The QUIK terminal provides traders with extensive tools for working on the stock exchange. If a trading participant does not want to advertise the transaction volume, an iceberg order is used.

The name for these orders was not chosen by chance. The analogy with the marine theme is obvious. Icebergs drifting in the world's oceans have an insignificant part of the block protruding above the surface of the water. The bulk of the ice is hidden from the eyes of an outside observer.

Iceberg order concept

The Quik terminal has many different chips for trading.

It is advisable to know all types of orders to ensure that you are only using what you really need in your trading. If you do not understand the same orders and requests to enter or exit the market, then how will you know that you are using all the opportunities to make money. But you must agree, the main goal of our stay in the market is to earn money and earn a lot. Therefore, in this article we will look at what an iceberg order is in Kwik. The name very accurately defines the essence of the function itself. A trader can hide the true size of his position, like an iceberg hides a large block of ice. After all, only the smallest part of the ice floe is visible near the iceberg; most of it is hidden under water.

Iceberg application in Quik

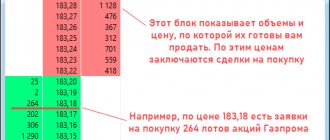

An iceberg order is an order to buy or sell N number of lots of an instrument with the condition that this N quantity will not be displayed in the order book in full, but in predetermined parts.

Ordinary traders with small brokerage accounts do not need this application, since large players encrypt huge volumes of instruments for purchase or sale. But an ordinary trader needs to be a little familiar with this order in order to understand where not to enter, since a major player is standing through an iceberg sell order and most likely he will push the market.

And vice versa, do not sell, even if there is a clear signal to sell. After all, there is an iceberg purchase order. And the market is more likely to begin to grow.

Advantages and disadvantages

Let's start with the advantages. An iceberg order helps a trading participant collect a significant volume of lots of an asset of interest without having a significant impact on the market.

Let's move on to the disadvantages. Such orders are in demand only by large exchange players. For private investors they are most often useless.

In addition, trading algorithms have long learned to track and identify icebergs. Consequently, such orders are unable to reliably hide the trading operations of large players.

Any trader can identify an iceberg. The main thing is to know what to pay attention to.

This is interesting. According to published statistics from the Moscow Exchange, currently approximately 10–12% of share purchase and sale transactions are carried out through iceberg orders.

How to submit an iceberg application in Quik: the first method

An iceberg order is placed only in shares. It cannot be traded on futures.

Select the desired tool from the current parameter table. And right-click and select “New iceberg order” from the pop-up menu. And we set the required amount of volume, and in the lower right corner we select the volume that will be shown in the glass.

Placing an iceberg order using the current parameter table

We buy with the left, we sell with the right

To start trading, you need to be able to use a mouse. All!

- “Left mouse button” - buy.

- “Right mouse button” - sell.

The order is placed at the price we click on in the order book. If there is an opposite order at this price, then a transaction occurs immediately. If not, then the application is placed in the “glass”.

For example

, if you left-click on the price of

153,540

and right-click on the price of

153,620

, then two orders will be placed in the “order book”. In the screenshot, two orders are in queue, one for sale, the other for purchase, and are waiting for further developments.

If you click on the selected one with the middle mouse button (wheel), the application will be cancelled.

Everything is super simple, the main thing is to try it! As promised, catch the video, by the way, in the video I also talk about a simple exercise that helps you get better at making transactions without risking your deposit.

Source

How to spot an iceberg order

This is more difficult to do on liquid instruments; quotes change quickly in the order book. You need to very carefully monitor the key levels on the chart and the number of lots in the order book.

Usually large players set a round sum of 700, 800, 950, etc. But they can also set an ordinary nondescript number, for example 573. When the entire volume in the glass is selected, this figure will pop up again and again. And on the chart the price will not be able to rise above a certain level, or lower if it falls.

It is not at all difficult even for a beginner to see such iceberg orders on shares of the second and lower echelons. The price of the instrument will remain in place, and in the glass, as soon as the volume is eaten, the same volume will appear in its place.

