The Pound Sterling Swiss Franc (GBP CHF) pair is one of the important currency pairs in Europe. It is a cross rate (currency pair without USD) where the pound is the base currency and the Swiss franc is the quoted currency. Thus, a rate of 1.23 means that 1 pound in June 2019 cost 1.23 Swiss francs.

The GBP CHF pair is quite popular among Forex traders. According to investing.com, the average volatility of the pair in 2021 fell by almost 30% - to 75 pp per day.

GBP/CHF forecast for today online

The forecast for today for the Pound and Franc is based on technical analysis indicators on 4 timeframes.

Previously, GBP/CHF was considered one of the most stable pairs, the forecast for which was relatively easy, but after Britain announced its exit from the EU, the stability of this instrument was greatly shaken. You should always read analytics before entering the market, but now the predictability of the pair’s behavior has decreased significantly, and volatility has increased, which, however, did not become a minus for intraday and medium-term traders, who now have the opportunity to increase their profits.

Despite the fact that the Pound/Frank is not the most common pair, it is not exotic. In general, despite all the changes in recent years, the long-known statement that the franc grows during global crises, when other currencies fall, still remains relevant.

Pound Sterling to Swiss Franc Today

1.294 -0.23%

The GBP – CHF currency pair is currently trading at 1.294, down -0.23% from the previous day.

| Key Statistics | Today | Yesterday |

| open | 1.291 -0.31% | 1.295 |

| Today's Low | 1.289 + 7.53% | 1.192 |

| Today's High | 1.298 -1.00% | 1.311 |

At allforecast.com we forecast future values using daily technical and fundamental analysis for a wide selection of currency pairs such as GBP and CHF.

We use a unique mathematical model that allows us to predict the behavior of the GBP/CHF currency pair.

If you are looking for a moment for a favorable GBP/CHF exchange rate, then our calculations and forecasts will be useful to you. You can choose the optimal time interval for yourself (daily, weekly, monthly)

GBP/CHF forecast for tomorrow (March 15, 2021): negative

Optimistic forecast:

1.2925

Pessimistic forecast:

1.2866

Average price:

1.2906

Expected daily volatility:

0.46%.

Trading the pound – Swiss franc pair.

This is one of the most volatile currency pairs. During one trading session, the movement exceeds several hundred points, but as they say, there are no rules without exceptions, and sometimes when extremely important news is released, longer movements in the rate are observed. The greatest activity in the market is observed from 11 o'clock Moscow time, when the London market begins its work. Currently, the time schedule has shifted slightly due to the failure of Russia to switch to winter time. Therefore, the European trading session begins an hour later, no longer at 9 a.m. Moscow time, but at 10 a.m. Weaker volatility is observed during the Asian trading session; its maximum value rarely exceeds 100 points; in fact, this is the most optimal choice for traders who love calm trading, and especially for those new to Forex. The American trading session is not particularly active either. This currency pair is perfect for a news trading strategy, and it is advisable to focus only on internal economic indicators for each currency, such as the unemployment rate, interest rate, retail sales (MoM) and some other factors.

The dynamics of movement for this pair can be seen on the GBP/CHF chart.

Which indicators should I choose to predict the GBP CHF exchange rate?

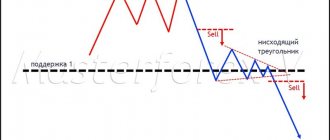

As previously noted, the exchange rate of the GBP CHF currency pair follows the levels of accumulation of market maker orders, which is clearly shown in the chart provided by the Masterforex-V Academy forum.

According to the Masterforex-V TS, there are strong and minor levels.

For a more complete analysis, I also suggest installing for FREE the author’s indicators of the Masterforex-V Academy: AO_ZOTIK (developed instead of Bill Williams’ AO) and an indicator developed instead of RSI – WPR_VSMARK.

The figure shows only 4 technical analysis tools included in the 30 proprietary know-how of the Masterforex-V trading system, which are used both for online trading and for professional training in Forex and the Exchange at the MasterForex-V Academy, but they already provide understanding logic of market movements.

Trading recommendations for working with the GBP/CHF currency pair

The Pound Sterling-Swiss Franc is classified as a minor currency due to its moderate level of liquidity. At the same time, high spreads do not allow scalpers to work effectively on price differences.

Such an asset is more attractive for binary trading, and FinmaxFX offers loyal trading conditions and a good percentage of profit on option transactions.

