MTS dividends in 2021 will definitely not fall below the level set in recent years. The mobile operator understands the importance of income for shareholders and sets itself high goals. It should be emphasized that the previous reporting period, designed for 3 years, has ended, and therefore the nearest board of directors is able to bring important news regarding the company’s financial policy. But shareholders should not worry, since no unexpected, unpleasant decisions are expected. Based on available forecasts, the main terms and conditions will remain the same as those in force in 2021. These are the ones you should focus on when calculating profitability and making a decision to sell or buy shares.

Overview of MTS company

MTS (Mobile TeleSystems) is one of the largest Russian telecoms.

Operates in Russia, Armenia, Belarus, Ukraine, Uzbekistan and Turkmenistan. The main activity is the provision of communications, mobile and broadband Internet. The headquarters is located in Moscow. The president of the company is Alexey Kornya.

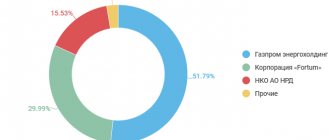

Main shareholders of MTS:

- AFK Sistema – 44.33%;

- Bastion – 5.77%;

- Stream Digital – 5.21%;

- MGTS – 0.38%;

- MTS management – 0.02%.

Free float is 44.29% - this is one of the highest indicators in Russia.

It should be taken into account that the share of effective participation of AFK Sistema, taking into account the ownership of shares in controlled legal entities, is 50.02%, which actually makes MTS a subsidiary of Sistema.

MTS shares are traded on the Moscow Exchange under the ticker MTSS. The company is also listed on the New York Stock Exchange. There are ADRs for MTS shares under the ticker MTB, one receipt contains 2 MTS shares.

Now 1 share of MTS costs about 325 rubles, and ADR – 9.5 dollars.

MTS has quite a lot of controlled companies in which the company's share is more than 90%, namely: MGTS (94.7%), RTK (100%), MTS Bank (94.47%), MTS Armenia (100%). In addition, MTS has a stake in such companies as NVision, DTV, Satellite TV, Stream Digital, Bastion, Ozon and a number of others.

Another actively developing direction of MTS is investment. In 2019, the MTS Investments project was launched, which so far includes investments in mutual funds through a subsidiary. But the company also plans to develop other areas, for example, creating a crowdfunding platform (fortunately, we already have experience - the Ozon.Invest platform).

In general, as you understand, MTS is a cool company.

ADR MTS dynamics 2021.02.11

ADR MTS dynamics 2021.02.11

Surely many were expecting something like -10%.

Meanwhile, analysts wavered yesterday:

Moscow. 11 February. INTERFAX - Investment company (IC) Sova Capital has lowered the forecast price of American Depository Receipts (ADR) of Mobile Telesystems (MTS) from $9.7 to $8.5 per share, according to the IC review.

In addition, the recommendation for these securities was downgraded by analysts from “buy” to “hold”.

As noted in the review, Sova Capital experts revised the MTS valuation model after the company announced plans to update the listing structure of its shares on stock exchanges. According to analysts, the uncertainty surrounding the continued existence of a listing of the company's securities in the United States raises concerns regarding liquidity and the emergence of additional risks in corporate governance. “MTS’s dividend policy and ongoing buyback program remain key factors supporting the securities, and we believe that the new listing structure may also lead to a revision of these main elements of MTS’s investment case,” the review says.

Moscow. 11 February. INTERFAX - Uralsib Corporation has put the forecast value and recommendation for American Depositary Receipts (ADR) of Mobile Telesystems (MTS) under review, the corporation's review says.

As reported, on February 8, MTS announced that it plans to update the structure of listing its shares on stock exchanges: including assessing whether listing in the United States is in the interests of shareholders, and will also consider the possibility of making the Moscow Exchange the main platform for trading securities.

“Even the theoretical possibility of MTS leaving the New York Stock Exchange will be negatively perceived by the market. In our opinion, ADR delisting looks like a highly likely scenario, despite the company's statements about the absence of any decisions in this regard at the moment. If the scenario is realized, this will inevitably lead to an outflow of some portfolio investors from MTS securities, and in addition to this, concerns may arise regarding the risk of a decline in the quality of corporate governance in the company. The news, in our opinion, will be received extremely negatively by the market and will put pressure on both ADR quotes and (to a lesser extent) local shares, at least until further clarity appears on this issue. Accordingly, we are withdrawing our recommendation for MTS ADR for review,” Uralsib analysts write.

