Hello, dear friends! In an unstable economy More and more people are starting to look for ways to save and increase their funds. Agree, currency is a lady with changeable moods, and therefore there is always a risk that it will depreciate. Where should we look for the most conservative investment option? The answer is obvious - buy material assets! Moreover, if real estate, due to its high cost, is not available to everyone, then buying precious metals is a real way to make money in the long term. Let's look together at investing in gold, the pros and cons of this type of investment.

Benefits of investing in gold

Throughout human history, gold price dynamics have been only positive. However, this rule only applies over a long period of time. Let us list several main advantages of the yellow metal as an investment instrument:

- This precious metal is in demand at all times and in all countries due to its high liquidity.

- Gold is not tied to a specific state, like a currency, and the demand for it is the same all over the world.

- The yellow metal has been accumulated by people for thousands of years, passed down from generation to generation, and has also historically been the best means of accumulating and preserving wealth.

- Gold is not subject to corrosion; it can lie in water and soil for centuries without changing shape or color, without reacting with chemically active substances, without deteriorating, without disappearing or losing its value.

It is for these qualities that people all over the world value and love gold. And in order to preserve their savings and make money on them, every investor should turn to this precious metal.

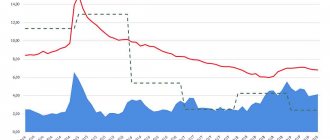

The price dynamics of the gold market in recent years have experienced both ups and downs. Today it is no longer subject to such significant fluctuations and is stable. A major collapse in value was observed after the entry into force of the Frank Law, which prohibited the trading of gold by banks and exchanges. An even greater price decline occurred after the Soros fund began selling its securities.

These days, similar shocks are typical for Bitcoin and other cryptocurrencies. Their quotes collapsed due to legislative obstacles. If we talk about gold, its value is influenced by many market factors, which are extremely difficult to predict. But based on the amount of yellow metal in circulation, it is clear that its price will only increase. Gold cannot simply be printed, as states do with their national currencies. Therefore, its price increase over time is inevitable.

Method 4: Tricky - buy shares of gold mining companies

If you personally don’t want to bother with gold, but want to make money from precious metals, you can buy yourself a piece of a gold mining company. To do this, it is enough to have an account with any Russian broker and several free thousand rubles in the account.

I will not talk about the features of investing in shares, the pros and cons of this financial instrument - this is beyond the scope of the article. I will only note the shares of which Russian public companies you can buy:

- Lenzoloto;

- Buryatzoloto;

- Pole.

And here’s another interesting article: How to save a million with a small salary

There are also LLC securities, but they are traded outside the market and their purchase should be approached with caution. There are also GDRs (global depositary receipts) traded on the Moscow Exchange of the following Russian companies:

- Nordgold (“subsidiary” of Severstal);

- Polymetal International plc.

There are also foreign companies, but their shares are traded mainly on the London and New York stock exchanges, for example, Barrick Gold (ticker ABX), Newmont Mining (ticker NEM), GoldCorp (ticker GG), so it is difficult for a Russian investor to approach them get there.

Well, still a couple of tips. You should buy shares of gold mining companies when the price of metals begins to rise significantly, and sell them at the peak of their value, without expecting prices to fall. Well, it’s better to diversify the risks by adding shares of some reliable mining companies, for example, Gazprom or Alrosa, into the “gold” portfolio.

Ways to invest in gold

Thanks to the progress and development of technology, investing in gold today is not just about buying it in metallic form. Let us list the main modifications and derivatives of the yellow metal that are in demand on the market and in which you can profitably invest:

- Gold bars.

- Gold coins.

- Compulsory medical insurance (unidentified metal accounts).

- Jewelry.

- Exchange stock indices.

Any of the listed investment methods has advantages and disadvantages. It is impossible to say unequivocally that one of them is ideal and the other is unpromising. We need to consider them all.

Method 5: Risky – play on Forex

This is a method for extreme sports enthusiasts. What's the point? Register with any Forex broker that allows you to trade with an instrument such as GLD / USD (or XAU / USD) - and go ahead, ride the waves of the exchange rate.

