Why buy dollars and euros?

Of course, in everyday life for Russian citizens there is no alternative to rubles. But when it comes to saving and saving money to make a major purchase or form their own retirement capital, it becomes quite logical that they want to avoid the negative impact of inflation on their savings. Unfortunately, over the past decades, the Russian currency has repeatedly demonstrated instability and low resistance to the influence of external factors, as a result of which it is definitely not worth calling it an effective investment instrument.

On the other hand, making a decision to transfer savings into foreign currencies is also not so simple. To get information about the situation on the domestic market and the position of the ruble, you just need to turn on the TV, while information about the positions of other currencies and the state of affairs in the world requires at least a good knowledge of the English language and the ability to find the necessary sources. However, for a number of reasons, citizens are more often positive about the idea of whether it is profitable to buy dollars now in 2021. Here are some of the obvious advantages:

- Dollars or euros can be purchased or sold at any time of the day, without even leaving your home. Almost all financial institutions work with them;

- Studying the situation over recent years leaves no doubt about whether it is worth buying dollars or euros now. Sooner or later, the ruble exchange rate will fall anyway;

- To carry out transactions with currency, you do not need deep knowledge of the laws of economics and statistics, skills in working with exchange instruments and financial analytics;

- Investments in foreign currency are the most accessible and simple way to combat inflation, especially taking into account the almost zero return on deposits in rubles;

- During a crisis, currency transactions open up many ideas on where to invest 1,000,000 rubles to earn money. Of course, speculation is dangerous, but quite profitable.

Along with the advantages, foreign exchange investments are also characterized by certain risks. It is impossible to completely get rid of them, and therefore it is necessary to develop an action plan taking into account possible complications. In particular:

- Even the best specialists cannot choose the ideal moment to buy. Due to the unpredictability of the exchange rate, you have to put up with lost profits;

- Hundreds of factors influence currency quotes. Therefore, it is impossible to reliably predict either the amount or timing of income from such investments;

- There is always a difference between buying and selling rates. In order to ultimately gain profit, sometimes you have to keep dollars or euros in your wallet for quite a long time.

What do exchange rates depend on?

Today there is not a single currency on the market whose value is entirely determined by the issuing state. Of course, central banks regularly take measures to regulate the exchange rates of national currency units, but their capabilities in comparison with the resources of the world market are quite limited. Therefore, global economic and political factors have a predominant influence on whether it is better to buy dollars or euros. Here are the most significant of them:

- Geopolitical phenomena. Social, economic or military clashes that occur within a state or near its borders immediately cause a fall in the value of its currency, regardless of the reaction of the world community;

- Legislative policy. The position of the monetary unit is affected by the adoption of new laws in the field of taxation, the introduction of excise taxes and customs duties, sanctions and bans on certain export and import transactions;

- Statements from officials. Members of the government or heads of national corporations in their speeches may well declare theses that influence the market situation and indicate whether it is profitable to buy dollars now;

- Decisions of the Central Bank. We are talking here about raising or lowering the discount rate to control the rate of inflation, conducting trade operations with currency to maintain the exchange rate of the national currency within certain limits;

- State of the raw materials market. The key factors are fluctuations in prices for mass export resources - oil and gas, hydrocarbons, ferrous and non-ferrous metals, gold, food, high-tech and agricultural goods;

- Movement of capital. A balanced economic policy and production development attract foreign investors and lead to the emergence of many options where it is profitable to invest money in 2021;

- Production rates. Increasing the output of goods causes an increase in gross domestic product and creates a surplus that can be used for export. The state of the manufacturing sector determines the stability of the currency as a whole;

- Trade balance. It is a consequence of the previous indicator. If exports dominate imports in volume, we are talking about a positive trade balance. This increases budget revenues and strengthens the monetary unit;

- Speculation. Of course, stock exchange players, even with huge capital, will not be able to influence what is more profitable to buy - the dollar or the euro. However, speculative operations are quite capable of collapsing or inflating the rates of less significant currencies;

- Natural phenomena. By themselves, fires, floods, earthquakes or hurricanes do not pose a serious threat to the currency. But if they damage large cities, industrial or agricultural centers, GDP begins to fall.

Is it worth exchanging rubles for dollars now - the paradox of the American currency

The weakening of the US dollar usually occurs against the backdrop of increased investor appetite for risk: if the prospects of developing countries look attractive, and investments in them can provide a high level of profitability, then capital flows are directed from the US, thus provoking a decline in the value of the dollar.

Expert opinion

Sergei Litvinchik

Author of the article. Expert, entrepreneur since 2014.

Ask a Question

By the way, you can invest not only in currency but also in real estate, if you have more than 1,000,000 rubles, investing in real estate is a very good decision even despite the escrow.

