When we buy any goods or assets, we ask ourselves: is it worth paying the price that is offered to us? Thus, we evaluate the cost of certain things every day, trying to determine a reasonable price and not overpay.

Not paying more for assets than they are worth is one of the axioms of smart investing. But to do this you need to learn how to correctly evaluate assets.

Explanation of the parable of the old man and the apple tree

The parable of the old man and the apple tree is essentially an example of how assets, including businesses, can be valued using different approaches. The apple tree is a business. Apples are a product that she produces, which can then be sold for money.

The first offer of $50 was based on the cost of firewood if you cut down an apple tree. In other words, this is the liquidation value. This valuation method does not take into account the fact that the apple tree produces apples. Therefore, valuation based on liquidation value is not suitable for valuing a going concern. This method is only suitable for valuing a “dead” business that no longer works and, in fact, is only suitable for selling off property (machines, computers, furniture, warehouses, etc.).

The next proposed price, $100, was based on one year's sales of apples. This evaluation method ignores the fact that the apple tree bears apples for more than one year and will bear fruit for several more years. In addition, revenue is not net profit and does not take into account the costs of caring for the apple tree.

The price of $1,500 offered by the Internet entrepreneur took into account the proceeds from the sale of apples in the future. The entrepreneur simply added up the amount of revenue over 15 years. But this valuation model does not take into account the concept of time value of money. In a nutshell, this means that 100 rubles in a year does not equal 100 rubles at the moment. Since 100 rubles can be invested at interest and in a year you will receive, for example, 106 rubles if the interest rate was 6%.

The next buyer, a doctor, offered the market price for the apple tree, namely the price announced by the previous buyer - $1,500. This valuation method could be useful if there were a developed market for apple trees, where the price was determined by a large number of sellers and buyers. But there is no such market, so this method is poorly suited for valuing goods that do not have a developed market. In addition, it is not a fact that the price offered by other participants will be fair. Obviously, using this method, you can “run into” an incorrect assessment of the product by other participants - the price of $1,500 per apple tree is determined incorrectly and is clearly overpriced.

The last buyer - a girl - made an assessment using the income capitalization method. Having determined for herself the required rate of return of 20%, she divided 100 by 20 and received a cost multiplier of 5. Then she multiplied the net profit of $45 by 5 and received a cost of $225.

The old man did the discounted cash flow valuation and came up with a value of $270. The old man and the girl agreed that both of these methods were the best way to value the asset and ended up making a deal at an average price of $250. Although these methods are different, they are based on common principles. Their assessment is based on the asset's business performance and the cash flows generated.

What is included in the assessment and why it is necessary to evaluate shares before purchasing

Below is a description of regulatory legislative acts and a definition of the process of evaluating shares in the Russian legal framework.

What laws govern

Today there are two main legislative acts regulating the valuation of shares:

- Federal Law No. 208 dated December 26, 1995, as amended on April 4, 2021. Additions and changes came into force on January 1, 2021. Defines the concepts of public (PJSC) and non-public joint-stock company. Until 2014, the concepts of “open and closed joint-stock company” were applicable.

PJSC shareholders have the right to sell or transfer shares at their discretion to third parties and organizations. Including on the stock exchange at the market rate. PJSC is obliged to disclose information on its activities and business conduct.

Including reports with economic indicators. The usual procedure is publication on the company website. An example is information on the activities of PJSC Gazprom. The data is published on the website in the “Shareholders and Investors/Information Disclosure” section.

Based on the data provided, it is possible to analyze economic activity, including forecasting the growth or decline in the value of securities in the future. Plus determination of different types of stock value - book value, estimated value, etc.

In a non-public joint-stock company (formerly closed joint-stock company), securities are distributed among the founders or a circle of persons determined by the charter. Shareholders have a priority right to repurchase shares from other holders. At the same time, the number of shareholders is limited to 500. There are no such restrictions for PJSC. There is also no priority right to repurchase securities from other shareholders.

