Dividends on NKHP shares in 2021 - size and register closure date

Home → Dividends→ Shares of NKHP JSC - forecast, payment history

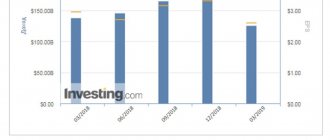

A table with the complete history of dividends of the NKHP company, indicating the amount of payment, the date of closure of the register and the forecast:

| Payment, rub. | Registry closing date | Last day of purchase |

| 6.16 (forecast) | July 27, 2021 | 23.07.2021 |

| 0.96 | July 27, 2020 | 23.07.2020 |

| 6.36 | January 15, 2020 | 13.01.2020 |

| 6.96 | July 9, 2019 | 05.07.2019 |

| 17.75 | December 17, 2018 | 13.12.2018 |

| 5.66 | June 26, 2018 | 22.06.2018 |

| 6.8 | December 15, 2017 | 13.12.2017 |

| 7.41 | September 8, 2017 | 06.09.2017 |

| 2.36 | July 10, 2017 | 06.07.2017 |

| 9.46 | December 21, 2016 | 19.12.2016 |

| 2.61 | June 24, 2016 | 22.06.2016 |

| 14.79 | December 20, 2015 | 16.12.2015 |

*Note 1: The Moscow Exchange operates on the T+2 trading system. This means that settlements for buying and selling shares occur within 2 business days. Therefore, to be included in the register of shareholders and receive dividends, you must be a shareholder 2 days before the cutoff.

*Note 2: Exact payout date varies by broker and issuer. The predicted nearest date for the receipt of dividends to the brokerage account for the company NKHP JSC: August 9, 2021.

Total dividends of NKHP JSC shares by year and changes in their size compared to the previous year:

| Year | Amount for the year, rub. | Change, % |

| 2021 | 6.16 (forecast) | -15.85% |

| 2020 | 7.32 | +5.17% |

| 2019 | 6.96 | -70.27% |

| 2018 | 23.41 | +41.28% |

| 2017 | 16.57 | +37.28% |

| 2016 | 12.07 | -18.39% |

| 2015 | 14.79 | n/a |

| Total = 87.28 |

The amount of dividends paid by NKHP JSC for the entire period is 87.28 rubles.

Average amount for 3 years: 6.81 rubles, for 5 years: 12.08 rubles.

You can buy shares of NKHP JSC with minimal commissions from stock brokers: Finam and BCS. Free deposits and withdrawals. Online registration.

Brief information about the issuer NKHP PJSC JSC

| Sector | Food |

| Issuer's full name | NKHP PJSC JSC |

| Issuer's name is short | NKHP JSC |

| Ticker on the stock exchange | NKHP |

| Number of shares in lot | 10 |

| Number of shares | 67 597 000 |

Other companies from the Food sector

| # | Company | Div. profitability for the year, % | The nearest registry closing date | Buy before |

| 1. | Rusagro | 11,85% | 18.09.2021 | 15.09.2021 |

| 2. | CherkizG-ao | 7,34% | 05.10.2021 | 01.10.2021 |

| 3. | RusAqua JSC | 3,79% | 27.05.2021 | 25.05.2021 |

| 4. | Beluga a.o. | 2,92% | 26.10.2021 | 22.10.2021 |

Calendar with upcoming and past dividend payments

| Immediate | Past | ||||

| Company Sector | Size, rub. | Registry closing date | Company Sector | Size, rub. | Registry closing date |

| RusAqua JSC Foodstuff | 5 | 27.05.2021 | MDMG-gdr Miscellaneous | 19 ✓ | 25.05.2021 |

| FGC UES JSC Energy | 0.016 | 29.05.2021 | TransK JSC Logistics | 403.88 ✓ | 24.05.2021 |

| SevSt-ao Metals and mining | 46.77 | 01.06.2021 | M.video Retail trade | 38 ✓ | 18.05.2021 |

| Tattel. JSC Telecoms | 0.0393 | 01.06.2021 | PIK JSC Construction | 22.51 ✓ | 17.05.2021 |

| SevSt-ao Metals and mining | 36.27 | 01.06.2021 | PIK JSC Construction | 22.92 ✓ | 17.05.2021 |

| GMKNorNik Metals and mining | 1021.2 | 01.06.2021 | Moscow Exchange Finance and Banking | 9.45 ✓ | 14.05.2021 |

| MOESK Energy | 0.0493 | 01.06.2021 | Sberbank Finance and Banking | 18.7 ✓ | 12.05.2021 |