Dividends on MTSS shares

Get information about dividends on MTS shares and their payment dates. For detailed information, see the relevant section of the page (ex-dividend date, dividend amount and payment date). Ex-dividendDividendTypePayment dateIncome

| 09.10.2020 | 31,92 | 01.11.2020 | 9,73% |

| 08.07.2020 | 31,92 | 01.08.2020 | 9,68% |

| 09.01.2020 | 31,92 | 01.02.2020 | 10,17% |

| 11.10.2019 | 28,66 | 01.12.2019 | 8,86% |

| 08.07.2019 | 22,58 | 01.08.2019 | 8,23% |

| 08.10.2018 | 26 | 01.11.2018 | 9,94% |

Participate in the forum to interact with users, share your opinions and ask questions to other members or authors. Please use standard writing style and adhere to our guidelines.

It is strictly prohibited:

- Posting links, advertising and spam;

- Profanity, as well as replacing letters with symbols;

- Insults towards forum participants and authors;

- Inciting ethnic and racial hatred;

- Comments containing capital letters.

- Comments are allowed only in Russian.

Mobile TeleSystems (JSC) JSC

| 8.54% | 85.9% | 1 |

| current yield | profit share | DSI index |

Cumulative dividends in the next 12m: RUB 28. (forecast) Average dividend growth rate 3y: n/a Nearest dividends: 19.6 rub. (5.98%) 07/09/2021 (forecast)

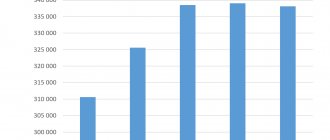

Total payments by year

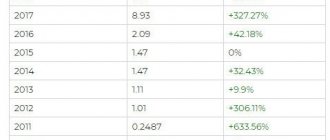

YearDividend (RUB)Change to previous year

| track 12m. (forecast) | 28 | -5.08% |

| 2020 | 29.5 | -29.61% |

| 2019 | 41.91 | +61.19% |

| 2018 | 26 | 0% |

| 2017 | 26 | 0% |

| 2016 | 26 | +3.3% |

| 2015 | 25.17 | +1.49% |

| 2014 | 24.8 | +25.13% |

| 2013 | 19.82 | +34.74% |

| 2012 | 14.71 | +1.17% |

| 2011 | 14.54 | -5.58% |

| 2010 | 15.4 | -23.57% |

| 2009 | 20.15 | +35.78% |

| 2008 | 14.84 | +53.46% |

| 2007 | 9.67 | +27.24% |

| 2006 | 7.6 | +32.13% |

| 2005 | 5.75 | +79.63% |

| 2004 | 3.2 | +88.36% |

| 2003 | 1.7 | n/a |

| 2002 | 0 | -100% |

| 2001 | 0.24 | n/a |

All payments

Dividend declaration date Register closing date Year for dividend accounting Dividend

