One million rubles is a fairly substantial sum of money to start an investor’s career. Such capital opens up a large number of investment opportunities for its owner. However, the more money a person has, the more doubts he has regarding choosing a suitable asset. So, where to invest a million rubles?

Let us immediately make a reservation that most of the investment objects listed below are also available to investors with slightly smaller and significantly larger savings. We can talk about half a million, 700,000, as well as 2, 3, 4, 5 and even 10 million rubles.

Bank deposits

Today in Russia, bank deposits are the most reliable investment option. Now the amount subject to compulsory insurance is 1 million 400 thousand rubles. Thus, it perfectly closes the lender's request.

But what to do if a potential investor wants to invest a lot of money in the bank. Let's say 1,500,000 million rubles. In such a situation, it would be wise to resort to diversification. That is, divide the available capital into several parts and invest them profitably in 2-3 different banks. The same can be said about two or three million rubles.

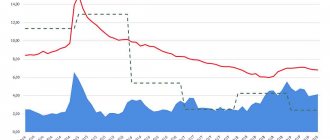

Investment security is good, but every sane investor is equally concerned about the profitability of an investment asset. But bank deposits now have serious problems with it. The average interest rate for the market is 7–8%. With a potential inflation rate of 4-6%, such investment returns are not very impressive.

There is also no need to count on the help of foreign currency deposits. After all, rates on them in 2021 will fluctuate from 0.5 to 2%.

If you still decide to invest your 1,000,000 rubles in a bank, then choose a reliable credit institution, which, according to the Central Bank of the Russian Federation, is among the 50 best in the country.

The mistake many investors make is that they limit their attention solely to the interest rate on the deposit. At the same time, you need to look at the capitalization of interest, the possibility of replenishing the deposit and the condition for premature closure of the account. Only after analyzing all of the above aspects can you choose the optimal banking product that is suitable for a particular investor.

Currency

Investments in foreign currency are familiar to the entire older generation of our country. True, at that time it was not yet fashionably called that, and only a few knew the very concept of “investment.” But what then, what today, those who store currency in the hope of selling it in the future with a profit are playing roulette.

Plus, no one has canceled the depreciation of money, and even inflation. You can deal with currency, but not by buying cash. Yes, and bank deposits in foreign currency are also ridiculous. The most effective way is to speculate in currencies on the stock exchange.

Real estate investing

Real estate is a good investment option and requires quite a lot of capital. True, if we are talking about Moscow, St. Petersburg, Kazan and other large cities, then 1 million rubles may not be enough to start work. To make good money in this market, you should have more substantial savings. You can enter this area with 3,000,000, or better yet, 5,000,000 million rubles.

There are two main ways to make money by purchasing an investment apartment:

- rental business;

- speculative resale.

To get maximum profit, say, from an investment of 4–5 million rubles, we recommend buying an apartment during the construction stage. In this case, after its completion, you will be able to resell the purchased asset at a much higher price. At best, we can talk about 70–75% profitability of the implemented investment project.

Mike Novogratz

Executive Director of Galaxy Investment Partners

I would invest in the gaming sector. Think about the metaverse, a concept of a virtual universe that will mix virtual and augmented realities and connect them to the physical world - and the gaming world. Once 5G arrives and we have games that can be played in the cloud, this space will be transformed over the next five years. For the investor, this mainly happens through venture capital.

I have a venture capital fund that invests in this space, and these are basically venture capital firms created to operate in this space. The virtual and real worlds will merge in the next five to ten years. This is really a 5-10 year thing and it's just exciting.

You will have to make a lot of small bets because you cannot be sure who will win. But if you gave me a million that in 10 years could be worth tons and tons of money, then this is the only place I would invest it.

Another way to spend that money: My passion is throwing great parties. First, my guests compete with each other all day, and in the evening great musicians play. Right now, if I had a small party, I'd ask Christon "Kingfish" Ingram to play. This 21-year-old blues singer is probably one of the best guitarists in the world. If I want to impress the people who gave me a million, The Killers would be amazing. I like those bands whose lyrics people know. When everyone knows the lyrics, you get that wonderful communal spirit of the hymn. So maybe I'll have a band like Coldplay.

Source: Bloomberg

0

Author of the publication

offline for 10 months

Investment portfolio of shares

Trading on the stock exchange can be carried out using different investment strategies. If the question: “What to invest a million rubles in?” comes from a novice investor, then the answer suggests itself. In this situation, you should invest in blue chips. This is the most conservative and reliable investment strategy on the stock exchange, which even a beginner can understand.