Iceberg order in the amount of 195 on the illiquid share Burzoloto

MECHANISM: BUYING/SELLING in CSCALP

The update for beginners has arrived. Today I’ll tell you how to buy/sell on the stock exchange. At the end of the article, catch a bonus

, I have prepared a video for you on how to properly configure the CryptoScalp drive after installing it, telling you all the nuances and life hacks for trading. Let's go!

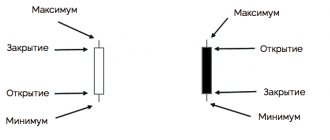

In order to understand how purchases and sales are made, we need to plunge a little into the theory, namely, understand the “GLASS” technique:

When traders' orders reach the exchange

, they are

either executed

(turned into transactions)

or queued

.

In stock exchange slang, this queue is called a “glass”.

in the CScalp “glass” are red

,

buyers are green

.

The price of an instrument changes vertically from bottom to top from 0 to infinity.

When prices rise

,

buyers move up

, and

when the price falls, the red ones (sellers) move down

.

QScalp. Tools for scalping. Instructions for use.

If you engage in frequent intraday transactions and/or scalp through the Quik terminal, then the question of a suitable and convenient drive for you probably arose after you made your first trade in Quik?))))

Now, I settled on the only convenient QScalp drive by Nikolai Moroshkin! Version 3.4 is now available. moroshkin.com/qscalp.html Discussion, support, answers to questions: www.2stocks.ru/forum/index.php?showtopic=15501&view=getlastpost

By the way, QScalp is the most convenient and suitable program for scalping of all available ones, after QuikOrdersDOM it’s like Heaven and Earth!

QScalp is the same analogue of the Bondar drive, but under Quik. The source code, written in C#, is also available.

Surprisingly, after Nikolai published his QScalp drive on 2stocks.ru, many essentially identical, but already paid analogues began to appear. For myself, as a user, I have identified several advantages: - convenient functionality. I hardly use a mouse. One keyboard; — presence of a “Trading Journal”. All transaction statistics are clear to see. From my transactions:

-it is also possible to set stops, not to mention limit and market orders; -trade feed. Identifying, for example, the execution of a large order or, for example, how they “eat up the big guy” is no longer a problem; -you can also customize the guide; -there is the possibility of “terminal emulation”, which is suitable when you first get acquainted with the terminal (I didn’t find out about it right away, which is why I lost money, tuition fees); -customizable color scheme;

Briefly.Basic keyboard operations:

-pressing and holding the “up arrow” key - opening and holding a long position. Releasing the key will close the long.

-pressing and holding the “down arrow” key - opening and holding a short. Releasing the key will close the short.

-if you hold down the “up arrow” or “down arrow” key, press and hold the right “Shift”, and then do the following:

-release the “up arrow” or “down arrow” key without releasing the right “Shift” key, and then release the right “Shift” key itself, thereby releasing the “up arrow” or “down arrow” key without closing the position . This will save you from such a case when, for example, you go to your trading terminal, say, to the chart and notice that the chart is moving up. Having realized this, you will switch to QScalp and then what? You will immediately open another position, i.e. add yourself. If you have enough money, a window will pop up notifying you about this and which is so easy to close)));

- Del key - closing a position; - Tab key - revolution; -Esc key - cancels all orders, including stop orders; -middle mouse button pressed on the specified price—places a stop order. The right mouse button removes it, like other requests;

Settings are easy to make by reading the program manual.

Source

Guest book

Nikolay Moroshkin

Roman Is it possible to somehow trade several instruments from one drive?

Is it possible to somehow switch between instruments? Yes, you can quickly load pre-saved settings via F3. You can also open several program windows; to do this, simply copy the folder with QScalp and launch each one from its own folder.

Thank you. Then everything suits me))

Roman

Is it possible to somehow trade several instruments from one drive?

Is it possible to somehow switch between instruments? Yes, you can quickly load pre-saved settings via F3. You can also open several program windows; to do this, simply copy the folder with QScalp and launch each one from its own folder.

QUIK trading terminal: a detailed review for beginners

Hello, dear friends! When a newbie first looks at an open trading terminal, it reminds him a little of the inside of a pilot's cockpit. A lot of incomprehensible buttons, strange icons, graphs, changing numbers in tables. In fact, this complexity is apparent, a couple of weeks of work and the platform seems convenient to you, and the purpose of the various tools is remembered in itself. Today the focus will be on a terminal called Quick , in addition to how to use QUIK, let’s compare its functionality with MetaTrader 5.