| n/a | 10/12/2021 (forecast) | n/a | 8.4 |

| n/a | 07/09/2021 (forecast) | n/a | 19.6 |

| 31.07.2020 | 12.10.2020 | 2020 | 8.93 |

| 09.04.2020 | 09.07.2020 | 2020 | 20.57 |

| 25.11.2019 | 10.01.2020 | 2019 | 13.25 |

| 30.07.2019 | 14.10.2019 | 2019 | 8.68 |

| 11.04.2019 | 09.07.2019 | 2019 | 19.98 |

| 30.07.2018 | 09.10.2018 | 2018 | 2.6 |

| 11.04.2018 | 09.07.2018 | 2018 | 23.4 |

| 31.07.2017 | 13.10.2017 | 2017 | 10.4 |

| 12.04.2017 | 10.07.2017 | 2017 | 15.6 |

| 01.08.2016 | 14.10.2016 | 2016 | 11.99 |

| 12.04.2016 | 05.07.2016 | 2016 | 14.01 |

| 31.07.2015 | 14.10.2015 | 2015 | 5.61 |

| 15.04.2015 | 07.07.2015 | 2015 | 19.56 |

| 01.08.2014 | 14.10.2014 | 2014 | 6.2 |

| 14.04.2014 | 07.07.2014 | 2014 | 18.6 |

| 02.08.2013 | 14.08.2013 | 2013 | 5.22 |

| 29.04.2013 | 08.05.2013 | 2013 | 14.6 |

| 12.04.2012 | 10.05.2012 | 2012 | 14.71 |

| 27.04.2011 | 10.05.2011 | 2011 | 14.54 |

| 20.05.2010 | 07.05.2010 | 2010 | 15.4 |

| 21.05.2009 | 08.05.2009 | 2009 | 20.15 |

| 16.04.2008 | 08.05.2008 | 2008 | 14.84 |

| 16.05.2007 | 14.05.2007 | 2007 | 9.67 |

| 23.05.2006 | 06.05.2006 | 2006 | 7.6 |

| 19.05.2005 | 03.05.2005 | 2005 | 5.75 |

| 25.06.2004 | 01.07.2004 | 2004 | 3.2 |

| 01.07.2003 | 01.07.2003 | 2003 | 1.7 |

| 01.08.2001 | 01.08.2001 | 2001 | 0.24 |

All dividends

Profit forecast next. 12m: 56893.29 million rub. Number of shares outstanding: 1745.42 million. Stability of payments: 1 Stability of growth: 1

All company dividends for the last 10 years

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 6 Jul 2021 | 8 Jul 2021 | 12M 2020 | 26,51 ₽ | 7,94% | 22 Jul 2021 | ||