- Federal Law No. 135 dated July 29, 1998, as amended on November 28, 2021 “On appraisal activities in the Russian Federation.” Determines the evaluation procedure itself. Including shares. Until 2006, a license was required for this type of activity.

The status of securities itself is defined in Chapter 7 of the Civil Code of the Russian Federation.

What are the net assets of an enterprise

From the value of all assets of the enterprise, we subtract its debt obligations and obtain net assets. Their value can be either positive or negative. In the latter case, this means that the company's debts exceed its assets.

According to Russian legislation, if according to the results of the financial year (in Russia it coincides with the calendar year, in the USA from 01.10 to 30.09) the net assets will be less than the authorized capital - it must be reduced.

The authorized capital of a public joint stock company cannot be less than 100,000 rubles. In the event of a decrease below this value due to a decrease in net assets (suppose they become negative), this is a reason for declaring the enterprise bankrupt with subsequent liquidation as a legal entity.

In Russian economic conditions, the main legislative act for determining net assets is Order of the Ministry of Finance of the Russian Federation No. 84N dated August 28, 2014 “On approval of the procedure for determining the value of net assets.”

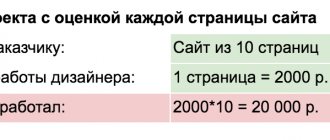

Benchmarking in practice

Let's make a comparison of the multipliers of two companies - Gazprom and Novatek. Both companies are analogues - they work in the gas production sector. According to the main cost multipliers, Gazprom looks cheaper. For example, the P/E ratio says that Gazprom is worth only 2.5 annual earnings, and Novatek is worth 7 annual earnings. This means that, theoretically, your investment in Gazprom should pay off faster.

| Ticker | GAZP | NVTK |

| Name | GAZPROM JSC | Novatek JSC |

| Industry | Oil and gas | Oil and gas |

| Capital | 3937.1419 | 3642.9599 |

| P/E | 2.57 | 6.98 |

| P/S | 0.48 | 4.11 |

| P/BV | 0.31 | 3.38 |

| EV/S | 1.23 | 4.41 |

| EV/EBITDA | 3.6 | 6.34 |

| DEBT/EBITDA | 2.5 | 0.57 |

| EPS gr. | 99% | 204% |

| ROE | 12% | 49% |

But if you look at return on equity (ROE) and profit growth, you can see that these indicators are better than Novatek. Return on equity is 49% versus 12% for Gazprom. And profit growth for the year was 204% versus 99%. That is, Novatek earns more money on its equity capital and has a higher rate of profit growth. Therefore, it is quite natural that Novatek shares will be more expensive than Gazprom.

Often the comparison is not between two individual stocks, but between individual stocks and industry averages. For example, if Gazprom’s P/E is 2.5, and all companies in the oil and gas industry have an average P/E of 5, then Gazprom is considered undervalued, and Novatek is considered overvalued.

The use of comparative analysis implies that the market values most companies fairly, but may be wrong about individual companies. In other words, we must assume that the market's assessment of Gazprom may be wrong, but all other companies in the oil and gas sector are assessed correctly by the market.

Using this analysis, we assume that the market will someday revalue Gazprom's shares and its P/E will become equal to the industry average, which means the price of its shares will increase. For example, at a price of 166 rubles, P/E is 2.5. The Price to Earnings ratio will rise to the industry average of 5, with a share price of RUB 323, implying growth of 95%.

Unfortunately, the P/E may also become equal to the average value in another - sadder case - if the company's earnings per share fall and the share price remains the same.

Multipliers must be uniform

The same coefficients can be calculated differently. For example, the price-to-earnings P/E ratio can be calculated in three different ways: as the ratio of the market price to 1) earnings for the last financial year, 2) to earnings for the last 12 months, 3) to forecast earnings for the next 12 months. Therefore, when making comparisons, you need to make sure that you are comparing the same multiples calculated in the same way.