Within a trading day, volatility can reach 150 points, which is quite comfortable for many categories of traders. In particular, peak activity occurs from 10 to 19 hours Moscow time.

The time period from 20 to 9 hours is suitable for transactions using conservative and calm methods, when the pair’s activity decreases to 15 points.

The key factors influencing the positions of the GBP/CHF pair are the following:

- Economics and politics of the EU;

- Foreign trade relations of each country;

- Trade balance between Switzerland and Great Britain;

- World economic news;

- Interest rates of Central Banks;

- Cost of gold;

- Demand and the euro exchange rate.

GBP/CHF pair chart

A live chart for the GBPCHF currency pair is an ideal solution for those who do not want to install MT4 for analysis.

So should you trust the established opinion of the Internet about the pound/Swiss franc exchange rate on the stock exchange?

More than 90% of materials about the pound-franc exchange rate are written either by failed traders or analysts and then copied from article to article, which constantly states that the pound/Swiss franc exchange rate is influenced by:

- forecasts and further financial news on the economies of Great Britain and Switzerland, which are either “better” or “worse” than forecasts;

- movement of capital on the Swiss Stock Exchange or on the London Stock Exchange LSE.

Another misconception is expressed about the dependence of the GBP CHF currency pair on stock (exchange) indices, for example, on the FTSE 100 or the main index of the Zurich exchange - SMI 20 (Swiss Market Index).

- To do this, you can take two charts: the US dollar - Swiss franc exchange rate and the SMI 20 index chart:

Are they similar?

What affects the GBP CHF rate is the presence of volumes on pound or franc futures, which are traded on the Chicago Mercantile Exchange CME).

For example, the chart below shows how strong trends (impulses) in franc futures (both falling and rising) are supported by growing trading volumes:

Trading and earnings on the pound sterling / Swiss franc pair

We have not seen a single trader who could earn 300%-700% over several years by trading only the GBP CHF currency pair, since this will not work, because most of the time currency pairs are traded in a flat, forming complex corrective patterns. Therefore, Masterforex-V traders choose not to work on ONE currency pair or market, but to look for trends in any instruments - be it currency pairs, stocks, futures, commodity and cryptocurrency markets. The new technical analysis of Masterforex-V allows you to find a trend in any market: for the dollar/franc pair, then for stock indices, then for cryptocurrencies: BTC and LTC, and so on.

For example, you can take the traders of our Rebate - auto-copy service pro-rebate.com, who, when working on DIFFERENT markets, have profits of 300%-700% over several years, which is several times higher than the return on investments in stocks, ETFs or Mutual funds.

GBP CHF rate on the Chart with indicators online

general characteristics

The British pound sterling against the Swiss franc is a cross rate, as can be understood by the absence of the US dollar in the currency pair. However, this does not completely exclude the influence of the dollar, since the conversion of pounds into francs occurs through USD.

The main currency in this case is the pound, which is purchased for Swiss francs. The standard output for this pair is considered to be a four-digit quote of the form 1.2348, but there is also a more accurate one, taking into account tick movements, displaying five digits – 1.23479.

If you look at the chart, you can clearly see that the main movements in the pair occur from 08:00 to 16:00 GMT, the rest of the time activity drops sharply to 15-20 points per hour no more.

Oddly enough, trading on this currency pair is almost equally active on all days of the week, and the 20-week volatility calculator shows almost the same results from Monday to Friday with a difference of only a few points. As for intraday activity, it is most evident during the European trading session, as well as during its overlap with the American one.

What affects the GBP CHF exchange rate

The UK economy is one of the strongest in Europe, second only to Germany and France, while the country perfectly combines both historical traditions ( for example, monarchical rule

), as well as modern innovations and technologies. The latest sectoral analysis of the English economy is as follows:

- In first place is industry, which accounts for 54% of GDP;

- The services sector, although it provides only 45% of GDP, nevertheless employs up to three quarters of the working population (banking, brokerage, insurance, consulting services, etc.);

- Agriculture provides the country with no more than 1% of GDP.

Switzerland occupies a small territory in the Alpine mountains between Germany, France, Italy and Austria. Despite its small size and not very abundant mineral reserves, the country is highly developed and has a stable economy. Switzerland successfully offers its banking services around the world, and many of the richest individuals and corporations invest in its economy as one of the most reliable. By sector it has the following structure:

- Services and trade are the main industries, accounting for 73.4% of GDP;

- Industry retains 25.9% of income;

- Less than 1% of GDP remains for agriculture (0.7).