Pros:

- ease of opening an account;

- no complications in the trading platform interface;

- Fabulous earnings are possible literally in moments.

Minuses:

- huge (no, like this: HUGE) risks due to the volatility of the instrument;

- fraud on the part of the broker or technical errors, such as slippage, cannot be ruled out;

- you need to study a lot and tediously to learn how to make a profit.

Outwardly, everything is simple: bought cheaper, sold more expensive. But here everything is like in poker: behind the external simplicity there is a whole scattering of pitfalls, and many of them are not precious.

You can reduce risks this way: choose a reliable broker or invest in the account of a professional manager who trades on a “gold” instrument, for example, through the PAMM account service.

Investments in bullion

One of the safest ways to invest in gold is to purchase bullion. The weight of a standard bar is 1 kilogram of gold. Before selling, its weight is measured, a certificate of conformity and contract documentation are prepared. Many banks trade bullion. If desired, you can choose the required weight and shape. Changes in the situation on the market or in legislation, dependence on the reliability of the bank are not scary for investors who have “live” gold in their hands in the form of metal.

Buying a gold bar is easy, but storing it safely is difficult. To do this, you can rent a safe deposit box or buy your own home safe. At the same time, only you will be responsible for the safety of your property, even in the case of a safe deposit box, the bank, like a bad wardrobe, is not responsible for the safety of things.

Another problem associated with purchasing bullion is the need to pay value added tax of 20% of the purchase price. If you then sell the metal back to the bank, VAT is not refunded. Therefore, in the absence of significant price rises, the buyer always remains at a loss when selling bullion. In addition, potential profits from subsequent sales also require taxes. You can really make money on bullion only if its value increases by more than 31%. This probability exists over a time period of at least 7-10 years.

Hence the conclusion is that while we win on bullion in terms of reliability, we lose in terms of associated costs. To invest in molded gold metal, you need to have a large amount of money, since affordable standard bars weighing a few grams are not produced. The acquisition will inevitably be followed by a headache - where to store it and how to pay taxes. Bullions have low liquidity. They are difficult to implement quickly. And when buying back, the bank will start looking for the smallest damage in order to reduce the price.

Method 6: Advanced – buy an option or futures

This option is for sophisticated investors. In terms of risk level, futures instruments are somewhere between stocks and forex. But this is the only real way to make millions in a few successful trades, regardless of the value of the underlying asset. A common mind and sober calculation are enough.

An option is a derivative financial instrument that allows you to buy an underlying asset at a previously agreed upon price. This is not the disgrace that is happening at binary options brokers, but a full-fledged exchange asset.

Futures are almost the same, but the seller and buyer are obliged to conclude a transaction, no matter what the price of the underlying asset turns out to be. In the case of an option, the seller may not exercise his right and not sell the instrument if the price does not suit him.

And here’s another interesting article: How to invest in startups: a complete guide for beginners

The price of options and futures themselves varies depending on the underlying price of the asset, its prospects in the market and the volume of the derivatives themselves. Well, for example, if gold becomes cheaper, then expensive options become unprofitable for sellers, and they urgently get rid of them. And if the price rises, then enterprising buyers can outbid cheap options and get gold at a price below the market.

Investing in gold coins

If you do not have a lot of money, but want to own real gold, then there is the following investment method especially for you - buying gold coins. As with bullion, you will have to worry about how to store and how to sell the coins later. Their value is also not growing quickly. Such investments are always designed for a long period of time.

In addition to the pure weight of the precious metal contained in the coin, its price is affected by the quality of mintage, circulation and prevalence. The rarer a piece is considered, the greater the demand for it among numismatists, and such coins can be sold for large sums of money.

Gold coins are also sold in banks. It is easy to buy a gold coin at Sberbank. Selling later is difficult. Even minor damage found will be grounds for refusal. To avoid this, transparent capsules, special numismatic albums and cotton gloves are used to store and protect coins if you still need to pick up a coin.

It is more difficult to deal with collectible coins than investment coins, despite the fact that their numismatic value, rarity and better quality of minting determine a much higher price. This is explained by the need to find an interested buyer who can pay the required amount.

