TOP 3 best brokers this year

| QUOTEX | " WEBSITE |

| POCKETOPTION | " WEBSITE |

| FINMAX | " WEBSITE |

The best working strategies for binary options on time frames of 1 minute (60 seconds), 5 minutes, 15 and one hour (60 minutes) for profitable trading.

On this page you will get acquainted with actually working, tested strategies for binary options for different trading time periods. I can immediately recommend testing these strategies first on a DEMO ACCOUNT , after successful trading, you can start trading on a real account.

Bollinger Bands and RSI Oscillator

An excellent profitable indicator are Bollinger Bands and the RSI tool. For profitable trading, you need to set the following values for these instruments:

- Bollinger Bands (period 20, deviation – 5);

- RSI – period 4.

These technical tools can be used on a live stock price chart, bypassing the settings in a busy trading terminal. We recommend preparing a digital option on the company’s website, selecting the order’s validity period, for example, 60 seconds, and then buying a contract in the direction of the trading signal. Here you can see a trade based on the RSI signal at the intersection of the upper Bollinger Band. The order quickly brought in 90% of the profit.

Binary options strategy for 60 seconds Fever

The strategy for binary options 60 seconds “Fever” was developed for trading and making money over short periods of time - 60 seconds or 1 minute. It belongs to indicator strategies, works on any underlying assets, and brings approximately 85% of contracts closed with profit and will definitely help you increase your deposit.

How the strategy works

The strategy is based on several technical indicators - a moving average and two MACD oscillators - to provide even more accurate trading signals.

As you know, the Moving Average indicator is a trending automatic market assessment tool, which on a chart shows the average value of an asset over a certain time period, and the points of price deviation from the calculated value. With its help, we will see the trend and the moments of its turning point.

Using the MACD oscillator, we will see the intensity of the market without market noise and its reversal point in two options of parameters at once. Why is the second MACD used? The fact is that the second charts of quotes on which trading will be carried out are characterized by a lot of market noise, due to which you can make an erroneous trading bet. Using a second oscillator with alternative parameters will allow you to filter out incomprehensible price movements and see the real reversal of quotes.

To set up a strategy template, you will need trading software with built-in custom indicators, second chart intervals, and trade execution without price slippage.

Binary options brokers have the settings we need in trading platforms.

So, we select an asset with a trending market, switch its chart to the 15s interval and add indicators with the following parameters:

- MA Simple – period 30

- MACD – parameters 6/12/9

- MACD – parameters 25/50/9

Having finished setting up the template, you will receive the following markup of the quote chart, which will be ready to receive signals:

On the chart you should have one moving average, relative to which the quotes will move, and two oscillators, the moving averages of which will confirm the market reversal for you and indicate the optimal points for concluding transactions.

How to make trades using trading signals binary options strategy 60 seconds “Fever”

To conclude a transaction, you will need to wait for a complex trading signal consisting of indicators of three indicators - the price breakdown of the SMA moving average, the intersection of the zero level on the junior oscillator and the intersection of moving averages with each other on the senior MACD. The signals will appear almost simultaneously, so you can immediately conclude a deal and within a minute with a high probability of closing it with a profit.

Indicators for trading UP:

- the price crossed the SMA from bottom to top

- on the lower MACD line they broke through the zero level upward

- on the senior MACD lines crossed and turned upward

A complex signal about the beginning of an upward movement on the chart will look something like this:

Indicators for trading DOWN:

- the price crossed the SMA from top to bottom

- on the lower MACD line they broke through the zero level downwards

- on the senior MACD lines crossed and turned downward

A complex signal about the beginning of a downward movement on the chart will look something like this:

In a one-sided trend, the predominant number of transactions will be with a forecast of the direction of movement of the asset market, and the entry will be made when the price returns to the trend after a small correction. However, indicators can also determine a deep correction, at which it is also possible to conclude a deal in the opposite direction to the trend.

Expiration time and money management

On the 15s timeframe, the expiration time for transactions with high market volatility should be 1 minute, however, when market volatility decreases, the expiration time should be extended to 2 minutes. If all the rules for entering the market are followed, 85% of transactions will be closed with profit. The main thing is to choose a suitable market situation where the binary options strategy 60 seconds Fever can reveal its potential. In order to reduce the level of risk, the volume of each trading bet should be reduced to 2-3% of the amount of trading capital, or to 1 dollar if there is a small amount of funds on deposit.