View full calendar for 2021 »

7 Best Dividend Stocks for 2021

| # | Company | Sector | Dividend yield for the year, % | The nearest registry closing date | Buy before |

| 1. | Surgnfgz-p | Oil Gas | 16,84% | 20.07.2021 | 16.07.2021 |

| 2. | iMMTSB JSC | Miscellaneous | 15,24% | 09.06.2021 | 07.06.2021 |

| 3. | Unipro JSC | Energy | 15,08% | 22.06.2021 | 18.06.2021 |

| 4. | ALROSA JSC | Metals and mining | 14,99% | 04.07.2021 | 30.06.2021 |

| 5. | NLMK JSC | Metals and mining | 14,91% | 09.06.2021 | 07.06.2021 |

| 6. | Rusagro | Food | 11,85% | 18.09.2021 | 15.09.2021 |

| 7. | MMK | Metals and mining | 11,80% | 17.06.2021 | 15.06.2021 |

View the full company rating for 2021 »

Interesting read:

- Full description: how to buy shares for an individual;

- How to trade on the stock exchange - step-by-step instructions;

- Investments in ETF funds;

- Investment portfolio - what is it;

- How many shares do you need to buy so that you can live on dividends?

- How to buy foreign shares as an individual;

- What is the stock return;

- Investments in shares;

← Return to main catalog

NKHP the hour is coming...

Dividend payments. Novorossiysk Bakery Products Plant (PJSC NKHP) on December 17, 2019 will determine the list of shareholders for the calculation of interim dividends for 9 months of 2021. The expected dividend yield at current prices is 6.8%.

This is an enterprise that has a long history, starting with a grain elevator and over the decades growing into a terminal, with a railway junction, storage facilities and cargo processing, as well as a deep-water berth for loading medium-tonnage ships.

NKHP complex

NKHP is a state-owned enterprise with a “market hint”.

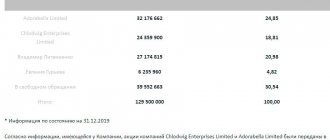

Capital structure

The shares are traded on the stock exchange with 3 listings. A deep-water berth - and a deep echelon (humor).

Is it worth buying NKHP shares in the current conditions and for what future? In this brief review we will try to outline a few of our thoughts on this matter.

In short, in the author’s opinion, it’s worth buying. But, not for the short term. At least for an average period of 1 year.

Over the past year, since the VTB Group became one of the major shareholders of NKHP, shares have risen in price from levels of about 210 rubles to the current value of 260 rubles per share. Growth of about 24%. But this is a low liquidity stock. With the number of transactions only a few dozen per day, and with a turnover of about 4 million rubles per day. Any large transaction can significantly move the price both up and down.

NKHP schedule since 2015

The stock has some history of dividend payments and may be worth counting on its development. Whether you believe in it is a purely individual question.

Access to cheaper funding, thanks to VTB's entry into the capital of NKHP, can have a beneficial effect on business profitability. For investors, this is definitely a plus. On November 14, 2021, the NKHP published its 9-month report. You can find it, for example, using the picture with a link to the website e-disclosure.ru:

NKHP reports

NKHP, as a terminal, has its own revenue segmentation, which is a boon for the sustainability of economic indicators:

- Port transshipment – 45% of revenue

- Trading operations – 51% of revenue

- Production – 3% of revenue

- Freight forwarding services – 1%

Information by segment

Grain production and supply is a profitable, growing, capital-intensive, but also very competitive business. Russia has huge cultivated areas. And recently, it is among the leaders in grain exports. But weak infrastructure and complex logistics negatively affect pricing and product quality. Which worsens the competitive position of the state as an exporter. The state will have to invest in infrastructure, thereby increasing business volumes and profits of logistics terminals. This segment of the food market will grow.

The weak performance of VTB's other acquisition, a stake in the retail chain Magnit, is alarming. What does Magnet have to do with it? It seems that VTB, as an investor, grabs everything without thinking about the performance of the acquired assets. You just have to go in and compare any two X5 stores Pyaterochka and Magnit. The difference is not in favor of Magnit.

Experts are racking their brains, when will Magnit’s shares shoot up? Or maybe first you need to go down to the ground, place price tags and wash the floor? And after that it will be possible to follow the trendy traffic coefficients? But this is a joke, with a bit of a joke. Retail business is one of the most difficult to manage. It's easier to speak and write.

