1.5.Financing scheme.

The assessment of an investment project should include the development of a scheme that ensures the possibility of real implementation of the project from a financial point of view.

The main goal of its development is to ensure the organization and construction of a structure for the movement of funds (money) in the investment project under consideration, the use of which at any stage of the calculations ensures the required amount of funds guaranteeing the continuation of work.

If probable risks and possible uncertainties are not taken into account, it can be stated that the financial feasibility of the project under evaluation is confirmed in cases where the values of the balance of the flow accumulated at the time of the calculation are ≥ 0.

By developing a financing scheme as part of assessing the effectiveness of investment projects, it is possible to identify the actual need for the volume of funds raised. It necessarily includes the possibility of investing (as necessary) a certain share of the positive balance of the total cash flow in various debt instruments of the Central Bank, or placing them on deposits. This operation is described as investing in additional funds.

It is allowed to send funds under two headings here. The first is net profit. The second is depreciation. This operation is carried out as an outflow of funds.

Inflows from the above funds are recorded as non-operating income into the project received in the course of the operating activities of project participants.

Net present value (Net Present Value, NPV)

In modern published works, the following terms are used to name the criterion of this method:

- net present value;

- net present value;

- net present value;

- net present value;

- the overall financial result from the implementation of the project;

- current value.

In the Methodological Recommendations for Assessing the Efficiency of Investment Projects (second edition) - Moscow, "Economy", 2000 - the official name of this criterion is proposed - net present value (NPV).

The value of net present value (NPV) is calculated as the difference between the discounted cash flows of income and expenses incurred in the process of implementing the investment over the forecast period.

The essence of the criterion is to compare the current value of future cash receipts from the project with the investment costs necessary for its implementation.

The application of the method involves the sequential passage of the following stages:

- Calculation of cash flow of an investment project.

- Selecting a discount rate that takes into account the profitability of alternative investments and the risk of the project.

- Determination of net present value.

The NPV or NPV for a constant discount rate and a one-time initial investment is determined by the following formula:

where I0 is the amount of initial investment; Сt - cash note from the sale of investments at time t; t — calculation step (year, quarter, month, etc.); i is the discount rate.

Cash flows must be calculated in current or deflated prices. When forecasting income by year, it is necessary, if possible, to take into account all types of Income, both production and non-production, that may be associated with a given project. Thus, if at the end of the project implementation period it is planned to receive funds in the form of the liquidation value of equipment or the release of part of working capital, they should be taken into account as income of the corresponding periods.

The basis of calculations using this method is the premise that the value of money varies over time. The process of recalculating the future value of cash flow into the current one is called discounting (from the English discont - reduce).

The rate at which discounting occurs is called the discount rate, and the factor F=1/ (1 + i)t is the discount factor.

If the project does not involve a one-time investment, but a sequential investment of financial resources over a number of years, then the formula for calculating NPV is modified as follows:

where I0 is the amount of initial investment; Сt - cash note from the sale of investments at time t; t — calculation step (year, quarter, month, etc.); i is the discount rate.

The conditions for making an investment decision based on this criterion are as follows: if NPV > 0, then the project should be accepted; if NPV<0, then the project should not be accepted; if NPV = 0, then accepting the project will bring neither profit nor loss.

This method is based on following the main goal determined by the investor - maximizing its final state or increasing the value of the company. Following this target setting is one of the conditions for a comparative assessment of investments based on this criterion.

A negative net present value indicates the inappropriateness of making decisions on financing and implementing a project, since if NPV < 0, then if the project is accepted, the value of the company will decrease, i.e. the company's owners will suffer a loss and the main target is not met.

A positive net present value indicates the advisability of making decisions on financing and implementing a project, and when comparing investment options, the option with the highest NPV value is considered preferable, since if NPV > 0, then if the project is accepted, the value of the company, and therefore the welfare of its owners will increase. If NPV = 0, then the project should be accepted provided that its implementation will increase the flow of income from previously implemented capital investment projects. For example, expanding a hotel's parking lot will increase the property's income stream.

The implementation of this method involves a number of assumptions that must be checked for the degree of their correspondence to reality and the results that possible deviations lead to.

