Risk is an unpleasant and even scary word. It is not surprising that in the minds of many people it is associated with great losses and other misfortunes. In real investing, risk is a constant companion, which may be why many people are afraid to invest their money anywhere other than their nest egg. To stop being afraid of risks, you need to learn how to manage them.

Risk management has become more relevant than ever since the financial crisis. It dawned on everyone that working for profit without paying due attention to the sources of possible losses is wrong. Risk management specialists in any field do the same thing - look for potential sources of risk and suggest ways to mitigate or eliminate them, if possible. Investors should do exactly the same thing.

This article is part of a course on investing from scratch on the Webinvestor Blog. If after reading you still have questions, ask them in the comments - I will try to answer in detail.

Before we move on, a little blurb:

I would like to recommend you the investment accounting service from the partner of the Webinvestor Blog - the company Intelinvest . On it you can monitor your portfolio through the website or mobile application, and you do not need to provide passwords to import transactions. You can keep track of any assets: stocks, bonds, cryptocurrencies, precious metals, forex investments, etc. There is a functional free version for testing. If you would like to make a full subscription, use promo code 1VYV9CMSTD to get 20% off your first payment.

Thank you for your attention, let's continue!

Existing classification

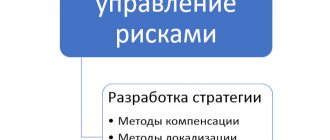

Modern science knows different types of investment risks. Their essence has long been studied, and methods of struggle have been developed. To understand the generally accepted classification, I suggest you familiarize yourself with the diagram below.

Now let's look at all types of investment risks in more detail.

The undiversified or systemic variety is associated with general factors that externally influence the entire market as a whole. That is, they affect all companies or securities equally. For example, we can talk about changes in the country's tax legislation or the current level of inflation.

The market variety represents the downside risk of the asset being considered by the investor. To characterize it, financiers use the concept of volatility, which is usually understood as the natural degree of fluctuation in the price of an investment object.

The risk of changes in interest rates is associated with the activities of the country's Central Bank. As the main regulator of the financial sector, the Central Bank in the course of its activities may change the interest rate level from time to time. If it decreases, the cost of business loans will also decrease. This decision traditionally stimulates the development of entrepreneurial activity, increases the return on investment and has a positive effect on the stock exchange. The inverse relationship also works.

The currency variety is associated with the risk of a sharp change in the exchange rate of one of the key national monetary units. The value of a currency is influenced by various factors: the stability of the country’s political system, events in the economy, the foreign policy situation, etc.

The inflation type of risk is determined by the existing level of inflation. Most often this is a negative factor that depreciates the value of money and reduces the investor’s profit.

The political variety is associated with the activities of government bodies, parties and public organizations. It reflects the state of political processes taking place in the country. If the system of government bodies is stable and investment security is at the proper level, then this factor will not have a significant impact on the investment processes taking place in the country. And vice versa.

A diversified or non-systemic variety is associated with a specific industry or enterprise.

The business variety is due to the likelihood of the company's management making the wrong decision. This factor directly depends on the professionalism and qualifications of the top management of the enterprise. This group of risks is quite significant, because in some cases a wrong decision can lead to the most dire consequences for a business, including bankruptcy.

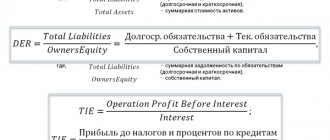

The credit type of risk is caused by the inability of an enterprise to fulfill its own financial obligations. First of all, we are talking about payments on bank loans and servicing accounts payable to their counterparties. In current world practice, to assess the level of a company’s creditworthiness, it is customary to resort to the services of rating agencies. For example, Fitch, Moody's and others.

Operational risks are associated with a company's assets. With the operations that are carried out in relation to them. They may involve both the actions of the investor himself and the activities of third parties. For example, brokers or management companies.

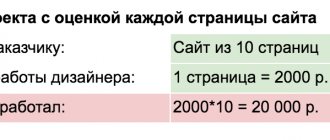

Methods for assessing the effectiveness of investment projects

2.1. Existing methods, the use of which is possible during the assessment of IP

Evaluation of an investment project in terms of the magnitude of its effectiveness has a direct impact on the financial condition of the organization and its development.

The goals for achieving which the investment attractiveness of an individual entrepreneur is assessed may vary depending on who is the investor, the state or private business. Sometimes they differ fundamentally.

The process of investing in anything is divided into three stages:

- Decision making (choosing the direction of investment and its goals);

- Direct investment of funds;

- The payback stage for the investor and providing him with the planned (calculated) profitability.

With the right investment, all expenses incurred are recouped, the expected profit is achieved, and the designated goals are achieved.

The specialized literature discusses many methods recommended for assessing an existing investment project. Three blocks are considered the most effective and in demand:

- Static methods;

- Dynamic methods;

- Alternative options.

