Updated January 23, 2021

Hello, dear readers of the KtoNaNovenkogo.ru blog. Twenty years ago, events took place in our country that in modern history have been called “Black August 1998.”

The default in Russia was an economic shock for most Russians.

Citizens who experienced a severe financial crisis still remember this period with horror. The possibility of a new default still frightens Russians. After all, what happened once can happen again. But is it?

1998 default

On August 14, 1998, when asked about the possibility of devaluing the ruble, Russian President Boris Yeltsin said: “It won’t happen. No. Firm and clear." The dollar exchange rate at that time was 6 rubles. 27 kopecks The American currency never returned to this level.

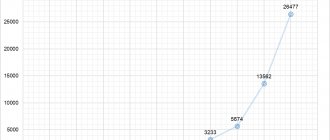

Prime Minister Sergei Kiriyenko announced a freeze on payments on GKOs (state short-term bonds) three days after Yeltsin’s speech. The Central Bank stopped supporting the ruble. Starting with a slight decline, the Russian ruble literally collapsed in the last days of August and the first week of September. At its peak (09.09.98), the dollar was worth almost 21 rubles.

The depreciation of the national currency led to multiple increases in prices, delays in salaries, pensions, and social benefits. Gross domestic product decreased threefold. Tax collection decreased and production fell. Some large banks went bankrupt, citizens lost their savings.

You can learn in detail about the causes and consequences of the crisis from our video.

According to estimates by the Moscow Banking Union, losses to the Russian economy in 1998 amounted to about $96 billion. Of these, corporations lost 33 billion, banks lost 45 billion, and the population lost 19 billion.

Historical reference

In one form or another, crises leading to a default state of the economy occur regularly. Over the past 25 years, the following have failed to meet their obligations:

- Mexico, 1994. The reason for the depreciation of the national currency (peso) was the issue of short-term government bonds. They were denominated in pesos, but depended on the dollar exchange rate. After political assassinations in 1994, trust in the state was lost, and investors began to withdraw money from Mexico. The government was forced to increase borrowing rates and cancel the dollar peg.

- Russia, 1998. The country's position, which seemed stable after the reforms of the early 90s, was precarious. The crisis in Asia has led to a drop in prices for raw materials, mainly oil. The state lost the ability to pay obligations on short-term bonds, which was announced on August 17, 1998.

- Argentina, 2001. The economic decline of the late 1990s led to an erosion of faith in the Government and a subsequent flight of capital. Individuals and corporations preferred to keep their savings in dollars. The authorities responded by banning the withdrawal of large sums from accounts - a decision that led to mass outrage. The last pre-default mistake was the introduction of a free exchange rate for government bonds. The state was unable to fulfill its obligations.

- Uruguay, 2003. The crisis was a response to the situation in Argentina. After Buenos Aeros introduced restrictions on withdrawals, 38% of deposits were withdrawn from Uruguay's two largest banks (which were controlled by Argentine investors). The consequence was devaluation and the subsequent inability of Uruguay to meet its obligations. The government made a request to defer the payment of bonds for 5 years, to which the consent of 93% of creditors was received.

- Greece, 2015. In January 2015, the country held elections for a new Government, which stated that it intended to conduct a dialogue on the restructuring of external debts. But after Athens’ June refusal to make another transfer, the International Monetary Fund suspended negotiations on refinancing. On June 28, 2015, the Government stopped the work of all financial institutions until July 6 (the goal is to curb the outflow of money from Greece) and introduced a limit on withdrawals from ATMs. On July 1, the country announced the inability to pay obligations.

What is default in simple words

Surveys conducted in 1999 showed that two-thirds of the inhabitants of our country cannot explain the term “default” and tell what it is in simple words. We will try to bridge this gap.

The word is borrowed from English - default. It means failure to fulfill obligations, cessation of payments, non-payment.

Even an ordinary person can default. To do this, it is enough to be late in paying the loan or not to make the monthly payment on the bank card.

Initially, the term referred only to loan debt, but with the development of financial instruments, the word acquired a broader meaning. For example, the most common way for governments to raise funds is through securities - bank bills, bonds, bonds. Cessation of interest or principal payments on a security is considered a default.

