Statistical indicators

| Sharpe ratio Shows the excess of the mutual fund's profitability over the profitability of a deposit in a reliable bank relative to the risk of the fund's portfolio. More details 0.059 Average in management efficiency | Alpha coefficient A positive value means that the return was higher than the return of the reference portfolio. Negative is the opposite. More details 0.331 Profitability is average | Beta Coefficient A value greater than one means risk is greater than the market average. A value less than one means, on the contrary, the risk is below average. More details 0.858 Average risk compared to others |

These indicators are calculated for 3 years.

Market analysis from VTB Group analysts

Nothing in the information or materials presented in this document constitutes or should be construed as individual investment advice and/or VTB Forex's intention to provide investment advisory services. VTB Forex cannot guarantee that the financial instruments, products and services described in this document are suitable for individuals in accordance with their investment profile. VTB Forex is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials. Neither past experience nor the financial success of others guarantees or determines the same results in the future. The value or income from any investment may change and/or be affected by changes in general market conditions, including interest rates, and the investor may lose the original investment amount. VTB Forex hereby informs you of the possible presence of a conflict of interest when offering the financial instruments, products and services discussed in the document, which may arise due to the wide diversification of VTB’s professional activities. When resolving conflicts of interest that arise, VTB Forex is guided by the interests of its clients. These materials are intended for distribution only in the territory of the Russian Federation and are not intended for distribution in other countries, including the UK, the countries of the European Union, the USA and Singapore, and also, although on the territory of the Russian Federation, to citizens and residents of these countries. VTB Forex does not offer financial services and financial products to citizens and residents of European Union countries. Any logos other than the VTB Forex logos, if any are shown in this presentation, are used solely for informational purposes and are not intended to mislead clients about the nature and specifics of the services provided by VTB Forex, or to obtain additional benefits through the use of such logos, and as promoting goods or services of the copyright holders of such logos, or damaging their business reputation. The terms and provisions contained in these materials should be interpreted solely in the context of the relevant transactions and operations and/or financial instruments and may not completely correspond to the meanings defined by the legislation of the Russian Federation or other applicable legislation. All rights to the information presented belong to VTB Forex. This information may not be reproduced, transmitted or distributed without the prior written permission of VTB Forex.

IMPORTANT INFORMATION

This material was prepared by VTB Forex specialists solely for informational purposes without any other obligations and does not constitute an offer or recommendation by VTB Forex. It is not provided for the purpose of making any decision on its basis and is not and should not be considered as: (i) a basis for entering into transactions in any financial instruments; (ii) guarantees or promises of future effectiveness of the strategy chosen by the recipient and/or profitability from transactions with financial instruments; (iii) information on which the recipient may rely in connection with any contract or agreement; (iv) financial or investment advice or consultation. The data and opinions presented in this material were obtained or developed by VTB Forex based on open sources. Although this material has been prepared with care, it may contain errors and inaccuracies. None of the specialists or management of VTB Forex bears, directly or indirectly, any responsibility or liability for the reliability, accuracy or completeness of the information contained in this material. We expressly disclaim responsibility and liability for any information contained in this material. Any information contained in this material is subject to change at any time without notice. Neither VTB Forex, nor VTB Forex specialists or management undertake any obligation to update, change, supplement this material or notify readers in any form if any of the facts, opinions, calculations mentioned in this material, forecasts or estimates will change or otherwise become irrelevant. In addition, you should keep in mind that past performance is not an indicator of future results. The financial instruments and strategies discussed in this material are not necessarily suitable for all individuals, who should make their own decisions using their own financial advisors as appropriate based on their own financial situation and specific goals. In particular, consultation with independent consultants is recommended should interested parties have any doubts regarding the suitability of the information and strategies in this review for their business objectives.

Share price of “VTB – Global Dividend Fund”

The share price as of November 8, 2021 is 55.88 rubles, NAV is 408,308,514.44 rubles.

Recent price

| By days | Share price, rub. | NAV, rub |

| 08 November | 55.88 | 408 308 514.44 |

| 07 November | 55.95 | 405 143 247.83 |

| 06 November | 55.15 | 399 779 245.64 |

| November 02 | 54.43 | 383 495 033.18 |

| November 01 | 54.60 | 387 191 783.74 |

| October 31 | 54.29 | 387 156 974.82 |

| October 30 | 54.01 | 384 885 812.96 |

| By month | Share price, rub. | NAV, rub |

| October | 54.29 | 387 156 974.82 |

| September | 56.81 | 378 467 258.24 |

| August | 55.96 | 287 080 702.54 |

| July | 54.56 | 259 713 197.92 |

| June | 53.89 | 206 231 196.35 |

| May | 53.26 | 185 769 224.90 |

| April | 53.69 | 153 024 566.86 |

The table “by month” shows the price for the last day of the month.

Change in unit value over 12 months

- Return for 12 months: 12.95%

- If you had invested 100,000 rubles on April 1, 2021, you would have received 112,947.51 rubles.

Here is a chart of changes in the value of the mutual fund "VTB - Global Dividend Fund":

- share profitability

- benchmark index return

Change in share value over 3 years

- Return over 3 years: 18.97%

- If you had invested 100,000 rubles on April 1, 2015, you would have received 118,969.06 rubles.