| 8 Oct 2020 | 12 Oct 2020 | 6M 2020 | 8,93 ₽ | 2,66% | 26 Oct 2020 | ||

| 7 Jul 2020 | 9 Jul 2020 | 12M 2019 | 20,57 ₽ | 6,11% | 23 Jul 2020 | ||

| 8 Jan 2020 | 10 Jan 2020 | 9M 2019 | 13,25 ₽ | 4,04% | 24 Jan 2020 | ||

| 10 Oct 2019 | 14 Oct 2019 | 6M 2019 | 8,68 ₽ | 3,18% | 28 Oct 2019 | ||

| 5 Jul 2019 | 9 Jul 2019 | 12M 2018 | 19,98 ₽ | 7,01% | July 23, 2019 | ||

| 5 Oct 2018 | 9 Oct 2018 | 6M 2018 | 2,60 ₽ | 0,95% | 23 Oct 2018 | ||

| 5 Jul 2018 | 9 Jul 2018 | 12M 2017 | 23,40 ₽ | 8,13% | July 23, 2018 | ||

| 11 Oct 2017 | 13 Oct 2017 | 6M 2017 | 10,40 ₽ | 3,56% | 27 Oct 2017 | ||

| 6 Jul 2017 | 10 Jul 2017 | 12M 2016 | 15,60 ₽ | 6,57% | July 24, 2017 | ||

| 12 Oct 2016 | 14 Oct 2016 | 6M 2016 | 11,99 ₽ | 5,16% | 28 Oct 2016 | ||

| 1 Jul 2016 | 5 Jul 2016 | 12M 2015 | 14,01 ₽ | 5,72% | July 19, 2016 | ||

| 12 Oct 2015 | 14 Oct 2015 | 6M 2015 | 5,61 ₽ | 2,61% | 28 Oct 2015 | ||

| 3 Jul 2015 | July 7, 2015 | 12M 2014 | 19,56 ₽ | 8,02% | July 21, 2015 | ||

| 10 Oct 2014 | 14 Oct 2014 | 6M 2014 | 6,20 ₽ | 2,74% | 28 Oct 2014 | ||

| July 3, 2014 | July 7, 2014 | 12M 2013 | 18,60 ₽ | 5,74% | July 21, 2014 | ||

| 14 Aug 2013 | 14 Aug 2013 | 6M 2013 | 5,22 ₽ | 1,74% | 28 Aug 2013 | ||

| May 8, 2013 | May 8, 2013 | 12M 2012 | 14,60 ₽ | 5,34% | May 22, 2013 | ||

| May 10, 2012 | May 10, 2012 | 12M 2011 | 14,71 ₽ | 6,32% | May 24, 2012 | ||

| May 10, 2011 | May 10, 2011 | 12M 2010 | 14,54 ₽ | 5,72% | May 24, 2011 | ||

| May 7, 2010 | May 7, 2010 | 12M 2009 | 15,40 ₽ | 6,23% | May 21, 2010 | ||

| May 8, 2009 | May 8, 2009 | 12M 2008 | 20,15 ₽ | 11,1% | May 22, 2009 | ||

| May 8, 2008 | May 8, 2008 | 12M 2007 | 14,84 ₽ | 5% | May 22, 2008 |

MTS (MTSS) dividends per share (annual values)

In this table, all dividend payments are summed up by the years for which the payment was accrued. % 201120122013201420152016201720182019 LTM Dividend, RUR/share? 14.5 14.7 19.8 24.8 25.2 15.6 33.8 22.58 42.5 29.5 Div income, joint-stock company, % 7.9% 6.0% 6.0% 14.7% 12.0% 6.0% 12.2% 9.5% 13.3% 9.2% Dividends/profit, % 51% 100% 105% 66% 121 % 68% 157% 110% Dividend payout, billion rubles 30.0 30.4 41.0 51.2 52.0 32.2 67.5 45.1 85.0 58.9 Compare the indicator with other companies At the end of 2021, MTS paid dividends in the amount of 42.5 rubles per ordinary share. The total volume of payments amounted to 84.956 billion rubles. The dividend yield of an ordinary share at the current market price is 13.3%.

MTS dividends for 2021

MTS announced record dividends.

By the way, we believe that the announcement of dividends went unnoticed by the market, as well as the upcoming redemption of shares; apparently everyone was registered on Twitter.

“MTS DIVIDENDS FOR 2021 COULD BE UP TO 46.8 BILLION RUBLES - COMPANY”

https://e-disclosure.ru/portal/event.aspx?EventId=iNZciv-CZ3kKBaRyTYax5Yw-BB

The wording may be confusing, but this is a common thing, for example, for 2016 there was the same wording, but this did not mean that for the entire 2021 the dividend was 15.6 rubles.

https://e-disclosure.ru/portal/event.aspx?EventId=4jC6FaQ-C6EipWXOTGrYdew-BB

1. So, the payout is historically the largest.

This gives 33.8 rubles in dividends for 2021! Shareholders should be very happy. Don’t buy at any price, it’s more than 10% on your investment.

Total for 2021 they will pay 20.8 + 46.8 = 67.6 billion rubles

FCF for 2021 is 71.5 billion rubles, but this does not take into account the payment of interest on the debt, and the net debt is more than 200 billion rubles.

Obviously, after paying %%, they will pay even more than 100% FCF.

FCF increased a) due to an increase in operating income b) due to a decrease in capex, but 5G is ahead and capex will grow again, although not by much.

That is, is there a chance of repeating the +30rub dividend? They probably exist.

Although the presentation talks about 52 billion rubles in 2021, that is, 26 rubles. This will become clearer based on the results of the interim dividends.

2. The second point is that Stream Digital will join

1) Propose to the annual General Meeting of Shareholders of MTS PJSC to make a decision on the reorganization of MTS PJSC in the form of merging the following subsidiaries into MTS PJSC: Stream Digital LLC and SSB JSC. 2) Approve the rationale for the conditions and procedure for the reorganization of MTS PJSC in the form of the merger of Stream Digital LLC and SSB JSC to MTS PJSC (Appendix). 2. Recommend to the annual General Meeting of Shareholders of MTS PJSC to make changes to the charter of MTS PJSC in connection with the reorganization in the form of merger of Stream Digital LLC, SSB JSC to MTS PJSC (Appendix).

There is no need to pay attention to the ransom of 234 rubles, this is a standard procedure.

As a result, 5.21% will be repaid in the near future. This means that when distributing the same amount as dividends in the future, the dividend will already be 5.5% higher . Conventionally, not 33.8 rubles, but 35.65 rubles.