But the current situation is nothing like that. For example, the yield on 10-year US Treasury bonds is testing new minimum levels: in March it fell below 1%, and then fell completely to 0.5%. Lower yields correspond to higher bond prices. Such low yields on the safest bonds indicate that investors do not believe in sustainable long-term growth of the US economy and prefer to remain in the least risky assets.

This means that this time the weakening of the dollar is associated with internal problems of the American economy, and not with the flow of funds to more promising markets.

Rating agencies are only adding fuel to the fire: at the end of July, Fitch revised its outlook for the US sovereign rating from neutral to negative, leaving the rating itself at the highest level of AAA.

https://www.kupi2metr.ru/investiruem-v-nedvizhimost-2020/

What influences the value of a currency now?

Of course, making a decision to buy or sell currency only on the basis of data on current exchange rates in a nearby bank is at least short-sighted. First of all, it is necessary to analyze the situation and highlight the main factors that determine whether it is profitable to buy dollars now: in 2021 there are not many of them, but the influence of each on the market is quite significant. This:

- Pandemic. The coronavirus has dealt a serious blow to the economies of China, the USA, Europe and other developed countries. Now data indicate a decrease in the intensity of its spread, but scientists do not exclude a re-outbreak in the fall and winter;

- Oil market. Hydrocarbon prices directly indicate whether it is worth buying dollars now: March 2021 began with the worst crisis in recent years, however, by the summer, OPEC+ members and Russia still agreed to reduce production;

- US politics. In order to eliminate the consequences of the pandemic, the White House is considering the prospects of waiving debt obligations to China and demanding material compensation from the Chinese government. This could cause serious damage to the dollar;

- Social tension. Protests and riots in America still raise doubts about whether it is necessary to buy dollars now. However, investors may be wary of Congress' use of military force and the escalation of racial conflicts in Europe;

- Hostilities. Clashes between the United States and Iran, the conflict in Syria and Turkey’s participation in it, and tensions in Venezuela pose a danger to the global hydrocarbon market. But as long as there are no supply interruptions, there is no need to worry.

USD/RUB exchange rate analysis

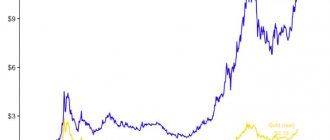

Experts conducted a statistical study since 1999, taking values over the last 20 years. The analysis takes into account the upward trend of the market. During this time, the USD/RUB rate has doubled. Periodically, the ruble strengthens against the dollar. But the exchange rate of the American currency is still much higher. The research factor was the days of the week, and profitability was taken as a variable. By looking at price changes by day, you can conclude whether the results are a pattern or an accident.

When is it more profitable to buy dollars and euros?

The first condition for a successful investment is the ability to purchase currency as cheaply as possible. However, even experts cannot always show exactly whether it makes sense to buy dollars now, or whether their exchange rate will be more profitable in a week. At the same time, there are some trends and patterns in the foreign exchange market that make it possible to quite accurately select the moment to make a transaction:

- Decreased currency quotes that are not associated with objective signs are usually artificial and indicate speculation. As a result, in the near future they may well increase, which will allow the investor to make money;

- An analysis of supply and demand will help you find out whether it makes sense to buy dollars now. If there is too much currency on the market, it quickly begins to fall in price, while if there is a lack of people willing to sell it, the rate usually increases;

- The best time to buy is often observed in the fourth week of each month, when exporters convert foreign currency earnings into rubles to pay taxes. As a result, an excess of dollars and euros appears on the market;

- In December and January, there may also be an excess of foreign currency on the exchanges. As a rule, during this period, wholesale buyers from other countries make payments to suppliers from Russia for oil and gas purchased during the year;

- The strengthening of the Russian monetary unit may be associated, among other things, with an increase in export operations, be it the sale abroad of large volumes of raw materials, precious metals or industrial products.

Exchange rate dynamics and future forecasts

The exchange rates of the US dollar and the euro are usually compared with each other - they calculate how many dollars are worth 1 euro. Currently, the rate fluctuates between 1.1 and 1.15 dollars per euro, but this was not always the case:

Dynamics of the euro to dollar exchange rate (EUR/USD)

As you can see, before the euro was launched into cash circulation, its exchange rate fell much below one, but since 2002, the euro has not yet fallen below the dollar in value. Significant fluctuations were recorded in 2008-2010, when the world economy was experiencing a crisis and Europe was experiencing a European debt crisis.

After this, an economic crisis began in individual eurozone countries - in Greece, Spain, Portugal, Ireland, Cyprus. This led to a serious decline in the euro's position.