When comparing the chart of this pair with other Forex assets, you can trace a significant coincidence, which is most evident in the ratio: GBP/SEK – 87.5%, Pound/Dollar – 82.2%, GBP/SGD – 78.4%, Pound/ Yen – 71.2%, NZD/CHF – 66.8%, NOK/SEK – 66.8%, XTI/USD – 59.6%, as well as platinum against the dollar – 59.4%, NZD/USD – 59 .2% and XBR/USD – 57.2%.

The greatest inverse correlation for GBP/CHF is with other European currency pairs (especially the euro and pound), as well as some European stock indices: Euro/Pound – -95.6%, EUR/NOK – -72.8%, EUR/ NZD – -68.7%, USD/NOK – -62.4%, EUR/CAD – -56.2%, USD/CAD – -55.6%, EUR/CHF – -50.4%, and IT40 – -48.8%, UK100 – -46.2%, SPA35 – -41%.

The Swiss currency is very stable, and the indicators of its economy change very rarely and insignificantly, so more attention should be paid to the analysis of factors affecting the pound. The main events affecting the couple are:

- World gold prices;

- Price and demand for the euro;

- Economic performance of both countries (most of the UK);

- Interest rates of the Central Bank and speeches of their leaders, as well as monetary policy;

- Global economic and political turmoil;

- Trade balances (both countries).

Example of trading the British Pound and the Swiss Franc

As you know, on such currency pairs Forex brokers set high spreads, which does not allow you to make decent money in the short term with small price changes, which is why we preferred option trading with the FiNMAX broker, which is regulated by the Center for Financial Markets

in Russia, and, in general, we have been working with him for a long time.

Here's how we earned $42.6 in 8 minutes on the GBP/CHF currency pair:

After we selected the asset, we specified the option expiration date for 10:30

:

The option will close in 8 minutes

.

Our forecast shows that at the time the transaction is closed, the GBP/CHF quote will rise in price, so we clicked on the UP

and confirmed the transaction with

the BUY

:

If at the time of closing the transaction the price rises by at least 1 point, we will receive 71% of the profit, since our growth condition will be fulfilled.

Time passed quickly, and look at the chart to see how the price behaved:

The price has increased, as we predicted. In just 8 minutes, we earned $42.6 in net profit ($102.6 in revenue minus $60 of our investment).

The FiNMAX broker is very convenient with a huge variety of options terms, so you can get 71% profit in a minute, two or as long as you want, since the profit on options does not depend on the time of the transaction.

Features of the currency pair

For a long time, the pair was considered one of the most reliable during periods of global instability, a real refuge for investors, however, problems in the Swiss economy, and especially recent events around the UK, today raise a big question on the further relevance of this judgment.

Despite the significant difference in interest rates (0.25% for the United Kingdom and -0.75% for Switzerland), the analysis shows that it will not be possible to earn a significant profit on a carry trade today due to the small swap sizes of only +0 .03 points on long positions; on short ones it now comes out to about -8.11 pips.

A good strategy for trading GBP CHF is trading on news, when shortly before the release of an important economic event, a trader places pending orders in one direction or the other at some distance from the current price value, which are opened and triggered only in the right case. This approach allows you to earn good money regardless of whether forecasts or not. When there are no important events yet, and the pair is in an intraday or medium-term sideways trend, trading to break through the flat may be a good solution.

(

5

ratings, average:

4,60

). Please rate us, we tried very hard!

Characteristics of the Pound paired with the Franc

This is a highly volatile pair, and in 1990 a record maximum rate of 2.7460 was recorded. In the period 1990-1992, the asset maintained a growing trend until the peak value was recorded.

Then there was a quote to the level of 2.09 and after that there was a slow but steady decline in the graph until the end of the autumn of 1995. The absolute bottom remained until 2008.

The year 2009 was marked by a sideways correction for the pair, after which the downward movement continued in 2010. Fundamental analysis of the asset shows the impact of the economic crisis in the eurozone on the position of the British currency.

At the same time, the Swiss franc acts as a safe-haven currency, so both factors together serve as even more pressure for the asset to move lower. At the current time, the market bottom for the GBP/CHF currency pair is not fixed.