Make adjustments

In some cases, multipliers may show a distorted picture. For example, at the time of writing this article, the P/E ratio for MTS is 66 units. Which should tell us that the shares are very expensive.

In fact, the reason for this abnormal P/E is that MTS has created a very large one-time cash reserve in 2021 to pay the fine. This reserve “ate up” most of the profit. Despite the very serious drop in net profit, market participants are in no hurry to sell shares, as they understand that next year this payment will no longer be made and profits will return to their usual values.

The strong drop in net income and the lack of a fall in shares led to the fact that the P/E value became abnormally high. Having made a simple adjustment of profit by the amount of the reserve, and recalculating P/E, we get a value of 8.

Buying expensive stocks can also be profitable

Conventional wisdom holds that buying stocks with cheap multiples should be better than buying stocks with expensive multiples. But in reality, sometimes the opposite happens.

For example, in 2015, the P/E of Lenenergo shares was 53, and in 2016 - 5.5. The theory tells us that it would have been more profitable to buy this stock in 2021, when the P/E is low. In reality, these shares were more profitable to buy in 2015, when their P/E was large, because in 2016 their market price doubled. It was too late to buy them when P/E became 5.5.

This happened because the company's earnings were extremely low in 2014-2015, so the price-to-earnings ratio was very high. But then profits sharply increased several dozen times, which led to a sharp increase in shares, but a decrease in P/E. Therefore, sometimes value multiples can “hide” profitable purchases from investors.

How can you find an undervalued company using multiples?

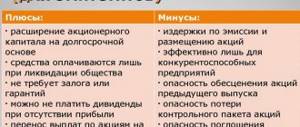

As can be seen from the examples of Novatek and Gazprom, expensive and cheap multiples can be justified due to the nature of the business. A company can be expensive if it has a high growth rate, but cheap if its growth rate is low.

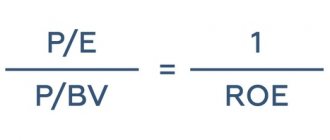

However, certain combinations of valuation ratios can point you toward a potentially undervalued company.

- Low P/E coupled with high expected EPS growth.

- Low P/B combined with high return on equity ROE.

- Low P/S combined with high return on sales.

Benefits of Benchmarking

- Benchmarking is simple and can be understood quickly and easily.

- There is no need to collect and process a large amount of data.

- Due to the absence of the need to process big data, comparative analysis does not require much labor and time.

- Today there are a large number of online services that can find companies with cheap multipliers in a couple of clicks. That is, manual work is reduced to a minimum.

Disadvantages of Benchmarking

- Comparative analysis does not give a clear answer about the undervaluation and overvaluation of shares. Low multiples for a “cheap” company may naturally be due to low expected earnings growth rates. And high multiples of an “expensive” company may be due to high rates of profit growth.

- Comparative analysis implies that the market may be wrong in some cases, but at the same time fairly values the majority of companies in the market, which may not always be the case.

- Comparative analysis can create an illusion and distort the picture in terms of stock valuation. For example, when analyzing a particular company, it may seem that its shares are undervalued compared to its peers, while the entire sector of these companies is overvalued compared to the market. For example, this could be seen during the dot-com bubble in the US market in 2000. Back then, shares of Internet companies were trading at very high multiples. An Internet company may well appear cheap compared to other Internet companies, but expensive compared to the rest of the market.

- A company can be cheap at some multiples and expensive at others due to accounting quirks or adjustments not made.

- The simplicity of comparative analysis plays a bad joke on him. Comparative analysis is available to absolutely everyone today. Today, even a schoolchild can easily compile a list of “cheap” stocks, not to mention professionals. The large number of people doing the same thing makes it much more difficult to find inefficiencies in the market, which include value stocks. Therefore, searching for undervalued stocks using comparative analysis is unlikely to generate large profits today.

