Many experts call the Russian market of innovative technologies undervalued with prospects for growth of 30-70% in the medium term. Let's analyze the shares of innovative Russian companies to understand whether they are worth investing in. also identify possible growth factors and determine buying points for different types of investors.

Quick navigation

Healing properties

The application for declaring Pharmsintez PJSC bankrupt was received by the Arbitration Court of St. Petersburg and the Leningrad Region on September 27; the date for the hearing to consider the claim has not yet been set. The essence of the claims boils down to the return of a debt for a small amount of 5.8 million rubles. This message on behalf of the General Director of the National Medical Research Center of Cardiology Sergei Boytsov was published in the SPARK database. The head of the institution refers to last year’s decision of the court of first instance to recover from Pharmsintez funds not paid under the contract.

The materials of the trial between Pharmsintez and the National Medical Research Center of Cardiology indicate that in 2021 they signed a contract for the use of premises and equipment necessary for the production of the drug Neovir, advertised as a complex remedy against viral and bacterial infections. Under the terms of the transaction, the contractor (plaintiff) undertook, on the customer’s instructions, to prepare a medicinal solution for intramuscular administration.

The work was completely completed, the acceptance certificates were signed, but the National Medical Research Center of Cardiology did not receive payment in full. The court sided with the institution subordinate to the Ministry of Health and decided to recover 5.8 million rubles from Pharmsintez PJSC. This amount eventually went into the bankruptcy case.

At the time of publication of the material, the parties refrained from commenting. As “DP” learned, in addition to the National Medical Research Center of Cardiology, other organizations also have financial claims against Pharmsintez. In particular, the legal department expressed its intention to file for bankruptcy of the enterprise. SPARK states that this company acts on behalf of the Moscow-based Biogenius LLC, which is engaged in research and development in the field of natural and technical sciences, as well as the production of medicines.

Frontier of replacement. The drug market is being actively restructured Pharmaceuticals

The state-owned company will sell a stake in the enterprise

Rusnano plans to sell its stake in Pharmsintez, one of the oldest domestic producers of pharmaceutical substances. Having invested 1.19 billion rubles in the enterprise, the state-owned company expects to exit it with a profit. Rusnano was able to achieve a record profitability of more than 40% four years ago by selling a stake in .

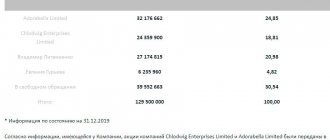

A source in the pharmaceutical market told Kommersant that Rusnano plans to sell its stake in PJSC Pharmsintez. The press service of the state-owned company confirmed this information, explaining that the deal will take place when “suitable conditions arise.” Now Rusnano owns 37% in Pharmsintez.

The Pharmsintez production complex, commissioned in 2001 in the Leningrad region, produces pharmaceutical substances. The main drugs are Sehydrin, Pencrofton and Neovir. According to Pharmsintez’s reporting for 2016, its shareholders also include the Estonian AS EPhaG (32.6%) and the American OPKO Pharmaseuticals LLC (16.8%). Rusnano became a shareholder of Pharmsintez in 2013 as a co-investor in a project for the production of drugs for the treatment of cancer and multiple sclerosis. The total cost of the project was 1.86 billion rubles, Rusnano’s investment was 1.19 billion rubles.

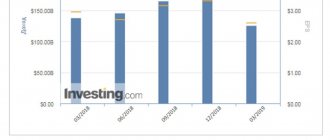

How Pharmsintez went public in 2010

Since 2015, Pharmsintez has become unprofitable. At the end of last year, the manufacturer’s net loss amounted to 280.58 million rubles. with revenue of 361.52 million rubles. At the same time, in the first half of 2021, Pharmsintez managed to double its revenue compared to the same period last year - to RUB 325.6 million. As Rusnano explains, the financial performance of Pharmsintez is influenced by the process of consolidating the assets of its subsidiaries, which began in 2021. Pharmsintez did not respond to Kommersant’s request.

Is Rusnano's investment policy effective?

Rusnano wants to exit Pharmsintez “with an acceptable level of profitability,” the company said. Taking into account the current financial situation, at best, one can count on other shareholders of Pharmsintez buying out the share, believes Nikolai Demidov, CEO of QuintilesIMS. According to QuintilesIMS, in the first half of 2021, sales of Sehydrin increased by 23%, while sales of Pencrofton and Neovir fell by 45% and 8%, respectively. “In addition to Sehydrin and Neovir, Pharmsintez’s drugs are clearly aimed at government contracts for the hospital and outpatient sector, the regional budgets for which have now been reduced,” notes Mr. Demidov.

How Rusnano parted ways with the homeopathic Kagocel

Rusnano, created by the state in 2011, has other pharmaceutical assets. The company acts as a co-investor in American drug developers Selecta Biosciences, BIND Biosciences, Cleveland BioLabs (drugs for cancer, cardiovascular diseases, influenza, malaria, nicotine addiction, etc.). She also owns 49% in the vaccine and drug developer NTpharma LLC (last week the Federal Antimonopoly Service approved an increase in Rusnano's share in the LLC to 55%), 33% in Nanolek LLC. In 2012, the state-owned company, together with the American venture capital fund Domain Associates LLC, established Novamedica, a developer of drugs in the field of gastroenterology, pain treatment, neurology, ophthalmology and rheumatology.