Blue chips are traditionally called shares issued by the most stable and largest joint stock companies with the largest capitalization. As an example, we can cite OJSC Gazprom or the company ALROSA.

If a more experienced investor wants to increase 1 or 2 million rubles with the help of the stock market, then he is free to act more riskily. But absolutely all traders should preach the principles of diversification or risk sharing.

A less experienced investor should not begin his work in the stock market with speculative trading. It requires serious practical experience from the trader. It is much better to invest your 1,000,000 rubles in long-term investments and receive income from shares through dividends. Their payment is made by companies annually, subject to an appropriate decision of the board of directors and the availability of profit based on the results of the year’s activities.

Such investing is especially profitable in the long term. The minimum period for such investments should be 3–5 years. Otherwise, it is unlikely that you will be able to make good money on a conservative strategy. The longer the investment period, the higher the investor's actual profit will be.

A novice investor needs to get used to not making hasty conclusions. Shares of even the most reliable companies may lose a little value in the short term. At the same time, they will show steady growth over the long term.

If we compare the profitability of buying shares, then compared to bank deposits they are on average 2–2.5 times more profitable.

Nilson Teixeira

Chief investment specialist at Macro Capital

The unprecedented, extreme liquidity that central banks have been pumping into the economy will continue for some time, meaning you can make significant profits by investing in the major stock indexes alone. Owning shares is not a big problem as long as you can turn them into a portfolio of big international names.

I'm from Brazil and I invest in emerging markets, so I would add Asian stocks to my portfolio, excluding Japanese ones, through exchange-traded funds, then US stock indices such as Nasdaq 100 and Russell 200. There is still a high degree of uncertainty in the coming months, we We are still in the brave new world of a pandemic, but I am optimistic in my forecasts as I believe that at some point we will have both a cure and a vaccine for the virus, to which prices will generally respond well.

It will take some time for banks to start raising rates, so you will have the perfect environment for growth. Even gold will respond well to all the liquidity and is another asset to consider.

Emerging markets tend to perform better under this scenario, but for Brazil specifically it comes with a lot of uncertainty. The country is trapped in mediocre growth and has just lost an entire decade of development. That's why short-term placements are now a more suitable option, especially for companies linked to commodities, such as iron ore producer Vale or meat packer JBS.

But unfortunately, in the long term, both Brazil and Mexico have worse growth prospects than Asia due to political, educational and institutional problems.

Another way to invest: I have been collecting Brazilian art for over 20 years, so this would be my investment method. The creations of previous generations of Brazilian artists, like those from the sculptor Luba Wolf, are still worth less than those of their male counterparts simply because they are women. I see this gap closing. And today, with all the talk about ESG and Brazil's environmental issues, the work of photographer Claudia Andujar, who captured images of indigenous Brazilians, will take on even greater significance.

Trust management rate

Many potential investors who want to invest 1–3 million rubles do not dare to trade on currency, commodity or stock exchanges on their own. Financial instruments have been created especially for such people, which are based on trust management of other people's money.

Many millionaires who have formed their capital in any area of business do not try to independently understand the specifics of stock trading, but hire professional traders to manage their money. Such professionals work for a pre-agreed commission or a certain percentage of the profit.

In addition to such direct interaction with exchange players, potential investors have other financial mechanisms that allow them to place their capital in trust. The most famous of them are mutual investment funds (MUIFs) and PAMM accounts.

If invested correctly, savings in the amount of 1,000,000–2,000,000 rubles can bring its owner serious, stable profits.

Bonds

A good alternative to a bank deposit is a bond. This security formalizes a debt to you, as an investor, to some company, or to a bank, or even to the state.

It turns out that you are lending money to one of them. And they can be called issuers and they are obliged to pay you the money borrowed from you. Also, pay interest according to a schedule that you will know in advance.

Important! The yield on bonds may be higher than on a bank deposit.

And besides, you can always sell these securities on the stock exchange. But you should also know that the price of a bond can change from the purchase price to the sale price. If there is very little left until maturity, the price changes little.

Important! This security is less risky than shares. That's why it is always included in an investment portfolio.

The biggest risk of investing in bonds is issuer default. Therefore, Federal loan bonds are considered the most reliable bonds. Although even the constituent entities of the Russian Federation issue bonds. It is worth understanding that a reliable issuer always tries to put forward better conditions than bank deposits in order to attract investors to its securities.