- If the superficial relative valuation of a stock performs poorly, it is necessary to move on to an in-depth valuation that will take into account the company's historical data, forecasts of its future earnings and cash flows, risk analysis, etc., which makes the analysis more complex, but increases the chances of getting more high profits.

Comparative analysis of stocks by multiples is a very simple way to find undervalued stocks.

But at the same time, because this method is so popular today and available to everyone, it is unlikely to be able to bring a significant premium to market returns (if at all). This does not mean that you should abandon the use of multiples when analyzing stocks. Relative analysis can be used as a filter for the initial selection of companies for the purpose of further in-depth study. Share on social networks

What are the types of stock prices?

Additionally, they are determined by multipliers of various types - economic indicators of a public joint stock company, expressed through a mathematical formula. Below are the types and methods of stock valuation.

Nominal

Before conducting an initial public offering, shareholders are faced with the task of determining the parameters of the issue: the number of shares and an estimate of their value. The standard procedure for an initial public offering (IPO) involves the participation of a professional participant in the stock market - an underwriter.

The extent of his involvement is not limited to consultations. The underwriter takes care of the entire process of placing shares on the public stock market, including the valuation of shares. The maximum degree of participation involves the purchase by the underwriter of the entire issue and its further sale to investors.

During the IPO process, the underwriter, together with the customer, determines the primary placement price. It is nominal and at this stage will not be a market one, depending on supply and demand.

Market

After an IPO, shares begin to be traded on the stock exchange. As a result of exchange trading, current market prices are formed. This is an automatic process.

It consists of three main components: a trading system on the exchange servers, a broker server and a trading program for the end client (trader). An order from a trader is received by the broker, the program checks it for compliance with the conditions and transmits it to the exchange.

This takes a fraction of a second. All orders form a feed of purchases and sales with set volumes. In trading slang - “stock book”.

An example is the queue of quotes for ordinary shares of Sberbank. At the top there is a sell order, at the bottom there is a buy order. With stated volumes. On the Moscow Exchange, 1 lot of Sberbank shares includes 10 shares. The difference between supply and demand is the spread.

The smaller it is, the better; there are no price gaps between buyers and sellers. The transaction occurs automatically, where the price of the seller and the buyer meets.

T+2 is the main trading mode on the MICEX for shares. This means that the registration of a purchased or sold share in the depository does not occur tomorrow, but on the second day after the transaction is concluded on the stock exchange.

Balance sheet

BVPS (bookvaluepershare). The valuation takes into account total share capital less the value of preferred shares and the number of shares outstanding. The price estimate is determined by the formula of dividing the first indicator by the second. The average value of shares in turnover in the calculation period is taken. The reason is that market events can change the quantity. For example, buyback.

The book-to-market ratio provides investors with a benchmark for valuation. If the market price is lower than the book value, the company's shares are undervalued by the market. Can serve as an indicator for buying shares.

In fact, the book value has value for accounting and is calculated over the past period of time. It does not take into account investors' expectations that prices will rise or fall in the future. The second nuance is that some assets may be valued below their real price.

Such assets are difficult to adequately value in monetary terms. An example is reputation or brand valuation. This is reflected in the book value of the company's shares.

Liquidation

Determined upon termination of the joint stock company's activities. After the fact of termination of the company's work, the value of all assets is determined. The company's external liabilities, including credit funds, are subtracted from this value.

From the remaining figure we subtract the cost of preferred shares (if available). The result is the liquidation value of the common shares payable to shareholders.

Investment

The market price of shares is defined as the value “here and now”. Investment - the investor’s subjective idea of the price of shares based on the totality of data. These include dividend payments and the investor's beliefs about the future growth of the asset in the future. Professional investment firms can value the same stock in completely different ways and present its investment price on their own measurement scale.

Relatively speaking, shares today cost 100 rubles. Experts decided that the investment value of these shares is 123 rubles. And they recommend investors to buy. And analysts consider the investment price of 89 rubles to be fair.

Then the recommendations will be to sell. The investment price of a stock is largely an empirical matter. It reflects the profitability and yield of a security when assessed subjectively. You should be very careful about this value in your investment plans.