Such assumptions include:

- the existence of only one objective function - the cost of capital;

- specified period for project implementation;

- data reliability;

- payments belong to certain points in time;

- existence of a perfect capital market.

When making decisions in the investment field, you often have to deal not with one goal, but with several goals. If a cost of capital method is used, these objectives should be considered when arriving at a solution outside of the cost of capital process. In this case, methods for making multi-objective decisions can also be analyzed.

The useful life must be established in the performance analysis before applying the cost of capital method. For this purpose, methods for determining the optimal service life may be analyzed, unless this has not been established in advance for technical or legal reasons.

In reality, there is no reliable data when making investment decisions.

Therefore, along with the proposed method for calculating the cost of capital based on predicted data, it is necessary to analyze the degree of uncertainty, at least for the most important investment objects. Methods of investing under conditions of uncertainty serve this purpose.

When forming and analyzing the method, it is assumed that all payments can be attributed to certain points in time. The time period between payments is usually one year. In reality, payments can be made at shorter intervals. In this case, you should pay attention to the compliance of the calculation period step (calculation step) with the conditions for granting the loan. For the correct application of this method, it is necessary that the calculation step be equal to or a multiple of the period for calculating interest on the loan.

The assumption of a perfect capital market, in which financial resources can be attracted or invested at any time and in unlimited quantities at a single calculated interest rate, is also problematic. In reality, such a market does not exist, and interest rates for investing and borrowing funds tend to differ from each other. This raises the problem of determining an appropriate interest rate. This is especially important since it has a significant impact on the value of capital.

When calculating NPV, discount rates that vary from year to year can be used. In this case, it is necessary to apply individual discount factors to each cash flow, which will correspond to this calculation step. In addition, it is possible that a project acceptable at a constant discount rate may become unacceptable at a variable one.

The net present value indicator takes into account the time value of money, has clear decision criteria and allows you to select projects for the purpose of maximizing the value of the company. In addition, this indicator is an absolute indicator and has the property of additivity, which allows you to add up the indicator values for various projects and use the total indicator for projects in order to optimize the investment portfolio.

For all its advantages, the method also has significant disadvantages. Due to the difficulty and ambiguity of forecasting and generating cash flow from investments, as well as the problem of choosing a discount rate, there may be a danger of underestimating the risk of the project.

3.Accounting for uncertainty

This procedure is essential when assessing any individual entrepreneurs. In order to obtain the most accurate results, it is necessary to establish the degree of uncertainty inherent in the IP under consideration.

Its meaning can be considered as:

- absolute certainty, when there can be only one outcome;

- uncertainty with a range of possible outcomes (but any of them can be foreseen);

- uncertainty, with the likelihood of options that cannot be foreseen in advance;

- uncertainty, characterized by absolutely unpredictable options for the development of events (so-called complete uncertainty).

Any of these options automatically entails risks for the investor, which has a certain impact on the final assessment given to the investment project.

The risks that arise when investing certain funds in any investment project are divided into several types:

- financial risks;

- economic risks;

- social;

- environmental risks;

- related to changes in legislation (legislative);

- depending on the political situation (political);

- criminal risks;

- climatic (due to natural anomalies).

IP analysis involves mandatory work on:

- identifying external factors that directly or indirectly influence the effectiveness of the project to be assessed;

- identification of factors that can cause deviations from the planned efficiency of the IP;

- possible spread of deviations arising in various financial indicators.

All this guarantees a reduction in possible risks and allows you to minimize or completely avoid losses at all stages of the investment project.

Having determined the method to be used to evaluate the proposed project in terms of its investment attractiveness, it is necessary to pay close attention directly to the process of receiving investments. Any of them has a couple of components:

- outflow (cash expenses are taken into account);

- inflow (provides for receipt of gross profit from the investment made).

Profitability Index (PI)

The profitability index (profitability, profitability) is calculated as the ratio of the net present value of cash inflows to the net present value of cash outflows (including initial investments):

where I0 is the enterprise’s investment at time 0; Сt is the cash flow of the enterprise at time t; i is the discount rate. Pk is the balance of the accumulated flow.

or

The conditions for accepting a project according to this investment criterion are as follows:

- if PI > 1, then the project should be accepted;

- if PI < 1, then the project should be rejected;

- if PI = 1, the project is neither profitable nor unprofitable.

