How to calculate return on investment? - This question interests every investor. The main goal of investing is to generate income, so it’s always interesting how much you earned and what your profitability is. In terms of profitability, mutual funds, stocks, bonds, deposits, real estate and many other instruments are compared. Any investor, trader or manager is interested in its effectiveness. Banks, management companies and brokers, when advertising their services, like to lure clients with high interest rates. Profitability is one of the most important indicators by which you can evaluate the effectiveness of investments and compare them with other investment alternatives. So, let's figure out what return on investment is and how to calculate it.

Return (rate of return, rate of return) is the degree to which the invested amount increases (or decreases) over a certain period of time. Unlike income, which is expressed in nominal values, that is, in rubles, dollars or euros, profitability is expressed as a percentage. Income can be received in two types:

- interest income is interest on deposits, coupons on bonds, dividends on shares, rent on real estate;

- increase in the value of purchased assets - when the sale price of an asset is greater than the purchase price - these are stocks, bonds, real estate, gold, silver, oil and other commodity assets.

Assets such as real estate, stocks and bonds can combine two sources of income. Calculation of profitability is needed to assess the growth or decline of investments and is a criterion for assessing the effectiveness of investments.

Where to invest money with a guaranteed return (7-10%)

The least risky instruments include bank deposits and federal loan bonds. The yield on deposits may vary depending on the level of their stability. The most reliable ones fall into the category of risk-free or low-risk investments. Their profitability does not exceed 10%, but the probability of losing investments as a whole is reduced to almost zero. According to Law 177-FZ, all deposits of individuals and individual entrepreneurs in the amount of up to 1.4 million rubles. insured by the state. If an insured event occurs, the investor will be returned 100% of the invested funds.

It is important to remember that no investment instrument can provide a 100% money back guarantee. In investments there is a directly proportional relationship: the higher the percentage of return, the higher the risks .

Bank deposits

The most popular option where to invest money at high interest rates is to open a bank deposit. Given the low return on investment, this option can hardly be considered as a way to increase capital: interest payments rarely cover annual inflation.

However, this is the most successful solution for saving because:

- investments with minimal risk;

- deposit insurance (if the amount does not exceed 1.4 million rubles);

- accessibility (some banks allow you to open a deposit by depositing a small amount);

- the ability to return funds if necessary (in some cases without recalculation at a lower rate).

The most profitable deposits

It is enough to simply answer the question of which bank to invest money in at relatively high interest rates if you refer to the latest data from financial portals. The information on the websites is updated daily and may differ upon individual review. As of today – October 21, 2021 – the list of the most advantageous offers from banks includes:

- “Juicy” from Tavrichesky Bank – up to 7.5% per annum;

- “Record” from Premier BCS – up to 7.35%;

- “Excellent forecast” from Uralsibbank – up to 7.2%;

- “BIG Deposit” from MTS Bank – 7.2%;

- “Profitable Plus” from OTP-Bank – up to 7.0%.

Which bank has the most profitable deposit today: top 13 best deposits

Watch the video on the topic:

Investment contribution

The difference between an investment deposit and a traditional one is that the funds are transferred for trust management. Part of the money is placed on a regular deposit, part is used for the bank to purchase financial instruments. Attractive options may be:

- VTB Privilege

Since October 2021, the “Investment” deposit tariff has been in effect. At the moment, it seems to be the most profitable option where you can invest money for six months or a year. The current rate is up to 8.9% per annum. The maximum profitability is available to holders of Multicard Bank when connecting. To open an account, clients will need to deposit at least 1 million rubles.

- Gazprombank

The “At the Top” deposit offers a yield of up to 8.6% per annum when opening an account for six months or a year. The minimum amount is 50 thousand rubles. The key condition is the mandatory execution of the NJ agreement.

- Uralsib

“Strategy” will allow you to have a yield of up to 8.3% per annum for consumers who have opened a deposit in the amount of at least 150 thousand rubles for 181 days. At the same time, you need to fill out applications for:

- receiving shares of URALSIB investment funds;

- investment and savings insurance policies;

- transfer of the account to trust management.

- Bank Rosgosstrah

“Double benefit” provides for the accrual of 8.5% annually on deposits whose amount is at least 100 thousand rubles. Validity period – 367 days. Special conditions: registration of one of the insurance poles from Rosgosstrakh Life.

