Interest in the stock market is constantly growing, as evidenced by the numbers of not only registered clients, but also active accounts. Buying securities no longer seems to people like some kind of Western-bourgeois deception; now many people hold shares of certain companies. There are many licensed stock brokers operating in the country, and then we will look at what the Sberbank broker , the most famous broker operating in the Russian market, offers.

From this article you will learn:

- Sberbank broker

- Trading instruments

- Trading conditions and account types

- Advantages of the Sberbank broker

- Disadvantages of the Sberbank broker

- Conclusion

About the broker

| Name | Public Joint Stock Company "Sberbank of Russia" |

| Year of foundation | 1991 |

| Regulator and license | Has the following licenses: number 045-02894-100000 (brokerage) number 045-03004-010000 (dealer) number 045-02768-000100 (depository) |

| Requisites | INN: 7706810730 Gearbox: 772501001 OGRN: 1147746683468 Account: 40701810700020009101 |

| Reliability rating | ACRA: AAA (according to Russian grading) Expert RA: AAA (according to Russian gradation) S&P: ВВВ- (stable) Moody's: Baaa3 (stable) Fitch: BBB- (positive) |

| Trading platforms | Stock, currency and derivatives sections of the Moscow Exchange, St. Petersburg Exchange, foreign exchanges |

| Trading platform | QUIK / Web version of QUIK / iQUIK X (for IOS) / QUIK Android X / Sberbank Investor mobile application |

| Minimum deposit | No limits |

| Authorized capital | RUB 67,760,844,000.00, change in the amount of authorized capital from April 2007 |

| Head office address | 117997, Moscow, Vavilova street, building 19 |

| Official site | https://www.sberbank.ru/ru/person/investments/broker_service |

| Hotline number | (8 |

| Free demo account | No |

| Minimum commission | 0.018% – stock market, subject to a turnover of 50 million rubles. 0.5 RUR/per contract – derivatives market 0.02% – currency section with a turnover of 100 million rubles. |

| Rating | 3 out of 5 |

Features of the activities of Sberbank of Russia in the securities market

The general trend in the development of market-type banking systems is the universalization of the activities of banks, which manifests itself, in particular, in the expansion of their presence in the securities market and the diversification of activities in this market. The model of the banking system adopted during the period of market reforms in Russia allows for various forms of participation of banks in operations on the securities market. Over the years since the reforms, banks have become the largest financial market operators, accounting for a significant share of securities portfolios held by institutional investors [1].

Banks in the securities market can be represented as professional (brokers, dealers, trustees, depositories) and non-professional (issuers and investors) market participants. Since September 1, 2013, the main regulator of the securities market is the Central Bank of the Russian Federation, which has the status of a mega-regulator [2].

Sberbank is a Russian commercial bank, an international financial group, one of the largest banks in Russia and Europe. Controlled by the Central Bank of Russia. Full name: public joint-stock company “Sberbank of Russia”. The central office of Sberbank is located in Moscow. The first step

Sberbank's entry into the international arena was the acquisition of a bank in Kazakhstan in 2006.

Sberbank is a universal bank providing a wide range of banking services. Sberbank's share in the total assets of the Russian banking sector was 28.7% as of January 1, 2021, 46% in the private deposit market, the loan portfolio corresponded to 38.7% of all loans issued to the population.

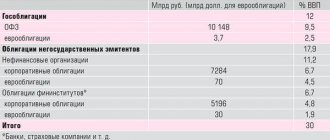

In 2015, the Group's assets increased by 8.5% to 27.3 trillion. rubles Loans and advances to customers remain the largest asset category, accounting for 68.5% of total assets at the end of 2015. The share of liquid assets, which includes cash, funds in banks and a portfolio of securities, amounted to 21.9%. In 2015, the securities portfolio increased by 30.2% and reached 2.9 trillion. rubles [4].

The Group's securities portfolio is 97.9% represented by debt instruments (bonds) and is mainly used for liquidity management. In 2015, the share of shares in the securities portfolio remained almost unchanged compared to 2014 and amounted to 1.9%. The share of corporate bonds in the portfolio structure by the end of 2015 amounted to 39.9%, having increased by 8.0 percentage points over the year.

