Raiffeisenbank bonds are a good investment tool for those who do not like risk. The yield on securities is not too high, but the reliability of the issuer attracts many investors. The dynamics of the shares are less optimistic, but the general trend shows an increase in prices, which directly indicates profitability, albeit long-term. Let's consider the features and profitability of the Central Bank of Raiffeisenbank.

We have been managing assets since 2004

99 billion rubles

volume of assets under management

Top 5

in the mutual fund market by volume of funds raised

120 years

on the European market

AAA.am rating

maximum reliability according to the National Rating Agency

The best management company

for retail investors 2021 (NAUFOR)

Professional managers

Federal Financial Markets Service certificates and extensive experience in the Russian market

Personal account In a bank branch

Briefly about the issuer

JSC Raiffeisenbank was founded in 1996 as a subsidiary of Raiffeisen Bank International AG. Until 2007, it had 100% Austrian capital and bore the name Raiffeisenbank Austria. From the beginning of 2006 to November 2007, a merger process took place with the Russian bank OJSC ImpexBank. After this event, Raiffeisenbank JSC does not leave the TOP-10 in terms of the volume of investments of individuals and their lending, and the TOP-15 Russian banks in terms of the volume of available assets. The financial institution provides a full range of services to individuals and legal clients both in rubles and in foreign currency, servicing residents and non-residents of the Russian Federation.

What is mutual fund

This abbreviation means “mutual investment fund.” This is a group of investors who invest money in securities, real estate, etc.

The totality of all investors' investments is called a portfolio. Each investor can buy a share (share). The number of shares purchased is determined by the amount of money invested. A share can be bought, sold, or used as collateral.

Important! The value of the share increases over time. Thus, by selling a share at a higher price, after a while you will make a good profit.

But how to acquire an income share and increase money? This is done by the management company. It is she who makes decisions about buying assets, freezing them or selling them for profit.

Similar mutual funds

How do we determine the similarity of mutual funds to each other?

| Name | Management Company | Profit |

| PROMSVYAZ-BONDS | Promsvyaz | 9.05% |

| RGS – Bonds | Savings Management | 9.02% |

| VTB Fund Balanced | VTB Capital Asset Management | 9.04% |

| MDM-world of funds | MDM | 9.15% |

| Alternative percentage | Invest-Ural | 9.70% |

| Capital-Balanced | Kapital | 8.61% |

| Analytical Center-Balanced | Analytical center | 8.60% |

| Solid-Invest | Solid Management | 8.99% |

| Global Capital – Bonds | Global Capital | 8.62% |

| Monomakh-Panorama | Monomakh | 8.44% |

Show all mutual funds from the database

Statistics

| YTD | 3m | 1g | 3g | 5l | 10 years | |

| Growth 1000 USD | 1020 | 1231 | 1155 | 1689 | 1999 | 2412 |

| Fund income | 2.05% | 23.14% | 15.53% | 19.09% | 14.86% | 9.2% |

| Rating in category | – | – | – | – | – | – |

| % in category | – | – | – | – | – | – |

RCMX - what is it?

Before looking at the specifics, let’s define in general what kind of fund it is and what stock index it follows. ETF RCMX is the first fund of Raiffeisen Capital Management Company, a subsidiary of . The structure of the BPIF portfolio was developed on the basis of the Moscow Exchange custom index 15 gross total return (MRBCTR) (in other words, on the 15 most liquid blue chips of the Russian stock market). In addition to the price difference, reinvested dividends are also taken into account when calculating profitability.

The calculation method is as follows: the initial limit of the share of one issuer to 13% with a gradual decrease by the end of 2021 to 9%. The index is rebalanced once a quarter (in March, June, September and December).

Bond Review

JSC Raiffeisenbank issues corporate exchange-traded bonds in rubles, usually short-term. The nominal value is 1000 rubles. The issue is carried out in documentary form to bearer. The maturity of the bonds is 3 or 5 years.

