Crises are normal. They happen from time to time in any economy where there is credit, and last from six months to several years. During this period, it is important for ordinary people not so much to increase as to save their savings by investing in their reliable assets. Bankiros.ru figures out how to do this with minimal risks.

Brokerage account

Open

Where is the best place to invest money in 2021?

2020 has become one of the most difficult years for the global economy and financial markets. Moreover, at the very beginning, quite good prospects awaited us - the stock market was at a record high level, and unemployment, on the contrary, was low, and housing prices were rising. However, the coronavirus pandemic has made serious adjustments to our lives - millions of people around the world have lost their jobs, tens of thousands of companies have gone bankrupt.

The experience of 2021 should serve as a warning and a lesson to all of us - it’s time to think about how you can insure yourself and make money.

Not an individual investment idea.

What is the difference between investing during a crisis and a pandemic?

The investment instruments themselves remain the same. But the conditions in which people have to invest have changed. There are fewer savings or the dynamics of their increase has decreased. The pandemic has dealt a significant blow to the economy. Many industries have practically stopped working. All this was preceded by a decline in oil prices, which caused currency surges. And no free money means no investment. An atmosphere of uncertainty remains. While no one can say what will happen next and when the pandemic will end. Therefore, you have to carefully calculate the risks and consequences of financial decisions. Even if you managed to save your savings, you have to reconsider your attitude towards them. For example, if the situation worsens in the near future, you may need money. This means that it is better to save them rather than invest them somewhere. Trust in financial institutions is falling , and not only in them, which is logical in a situation where no one can guarantee anything. Hence, this too may turn off investors. Fraudsters are becoming more active Taking advantage of panic and uncertainty, deceivers come up with new schemes and begin to use old ones more actively. During a crisis, it is easy for a desperate person to believe in promises of getting rich with minimal investment, and then losing everything. At the same time, more cautious people begin to doubt the proposals even more. Is it worth investing during a crisis and pandemic? Personal finance and investment management expert Igor Fainman believes so. Even if you have never done this, you don’t have to delay the start.

It is best to start right away with practice: take the first steps and gain sensory experience.

You need to start with small amounts and increase them only when you have an understanding of how the investment itself works. Igor Fainman, expert in personal finance and investment management At the same time, the rules are the same for 15 thousand rubles and for 100 million dollars.

The basic principles are always based on risk assessment and diversification of invested funds. It is important not to keep all your eggs in one basket and use different investment tools. It is better to avoid short-term speculative investments. As a rule, they do not bring income, and you also risk losing your investment.

Invest money in stocks

In 2021, investing in stocks is still relevant. Dividend-paying stocks may not provide the explosive price growth that is typical of pure growth stocks, but they offer stable and predictable returns. And because of these stable returns, they tend to have greater price stability.

Shares of Russian companies

The crisis associated with the coronavirus epidemic has cost the Russian economy dearly. And no one can give accurate forecasts for the restoration of pre-crisis indicators. Like the whole world, Russian business is faced with a new type of crisis - rapid and large-scale.

Now, when a gradual restoration of production begins, it is worth giving preference to the shares of the giants that suffered the least from the crisis. For example:

- Gazprom - the price of gas continues to rise, the dividend yield on the company's shares remains unchanged.

- Sber - after a change of shareholder in March 2021, dividends on the company's shares gradually increased, and in September Sberbank approved the payment of record dividends for the Russian market.

- Norilsk Nickel - prices for metals sold by the company (palladium, nickel, copper and platinum) are growing steadily.

Shares of foreign companies

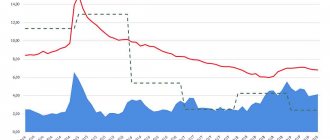

In 2021, we witnessed one of the craziest years in the history of the stock market, which will definitely now be written down in books. After losing more than a third of its value in less than five weeks in the first quarter, the benchmark S&P 500 rose to finish 2021 with annual returns twice the average annual return of the past 40 years. This is an incredible result given the global economic and geopolitical situation.

