Securities data

| Ticker | VZRZ, VZRZP |

| Trading platforms and trading times | Moscow Exchange MOEX, RTS |

| Name | PJSC Bank "Vozrozhdenie" |

| Number of securities in circulation | Ordinary shares - 23,748,694 shares Preferred shares - 1,294,505 shares |

| Denomination | 10 rubles for all types of promotions |

| Dividends | Paid |

| Year of foundation | 1991 |

| Founded by | Dmitry Orlov |

| Headquarters | Moscow |

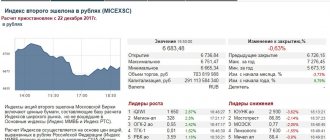

Exchange rate dynamics for all time

In 2005, Vozrozhdenie Bank share prices fluctuated at levels of 323-381 rubles per lot. In this case, one lot equaled one share. But from the beginning of November of that year to the end of December, the securities literally “shot” and made a jump from 337.95 to the level of 839.04. More than double growth in two months - such impressive results are rarely seen on the stock exchange.

Until May 2006, the rate remained at levels from 891 to 800 per share. But then in just two weeks the shares depreciated to 650 rubles. Until September, there was consolidation at the levels of 650-750 rubles, and from the end of August this process ended with a sharp increase. On August 15, 2006, trading was carried out at the level of 755 rubles, and on January 16, 2007, the price of the security was 1977.57 at the time the exchange closed.

True, already on February 9, 2007, the share was sold at 1518.80, and on March 5 at 1329.09 rubles. On April 10, you could sell or buy at 1,741.07; six months later, on October 10, you could sell at closing at 1,346.11 rubles.

That is, throughout 2007, Vozrozhdenie Bank securities were bought and sold with great volatility. On such days you can either make good money or lose it quickly. You need strong nerves, close stop losses and cold calculations.

By mid-January 2008, the price of the security reached the level of 1731.99, it would seem that everything had calmed down. But the global financial crisis was flaring up in the world, despite all the statements of “analysts”, including on the RBC TV channel, about a “safe haven” in Russian securities - everything went downhill, and especially in the banking sector.

The fall stopped in March 2009 at the level of 180.31 rubles per share. A little more than a year - and the size of the depreciation of securities amounted to more than 900%. In fact, there was no point in selling shares of Bank Vozrozhdenie at the end of 2008-2009. It was necessary to hold on in the hope that the bank would stand and the crisis would end.

A pleasant surprise awaited everyone who did not sell and bought at the “bottom” - an increase to 676.60 rubles in June, then, however, there was a slight rollback to 514.08 rubles in July, but the growing trend resumed, the securities could be sold at 1208.15 in September, at 1438.52 in February of the following 2010. That is, over nine months the shares showed an impressive growth of almost 800%.

Such races on the stock exchange are not in vain. Those who bought on time want to lock in profits and begin to sell securities. For Bank Vozrozhdenie, such a sale of shares resulted in a drop in quotations to the level of 835 rubles already in July 2010.

But in mid-January 2011, shares of Bank Vozrozhdenie could be bought or sold for 1,500 rubles, and the local maximum was recorded on January 19 - 1,540.

As it turned out later, this was the last peak on the quote chart. Subsequently, the price generally decreased - 539 rubles in December 2011, a period of fluctuation in the 540-640 corridor from June 2012 to March 2013, a new decrease to 341.40 per share in September 2013.

In general, there were 240-480 shares in the corridor and lasted the entire rest of the period of exchange trading, except for June 2021 to July 2021, when quotes rose to 747 rubles.

At the moment, it is not possible to buy Vozrozhdenie Bank shares on the stock exchange. They can be sold to the real owners of the securities: the current owner of 96.3% of the shares, VTB Bank, on March 14, 2021 sent a request to buy back shares of Bank Vozrozhdenie at a price of 481 rubles 68 kopecks per security.

Pre-sale preparation

Read on RBC Pro

The first trillionaires: who is breathing down the backs of Elon Musk and Jeff Bezos How Airbnb found a new source of income in a world without tourism Why it has become unfashionable to be a leader You won’t get off with dismissal: for which the CFO faces prison

The reason for the Central Bank’s order to sell Vozrozhdenie is Dmitry Ananyev’s “unsatisfactory business reputation” due to the reorganization of Promsvyazbank in December 2021. At the time the order was issued, brothers Dmitry and Alexey Ananyev owned 52.7% of the bank’s shares through the Dutch Promsvyaz Capital BV. But in the process of dividing assets, as a result of which Alexey Ananyev left the family banking business, the stake in Vozrozhdenie was divided between six Cypriot offshore companies, each of which owns no more than 10% of the bank's shares.