Table 1. Structure of the securities portfolio of the Sberbank Group in 2014-2015.

| Indicators | 31.12.2014, billion rubles | Share,% | 31.12.2015, billion rubles | Share,% |

| Federal loan bonds | 807,9 | 36,3 | 872,2 | 30,0 |

| Corporate bonds | 712,7 | 31,9 | 1 156,9 | 39,9 |

| Government bonds and municipal bonds of foreign countries | 355,5 | 15,9 | 413,0 | 14,2 |

| Eurobonds of the Russian Federation | 217,3 | 9,7 | 325,7 | 11,2 |

| Municipal and subfederal bonds | 93,3 | 4,2 | 76,4 | 2,6 |

| Bills of exchange | 0,4 | 0,0 | 0,4 | 0,0 |

| Total debt securities | 2 187,1 | 98,0 | 2 844,6 | 97,9 |

| Corporate shares | 40,2 | 1,8 | 56,2 | 1,9 |

| Investment fund units | 4,6 | 0,2 | 5,2 | 0,2 |

| Total securities | 2 231,9 | 100,0 | 2 906,0 | 100,0 |

Table 2. Structure of the Sberbank Group's debt securities portfolio by credit rating level in 2014-2015.

| Indicators | 31.12.2014, billion rubles | Share,% | 31.12.2015, billion rubles | Share,% |

| Investment rating | 1 790,3 | 81,9 | 1 672,9 | 58,8 |

| Speculative rating | 312,5 | 14,3 | 1 079,1 | 37,9 |

| No ratings | 84,3 | 3,8 | 92,6 | 3,3 |

| Total debt securities | 2 187,1 | 100,0 | 2 844,6 | 100,0 |

The share of corporate bonds with an investment rating was 39.1% (63.0% at the end of 2014). The share of securities pledged as part of repurchase transactions decreased in 2015 from 52.4% to 7.6%. This decrease was the result of a significant reduction in dependence on funds from the Bank of Russia due to a flexible interest rate policy and attracting additional amounts of customer funds[4].

The last time Sberbank placed its shares was in 2007, and in the same year the shares were split. Currently, the total number of outstanding shares of Sberbank is:

- ordinary shares with a par value of 3 rubles. 21,586,948,000 pcs.

- preferred shares with a par value of 3 rubles. 1,000,000,000 pcs.

The maximum number of authorized ordinary shares is 15,000,000,000.

Table 3. Sberbank shareholder structure as of the date of closing the register of shareholders (end of business day April 14, 2016)

| Category of shareholders | Share in authorized capital,% |

| Bank of Russia | 50.0+1 share |

| Legal entities - non-residents | 45,60 |

| Resident legal entities | 1,50 |

| Private investors | 2,90 |

As an issuer, Sberbank issues promissory notes. A bill of exchange is a security that certifies the unconditional monetary obligation of the drawer to pay, upon the maturity date specified on the bill of exchange, in a certain place a certain amount of money to the owner of the bill (the holder of the bill) or his order[1]. The Bank's promissory note is used: for quick and convenient payments for goods, works, services; for a profitable investment of funds in order to generate income; for use as collateral when obtaining a loan or guarantee from the Bank.

The Bank's bills of exchange are issued on forms that have a high degree of protection against counterfeiting and are printed on the MPF of the FSUE GOZNAK branch. The Bank has created an electronic database for all issued bills of exchange.

A bill of exchange can be transferred to another person by means of an endorsement (endorsement). The endorsement is affixed with the handwritten signature of the holder of the bill or the attorney under the power of attorney on the back of the bill. Each endorsement must have a serial number. Partial endorsement is invalid.

An individual’s funds placed in promissory notes of Sberbank PJSC are not subject to compulsory insurance in accordance with Federal Law No. 177-FZ dated December 23, 2003 “On the insurance of deposits of individuals in banks of the Russian Federation.”

