About commercial real estate

With the right investment strategy, commercial real estate will be much more profitable than residential real estate. Investment returns can reach 9-13% per annum versus 4-6%, respectively.

Investments in commercial real estate have only begun to gain popularity in the last 5-10 years. Why is it so late, you ask? Firstly, the size of investments can be measured in billions (large office centers, hotels, warehouses).

Secondly, investing in housing is more understandable to private entrepreneurs - simply due to accumulated experience and a well-studied market.

In commercial real estate there is no “elite” as such, here we are talking about large investments in high-quality office blocks and warehouses (assets with high returns and associated risks), street retail (more moderate returns and risks) and hotel rooms (long-term payback and stable profitability).

VTB competition - come up with a name for the voice assistant and win an Iphone 12

From my point of view, the most in demand are offices in popular locations and retail premises in street retail. There are several ways to invest in commercial properties:

- Purchase an object for the purpose of its further sale/rent;

- Purchase a ready-made rental business (GAB);

- Buy units/shares in mutual funds.

Each option has its own specifics; the investor chooses the one that corresponds to the possibilities.

Glossary of terms

A share is a security that confirms ownership of a share in the property of a real estate fund

ETF – fund of funds. This is a kind of shell for several assets, each of which is traded on the exchange. For example, a real estate ETF can collect shares or bonds of all Russian developers.

A developer is a company uniting one or more contractors (developers) that raises funds from shareholders or uses borrowed capital (bank loans) for the construction and sale of residential properties.

Development is the whole range of activities for the construction of residential facilities, including the design and creation of associated infrastructure.

Purchasing a property for sale/rent

Office real estate

In the last year, the situation on the office market in Moscow has been especially favorable for investors: few new properties are being introduced, supply is gradually being washed out, vacancies are falling - all this leads to a shortage of high-quality office space, especially in the central regions of Moscow.

Meanwhile, demand continues to grow, which means that investments in the segment will pay off generously. Even with limited capital, you can invest in small office blocks with an area of 80 sq. m. m – small and medium-sized premises are sold today already at the construction stage of the business center.

The average profitability of such properties in Moscow for private investors is usually 12-14%. Occupancy and, accordingly, cash flow will largely depend on a combination of factors: high class business center, favorable location (proximity to business centers), convenient transport accessibility, developed infrastructure of the area and the facility itself (availability of parking, catering establishments, landscaped territory).

You also need to determine the target audience, its needs and demand, analyze the volume of competitive offers, etc.

Risks. The investor must make financial calculations in advance (rates, indexation, operating costs and utility space in square meters, “quality” of tenants) and risk analysis (terms of the contract).

Street retail

For retail premises, the decisive factor influencing the rate is traffic, and therefore location. For the location, the following are important: the first line of houses, high traffic (in the center of residential areas, in places with high passenger traffic - not far from the metro, train stations, transport hubs), the possibility of installing shop windows/signs, transport accessibility, the presence of transport interchanges and hubs.

Risks. The future facility must meet the requirements of a potential tenant: food retailers need loading/unloading areas (or the ability to organize them), a suitable layout for the sales area; for catering – hood and high electrical power.

Remember that it is not always possible to change the technical characteristics: for example, the status of a cultural heritage site imposes strict restrictions on the building, the owner will have to coordinate all repair work with the authorities, etc.

There may be other surprises. Thus, the implementation of the “My Street” program led to the fact that many top locations in the city center lost their advantages due to a reduction in parking spaces.

Resale of contracts

One way to make money in real estate without investing too much in it is through flipping contracts. All you need to do is find a struggling seller and a motivated buyer and bring them together.

By bringing both parties together, you eliminate the need to hunt for a buyer after the contract is concluded, which poses more risk. Instead, by locating the seller and buyer in advance, you can easily enter into an agreement with the confidence that you won't have to worry about closing the deal.

To do this, you must find either empty homes or homes with late mortgage payments. It's complicated. You're trying to find distressed sellers, but vacant homes are a better place to do it.

Purchase of a ready-made rental business (GAB)

GAB (ready rental business) is the purchase of liquid premises with lease agreements and stable cash flows. This is a convenient and highly profitable form of investment.

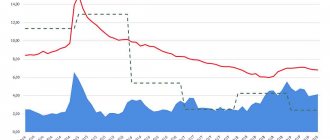

Thus, the market average capitalization rate for office real estate today reaches 10% (in some cases it may be lower than 10%). For comparison, the weighted average deposit rate for the second ten days of December is 6.17%. In addition to the office segment, the purchase of GABs is common in the retail real estate segment: in street retail, the share of such transactions is 90-95%.

Office real estate

Today on the market, many large developers are engaged in the sale of GABs, for example, Stone Hedge, Sminex, Coldy, etc. They form a finished product: they invest in office space, fill it with reliable tenants, enter into long-term lease agreements (3-7 years), and sell the properties to investors.

Sometimes this happens during the construction phase of a business center; A striking example is the DM Tower business center (developed by KR Properties) next to the territory of the Danilovskaya Manufactory, where office space is sold by floors and compact blocks from 70 to 1,050 sq. m. m.

At the moment, about 40% of the space in DM Tower has already been sold, although monolithic work has not yet been completed.

Risks. The stated payback period for the sale of a ready-made rental business is 8-9 years. At the same time, the rental agreement specifies the rental rate for the entire period of the agreement, including indexation.

However, investors need to evaluate the net operating income for this period: in practice, the rate is not always indexed.

The market is a moving phenomenon: supply and demand change, the landlord’s market can turn into a tenant’s market, and then the owner will have to make concessions, optimizing rental conditions.

Therefore, actual payback periods vary around 10-10.5 (sometimes up to 12) years. You also need to understand that the more “formed” the product you purchase and the fewer risks you take on, the lower the profitability will be.