See the chart of changes in the value of the VTB Global Dividend Fund share for 36 months:

- share profitability

- benchmark index return

Dividend policy

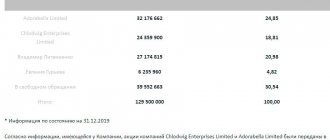

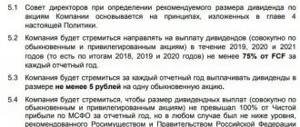

Another nightmare of a VTB shareholder is the issuer’s unclear policy. Let's start with the fact that there is no direct VTB policy. The Charter stipulates that the company must pay at least 25% of net profit according to IFRS. As a state-owned company, VTB must pay 50% of net profit under IFRS.

Mr. Kostin (head of VTB) promised that the bank would pay 50% of profits by the end of 2021. Until this time, the bank distributed approximately 25-30% of profits, as stated in the Charter.

However, the Charter refers only to ordinary shares. Let me remind you that VTB’s capital consists of ordinary and preferred shares. All preferences and most of the customs belong to the state. It is clear that the bank will not offend its owner, so it actually distributes dividends among all types of shares, and in a very interesting way.

The bank makes sure that the dividend yield of each type of stock is the same. For preferred shares, such yield is determined in relation to the par value (0.01 rubles for the first type and 0.1 rubles for the second), and for ordinary shares - based on the average share price for the year.

And here’s another interesting article: Severstal dividends in 2021: should we expect a reduction in payments?

In effect, this means that each subsequent issue of ordinary and preferred shares reduces the dividend per share. Even if the bank pays stable dividends, the yield will fall only due to share dilution. In relation to minority shareholders, this is generally dishonest, since the preferred shares do not even go into circulation, but are immediately sold to the state at par.

Similar mutual funds

How do we determine the similarity of mutual funds to each other?

| Name | Management Company | Profit |

| Dmitry Donskoy | Parma-Management | 12.89% |

| Discovery – Emerging Markets | Opening | 13.25% |

| Alpha Capital Bonds Plus | Alfa Capital | 12.51% |

| Arsagera-Mixed Investment Fund | Arsagera | 13.62% |

| Lombard list | Invest-Ural | 13.15% |

| Arsagera – KR bond fund 1.55 | Arsagera | 12.37% |

| Aton Bond Fund | Aton management | 13.13% |

| RSHB - Treasury | RSHB Asset Management | 12.89% |

| URALSIB Conservative | Management company URALSIB | 12.34% |

| REGION Bond Fund | REGION EsM | 13.36% |

Show all mutual funds from the database

How to buy VTB shares and receive dividends

To purchase securities, you must open a brokerage account. This can be done from representatives of the MSE (Moscow Stock Exchange) - licensed brokers.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

The list of the best brokers includes the following companies: ZerichCapital, VTB 24, BCS, Aton, Alfa Bank, Promsvyazbank, Otkritie broker, Sberbank.

Warning about Forex and BO

Forex and BO are in no way connected with company securities. There are no regulators here.

Shares can only be purchased through brokers who are licensed by the Central Bank.

What will happen to VTB next?

In 2021, VTB seems to suffer more than other banks. About 80% of its profit comes from serving corporate clients. And now most businesses are closed, the percentage of bankruptcies is growing, as are non-repaid loans. Bloomberg analysts predict that VTB will decline in revenue by 18% and net profit under IFRS by 2.5 times.

In such conditions, the government decided not to suck dividends from the bank (after all, it would then have to give the bank money back in order to recapitalize it), but to immediately leave the money to form reserves.

Dmitry Pyanov, a member of the bank’s board, promises that by the end of 2020, VTB will return to the practice of paying 50% of net profit under IFRS. No not like this. I quote: “The bank allows the possibility of returning to the payment practice.” That is, maybe it will, maybe not. Considering how many times the bank has let its shareholders down, I'm leaning towards the latter. I think other shareholders do too.

And here’s another interesting article: How to save up for an apartment, even if you have a small salary

There is also a point - even if the bank returns to the practice of paying 50% of net profit, then what will be the size of this net profit? What if the bank decides to recapitalize by issuing another block of shares, which will be directly transferred to the government or other key shareholders?

Is it worth buying VTB shares?

- Yes, for the future 43%, 16 votes

16 votes 43%16 votes - 43% of all votes

- Of course not! 43%, 16 votes

16 votes 43%

16 votes - 43% of all votes

- It's time to short! 8%, 3 votes

3 votes 8%

3 votes - 8% of all votes

- Yes, for the sake of dividends 5%, 2 votes

2 votes 5%

2 votes - 5% of all votes

Total votes: 37

09.08.2020

In general, all this is doubtful. I would not add VTB shares to my portfolio, especially since the Moscow Exchange has shares of more attractive financial sector issuers - Sberbank and Tinkoff (TCS Group). Given the paltry 2020 dividends and dubious prospects, I don't expect there to be a rally at VTB. More like a fall. But let's wait and see. Write in the comments what you think about it. Good luck, and may the dividends be with you!

Rate this article

[Total votes: Average rating: ]