Each of them has its own pros and cons.

2.1.1.Static method

Distinctive features are the clarity of the calculations performed and their simplicity. It should be noted that in this case, the choice of base for comparing payback time, which is a standard indicator, is purely subjective.

Statics does not consider the profitability of the evaluated project outside the time period determined by the payback period. This does not allow the use of similar methods to compare several projects with the same payback periods and different deadlines.

The method under consideration cannot be used to evaluate an investment project that is innovative and associated with the release of new product samples.

2.1.2.Dynamic methods (another name, discounted)

The basis of these methods is the use of the concept of a variable cost of money, which changes over time.

The classic options are considered to be:

- Net present value of investment (international abbreviation NPV). Alternative name, current present value. Calculated by the formula

- Return on investment index (international abbreviation PI). Determined by the formula

- Internal rate (IRR) of return on completed investments. Alternative name, yield. Calculated using the formula

- Modified VNR (international abbreviation MIRR)

Symbols used:

- CFt – payment due after a certain period equal to t years (at t=1...N) and the initial investment made, the value of which is equal to IC= -CF0;

- NCF – net cash flows (alternative name, discounted);

- WACC – this is the weighted average cost of capital attracted;

- I – investments;

- N – duration of the project in time;

- i is the rate at which discounting is carried out.

In reality, there are certain difficulties in the methods that are used to determine the value taken as the rate of return when assessing the investment project under consideration. This is due to the high complexity of calculations, mainly of a technical nature. The issue regarding the correctness of using discounted income when assessing the effectiveness of the project under consideration has not been sufficiently worked out.

In cases where the indicator is positive, regardless of its absolute value, the project is assessed as effective.

2.1.3. Alternative Methods

Three of them are most in demand:

2.1.3.1.Adjusted present value.

The essence of the method. The existing cash flow is divided into a number of components, followed by separate processing of each. The method takes into account (if any) subsidies and benefits provided by municipalities or the state, as well as the amounts spent on insurance against the occurrence of probable risks.

It is very convenient to assess the effectiveness of an investment project using this option for individual entrepreneurs who have different sources of income and forms of taxation that differ from the standard ones.

Minuses. The method requires a significant amount of preliminary work. This is explained by the need for significant amounts of additional information.

The calculation is made as follows: NPV + PV (for the definition of abbreviations, see above).

2.1.3.2. Real options.

Assessment of economic efficiency using this method is one of the most flexible assessment options. The assessment includes the possibility of acquiring or creating assets within a certain (fixed) time.

Advantages. The option allows you to evaluate the actual value of the project (comprehensive) by performing a calculation using the formula

Designations:

- IC is the amount of capital invested in the project;

- r – discount rate;

- PL – planned value of the profitability index (alternative name, expected);

- t is the period for which the option in question is calculated.

2.1.3.3.Added value.

The method is based on the following thesis: the profitability of the investments made must necessarily be greater than the value of the cost of attracted capital (a weighted average is considered).

The advantage of this method is the following: its use provides the opportunity to determine (if any) facts of insufficiently efficient use of financial resources attracted to the project as investments.

The disadvantage of the method is the impossibility of taking into account predicted data for each of the available cash flows. This may lead to certain incorrect calculations of individual indicators in cases where the project has complex and multi-channel cash flows that take into account the time factor and changes in the value of money online.

The digital value characterizing this method is obtained by the difference between two cost values: manufactured products sold and raw materials used for their production.

All considered methods are characterized by pros and cons of application. None of them guarantees that the decisions made will be correct. This is due to the fact that any individual entrepreneur is designed for “tomorrow”, and the decision must be made today. This is precisely the reason that any individual entrepreneur involves risks and uncertainty.

Analysis and evaluation

The mere understanding of the existence of investment risks cannot protect the investor’s money. To achieve this, a number of practical steps should be taken. First of all, the investor needs to carefully analyze the investment project under consideration. The analysis will allow us to identify existing risks. But in order to maximize the safety of investments, their competent assessment is necessary.

Investment risk assessment can be carried out using several methods.

1. The expert method is basic in making investment decisions. It implies the involvement of an independent expert on this type of investment in the assessment of the project. The expert examines the potential investment and gives his opinion on the potential level of risk.

Several experts can be simultaneously involved in the examination of a specific project. They can study it together or each separately. The latter option is called the Delphi method, in which all experts act separately from each other and make exclusively independent judgments. Then, by comparing the expert opinions obtained, it will be possible to make a final decision.

2. Method of analysis. This technique considers the feasibility of costs. It is aimed at identifying possible risk areas. Such an analysis is carried out directly by the investor or a third party whom he has engaged for such a risk assessment.