The Central Bank classified these offshore companies as “one group of persons” with Dmitry Ananyev. According to the share capital structure, offshore companies in total own the same 52.7% of Vozrozhdenie shares that previously belonged to Promsvyaz Capital. The bank reported that the new shareholder structure is a reflection of the actions of the main shareholders in the pre-sale preparation of Vozrozhdenie shares, that is, structuring the purchase and sale transaction, which will take place in several stages.

Dmitry Ananyev (Photo: Grigory Sysoev / RIA Novosti)

A representative of Promsvyaz Capital declined to comment on the bank's shareholder structure.

“Despite the fact that the bank’s 52.7% share of shares is divided between different companies, as soon as the volume of shares sold to one owner or persons affiliated with each other exceeds 30%, the sellers will be required to issue an offer to buy back shares to minority shareholders,” says Mikhail Alexandrov.

Bonum Capital representative Anton Averin refused to comment on the offer, saying that the structure of the deal will not be disclosed beyond what the Central Bank requires. According to the regulations of the Central Bank, in order to approve a new shareholder of any bank, the owner structure of the buyer must be disclosed, down to a public company or individual, recalls Igor Dubov, partner at Iontsev, Lyakhovsky and Partners.

About company

Vozrozhdenie Bank was registered in 1991 and at the beginning of its development had 34 branches in Moscow and the region. The following year, the credit institution received MICEX membership and began trading its shares.

In the mid-90s, Vozrozhdenie began collaborating with VISA and the World Bank.

1997 was marked by its entry into the international arena, ADRs began to be sold to foreign investors on international exchanges, and the bank itself received a rating from Standard & Poor's.

In 1998, bank managers made an important decision to develop an ATM network. This led to the fact that in 2002 Vozrozhdenie had the largest network of machines for accepting and issuing cash in the Moscow region.

Activities in the first decade of the 21st century were assessed in 2010 by The Banker magazine: Bank Vozrozhdenie was named credit institution of the year. A significant reward, considering that banks from 140 countries are taken into account.

In 2013, the bank achieved very good results: profit amounted to 1.5 billion rubles, assets - 211 billion rubles, and the loan portfolio to corporate clients - 125.6 billion rubles. Moreover, the share of small and medium-sized enterprises among borrowers reached 64.3%.

But in 2014, the founder and main shareholder of Vozrozhdenie, Dmitry Orlov, died, and his heirs decided to sell their share in the business.

On October 2, 2021, VTB Bank bought a stake in Vozrozhdenie shares from the Ananyev brothers and consolidated 85% of the securities in its hands.

Since then, the process of consolidating all securities in the hands of one owner has been underway, for which a redemption demand has been sent and a price has been announced.

Production of the company

All types of banking services for corporate and private clients. Traditional bank deposits, issuing credit cards, a network of ATMs and branches - Bank Vozrozhdenie has all this. The organization is involved in mortgage lending and has been a member of the deposit insurance system since 2004.

The bank serves both large and small businesses, developing its loan portfolio for all segments of business and the population.

Main shareholders

At the time of purchase of VTB (October 2018), share capital was distributed as follows:

- VTB Bank - 85% of ordinary shares;

- the Cypriot company Bonum CapitalLimited owned 6.07% of the shares;

- PJSC Promsvyazbank had a 2.52% stake.

But the consolidation process continues: in March 2021, VTB’s share reached 95% and continues to increase as Vozrozhdenie Bank shares are repurchased

Key figure and her role

Currently, the chairman of the board of Vozrozhdenie Bank is Gennady Soldatenkov, and the chairman of the board of directors is Dmitry Olyunin.

Their main task is to maintain the client base and the rhythmic work of the credit institution in the face of a change of owner, delisting from the stock exchange, and integration into the structures of a new banking association.

The integration process is planned to be completed in 2021.

Subsidiaries have branches in 17 regions of Russia, including:

- Kaliningrad region;

- Murmansk region;

- St. Petersburg and Leningrad region;

- Moscow and region;

- Tula region;

- Voronezh region;

- Nizhny Novgorod Region;

- Rostov region;

- Volgograd region;

- Krasnodar region;

- Stavropol region;

- Dagestan;

- Mordovia.

There are also branches of Bank Vozrozhdenie in Volgodonsk and Novorossiysk.