In addition to financial obligations, the term refers to the failure to fulfill any conditions stipulated by the loan agreement or the terms of the issue of securities. Thus, a mandatory requirement when issuing a loan to a business is submitting reports to the bank. Failure to submit a balance sheet or profit report on time is considered a default.

To summarize, the term can be given several definitions. Default is:

- Failure to fulfill debt obligations on time.

- Insolvency of any entity. The latter can be an individual, a company or a state.

- Violation of the conditions for obtaining a loan (credit), issuing securities and other agreements to raise funds.

In the broadest sense, default is understood as a violation of any obligations - failure to fulfill trade agreements, deviation from political and diplomatic agreements. But usually there is a classical interpretation of the term.

What to do if the state defaults

Economists talk about 2 possible ways out of the situation:

- providing the country with external financial assistance in the form, for example, of a new loan;

- debt restructuring (possible by agreement with creditors).

Due to distrust in the “problematic” economy, both options are difficult. Nevertheless, the option of receiving payment for the debt, for example, in parts, is more attractive to the creditor than the complete refusal of the authorities to repay their obligations.

The government can use the released funds to partially satisfy its internal debts (for wages, pensions and benefits), as well as for the development of various economic spheres.

The gradual growth of the economy will lead to an increase in budget revenues, which means the state will be able to speed up the repayment of external debt, gradually emerging from a default state.

Economic recovery may provide an opportunity to count on receiving financial assistance from other states.

Types of default situations

Economists distinguish two types of default - ordinary and technical.

- Technical default occurs due to temporary difficulties. The borrower is ready to fulfill its obligations, but currently has some problems.

In the case of individuals, this situation often arises when salaries are delayed. When concluding a loan agreement, employees often tie the monthly payment date to the day they receive their earnings. Late transfer of money leads to violation of the terms of the loan. However, the receipt of funds after a short period of time (what is this?) corrects the situation.The reasons for a technical default may be the oversight of employees, a failure of the payment system, or unforeseen circumstances. Usually the situation quickly resolves and has no consequences.

- Ordinary default results from the debtor's inability to fulfill its obligations. There are no funds to pay the debt, and none are expected. In simple words, ordinary default is a situation that is close to bankruptcy, that is, declaring the debtor insolvent in court. Only competent and decisive actions by crisis managers can correct the situation.

According to the category of the borrower, default can be:

- sovereign (state);

- corporate;

- banking, etc.

Sovereign default is also called level 1 default. It affects all citizens of the country and has negative consequences on a global scale.

Reasons for insolvency

The main reason for default is the imbalance of the debtor's income and expenses. The budget deficit is covered by loans and credits. Debt servicing leads to even higher costs.

To cover expenses, the debtor attracts new funds, the cost of borrowed money increases. As a result, the subject's debt obligations grow like a soap bubble, which will sooner or later burst.

Budget deficits are caused by:

- irresponsible behavior of the borrower;

- falling income;

- force majeure;

- economic crisis;

- change of political regime, etc.

When receiving a loan or credit, the debtor is not able to foresee what awaits him in the future:

- An ordinary person can be financially disrupted by job loss, transfer to a low-paid position, or illness.

- The company's profit decreases due to a reduction in demand, loss of part of the market, and technological lagging behind competitors.

- At the state level, a drop in revenue is expressed in low tax collection due to a decline in production or the departure of taxpayers into the shadow economy. Sometimes, when changing political course, the government may refuse to pay on old debts.

Causes and consequences of government default

Having understood what a default is, you need to understand its causes and possible consequences.

As a rule, a country's default occurs as a result of several factors. The main ones:

- decrease in revenues or increase in state budget expenditures;

- crisis - both internal and in partner countries;

- general world instability;

- change of board;

- general political, social and economic instability;

- slow economic development or lack thereof;

- problematic relationships at the international level.