Table 4. Tariffs for operations with promissory notes of Sberbank of Russia (from 03/01/2012) [3]

| Name of service | Cost of service including VAT |

| Operations with promissory notes | |

| Issuance of a bill | for free |

| Payment of bills | for free |

| Providing information on the issue/payment/authenticity of a promissory note | for free |

| Equivalent exchange of bills | for free |

| Issuance of bills of exchange in exchange for similar bills of exchange | for free |

| Issuance, at the request of the client, of duplicates of Agreements for the issuance/exchange/storage of bills of exchange or Certificates of acceptance and transfer of bills of exchange | for free |

| Storage of promissory notes not received by the client or accepted under storage agreements: | |

| up to USD 1 million inclusive | 15 rub. per day, min 465 rub. for the entire storage period |

| over 1 million US dollars | up to 5 million US dollars inclusive 30 rub. per day, min 465 rub. for the entire storage period |

| over 5 million US dollars | 45 rub. per day, min 465 rub. for the entire storage period |

Sberbank issues the following types of promissory notes:

- an interest-bearing bill with a par value in rubles and foreign currency, the income on which is paid in the form of interest accrued on the bill amount (par value);

- a discount bill with a par value in rubles and foreign currency, the income on which is paid in the form of the difference between the bill amount (face value) and the sale price of the bill to the first Bill holder.

Interest-bearing bills are issued with the following payment terms:

- “upon presentation, but not earlier than a certain date and no later than a certain date” for a period of 91 to 730 days with accrual of income in the amount established by the Bank;

- “upon presentation, but not earlier than a certain date” for a period of 14 to 730 days with accrual of income in the amount established for the “On Demand” deposit.

Discount bills are issued with the following payment terms:

- “on a certain day” for a period of 91 to 730 days with accrual of income in the amount established by the Bank;

- “upon presentation, but not earlier than a certain date” for a period of 14 to 730 days without accruing income on the bill amount.

Sberbank also issues simple convertible bills (interest-bearing and discount bills). The bill is denominated in US dollars or euros and contains a payment clause in the currency of the Russian Federation, i.e. paid by Sberbank in the currency of the Russian Federation. The first bill holder purchases the bill for the currency of the Russian Federation.

A savings certificate is a security document that is issued to the bearer . A savings certificate, like a deposit, is designed to store and increase funds with a return significantly higher than on deposits.

Table 5. Interest rates on Savings Certificates of Sberbank of Russia [3]

| Denomination | 91-180 days | 181-365 days | 366-730 days | 731-1094 days | 1095 days |

| from 10,000 to 50,000 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 |

| from 50,000 to 1 000 000 | 6,4 | 6,75 | 6,65 | 6,65 | 6,65 |

| from 1,000,000 to 8 000 000 | 7,2 | 7,55 | 7,45 | 7,45 | 7,45 |

| from 8,000,000 to 100 000 000 | 7,85 | 8,20 | 8,10 | 8,10 | 8,10 |

| from 100,000,000 | 8,45 | 8,80 | 8,70 | 8,70 | 8,70 |

The savings certificate of Sberbank of Russia has the following characteristics:

- Interest rate: from 0.01 to 8.80% in rubles;

- Deposit term: from 91 days to 1095 days;

- Not replenished;

- Without partial removal;

- Minimum deposit amount: 10,000 rubles.

The increased interest rate is explained simply: all Sberbank deposits participate in the deposit insurance system, and savings certificates are not subject to insurance.

Sberbank's corporate and investment business Sberbank CIB offers brokerage services for clients who make decisions and are directly involved in managing their capital independently.

More than 180 thousand investors throughout Russia use Sberbank's brokerage services. They buy and sell securities through the Bank because it is easy, fast and convenient. You can perform transactions in real time from anywhere in the world using the Internet. Developed information and technical support and a wide branch network of Sberbank create unique conditions for working in financial markets.

Sberbank provides the opportunity to make transactions with various financial instruments on the following trading platforms:

- the “Main Market” sector of the Moscow Exchange Group stock market (shares, government, corporate, municipal and subfederal bonds);

- derivatives market (futures and options contracts);

- over-the-counter market (Eurobonds, depositary receipts and shares (units) of foreign investment funds (ETFs)).