Company plans for the future

All plans depend on VTB management and how they see the future of Renaissance. Most likely, the brand will remain, but all structures will work in close integration with the main owner bank.

Dividend statistics

Bank Vozrozhdenie has paid the following dividends on shares over the past 10 years.

Ordinary shares:

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2017 | 6 Jul 2018 | 10 Jul 2018 | 12M 2017 | 0,50 ₽ | July 24, 2018 | ||

| 2016 | year | July 7, 2017 | 11 Jul 2017 | 12M 2016 | 7,70 ₽ | July 25, 2017 | |

| 2014 | June 9, 2015 | June 11, 2015 | 12M 2014 | 0,50 ₽ | June 25, 2015 | ||

| 2013 | 4 Jul 2014 | 8 Jul 2014 | 12M 2013 | 0,50 ₽ | July 22, 2014 | ||

| 2012 | May 13, 2013 | May 13, 2013 | 12M 2012 | 0,50 ₽ | May 27, 2013 | ||

| 2011 | May 11, 2012 | May 11, 2012 | 12M 2011 | 0,50 ₽ | May 25, 2012 | ||

| 2010 | May 5, 2011 | May 5, 2011 | 12M 2010 | 0,50 ₽ | May 19, 2011 | ||

| 2009 | May 6, 2010 | May 6, 2010 | 12M 2009 | 0,50 ₽ | May 20, 2010 | ||

| 2008 | May 8, 2009 | May 8, 2009 | 12M 2008 | 0,50 ₽ | May 22, 2009 | ||

| 2007 | May 12, 2008 | May 12, 2008 | 12M 2007 | 0,50 ₽ | May 26, 2008 |

Preference shares:

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | June 9, 2021 | June 11, 2021 | 12M 2020 | 2,00 ₽ | 0,81% | June 25, 2021 | |

| 2018 | 16 Jul 2020 | 20 Jul 2020 | 12M 2019 | 2,00 ₽ | 0,63% | 3 Aug 2020 | |

| 2017 | June 7, 2019 | June 11, 2019 | 12M 2018 | 2,00 ₽ | 0,93% | June 25, 2019 | |

| 2016 | 6 Jul 2018 | 10 Jul 2018 | 12M 2017 | 2,00 ₽ | 0,98% | July 24, 2018 | |

| 2014 | July 7, 2017 | 11 Jul 2017 | 12M 2016 | 7,70 ₽ | 4,68% | July 25, 2017 | |

| 2013 | June 9, 2015 | June 11, 2015 | 12M 2014 | 2,00 ₽ | 0,84% | June 25, 2015 | |

| 2012 | 4 Jul 2014 | 8 Jul 2014 | 12M 2013 | 2,00 ₽ | 1,88% | July 22, 2014 | |

| 2011 | May 13, 2013 | May 13, 2013 | 12M 2012 | 2,00 ₽ | 1,53% | May 27, 2013 | |

| 2010 | May 11, 2012 | May 11, 2012 | 12M 2011 | 2,00 ₽ | 0,89% | May 25, 2012 | |

| 2009 | May 5, 2011 | May 5, 2011 | 12M 2010 | 2,00 ₽ | 0,48% | May 19, 2011 | |

| 2008 | May 6, 2010 | May 6, 2010 | 12M 2009 | 2,00 ₽ | 0,51% | May 20, 2010 | |

| 2007 | May 8, 2009 | May 8, 2009 | 12M 2008 | 2,00 ₽ | 0,66% | May 22, 2009 | |

| 2006 | May 12, 2008 | May 12, 2008 | 12M 2007 | 2,00 ₽ | 0,34% | May 26, 2008 |

Interesting facts about the company

- The bank was one of the first to list its shares on the MICEX.

- He was a pioneer in the development of the ATM network.

- In 1998, he created his own processing center for printing and issuing plastic cards, which he distributed among his clients.

What can the story of Bank Vozrozhdenie teach us?

Open letter. Is there justice in the Renaissance?

The epic takeover of PJSC Bank Vozrozhdenie by VTB Bank is coming to an end. Now it has been decided to do this through a sequential merger with BM Bank (100% subsidiary of VTB).