If you are choosing among stocks that pay dividends, you should pay special attention to the so-called. dividend aristocrats (i.e. those who provide stable dividend growth for at least 25 years in a row). These are companies that know how to increase their cash flow to ensure annual dividend growth. For example, Coca-Cola, Hormel, Genuine Parts, Procter & Gamble, and Johnson & Johnson have all increased their dividends for more than 50 years in a row.

Other options

Structured products can be used as an alternative to direct investing - many provide a minimum fixed return plus an additional return calculated by multiplying any increase in the underlying index by a fixed percentage. This percentage is often called the ownership interest.

Structured products are a package of products consisting of one or more underlying assets (for example, bonds) and a set of financial instruments related to these underlying assets. These are low-risk investments and can provide capital protection of up to 100%.

Bank deposit

The simplest thing you can do is open a deposit account at a bank. Such investments are safe, but usually do not have high returns. Interest rates on deposits are falling all the time. And now in various credit institutions they range from 4.5% to 6% per annum, which is not even able to compensate for inflation.

For bank deposits, the profitability is determined by the key rate set by the Central Bank of the Russian Federation. This is the main economic indicator that speaks about the real cost of paper money in the country and the level of inflation processes.

Official data on rising prices for basic goods hardly reflect the actual picture of what is happening, which everyone can see from the price tags in stores. Therefore, the interest rate, and hence the yield on deposits, will continue to decline further.

The situation is slightly different with foreign currency deposits. Bank deposits in euros do not give their owners a return of more than 1% per year. Investments in dollars do not promise much higher returns. With an eye on Europe, the Central Bank may well introduce a negative rate on deposits in foreign currency, so that depositors will have to pay for storing their own money. No matter how absurd it may sound, the reality of such a situation cannot be ruled out.

The main advantages of keeping funds on a bank deposit are low risks, predictable returns, participation in the deposit insurance program and the availability of this type of investment for everyone.

The disadvantages are the impossibility of withdrawing funds before the end of the contract without loss of dividends and the low level of profitability.

Invest money in currency

The most popular way to invest in currencies is to trade currencies on an exchange, but you can also buy ETFs, invest in corporations, etc. Like all investments, investing in currencies involves risk, especially during uncertain economic times.

In 2021, economic analysts recommend that Russians invest in several currencies at once - i.e. make diversified baskets. Currencies are very volatile assets that change in value quite quickly. Moreover, it is impossible to predict in which direction - decline or growth - the change in their value will go. Many are now betting on the euro due to its strengthening in the financial market. Yuan and yen are also considered potentially profitable currencies.

But the forecasts for the ruble are not the most rosy - due to the persistence of geopolitical tensions.

Buying precious metals

The profitability of investing in precious metals is determined by the increase in their value. Historically, the value of gold and silver, despite short-term fluctuations, only increases in the long term. However, this perspective can be measured in both years and decades. Those who purchased the yellow metal back in 1979, due to almost thirty years of market stagnation, began to make a profit from their purchase only after 2008.

Precious metals by themselves do not generate additional value. Their profitability depends entirely on demand and price growth. According to data for 2021, only 59% of all gold produced in the world went to industrial and jewelry needs. 41% of the precious metal went to satisfy investment demand and replenish the reserves of leading central banks.

Gold is considered an anti-crisis asset.

And now it’s not just a crisis, but according to analysts: the collapse of the world economy. Right now, gold can protect your million from inflation. There are several options for investing in precious metals:

- Buying gold coins or bars from a bank or pawn shop.

- Opening a bank compulsory medical insurance (an impersonal metal account).

- Purchase of securities of gold mining enterprises, ETFs and mutual funds.

Among the advantages of such investments are high returns during economic crises, clarity and accessibility of investments.