It is easy to see that when evaluating projects involving the same amount of initial investment, the PI criterion is fully consistent with the NPV criterion.

Thus, the PI criterion has an advantage when selecting one project from a number of projects with approximately the same MPV values, but different volumes of required investments. In this case, the one that provides greater investment efficiency is more profitable. In this regard, this indicator allows you to rank projects with limited investment resources.

The disadvantages of the method include its ambiguity when discounting cash inflows and outflows separately.

Tasks for assessing project effectiveness

To ensure business competitiveness in modern conditions, it is necessary to constantly monitor ongoing projects, as well as evaluate their effectiveness. The assessment process involves solving the following list of main tasks:

- determining the percentage of feasibility, which means checking whether the project meets all required parameters and established limitations;

- establishing the feasibility of implementing the project, which involves considering and comparing the total results and costs incurred;

- studying the comparative effectiveness of the project, researching and comparing its advantages in comparison with analogues and alternative ideas.

Internal Rate of Return (IRR)

The internal rate of return, or internal rate of return, of investment (JRR) is understood as the value of the discount rate at which the NPV of the project is equal to zero: IRR=i, at which NPV= f(i)=0

The meaning of calculating this coefficient when analyzing the effectiveness of planned investments is as follows: IRR shows the maximum permissible relative level of expenses that can be associated with a given project. For example, if a project is financed entirely by a loan from a commercial bank, then the IRR value shows the upper limit of the acceptable level of the bank interest rate, above which the project will be unprofitable.

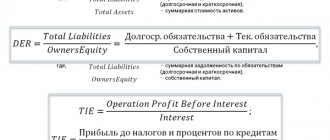

In practice, any enterprise finances its activities from various sources. As payment for the use of financial resources advanced into the activities of an enterprise, it pays interest, dividends, remunerations, etc., i.e., it incurs some reasonable expenses to maintain its economic potential. The indicator characterizing the relative level of these incomes can be called the price of advanced capital (capital cost - CC). This indicator reflects the minimum return on capital invested in its activities at the enterprise, its profitability and is calculated using the weighted arithmetic average formula.

The economic meaning of this indicator is as follows: an enterprise can make any investment decisions, the level of profitability of which is not lower than the current value of the CC indicator (price of the source of funds for this project). It is with this that the IRR calculated for a specific project is compared, and the relationship between them is as follows:

- if IRR > CC, then the project should be accepted;

- if IRR < CC, then the project should be rejected;

- if IRR = СС, then the project is neither profitable nor unprofitable.

Another interpretation option is to treat the internal rate of return as a possible discount rate at which the project is still profitable according to the NPV criterion. The decision is made based on comparison of IRR with standard profitability; Moreover, the higher the internal rate of return and the greater the difference between its value and the selected discount rate, the greater the margin of safety the project has. This criterion is the main guideline when an investor makes an investment decision, which does not at all detract from the role of other criteria.

To calculate IRR using discount tables, two values of the discount factor i1 < i2 are selected so that in the interval (i1,i2) the function NPV = f(i) changes its value from “+” to “-” or from “-” to "+".

Next apply the formula:

where i1 is the value of the discount factor at which f(i1) > O (f(i1) < 0), r2 is the value of the discount factor at which f(i2) < 0 < f(i2) > 0).

Indicators for assessing project effectiveness

Performance indicators reflect the quantitative characteristics of the results of the implementation of a particular project. When considering certain indicators, it is necessary to take into account such important factors as the company’s field of activity, its economic level of development, as well as the features of the project under study.

This is necessary to develop the most optimal system of indicators, allowing for an assessment of all parameters as accurately and informatively as possible.

All main indicators can be divided into the following groups:

- reflecting financial and commercial performance, which makes it possible to determine the economic consequences for all project participants;

- reflecting budgetary efficiency. These indicators demonstrate the consequences of implementing a specific project for budgets at various levels;

- determining socio-economic results. Based on such indicators, the effect of the implementation of the project is determined, which applies to both its direct participants and indirectly affected parties.