Also through the Bank you can:

- submit applications through the QUIK online trading system or by telephone to a specialized trade desk service;

- receive a service for making unsecured transactions (margin trading), which allows you to carry out transactions with securities in a volume exceeding the value of your own assets: cash and/or securities;

- receive a service for executing over-the-counter repo transactions (OTS-REPO), which is an alternative to lending against securities and allows you to quickly receive funds from the securities in the client’s portfolio;

- receive a service for making OTS-repo overnight transactions, which allows you to receive additional income in the amount of 2% per annum from the short-term placement of securities in the client’s portfolio.

An OTC-repo transaction usually consists of two parts. The first part of the transaction: the client sells securities at a price calculated taking into account the initial discount to the closing price of the previous trading day. Second part of the transaction: after a period determined at the conclusion of the transaction, the client buys back the securities sold under the first part of the transaction at a price calculated taking into account the OTC-repo rate and the OTC-repo period. OTS-REPO transactions can be executed provided that the planned volume for the first part of the transaction is equal to or exceeds RUB 200,000. Conditions for providing funds under an OTS-REPO transaction: period from 7 to 35 days, rate 17% per annum; period from 36 to 105 days, rate 19% per annum.

Internet trading is the easiest and most convenient way to buy and sell securities on the stock exchange using a trading system installed on a personal computer or laptop. The Bank's clients can independently manage their own assets in real time and carry out trading operations by placing orders via the Internet on the following trading platforms: the "Main Market" sector of the Moscow Exchange Group stock market (shares, government, corporate, municipal and subfederal bonds); derivatives market (futures contracts).

The advantages of online trading for bank clients are as follows:

- the investor constantly sees a picture of trading in front of him, and on several exchanges simultaneously in real time;

- timely receipt by the investor of economic, financial news and analytical reviews of brokers;

- efficiency of issuing orders to a broker to buy or sell via the Internet;

- the ability to quickly monitor the status of your exchange account, etc.

For a commercial bank, an online securities trading system also has a number of advantages, including:

- low transaction costs;

- receiving stock exchange information in real time, posting quotes directly to trading systems;

- high degree of safety during operations [1].

Sberbank also provides a service for opening an Individual Investment Account (IIA). An individual investment account is a special type of brokerage account under which an individual can receive a tax deduction for the amount of contribution to an individual investment account, or is exempt from paying income tax on all profits received from operations on this account.

An IIS can only be opened by an individual tax resident of the Russian Federation. An IIS can be opened by both a new and an existing client who has entered into a brokerage service agreement. It became possible to open an IIA starting from January 1, 2015: one individual can open only one IIA. The minimum period for investing funds in an individual investment account is 3 years (counted from the date of conclusion of the agreement).

Table 6. Types of Individual Investment Account [3]

| IIS with deduction for contributions (first type) | IIS with income deduction (second type) |

| Only cash can be deposited into the account. The maximum contribution to an IIS is no more than 400 thousand rubles. (during the calendar year) | |

| There is no tax during the validity period of the IIS; the tax base is determined for the entire period at the time the account is closed. If the IIS is closed earlier than three years, the right to the benefit is lost. | |

| To receive a deduction, you must have income (for example, wages) taxed at a rate of 13% in the corresponding tax period | Availability of income taxed at a rate of 13%, optional |

| For the amount of the contribution, a personal income tax deduction is provided annually in the amount of up to 52 thousand rubles. (13% of 400 thousand rubles) | There is no deduction for contributions |

| Tax rate when closing an account – 13% | When closing an account, income is exempt from tax |

| The type of deduction can be selected during the validity period of the IIS. Combining two types of deductions is impossible! | |

The trustee is Sberbank Asset Management JSC (the company was renamed in November 2012, the former name was Troika Dialog Management Company CJSC), one of the oldest, largest and most successful management companies in Russia, has been operating since 1996 and is rightfully considered founder of the domestic asset management industry.