Also, Raiffeisenbank bonds are characterized by:

- Possible early repayment under offer.

- The frequency of coupon payments is 2-4 times a year.

- Variable coupon from 0.01 to 11.4% per annum, constant about 11% per annum.

In the last 2-3 years, the bank practically did not issue any issues, and some issues were cancelled. This does not indicate financial problems; on the contrary, Raiffeisen refused to issue the Central Bank to the stock market.

If we analyze past issues, Raiffeisenbank repays all debt obligations on time. At the same time, the volume of the issue is quite large and amounts to 5-10 billion rubles.

As of the beginning of December 2021, 7 issues of corporate bonds with par value of 1000 rubles are being prepared. The volume of the issue depends on the issue and will amount to 5–10 billion rubles, as in the previous ones.

List of all funds

Today, the company manages seventeen mutual funds. Their comparative characteristics are shown in the table.

| Name | Ticker (Bloomberg)/ ISIN | Registration No. | Registration date | Strategy | Risk | Management company remuneration, % | Profitability for 3 years, % | Number of shareholders | Minimum investment period, years |

| Raiffeisen - Shares | RAIFEQT EN | 0241-74050443 | 04.08.04 | shares with high liquidity | price | 3.,9 | 52,9 | 3646 | 3 |

| Raiffeisen - Bonds | RAIFBND RU | 0242-74050284 | 04.08.04 | bonds of reliable issuers | credit, interest | 1,8 | 23,3 | 19 090 | 1 |

| Raiffeisen – Dividend shares | RAIFBLC RU/RU000A100SN9 | 0243-74050367 | 04.08.04 | shares of domestic companies paying dividends | price | 3,9 | 44,2 | 1561 | 3 |

| Raiffeisen - USA | RAIFFOF RU/RU000A0JURC3 | 0647-94120199 | 26.10.06 | shares of US companies included in the S&P500 index | price, currency | 2,9 | 39,6 | 4081 | 3 |

| Raiffeisen - Consumer Sector | RAIFCNS RU | 0986-94131808 | 20.09.07 | shares of retailers, service companies | price, currency | 3,9 | 18,6 | 2069 | 3 |

| Raiffeisen - Primary Sector | RAIFCOM RU | 0987-94132127 | 20.09.07 | shares of Russian issuers in the oil, gas, metallurgical industries | price | 3,9 | 68,1 | 3638 | 3 |

| Raiffeisen – Information Technology | RAIFTEL RU | 0988-94131961 | 20.09.07 | hightech stocks | price, currency | 3,9 | 76 | 4840 | 3 |

| Raiffeisen – Electric Power Industry | RFPWREN RU | 0981-94132044 | 20.09.07 | shares of Russian electric power companies | price | 3,9 | 11,9 | 2169 | 3 |

| Raiffeisen – MICEX Blue Chip Index | RAIFMCX RU/RU000A0JURB5 | 0983-94131725 | 20.09.07 | index shares | price | 0,5 | 64,2 | 1872 | 3 |

| Raiffeisen-Industrial | RFCORPI RU | 0984-94131889 | 20.09.07 | heavy industry stocks | price | 3,9 | 46,1 | 751 | 3 |

| Raiffeisen – Precious metals | RPREMET EN | 1953-94168467 | 27.10.10 | ETF units investing in precious metals other than gold | price, currency | 2,4 | 19,5 | 220 | 3 |

| Raiffeisen - Europe | RAIBRIC EN | 2063-94172606 | 22.02.11 | European stocks ETF | price, currency | 2,4 | 21,3 | 479 | 3 |

| Raiffeisen - Emerging Markets | RAIASIA RU | 2075-94172523 | 03.03.11 | shares of issuers of developing countries, mainly Asian | price, currency | 3,9 | 31,8 | 540 | 3 |