Street retail

It is extremely rare to buy an empty building “for yourself” in street retail. As a rule, premises are sold with long-term lease agreements in force, which allows the investor to predict the return on investment.

Many companies on the market are engaged in the sale of GABs in retail real estate. The profitability of such objects varies from 5% to 15%. In top central locations, profitability is lower (due to high costs), but the risk of being left without tenants is much lower.

Risks. Having a tenant can sometimes become a burden. Other pitfalls: the complexity of managing a large facility, the difficult structuring of an acquisition transaction and the risks when purchasing premises. For example, over the past two years, many owners have been faced with the fact that the purchased building fell under Resolution 8 No. 819-PP, according to which it was regarded as an unauthorized building and was subject to demolition.

Lending

Lenders provide short-term loans to people who usually cannot get them from banks. These are loans with high interest rates because they are for a very short period. To complete your first transaction, you can contact such a lender. If you have a profitable option but are short on cash, this might be the best option.

You can also become a lender yourself, but you will need capital. This likely won't be the first way to make money in real estate, but as you build up your network, capital, and a solid pipeline of deals, you can provide bridge loans and make big profits.

Even with limited capital, if you can recognize good deals, provide a small amount and ensure success, you will likely find investors who will enter the business without much difficulty. The interest rates here make sense. There's more risk, but there's more reward. This can be a way to keep money liquid and make good profits quickly without having to wait years for earnings to materialize.

Investments in closed-end mutual funds (UIFs)

This is the least risky instrument for investing in commercial real estate: stable profitability, a minimum entry threshold and the opportunity to invest in almost any (including large) objects - shopping centers, offices, mixed-use complexes, etc. Investors buy units - conditional shares of the mutual fund's property, and portfolio managers select an asset for investment, assess risks, invest funds and manage the object.

For the investor, this scheme saves time, effort and money (payment of taxes and operating costs). Most investors can afford to buy shares in a mutual fund: the investment amount in most funds starts from 1-2 million rubles. The profitability of such projects can reach 10-13% per annum.

Risks. There are no guarantees of profit in mutual funds: a shareholder may not only not make money, but also lose money. It all depends on the experience of those who manage capital, their knowledge of the market and economic situation, seasonality, macroeconomic factors (crises, exchange rates, oil prices, etc.).

Informal collective investment

In this case, a pool of investors entrusts the management of joint capital to one person, who invests the collected funds in real estate, receives profit and distributes it among the fund participants.

The advantage of this approach to making a profit from real estate investment is the ability to choose an attractive property without bank financing. The profitability of such investments can reach 30-40% per annum.

Such investments are often found on the market of Russian new buildings. A group of investors buys several floors of a residential building at the foundation pit stage, and after the facility is put into operation, resells the square meters purchased in bulk.

The main disadvantage of informal collective investment is the human factor. The manager chosen by the shareholders can spend the fund’s funds for non-targeted needs. No legal documents are concluded during the transaction.

Joint real estate investment market

So, let's invest...?

Many people want to invest in real estate today, but not everyone can. The cost of entry is high, and with it the cost of error is high. The more profitable the object, the greater the risks. The decision in which direction to shift the risk/return balance remains with the investor.

When investing in luxury real estate, we are usually talking about millions, so you not only need to have solid capital, but also have a good knowledge of the market and the competitive environment. Luxury housing is a controversial asset. Expensive apartments, as a rule, have low liquidity - you can look for a buyer for them for years. But a relatively new format of apart-hotels, which bring maximum profit when rented out on a daily basis, is proving promising.

The commercial real estate market, which until recently was not very popular among investors, is, on the contrary, quickly beginning to gain momentum. There is a wide selection of properties, often more highly profitable than residential ones.

conclusions

Collective investments in real estate: closed-end mutual fund, REIT, ETF, crowdinvesting - available for both beginners and experienced investors.

- Entry threshold: from 300 thousand rubles to 5 million.

- Profitability: rent - from 5% per annum. Development – from 10% per annum.

- Registration: purchase of a fund share.

- Risks: bankruptcy of the management company, fraud, crisis in the real estate market.

The most important achievements of the collective investment market are the opportunity to invest in objects that, due to their high cost, are inaccessible to an investor with a small capital, and professional expertise from the management company.

How to reach your maximum

- We decide on the amount of investment. For highly profitable properties, you can use leverage.

- We indicate the final goal of the investment: whether you are buying premises for subsequent sale/renting or a ready-made rental business - depending on this, you will build a financial model.

- We assess the degree of risk acceptable to the investor, investment terms, and payback expectations.

- We look for an object - ourselves (if we know the market deeply) or turn to consultants. To make a choice, we evaluate the location, infrastructure, and condition of the object.

- We carry out due diligence.

- We structure the deal.

- We manage the property: ourselves or we hire a professional management company.

- We receive income. We follow market trends, make renovations and change the concept if necessary.

To avoid disappointment, be patient. Even the most liquid real estate properties usually take a long time to pay off, but with a competent investment strategy, the results will certainly please you.

Photo on the cover and in the material: Unsplash

Crowdinvesting risks and benefits

In addition to closed mutual funds, there is crowdinvesting. Crowdinvesting platforms differ from classic closed-end mutual funds in that a separate fund is registered for each property.

The main players in the Russian market are crowdinvesting platforms: Aktivo, Credo Capital and others. Advantages of crowdinvesting:

- Participation in large projects that are usually inaccessible to a private investor.

- Reducing risks by investing in several projects at once.

- Speed and convenience of transactions thanks to modern online technologies.

- Transparency of the system - access to the database of investment objects.

This collective method of investing in real estate is a high-risk investment, since there is a high probability of making a profit above the market average or completely losing the invested amount.

High-risk collective investments