Today, the company offers professional services for asset management in the securities market using the collective form of investment of mutual funds (UIFs). Advantages of mutual funds:

- Professional management. The funds are managed by professional portfolio managers.

- Transparency. Regular disclosure of information about the activities of a mutual fund in accordance with legal requirements on the company’s website, as well as in the printed publication.

- Diversification. The product line ranges from diversified portfolios of stocks and bonds to more highly specialized sectoral and country funds.

- Availability.

- Mobility. Possibility to carry out operations with shares throughout Russia.

By investing money in mutual funds, clients become participants in the stock market, but at the same time all transactions with securities and other assets of the funds are carried out. Professional portfolio managers, who have extensive and long-term experience in the market and have been repeatedly recognized as one of the best in Russia, manage the pooled funds of shareholders in accordance with the chosen investment strategy.

As a professional participant in the securities market, Sberbank offers a wide range of depository services, including:

- opening of all types of securities accounts necessary for accounting and transfer of rights to Russian and foreign securities;

- storage and accounting of ownership rights to securities, including storage and accounting of documentary / non-issued securities;

- carrying out depository operations on transactions with securities, including using correspondent securities accounts of Sberbank in the international settlement and clearing centers Clearstream Banking and Euroclear Bank;

- encumbering securities with obligations: registration and accounting of collateral transactions;

- carrying out corporate actions of issuers: consolidation, conversion, splitting, participation in shareholders' meetings by proxy;

- payment of income on securities, redemption of securities and securities coupons.

The Sberbank Depository acts as a sub-custodian of JP Morgan for the storage of the underlying asset for the issue of depositary receipts for shares of OJSC NK Rosneft, OJSC Novorossiysk Commercial Sea Port, OJSC Magnit, OJSC Rostelecom and OJSC MTS ( sponsored program), and is also a subcustodian of The Bank of New York Mellon for storing the underlying asset for the issue of depository receipts of Sberbank PJSC, GUM Trading House OJSC and MTS OJSC (unsponsored program).

On October 24, 2013, the Depository of Sberbank PJSC accepted for service from the Depository of ING Bank (Eurasia) CJSC 44 programs of depositary receipts of 27 issuers of shares, including: OJSC Surgutneftegaz, OJSC Tatneft, OJSC ", OJSC Avia, OJSC Avtovaz" , OJSC "Pharmacy Chain 36.6", OJSC "Irkutskenergo", OJSC "Red October", OJSC "Lenenergo", OJSC TD "TSUM", OJSC "Pharmstandard", etc. [3].

The Sberbank depository is one of the largest bank depositories in Russia. It offers its clients (residents and non-residents of the Russian Federation) a full range of depository services with securities of Russian and foreign issuers in all regions of the Russian Federation. Depository activities have been carried out by Sberbank since 1997.

Sberbank has a wide branch network in Russia and services more than 390,000 securities accounts. Clients of the Sberbank Depository can submit depository orders and receive reports on the execution of transactions at more than 70 depository service points throughout Russia. To exchange information with clients, the Bank uses various types of remote services, including the Bank-Client, SWIFT and Sberbank EDI systems.

Depository accounting is carried out in the centralized automated information system “Depositary” (developed by Sberbank), which meets the requirements for maintaining depository accounting imposed by regulatory documents of the Russian Federation, and also has a high degree of security and fault tolerance.

The information security measures applied to the system correspond to the highest category and ensure the safety and confidentiality of stored information. Its high efficiency has been repeatedly proven, in particular, during the “people’s” IPOs of Rosneft Oil Company OJSC and Sberbank PJSC.

In conclusion, it should be noted that Sberbank is constantly improving its services in order to offer clients the best investment products. Free seminars and training courses are held for beginning investors. Sberbank specialists advise clients on all issues that arise, introduce them to the procedure for working and servicing the financial markets, prepare all the necessary documents to start investing, and warn about risks.

LITERATURE

- Panova T.A. Bank operations with securities: educational and methodological complex. M.: Publishing house. EAOI Center, 2011. 388 p.