Setting the indicator

- You need to download the technical tool to your PC.

- Download MT4, for example, from the GrandCapital broker website.

- Unpack the archive with the program.

- Copy the ex4 format files to the root MT4 folder, to the folder with technical indicators Indicators.

- Download the template with the selected trading strategy to your computer.

- Copy the template to your MT4 templates folder in the Templates folder.

- Restart the trading terminal.

- Select the desired underlying asset, time interval 60 seconds or M1, right-click in the “Charts” menu, hover over “Template”, select a strategy template, or go to the tab with technical indicators and select the one that you will use for scalping.

60 second options strategy: MA + Stochastic

This is an indicator trading system.

Set of necessary indicators:

- SMA.

- Stochastic Oscillator.

We leave the indicator settings as original. Then we set a one-minute candlestick chart and an expiration time of 1 minute.

So, how to trade 60 second options

according to this trading strategy? Two indicators plotted on the chart will help us with this.

Example of a PUT signal (Below)

In order for an options trader to have the right to enter into a “Below” transaction, the following conditions must be met:

- a bearish candle (red) confidently crosses the SMA indicator from below to above;

- look at the readings of the Stochastic Oscillator. Its lines should leave the zone (80) and be directed downwards.

As you can see, the trade on the best options strategy for 60 seconds

confidently closes in money.

Example of a CALL signal (Above)

To obtain the right to consider transactions for the purchase of a contract of the “Higher” type, the following picture must be observed on the chart of the trading platform:

- a bullish candle (green) confidently crosses the SMA indicator from top to bottom;

- We monitor the readings of the Stochastic Oscillator. Its lines should leave the zone (20) and be directed upward.

The screenshot above shows that there was a prolonged downward trend, since both Stochastic lines were in the oversold zone (20). There were attempts to exit this area, but sellers prevailed over buyers, which put strong pressure on the financial asset.

However, over time, the green candle crossed the simple moving average (SMA) from the bottom up, which gave reason to believe that a trend reversal had occurred. We made a deal with an expiration date of 1 minute and were not disappointed.

Optimization

There are no 100% profitable trades for any strategy, even beyond a highly profitable one. Therefore, Martingale will help out here. Above we wrote the essence of using this system.

conclusions

We have presented to your attention several indicators for binary options that can be used for trading on minute charts. The trading strategies we provide can be used to obtain maximum benefits. Using the tools presented above, you can earn income in 70-90% of cases and this is not fiction, but the reality of professional traders. To get maximum income, we recommend that you trade only with the trend so that the percentage of successful financial transactions is as high as possible.

If possible, leave a comment under the article, tell us about your own experience of using such algorithms and the strategies presented in the material. Share the link with your friends, because it contains valuable information for beginning traders.

It’s up to you to decide which indicator to use in trading; each of them has its own characteristics, advantages and disadvantages. To trade as efficiently as possible, try to speculate only on minute charts, then you can reach a professional level of making transactions - up to 200 binary options per day. We wish you good luck!

Previous article: Program for automatic trading of binary options Next article: Strategies for trading binary options "touch" type

Binary options trading strategy for 1 minute Maestro

Binary options trading strategy for 1 minute Maestro is based on technical indicators and provides highly accurate signals for concluding transactions, allowing 85% of them to be closed in profit.

How does the 1 minute Maestro binary options strategy work?

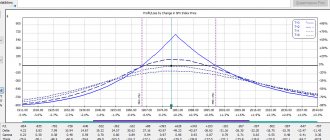

The strategy is based on the most famous technical indicators in stock trading: Bollinger Bands, Simple MA and RSI with special settings. Since the Bollinger Band indicator is used here, the strategy is carried out according to the principle of channel trading, that is, based on the pattern of price behavior inside the channel constructed by the indicator.

The moving average and RSI are used as guarantors of a short-term trend reversal, so you will enter the market based on a trading signal that will be generated simultaneously by three indicators, which ensures its high accuracy.

