Currently, in economic science, the term investment activity has not received a generally accepted definition. In this regard, this concept is somewhat vague.

Nevertheless, its connection with the three basic terms of investment theory is obvious. Firstly, this is investment activity. Secondly, the investment process. Thirdly, a number of financiers invariably link the concept under consideration with the investment climate.

Thus, investment activity can be understood as the actual implementation of the existing investment potential, taking into account the current level of risks.

Ambiguity in the interpretation of the concept of “investment activity”

Let's start our discussion by mentioning that financial analysts interpret the concept of investment activity in different ways. In theory, the term “investment” defines the direction of activity, and the term “activity” implies the intensity of work in this direction. However, in various publications you can find 3 variants of interpretation of the concept we are considering:

Take our proprietary course on choosing stocks on the stock market → training course

| Interpretation | Explanations |

| Economic efficiency of investment activities | This interpretation connects the concept of “investment activity” with the amount of income per volume of capital investments. It is intended to substantiate the fact that an increase in income has a beneficial effect on the level of capital investment of an enterprise. |

| Intensity of investment activity | This refers to the intensity of work associated with investing funds to achieve the goals. |

| Investment attractiveness | Indicates the company’s (in)ability to carry out investment activities at a speed that would ensure the growth of the economic potential of this organization. |

The choice of one of the interpretations presented in the table depends on the purpose for which the analysis of the company’s investment activity is carried out, because each of the indicated approaches to determining inv. activity reflects only a fraction of its properties.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Investment activity: definition, purpose, dependence on various factors

To understand the concept of “investment activity”, you need to familiarize yourself with two other economic definitions:

- Investment potential (InvP) is the totality of all objective indicators and prerequisites for investment. At the same time, the prerequisites for investing will depend on economic maturity, economic health, diversity of investment areas, and the availability of potential objects for investment. The organization's invp is based on the implementation of the tasks laid down in the company's investment policy and characterizing the dynamics and direction of development of its investment activities.

- Investment risks are the probability of complete or partial loss of one’s financial investments or failure to receive the expected profit.

Now we can move on to the concept of investment activity. This term means the actual implementation of the company's investment potential, taking into account the level of associated investment risks .

Investment activity is an independent economic category used exclusively in the context of investment activity. She is called upon:

- correlate individual macroeconomic indicators that describe and characterize the degree of variability of the company’s investment activities,

- reflect the dynamics of attracting investments and their structure.

Factors influencing the level of investment activity are:

- level of investment risks,

- availability of funds and capital,

- availability of investment capital (innovation opportunities),

- availability of production means or production capital,

- availability of labor capital.

Factors

Above, the concept of investment activity is discussed at the macro level. Undoubtedly, all macro indicators must be taken into account when making an investment decision, but what indicators should an investor pay attention to in relation to a specific asset? These factors are:

- enterprise size/labor availability

- financial performance/economic condition/capital availability

- stage of company development

- profitability of previous investment projects

- share price

- production potential

- innovative potential

- management and governance structure

- method of accounting for depreciation.

Accordingly, in the presence of all the above factors, the potential for increasing investment activity in a country/region/company is very high, and, conversely, in their absence, there are all the prerequisites for recession, stagnation and stagnation.

Assessment of investment activity of a commercial enterprise

The degree of investment activity of an enterprise is directly influenced by the investment strategy chosen by the investor and his behavior. The most common options for choosing an investment strategy are described in the table:

| Active strategy (aggressive) | Passive strategy (conservative) |

| The result of following an active strategy is the development and expansion of the market, the opening of new organizations, technologies, projects on the market (creation of added value). An active strategy is more effective than a passive one, since the implementation of innovative ideas requires a lot of attractive funds and resources. | The result for adherents of a passive investment strategy is participation in previously organized projects. The passive strategy is less effective because participation in existing investment projects does not involve attracting new resources and funds. |