Investing in gold

Investments in precious metals in general and gold in particular have always been considered the height of safety. With the passage of time, this state of affairs even improved. Currently, they can allow an investor not only to save, but even to increase the existing million rubles. The cost of precious metals has shown steady positive dynamics over recent years. This situation is also unlikely to change in 2017–2018.

However, every investor needs to understand the Russian specifics of investing in gold. It makes no sense to invest your million in gold bars. This can be explained extremely simply. Such transactions in our country are subject to VAT. In fact, this means an additional 13% to the cost of the purchased precious metal.

Gold bullion coins are a completely different matter. You will not have to pay any taxes or fees to purchase them. Therefore, today this is exactly the gold asset in which it makes sense to invest a million.

Since most potential investors in Russia, when handling large sums of money, try first of all to protect them from inflation, we have brought you the most reliable areas of investment. More profitable assets promise much greater profits, but are accompanied by serious risks.

Hans Olsen

Chief Investment Officer, Fiduciary Trust

If I already had a diversified portfolio and I had a million dollars, I would think about real estate outside of some A cities. This is part of the mindset shift that Covid has brought about. If you don't want to live in the city center and think differently about your work and personal life, then real estate outside the city becomes of great importance, especially if you have a family. I would say "out of town" - that's 90 minutes to two hours outside of, say, Boston or New York.

I'm thinking about buying a piece of land on the coast in Maine. As the population spreads more and more, people are thinking about how to rebuild their commercial lives, and places like this, where you have a lot of natural beauty around you, a really great quality of life and property prices that are still quite reasonable, provide the opportunity and provide long term option for this type of investment.

You will receive both profit and pleasure. Unlike other assets, this option will not only allow you to earn money, but will also leave pleasant memories.

Another way to invest is to buy back and restore some old Land Rovers, early Defenders or previous series models. I love doing this, in fact it is my passion. You can buy a car, restore it and have fun while making money. I would consider buying older Land Rovers from the late 60s or early 70s.

The cost depends on where you buy it, I got mine for about $5,000. You can easily invest $25,000 to $30,000 in restoration—or do it yourself if you're comfortable—and then sell them for $50,000 to $70,000. These cars are no longer produced, so their value lies in their limited availability. These old Land Rovers were designed so that they could be taken apart and put back together with a screwdriver and a wrench. This is truly a guided art. I bought mine on Craigslist about eight years ago. I could probably double my money selling it, but at the same time I can put my dogs in the back seats and have a great time.

Where is it better not to invest money?

There are not only profitable and transparent investment schemes. There are also investment options that border on recklessness. Having invested capital there, with an almost 100% guarantee, a person will be left with nothing.

- Financial pyramids. The most striking example of a financial pyramid, one of the biggest scams of the 90s of the 20th century, is Sergei Mavrodi with his MMM. Millions of people were deceived, most of them lost their last money. The situation itself is reminiscent of the plot of the fairy tale “Pinocchio” about the “Field of Fools”. Any offers to contribute little and immediately receive a fabulous amount without doing anything is a scam.

- Too attractive offers. Offers can be simply profitable, or they can promise too much. For example, one of the mutual fund advertisements in Yandex promises the investor 1872% annual income. This is tempting, but hardly true. In fact, the fund does not even guarantee a return on investment.

- Casino, sports betting, lotteries. Any person dreams of getting a lot of money at once for no reason. This is exactly what the owners of such enterprises count on. But, you need to understand, none of them is ready to let things take their course. Otherwise they will simply go bankrupt. Everything is carefully calculated. Sometimes small wins occur, but all this is only to lull the vigilance of overly gambling people.

- Purchasing a program that generates passive income. Surely you have come across similar offers. “buy the program, install it on your computer, and you can lie on the couch and the money will drip into your account!” It is not clear who is going to pay for what, but the promise of easy money dulls vigilance. In fact, the outcome of such a purchase has only two options - losing the invested money on a useless purchase or losing all the money from bank accounts.

Art and cultural collectibles

Art objects and antiques are one of the most profitable and at the same time risky investment areas. Valuable antiques are difficult to store. The risk of acquiring a fake is always high: even the largest museums with a staff of experts are not immune from this.

Old books are considered a win-win option: the first editions of Akhmatova, Tsvetaeva, Mandelstam. Vintage movie posters from the 30s to the 50s are rising in price. Many items from the Soviet era have nostalgic and collectible value - for example, sawdust dolls sell for 50-60 thousand rubles.