- First, let’s evaluate the financial indicators of Bank Vozrozhdenie (since the fall of 2021, it will be managed by the state-owned VTB):

Unfortunately, there has been no growth in equity (book value) per share for a very long time. It is no secret that the fundamental basis of the value of a share, as well as the dividends paid on it, is the size and growth rate of equity capital attributable to it (ROE - the ratio of profit to equity). Note that over 12 years, 9.7 rubles were paid out of equity per share. for one ordinary (JSC) and 19.7 rubles. per one preferred (ap) share. That is, over 8 years, no more than 2% of the shareholders’ equity capital was paid in the form of dividends. However, by the time of the merger of PJSC Bank Vozrozhdenie with BM Bank, and, as a consequence, liquidation as a separate legal entity, the amount of capital is 786 rubles. per one ordinary and one preferred share. That is, taking into account the reliability of the official financial statements and relying on the auditor’s report (Ernst and Young LLC) and the control of the Bank of Russia, it can be argued that the shareholders have a non-fictional 786 rubles. per share (both for 1 JSC and for 1 AP). These funds consist both of those once contributed by shareholders, as a result of payment for the issue of shares (the par value of ordinary and preferred shares is the same), and earned as a result of the bank’s activities over all years of activity as a commercial organization.

- Let us analyze how the management bodies (Boards of Directors) of PJSC Bank Vozrozhdenie and VTB Bank relate to reporting data.

Let's consider the following issue on the agenda of the Board of Directors of PJSC Bank Vozrozhdenie

“On issue No. 5: Determining the repurchase price for shares of Bank Vozrozhdenie (PJSC):

In connection with the submission for consideration of the extraordinary General Meeting of Shareholders of the Public Joint Stock Company Bank Vozrozhdenie the issue of reorganization of the Public Joint Stock Company Bank Vozrozhdenie in the form of its merger with the Joint Stock Company BM-Bank:

— determine the repurchase price of one ordinary share of the Public Joint Stock Company Bank Vozrozhdenie with a par value of 10 (Ten) rubles in the amount of 437.00 (Four hundred thirty-seven) rubles;

— determine the repurchase price of one preferred share with a certain amount of dividend of the Public Joint Stock Company Bank Vozrozhdenie with a par value of 10 (Ten) rubles in the amount of 291.80 rubles (Two hundred ninety-one rubles and eighty kopecks).”

Let us highlight two significant points:

- The redemption price is very different for ordinary and preferred (that’s another name - why not defective?) shares: 437.00 rubles. and 291.80 rub. per share respectively. Perhaps they thought that an additional 10 rubles. (19.7 rubles - 9.7 rubles) of dividends received is quite worthy compensation for the difference of 145 rubles?

- The redemption price of both types of shares is much less than the amount of equity per share.

| Promotion | Redemption price | Book Price (Equity per share) | Loss of capital per share |

| Ordinary | 437.00 rub. | 786.50 rub. | 349.50 rub. |

| Privileged | 291.80 rub. | 786.50 rub. | 494.70 rub. |

Some might argue that equity does not apply to preferred stock. But here we will turn to the Law “On Joint Stock Companies” and the Charter of PJSC Bank Vozrozhdenie and model the process of liquidation (and this is what happens as a result of merger) of this organization.

According to clause 1 of Article 23 of the Federal Law “On Joint Stock Companies”, an equal (even more beneficial to the owners of preferred shares) distribution of the value of property between the owners of ordinary and preferred shares will occur in the event of liquidation.

The Law “On Joint Stock Companies” establishes the following order of payments:

1. first of all, payments are made on shares that must be repurchased in accordance with Article 75 of the Federal Law “On Joint-Stock Companies” (repurchase of shares by the company at the request of shareholders);

2. secondly, payments are made of accrued but unpaid dividends on preferred shares and the liquidation value of preferred shares determined by the company’s charter;

3. thirdly, the property of the liquidated company is distributed among shareholders - owners of ordinary shares and all types of preferred shares.

The distribution of property of each stage is carried out after the complete distribution of the property of the previous stage.

Liquidation value for preferred shares is a separate mandatory type of payment to the owners of preferred shares, paid in addition to the distribution of the remaining property of the company.

In accordance with paragraph 2 of Article 32 of the Federal Law “On Joint Stock Companies”:

"2. The company's charter must determine the amount of dividend and (or) the value paid upon liquidation of the company (liquidation value) for preferred shares of each type. The size of the dividend and liquidation value are determined in a fixed amount of money or as a percentage of the par value of preferred shares.”

Clause 5.3 of the Charter of Bank Vozrozhdenie states that the liquidation value of preferred shares is equal to the par value of the preferred share, that is, 10 rubles.