However, the NKHP business, for all its capital intensity, is easier to structure and manage than a chain of several thousand stores.

Another risk of buying NKHP shares is the unclear prospect after the consolidation of assets in the grain industry by the large state-owned VTB group.

Brief summary of why to buy NKHP shares:

pros

- Dividend income

- Growing segment of the food industry

- Strategic industry for the state

- Sustainable business

Risks

- Office

Follow publications on myfinway.ru

Subscribe to the myfinway channel in Telegram and Yandex Zen

Happy investment!

1 288

“NKHP’s grain transshipment capacity will increase to 11.6 million tons per year by the end of 2024”

In recent years, Russia has taken a strong position in the world grain market, becoming the largest exporter of wheat. Moreover, the margin of safety in this area is such that the leading position was not shaken by either measures to regulate grain exports or restrictions related to the spread of coronavirus. By the beginning of April, grain exports from the beginning of the current agricultural year (from July 1, 2021) exceeded the figures for the same period of the last agricultural year by almost 27%. All this attracts investors’ attention to the key elements of the logistics chain, the development of port infrastructure, and the creation of reserve capacities for further growth in supply volumes. In particular, the owner of one of the largest grain transshipment terminals in the Russian Federation, the Novorossiysk Bread Products Plant (NKHP, part of the OZK group), plans to almost double its transshipment capacity by 2025. The general director of the plant, Denis Demenkov, told Interfax about how NKHP worked in difficult conditions last year, which helped the enterprise, despite various restrictions, set a record for grain transshipment, how the implementation of a large investment project is progressing and when it will begin accepting grain express trains.

— Denis Borisovich, last year the plant set an absolute record for grain transshipment - about 6.3 million tons, almost doubled revenue from port transshipment, and more than doubled net profit. What helped you achieve such indicators under restrictions? What is your revenue and net profit forecast for 2021?

— Yes, last year I had to work under conditions of epidemiological restrictions, the introduction of an export quota, and uncertainty in the grain markets. We had to adapt to new circumstances and look for new opportunities. As a result, all our obligations were fulfilled on time and in full, which ultimately affected our net and operating profit. The first, as we have already reported, increased 2.3 times compared to 2021, the second almost doubled, to 3.12 billion rubles.

We are now taking all necessary measures to maintain economic sustainability in the current conditions. We plan to maintain this year’s financial indicators at levels comparable to last year. However, the volatility of exchange rates and the unpredictable situation in foreign markets may have an impact on them.

— What are your export plans for the current year? Is it possible to repeat last year's record? How might measures to regulate grain exports affect shipments?

— Our plant is the largest export terminal for grain transshipment in the Azov-Black Sea basin. Indeed, 2021 turned out to be a record year for the company. Transshipment amounted to 6.289 million tons of grain, which is 1.6 times higher than in 2021 and is an absolute record in history. From August to October 2020, the plant updated monthly transshipment records, the highest was achieved in October - 803 thousand tons.

In 2021, depending on the situation on the Russian and international grain markets and the volume of contracted export supplies, we plan to maintain the transshipment rate at the level of last year’s record.

— Which countries account for the largest volume of supplies today? Have new markets emerged?

— Dry cargo ships from the NKHP terminal (in 2021 - IF) were sent to traditional export destinations for the supply of Russian wheat: countries in Africa, Southeast and South-West Asia and a number of others. In total, the grain was exported to 31 countries.

As for the distribution of volumes, about 28% of all shipments from the plant went to buyers from Egypt. In weight terms, this is 1.75 million tons of grain. In second place are customers from Saudi Arabia: more than 880 thousand tons in total were sent to the kingdom, or 14% of the total volume of shipments. The top 3 importers are closed by the Republic of Turkey - its share accounted for about 500 thousand tons, or about 8% of all supplies. The smallest batch - 8.6 thousand tons - went to Namibia.

Among the Russian exporting companies that ensured the utilization of the plant's capacity last year, the OZK group accounted for about 40% of the total supply volume, or about 2.5 million tons of grain.

— Are there plans to expand the range of cargo handled?

— This season we export wheat, barley, and corn. We do not plan to expand the range of goods.

— The company is implementing a modernization program designed until 2024. What projects have already been implemented?

— Currently, as part of the investment program “Reconstruction of the grain storage and transshipment complex,” the existing elevators N1, N2 have been reconstructed, a grain storage facility consisting of 14 metal silos with a total capacity of 110 thousand tons has been built, and a connection has been made between the existing export transport gallery and the elevators.

Upon acceptance: the construction of a receiving facility for railway transport has been completed, and the technical re-equipment of auto and railway reception facilities has been carried out.

In addition, in the last days of March, a pedestrian bridge was opened across the railway tracks of the plant towards the Novorossiysk station. The city infrastructure facility, which is more than a hundred years old, has long required reconstruction. The bridge, in fact, was rebuilt, the necessary utilities were laid, and now it will be handed over to the municipality.

— What work is planned as part of the investment program?

— All work is divided into several stages and are at different stages of implementation. In particular, it is planned to build a new device for receiving grain from vehicles and a grain supply gallery to the mill with the construction of a near-mill elevator. In fact, this will be a new automatic reception and silos with a storage capacity of 50 thousand tons. Now the containers for the mill have already been installed, foundation work for the silos has begun, the foundation for the automatic reception is ready, and the installation of the necessary equipment is underway.

Another object is a transformer substation for newly designed switchgears. Construction and installation work has already been completed here to reconstruct the cable route from the Novorossiysk substation. The plans include piping the installed equipment and technical connection to the substation. Finally, work is underway to build a car terminal with access roads.

But I would like to dwell separately on the construction of a new berth N22A in the port of Novorossiysk. The project involves constructing a new pier in the form of a double-sided pier at the head of the existing N3 pier. In the same place from the territory of the plant, build a new grain gallery, and organize a new pier for transshipment of grain N22A.

At the moment, the ranking procedure has been completed by the analytical center under the Government of the Russian Federation, the project is included in the passport of the federal project “Development of Sea Ports” of a comprehensive plan for the modernization and expansion of the main infrastructure until 2024. A declaration of intent to invest in new construction was developed and agreed upon by Rosmorrechflot. Commissioning of the facility is scheduled for the fourth quarter of 2024.

— How much will transshipment capacity increase as a result of modernization? What is the volume of investment in the project?

— As a result of all planned activities, by the end of 2024, the nominal grain transshipment capacity will increase to 11.6 million tons per year, and the one-time grain storage capacity will increase to 300 thousand tons.

As for costs, it is planned to invest 12.4 billion rubles without taking into account the pier, since the capital costs for its construction will have to be calculated based on the design results.

— Last year it was reported that the OZK group began forming a network of grain cargo-forming hubs to NKHP. At what stage is this project now? When will NKHP accept the first grain express?

— Indeed, in order to load both the current and planned commissioning capacities, reconstruction of the railway tracks of the Verkhniy park is provided. Now the train with grain addressed to NKHP at the first stage ends up on the public exhibition tracks of the Novorossiysk junction station. Then it is divided into so-called “half-feeds” of 25 cars each, after which it enters the territory of the plant. Our goal is to carry out the reconstruction in such a way that trains reach the plant immediately, bypassing the Novorossiysk station. As a result, we will be able to accept route trains in their entirety, eliminating their accumulation and settling on exhibition tracks.

As for the reconstruction project itself, it involves lengthening its own railway tracks from 8.5 km to 12.5 km, electrifying both the tracks on the territory of the plant and in the Verkhny park, which will make it possible to run routes with mainline electric locomotives. And in order to load all this modernized infrastructure, UGC began to form a network of grain cargo-forming units (GSU), grain from which will be directly supplied to the plant. The pilot project will be implemented in the Tambov region.

Today, UGC has entered into agreements with a number of elevators that are ready to send grain routes to the plant. These are stations in the Central and North Caucasus federal districts, from where it is planned to depart on one route per day in the 2021/2022 season. The final volume of traffic will depend on market conditions for the next season.

As for the timing, the first routes under the new scheme should arrive already in the 2021/2022 season. Initially we plan up to two routes per day. At the moment, we are waiting to receive state examination of the design documentation for technical connection to the railway network of Russian Railways JSC. After this, technical connection activities will be included in the investment program of SKZD (branch of Russian Railways - IF). As a result, upon completion of the program, we plan to increase the average daily turnover of grain cars from the current 150-180 to 400-500 cars, and reduce their downtime. This will increase the railway acceptance capacity to four routes per day. But for now these are plans that largely depend on Russian Railways.

— NKHP is also engaged in the production of flour, although the volumes are insignificant and mainly for the domestic market. Do you plan to develop this line of business, taking into account the growing export transshipment capacity?