Modified Internal Rate of Return (IRR)

The modified rate of return (MIRR) eliminates the significant shortcoming of the project's internal rate of return, which arises in the event of repeated cash outflows. An example of such repeated outflow is the purchase by installments or construction of a real estate project carried out over several years. The main difference of this method is that reinvestment is carried out at a risk-free rate, the value of which is determined based on financial market analysis.

In Russian practice, this may be the profitability of a fixed-term foreign currency deposit offered by the Savings Bank of Russia. In each specific case, the analyst determines the value of the risk-free rate individually, but, as a rule, its level is relatively low.

Thus, discounting costs at a risk-free rate makes it possible to calculate their total current value, the value of which allows a more objective assessment of the level of return on investments, and is a more correct method in the case of making investment decisions with extraordinary cash flows.

Discounted Payback Period (DPP)

The discounted payback period of an investment (Discounted Payback Period, DPP) eliminates the disadvantage of the static method of the payback period of investments and takes into account the time value of money, and the corresponding formula for calculating the discounted payback period, DPP, is: DPP = min n, in which

Obviously, in the case of discounting, the payback period increases, i.e., always DPP > PP.

The simplest calculations show that such a technique, in conditions of a low discount rate, characteristic of a stable Western economy, improves the result by an imperceptible amount, but for a significantly higher discount rate, characteristic of the Russian economy, this gives a significant change in the calculated payback period. In other words, a project acceptable under the PP criterion may be unacceptable under the DPP criterion.

When using the PP and DPP criteria in evaluating investment projects, decisions can be made based on the following conditions: a) the project is accepted if payback occurs; b) the project is accepted only if the payback period does not exceed the deadline established for a particular company.

In general, the determination of the payback period is of an auxiliary nature relative to the net present value of the project or the internal rate of return. In addition, the disadvantage of such an indicator as the payback period is that it does not take into account subsequent cash inflows, and therefore can serve as an incorrect criterion for the attractiveness of the project.

STATIC METHODS FOR ASSESSING INVESTMENT PROJECTS.

Criteria for assessing project effectiveness

Evaluation criteria make it possible to establish certain guidelines that are taken as a basis in the process of studying all aspects of the project. A group of simple criteria include:

- payback period for investments, which allows you to see how long it will take to return the initially invested resources;

- a simple rate of return, reflecting that part of the financial investment that is reimbursed by the profit received during a certain planned interval. This criterion allows you to quickly evaluate the project, which is especially important when there is a shortage of funds.

Also, criteria are often used that are based on the calculation of the time value of monetary resources. These include the profitability index, net present value, discounted payback period, etc.

The evaluation criteria used today allow both business owners and potential investors to weigh all the arguments and make an informed decision on the advisability of implementing a certain project.

Payback Period (PP)

The most common static indicator for evaluating investment projects is the payback period (Payback Period - PP).

The payback period is understood as the period of time from the start of the project until the moment of operation of the facility, at which the income from operation becomes equal to the initial investment (capital costs and operating costs).

This indicator answers the question: when will the full return of the invested capital occur? The economic meaning of the indicator is to determine the period within which an investor can return the invested capital.

To calculate the payback period, the elements of the payment series are summed up on an accrual basis, forming the balance of the accumulated flow, until the amount takes a positive value. The serial number of the planning interval, in which the balance of the accumulated flow takes a positive value, indicates the payback period expressed in planning intervals.

The general formula for calculating the PP indicator is: PP = min n, at which

where Pt is the value of the accumulated flow balance; 1B - the amount of initial investment.

When a fraction is obtained, it is rounded up to the nearest whole number. Often the PP indicator is calculated more accurately, i.e. the fractional part of the interval (calculation period) is also considered; in this case, the assumption is made that within one step (calculation period) the balance of the accumulated cash flow changes linearly. Then the “distance” from the beginning of the step to the moment of payback (expressed in the duration of the calculation step) is determined by the formula:

where Pk- is the negative value of the balance of the accumulated flow at the step until the payback period; Pk+ is the positive value of the balance of the accumulated flow at the step after the payback moment.

For projects that have constant income at regular intervals (for example, constant annual income - annuity), you can use the following payback period formula: PP = I0/A

where PP is the payback period in planning intervals; I0 - the amount of initial investment; A is the size of the annuity.