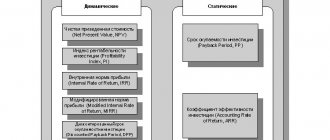

Based on the study of the indicators listed below, the company’s investment activity is assessed:

| Indicator influencing the investment activity indicator | Explanations |

| General policy of the enterprise regarding investment | The number of existing projects, their dynamics, their volume, and their compliance with the company’s development strategy are taken into account |

| Interest of management personnel | You should look at how many investment projects each manager proposed, and which of them were approved |

| Existing Asset Replacement Policy | It is necessary to take into account the degree of physical and moral wear and tear of all types of property |

| Level of investment in working capital | Amount of funds invested in the purchase of current assets |

| Direction of investment funds | Attention is drawn to the payback time of the investment project, its average life and expected life time |

The essence of the phenomenon

In the broad sense of the word, the investment activity indicator characterizes the specific result of the dynamic interaction of existing investment opportunities with the probability of achieving the task that was originally set by the investor.

If we try to make it more specific, the concept under consideration can be considered a measure of the intensity of the investment process. In other words, this is how active the investor’s activities are, directly aimed at investing funds.

Investment activity is characterized by qualitative and quantitative indicators of investments made. With its help, we can evaluate investments made at any level. Thus, one can consider a hotel enterprise or company, a municipality, a federal subject, a state, as well as the world economy as a whole.

The investment activity indicator is one of the most visual characteristics of the rise and development of the country's economy. It reflects the dynamics of the implementation of investment projects, their payback and profitability.

In modern Russia, as in any other country in the world, financial investments play a decisive role not only in maintaining, but also in increasing the economic potential of the state. It all starts at the level of individual business entities. New factories are being built. Existing enterprises have the opportunity to modernize their own production. As a result, the volume of production of goods that are competitive in the international arena increases. This increases the activity of the Russian Federation in foreign markets.

In the context of a difficult foreign policy situation, the positive dynamics of investment activity in Russia is the key to a sustainable, systematic overcoming by our state of the consequences of the economic crisis.

Investment activity ratio: what is it

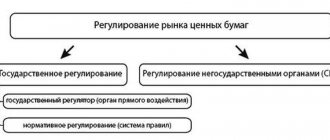

An economic indicator characterizing the total amount of finance aimed at investing in the activities of other companies and for the development and modernization of the enterprise's production is the investment activity coefficient (IAC). KIA characterizes the ratio of long-term financial investments, profitable investments in material assets and construction in progress to the total value of non-current assets .

Having the value of this indicator, the analyst will be able to find out the degree of efficiency of the investment activities of the organization under study. Thus, if the coefficient is characterized by unreasonably low/high values, this will indicate that the work of the company’s management is not sufficiently controlled by the owners of the enterprise, and that in general the development strategy of the organization is incorrect.

Important! The investment activity coefficient refers to the structural index method, which characterizes exclusively the rate of renewal of non-current assets. This does not take into account investments in working capital and conditions for attracting sources of financing.

Fluctuations in investment activity in Russia

The reasons that are the basis for the decline in investment activity in the Russian Federation :

- a small share of own funds is directed by enterprises to investment activities

- decline in confidence in the country's banking system

- uncertainty in the mutual fund investment market

- general reduction in budget funding.

Measures leading to increased investment activity :

- focus on the innovative nature of the economy, development of scientific and production potential

- subsidizing regions with weak economies and low living standards

- attracting government funding to vital sectors of the economy: energy, agriculture, food sector, etc.

- creation of free economic zones.

Calculation of the value of the investment activity coefficient (general formula)

The investment activity coefficient is calculated by dividing the sum of several indicators by the total volume of non-current assets. The numerator of the quotient contains the following indicators:

- non-current assets in the form of long-term investments,

- investments in material assets,

- Construction in progress.