Accordingly, in the event of the liquidation of Bank Vozrozhdenie, the owners of ordinary shares of the company would receive only item 3 of the list given above, and the owners of preferred shares, in addition to the distribution of the remaining property on an equal basis with the owners of ordinary shares, would receive unpaid dividends and liquidation value preferred shares, that is, more than the holders of ordinary shares, by at least 10 rubles per share.

As part of a corporate reorganization procedure, the rights of holders of ordinary and preferred shares will also be the same (both types of shares become voting). In addition, the par value of ordinary and preferred shares of Bank Vozrozhdenie (PJSC) is also the same and amounts to 10 rubles. The fact that the preferred shares of Bank Vozrozhdenie (PJSC) were not voting during the period of the organization’s activities does not matter for determining the share of book value per share. In all other respects, ordinary and preferred shares of Bank Vozrozhdenie (PJSC) do not differ, with the exception of one parameter - all ordinary shares are concentrated in the hands of one owner - VTB Bank (PJSC).

That is, in essence, the redemption price for preferred shares should be at least not lower than the redemption price for ordinary shares! As proof, let us recall that decent companies, for example, Lukoil and Norilsk Nickel, once converted preferred shares into ordinary shares in a 1:1 ratio, despite different quotes (preferred shares were traded at a discount to ordinary shares).

Do members of the Board of Directors understand these legal and economic issues? Did they understand well the meaning of the Law and their own Charter? Are they acting in the best interests of ALL shareholders? Or maybe they think that the amount of equity capital of PJSC Bank Vozrozhdenie is fake (non-existent)? And together with the auditor and the Bank of Russia, they misled shareholders?

Composition of the Board of Directors

| Full name | Position on the Board of Directors | Position outside the Board of Directors |

| Puchkov Andrey Sergeevich | Chairman of the Board of Directors | First Deputy President - Chairman of the Board of VTB Bank (PJSC) |

| Pechatnikov Anatoly Yurievich | Deputy Chairman of the Board of Directors, Chairman of the HR and Remuneration Committee | Deputy President - Chairman of the Management Board of VTB Bank (PJSC). |

| Bortnikov Denis Alexandrovich | Deputy President - Chairman of the Management Board VTB Bank (PJSC) | |

| Kondratenko Maxim Dmitrievich | Member of the Board of Directors Chairman of the Audit Committee | Member of the Management Board of VTB Bank (PJSC) |

| Levykin Vladimir Dmitrievich | Member of the Board of Directors Member of the HR and Remuneration Committee Member of the Audit Committee | Head of the Strategy and Corporate Development Department - Senior Vice President of VTB Bank (PJSC) |

| Soldatenkov Gennady Vladimirovich | Member of the Board of Directors | Chairman of the Board of Bank Vozrozhdenie (PJSC). |

| Klopotovsky Andrey Georgievich | Member of the Board of Directors Member of the Audit Committee | President - Chairman of the Board of Joint Stock Company "BM-Bank" |

5 from VTB and 1 from BM Bank. Conflicts of interest are inevitable.

Why don’t they want or can’t understand that by asserting a price lower than the book price (equity capital) per share, they sign for the incorrectness of their own reporting, for which they are responsible to the shareholders? And what then is the figure indicated in the official reports and why is the stock valuation so different from it?

The next important point is the source of funds from which the buyout will be carried out from shareholders who do not agree with the reorganization. Obviously, there will be no owners of ordinary shares among them (the only owner is VTB), only preferred ones remain. Since the repurchase will be carried out at the expense of the equity capital of PJSC Bank Vozrozhdenie, it turns out that out of 786.50 rubles. due to the owner of 1 preferred share, he will receive as much as 291.80 rubles. Who will get 494.70 rubles?

It turns out to be the one who will become a shareholder of the new structure! As they say, we will clear ourselves of the annoying minority shareholders who are dissatisfied with the remarkable results of managing the bank, and at the same time we will grab a little from them for the opportunity to escape from the joint effective business. What is the asking price? Let's calculate the total amount of “saved”: number of applications 1,294,505 * 494.70 rubles = 640 million rubles. VTB Bank apparently found it difficult to earn money as a result of its core banking activities - they decided to improve matters with the money of minority shareholders.

Maybe then stay and become a shareholder of BM Bank, go for the conversion of your terribly preferred shares into shares of this wonderful bank?

But, alas, it won’t work! The shares turn out to be not preferred, but defective!