However, now you should not expect strong growth of the euro - the prospects for Britain’s exit from the EU, the migration crisis and other factors do not in any way contribute to the strengthening of the European currency.

At the same time, for Russians, the dynamics of the euro/ruble exchange rate is almost identical to the dynamics of the dollar exchange rate. As mentioned above, the Bank of Russia calculates the average exchange rate of the dollar, on the basis of which it calculates the rates of all other currencies.

Dynamics of the euro to ruble exchange rate (EUR/RUB)

Dynamics of the US dollar to ruble exchange rate (USD/RUB)

Taking into account the double devaluation of the ruble, for Russians the question is rather like this: “Should I buy currency or keep money in rubles?” than “Which currency is better to choose?” However, for the long term, the relationship between the dollar and the euro must also be taken into account.

The dollar still accounts for 44% of the turnover on foreign exchange markets, more than half of international debt securities are issued in it, and the dollar also occupies more than 60% of the structure of international reserves of the world's countries.

However, despite the fact that there are still few prospects for the euro to strengthen, the dollar is also gradually losing its position. Thus, already in 2021, the US economy was not the largest in the world (though in terms of purchasing power parity) - China’s share grew to 18% in global GDP versus 15% for the United States. However, the entire eurozone still accounts for only 11% of global GDP.

The US has structural problems - the budget deficit, the constant growth of public debt, and the balance of payments deficit. This is reinforced by the very strange policy of the current President Donald Trump, who is escalating the confrontation with China and also making controversial decisions on the budget (for example, in the first weeks of 2019, due to the President’s refusal to sign the budget, the United States lost $6 billion).

In the eurozone, from a financial point of view, the situation is more favorable - the balance of payments is in surplus, the budget deficit is small, and the public debt is decreasing.

However, political factors seriously threaten the “health” of the euro - Brexit could bring considerable losses to the European Union. There is information that a referendum on leaving the eurozone and returning to the national currency may be held in Italy. However, negotiations on Britain's exit are expected to proceed in a constructive manner, and Italy is likely to remain in the eurozone.

Therefore, interest in the euro as a reserve currency is increasing, although at the moment the dollar still looks like a more reliable investment, despite the difficult situation in the United States.

When is it more profitable to sell dollars and euros?

It is logical to assume that the second condition for reasonable investment will be the chance at the right moment to get rid of currency and exchange it for rubles with a profit. It is just as difficult to determine the maximum quotes as the minimum, especially in the presence of local corrections, so you should think about selling dollars and euros if there are clear signs of a trend reversal or a predicted shortage of supply on the exchange. In particular:

- By the first week of each month, the largest corporations have already closed their tax payments and are beginning to actively buy foreign currency to order raw materials and equipment used in production from foreign suppliers;

- At the end of each quarter, the state replenishes the budget at the expense of taxpayers and begins to repay obligations to foreign creditors. The Ministry of Finance purchases dollars and euros in large quantities, which provokes a shortage;

- A short-term collapse in ruble quotations within 10–15% is often caused by announcements of the next package of sanctions adopted by the United States and European countries against the Russian Federation. By observing the statements of politicians, one can predict this situation;

- At the beginning of December, retail chains replenish stocks of imported goods in anticipation of traditional New Year sales. For settlements with manufacturers, only foreign currency is used, which is why there is an excess supply of the ruble on the market;

- Before serious events, major officials sometimes make statements about whether it is worth buying dollars in Russia now. This always causes a stir and an increase in currency quotes, which means a good time to sell.

Where is the best place to buy dollars and euros?

As noted above, the likelihood of problems with buying or selling euros and dollars is vanishingly small. Today, not only absolutely all banks work with these currencies, but also hundreds of other financial institutions, including on the Internet. But it is precisely their number that can add trouble to the investor: each company sets exchange rates based on its own economic strategy, so before making a transaction you will have to compare many offers. Where can you buy currency:

- At the bank's cash desk. You can choose where to buy currency on the Internet, using data on exchange rates from banking websites. All banknotes are checked for authenticity, and fees are known in advance. However, the cash register may not have the required amount;

- In the bank app. Each institution has an application or web interface where, among other things, you can buy or sell euros, dollars or rubles, around the clock. To do this, you need to become a bank client and open a foreign currency account;

- In the Internet. If you have an electronic wallet, it is easy to buy currency through the interface of the payment system itself or use one of the many exchange sites. You can find profitable courses on the portal;

- At the exchange office. These kiosks are run by banking organizations, however, they often offer better exchange rates. They don’t have websites, so you won’t be able to see on the Internet whether you can buy dollars now;

- On the currency exchange. Dollars or euros, along with other currencies, are traded on both stock exchanges and Forex. However, to gain access to the site, you must register on the broker’s website and top up your deposit account with at least $100.