- OTP Bank

As part of the “Double Benefit Plus”, the client will be able to receive passive income annually at 8.0%. Key conditions: amount of at least 50 thousand rubles, term - one year, conclusion of an ILI agreement for 5 years.

OFZ

Bond loans of the Ministry of Finance of the Russian Federation are attractive to citizens due to the availability of investments with a guaranteed profit. The entry threshold is 10 thousand rubles, can be purchased at any Sberbank branch. Investment risks are limited: income is paid at a fixed rate, while the state acts as a guarantor of money return.

The yield varies depending on the period of holding the bonds: the longer the period, the higher the interest. The average ranges from 4.23% to 5.94%. When holding a security for three years, it can reach 7% per annum at maturity.

Federal loan bonds for individuals in 2021: yield

The barrier to entry into the market is high, there is no insurance

An important point is that individuals cannot invest less than 1.5 million rubles in microfinance organizations. They are equated to unqualified investors; the state, using a limit on the amount of investment, cuts off those who, in the event of bankruptcy of an microfinance organization, will lose everything they have acquired in their lives. For a professional investor who is prone to risks, even failure will not be so difficult. Professional investors do not bet on only one instrument, distributing money across different “baskets”. In addition, such investments are not insured by the state. It is important.

Financial instruments with a high rate of return (up to 15% per annum)

Conservative methods do not pose a serious investment risk, but at the same time do not provide significant monthly capitalization. However, there are alternative options where to invest money at a good interest rate with a guarantee for 3 months or a longer period.

Bonds

Along with the government, IOUs can also be issued by commercial enterprises. On average, the income on corporate bonds is higher; the amount of payments depends directly on the issuer. According to 2021 data, among the “blue chips” - reliable, large companies in Russia - the most profitable bonds are represented in Sberbank - 12.27%.

The TOP companies in which you can invest money with a guaranteed monthly return also include:

- X5 Retail Group – 9.25%;

- Retail chain "Magnit" - 8.7%;

- MTS – 8.4%.

Higher coupons, close to 15%, are more common in third-tier bonds. However, there is a risk that the company will not fulfill its obligations.

Investments in startups

You can profitably invest money at high interest rates in a startup to help in the development and promotion of various projects. The attractiveness of the investment is that the potential income is unlimited. On special websites, offers from entrepreneurs are posted with various conditions: profitability from 10 to 80% per annum, payback period from 12 months to several years.

Since startups represent companies with a short operating history, investments are associated with high risks. It is necessary to conduct a thorough analysis and compare a large number of options to make the optimal decision.

Investments in business projects: 9 ways + 11 best investment platforms

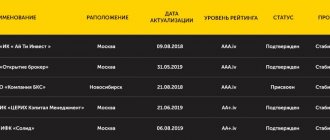

Mutual funds

Mutual investment funds operate according to the following scheme:

- a share is purchased (part of a collective fund);

- the total investments of the participants are transferred to trust management;

- the profit received is distributed among members in accordance with the number of shares.

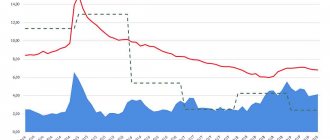

Depending on the riskiness of the financial instruments traded, the funds' profits vary. At the moment, mutual funds are formed by large Russian banks in different areas, and accordingly, with different returns:

- Uralsbibbank - up to 37.5% per year;

- VTB Bank – up to 31.53%;

- Sberbank – up to 27.12%;

- Rosselkhozbank – up to 23.8;

- Opening – up to 20.99% and others.

VTB mutual funds: profitability, conditions and investment prospects, reviews

Sberbank mutual funds for private clients: instructions for purchasing units + review of profitability

Mutual funds of Rosselkhozbank: profitability, investment conditions, cost of shares

What are mutual funds and how do they work: we invest wisely

Metal bills

An alternative option for investing money at a high interest rate for a month or more is to buy virtual precious metals. An impersonal bank account has a number of advantages:

- the ability to withdraw/replenish funds without restrictions (no fines, recalculations on the amount issued);

- choice of any currency - Russian ruble, dollar or euro;

- with long-term storage, the profit can exceed 50%.

Traditionally, banks provide the opportunity to purchase gold, silver, platinum or palladium. Over the past three years, the cost of each of them has increased significantly in price: by 66%, 48%, 11% and 68%, respectively.

Investment projects

Income from investment projects is generated as a result of their direct implementation. A well-formed business plan and targeted action on potential consumers can bring significant profits. Therefore, when choosing, it is necessary to analyze in detail the attractiveness of investments.

