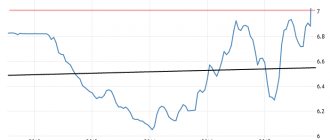

Yellen's speech did not change the trend of risk aversion

Address for questions and suggestions about the site: [email protected]

Copyright © 2008–2021. LLC "Company BKS" Moscow, Prospekt Mira, 69, building 1 All rights reserved. Any use of site materials without permission is prohibited. License for brokerage activities No. 154-04434-100000, issued by the Federal Commission for the Securities Market of the Russian Federation on January 10, 2001.

The data is exchange information, the owner (owner) of which is PJSC Moscow Exchange. Distribution, broadcast or other provision of exchange information to third parties is possible only in the manner and under the conditions provided for by the procedure for using exchange information provided by Moscow Exchange OJSC. Brokercreditservice Company LLC, license No. 154-04434-100000 dated January 10, 2001 for brokerage activities. Issued by the Federal Financial Markets Service. No expiration date.

* The materials presented in this section do not constitute individual investment recommendations. The financial instruments or transactions mentioned in this section may not be suitable for you and may not correspond to your investment profile, financial situation, investment experience, knowledge, investment objectives, risk appetite and return. Determining the suitability of a financial instrument or transaction for investment objectives, investment horizon and risk tolerance is the responsibility of the investor. BKS Company LLC is not responsible for possible losses of the investor in the event of transactions or investing in financial instruments mentioned in this section.

The information cannot be considered a public offer, an offer or an invitation to purchase or sell any securities or other financial instruments, or to make transactions with them. The information cannot be considered as guarantees or promises of future investment returns, risk levels, costs, or break-even of investments. Past investment performance does not determine future returns. This is not an advertisement of securities. Before making an investment decision, the Investor must independently assess the economic risks and benefits, tax, legal, and accounting consequences of entering into a transaction, his readiness and ability to accept such risks. The client also bears the costs of paying for brokerage and depositary services, submitting orders by telephone, and other expenses payable by the client. The full list of tariffs of BCS Company LLC is given in Appendix No. 11 to the Regulations for the provision of services on the securities market of BCS Company LLC. Before making transactions, you also need to familiarize yourself with: notice of risks associated with transactions on the securities market; information about the client’s risks associated with making transactions with incomplete coverage, the occurrence of uncovered positions, temporarily uncovered positions; a statement disclosing the risks associated with conducting transactions in the market for futures contracts, forward contracts and options; declaration of risks associated with the acquisition of foreign securities.

The information and opinions provided are based on public sources that are recognized as reliable, however, BKS Company LLC is not responsible for the accuracy of the information provided. The information and opinions provided are formed by various experts, including independent ones, and opinions on the same situation can differ radically even among BCS experts. Given the foregoing, you should not rely solely on the materials presented at the expense of conducting independent analysis. BKS Company LLC and its affiliates and employees are not responsible for the use of this information, for direct or indirect damage resulting from the use of this information, as well as for its accuracy.

Market news | Yellen's speech was published.

She wants to up the ante, but realizes there are problems. She's afraid of derailing the train. Let's see what else he says today. DJ Fed Chair Yellen highlighted potential risks, reiterated that Fed expects rate hikes to be "gradual" -2-10-Feb-2016 (Continued)

WASHINGTON, February 10 ( Dow Jones

). In testimony before Congress on Wednesday, Federal Reserve Chair Janet Yellen flagged risks to the U.S. economic outlook that could delay the central bank's plans to gradually raise short-term interest rates.

Financial conditions have been less supportive of economic growth recently, economic turmoil in China and other foreign economies could still weigh on the U.S., and market participants' inflation expectations continue to decline, Yellen said at the start of her testimony before the relevant House and Representatives committees. Senate

The Fed chair did not directly address the possibility of a later rate hike, but listing possible risks gave her comments a pessimistic tone, which in turn underscored the Fed's concerns about subsequent rate hikes following December's monetary tightening. Until December last year, interest rates had remained near zero for seven years.

(Continuation)

“Financial conditions in the United States have been less supportive of economic growth recently, with stock markets lower, borrowing costs rising for riskier borrowers, and the currency continuing to strengthen,” Yellen said. “If this situation continues, it could worsen the outlook for economic activity and the labor market, although falling long-term interest rates and oil prices will offset some of the negative effects.”

When the Fed tightened monetary policy in December, central bank officials targeted four rate hikes of 0.25 percentage points for 2021. Investor skepticism regarding these plans has only intensified in recent weeks.

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2021 09:50 ET (14:50 GMT)

DJ Fed Chair Yellen pointed to potential -2-

The next Fed meeting will take place on March 15-16. Traders in the futures markets estimate the likelihood of monetary policy tightening during this meeting as zero, and they estimate the likelihood of a rate hike in 2021 at 19%. The target level of the central bank's key interest rate is in the range of 0.25%-0.5%.