Selecting promising objects requires experience. It is worth paying attention to the cult phenomena of our time: on October 13, 2020, the first edition of the book “Harry Potter and the Philosopher’s Stone” was sold for 68,000 pounds sterling. Charlotte Ramsay purchased this copy in 1997, there were 500 books in circulation. The owner was going to sell the book at a flea market, but then decided to put it up for auction.

Airbag

Another important step in conditions of market uncertainty is the creation of a financial airbag. Savings will come in handy if you unexpectedly have to change your job, place of residence or profession. The reserve should provide at least 6 months of life without any income: if the average monthly expenses, taking into account loans, are 80 thousand, then 500 thousand rubles will be enough for just six months.

The optimal way to store a reserve is a replenished account with the possibility of partial early withdrawal and the accrual of interest on the balance. It is advisable to keep part of your savings in euros or dollars.

How to make investments wisely and avoid fraud - advice from practitioners

Selecting promising projects for investment is a science and at the same time a skill that comes with experience. All professional investors have at least once made a mistake in choosing the direction of investment and lost their money.

To avoid typical neophyte mistakes, follow these rules:

- Avoid investing in projects that even remotely resemble financial pyramids.

- Make investment decisions based on multilateral analysis and calculations , and never be led by emotions.

- Use the help of professionals : it is better to pay for competent advice today than to lose the entire investment amount in the future.

- Do not trust your finances to private individuals and intermediaries with a dubious reputation.

- Work only with companies that operate officially and have permits.

When visiting the websites of investment organizations, be interested in licenses, contact information, details and names of managers.

Try to talk more often with company employees in person: direct contact will provide much more food for thought than lengthy correspondence.

An overview of all working and proven ways to invest money to generate income in passive mode - in the free anti-crisis online marathon “Passive Income”.

Register for the marathon and make your money work for you.

Where to invest 500,000 rubles to earn money: a promising startup

Implementing your own business idea will help you increase your capital and realize your own potential. To reduce the level of risk, you can turn to startup exchanges for help.

One of the projects is called ShareinStock. This site will help you invest your money wisely. Consider opening your own online store as a startup option.

Online stores are growing like mushrooms after rain. But if you approach the issue thoughtfully, you can invest 500,000 rubles in online sales. For this money you can buy a ready-made store or open a new one from scratch. Why such a large amount, since there is no need to pay rent for premises and salaries to sellers? Expense items will be:

- payment for hosting and domain name;

- creating a user-friendly interface, filling the site with content and product descriptions, SEO optimization;

- payment for the services of an administrator who answers calls and processes orders;

- minimum purchase of popular goods;

- advertising on the Internet and social networks, development of a marketing strategy.

With a successful combination of circumstances, the funds invested in the online store will pay off within six months. A well-functioning mechanism will not require your participation; a qualified administrator is sufficient to resolve organizational issues. All you have to do is monitor current trends and make adjustments if necessary.

Conclusion: investing in a startup is an opportunity to make huge profits and at the same time a high degree of risk.

Metal deposit

Compulsory medical insurance is a kind of hybrid of an investment product and a bank demand deposit. A metal account can be replenished, money can be withdrawn from it in parts, or closed early - without penalty deductions. VAT is not charged on unallocated gold; you can buy from 1 gram.

If the virtual gold remains in the account for more than 3 years, you will not have to pay personal income tax. Also, sales profits are exempt from personal income tax if they do not exceed 250,000 per year. The biggest disadvantage of compulsory health insurance is that accounts do not fall under the deposit insurance system.

Opening a franchise business

Starting a business as a franchisee is easier than starting from scratch. Russian Forbes has compiled a list of the top 30 most profitable franchises, it includes options with investments of up to 500,000:

- Fast&Shine, dry car wash – investment 400 thousand, net profit 2.1 million rubles per year;

- White & Smile, teeth whitening salon – investments 300 thousand, profit up to 1 million rubles per year;

- Samura, ceramic knives – 0.5 million rubles of investment, up to 2.7 million profits;

- “Children on the floor”, dance school – 310 thousand investments, 0.4 million rubles in profit per year.

Other interesting offers include: vending machines selling sports nutrition “Protein Shake” (295 thousand rubles); chain of apartments “Profitable Apartment” (400 thousand rubles); laboratory diagnostics “Hemotest” (from 150 thousand rubles).

Bottom line

Investing money in your own business, opened as a franchise or from scratch, as well as running an online project, is an active investment that requires the owner’s constant attention. If a private investor has 500 thousand rubles, but no free time, it is more advisable to opt for passive investments - purchasing mutual funds, ETFs, shares, bonds. It’s even easier to open an impersonal metal account or invest free funds in crowdlending.