Here is an example: investments in profitable sites from the project incomesites.rf. Investors' money is invested in the purchase of sites that generate advertising income. The investor is invited to draw up an agreement with equity participation. Profit is paid monthly. The entry threshold is 1 million rubles. Profitability - 25-50% per annum. You can sell your site at any time.

Watch a video on this topic:

Real estate

Along with bank deposits, a popular option for investing money at a high interest rate is the purchase of real estate. The main difficulty is that a large initial capital is required.

Alternative:

- purchase of residential premises with a mortgage for rent, resale (you will need to contribute 20-30% of the initial amount)

- become a participant in collective investments in commercial real estate - retail chains, hotel complexes, etc.

An example is the investment program Avenu Apart , which assumes an entry threshold of 300 thousand rubles, a profitability level of up to 15%. The project involves investing in the construction of a hotel with profitable apartments in St. Petersburg. Payments to depositors will be made starting next month.

Investments in commercial real estate are also offered by the investment company Aktivo , which is a pioneer in the field of crowdinvesting in the Russian Federation. Shareholders' assets are invested in the construction of commercial real estate (supermarkets and shopping centers). The minimum amount to start is from 300 thousand rubles. Payback period is about 7 years. Yield up to 15% per annum.

Article on the topic: How to make money on apartments: what is profitable real estate + 10 earning strategies

Investments in structured products

Structured products are ready-made packages of securities with the parameters you need, which our analysts have already compiled for you. You simply choose a ready-made product and purchase it; then all you have to do is wait for the income, the forecast of which has also been compiled for you.

The main advantage of such investments is the opportunity to protect your capital. That is, no matter what happens, you will not lose your money. The product is designed in such a way that even in unfavorable market conditions, your investment will be returned in full. Such a product can provide good profitability, which is also, of course, a plus.

One of the disadvantages of structured products is that it is a relatively expensive financial instrument. To enter you will need an amount of 300 thousand rubles.

Investments with a yield of 20% per annum

Money can increase annually by more than 20% of its initial value by choosing riskier investment options.

Stock

On the stock exchange, shares are one of the most common financial instruments. The advantage is the ease of buying and selling securities. The basic principle of making a profit is to “wait” for the right moment to sell.

An investment portfolio may include high-risk shares of companies to generate income of 20% or more. However, it is not recommended to rely on aggressive investments - ultimately, all funds may be lost altogether.

Related articles: How to buy Gazprom shares for an individual and receive dividends

How to start investing from scratch: secrets of millionaire investors

Concept, methods and tools of fundamental analysis

Stock trading for beginners: 5 best trading strategies, earning schemes, tips for beginners

Private lending

In the case of private lending, you are the direct lender. Accordingly, the rate on funds issued as debt is set independently. In some cases, profitability can reach 50% per annum.

The risks of this option are that individuals may turn out to be unscrupulous, insolvent borrowers. The result is the loss of personal money without the possibility of its return. For bank deposits, money can be compensated through insurance; in this case, you will have to be responsible for yourself. The only guarantee is a well-drafted contract.

You can start investing in private loans on the services Vdolg.Ru, Zaimigo.Ru, Fingooroo.ru

PAMM accounts

PAMM accounts have become a popular solution for online investments. They also represent a transfer of money into trust. A trading account is created by a trader at a dealing center, within which he carries out trading operations according to a specific strategy. Investors can choose any manager to contribute their share of the funds to the general account.

Passive income per month can reach from 3 to 9% with the right choice. The result depends on both the trader and the PAMM broker, since transactions between participants are carried out through it and a database of managers is formed. The more reliable the traders, the more convenient the service conditions, the higher the trust in the broker. Currently the list of best companies includes:

- Alpari;

- ForexClub;

- RoboForex;

- InstaForex;

- Amarkets.

PAMM accounts - what are they: how does it work, how to build a portfolio and earn money, rating of the best

Cryptocurrency

At first glance, cryptocurrency may seem like a rather complex financial instrument, since it behaves unstable on the trading market: jumps can be constantly observed in the currency exchange rate chart. However, this option may be attractive for:

- Long term prospects. The price of the most popular cryptocurrency Bitcoin has increased by 72% over the past year, and by more than 2000% over the past five years.

- Speculation. Based on the difference in the ups and downs of the value of cryptocurrency, you can secure a daily income of several percent.