Incredible accuracy in forecasts.

Yellen's competence is confirmed by her incredible accuracy in forecasts. In TheWallStreetJournal's ranking of nearly 700 economic predictions made between 2009 and 2012, Yellen ranked first with an accuracy rate of 0.52 points. At the same time, her former boss Bernanke was only in fifth place with a score of 0.29 points.

In December 2007, almost a year before the bankruptcy of Lehman Brothers, she became one of the few who spoke about the approaching global financial crisis. Yellen expressed concern about what she dubbed the “600-pound gorilla,” her designation at the June 2007 Fed meeting in reference to the housing bubble and signs that it might burst. When the bubble burst, it directly led to the financial crisis.

By the way, Janet Yellen's husband is also a highly respected economist, John Akerlof, who won the 2001 Nobel Prize for his analysis of markets with asymmetric information.

Childhood and youth

Janet Louise Yellen was born on August 13, 1946 in New York, USA, and is of Jewish ethnicity. She graduated from Fort Hamilton High School, where she worked as editor-in-chief of a wall newspaper. Black and white photographs have been preserved in which the future US Treasury Secretary stood in a row of students in a biology class. Then the girl was most interested in this science.

Janet Yellen in her youth / Business Insider

As a young woman, she graduated from Brown University with a degree in economics and then received her doctorate from Yale University. At this prestigious university, the girl studied under the tutelage of Nobel laureates James Tobin and Joseph Stiglitz. She was named one of the brightest students, which was promoted by her dissertation “Employment and capital formation in an open economy.”

Janet Yellen - monetary policy

During her youth, Yellen spent a lot of time studying the consequences that unemployed people face. Subsequently, the problem of unemployment in the US economy becomes one of the main ones for her, while rising inflation does not cause her any concern.

The Fed Chairman knows how to find compromises in his work at the Fed. She is not used to going ahead and pitting people against each other. The head of the Federal Reserve all the time uses her main talent, as well as her teaching experience: she clearly, specifically, legitimately shows her own attitude and holds the interest of listeners during the entire speech and, thus, guarantees herself a significant increase in points in the confrontation for maintaining popular opinion and expert opinions. communities.

She began working at the Fed back in 1994, when it was headed by Alan Greenspan. Janet was one of the few who constantly argued with the head of the Federal Reserve over monetary policy. The head of the Federal Reserve also claims that when there is no competition in the economy, the efficiency of general production facilities decreases, and the end consumer loses as a result. This happens because product prices begin to rise.

In June 2007, at the San Francisco Federal Reserve, she was among those who said they needed to start worrying about the risks of mortgages. She turned out to be right about this.

Under Trump

The 45th President Donald Trump, breaking with tradition, did not nominate Yellen for a second term. She has repeatedly criticized the Republican's economic policies, saying that he "understands nothing about economics."

Yellen is a recipient of awards from Yale University, an honorary Doctor of Laws from Brown University (1998) and an Honorary Doctor of Letters from Bard College (2000), an honorary Doctor of Laws from the University of Warwick (2015), and an Honorary Fellow of the British Academy (2016).

According to materials from the US Government Ethics Office (dated January 1, 2021), over the past two years, a number of large companies have paid Yellen a total of more than $7 million. These include American banks Citigroup and Goldman Sachs, as well as Google Corporation. Yellen received this money as payment for speeches to company employees.

Early biography of Yellen

Janet Yellen was born in Brooklyn in 1946. The current head of the Federal Reserve grew up in a simple family of Jewish origin, where her mother worked as a housewife and her father worked as a therapist. She graduated from the educational institution with a gold medal, and at the end of the year she was entrusted with giving a graduation speech.

It must be said that the head of the Fed has been cultivating self-control since childhood. Many friends of that time, discussing the character of Janet Yellen, say that already at that time it became clear to everyone that this girl would go far. One day, the editor-in-chief of a student newspaper gave her the task of conducting a survey with a student speaking at the end of the school year. And she spent it - with herself. Its contents are still preserved in the Brooklyn Public Library. In her speech, Yellen described herself as a well-rounded, attractive and talented high school senior. Someone asked her what the future head of the Federal Reserve thought about the work of the magazine in school, she said: “No comment!”

Janet Yellen began her path to Olympus by teaching at Harvard, and later taught students at the University of California. She has published many books. One of the most popular was “Monetary Policy: Goals and Strategy.”

She became Chairman of the Federal Reserve in 2014, thereby becoming the first woman to ever hold this post. While she was working as an economist at the Federal Reserve, she met her future husband, Nobel Prize winner and University of California professor George Akerlof. Relatives and friends praise Janet Yellen for her delicious cooking.