So, setting up a template should begin with choosing a suitable trading asset - this should be a currency pair in the market of which the price makes wave movements. Switch the asset quote chart to the 15s interval, which will allow you to make short-term trading bets for 1 minute of expiration.

After that, add indicators to the chart, giving them the following settings:

- Bollinger Waves

- Simple moving average – in two variants of moving average 3 and 5

- RSI with a period of 10 and level marks of 50/50

Do not be alarmed by the relatively large number of indicators used on the chart, since the indicators they generate will appear in a simple form. In this case, all indicators will appear simultaneously, thus forming one trading signal to conclude a transaction.

Trading signals binary options strategy for 1 minute “Maestro”

First, let us remind you of the principle of channel trading using the Bollinger Wave indicator. When the price of an asset moves inside the channel constructed by the indicator, as a rule, it fluctuates from its upper border to the lower one, rebounding from them each time. The moment the price touches the channel is perceived as a trading signal to conclude a deal with a forecast of a rebound and a reversal of quotes in the opposite direction.

However, there are often cases when quotes impulsively break through the channel boundary or, having touched it, move in a new direction insufficient time to conclude a deal. To avoid false signals, the system uses MA indicators, the intersection of which confirms the market reversal, as well as the RSI oscillator, which confirms the duration of the new trend by moving the moving average relative to the 50 level.

A price increase contract is issued when:

- quotes touch the lower border of the Bollinger channel

- moving averages will cross upward

- RSI line move above level 50

On the same segment of the chart, a trading signal for a decline looks like this:

Expiration date and money management

When trading on the 15s chart interval, binary options strategy signals for 1 minute are designed to conclude a transaction with an expiration of 1 minute. If you increase the time frame of the chart, then you will be able to make longer trading bets. Proper risk management in the strategy is to reduce the amount of the transaction to 3% of the deposit volume. With a small trading capital, the lot size should be set to the minimum.

Using Fundamental Analysis

Despite the loud name, such strategies are extremely simple. All of them are based on news trading, so in fact we are talking about different variations of the same trading strategy. Economic news is constantly coming out around the world, but most of it goes unnoticed by the financial markets. But some of these news, especially important ones, can cause serious movements either in a particular currency or in the entire financial market. Important political events can also have a big impact on market volatility.

All this news is collected in the economic calendar. Every broker has them. You can also find them on third-party Internet resources.

The required attributes of such a calendar are the date and time of news release, the previous indicator, and the forecast. Actual indicators appear in the empty column as news is released. To make it easier for the visitor to navigate the sea of economic news, they are marked in calendars by degree of importance:

- unimportant;

- medium importance;

- very important.

Read more: Does the ladder strategy work on binary options?

Actual performance may be better or worse than forecast. Trading strategies using fundamental analysis are built on this. When important news performs better than expected, you can expect the price of the assets they are tied to to skyrocket for some time. If the indicators turn out to be worse than expected, the price of the asset may fall rapidly.

Accordingly, based on such economic news, “Up” or “Down” options are purchased. Theoretically, by trading using this strategy, you can make a good profit in a short time: make 10-12 successful transactions in 15-20 minutes.

In practice, the confrontation between buyers and sellers in the market at such moments becomes tougher to the limit. The price on the chart is moving like crazy, and it is impossible to predict where it will go in the next second. Such “jerks” manifest themselves especially strongly on short timeframes, and most strongly on the minute one.

It is impossible to track price fluctuations using indicators at such moments. Therefore, you have to trade relying only on intuition, which rarely leads to an overall positive result.

Binary options strategy for 5 minutes “Temper” for beginner traders

When placing bets on this vehicle, you can count on a good profit. Essentially, this is scalping the foreign exchange market. With the help of his signals, a trader will be able to receive signals with an average accuracy of 86%.

Temper strategy indicators

Trading will be concluded based on three indicators intended for scalping the market.

To generate potentially profitable signals with an expiration period of no more than 5 minutes, you will need to install the following indicators on the live chart:

- TTM Scalper Indicator.

- Trend Trigger Factor.

- Inverse Fisher Transform on CCI version 2.

Important:

to apply the above set of indicators according to

the options strategy for beginners

on the TradingView service.