Factors behind the dollar's fall

Analysts disagree on what exactly has caused the dollar to fall in recent months. Global economic processes are complex in nature, and often they can only be explained by analyzing a combination of various factors. Below are three reasons that, among others, could have the greatest impact on the dollar.

Expectations of weak growth of the American economy. The situation with coronavirus in the United States from the very beginning looks more serious than in Europe and China. Some states were forced to quickly return to restrictions amid rising case numbers. Among them are such important and large states as California, Texas, Arizona, Florida and several others.

Despite unprecedented support for the economy from both the Fed and Congress, the feasibility of further assistance is now in question and is a political stumbling block between Democrats and Republicans (the last stimulus package of at least $1 trillion was suspended in August and is still so and was not accepted). It could also undermine the emerging economic recovery.

Overall, the United States is coping with the spread of coronavirus worse than Europe. Unemployment in the country, despite a noticeable decline from peak levels in April of this year, remains extremely high (7.9% in September). From the beginning of the crisis until the fall, it was consistently higher than in the eurozone, so economists expect that over the horizon of 1-2 years, European countries may show a more confident and rapid recovery and transition to a growth phase.

It is also interesting how fears of a long recovery of the US economy from the crisis are combined with record values of the American stock market. And if in relation to IT giants, which were really able to show good results during the pandemic, such stock behavior may be justified, then market valuations of companies from the real sector of the economy look more and more overheated.

US presidential elections. Opinion polls favor Democratic candidate Joe Biden. However, the situation can change very quickly, and the recent 2021 presidential election has shown how such polls can be misleading.

Political uncertainty is an important factor for the stock market and may explain the dollar's weakness.

Strengthening the euro. The correction of the DXY index is largely explained by the growth of the euro against the dollar. Since May this year, the euro has strengthened by almost 10% and is now trading around the 1.2 mark for the first time since 2021. There are two main reasons for this:

- EU countries agreed in July on a joint economic aid package, which includes issuing bonds totaling €750 billion. For the first time, European countries are issuing debt not individually, but jointly. The issuer is the EU, and the rating of these bonds will be maximum (AAA). The creation of such a market is seen as an important step towards EU fiscal integration, which has been largely absent until now. Demand for these securities turned out to be rushed, which contributes to the growth of the attractiveness of the euro as a reserve currency.

- Narrowing of the difference between euro and dollar rates. After the Fed lowered the rate to 0.0-0.25% in March, the attractiveness of the euro as a funding currency fell. In recent years, the following strategy has worked: borrow funds in euros (at a negative rate), convert them into dollars and profit from the difference in interest rates. Now investors are curtailing their positions, buying back the euro and thereby pushing the European currency rate up.

Will there be an increase in apartment prices?

Where to store dollars and euros?

In most cases, citizens do not have significant savings in cash, so when purchasing currency they usually do not have the question of where to store it. However, if we are talking about larger amounts, leaving them in your wallet is simply unreasonable. By thinking about where to invest money so that it works in 2021, a citizen will not only protect his capital from inflation, but will also receive additional income in the future. Each storage method has advantages and disadvantages:

- In my apartment. Of course, a home safe will protect your savings from encroachment by the state, the tax service and collectors. However, this method does not guarantee absolute safety - no one is insured against fire, flooding or theft;

- On a bank account. Unlike pounds or yuan, personal accounts in dollars or euros can be opened at any bank. But this will not bring benefits to the investor: for simple storage of money, institutions pay a maximum of 1% per annum of the balance;

- On a deposit account. Opening a deposit is the most affordable option where to invest 50,000 rubles to earn money and protect capital from inflation. However, in euros, the benefit will be symbolic, since rates on this currency are usually 0.1%;

- In a safe deposit box. The method is considered one of the most reliable, but is only suitable for short-term storage of funds: firstly, the bank charges up to 40–50 rubles per day for renting a safe deposit box, and secondly, the money will not work and will not bring profit;

- In electronic form. Placing money in a personal electronic wallet raises some concerns, although well-known electronic payment systems like WebMoney and Yandex.Money have existed for more than twenty years and have never given rise to doubt;

- In securities. After purchasing currency on the stock exchange, you should immediately think about which stocks are best to invest in so that your capital does not lie idle. You can also buy bonds - in terms of reliability they are equal to deposits, and in terms of profitability they are superior to them.

It will be useful!

——————-

Where and how the MoneyPap family invests (successfully) (PDF) . In this document, I honestly tell you what profitable instruments my family invests in. Download the PDF for free - here.

——————-