The general formula for calculating the investment activity coefficient is as follows:

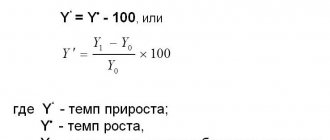

Also, to analyze investment activity, investors use the following general formula for calculating the coefficient:

Based on the obtained coefficient value, it will be possible to understand:

- whether the investment project has social benefits, whether the company’s resources are effectively exploited during its implementation;

- whether the investment project is attractive to investors (whether the project participants expect to receive income from investing financial resources, and in what volume).

Coefficients for determining the investment activity of an enterprise

There are a total of 6 coefficients, the analysis of which together will produce the most accurate economic analysis of the company’s work aimed at effectively investing the available “free” funds from turnover:

| Index | Economic sense | Calculation formula |

| Real investment ratio | Demonstrates what part of the total investment is occupied by real investments for production purposes. | |

| Investment leverage effect | Designed to show the amount of increase in return on investment that appears due to the use of loans despite the need to pay interest for the use of borrowed funds. | |

| Financial investment ratio | Demonstrates the company's activity on the stock market. | |

| Capital investment realization ratio | Describes how close a capital investment is to completion and whether it is operational. | |

| Coefficient of intensification of the use of own funds to finance investment activities | Characterizes the increase in own sources of financing investment activities this year compared to the previous year. | |

| Coefficient of intensification of the use of external sources of financing investment activities | Shows how quickly an enterprise attracts borrowed funds and creates attracted sources of financing for investment activities. It helps to understand whether there is a need for its own investment resources in order to properly solve the set investment tasks, and whether the company is trying to speed up its investment processes by attracting capital from outside. |

The methodology for assessing all the coefficients listed in the table makes it possible to economically sound and reliably calculate the level of investment activity of an organization, as well as the degree of influence of various indicators on the investment process. Since each value of the indicated coefficients corresponds to its own rank, and the sum of all ranks taken together characterizes the inv. activity, the methodology will allow for an unambiguous interpretation of the indicators and their meanings.

The insufficient influx of foreign direct investment forces us to look for new organizational forms of joint entrepreneurial activity.

The most attractive for foreign investors are free economic zones, where the number of enterprises with foreign capital has reached 18%.

Increasing investment activity is possible, but with close cooperation between federal and territorial authorities.

This allows you to minimize investment risks and effectively invest savings and private investments. A real way to improve investment activity is to provide enterprises with greater independence, including issues of attracting foreign capital.

The tasks of the administrative bodies of the region are to maintain basic life support systems.

Thus, the strategic goals and priority areas of joint business activities are as follows:

1) development and improvement of export potential, increasing the level of competitiveness;

2) creation of a mechanism for regional stimulation of exports, primarily through tax incentives for exporters and long-term preferential loans issued for the development of export production, as well as the creation of collateral and insurance funds that protect against all risks;

3) rationalization of imports in order to change the structure of the economy and improve key industries aimed at strengthening the export base;

4) exemption from taxes on an irrevocable basis, on the terms of a commercial loan, or cancellation completely.

All this is aimed at achieving one goal: to create favorable conditions for the successful development of joint business activities and for more effective use of foreign investments in the interests of the economy.

The main difficulty of economic reforms lies in the insufficient capacity of domestic government savings and the inability to fully fill the investment gap to overcome the economic downturn by private investors.

Investments in the real sector, due to the high risk, are not attractive for all entities: for bank capital, for domestic and foreign investors, as well as for the population. Future investors try to invest in more profitable and reliable financial assets.

High inflation led to interest rates that far exceeded the potential profitability of many production projects. This made medium- and especially long-term loans unavailable.

The main weakness of the state investment policy is the insecurity of budget expenditures for investment purposes. These expenses were financed until recently on a residual basis.

And the consequence of this was the increase in accounts payable in the investment sphere from year to year and a constant decrease in the volume of actual investments in production.

The experience of recent years shows that objective prerequisites are emerging for breaking the investment impasse. In combination with control of the money supply, inflation can be significantly reduced.