| Raiffeisen - Gold | RAIGOLD RU/RU000A0JURA7 | 2241 | 08.11.11 | Gold Index ETF | price, currency | 2,4 | 19,4 | 1119 | 3 |

| Raiffeisen – Corporate bonds | RAIFTRS RU/RU000A100SM1 | 2260 | 29.11.11 | corporate bonds of reliable Russian companies | liquidity risk, credit | 1,8 | 22,9 | 3168 | 2 |

| Raiffeisen – Active Management Fund | RACTMGT RU | 2261 | 29.11.11 | shares of the most promising Russian and foreign issuers | price, currency | 3,9 | 43,3 | 4160 | 3 |

| Raiffeisen – Debt markets of developed countries | RFEURBD RU | 2356 | 15.05.12 | bonds of economically developed countries | price, currency | 1,6 | 3,5 | 1129 | 1 |

All open-end funds (OPIF). When purchasing shares for the first time through Raiffeisenbank offices, you will pay 50,000 rubles, through a management company - 15,000 rubles. Subsequent contributions start from 10,000 rubles.

For all mutual funds there is the possibility of purchasing online and early sale. The commission varies from 0 to 3% depending on the holding period of the share: the longer the holding period, the lower the commission.

The main advantages of investing in Raiffeisenbank mutual funds

Investing in mutual funds opens up the following opportunities and advantages for Raiffeisenbank clients:

- no need to monitor the situation and study the nuances of the stock market - all this is undertaken by qualified specialists of the management company Raiffeisen-Capital;

- customized solutions that meet risk and return expectations;

- high level of investment reliability.

Raiffeisenbank mutual funds are one of the best options for obtaining stable passive income at low costs. Raiffeisen-Capital specialists will help clients choose the right mutual fund for the most profitable investment.

Investment conditions

Up-to-date information with the conditions for investing in the exchange-traded fund "Raiffeisen - MICEX Blue Chip Index" at the time of purchase is available on the official website of the Moscow Stock Exchange.

| Ticker | RCMX |

| ISIN code | RU000A101 MF6 |

| Management Company | LLC Management Company "Raiffeisen Capital" |

| Start date of trading | 22/05/2020 |

| Tracked Index | MRBCTR |

| Currency | RUB |

| Type of securities | Stock |

| Management Committee Commission | 1% |

| Listing level on Moscow Exchange | 3 |

| Size 1 lot | 1 |

| Dividends | Reinvestment |

| Taxation | 13% on the sale of securities |

The Raiffeisen Fund commission is as follows: 0.5% is charged for investment management, 0.4% for depositories, 0.1% for other expenses.

Management strategy of Raiffeisen Capital

Investment portfolios are managed taking into account global practices and accumulated experience, which allows us to offer clients the most successful investment options.

Fundamental approach

The proposed portfolios have a bottom-up structure that allows you to analyze each company separately, the efficiency of the business and the attractiveness of investing in it.

The formed investment committee makes decisions that affect the content of portfolios and are binding on portfolio managers. The presence of a risk assessment manager who has the authority to block any decision made allows us to form another strategic direction of the fundamental approach to the formation of investment portfolios.

Control and selection of investment objects

Companies for investment undergo a strict and multifaceted selection, which takes into account all the parameters of the company, the success of investments in it, etc.

- Liquidity, company transparency, corporate governance standards are what are included in the initial analysis of each investment object.

- Business valuation parameters developed by Raiffeisen Capital allow you to analyze information about the company taken from various sources.

- Personal meetings with managers, as well as participation in investment conferences, are of great importance.

- If the company meets the investment requirements, has no conflicts with the law and passes the risk manager’s inspection, then it is included in the investment portfolio.

Even after the company is approved and included in the portfolio, employees of the management company monitor the state of affairs, promptly monitoring the slightest changes. If a company becomes too risky an investment, it is excluded from the offer package.