After applying all the indicators to the working chart, you should get the following:

How to use the Temper strategy

Analyze the price chart during the most highly volatile period, that is, during the European and American trading sessions.

Rules for purchasing “Higher/Below” contracts using the “Temper” TS

After conducting technical analysis using our set of indicators in order to open a trade “ Up

” the following situation will need to be created:

- The Trend Trigger Factor indicator has drawn an oversold zone from which the Japanese candlestick begins a bullish movement;

- the TTM Scalper Indicator assistant has indicated a local resistance level (blue dots on the price chart). The candle must overcome the level of these points (break through from bottom to top);

- the Inverse Fisher Transform on CCIv2 oscillator comes out of the lower channel.

Down contracts can only be opened after meeting the following technical conditions of our binary options strategy for beginners:

- The Trend Trigger Factor indicator has drawn an overbought zone from which the Japanese candlestick begins a bearish movement;

- the TTM Scalper Indicator assistant has indicated a local support level (blue dots on the price chart). The candle must overcome the level of these points (break through from top to bottom);

- the Inverse Fisher Transform on CCIv2 oscillator comes out of the top channel.

Deciding on expiration

If we work on a minute timeframe, we select an expiration of 5 minutes. In this trading tactic, the following formula applies to expiration: timeframe = 5 candles

. So, in a short period of time, each trader will have a lot of potentially profitable signals.

Conditions for purchasing a reduction contract

To complete the downward operation, you need to wait for the moment when the candle crosses the EMA band in the top-down direction, and then stops under the band.

The signal-filtering indicator must cross its histogram with the zero level and leave the positive zone, turning into a negative one.

The operation is completed after the signal candle closes. When the intersection of candles with an exponential MA and MACD with a zero level has already occurred. The expiration is set the same as the TF - 1 minute.

Trading strategy for binary options for 15 minutes “Three Kings”

The strategy is based on such well-known indicators as: MACD, RSI and MA. With the help of trading signals you can increase your deposit by 70-80%.

The key indicator in this TS will be RSI. But you don’t need to immediately conclude that this will be counter-trend trading. The signal to open a position will be the RSI crossing the 50th mark. And it is better to avoid options trading strategies for 15 minutes

, which are sharpened against the trend. Despite the main problem of all indicators - lag, this system neutralizes this issue by the fact that we will conclude a deal based on the timing of only one time candle.

Time frames for the 15 minute strategy will be used: 15, 30 and 1 hour.

Set of indicators

- Moving average SMA with a period of 10.

- Relative Strength Index RSI (standard settings).

- MACD (settings remain the same).

As a result, you should get a picture like this:

Once again, we note that crossing the 50th RSI mark indicates a very strong signal. However, it needs additional filtering

, like all other signals. The simplest filter in this TS is the SMA with a period of 10. We look at the location of Japanese candles in relation to the moving average (above or below).

The second filter can be the MACD technical analysis tool. It even itself is capable of giving incredibly accurate signals, which are formed based on the intersection of the base and main lines.

Signals for the “Three Kings” strategy

It's time to consider trading signals that will enable a trader to open a CALL type transaction (“Higher”):

- RSI crossed the 50 level from bottom to top.

- MACD shows the intersection of lines below the zero meridian.

- The Japanese candlestick is forming above the SMA (10).

- We buy the CALL option (“Higher”). Expiration time is 15 minutes.

Let's now look at the exact 15 minute options signals with the possibility of a PUT trade:

- RSI crossed the 50 level from top to bottom.

- MACD shows the intersection of lines above the zero meridian.

- The Japanese candlestick is formed below the SMA (10).

- We buy the PUT option (“Below”). Expiration time is 15 minutes.

Even if the trade closes at a loss, you can use the Martingale system. This is when each losing trade increases the rate by 2.5 times. We tested this simple strategy for 15 minute options

on different currency pairs. The result everywhere exceeded all our expectations. The approximate percentage of profitable trades reached 72%.

R

We recommend taking into account trading signals that differ in the range of intersection of RSI and MACD. Here's what we're talking about:

Also, the RSI indicator may not cross the 50 mark for a long time, but hover around it. In this situation, you should be patient. Scroll through the chart of the selected asset and see how the price reacted to similar situations.