We learn from the agenda of the meeting of the Board of Directors of VTB Bank:

"On issue 6

“On the merger of the Public Joint Stock Company Bank “Vozrozhdenie” into the Joint Stock Company “BM-Bank””:

To consider it expedient to adopt, in accordance with the established procedure, decisions on the reorganization of Bank Vozrozhdenie (PJSC) and JSC BM-Bank in the form of merging Bank Vozrozhdenie (PJSC) with JSC BM-Bank on the following conditions:

……………………………………………….

The number of ordinary shares of Bank Vozrozhdenie (PJSC) that are converted into one ordinary share of JSC BM-Bank (the conversion ratio of ordinary shares of Bank Vozrozhdenie (PJSC) into ordinary shares of JSC BM-Bank) will be 685/437 .

One ordinary share of Bank Vozrozhdenie (PJSC) is converted into 437/685 ordinary shares of BM-Bank JSC.

The number of preferred shares of Bank Vozrozhdenie (PJSC) that are converted into one ordinary share of BM-Bank JSC (the conversion coefficient of preferred shares of Vozrozhdenie Bank (PJSC) into ordinary shares of BM-Bank JSC) will be 685/167 .

One preferred share of Bank Vozrozhdenie (PJSC) is converted into 167/685 ordinary shares of BM-Bank JSC.

Voting results: the decision has been made .”

Wherever you throw it, there’s a wedge everywhere!

And if the buyout price was 1.5 times worse = 437/291.8, then the conversion rate was 167/685=0.2438 versus 437/685=0.6380, 2.62 times worse. It’s complete nonsense - completely different valuations of the same shares in rubles and in shares of the wonderful BM Bank! That is, in this case, if we assume that ordinary shares participate in the exchange at the rate of 437 rubles, then preferred shares at the rate of 437/2.62 = 166.80 rubles! Amazing nonlinearity or special economic knowledge of the powerful members of the VTB board of directors?

So: “Run Forest, run!” Minority shareholders better present their “preferred shares” for redemption! (Money or prize? Money!)

| Full name | Position on the Board of Directors | Position outside the Board of Directors |

| Grigorenko Dmitry Yurievich | Chairman of the Supervisory Board | Deputy Chairman of the Government of the Russian Federation - Chief of Staff of the Government of the Russian Federation. Official duties: coordinates the work of federal executive authorities. |

| Warnig Matthias | Member of the Supervisory Board, Member of the Strategy and Corporate Governance Committee | Executive Director of Nord Stream 2 AG (Switzerland) and much more |

| Zadornov Mikhail Mikhailovich | Member of the Supervisory Board | President - Chairman of the Board, PJSC Bank FC Otkritie. |

| Kostin Andrey Leonidovich | Member of the Supervisory Board, Chairman of the Strategy and Corporate Governance Committee | President - Chairman of the Board |

| Moiseev Alexey Vladimirovich | Member of the Supervisory Board, Member of the Strategy and Corporate Governance Committee | Deputy Minister, Ministry of Finance of the Russian Federation |

| Reshetnikov Maxim Gennadievich | Member of the Supervisory Board | Minister, Ministry of Economic Development of the Russian Federation |

| Sidorenko Valery Valerievich | Member of the Supervisory Board, Member of the Strategy and Corporate Governance Committee | First Deputy Chief of Staff of the Government of the Russian Federation |

| Sokolov Alexander Konstantinovich | Member of the Supervisory Board, Member of the Strategy and Corporate Governance Committee | President-Chairman of the Board, TRUST Bank (PJSC) |

| Independent members | ||

| De Silguy Yves Thibault | Independent member of the supervisory board (decision of the Supervisory Board of VTB Bank (PJSC) dated September 28, 2020 (Minutes No. 7 dated September 29, 2020)), senior independent director, chairman of the audit committee, member of the personnel and remuneration committee | Chairman of the Supervisory Board of Sofisport, SA (France). Vice President, Leading Director of the Group Board of Directors, Authorized Administrator of VINCI, SAS (France) |

| Repin Igor Nikolaevich | Independent member of the supervisory board, member of the strategy and corporate governance committee, member of the audit committee, Chairman of the HR and Remuneration Committee | Deputy Executive Director of the Association of Professional Investors. |

| Mammadov Israfil Aydin ogly | Independent member of the supervisory board, member of the audit committee, member of the personnel and remuneration committee | Executive Director, State Oil Fund of the Republic of Azerbaijan |

As far as I know, the decision was made unanimously. And as for the opinion of the majority of directors, everything is clear without words (as in the case of the Board of Directors of PJSC Bank Vozrozhdenie), there is no point in being distressed and surprised by their behavior.