It should be borne in mind that the elements of the payment series in this case must be ordered by sign, i.e., first the outflow of funds (investments) is implied, and then the inflow. Otherwise, the payback period may be calculated incorrectly, since when the sign of the payment series is changed to the opposite one, the sign of the sum of its elements may also change.

Accounting Rate of Return (ARR)

Another indicator of the static financial assessment of a project is the investment efficiency ratio (Account Rate of Return or ARR). This ratio is also called the accounting rate of return or the project profitability ratio.

There are several algorithms for calculating ARR.

The first calculation option is based on the ratio of the average annual profit (minus deductions to the budget) from the implementation of the project for the period to the average investment: ARR =Pr /(1/2)Iav.0

where Pr is the average annual profit (minus deductions to the budget) from the implementation of the project, Iav.0 is the average amount of initial investments, if it is assumed that after the expiration of the project, all capital costs will be written off.

Sometimes the project profitability indicator is calculated based on the initial investment: ARR = Pr/I0

Calculated on the basis of the initial investment volume, it can be used for projects that create a stream of uniform income (for example, an annuity) for an indefinite or rather long period.

The second calculation option is based on the ratio of the average annual profit (minus deductions to the budget) from the implementation of the project for the period to the average amount of investment, taking into account the residual or liquidation value of the initial investment (for example, taking into account the liquidation value of equipment upon completion of the project): ARR= Pr/(1 /2)*(I0-If),

where Pr is the average annual profit (minus contributions to the budget) from the implementation of the project; I0 is the average amount of initial investment; If is the residual or liquidation value of the original investment.

The advantage of the investment efficiency indicator is the ease of calculation. At the same time, it also has significant disadvantages. This indicator does not take into account the time value of money and does not involve discounting; accordingly, it does not take into account the distribution of profits over the years, and, therefore, is applicable only for assessing short-term projects with a uniform flow of income. In addition, it is impossible to assess possible differences between projects due to different implementation periods.

Since the method is based on the use of the accounting characteristics of the investment project - the average annual profit, the investment efficiency ratio does not provide a quantitative assessment of the increase in the economic potential of the company. However, this ratio provides information about the impact of the investment. On the company's financial statements. Financial reporting indicators are sometimes the most important when investors and shareholders analyze the attractiveness of a company.

This material was prepared based on the book “Commercial Evaluation of Investments”

Authors: I.A.

Buzova, G.A. Makhovikova, V.V. Terekhova. Publishing house "PETER", 2003. 01/01/1970

All materials by tag: business planning, attraction of investments

Calculator for calculating the profitability of this business

Net profit (monthly):

Payback period:

Profitability:

More detailed calculations can be made in our free application

Save the article to study the material carefully

Remember article

You can save this page using:

Objectives of investment analysis. Classification of investments, sources of information

Investment (Latin “investio” - I put on) means, in the most general definition, a long-term investment of capital in the economy or a temporary refusal of an economic entity to consume its own resources (capital) and use them to increase its own capital (generate income).

The opposite concept of investment is “disinvestment,” which involves the process of releasing funds as a result of the sale of long-term assets. Disinvestment may occur if the use (operation) of assets is unprofitable.

In modern conditions, the activities of an organization are associated with the investment of resources in the acquisition of assets, the development of new industries or activities, and the purchase of securities. All this represents the investment activity of the organization, the analysis of the dynamics and structure of which must be given special attention.

The purpose of investment analysis is to objectively assess the effectiveness, feasibility and risks of investment projects and justify the investment model (policy) of the organization.

The objectives of investment analysis are:

- analysis of financial statements and interpretation of its results for the implementation of the investment project;

- assessment of available sources of financing and justification for attracting borrowed capital;

- calculation and analysis of financial indicators and performance indicators of the investment project;

- study and assessment of risks and their comparison with the profitability of the investment project;

- monitoring the investment project throughout the entire period of its implementation and after the completion date;

- making informed management decisions on changing investment performance indicators based on monitoring.

The main regulatory documents regulating investment activities in the Russian Federation include:

- Civil Code of the Russian Federation (as amended and supplemented);

- Federal Law “On investment activity in the Russian Federation, carried out in the form of capital investments” dated 02.25.99 No. 39-FZ (as amended on December 25, 2021 No. 478-FZ);

- Federal Law “On the Securities Market” dated April 22, 1996 No. 39-FZ (as amended on December 27, 2021).