As a result, the interest rate will go down, the refinancing rate of the Central Bank will fall, and the yield of state bonds will decrease.

But in order to take advantage of the improvement in the investment climate, an impulse is needed that will set the investment mechanism in motion.

As such, we have a development budget, which has become an integral and organic part of the federal budget. With proper organization of development budget management, the mobilization of funds from private investors to finance priority projects in the real sector of the economy increases tenfold.

The development budget concentrates only part of the resources allocated by the state for investment purposes.

Financial resources for the state to fulfill its social obligations are aimed at the construction of facilities, ensuring the safe operation of technically complex systems (such as power plants, river routes), as well as the construction of expensive facilities - are provided through the current budget.

Funds raised in the development budget in the form of loans are directed toward goals the achievement of which can generate income, which makes it possible to pay off the loans. To do this, incoming funds must be placed on an urgent and repayable basis. To ensure the highest efficiency in the use of development budget funds, a selection of financed projects is carried out at the same time.

Given the economic situation in the country, the priority can only be a sharp increase in funds for economic growth. Only this approach allows us to end the crisis in the shortest possible time.

When studying the world experience in organizing the financing of investment projects, it is clear that high investment reliability and efficiency are achieved subject to the use of the principle of project financing. A prerequisite is the investment of a certain part of your own financial resources.

But in projects for which resources are allocated from the development budget, the investor’s personal funds must be at least 20%.

In such conditions, financial support from the state can be up to 40%, which corresponds to world practice.

At the same time, it is proposed to use the provision of tied loans, when the state does not transfer budget money to the borrower’s accounts, but pays for goods and services necessary for the implementation of the project on the terms of choice among suppliers. At the same time, the state can, at the expense of the development budget, provide a commercial bank with guarantees for financing this project in the amount of up to 40% of the loan.

There is a limitation on the guarantee provided, which is determined by the need for the bank to be responsible for choosing a client and checking the economic efficiency of the project.

A high level of guarantee protection results in a lower volume of guarantees provided.

It is proposed to generate development budget revenues from sources of financing the budget deficit, as well as targeted investment loans from the World Bank and loans issued in accordance with concluded intergovernmental agreements.

It should be noted that simply forming a development budget as a set of items in the federal budget does not solve the problem.

A special mechanism for its implementation is being introduced, which does not depend on the current progress of execution of the federal budget.

If this is not done, then economic growth will not accelerate due to current problems.

This mechanism is to assign relevant sources to the development budget in budget legislation. The economic crisis has many long-term and short-term factors that predetermine its deepening.

But among them there is one that is from time to time inherent in the economies of different countries of all economic systems.

It is associated with the state of the investment process in the country's economy.

Ultimately, it determines the possibilities for economic development, as well as the state of the economic structure.

Therefore, when ensuring an effective economy, there is always the problem of finding appropriate mechanisms and sources that make it possible to achieve the necessary results.

To overcome the crisis, the development and implementation of an effective state investment policy is required.

This is necessary primarily because investments and related structural changes in the economy play a major role in shaping macroeconomic proportions. The difficulty of regulating investment activity is that it covers diverse areas of economic life.

This includes the sphere of scientific and technological progress, state economic management, financial and banking activities, commercial settlement of enterprises, pricing, etc.

Often the problem of investment is reduced to methods of allocating capital investment resources.

The investment process, reflecting the reproduction of production assets, includes the formation of the accumulated part of the national income, the distribution and financing of capital investments, and the use of fixed assets. Considering the national economy, we can say that the sources of investment are the compensation fund, in the form of depreciation charges, and the accumulation fund, which acts as part of the national income.

At enterprises and associations, as well as in other economic entities, it is carried out at the expense of the investor’s own financial resources, borrowed financial resources from investors, attracted financial resources from investors, as well as budgetary investment allocations.

With these budget loans, the share of loans to the private sector is constantly increasing.

It must be said that the financial infrastructure of the market ensures savings and converts them into effective investments. This is especially relevant in the current period of development and formation of market structures, the search for market forms of management, forms of implementation of the investment process.