How to invest (step by step instructions)

This is easy to do:

- Step 1 – visit the Raiffeisenbank office with your passport. When purchasing a share for the first time, you must fill out an application form;

- Step 2 – selecting a suitable mutual fund;

- 3rd step – payment.

In the future, additional shares can be purchased upon request through the Internet bank.

You can also buy shares remotely. The purchasing algorithm in this case will look like:

- Step 1 – go to the Raiffeisenbank website;

- Step 2 – registering a personal account through the Government Services Portal;

- Step 3 – choosing a mutual fund;

- 4th step – payment.

How to buy Raiffeisen mutual funds

In order to purchase mutual funds offered by Raiffeisen Capital, you must leave a request on the website, and then go to the nearest Raiffeisenbank branch, draw up an agreement there and make a purchase. Online purchasing is available only to those who have already opened an account with the company and purchased shares. New clients - only to the bank.

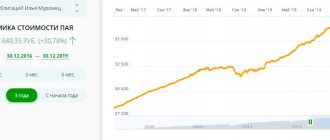

Quote chart

Despite the sharp economic downturn around the world due to quarantine measures taken in 2021, BPIF has shown an increase in aggregate volume. At the time of issue, the closing price was 984.5 rubles, today – 1083.7 rubles.

Over the past three months, no losses have been noted on the quote chart; the value of the fund is gradually increasing. The active rise began on June 15, 2021.

You can track the quote chart in real time on the official website of the Moscow Exchange, as well as on financial portals, for example, on the Finam website.

Dynamics of share value and NAV

Below are graphs of unit value and net asset value for all funds for the last three years.

Net asset value is all assets of a mutual fund in monetary terms minus liabilities as of the calculation date (depository fees, management expenses, etc.).

Raiffeisen - Shares

Over 3 years, the share showed an increase in price from 25.8 to 39.5 thousand rubles. NAV increased by 86.2%. The fund's return over 3 years was 52.9%, which is much higher than the return on bank deposits.

A fund for risk takers with the expectation of high returns. The mutual fund portfolio is not industry-linked, which reduces risks.

Raiffeisen - Bonds

The fund's return for 3 years was 23.3%, and for the year – 10.8%. Net asset value increased by 81.5%.

The mutual fund's portfolio consists of bonds of Russian issuers (state, regional and corporate). Investments in bonds are less profitable than stocks, but more reliable.

Raiffeisen – Dividend shares

The cost of the share increased from 18.9 to 27.2 thousand rubles. The fund's return over three years was 44.2%, assets increased by 237%.

Shares are selected for the mutual fund portfolio with an eye to high dividend payments. Diversification of investments in different sectors of the economy helps reduce risks.

Raiffeisen - USA

The cost of the share increased from 32.3 to 45 thousand rubles. The fund's three-year return was 39.6%. NAV growth by 15%.

Raiffeisen - Consumer Sector

The cost of the share changed from 12.8 to 15.1 thousand rubles. The yield was 18.6%. NAV decreased by 23.7%.

Which is not surprising: due to the crisis and the decline in the effective demand of the population, the Russian consumer sector is going through hard times.

Raiffeisen - Primary Sector

The fund's three-year return was 68.1%, NAV almost doubled - by 192%. Rising energy prices also have a positive impact on shares of mining companies.

Raiffeisen – Information Technology

The fund is a growth leader: profitability increased by 76%, NAV by 957%.

Raiffeisen – Electric Power Industry

Over 3 years, the mutual fund earned its investors 11.9%. Taking into account the paid commissions and remunerations of the management company, the income of investors was even lower. NAV decreased by 59.1%.

Raiffeisen – MICEX Blue Chip Index

The fund showed good growth: the unit return was 64.2%, assets grew by 236%.

Raiffeisen – Industrial

Mutual fund yield is 46%, NAV increased by 8%. The fund's assets include Russian and foreign shares in the chemical, metallurgical and engineering industries.

Raiffeisen – Precious metals

The fund's yield is 19.5%, NAV decreased by 22%. The mutual fund was created as a refuge for preserving capital during a crisis.

Raiffeisen - Europe

The shares showed a return of just over 20%, net assets decreased by 5.6%.

Raiffeisen - Emerging Markets

The yield of the mutual fund was almost 32%, the NAV increased by 2%.

Raiffeisen - Gold

The fund's return was 19.4%, net assets decreased by 20%.

Raiffeisen – Corporate bonds

The fund's return was 22.9%, NAV increased by almost 8450%. An alternative to a bank deposit.

Raiffeisen – Active Management Fund

The fund's return was 43.3%, NAV increased by 67%.

Raiffeisen – Debt markets of developed countries

The mutual fund's return over three years was 3.5%, NAV decreased by 66%. This is the case when a bank deposit looks more attractive.

To increase the benefits from your investments, it is important to choose the time of purchase, the well-known principle: “Buy cheap.” The positive dynamics of the mutual fund's performance indicators is not a guarantee that its profitability will continue to grow; it may be worth taking a closer look at outsider funds.

Newbie

To invest in mutual funds, it is advisable for beginners to at least briefly familiarize themselves with the equipment.

What is a mutual fund and why is it needed?

The meaning of the abbreviation is mutual investment fund. A mutual fund pools the funds of investors to invest them in any financial instruments (securities, currency, precious metals, etc.) in order to make a profit.

The management company decides what to invest in. If the management company has chosen the right strategy, the mutual fund portfolio will increase in value, bringing income to shareholders.

Profit is distributed among shareholders in proportion to the amount they invested. The investor can make a profit at the end of the period of holding the share.

Advantages and disadvantages of mutual funds

| Pros: | Minuses: |

| Simplicity and accessibility of investment. | Paying for professional services is expensive. |

| They do not require special knowledge for competent investment management; there are professionals for this. | Commissions (for the acquisition, sale of shares, for management) will have to be paid, even if you receive a loss. |

| It is possible to get higher profits compared to bank deposits. | Profit is not guaranteed, and no one is insured against losses. |

Risks

Any investment involves risk. For mutual funds, as for other assets, the statement “the higher the risk, the higher the profitability” is true.

What affects the risk level of a mutual fund

In the case of mutual funds, the following risks exist:

- the risk of not receiving the income expected due to unfavorable movements in the asset price (price risk);

- depreciation of assets in foreign currency due to changes in exchange rates (exchange);

- the issuer of debt securities will not be able to pay the promised interest on the loan (credit);

- liquidity risk that does not allow the asset to be quickly sold.

In addition, there are risks associated with the actions of the management company: incorrect assessment of the asset when included in the portfolio, increase in tariffs for servicing the mutual fund, operational failures, etc.

What can be done to reduce risks

You can reduce risks by investing not in one mutual fund, but in several different ones. Like that saying about the eggs and the basket. For example, send part of the investment to a mutual fund holding shares, and part to a fund with debt securities or precious metals.

My review

In general, my review of Raiffeisen mutual funds is positive. The company offers good funds to choose from - you can build a diversified portfolio. However, the downside is a large investment amount: not everyone has 50 thousand rubles to spare. Sberbank or VTB have a lower entry threshold. A large entry amount makes it difficult for a novice investor to assemble a diverse portfolio. To invest in at least 5 different funds, you will need at least 250 thousand rubles.

A significant advantage is the minimal commissions. You don't have to pay anything at all to buy shares. There is also no management fee - it is already included in the price of the share. If you own shares for more than 3 years, you will not need to pay a discount. Let me also remind you that if you own shares for more than 3 years, you will not be required to pay personal income tax. So, if you buy shares of the Raiffeisen Mutual Fund and hold them until the end - more than 3 years, then you will not have to pay anything at all. Get a net profit. So go ahead - good luck, and may the money be with you!

Rate this article

[Total votes: 2 Average rating: 5]