The main advantage of precious coins over bullion is that there is no need to pay VAT. Over a period of 3-5 years, the price of a coin can increase significantly, which will provide you with a corresponding profit. But in order to get this benefit and not make a mistake in choosing coins for investment, you must have knowledge of the conditions of the numismatic and gold markets.

Method 3: Confused - buy coins

This is the way of real samurai. We are talking about investment coins. Sberbank sells them especially a lot; it even has a specialized store on Arbat.

What's the catch? Bullion coins are highly valued by collectors, and if there are few of them, the price begins to rise. This is where you can make money. However, predicting which coin will rise is like guessing which horse will finish first: predictions can be made, but there are no guarantees.

Most often, investment coins are bought as a gift or for the purpose of further resale by professional resellers with high turnover. For a simple investor, holding savings in such coins is not the best idea.

On the other hand, one successful transaction on the market for collectible gold coins can give such a profit that stockbrokers have never dreamed of.

Investments in compulsory medical insurance

If you have insufficient financial resources, you can take a closer look at investing in the form of compulsory medical insurance (impersonal metal accounts). You can open such an account even for 1-2 grams of precious metal in almost any bank. In this case, you will not own physical metal, but will be able to carry out transactions with it through a bank that fulfills monetary obligations to you. If you want to withdraw metal from your account in the form of an ingot, you must pay VAT.

Among the advantages of compulsory medical insurance are the absence of worries about storage and the ability to sell at current quotes at any time. However, compulsory medical insurance does not fall under the deposit insurance program. Here a lot depends on the reliability of the bank.

You can invest profitably in an impersonal metal account with only 1-2 thousand rubles in your pocket. But, if you sell precious metal from your account earlier than three years after purchase, you will have to pay VAT. So, you can count on profit only after a three-year holding period.

Opening compulsory medical insurance is available on the online platform of Sberbank or in its offices. When concluding an agreement, a bank record is created about the amount of metal in the account, which the client then manages himself, buying or selling gold.

Method 2: Universal - open compulsory medical insurance

An impersonal account is an excellent option for those who decide to speculate on gold, but do not want to incur additional costs. Compulsory medical insurance is an analogue of a deposit, only the main unit of account is not currency, but grams (or tenths of a gram for gold). You can buy any amount of virtual gold and sell it when the price reaches the desired level.

Pros:

- no need to bear transportation and storage costs;

- prices for compulsory medical insurance are more volatile, there is a chance to speculate;

- convenient – buying and selling can be done directly in the online store;

- There are no problems with the implementation of compulsory medical insurance.

It is also possible to order bars from the bank that are equivalent in weight to the grams purchased at compulsory medical insurance. However, you will have to pay delivery and VAT.

Cons of compulsory medical insurance:

- no interest is accrued on the deposit balance;

- draconian spreads;

- the money in the account is not protected by the DIA; if the bank collapses, you will not receive compensation;

- The account cannot be transferred to another bank.

It should be taken into account that after selling the metal with compulsory medical insurance at a profit, you must pay personal income tax on the income. The investor himself acts as a tax agent. True, if you keep the account active for more than 3 years, you can get a tax deduction of 3 million rubles for each year of ownership. For the average investor, this size is more than enough.

Investing in Jewelry

Here are the most controversial issues. If coins and bars hidden in a safe are just waiting for their finest hour in the form of an increased price, then jewelry can make you happy every day when you wear it.

Jewelry products cannot be called an investment instrument due to negative returns. Their price includes the store's markup and the cost of the jeweler's work. At the same time, jewelry is not made from pure gold, but uses alloys, stone inserts, etc. If you want to sell jewelry at a pawnshop, they will accept it as scrap at a price three times lower than in the retail chain.

But the sale of scrap can also bring profit in years to come, when the price of gold has risen sufficiently. One gram of gold scrap, which cost 1,400 rubles in 2021, was valued in the form of jewelry in 2010 at only 1,000 rubles per gram. And this is already 5% of annual income.

If you buy exclusive handmade gold jewelry, then their artistic value may in the future attract connoisseurs, who, however, will need to be looked for.