Institutional investors, as a rule, are investment and commercial banks, investment and pension funds, and insurance companies.

With the help of this system, savings of the population are formed into investments.

The credit and financial sector provides funds for investment at the disposal of enterprises and other economic entities.

There is a movement of funds from where there is a surplus to where there is a shortage of them, as well as from industries with low profitability to investments in industries with greater profitability.

Unilateral inflation policies have led to devastating hyperinflation, rapidly rising prices and devaluation of money.

The fall in gross domestic product with a reduction and deterioration in the structure of foreign trade turnover with an aggravation of the balance of payments deficit speaks for itself.

Non-payments and inflation eat up savings and consumption funds. This paralyzes economic development and the reproduction process. The influx of external capital for the structural and qualitative renewal of production remains scanty, and the outflow from internal circulation, as well as the movement of commodity resources and financial resources into the sphere of shadow circulation, has acquired unjustified proportions. Investment and innovation processes in the production sector have almost stopped. At different stages of the circulation of fixed assets, it is necessary to bring economic management into a single mechanism through a continuous investment process. This is understood as the transformation of investment into - growth of national income.

In the field of investment management, both final and intermediate goals are formed.

To do this you need:

1) determine the criteria for selecting the main directions of capital investment;

2) determine the conditions under which opportunities for expanded reproduction are provided for all participants in the investment process;

3) formulate the principles and conditions of financing at different stages of the investment process, including the formation of investment resources.

The effect of technical re-equipment of enterprises through leasing will be expressed in the growth of their profits and, accordingly, the payment of taxes to the budget, which more than compensates for the benefits to investors.

Considering the role of leasing of machinery and equipment in improving scientific and technological development, the state needs to support organizations carrying out leasing operations.

Now all efforts are aimed at creating conditions for the development of investment activity of enterprises, since the amount of profit received by enterprises is many times higher than their capital costs.

In creating favorable conditions for enhancing investment activity in the country’s economy, a lot remains to be done: stabilize the financial system, reduce inflation to an acceptable level, since in conditions of non-payments and uncontrolled price increases, investment activity is speculative in nature.

It is aimed primarily at maintaining the existing situation, and not at creating economic conditions for increasing production, updating the range and improving the quality of goods and services.

Table of contents

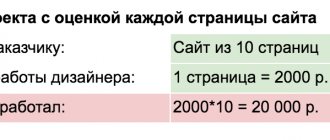

An example of calculating the coefficient of investment activity of an enterprise

Let’s imagine a hypothetical company, Stiles LLC, about which the following information regarding investment activities is known:

| Index | Balance line | Amount for 2021 (thousand rubles) | Amount for 2021 (thousand rubles) |

| Construction in progress | 130 | 0 | 62 |

| Profitable investments | 135 | 0 | 0 |

| Long-term financial investments | 140 | 0 | 0 |

| Fixed assets | 190 | 37 334 | 37 756 |

KIA = (p.130 + p.135 + p.140) : p.190

KIA(2017) = (0 + 0 + 0) : 37,334 = 0

KIA(2018) = (62 + 0 + 0) : 37,756 = 0.0016

Judging by the value of the investment activity coefficient, the company allocates only 0.0016% of the total volume of non-current assets for the reporting year 2021 to improve and modernize property, and to invest money in other companies. As for 2017, no funds were allocated at all for the modernization of production and financial investments in other funds.

Perhaps the company receives little net profit, and therefore does not have the opportunity to modernize its equipment.

Answers to frequently asked questions about the investment activity ratio

Question: The company whose activities need to be analyzed, and which cooperates with a Russian enterprise, is located in Kazakhstan; accordingly, both the balance sheet and other financial statements are prepared on the basis of regulations and laws of the Republic of Kazakhstan. What does the formula for calculating the investment activity coefficient for the Republic of Kazakhstan look like?

Answer: (2)

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |