Financing of investment projects

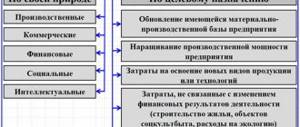

In simple words, this is ensuring the financial activities of an enterprise using funds received from various sources. In some countries, a start-up business can qualify for budget funding for investments, which is given to organizations that fall under preferential status - new, carry out certain activities, or are involved in charity. Today it is often said that investment financing in terms of duration is massively moving into long-term financing, while short-term financing remains a thing of the past. Considering what kind of financing of an enterprise’s investment activities there is, the following groups are distinguished taking into account the main criterion:

- by origin - own or borrowed funds;

- according to the investor’s position in the legal field: borrowed, own, attracted;

- by frequency - current and special.

From time to time, investing involves attracting external funds in the form of a loan, and then it is worth studying in advance who the guarantor is and choosing this person in order to still receive approval for an application from a bank or other financial organization, in particular, for a large amount.

What forms of interaction between the state and the investor are highlighted when financing large projects?

Obtaining the status of a regional investment project

A regional investment project (RIP) involves the creation of new or modernization of existing goods production facilities. Regions themselves determine the requirements for investment projects for inclusion in regional registers. The number of regional investment projects is significant: for example, in the Sverdlovsk region alone there are 53 strategically important RIPs in the transport and logistics, metallurgical, agro-industrial and social sectors. The total investment required for these projects is 1.5 trillion rubles, and it is planned to create 24 thousand jobs.

What does obtaining RIPA status give to the project initiator?

The state purposefully supports the implementation of priority regional investment projects. Financial support is expressed in the form of mitigation of the tax burden, grants, subsidies, federal and regional business support programs, compensation for certain expenses and reimbursement of interest on investment loans.

The most important advantage of obtaining the status of a regional investment project is the ability to use investment tax benefits.

For some projects (for projects implemented in the Republic of Tyva, Magadan Region, Trans-Baikal Territory and others) implemented in the form of RIP, a 0% income tax rate is provided. That is, tax benefits are provided not only at the regional, but also at the federal level.

The use of tax benefits when implementing investment projects can reduce investment costs by 10-20%. Obtaining tax benefits in most Russian regions is carried out by decision of regional authorities. The investor provides a business plan for the investment project with a financial model and other documents according to the established list, regional authorities enter into an investment contract with the investor, which determines the tax benefits provided. However, in some regions, for example, in the Leningrad region, tax benefits are provided through a notification procedure.

Agency for Strategic Initiatives ( ) in the formation of the “National Investment Climate Rating” for 2018

identified the regions that provide the largest volume of tax benefits for businesses in relation to the total amount of tax revenues, including: Kaliningrad region, Bryansk region, Republic of Tyva, Magadan region and Chukotka Autonomous Okrug.

Conclusion of special investment contracts (SIC)

Special investment contract

- this is an agreement between the investor and the state, which defines the obligations of the project initiator to modernize or master the production of industrial products within the prescribed period, as well as the obligations of the Russian Federation or an individual constituent entity of the Russian Federation in terms of guarantees to ensure the stability of tax and regulatory conditions and the provision of support.

The mechanism for concluding a special investment contract is described in the Federal Law of December 31, 2014 No. 488-FZ “On Industrial Policy in the Russian Federation”, and the rules for concluding a special investment contract are enshrined in the Decree of the Government of the Russian Federation dated July 16, 2015 No. 709 “On special investment contracts for certain industries "

The purpose of concluding a Spic is to attract investment into the real sector of the economy and support large investment projects being implemented in Russia. Conclusion SpIC is provided for any industry, but only in relation to the production of products, and not for the service sector.

According to the Industrial Development Fund, which is the operator for concluding special investment contracts, to date 33 special investment contracts have already been concluded. Key indicators for signed SICs:

Table 2. TOP of the largest investment projects for SPIK

| Name of the investment project | Date of conclusion and expiration of the SIC | Investments, million rubles. | Industry |

| "Usolsky Potash Plant", Perm region, Usolye | 11.11.2016 — 31.12.2025 | 72 859,9 | Chemical-technological complex and bioengineering technologies |

| “Creation of a mining and processing plant for the extraction and enrichment of potassium salts and development of potassium chloride production”, Volgograd region, Kotelnikovo | 30.11.2016 — 31.12.2025 | 57 250,5 | Chemical-technological complex and bioengineering technologies |

| “Development of the model range of KAMAZ and Mercedes-Benz vehicles and modernization of capacities for their production” | 25.05.2018 — 24.05.2028 | 46 376,7 | Automotive and railway engineering |

Investment financing methods

Most often, investment financing concerns a legal entity rather than an individual. Although sometimes this term is also relevant for individual economic activity. Let me emphasize: there are not many methods and the main difference between them is how exactly and from whom the funds will be received. Increasingly they say that investing is carried out not so much in an enterprise, but in a specific project. By dividing working capital, the amount is reduced and the payback period of the project is shortened. Next, I will draw attention to popular methods, and also clarify that there are also equity participation and forward transactions among the current methods

At my own expense

Let's imagine you received dividends using federal loan bonds, or the company of which you are a shareholder made a payment of income for a certain period. You decide to invest your own money in investment products, choosing the most suitable ones in terms of investment amount, period of work, and risk level. Other sources of investment include the following:

- income that remains after paying taxes;

- sale of shares in the authorized capital;

- sinking funds.

Through borrowed funds

Sometimes a person wants to invest in the fixed capital of a company by purchasing part of the shares, but there are not enough funds. In this case, it is worth considering borrowed funds that are mobilized for a certain period and returned with interest. A popular form is issuing bills, bonds, as well as obtaining a loan from banks or individuals with further payment of both the debt itself and interest for use.

Due to raised funds

Often, in order to finance investments in intangible assets, funds are used that can be accumulated from the funds of enterprises on an indefinite basis, for example, the issue of shares, shares, resources. In fact, if you need funds, you either issue an additional block of shares and sell it, or raise funds through further dividend payments. This area includes government financing of investments for companies that can qualify for such budget support.

Through capital from venture funds

In this case, the venture fund either sponsors a company with the aim of receiving income from goods or services sold in the future, or wants to receive part of the shares in the package, including a controlling stake. In our country, this method is not very widespread, but in Europe and the USA before the onset of the coronavirus crisis, it was in demand. And if you are interested in what types of US dollar bills there are and what each denomination is famous for, I recommend an article on the blog https://www.gq-blog.com/ with explanations and illustrations.

LECTURE No. 5. Methods of financing investment projects

Investment financing method

– is the financing of the investment process by attracting investment resources.

Investment financing methods:

1) self-financing;

2) financing through capital market mechanisms;

3) raising capital through the credit market;

4) budget financing;

5) combined investment financing schemes.

The investment process financing scheme consists of several unified sources of financing investment activities and financing methods.

Self-financing

is formed exclusively from its own financial resources generated from internal sources (net profit, depreciation charges, on-farm reserves).

Internal self-financing is very difficult to predict, but it is the most reliable method of financing investments.

Any business expansion begins with attracting additional sources of financing.

There are two main options for investing resources in the capital market: equity and debt financing.

In the first case, the company receives funds from additional sales of shares by increasing the number of owners, or through additional contributions from existing owners.

In the second, the company issues and sells fixed-term securities (bonds).

This entitles their holders to long-term receipt of current income and return of the capital provided according to the conditions.

Capital market

as a source of financing for a particular enterprise is very extensive.

If the remuneration conditions for prospective investors are attractive in the long term, then investment requests are satisfied in sufficiently large volumes.

But this is only theoretically possible; in practice, not every company can use the capital market as a means of using additional sources of financing.

The operation of the market and the requirements for its participants are fully regulated by both government agencies and market mechanisms themselves.

As for the market mechanisms that hinder the possibility of attracting large amounts of financing, we can note the relationship between the capital structure and financial risk and the effect of the enterprise's reserve borrowing potential.

The main form of raising funds for investment is the expansion of share capital, then loans and the issue of bonds.

The advantages of this form of financing are that earnings per share directly depend on the performance of the enterprise, and issuing shares for public sale increases their liquidity.

Of course, there are also disadvantages: an increase in the number of shareholders leads to the division of income between a large number of participants.

Corporate bonds -

These are documented investments made in enterprises with the aim of obtaining specified amounts of income, as well as repaying (returning) previously borrowed amounts by a certain date.

Of course, on the one hand, the owner of such securities receives a definite income that does not depend on bond prices on the market, but, on the other hand, since bonds are traded on the secondary market, investors always have the opportunity to play on the difference in prices - nominal and market.

This is what underpins the investment attractiveness of corporate bonds.

Raising capital through the credit market

– funds received as a result of a loan (credit) from a bank.

This is done mainly to eliminate any temporary gaps in the reproductive process.

An investment loan has certain differences from other loan transactions.

Firstly, it has a longer period of provision and a high degree of risk.

The loan is issued subject to the basic principles of lending: repayment, urgency, payment, security, intended use.

Long-term loans can generally be extremely beneficial to large and small businesses.

They are considered as the best means of external financing of capital investments if the enterprise cannot increase or maintain its profitability using current profits or raising funds in the long-term loan capital markets by issuing bonds at low prices.

The firm has a priority to obtain better credit terms than when selling on the bond market.

If necessary, individual terms of the loan can be changed by agreement, and the shorter repayment period of the loan compared to a conventional bond loan can be considered an advantage at high interest rates.

The forms of providing an investment loan can be different:

1) revolving loans;

2) convertible into fixed-term;

3) credit lines;

4) urgent loans.

Urgent loan

– this is a precisely established repayment period, payment in installments (annually, semi-annually, quarterly) under the main loan agreement.

A borrower with a stable financial position can open a special loan account, formalized by a loan agreement, where the bank undertakes to provide a loan as needed, i.e., to pay for settlement documents received in the name of the borrower within the established limit.

Such a loan can be issued by a so-called credit line (a legally formalized obligation of a credit institution to the borrower for the right to provide a loan within a specified amount during a certain period).

It can be open for a period of no more than a year.

The line of credit can be revolving (revolving) or non-revolving (framework).

A revolving line of credit is provided by the bank if the borrower experiences a long-term shortage of working capital to maintain the required production volume.

The term of such a loan cannot exceed one year.

As a rule, the bank requires additional guarantees from the borrower. At the same time, the interest rate is slightly higher than for a regular term loan.

A non-renewable (framework) line of credit is provided by the bank to pay for goods supplies within the framework of one loan agreement, which is implemented after the limit is exhausted or the loan debt is repaid for a specific lending object.

The opening of any credit line is based on long-term cooperation between the lender and the borrower. This provides a number of advantages for each of them. The borrower gets the opportunity to more accurately assess the prospects for expanding its activities, reduce overhead costs and loss of time associated with negotiating and concluding each individual loan agreement.

The lending bank enjoys the same benefits, and in addition, gets acquainted with the activities of the borrower.

As a rule, every loan agreement contains guarantee obligations.

The lender sets conditions to minimize the risk of the loan provided:

1) first of all, the loan is provided to enterprises engaged in wood processing, non-ferrous and ferrous metallurgy, the oil and gas industry, and the military-industrial complex;

2) the minimum debt coverage ratio (1.5) is determined based on the total amount of short- and long-term debt of the borrower;

3) the borrower’s funds in the project must exceed 30% of the total cost of the project;

4) the project must have good prospects for generating income in foreign currency;

5) the project must be safe for the environment and contribute to the economic development of Russia;

6) the profitability of the project must be more than 15%.

Budget financing of investments

– allocation of funds to legal entities for investment purposes from the state budget.

Only state-owned enterprises, as well as legal entities associated with the implementation of government programs, can receive government investment.

This funding is carried out in accordance with the level of decision making.

At the federal level, only federal programs and federally owned facilities are funded; at the regional level - only regional programs and objects owned by individual specific territories.

Direct budget support can be provided in the form of guarantees or budget investments and budget loans.

Budgetary allocations are limited and apply mainly to state-owned enterprises and organizations of strategic importance.

Budget investments

– participation of the state in the capital of the organization.

Budget loans (financed on the basis of repayment) are a tool for government stimulation of capital investment.

An innovation in investment policy is the transition from the distribution of budget allocations for capital construction between industries and regions to selective partial financing of specific objects and the formation of a composition of such objects on a competitive basis, which greatly contributes to the implementation of the principle: achieving maximum effect at minimum costs.

Enterprises can also use an investment tax credit

, which represents a deferred payment of tax.

The condition of this loan is repayment. The period for its provision is from one year to five years. Interest for using an investment tax credit is set at a rate of no less than 50 and no more than 75% of the refinancing rate of the Bank of Russia. Investment tax credit can be provided for income tax, as well as for regional and local taxes.

An investment tax credit is issued based on an application from the enterprise and documents confirming the need for the loan. When a positive decision is made on an investment tax credit, an agreement is concluded between the taxpayer enterprise and the executive authority.

During the term of this agreement, the enterprise reduces tax payments (but not more than 50%) for each reporting period until the amount of the loan specified in the agreement is reached.

Risk capital

– one of the promising sources of funds for the development of small businesses.

This is a common risk scheme, based on the fact that part of the invested projects will have high returns, which can cover all losses in the event of failure to implement the rest of the investments.

This so-called venture investment is carried out without the small business providing collateral.

This method of financing is used through an intermediary (venture capital company) between investors and the entrepreneur.

When choosing a method of financing capital investments, an enterprise must take into account both its capabilities and the advantages and disadvantages of each source of investment funds.

Table of contents

Debt financing

As was said earlier, in order to mobilize additional financial resources, companies practice issuing and selling bonds on the securities market. The purpose of issuing and circulating bonds is:

- attracting borrowed funds for a period of up to a year, over a year or a longer period on acceptable terms; solving this problem will ensure the solvency and liquidity of the enterprise, especially since investment programs always require a certain period of investment;

- By issuing bonds, firms ensure their independence from banks and themselves determine the size, terms and conditions of repayment of the bond issue. Therefore, the issuer must check the possibility of attracting a significant amount of the necessary resources in this way.

Bond loans have certain advantages and disadvantages. So, for the issuer:

- resources are increasing that will make it possible to finance both current (current) assets and long-term needs (investment projects);

- interest on bonds is predetermined and hence the predictability of servicing costs;

- In terms of raising funds, it is considered that the source is less labor-intensive and costs less.

All this despite the fact that settlements on bonds are mandatory without taking into account the financial results of the organization’s current activities, while payment of dividends on shares is optional.

For investors, bonds, as a form of investment, are beneficial in that their interest payments do not depend on the activities of the issuer or on the capital market, but there are risks associated with the possible bankruptcy of the issuer.

Self-financing

Methods of financing using your own funds are associated with skillful management of your own capital. It is known that the authorized capital is the only source of financing at the time of creation of a commercial organization. In the future, the organization strives to ensure self-financing, which means it covers current operating costs (purchase of raw materials, staff payments, etc.) with its income, and directs other resources, such as depreciation charges, retained earnings, to finance measures to expand and update production , creating the possibility of using expensive equipment, etc. Thus, the source of self-financing is the resources extracted from the products of the economic entity itself. Hence, the decision on self-financing occurs after summing up the results of the financial year. This is the case if there is demand for manufactured products, which allows you to protect yourself from the risk of external debt.

In foreign countries, the practice of self-financing has become widespread. This was facilitated by:

- some difficulties in obtaining funds on the capital market, the desire of firms to protect themselves from the risk of external debt, exchange rate fluctuations on the stock exchange;

- weak equity earnings and the threat posed to bond values and yields;

- erosion of money, the cost of borrowed funds, the interest rate on which measures the minimum threshold of profitability of the financed investment;

- a system of profit taxation in which a tax is levied on the company, and then, when using profits for consumption, an income tax is levied on individuals - shareholders, i.e. double taxation occurs;

- tax measures that create favorable conditions for accelerated depreciation, leading to an increase in resources for the renewal of fixed capital.

Despite all this, it is believed that self-financing has some negative features, first of all, they are associated with the oligopolistic nature of the market. With self-financing, industrial groups strive to gain a dominant position in the market, incl. independence from the influence of exchange processes and banking control, weaken the position of shareholders in favor of managers, the financial market as an arbiter of investment distribution, and lack of control by government authorities.

Industrial groups, incl. holdings strive to establish such connections between parent and subsidiary companies, which leads to the expansion of self-financing, and maintain prices at an appropriate level to ensure the expected level of self-financing.

In general, self-financing is a tool that helps firms defend and strengthen their competitiveness, rationally use and update equipment in accordance with the requirements of technical progress. Therefore, the state must support self-financing by indirect methods (taxes), other advantages, taking into account the financial and economic capabilities of the company, the state of the financial market, the resources of the banking system, etc.

The most important sources of financing the current and long-term needs of the company are the profits mobilized by it itself. However, the volume of profit is limited, since a certain part of the profit must necessarily cover the corresponding needs. Hence the task of optimizing part of the profit allocated for consumption and for refinancing in the activities of the enterprise itself, especially for investment.

Another major source of self-financing is depreciation. The role of depreciation in the reproduction process is great. This requires a skillful depreciation policy of the organization, which will allow:

- more accurately take into account depreciation in the cost of products and apply various accrual methods, optimize depreciation charges as part of revenue from product sales;

- reduce taxable profits and reinvest the amount by which profits are reduced and thus minimize the risks of excessive distribution of profits in favor of consumption.