— The history of the flour milling complex goes back more than 70 years. The annual processing volume is 36.4 thousand tons, which in terms of finished products is 27.5 thousand tons of premium and first grade baking wheat flour. Now the flour milling complex provides flour to bakeries in the Krasnodar region, which produce social bread for the population and supply products to municipalities with a total population of more than 1.5 million people, large and small private bakeries, and farms. The current capacity is sufficient and the question of expanding the business line is not yet raised, since we are focused on increasing transshipment capacity.

— Are you considering the possibility of holding an SPO or, conversely, delisting shares in the future?

— At this stage of the company’s development, an SPO is not being considered, and delisting by shareholders is also not being discussed.

— Many companies, due to the difficult economic situation, are reducing or even refusing to pay dividends for 2021. What is the situation in the NKHP?

— The decision on the distribution of profits for 2021 and the amount of dividends will be made by the general meeting of shareholders. The current situation in the transshipment market, forecasts for 2021, the ongoing investment program, and requirements for dividend payments of companies with state participation will be taken into account.

In our opinion, there are now four main factors influencing decisions on dividend policy: the already mentioned investment program, requirements for dividends of companies with state participation, as well as the level of free-float and the presence or absence of plans to issue shares.

NKHP dividends for 9 months 2021. Pleasant bonus to the offer

The interim dividend parade continues.

Record dividends from NKHP.

VTB decided that owning a package obliges you to receive a small bonus, at the level of %% of the loan rate.

https://www.e-disclosure.ru/portal/event.aspx?EventId=ql00QkPlWEi7-CX9T9kgGeA-BB

To recommend to the extraordinary general meeting of shareholders of the Company: 1. Part of the Company’s net profit in the amount of 1,199,846,750 (One billion one hundred ninety-nine million eight hundred forty-six thousand seven hundred fifty) rubles received based on the results of the Company’s activities for 9 months of 2021 should be used for payment dividends on ordinary registered shares of the Company; 2. Pay dividends based on the results of the Company’s activities for 9 months of 2021 in cash in the amount of 17.75 rubles for each ordinary registered share of the Company. The amount of accrued dividends per one shareholder of the Company should be made with an accuracy of one kopeck. Rounding of numbers when calculating is carried out according to the rules of mathematical rounding; 3. Payment of dividends to nominal holders of shares and trustees who are professional participants in the securities market, registered in the register of shareholders of the Company, should be made no later than 10 working days, and to other persons registered in the register of shareholders - 25 working days from the date on which the dividends are determined (recorded). persons entitled to receive dividends; 4. Payment of dividends in cash to individuals whose rights to shares are recorded in the register of shareholders of the Company shall be made by transferring funds to their bank accounts, details of which are available from the registrar of the Company, or in the absence of information about bank accounts, by postal transfer of funds, and to other persons whose rights to shares are recorded in the register of shareholders of the Company, by transferring funds to their bank accounts. Persons who have the right to receive dividends and whose rights to shares are accounted for by the nominal holder of shares, receive dividends in cash in the manner established by the legislation of the Russian Federation on securities; 5. Set the date on which persons entitled to receive dividends are determined - December 17, 2021 . Issue No. 3. Convening an extraordinary general meeting of shareholders of the Company on December 4, 2018. Decision: To convene an extraordinary general meeting of shareholders of the Company in the form of absentee voting (hereinafter referred to as the “Meeting”), and also determine: - the date of the Meeting: December 4, 2021. ; — closing date for accepting voting ballots: December 4, 2021; — postal address to which completed voting ballots should be sent: 353901, Russian Federation, Krasnodar Territory, Novorossiysk, st. Elevatornaya, 22; — date on which persons entitled to participate in the Meeting are determined (fixed): November 09, 2021. Approve the following agenda of the Meeting: 1. On the payment (announcement) of dividends, the amount, form of their payment and the date on which persons are determined , entitled to receive dividends based on the results of 9 months of 2021.

A nice bonus to the offer for those who hold it.

The semi-annual payment was probably intentionally missed due to a change of shareholders.

21.08.2018, 11:49

VTB is increasing its stake in NKHP. Have Summa assets started to be divided?

Moscow. August 21. INTERFAX - The Federal Antimonopoly Service has granted the request of VTB Bank (MOEX: VTBR), issuing preliminary consent to the acquisition of 10.93% of the voting shares of PJSC Novorossiysk Bread Products Plant (MOEX: NKHP), the agency reported. Together with the shares VTB already has, its share in NKHP after ... Read more

Taking into account the share price and the expected offer, anyone can enter the cutoff without risk.