Structure of the GBP/CHF currency pair

The British economy is one of the strongest in the European region, behind Germany and France. The country combines historical traditions with modern technologies and innovations.

Almost 54 percent of GDP is generated by the industrial sector and 45 percent of GDP by the services sector, in particular banking, brokerage, insurance, consulting and others. Agriculture accounts for no more than 1 percent of the GDP structure.

Switzerland is a developed European country with a stable economy. The services of its banking sector are known and popular throughout the world, while there is a large influx of capital into the market due to its reliable status.

73.4 percent of GDP is generated by the services and trade sector, 25.9 percent by the industrial sector and less than 1 percent by agriculture.

Both countries maintain a high level of business activity, which determines the attractiveness of the combination of their currencies as a trading asset in the Forex market and in the binary options segment.

All FinmaxFX clients can trade the pair profitably and successfully, receiving bonuses and taking advantage of privileges, while steadily increasing profits.

The GBP/CHF currency pair is widely popular among traders in various areas. The franc strengthens during periods of crisis, as investors seek to preserve their capital and redirect it to the reserve currency.

Features of the behavior of the GBP/CHF currency pair

Despite the fact that there is no US dollar in the pair and that is why it is called a cross rate, the US currency has some influence on the position of the asset, in particular, the conversion process takes place in the dollar equivalent.

The ratio of monetary units in a pair shows how much one British pound is worth in franc equivalent. The quote is displayed in four-digit form, and five decimal places are used to display tick movements.

Trading activity with this asset is characterized as moderate and equally active during business days. The difference in values can be several points, no more.

Peak activity of traders occurs during the European session and at the junction with the American one.

Often the behavior on the chart coincides or is proportionally correlated with movements of such assets as “pound-dollar”, “pound-yen”, “pound-Singapore dollar” and others.

The Swiss franc is characterized by stability, since the economic performance of countries does not change sharply, so it is important to focus on the factors influencing the British pound.

GBP/CHF Analytics – Moving Averages

| GBPCHF | M30 | H1 | H4 | D | W | M |

| MA5 | trend down 1.2672 | trend down 1.2675 | trend up 1.2651 | trend down 1.2702 | trend up 1.2418 | trend up 1.2185 |

| MA10 | trend down 1.2679 | trend down 1.2661 | trend down 1.2711 | trend up 1.2580 | trend up 1.2246 | trend up 1.2045 |

| MA20 | trend down 1.2662 | trend up 1.2643 | trend down 1.2732 | trend up 1.2445 | trend up 1.2081 | trend up 1.2229 |

| MA50 | trend up 1.2651 | trend down 1.2724 | trend up 1.2574 | trend up 1.2215 | trend up 1.1967 | trend up 1.2626 |

| MA100 | trend down 1.2725 | trend down 1.2728 | trend up 1.2441 | trend up 1.2079 | trend up 1.2275 | trend down 1.3522 |

| MA200 | trend down 1.2728 | trend up 1.2615 | trend up 1.2267 | trend up 1.1983 | trend up 1.2611 | trend down 1.6377 |

| Sales | 5 | 4 | 2 | 1 | 0 | 2 |

| Purchases | 1 | 2 | 4 | 5 | 6 | 4 |

| Bottom line | sale | sale | purchase | purchase | purchase | purchase |

Which brokers are recommended for trading the GBP/CHF pair

The current rating of recommended brokers by the Masterforex-V Academy shows that the TOP 5 brokers are ideal for opening a real account with them. According to statistics from the free autocopy rebate service pro-rebate.com, about half of the traders trading on real accounts opened their accounts with NordFX , where you can find

- not only the main currency pairs AUD USD, EUR USD, USD JPY, GBP USD, NZD USD, USD CHF, USD CAD, USD RUB, but also their cross rates EUR CHF, EUR JPY, CAD CHF, EUR GBP, EUR NZD, AUD CHF, EUR AUD, EUR NZD, EUR CAD, USD SEK, USD NOK;

- stock indices S&P 500, Dow Jones 30, FTSE 100, NIKKEI 225, DAX 30;

- cryptocurrencies: BTC, ETH, DSH, BAB, ZEC, NEO, OMG and others;

- cryptocurrency indices 10ALT, TOP3ALT, TOP5CRYPT, TOP14CRYPT;

- CFDs on gold, silver and oil.