Deputy General Director of Stada CIS Ivan Glushkov believes that of all Rusnano’s projects in pharmaceuticals, Pharmsintez is the least promising.

“But if the government decides to support Russian manufacturers of substances, the cost of Pharmsintez could increase significantly,” he says. Market participants found it difficult to estimate the current value of Pharmsintez.

In 2013, Rusnano sold 34.45% in Nearmedic Pharma (manufacturer of the antiviral drug Kagocel) to its managers with a profitability exceeding 40%. This became a record figure for a state-owned company, its chairman of the board, Anatoly Chubais, said at the time (see Kommersant, December 16, 2013).

Maria Kotova

Frontier of replacement. The drug market is being actively restructured

5588

Evgeniy Petrov

The beneficiary of Biogenius is Sergei Bezhanov. Since 2017, he has been on the list of affiliates of Pharmsintez PJSC, holding the post of member of the board of directors of the joint-stock company. In mid-2018, he was removed from the list. The corresponding entry is in the information disclosure section on the Pharmsintez website.

“Biogenius” of Sergei Bezhanov also recently sued Pharmsintez, demanding to collect a debt of 3 million rubles and penalties of 2.2 million rubles. The dispute arose over rent. In May of this year, the Moscow Arbitration Court supported the position of Biogenius.

How to buy shares of innovative companies

I rarely pay attention to shares of innovative companies, because... They often have unstable income, no dividends, and are not displayed under the selection parameters I set. After analysis , I added Pharmsintez (LIFE) shares to the portfolio through the broker BKS at a price of 6.65 rubles. Around 1000 rubles. I plan to buy Qiwi after the dividend gap closes.