The position of the “independents” is amazing! Especially the Deputy Executive Director of the Association of Professional Investors! It would seem that it was he who should have tried to protect the interests of minority shareholders! But no, and he voted “YES”. So, we did not see or hear any special opinion from any of the respected Members of the Board of Directors.

Minority shareholders should seriously consider whether they should rely on and vote for such “independent” directors in the future. Are they professional and independent?

- Strange features of stock exchange circulation.

We understand that the 100% owner of ordinary shares of PJSC Bank Vozrozhdenie, VTB Bank, does not care about the valuation (as well as the exchange ratios), since it is clear in advance that it will not offer its shares for repurchase. Transfers from one pocket to another, since VTB is also a 100% owner of ordinary shares of BM Bank (there are no preferred shares). The coefficients and repurchase prices in this scheme are significant only for minority shareholders - owners of preferred shares of PJSC Bank Vozrozhdenie.

And what saved them from being bought out at an even lower price (if we evaluate the information based on the conversion rate, then it would have been so) was only the exchange circulation and the weighted average share price over the last 6 months of 291 rubles.

We have never liked this provision of the JSC Law, but our legislative environment has not generated anything better or smarter at the moment. Why don't you like it?

Because, oddly enough, this is a stupid norm that allows you to manipulate the price of shares in one direction or the other. That is, if minority shareholders (following the example of Game Stop) conspired and simply circulated turnover on the stock exchange at different, but on the contrary, inflated prices, then according to the law this would be considered normal, and the shares of PJSC Bank Vozrozhdenie could be purchased at inadequate prices. But here, of course, VTB has insurance - to do nothing for as long as possible or, on the contrary, to “properly” participate in the auction, as YUKOS once did in relation to the Eastern Oil Company (VNK). Then, completely unexpectedly, a huge transaction was carried out on the stock exchange in the off-trade mode at a reduced price, as a result of which the 6-month weighted average price collapsed, and an offer was given for VNK shares at a significantly lower price.

The only correct approach from the point of view of the Legislation should be to focus on the book price of the share (equity per share) - it is this that is the lower limit on the repurchase price! But the Law on Valuation Activities allows the appraiser to evaluate an asset using only 2 approaches!!! (in our case, the costly method was ignored, as if we had not a bank, but a long-term construction project) With this approach, the assessment can be shifted in any direction tens of times - all in to please the customer of the assessment. Unfortunately, our society has not yet reached the necessary level of self-development and we all have to get along with very unique ideas about the economic essence of phenomena.

- Voting procedure.

The next striking thing is the voting procedure itself. During corporate transformation procedures and during mergers in particular, the Law provides for voting rights for owners of preferred shares on an equal basis with owners of ordinary shares. This means that all shareholders of the company form a single set - all shares become voting. In fact, they all together make a decision about the future of their joint business, and those who disagree, subsequently, as a result of the decision being made, are given the opportunity to leave the business, having received fair compensation for their shares, that is, at least earned in the form of book value per share.

And here, the owners of preferred shares of PJSC Bank Vozrozhdenie have the privilege to vote together with the owners of ordinary shares, but only for different conditions!!! I immediately remember the joke about different names in an Indian tribe. Obviously, if the decision is made by a general quorum, then the consequences should be equivalent, otherwise, why give the owners of preferred shares their miserable 5% of votes (the ratio of the number of joint-stock companies and joint-stock companies in the authorized capital is 95% and 5%)? 95% vote simultaneously both for the conditions for themselves and for the conditions for 5% of preferred shares, as a result, the decision will always be made, and the conditions for the remaining 5% can be anything (even mockingly bad), they can change something with their 5- 10% of the votes still won’t be able to. This reorganization and the actions of bank management bodies demonstrate to us such practice and such quality of corporate governance!

For many, it is obvious that the rights of owners of preferred shares are deteriorating as a result of this reorganization (a significant loss in the share of ownership in equity capital) and the delisting of shares (conversion of quoted shares into unquoted ones with replacement of the type of shares), but the provisions of the Law seem to be inappropriate here. Why collect 80% of preferred shares for delisting? Why obtain a qualified majority when making decisions to impair the rights of preferred shareholders? In Russian reality, all these “conventions” are useless!

- Bank of Russia. Hope and support for minority shareholders.

Can the regulator help? He has all the rights and opportunities, including protecting the interests of minority shareholders in the Court. But is there a desire, and most importantly, an understanding of the injustice of what is happening?