- Official website of the Bank of Russia // Electronic resource: http: // www.cbr.ru

- Official website of Sberbank of Russia // Electronic resource: http: // www. sberbank. ru

- Official website of the Sberbank of Russia Group // Electronic resource: http: // www. sberbank.com

Brief history of the broker and awards

Broker Sberbank is part of the largest and most reliable bank in Russia. The brokerage firm developed systematically, gradually improving its services and working on software expansion.

In the ranking of the Moscow Exchange in terms of the number of registered users, Sberbank occupies a leading position. At the same time, in terms of the volume of active clients on the Moscow Exchange, it is somewhere in 6th place. As for the trading turnover for client positions, Sber is almost always far from the top lines.

The investment direction of Sberbank CIB often receives prestigious awards.

For example, for 2017–2018. the company received the following titles:

- The most innovative organization according to Banker;

- The best dealer and investment bank in the derivatives market - from MMBA;

- The best investment bank from Global finance.

Terms of service and tariffs

Since July 2021, the company has only two basic tariff plans: “Independent” and “Investment”.

The table shows only part of the information about tariffs. More complete and current data can be viewed by downloading the regulations from the official website of the Sberbank broker: https://www.sberbank.ru/ru/person/investments/broker_service/tarifs

| Account types | "Independent" "Investment" | |

| Broker commission | Independent | Stock market: from 0.018 to 0.060%, depending on the volume of trading operations Currency: from 0.02 to 0.2%, depending on the volume of trading operations Futures and options: 0.5 rubles per contract Analytical support and trading ideas: no |

| Investment | Stock market: 0.3% of trading amounts Currency: 0.2% of the trading amount Futures and options: 0.5 rubles per contract Analytical support and trading ideas: yes | |

| Exchange fees | From 0.00154 to 0.01% | |

| Depository fee | 149 rub. per month | |

| Commission on over-the-counter market transactions | From 0.1% of turnover to 1.5% of transaction amount | |

| Fee for using the terminal | KVIC, KVIC Android X, webKVIC, Sberbank Investor application is provided free of charge | |

| Fee for withdrawal of funds | Withdrawal from a brokerage account to a current account in Sberbank, incl. through Sberbank online - free. | |

| Deposit and withdrawal methods | Internet bank Replenishment through the cash desk in the office Bank transfer Via mobile application Via Kwik terminal Voice order | |

What is the difference between a brokerage account and an IIS?

An individual investment account opened together with a brokerage account is intended exclusively for individuals. The general orientation does not interfere with assessing the difference and seeing the differences from each other.

| Categories | IIS | Brokerage account |

| Number of accounts | 1 | No limits |

| Investment amount | Up to 400,000 | — « — |

| Minimum term | 3 years | — « — |

| Assets for enrollment | money | Funds and securities |

| Withdrawal (full and partial) | Before the deadline – loss of profit and tax benefits | Anytime without sanctions |

| Markets and exchanges | Russian | Western and Russian |

| Forex | Limited | Available |

| Tax regime | 13% benefit and deductions on contributions and income | Taxation of residents 13%, non-residents – 30%, benefit after 3 years of holding securities |

| Insurance | Absent | Absent |

A comparison of parameters shows how the IIS works. In essence, the account is more like a multi-year investment with the greatest return at the end of the term. Management and wise investment of money is entrusted to bank employees.

Broker Products

In addition to standard brokerage services, Sberbank offers additional investment products and services. Among them, for example, there are interesting structured instruments or services for buying and selling currency at the current market price with free withdrawal within one day to a foreign currency bank account.

Structured Products

Sberbank Broker offers a number of structured products for purchase:

- ETFs (exchange traded funds). Liquid instruments that allow you to make transactions with diversified portfolios of securities, commodities or an index with minimal investment.

- Structured notes (available only to qualified investors). The price of these instruments is tied to the underlying element (asset). This could be oil, an index, a precious metal, a portfolio of securities, etc.

- Mutual investment funds (mutual investment funds). Securities allow you to invest money in a certain pool of investment instruments, such as real estate, a portfolio of stocks or bonds, etc. Such instruments are inferior in liquidity to ETFs, but they provide greater choice and the opportunity to invest in the ideas of a specific management company.