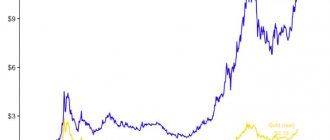

Assessment of the current state of the gold price

Making a forecast for the price of gold is a completely thankless task. Today we’ll say one thing, and tomorrow Trump will sneeze on Twitter and it will grow by 4%. And the day after tomorrow it will fall by 6%. In general, this is pointless. In general terms we can say the following:

- The situation in the Middle East is far from calm, incidents with Iran occur regularly, Saudi Arabia is attacked by drones, and from time to time someone detains someone’s oil tankers. All this, of course, suggests a possible flare-up of the conflict and possible military action.

- US-China negotiations are not making much progress in 2021. The balance of payments is changing, and it is completely unclear what will happen next. There is no talk of military action, but the “trade war” and reproaches from the Americans are spurring investor interest in defensive assets.

- The course towards de-dollarization has not been a local trend in Russia for quite some time. More and more countries are refusing to use the dollar in payments, so its role is decreasing. We have agreements with India, China, Iran. The list of countries will only continue to grow.

From all that has been said, we can draw a simple conclusion, which suggests itself - gold in the range from $1400 to $1450 can be called attractive for purchases. And you can do them by dividing the total amount into components. For example, buy a little at 1450 and wait, maybe they will let you buy at 1440, and so on.

Comparison of the return on investment in gold over the year

Let's say you invested 1 million rubles in one of the types of investments in gold. What will you get in a year? This is clearly illustrated by the table below.

As you can see, investing in gold is interesting for saving and increasing savings. Choosing the right option depends on the amount of money you have and the period for which you want to invest the funds. All investment options have advantages and disadvantages.

In the long term, it is more profitable to buy gold coins (we wrote earlier about the profitability of gold St. George the Victorious) and bars. You can try stock indices and compulsory medical insurance on a short-term period.

Related links:

- How to profitably invest money in the second half of 2021?

- Why are millionaires and central banks buying gold?

- Monetary stimulus from A to Z

Trading gold through a broker

The easiest way to invest in gold. Trading gold through a broker does not involve the physical purchase of metal, but with this method of investing in gold you can make money not only on the rise, but also on the fall in the price of gold. Another advantage is the possibility of using so-called leverage, which allows you to trade in volumes significantly exceeding the deposit. When opening transactions using leverage, you should leave a reserve of free funds on your balance so as not to run into a stop-out. In addition to all of the above, when investing in gold through a broker, you do not need to go anywhere, pay taxes and worry about the safe storage of the metal.

I also recommend reading:

How to trade S&P500 futures

S&P500 futures are another way to make money on indices

I’ll briefly tell you how to start investing in gold through a broker:

- First you need to register and open a trading account with a broker.

Almost all brokers provide the opportunity to trade gold. Personally, I trade gold through the broker Aforex and so far I’m happy with everything. You can open a trading account by filling out a simple registration form here. I wrote how to register in my review of Aforex.

- Top up your account and download the MetaTrader 4 trading terminal.

You should download the trading terminal only from the broker’s official website

- Open the terminal, enter your login password and invest in gold

After entering the terminal, you need to select the XAU/USD pair; to do this, follow the instructions in the picture.

After the XAU\USD chart opens, click on the “New Order” button and in the window that appears, select the transaction volume, direction (buy or sell) and, if necessary, set a stop loss and take profit.

When setting transaction volumes, it should be taken into account that 1 lot is 100 troy ounces of gold. With standard leverage, to open a transaction with a minimum volume of 0.01 lot (1 troy ounce), only about $13 is required, the remaining funds on the balance will work as a safety net in case of drawdown. If the topic of independent trading interests you, I recommend reading the Forex section.

Purchasing gold bars

The procedure for purchasing gold bars includes weighing, as well as issuing a certificate. There are also restrictions on the minimum volume of gold purchased; naturally, no one will sell you 1 or 2 grams. You can buy bullion from banks that have the appropriate license. Once you have become the owner of such an asset, you should seriously think about how to ensure its security. An option is to rent a safe deposit box at a bank and store it there.