Here is the Bank of Russia’s response to information about a possible violation of rights. Apart from listing the provisions of the legislation, there is essentially nothing in the Central Bank’s response. From the Regulator's point of view, the following is key:

“The requirements for the procedure for determining the ratio (coefficient) of conversion of shares of companies that have decided to reorganize in the form of a merger are not established by the legislation of the Russian Federation.”

In general, defend yourself as you wish, or provide specific supporting materials related to the violation of the Law.

As usual, once again it does not come to the point of actually protecting the interests of investors (receiving specific monetary losses).

- Prospects for the Court and whether it is necessary to sue.

I don’t know whether there is a need to discuss the prospects of a trial with the state-owned VTB Bank in our independent Court? However, I think that it is necessary to sue - do not sue to lose now and immediately. But the main thing is to record a similar case in history: where everything is clear to everyone, but at the same time it will, apparently, be legal.

I consider it a reasonable action to sell shares at the redemption price (for this you need to vote “against” or not participate in the vote), and then prove losses (lost profit) in comparison with the fair price. A template for a statement of claim can be prepared and I hope for a large number of participants who care about their rights and money. If the lawsuit is a class action, this increases the chances of a positive outcome.

It is the practice of resistance, despite the fact that your wallet will still be taken from you, that may reduce the likelihood of similar events repeating in the future. And the names of the people who made such decisions will be enshrined in the information space and publicly announced. History for history's sake. When posterity asks, “Did such astonishing and counterintuitive things really happen in the stock market?” there will be a documented answer.

- conclusions

- The decision on the price and conversion rates of preferred shares is made unilaterally by VTB representatives. In our opinion, there is a clear conflict of interest.

- The repurchase price is significantly lower than the book value of preferred shares. The difference between the amount of equity capital attributable to preferred shares and the amount that will be spent on the repurchase is RUB 640 million. and will go to VTB Bank (we hope the members of the board of directors will receive good bonuses for such a lucrative deal).

- Preferred stock conversion rates are even worse than the redemption price. Therefore, choose the lesser evil.

- There is a clear inconsistency in voting by a general quorum and different consequences for different voting participants.

- The Bank of Russia is unlikely to help minority shareholders.

- It is necessary and correct to appeal to the Court, regardless of the predicted result.

- It is necessary to disseminate information, only maximum publicity and understanding by citizens of the unfair behavior of the powerful can reduce the risk of such actions in the future.

- Remember the names of board members (especially independent ones) and try not to support them anywhere and ever with your votes. In the absence of the opportunity for citizens to choose judges (the Judicial system, unfortunately, can hardly be called independent), the only effective measure to combat injustice is public censure.

Where and how to buy/sell shares today

It will no longer be possible to buy shares, but holders of Vozrozhdenie securities can sell them at a profit.

How to sell shares of PJSC Bank Vozrozhdenie more profitably

The procedure for selling shares of Bank Vozrozhdenie includes a redemption requirement from minority shareholders, the owners of a controlling stake, in this case VTB.

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Let me remind you that the right to demand ransom starts on March 14, 2019 and is valid for 6 months. If VTB Bank has not sent an official notice to the owners of the securities, then the owners have the right to independently declare that the bank is obliged to repurchase the shares.

Payment for the entire package and change of owner must occur within 15 days. Moreover, if the owner of Vozrozhdenie Bank shares has not received a notice from VTB, then he can submit a redemption request within one year, that is, until March 14, 2020.

What affects the stock price

In this case, nothing has any effect, the ransom price has been determined and is 481 rubles 68 kopecks.

Company prospects

It is unclear how Bank Vozrozhdenie will develop within the structure of VTB; the management of the state bank has not made any clear statements. All that remains is to wait.

Analytics and forecast for the security

Vozrozhdenie shares will be purchased from all minority owners and most likely will not be put into circulation again.

Alternative in this industry

Since Vozrozhdenie’s assets are concentrated in the hands of a large state bank, we can only talk about competition from Sberbank. It is larger, has more assets, and has a wider network. In general, VTB is a weak competitor for Sberbank both from the point of view of management, and from the point of view of assets, and customer trust.

No need to reissue the card

Photo source: TV channel “360”

What will happen to open customer accounts? Bank account numbers at the bank will remain the same. There is no need to specially reissue the card or renew existing contracts.

The ATM network was also united - now Vozrozhdenie clients have access to all VTB self-service devices, where they can withdraw and deposit cash using cards for free.