increased by 12.99% and 2.25%, respectively.

People who bought gold for 5,000 could receive 649 rubles in income. Those who purchased silver for the same amount - 112 rubles.

Reselling things on Avito

Try buying and reselling things on the Avito electronic bulletin board! You can’t even imagine how many things you can earn money from are sold on this site.

To begin, select a category of items that would be of interest to you for resale. As a rule, buyers have a rough idea of prices, so it will not be possible to significantly increase the price of an overbought item.

Reselling things on Avito is a fairly safe process, however, rarely does anyone manage to earn a lot using this scheme.

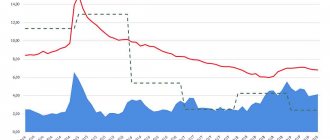

Option 9. Precious metals

The safest way to invest money. 1 gram of gold now will remain the same gram of gold in 50 years. Metal prices can fluctuate but rise steadily over the long term. Real money can depreciate and turn into a pile of unnecessary papers, but metals cannot. This is confirmed by a comparative chart of the price of gold and the MICEX index.

It can be seen that even defaults and crises do not affect the price of the precious metal.

Physical ownership allows you not to worry about the funds being lost in the event of a default. You can purchase precious metals in the form of bars or investment coins; we will consider both methods.