| Tool | Beginning of the week | Weekend | Profit/loss in $ | Yield in % |

| Investments in your own business | ||||

| Online store | 9200 | 492 | 5,35 | |

| Internet projects (sites) | 4000 | 109 | 2,73 | |

| Total | 13200 | 601 | 4,55 | |

| Independent Forex trading | ||||

| FxPro account | 1321,42 | 1349,01 | 27,59 | 2,09 |

| Roboforex account | 5457,05 | 5510,52 | 53,47 | 0,98 |

| Amarkets account | 1213,44 | 1213,44 | 0 | 0,00 |

| Total | 7991,91 | 8072,97 | 81,06 | 1,01 |

| PAMM accounts FxOpen | ||||

| hyBrazil | 277,47 | 253,00 | -24,47 | -8,82 |

| 100W | 318,51 | 321,41 | 2,90 | 0,91 |

| Goodsense | 300,59 | 304,48 | 3,89 | 1,29 |

| Total | 896,57 | 878,89 | -17,68 | -1,97 |

| Investing in cryptocurrency | ||||

| Bitcoin (BTC) | 3000 | |||

| Ethereum (ETH) | 800 | |||

| Ripple (XRP) | 800 | |||

| Litecoin (LTC) | 550 | |||

| Stellar (XLM) | 350 | |||

| Total | 5500 | |||

| Investments through BCS Broker | ||||

| Gazprom (GAZP) | 400 | 400 | 0 | 0,00 |

| Lenenergo (LSNG) | 453 | 453 | 0 | 0,00 |

| Unipro (UPRO) | 498 | 498 | 0 | 0,00 |

| Gazprom Neft (SIBN) | 247,88 | 247,88 | 0 | 0,00 |

| FGC UES (FEES) | 238,04 | 238,04 | 0 | 0,00 |

| TGK-1 (TGKA) | 267,53 | 267,53 | 0 | 0,00 |

| Alrosa (ALRS) | 511,68 | 585,16 | 73,48 | 14,36 |

| Polymetal (POLY) | 437,45 | 455,98 | 18,53 | 4,24 |

| RusAgro (AGRO) | 343,92 | 394,42 | 50,5 | 14,68 |

| KAMAZ (KMAZ) | 236,4 | 253,36 | 16,96 | 7,17 |

| Ross. networks (RSTI) | 306,21 | 306,21 | 0 | 0,00 |

| Bank St. Petersburg. (BSPB) | 466,89 | 466,89 | 0 | 0,00 |

| MMK (MAGN) | 400,34 | 447,11 | 46,77 | 11,68 |

| 562,74 | 562,74 | 0 | 0,00 | |

| Lukoil (LKOH) | 440,09 | 440,09 | 0 | 0,00 |

| Pharmsintez (LIFE) | 260,92 | 260,92 | 0 | 0,00 |

| Account balance | 56,33 | 56,33 | 0 | 0,00 |

| Total | 6127,42 | 6333,66 | 206,24 | 3,37 |

| Brokerage account Tinkoff Investments (Moscow Exchange shares only) | ||||

| Surgutneftegaz prev. | 97,81 | 97,81 | 0 | 0,00 |

| Aeroflot (AFLT) | 289,92 | 289,92 | 0 | 0,00 |

| MTS (MTSS) | 475 | 475 | 0 | 0,00 |

| Beluga Group (BELU) | 501,43 | 501,43 | 0 | 0,00 |

| Cherkizovo (GCHE) | 365,6 | 365,6 | 0 | 0,00 |

| Inter RAO (IRAO) | 138,3 | 138,3 | 0 | 0,00 |

| Account balance | 830,2 | 830,2 | 0 | 0,00 |

| Total | 2698,26 | 2698,26 | 0 | 0,00 |

| Stock RoboForex (CFD contracts) | ||||

| VOLKSWAGEN AG (VOW) | 603 | 603 | 0 | 0,00 |

| Intel Corporation (INTC) | 619,79 | 619,79 | 0 | 0,00 |

| Wells Fargo (WFC) | 383,25 | 383,25 | 0 | 0,00 |

| AT&T | 291,2 | 291,2 | 0 | 0,00 |

| American Tobacco (BTI) | 330,5 | 380,1 | 49,6 | 15,01 |

| Kimco Realty (KIM) | 349,5 | 456 | 106,5 | 30,47 |

| MGS Networks (MSGN) | 335,75 | 408 | 72,25 | 21,52 |

| Kroger (KR) | 669,5 | 669,5 | 0 | 0,00 |

| Zoom (ZM) | 1522,5 | 1522,5 | 0 | 0,00 |

| Netflix (NFLX) | 1941,5 | 1941,5 | 0 | 0,00 |

| Xerox (XRX) | 400,9 | 450,5 | 49,6 | 12,37 |

| Realty Income (O) | 920,1 | 970,95 | 50,85 | 5,53 |

| Carnival (CCL) | 600,3 | 730,5 | 130,2 | 21,69 |

| Spirit Airlines (SAVE) | 725,5 | 855,3 | 129,8 | 17,89 |

| 21 Century Fox (FOX) | 509,5 | 550,5 | 41 | 8,05 |

| Alibaba (BABA) | 3826,5 | 3826,5 | 0 | 0,00 |

| Pfizer (PFE) | 1083 | 1083 | 0 | 0,00 |

| Tesla (TSLA) | 1745,5 | 1745,5 | 0 | 0,00 |

| Account balance | 361,78 | 361,78 | 0 | 0,00 |

| Total | 17219,57 | 17849,37 | 629,8 | 3,66 |

| Stock CFDs via FxPro (MT4) | ||||

| Cisco (CSCO) | 837,5 | 837,5 | 0 | 0,00 |

| Boeing | 2605,2 | 3295,5 | 690,3 | 26,50 |

| Citigroup | 931,2 | 1058,5 | 127,3 | 13,67 |

| IBM | 1706,4 | 1706,4 | 0 | 0,00 |

| Kraft Heinz | 743,2 | 743,2 | 0 | 0,00 |

| MGM Resort | 467,2 | 555,3 | 88,1 | 18,86 |

| Alibaba | 2551,5 | 2551,5 | 0 | 0,00 |

| Oracle | 556,5 | 556,5 | 0 | 0,00 |

| Account balance | 60,36 | 60,36 | 0 | 0,00 |

| Total | 10459,06 | 11364,76 | 905,7 | 8,66 |

| Investments in real estate | ||||

| Rental | 5300 | 60 | 1,13 | |

| Non-distribution profit | 12679,01 | |||

| Total | 82071,8 | 84537,92 | 2466,12 | 3,00 |

For the rest of the report:

- Orders arrived and shipped to customers, net profit $492 per week . The online store website is in the TOP 3 in the city for 35% of positions. More clients come to the office because... still need advice on products.

- Internet projects move forward with difficulty, but the income is more or less stable +109$.

For independent trading, scalping strategies through FxPro worked at +$27.59, intraday and medium-term trading through turned out to be more profitable (+$53.47) . FxOpen PAMM accounts show a minus for the 2nd week, so I will withdraw money and trade on my own or test trading robots.

I continue to take profits on Russian securities. The maximum return in the portfolio of over 14% was shown by the shares of Alrosa and Rusagro. The total income for the week on Russian securities was $206.24 or 3.37%.

Volatility and growth in shares of foreign companies has been encouraging for the second week in a row. On the positive side of the election and the arrival of vaccines, investors are more willing to invest in securities. (KIM), as well as airline and cruise stocks, returned well at 30.47% The profit for the week was $629.8 or 3.66%. Trading CFDs on shares through turned out to be more successful due to Boeing with a yield of 26.5%. For this transaction, the income was $690.3, and the total was $905.7.

In general, the profit for the week amounted to $2466.12 or 3% of the deposit. I have long wanted to lock in a weekly income of over $2000 and so far I have succeeded.

Is it worth investing in shares of innovative companies?

There are 2 opinions regarding adding shares of innovative companies to the investment portfolio. Some analysts say that such investments will bring good returns in 5-10 years, others say that it is worth buying in small volumes at drawdowns of no more than 2-3% of the portfolio and selling on news. I stick more to the 2nd speculative option, because... I believe that not all shares of innovative companies will bring profit even after 10 years; in the medium term, you can make good money on them. Also pay attention to undervalued stocks with growth prospects.