IPO

The Sberbank broker allows you to participate in initial placements of securities, but applications for participation are considered separately and accepted in advance.

More

Sberbank broker actively offers so-called federal loan bonds for the population (OFZ-N). There is no particular point in buying them from a private investor who has access to the exchange. But as an alternative to a deposit, such a product has a right to exist, since it is more liquid and profitable than a bank deposit.

What services does it offer?

As a broker, Sberbank Kib provides the following services:

- execution of operations in global markets;

- demo account;

- margin trading;

- conducting transactions to obtain additional income from short-term placed securities (overnight repo).

The service keeps records of transactions for the sale and purchase of securities and depositary accounts.

Sberbank broker services include financing and placement of securities (bonds, derivatives market instruments, shares), transactions with commodity contracts and currencies.

The service offers structured products and specialized derivative instruments. These services are used for hedging transactions in commodities, currencies and interest rates.

The company provides financial advisory services, liability management, acquisitions and mergers, and mezzanine financing. Sberbank broker services also include restructuring and assistance in obtaining a credit rating. The broker conducts an examination of the placement of depositary receipts and shares on the market.

Working with a broker

Interaction with a broker can be divided into several stages:

- registration and identification of data in the Sberbank broker;

- opening a brokerage account;

- replenishment of funds;

- carrying out transactions in financial markets.

Registration on the official website

First, you should open an account with Sberbank and register in the Sberbank Online system. To do this, you will need standard identification data and their confirmation with documents.

Instructions for opening an account

A brokerage account can be registered in two ways:

- Through Sberbank Online. In this case, the entire procedure for opening an account with a broker will go through the user’s personal account in the application.

- Through an office visit with the investment department. In this case, you must have your passport with you. This method can be used if the potential investor does not have a personal account connected.

Demo account

It is not possible to use the demo version of trading in the broker's Sberbank terminals.

Account replenishment and withdrawal of funds

It is better to replenish and withdraw money through a current account in Sberbank, because... in this case no fees will be charged. If transfers are made through another bank, a fee will be charged in accordance with the terms of service.

You can top up your account through:

- cash desk at a Sberbank branch;

- personal account in Sberbank Online.

You can request a withdrawal of money through:

- "Sberbank Online";

- KVIC trading terminal;

- Sberbank Investor application.

Technical support

To communicate with technical support on issues of interest to the client, Sberbank offers the following communication channels:

- hotline;

- Email;

- request in your personal account.

How to close an account with Sberbank?

Before closing your account, you must:

- Sell all available assets.

- Wait for the settlement procedure to complete.

- Withdraw money to a Sberbank payment instrument or receive it in cash.

After this, you should submit an order to close the account at any additional branch of Sberbank. And as a result, receive a written, sealed notice of termination of the brokerage and depository agreements.

Pros and cons of the company

Among the advantages of the Sberbank broker are the following:

- unconditional reliability;

- own application and classic KVIC;

- fast transactions for transferring funds between accounts.

Disadvantages of the broker:

- meager range of tariffs + monthly depository fee;

- insufficient information content of products;

- lack of additional trading software;

- analytical support only in the premium tariff;

- no demo account;

- lack of a forex dealer license. Accordingly, clients have no access to the Forex market.

Real reviews

Next, I will show reviews of the Sberbank broker from the point of view of different participants in legal relations. Including:

- active traders;

- clients;

- employees.

Traders

Reviews from traders lead to sad thoughts. Most of the comments concern frequent software glitches and other technical problems that are not resolved in a timely manner - even after contacting technical support.

Clients

Customer reviews also leave an unfavorable impression of the broker's activities. In some way, like with traders, they are associated with technical problems and poor customer focus of employees.

Employees

For the most part, employees of the financial structures of the largest bank speak well of the corporate culture and working conditions in the company.

Alternatives

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here you can see a list of other Russian brokerage companies that occupy leading positions in our market - an alternative to the Sberbank broker.