As a rule, the company’s own funds to finance the company’s needs are not enough. Therefore, funds are mobilized and raised on the capital market. To finance important projects, there may be a one-time increase in the authorized capital through additional issues of shares, i.e. equity financing is used, which is like an increase in the company’s own funds. Additional funds are earned by selling shares by increasing the number of owners or through additional contributions from existing owners.

This process occurs by:

- selling shares directly to investors by subscription;

- through investment institutions (they buy the issue and distribute it at a fixed price among legal entities and individuals);

- tender sale (investment institutions buy an issue for sale, arrange an auction and set the optimal price for shares there);

- placement of shares by a broker among its clients.

Accounts payable

One of the sources of financing the current activities of organizations is accounts payable; issues of attracting them were considered earlier. Until a certain moment (date) of transfer of funds and a repayment operation (before payment to suppliers for received raw materials, taxes to budgets of various levels, wages, etc.), organizations use other people's funds.

Their features: unplanned, i.e. unplanned attraction of foreign funds into economic circulation, spontaneity, sharp fluctuations in their amounts. Within the current payment terms, it is natural, legal and may be illegal, i.e. expired.

They represent a short-term source and can be used to finance current assets.

Hence, skillful management of accounts payable at the organizational level is necessary and it can go in the following directions: a) selection of suppliers, establishment of long-term relationships; b) carrying out timely payments without penalties, and in this case the source will appear to be free; c) skillful use of resources until the moment of settlement, partial repayment of them from accounts receivable, etc.

Part of accounts payable is commercial (mutual) lending, which is widely used. Its necessity arises from the constantly emerging gaps in time between the shipment of products, goods and actual payment. Here, at the end of the trading transaction, the credit transaction begins and it will be completed when the loan debt is repaid. Thus, there is a transfer of capital from the producer enterprise to the consumer enterprise, i.e. loan capital merges with industrial capital. In the turnover of the consumer enterprise there are funds from supplier enterprises (business partners), and the latter receive income in the form of interest for providing a loan, which is included in the price of goods sold and the amount of the bill. The transfer of these capitals comes from the manufacturing enterprise to consumer enterprises or from the manufacturing enterprise to trading firms that sell them.

Commercial credit promotes the rapid sale of goods and profit-making opportunities, accelerating the turnover of current assets and maneuvering them, is prompt in providing funds in commodity form, and providing financial support to each other.

This is typical for sectors of the economy, especially agriculture.

A commercial loan differs from a bank loan:

- the creditor is not specialized financial institutions, but any legal entities associated with the production or sale of goods or services;

- provided exclusively in commodity form;

- loan capital is integrated with industrial or commercial capital;

- the average cost of a commercial loan is usually lower than the average bank interest rate;

- the loan fee is included in the price of the product, and is not determined by a specially fixed percentage of the base amount.

In foreign practice, commercial credit has become extremely widespread. For example, in Italy, up to 85% of the amount of transactions in wholesale trade are carried out on the terms of a commercial loan, and the average term for it is about 60 days, which significantly exceeds the period for the actual sale of goods to direct consumers.

In Russia, this form of credit is expanding sharply, its types are: credit with deferred payment; open account loan; loan with a bill of exchange; loan in the form of consignment.

Very briefly about them. In commercial lending with deferred payment, the supplier, after shipping the product, issues an invoice indicating the size, prices, cost, delivery terms, payment terms, and on their basis a loan is provided to the payer. A commercial loan on an open account is used when there are constant multiple deliveries of products in small quantities between firms and the terms of the loan are stipulated in the contract.

Commercial loan with debt registration by promissory note. After receiving the goods, the consumer company issues a bill indicating the payment term. The emerging turnover is serviced by promissory notes and bills of exchange.

With a promissory note, the buyer (drawer) issues the bill to the seller, the latter ships the product (goods) and presents the bill for payment on time, and the buyer pays for the delivered goods (cancels the bill). With a bill of exchange, the drawer (drawer) issues the bill of exchange, the recipient of the money on the bill (remitee) ships the goods and sends the bill to the payer (drawee) for acceptance, and sends the last accepted bill to the drawer.

With a commercial loan in the form of consignment, the supplier ships the products to the warehouse of a trading enterprise with instructions to sell them, and if sold, settlements are made with the supplier.