3. Method of analogies. It involves analyzing similar investment projects implemented in the past.

4. Quantitative assessment method. This technique provides for a numerical determination of the investment risk indicator. This assessment method contains several independent analytical tools, which together are capable of providing quantitative and qualitative certainty when the investor makes a final decision. These tools are:

- determining the level of project sustainability;

- analysis of project development scenarios;

- project sensitivity analysis;

- risk simulation modeling using the Monte Carlo method.

The listed methods for assessing investment risks allow the investor to make the right, informed decision. The more techniques are used in practice, the higher the likelihood of an adequate result.

Management of risks

Proper management of investment risks allows an investor to minimize existing dangers and achieve a consistently high return on investment. There is a set of methods and principles that should be based on when deciding whether an investment is appropriate.

Basic principles:

- the risk should not be excessive - the right balance is necessary;

- You cannot risk an amount that exceeds your own capital or do not invest borrowed money;

- risk sharing or diversification - do not invest all your funds in one, even a very promising asset;

- it is necessary to clearly understand the consequences;

- You can’t take big risks for little gain.

Guided by the listed principles, an investor will always be able to diversify or significantly reduce the level of investment risks.

Risk-based investment methods

There are several techniques that every practicing investor must master.

1. Mandatory creation of an investment strategy.

Any investor must understand what he is doing and what result he wants to achieve. There is an investment strategy for this. In practice, it allows you to best diversify risks.

It is customary to distinguish the following types of strategies:

- conservative;

- moderate;

- aggressive.

Each of them is determined by a specific set of investment instruments or assets and the level of risk that they imply. The investor needs to find his own balance and, taking this into account, develop an investment strategy that he will adhere to.

The classic investment strategy looks like this:

- conservative assets - 40%;

- moderate assets - 40%;

- aggressive assets - 20%.

2. Dynamic development of the investment portfolio.

The situation on the stock exchange never stands still. Many events occur every day that affect the value of securities. An investor must be able to change the specific structure of his own investment portfolio depending on the current market conditions.

3. Mandatory creation of an investment plan.

The investment plan implies the determination of a strict frequency of investments. In other words, the investor needs to decide how often he will invest money. Every day, week, month or quarter.

The investment plan must be followed. If you initially decided to invest once a week, then you do not need to do it more often or less often.

4. Maintain the timing of investments made.

Any successful investor has two virtues:

- stable nervous system;

- patience.

You should never panic and react to momentary market fluctuations. In other words, you should not prematurely exit a long-term investment due to a short-term decline in the asset price.

Competent management of investment risks requires the investor to systematically and accurately implement the chosen investment strategy.

Risk insurance

Investment risk insurance is a reliable financial protection tool that every investor should consider. Naturally, you should not insure all investments. Otherwise, you will have to forget about profit. However, insuring your riskiest, highest-yield assets can be a great solution.

Currently, insurance companies in Russia and the world offer everyone who wants to insure their own investments against numerous types of risks. In each specific case, the choice remains with the investor. As an example, we can consider insurance for the following risks:

- business;

- political;

- market;

- inflationary;

- systemic;

- and others.

Investment risk insurance is an effective mechanism for protecting investments from negative economic factors.

Investment risks are an objective reality. There are no completely safe investments. To protect yourself as much as possible, an investor needs to use existing methods for assessing and managing investment risks.

Risks in investment activities

Before we move on, a little blurb:

I would like to recommend you the investment accounting service from the partner of the Webinvestor Blog - the company Intelinvest . On it you can monitor your portfolio through the website or mobile application, and you do not need to provide passwords to import transactions. You can keep track of any assets: stocks, bonds, cryptocurrencies, precious metals, forex investments, etc. There is a functional free version for testing. If you would like to make a full subscription, use promo code 1VYV9CMSTD to get 20% off your first payment.

Thank you for your attention, let's continue!

There are no risk-free assets - this is an axiom you need to remember.

What is investment risk? This is the likelihood of any unexpected losses associated with your investments. Various commissions, server fees when trading with advisors, manager's remuneration in PAMM accounts and other similar expenses are not considered risks.

The reasons for unexpected losses can be very different - from the incompetence of the investor himself to the political situation in the world. They can be combined into two large groups:

- Systematic or market risks. Affect all participants in the financial system or a specific market. The most striking example is the financial crisis, which made its own adjustments to the work of ALL financial institutions in the world. The market risk for, for example, a portfolio of shares will be a fall in the stock index - it affects all companies, regardless of participation in the index.

- Non-systematic , they are also specific risks. Each investment instrument has its own unique qualities. And their potential sources of losses are also different. It is these specific risks that the average web investor usually deals with.

It is extremely difficult for an investor to protect himself from market risks, especially those of a global nature. But specific risks are completely within his control thanks to some techniques that you will learn about in the third part of the article.