Emission

This price is offered to the first buyers in an initial public offering (IPO). Immediately before going to public auction. The joint stock company, together with the underwriter, determines the issue price and offers interested investors to buy the package at that price.

The standard procedure involves the following steps:

- Before the start of public trading on the stock exchange, the issue price is determined.

- It is officially announced, and applications to purchase shares at this price begin to be accepted. There are start and end dates for admission.

Calculated

It is also necessary for non-public joint stock companies in accounting calculations. In the Russian Federation, the procedure for determining the settlement price of securities not traded on the securities market is determined by the Tax Code and Order of the Federal Financial Markets Service of October 9, 2010 No. 10-66\пз-н. Quote from paragraph 4 (source - Consultant Plus):

Some experts allow the use of determining the settlement price in a similar way to the balance price.

How to use the dividend discount model?

I'll show you how this model works with an example. Let's say that this year the company plans to pay 10 rubles per share. And you want to get 8% return on your investment. Plus, you expect the company to raise its dividend by an average of 5% per year. In this case, the fair price of the share is: 10*(1+0.05)/(0.08-0.05) = 350 rubles.

We must not forget about the principle of margin of safety. It is not a fact that in reality dividends and growth rates will turn out to be as you predicted. Therefore, you must buy a share with a margin of safety - for example, for 300 rubles.

The main disadvantage of this model is that it is very sensitive to changes. Let's say that in our example, dividends would grow not by 5%, but by 4%. In this case, we get a completely different cost - 260 rubles. And if dividends grow by 6%, then the cost will be 530 rubles. This gives us a very wide fair value range. Therefore, this model is suitable for companies that have stable and predictable dividend growth rates.

But there is a way out of this situation - a two-stage discounting model. At an early stage of their development, companies can maintain high rates of growth in their profits and dividends. But sooner or later, every company will hit a ceiling and its growth rate will slow down. The two-stage model allows for one dividend growth rate in the early stage and a different growth rate in the mature stage. The calculation formula in this case becomes more complex, so it is much easier to use a special calculator to evaluate shares.

Formation of market value of shares

Supply and demand are two components of market price formation. Relevant for public companies with shares trading on the stock exchange.

The mood of buyers and sellers can change during trading under the influence of various factors: geopolitics, world and company news, economic reports, etc. The shorter the time frame for observations, the less predictable the price behaves, organizing the so-called “market noise”.

Over long periods of time, the price of shares largely reflects fundamental analysis and indicators of management quality, investors' expectations about the future activities of the joint-stock company, and the size of dividend payments. At the same time, the value of shares of even such giants as Gazprom can change quite unpredictably. It's good to grow and it's good to fall.

Gazprom share price chart since 2006.

Factors influencing stock returns

The parameter consists of real payments and market expectations of investors. Therefore, the size of dividends is affected by:

- Net profit amount.

- The policy of the enterprise that determines the amount of payments (they may decide to use the received profit to expand production) and the calculation formula.

Market value is an illusion, credibility and advertising. When an enterprise is a strong average in terms of indicators, a leader in the industry, investors’ expectations of making a profit are understandable.

But there is also advertising when:

- the payment of dividends becomes a discussed media event;

- members of the board are VIPs;

- the company's successes are regularly reported on TV.

The formula is simple: as more people want to buy securities, quotes rise. Sometimes large holders deliberately create the illusion of reliability and get rid of stale goods.

Approaches to assessment

A description of various ways and approaches to assessing the value of an enterprise follows. As a result - its shares.

Expensive

The costs (tangible and intangible assets, organizational expenses) of creating and organizing an enterprise similar to the customer are assessed. The company's estimated future profit is added. Debt obligations are subtracted from the resulting figure. The result is the theoretical market value of the joint stock company, which reflects 100% of the value of the shares.