The disadvantages include low profits in a stable economy, as well as commission expenses, VAT (gold coins are not taxed), and personal income tax when buying and selling assets.

IPO

IPO is the initial public offering of a company's shares. And for an individual investor it is quite risky, so this option is more suitable for qualified investors.

Once the stock price is set and trading begins on the exchange, individuals can begin purchasing IPO shares. An alternative to buying shares outright is to invest in one of several mutual funds that invest in IPOs.

There is no point in overestimating an IPO - if a company's shares are a good investment, they will remain so after. It may even be better to wait until after the IPO, when the share price has stabilized or even fallen—when the excitement has subsided.

Earning money ideas for “creative” people

One of the ways to make money in difficult conditions is to organize “apartment events”, home viewings, or organize “salons”. Something that can always be imagined as a house party and where creative people can do business.

As usual, there will be a lot of criminal and semi-criminal activities. Starting from moonshine and smuggling, and ending with robbery, arms and drug trafficking.

Living standards will decline steadily in the coming years. And you need to be prepared for this. And prepare now. Although we should have started yesterday.

And we will have to create the “new economy” ourselves. And this means that you need to be useful, necessary and in demand for the people among whom you live.

Bank deposits

Banks accept deposits from customers (essentially borrowing money from account holders) and lend it to other customers. And when a bank lends your money to other customers, it is essentially "investing" those funds.

Deposits are made with banks for different periods of time, have different levels of required minimum deposits and maturity dates. Deposits of individuals in Russian banks are insured by the state for a certain amount.

Whether it is worth investing in a bank now is a moot point - after the coronavirus crisis, the interest rates on deposits are offered quite low.

Bonds

It all depends on what kind of bonds you would like to buy and how much you expect to protect your money with bonds.

Government (federal and municipal) bonds are more reliable. Bonds of companies and enterprises are reliable only as long as the issuer is willing to pay its debts.

After all, a bond is actually a promissory note from your borrower to whom you lent money at a fixed or variable interest rate.

Overall, bond yields are low. However, so is the reliability of some of them. If you want to lend your money to someone at a small interest rate, then it is easier to use a bank deposit.

Other money investments

The residential and commercial real estate sector looks quite mixed in 2021. The transition to remote work had a negative impact on commercial real estate - the vacancy of office space increased sharply, and retail space suffered due to the closure of stores. But sooner or later the restrictions will end, and so will the stimulus funding.

One of the main reasons to invest in real estate is because it acts as a counterweight to the stock market. This is a very low risk investment. However, there are also disadvantages to investing in real estate - lack of diversification, lower liquidity and maintenance and repair costs.

What to do with money during a crisis

The economy never stays at the same level, like any other sphere, it has its moments of ups and downs. And if everything is quite easy with economic recovery, then the financial crisis negatively affects all areas of life. At such moments, the main task becomes to preserve existing savings in full, and this is impossible to do without smart investments.

A crisis always affects the exchange rate, depreciating it. Therefore, even in times of financial instability, cash should not just lie under the pillow, or in a spending bank account, it should work.

If it was not possible to create a so-called “safety cushion” before the onset of financial problems, you need to start saving today. These funds will help you stay afloat in the event of a job loss or a sharp reduction in income. Its size must be at least 6 monthly family income. You can collect the required amount by reducing expenses on entertainment, equipment, expensive clothes and various take-out foods. Once the “safety cushion” has been formed, you can begin investing the funds that remain free after making “basic” expenses.

Method 3: On deposit accounts

This option is for those who do not like to take risks, but want to not only keep their money physically intact, but also preserve its purchasing power. This method is good in times of stability, but during periods of falling national currency exchange rates you should not rely on it - even if the bank does not go bankrupt, it does not guarantee an adequate increase in profitability. If the financial institution “decides to live for a long time,” then the Deposit Guarantee Fund will return the money, but during the waiting period, inflation will “eat up” part of it.