The announcement of a default state in a country threatens the following:

- faith will disappear not only in the effectiveness of the government, but also in the banking and economic sector as a whole;

- it is very likely that prices for products and services will rise very quickly, as will the rate of inflation;

- devaluation will occur (the national currency will lose its value in relation to international ones);

- the standard of living of the population will decrease (including due to a reduction in the state’s ability to pay pensions, salaries to public sector employees and social benefits);

- discontent will grow and accumulate;

- tensions may result in strikes or riots;

- the population may demand a change of government or regime;

- other countries will avoid financial and economic contracts, new loans to the state will become unavailable;

- “domestic” investors will not be ready to invest in a default economy, which will lead to capital outflow.

All of the above will lead to the fact that the debt will only grow, and it will be impossible to count on help (both on the international market and domestic).

Consequences of default

A borrower who defaults loses the confidence of creditors. If you refuse to pay your debts once, it is very difficult to find a new loan. Investment risks are growing; money can only be obtained at high interest rates, which further aggravates the debtor’s financial situation.

At the same time, there are positive aspects when declaring a default. Stopping payments on external debts gives the borrower the opportunity to use funds for their financial recovery and get out of the crisis. Therefore, at the corporate level, before declaring a debtor bankrupt, crisis managers are sent to the company or organization. The purpose of their work is to restore the borrower’s solvency.

What does a sovereign default lead to?

On the world stage, the obligation to fulfill signed international treaties was introduced by the Peace of Westphalia in 1648. The insolvency of a country leads to particularly severe consequences:

- The authority of the state and national business is undermined. Cheap loans are becoming unaffordable for governments and corporations.

- The national currency is devaluing and imported goods are becoming more expensive.

- If the economy (what is it?) is heavily dependent on foreign supplies, the purchasing power of money decreases. The population becomes poorer and cannot buy goods in the same quantities.

- Declining demand has a negative impact on industrial production. The sales market is shrinking, costs are rising. The crisis is hitting companies that use imported raw materials especially hard. Many corporations are going bankrupt.

- To reduce costs, enterprises cut staff and reduce wages, which leads to even greater impoverishment of ordinary citizens and an increase in various types of unemployment.

- The banking sector is suffering. The outflow of investment, the inability to receive international assistance and the depreciation of reserves are collapsing the financial system.

In the event of a sovereign default, not only the bankrupt state suffers, but also the creditor countries. The consequence could be a collapse of financial markets and an international economic crisis. As a result, not only the population of the state that refuses to pay its debts suffers, but also citizens of other territories.

At the same time, default mobilizes state reserves. Budget funds are spent more efficiently. Creditors are afraid of losing everything and go for debt restructuring (what is this?), agreeing to longer payments or refusing interest.

Weak companies disappear, the strongest survive (natural review). The depreciation of the national currency helps to increase the competitiveness of domestic producers. In essence, although this is a painful tool, it is necessary for improving the economy.

Lessons from the 1998 crisis

The consequences of the Russian default in 1998 are still affecting the economy. Some of them are gradually smoothing out, others will continue to influence life in our country for a long time.

What lessons did citizens and government learn from the financial crisis?

- The events of those years undermined the people's trust in the authorities for a long time. It is no secret that in the event of any danger, citizens exchange the national currency for dollars or euros and take away bank deposits (what is this?). Government bonds do not inspire confidence within the country. Citizens prefer to invest money in business or banking sector rather than give it to the government.

- Russians began to trust their money to banks more responsibly. High interest rates are not the main motive for choosing a deposit, but rather cause caution. The created deposit insurance system changed the behavior of depositors and increased the stability of the banking system.

- After the financial collapse, the state avoids borrowing money abroad. Russia now has one of the lowest levels of public debt (about 13% of GDP). At the same time, reserves are growing, which allows the economy to feel stable under the influence of external sanctions. There are periodic conversations about the need to invest in industry and agriculture, but so far the position of the authorities has remained unchanged. Low public debt and growing reserves remain economic policy priorities.

- Having abandoned external sources, the government prefers to look for funds for investment (what is this?) and social needs within the country, often neglecting the well-being of its citizens.

- State intervention in the country's economy has increased. The government has learned that it is much easier to manage state-owned enterprises than private businesses. According to recent studies, the public sector's share of the market is about 70%.

In general, the budgetary policy of the Russian government after the default of 1998 is aimed at increasing the economic stability of the country.

Good luck to you! See you soon on the blog pages KtoNaNovenkogo.ru