Comparative

Comparison of the valuation of the company's securities with shares of companies that are as close as possible by type of activity. That is, it is not enough to take one industry. It is necessary to select for comparison shares of companies in the same narrow niche in which the company whose shares are being assessed operates.

Profitable

One of the most popular approaches to assessment. Methods:

First, discounting cash flows. We determine the value of the company at the current moment, taking into account future planned cash receipts. We determine future income through the cash flow parameter (Cash Pot.):

Den.Pot.=Net.Gr.+Depreciation. -Pr.Ob.Cap. - Cap.Vl.

Net.Profit - net profit;

Shock absorption — depreciation;

Pr.Ob.Cap. — increase in working capital. Calculated as the difference at the beginning and end of the time period;

Cap.Vl. - capital investments.

We calculate the value of the company taking into account the planned flows (formula above) of future periods - 1,2, ...n.

St-calc.=Den.Pot.1/(1+d)+Den.Pot.2/(1+d2)+…Den.Pot.n/(1+dn)+St-st last./(1 +dn)

St-strasch. — the company’s estimated price;

d is the discount rate. Variable value, depends on various factors. Various calculation options. The calculation mechanism is described here;

Cash Pot.1,2,n - cash flows for time periods. Default is 1 year;

Article last — the price of companies in the period of time after the forecast (post-forecast).

Calculation formula:

Sequence value=Den.Pot.n (1+s)/(dt).

t is the rate of income receipt (the growth rate of the enterprise).

Calculating costs using this method involves taking into account variables. In reality, they can vary widely. The recommended calculation period is 1–3 years. The resulting estimated price of the enterprise is used to value the shares.

Secondly, capitalization of income in future periods of time. Works well at predictable, highly correlated income levels. That is, if the company has a stable business with fairly well-planned revenues.

Simple formula: Calculation value = Income * Capitalization rate.

The desire for profitable investments

Of course, at present, in order to successfully do business in the investment market, you need to be able to correctly purchase securities, and this costs a lot of skill and experience, therefore, we can say that stock valuation is a very important and necessary process that helps to some extent reduce the risks of losses and unforeseen circumstances. You need to understand that this is a risky business, therefore, when investing your funds in someone else’s business, it is advisable to carefully research and weigh everything before making a decision, and it would also be a good idea to conduct your own, static assessment to minimize the risk of losses.

If we touch on the issue of risks, they can be very different and depend on many factors.

As a last resort, before making a decision, it is important to study forecasts of how the company will behave in the future in a competitive market environment before purchasing shares, and also carefully monitor this.

Assessment methods

The main methods for valuing securities are described above in the chapter “Approaches to Valuation”. When applying methods and approaches to valuation, it is important to take into account the fact that the company is public. Are shares traded or not on the stock exchange, that is, are they freely available? If the company is public, the valuation process is greatly simplified.

The market is already giving an answer regarding the size of the market and issue price. Professional market participants, based on the information disclosed by the PJSC (they are obliged to do this), estimate the income portion in the future, present the subjective price of the company’s shares on a specific date in the coming period. In this case, fundamental analysis multipliers are widely used.

From a legislative point of view

In the modern financial market, a situation often arises in which available funds are accumulated by certain business representatives, but the need for investment arises from completely different business entities, which entails an uneven distribution of funds. For this purpose, there is state regulation of the movement of securities to facilitate uninterrupted financial circulation, which is guided by the Law of the Russian Federation “On the Securities Market” No. 93 of April 22, 1996, as well as the Law of the Russian Federation “On Joint Stock Companies” No. 208 of December 26, 1995.

According to these regulations, the valuation of shares is carried out in the cases described above, and is a procedure not only for determining their net value, but also for identifying their position in the modern market. This process is fully guided by legislation at every stage.

Assessment steps

- The purpose of valuing the company's shares is determined. What assessment should the customer ultimately receive - liquidation, emission, etc.

- Taking into account the industry affiliation of the enterprise, an analysis of its actions in the market is made.