The advantage of electronic currency is its development and expansion. The creation of digital money is associated with the development of modern technologies. The further the progress, the more confident the cryptocurrency as a whole will feel.

The market is regularly replenished with new participants who can become objects of investment. You can make money on cryptocurrency at any time and place - it is allowed in almost all countries of the world.

How to make money on the difference in cryptocurrencies using exchangers, telegram bots and aggregators

ETF funds

ETFs are exchange-traded investment funds that include securities of dozens of the largest companies in Russia and the world. The advantage of this option is accessibility (entrance requires from 700 to 2800 rubles) and diversification (distribution of risks provides a higher guarantee of income). It is possible to make a profit due to the difference in the index of a particular exchange.

Index fund options that may be considered:

- ETF of Russian shares - average return for the year is 29.7%;

- precious metals – 18.9%;

- Eurobonds of Russian issuers – 7.3%, including ruble hedged – 15.5%;

- US government bonds – 6.8%.

At the moment, the ETF market is only in the initial stages of development. Access to world stock exchange indices can be obtained through a single provider – FinEx. When choosing funds, it is recommended to take into account such parameters as:

- aggregate size;

- structure (what companies are included);

- growth rates in recent years (it is recommended to take into account options with a stable positive trend);

- currency risks (dollars are considered the most stable).

ETF funds: what are they, profitability, top 5 best on the Moscow Exchange, how to search and buy, investment strategies

Instead of an introduction

To be honest, I haven’t done such calculations manually for a very long time. For what? After all, there are a lot of convenient applications and online calculators. As a last resort, a “fail-safe” Excel table will help out.

But it doesn’t hurt to know the elementary formulas for basic calculations! Agree, interest on deposits or loans can definitely be classified as “basic”.

Below we will recall school algebra. It must be useful at least somewhere in life.

If you close your deposit early

Some investors, for personal reasons, decide to withdraw money from the deposit early. For example, a contract was concluded for 2 years, and after a year a decision was made to withdraw the money.

In this case, banks remove interest, since the terms of the agreement are not fulfilled. A deposit under a profitable program turns into a demand deposit with a rate of 0.1%. Some banks offer preferential conditions for terminating the contract while maintaining half or ⅔ of the rate, but such offers are rare.

If interest was paid periodically to the client in person, then when the money is issued upon early termination, a recalculation is made. These paid amounts will be deducted, the client will receive less.

Information sources:

- Sberbank website: Top up your deposit.

- Rosselkhozbank website: Deposit Replenishable.

- Raiffeisenbank website: Deposit Personal choice.

- Sovcombank website: Deposit Hot interest

- Eastern Bank website: Sberknizhka.

- UBRD website: Convenient contribution.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

conclusions

By and large, the choice of deposit directly depends on what tasks you set for yourself, what conditions interest you, and what goals you are pursuing . If you decide to open a bank account, first analyze your specific situation, and do not go into the abstract. Remember that the choice should be made not only on the basis of the promised profitability, but also on bank reliability and deposit conditions.

Never trust the fate of your savings to bank employees. It is foolish to ask advice from people who are interested in selling a product recommended by bank policy, and not what will be most profitable for you. Any normal employee will try to push you something for which he will be rewarded with a coin, and not something that interests you.

I sincerely hope that this article will help you feel freer when choosing a tariff plan for your deposit and will not allow you to be a “black sheep” in communicating with a bank employee. Good luck with your investments, favorable conditions and see you soon! Don't forget to subscribe to blog updates to receive the latest articles in your email.

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Andrey

05/12/2021 at 23:12 Hello. Help me solve the problem with a comment. I forgot everything and I need to learn this called.You came to one of the nearest bank branches and found out that you can open an account there for three years at 15 percent per annum. Moreover, interest on your deposit will be accrued every six months

Reply ↓

About interest on deposit

The rate assigned under your program is reflected in the agreement concluded with the bank at the time of opening the deposit account. If we consider how interest is calculated on a deposit, then it is valid every day as long as the agreement is valid.

And income payments are carried out at different frequencies. Each bank and each program is individual in this regard. Payment possible:

- monthly;

- quarterly;

- semiannually;

- once a year;

- upon expiration of the deposit term.

Every day money works and makes a profit. By opening a bank deposit, a person protects his money from depreciation and stores it securely. Deposits are definitely better than putting money under your pillow at home.

The income from the deposit cannot be called particularly high; the profit only slightly exceeds inflation. But still, this is one of the most reliable investment tools.