- Federal Law “On Foreign Investments in the Russian Federation” dated July 9, 1999 No. 160-FZ (as amended on May 31, 2021), etc.

The main features of the investment process are:

- investments must lead to capital growth;

- investments can be in capital investments, assets (non-current and current), financial instruments, intangible assets, etc.;

- investment is possible in the form of investments of cash, movable and immovable property;

- investments are usually long-term in nature.

To analyze the effectiveness of real investments, an assessment of their structure is of great importance, which can be:

technological, reproductive, by sources of investment and by other characteristics (industry, regional).

The technological structure is represented by the costs of construction and installation work, the purchase of machinery and equipment, and design and survey work.

The reproduction structure of investments indicates the share of capital investments allocated to new construction, the purchase of modern equipment and the re-equipment of production.

Investments by sources of their financing characterize the capital structure and are aimed at creating a rational structure of own and borrowed funds.

In economics, it is customary to classify investments according to various criteria. For the purposes of investment analysis, it is legitimate to distinguish three types of investments according to the objects of investment of resources:

- real (capital) investments;

- intangible (potential) investments;

- financial (portfolio) investments.

Real investments represent capital investments in the development of the material and technical base of an economic entity. It should be noted that in the case of real investments, the condition for achieving the predicted events, as a rule, is the use of non-current assets for the production of the product and its sale. To analyze the effectiveness of real investments, it is of great importance to assess their structure, which can be technological, reproductive, sectoral, by sources of investment and by other characteristics.

Intangible (potential) investments are investments in intangible assets associated with R&D, the creation of new products and services, new knowledge and skills (human capital). This type of investment is especially important in the formation and development of the scientific and technical potential of an organization in the digital economy.

Financial (portfolio) investments are usually understood as investing capital in financial assets (securities). The main types of financial assets include bonds, shares, bills.

There are portfolio investments in government securities and equity securities.

The main concept in the Federal Law is an investment project, which means the economic feasibility of making investments in various types. An investment project can be characterized using the following factors:

- project scale;

- terms of implementation (payback).

If the investment object turns out to be significant for an economic entity, management decisions must be preceded by the planning or design stage, which is the stage of development of the investment project. V.V. Kovalev understands an investment project as “the totality of investments and the income they generate. Thus, in an investment project there is always an investment (outflow of capital) with subsequent receipts (inflow of funds).”

Investments, as a rule, relate to decisions of a strategic nature and require detailed analytical justification. Therefore, when analyzing investment projects, the financial manager must take into account:

- riskiness of investment projects;

- time value of money;

- limited resources;

- attractiveness of investment projects.

The main method of achieving the projected goals is mathematical modeling of the relevant decisions and their consequences on the financial results of the business entity.

During modeling, an investment project is considered in the time of its action and is divided into several equal intervals - design intervals. For each planning interval, budgets are drawn up - estimates of receipts and payments that reflect the results of all operations in a specific period of time. The balance of such a budget is the difference between receipts and payments and is the cash flow of the investment project.

In a broad sense, the cash flow of an investment project consists of the following main elements:

- investment costs;

- proceeds from sale;

- total costs;

- taxes and payments.

At the initial stage of the investment period, cash flows, as a rule, turn out to be negative; there is an outflow of resources due to the acquisition of fixed assets and the formation of net working capital. After completing the initial stage of the investment project, the cash flow stabilizes and becomes positive.

Analysis of sales proceeds, as well as analysis of costs arising during the implementation of a project, can be assessed either positively or negatively. The financial manager must analyze the riskiness of projects and promptly control them from the point of maximizing income and property of shareholders.

In investment analysis, the concepts of profit and cash flow play an important role. It should be noted that in the theory of investment analysis, the concept of “profit” does not coincide with its accounting definition. In investment activities, the fact of receiving a profit is preceded by the reimbursement of the initial investment, which corresponds to the concept of “depreciation” (English: “amortization” - repayment).

In the case of investing in non-current assets, this function is performed by depreciation charges.

Thus, the justification for the investment project is based on calculating the amounts of depreciation and profit within the time interval of the study.