MetaTrader is more often used to work on Forex; if stock market instruments are presented there, only CFDs on them are available. There are certain differences in functionality. We'll talk about this in the final part of the review.

Getting started with QUIK

Registration and installation

We will work with software downloaded from the BCS website. A full review of the BCS broker was done earlier. When working on a real account, Kwik will be free. If your deposit is less than 30,000 rubles (300 rubles per month), the company provides demo access to it. A training account is sufficient for review.

Immediately after registration, you will receive a link to the terminal itself, keys and instructions for installing the software. The process is standard: run the .exe file, select the drive and folder where QUIK should be located.

Let's launch the terminal. The login and password are in the letter that contained a link to download Kwik for PC. For further work, you need to copy the public key file (pubring.txk) key ; we previously downloaded them from the link in the letter. If it is not there, you will see a message like:

Also, when logging in, you need to specify the server from which the terminal will receive data. Everything here is similar to MetaTrader - for training accounts we select the appropriate servers.

If the keys are in the required folder, a connection to the server occurs. We receive a message about this. A notification may appear indicating that some of the instruments will soon expire. The terminal can replace them automatically, but this can also be done manually later.

Immediately after launch, the workspace will look like this:

If you are not working with BCS, the appearance of the terminal after launch may be different. It depends on the broker and software version.

Let's briefly go through the main functionality:

- System . These are the main parameters of the terminal. Here you make settings, order data, select the server type if necessary.

- Create a window . We will study this menu below when setting up workspaces. The menu is used to display information on transactions and add new windows.

- Actions . Here you can edit tables and place requests for opening positions. You will also find a set of filters here.

- Broker . Here the KVIK terminal allows you to set limits on the derivatives market, cash, and securities. They can also be saved to a file or uploaded to the platform.

- Extensions . Necessary for creating volatility charts and your own strategy (which is also loaded from a previously created template).

- Services . Through this menu we have access to Lua and QPILE scripts, and general filters are also located here. You can also set a criterion for automatically canceling orders when certain conditions are met.

- Window . Configuring the arrangement of windows in the workspace. There are several preset layouts.

For greater clarity, let’s delete all windows open after starting the terminal and add everything necessary for trading shares and OFZs.

Where to trade with QUIK

If you are just starting out as a trader, it is advisable to choose a broker where you can try both Kwik and MT5. BCS is a good fit for this role; below I will briefly list the main trading conditions here:

- No restrictions on starting capital;

- There is a single account for working with shares and other stock market instruments. Access to all major exchanges in the world has been implemented. More than 950 assets are available on the St. Petersburg site alone;

- Leverage – up to 1:200;

- Uses MT5, Kwik, and has its own developments;

- The spread is minimal, at the Exness broker level;

- There is a demo account for QUIK.

Source

Difference between QUIK functionality and MT5

There is an opinion that Kwik is the choice of professionals, and MetaTrader is more of a pampering game and you can’t make serious money with it. A controversial statement, since both platforms have their merits.

Through Kwik you can work on the stock, derivatives and foreign exchange markets. There is an options board and generally maximum analytical information. Having a full glass in both desktop and mobile versions is worth a lot. There are no obstacles to automating trade and developing your own ATS.

On the other hand, MT5 is more user-friendly, information on commissions is visible, as is the trading history. It is much more convenient to test robots.

If we compare both terminals according to a number of criteria, we get the following picture (the winner is indicated on the right side):

- Support from brokers – QUIK ;

- Interface and ease of use - MT5 ;

- Usage fee – QUIK ;

- Availability of statistics on trading history, commissions - MT5 ;

- Work speed – MT5 ;

- Ease of creating and testing robots - MT5 .

As you can see, MT5 is at least no worse than Kwik . In the past, indeed, QUIK was practically the only solution for working on the stock market, but since then the situation has changed. Trading on Kwik is still considered prestigious, but those who tried MT5 did not have any special complaints about it.