Financial betting trading systems

A trading style based on financial betting cannot be called a strategy. In its pure form, this style does not require any market analysis. Its essence boils down to the fact that in case of loss, the next bet is increased to compensate for the losses from the losing bet.

A prominent representative of this trading style is the Martengale method, often used by roulette players. But, unlike roulette, winnings on binary options are always less than the bet amount. Therefore, you have to increase the next bet not by 2 times, as in a casino, but by 2.5 or even 3.

This trading style has a number of advantages in the eyes of a novice trader:

- There is no need to waste time studying the market and developing your own strategy. The first profitable trade covers the losses from the losers.

- The psychological fear of losing is reduced to a minimum.

But this trading style also has a big disadvantage: you need to have funds on your balance that are tens and hundreds of thousands of times higher than the initial bet.

As you can see from the table, in order to make 15 consecutive bets with an initial bet of $1 and a threefold increase in each subsequent one, then to complete the 15th transaction you will need to have a total of $3,188,616 in your account. The amount for the vast majority of people is astronomical, but even it cannot 100% guarantee a positive result - the possibility of making 15 losing bets cannot be completely ruled out. The result is the loss of the entire deposit.

Using a Martingale makes sense only after thoroughly working out your own trading strategy. In this case, trading performance increases many times over. But even in this case, it is better to use martingale in limited quantities - no more than 4-5 bets. It is better to lose part of your deposit than all of it.

Simple strategy for options 15 minutes

Note that this system is quite effective in terms of high-quality signals. Transactions will be concluded with an expiration period of 15 minutes. Although the analysis will be performed on the M5 timeframe

. Any currency pairs can be used; of course, it is desirable that they be highly volatile assets. We recommend trading using this strategy from 10:00 to 20:00 Moscow time.

Set of indicators

So, the following advisors should be installed on a live chart, allowing you to perform technical analysis:

- Vortex Indicator;

- True Strength Indicator.

That's all the trading indicators you need to trade a simple 15 minute options strategy. Analysis of assets for it will be carried out on a live chart of the TradingView service.

First, install the True Strength Indicator. True” into the search box

”, as the indicator we are looking for lights up.

Then in the same search box we write “ Vortex Indicator

” and select the corresponding “turkey”:

As a result, we get a work schedule like this:

That's all, the live chart is ready for analysis of any financial assets. Now the main thing is not to miss signals for concluding options contracts for 15 minutes

.

Examples of “Up”/“Down” signals

Contracts “ Up

” can be concluded only if the following situation is observed on the market:

- True Strength Indicator showed the intersection of the red and black lines. It is important that the red line is at the top until it intersects, and after it intersects, it moves down.

- The Vortex dol indicator lines (red and blue) should intersect each other. Before the intersection, the red line should be at the top, and after – at the bottom.

Important:

We conclude a deal only when both indicators simultaneously show an intersection or this insignificant distance.

Trades “ Down

” can be considered under the following market circumstances:

- True Strength Indicator showed the intersection of the red and black lines. It is important that the red line is at the bottom until it intersects, and after it intersects, it moves up.

- The Vortex dol indicator lines (red and blue) should intersect each other. Before crossing, the red line should be below, and after - above.

According to this simple, but at the same time profitable trading system, it is not recommended to consider signals during the publication of important macroeconomic news. Take an hour break at this time (30 minutes before publication and 30 after the news release).

Contract expiration dates and account management

As you may have guessed, we will consider signals based on the above trading system on the M5 chart, and the expiration date of the transaction is 15 minutes (or 3 time candles). As for money management, we strongly advise you not to invest more than 2% of your deposit in one transaction. That is, with a deposit of $100, the contract amount should be no more than $2.

Conditions for purchasing an upgrade contract

To complete the upward operation, you need to wait for the moment when the candle crosses the EMA band in the upward direction, and then stops above the band.

The signal-filtering indicator must intersect its histogram with the zero level and leave the negative zone, moving into a positive one.

There will be no positive result if there is no simultaneous coincidence of the indicators of the two instruments. If there is an intersection of the EMA with a candle, and the histogram at this time is located above or below the zero level, this is a loss for the trader.

Entry into the market is carried out on a further candle after the completion of the signal candle.