- The contractor evaluates the information provided and the information provided by the customer. The Contractor makes a conclusion about the sufficiency of information to fulfill its obligations under the contract to the customer.

- A forecast is made for the customer's expected future income (if necessary).

- The contractor makes a final assessment of the company's securities in accordance with the business case received from the customer.

Prospects for stock valuation

According to the RAEX rating agency, the Russian valuation business in the field of business and securities based on the results of 2021 grew at a low pace - 2% growth. In absolute terms - 1.4 billion rubles. For comparison, the growth of the intellectual property and intangible assets valuation sector was 18%.

The reason for the low growth rates in the securities sector is external sanctions, and as a consequence, low economic growth rates. If they exist at all. The lack of a major influx of investment capital (external money) dictates a sluggish market for the stock valuation business.

Revival can only be expected with a positive change in economic growth and the arrival of a new wave of foreign investment in our market. In this situation, joint-stock companies are interested in entering the stock exchange and placing shares at a higher price.

Types of profitability

By investing your savings in the purchase of securities, you can receive rewards from two sources:

- dividend payments;

- exchange rate growth.

Dividends represent a portion of the profits allocated to you as a shareholder. In this case, the amount of dividends is set by the board of directors per share.

Therefore, the more of them you have, the more money you will receive. Payments can be made quarterly, semi-annually or annually. Domestic companies usually pay remuneration based on the results of the full financial year.

The profit from the increase in the exchange rate consists of the difference between the sale price minus the cost of purchasing securities.

How can a company value its shares?

- We choose a consulting company to evaluate the securities of our company. When choosing, we take into account the experience of the appraisal company in an industry similar to ours. If the proposed counterparty worked mainly in retail valuation, and our company is engaged in mechanical engineering, it is better to look for another option.

- We agree on the terms of the share valuation agreement at the level of legal departments (terms, conditions). We sign the contract and exchange the first copies.

- We make the prepayment required under the contract, partial or full.

- We present the necessary documents to the appraisal company. The required set includes a copy of the company's charter, balance sheets for the periods determined by the consulting company.

- The appraisal company carries out the work and is obliged to submit a report with the output data to the customer within the time period specified in the contract.

TOP appraisal companies

Use official trusted sources of information to select appraisal companies. I advise you to use the rankings of the Russian rating agency RAEX-Analyst. Created in 2015. Prior to this, the team of experts worked at the Expert RA since 1997. The brand is RAEX. To analyze 2021 estimates.

Top twenty:

In first place is the consulting group SRG. We go to the group’s website, then “Evaluative.

Helpful Tips for Valuing Stocks

Below are some recommendations when evaluating a company's securities.

Contact trusted companies

Above in the text I have provided a list of leading appraisal companies. Another indicator of reliability can be participation in a self-regulatory organization of appraisers.

Due to the fact that a license for such activities is not required, the quality of work of participating members is independently regulated through such a non-profit organization. On the information portal “All about self-regulation” you can find information from SRO appraisers by region. Including a register of such NPOs.

Analyze reviews of companies

Make an analysis of the company's economic activities based on reviews of analysts from large professional market participants and ordinary investors.

Resources for finding information:

- Financial portal RBC Quote. Includes recommendations from professional experts, price forecasts, and review materials. An example is the Gazprom review page.

- Information resource SMART-LAB. Opinions, analytics, recommendations of private traders. Includes the MICEX Stock Forum.

- Information and analytical site BCS Express. Includes investment ideas, forecasts from professional participants, and trading recommendations.

- Financial portal. Includes the Comon trading community.

- Information resource "Open Journal" of the broker "Otkrytie".

Consult with specialists before contacting an appraisal company

The easiest way to avoid trouble before contacting an appraisal company is to get professional legal advice on this issue. This is the first step that can and must be taken.

A company specialist will explain the intricacies of the legislation and talk about pitfalls. The consultation fee is undoubtedly less than the possible loss of profit that may arise from poor securities valuation.