— Author of the review: Ksenia Safonova is an entrepreneur, business consultant, founder of several women’s startups from scratch, and runs a consulting business in Canada.

Beauty, health, education

If you already have enough savings for unforeseen expenses, the extra money can be spent on: - obtaining a new promising specialty as a data analyst, web developer, 3D designer, internet marketer - 100-300 thousand rubles; — anti-aging plastic surgery – 350-500 thousand rubles; — rhinoplasty – 50-250 thousand rubles; — hair transplant – 300-500 thousand rubles; - installation of dental implants - 60-100 thousand rubles for each.

The good news is that since dental treatment and plastic surgery are expensive medical services, they are eligible for a 13% tax deduction.

Common mistakes of novice investors

We talked about the general principles of investing above, and now we’ll focus on the mistakes that beginners often make when they start generating passive income. Among the most common:

- Invest other people's money. Investment capital cannot be borrowed - neither from friends nor from banks. This is associated with great risks: when investing in assets for the first time, beginners can suffer greatly. What funds will be used to pay off debts later if the business goes bankrupt?

- Invest every last penny. First, set aside money for living expenses and unexpected expenses. Create a nest egg for yourself in the form of a bank deposit - and only then actively invest. You only need to invest the amount that you are willing to accept losing.

- Act at random. This means that beginners ignore the learning stage, and minimal knowledge is needed everywhere - on the stock exchange, the real estate market or in the retail business. Without understanding how and where to invest wisely, you cannot make money.

- Give in to emotions. This is especially true for the securities market. Beginners react to the slightest price fluctuations, which is why they risk selling the asset too early, when the price has not reached the peak, or buying too late due to their indecisiveness. And you need to act in accordance with the strategy. If you don't have one, trustees or financial advisors can help.

- Believe empty promises. We are talking about investments with sky-high returns - for example, gullible beginners are promised 500% of the starting capital every month. Remember that only scammers can guarantee anything in the world of investments, especially such a large profit.

Crowdfunding and crowdlending

The concept of crowdfunding became commonplace already 8-10 years ago: in Russia, Planeta and Boomstarter became the largest crowd funding platforms. Financing small businesses through crowdlending services attracted the attention of private investors later.

Participating in crowdfunding is similar to pre-ordering a product at a reduced price. If the project works, sponsors receive prepaid goods, and if the product launch turns out to be profitable, they may receive additional cash rewards.

There are already many platforms for crowdlending in Russia. There is AtomInvest, which provides the opportunity to invest in short-term loans to companies carrying out private and government contracts. The minimum investment on the site is 10 thousand rubles, the average investor return is 23.4%.

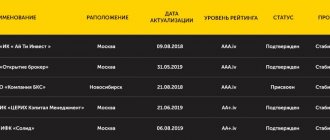

Another site, JetLand, promises private investors a return of 24.9%. The monthly portfolio default rate does not exceed 2%; there are already 3,054 investors on the platform. The yield on the Penenza crowdlending service is even higher - 30-37% among AAA class borrowers and 25% on average.

Crowdlending has also appeared on the Sberbank site - SberCredo offers to invest in small businesses for six months at 17.3% or higher, already taking into account personal income tax, which the platform withholds.

Investing in franchising

At the moment, franchising is one of the most promising areas of investment and business. Fortunately, there are many companies on the market that sell franchises of their enterprises. Franchising also has the following number of undoubted advantages:

- using the strengths and capabilities of other people with extensive experience in a certain field;

- obtaining a stable and increasing income over time; the opportunity to become a representative of a famous brand in a specific region

- or city, which will also allow you to receive passive income;

- high profitability;

- excellent prospects for the future (expanding your own business, opening new outlets);

- working with a ready-made business model; reduced risks compared to starting a business on your own.

Success will depend on the diligence and desire of the investor himself. Even at the very beginning, he will need to familiarize himself with the specifics of the market and make the right choice in favor of a specific brand.

Cryptocurrency

Cryptocurrency trading is even riskier than traditional stock trading. Many tokens take off on the wave of ICO hype, and fall just as quickly. Investing in cryptocurrency and blockchain technology requires a deep dive into the topic. In addition to Bitcoin, altcoins Ethereum, Litecoin, Binance, EOS, Chainlink (LINK) are promising.

It is necessary to understand the topic of cryptocurrencies, it is advisable to test the crypto market and start with small investments. Read analytics and reviews on crypto on thematic resources.