After the shares are redeemed, a new buyback (and the shares will then be redeemed again and the dividend will increase again). AFK Sistema somehow needs to reduce its debt by 50 billion rubles. By the way, what does this give to AFK System?

3. Effect on the AFK System.

Standard dividend of 26 rubles or 52 billion rubles. assumed payments of 31.2 billion rubles in the summer, in the base case we believe that AFK Sistema would account for 50% of this amount, that is, 15.6 billion rubles.

But the dividend was increased from 31.2 billion rubles to 46.8 billion rubles, that is, the share of AFK Sistema is 23.4 billion rubles ( 7.8 billion rubles more or 0.65 rubles per share )

On the call they said that servicing the debt would cost 17 billion rubles, that is, 6.4 billion rubles already remain. Another 43.6 billion rubles are needed. But this is already better than the initial input data suggested.

Another 43.6 billion rubles are needed. But this is already better than the initial input data suggested.

That is, the effect per 1 share of AFK Sistema is +0.65 rubles .

You can also expect that similar pumping will happen from other strong daughters.

4. So, if we return to MTS.

The dividend for 2021 is 33.8 rubles (it is not a fact that it will be repeated for 2021, but there is a possibility of more than 30 rubles),

Redemption of shares will increase the value of each share by 5.5% and future dividends by 5.5%.

The probability of BuyBack No. 3 is high

How much interim dividend will be paid? If they adhere to the strategy outlined in the presentation, then the dividend in the fall will be 3 rubles. But we believe they pay the entire FCF and will be able to pay another 10-12 rubles. Then you can get over the next 6 months 23.4 + (10÷12) = 33.4÷35.4

MTS bonds are traded with a yield of ~7.5%, with an issue date later than 2021, that is, there is no tax on them. With dividends of 30-35 rubles (26.1-30.45 including tax), shares can cost

26.1/7.5% = 350 rub.

30.45/7.5% = 400 rubles

Considering that the Central Bank will further reduce the rate, this is quite realistic in a year.

From the current 280 rubles, this is a body growth of 70-120 rubles or 25-43% + dividends on top of 10-15%.

We believe the shares are worthy of attention and their share in every conservative portfolio.

Dividends paid by MTS

This table shows all the latest dividend payments of MTS separately: 1 line - 1 payment decision. Ticker date T-2 cut-off date Year Dividend period, rub Share price Div. yield MTSS 10/08/2020 10/12/2020 2021 Q2 8.93 334.65 2.7% MTSS 07/07/2020 07/09/2020 2021 Q4 20.57 338.05 6.1% MTSS 01/08/2020 10.0 1.2020 2021 3 quarter 13.25 328.15 4.0% MTSS 10/10/2019 10/14/2019 2021 Q2 8.68 272.75 3.2% MTSS 07/05/2019 07/09/2019 2018 Q4 19.98 284.95 7.0 % MTSS 10/05/2018 10/09/2018 2021 Q2 2.6 275.1 0.9% MTSS 07/05/2018 07/09/2018 2021 Q4 23.4 288 8.1% MTSS 10/11/2017 10/13/2017 2021 Q2 10 .4 291.95 3.6% MTSS 07/06/2017 07/10/2017 2021 Q4 15.6 237.55 6.6% +add dividends All dividends Buy shares

MTS dividends in 2021

In January 2021, the company has already paid special dividends - it distributed the proceeds from the sale of its Ukrainian subsidiary: 13.25 rubles of additional dividends per share. This amount is not taken into account in the overall “offset”.

Based on the results of 2021, MTS has already paid part of the dividends - in October 2021, shareholders received 8.68 rubles per share.

Payment of final dividends for 2021 will occur in July 2020. MTS will pay 20.57 rubles per share, which at the current share price of 326 rubles gives a dividend yield of 6.3%.

Thus, the total amount of MTS dividends in 2021 is 29.25 rubles + 13.25 rubles special dividend. Quite consistent with the company's dividend policy. The total profitability of MTS for this year exceeds 13%.

And here’s another interesting article: The hottest dividends of Russian companies in July 2021 The last day to buy MTS shares for dividends is July 7, 2021 (the register of shareholders will close on July 9, but due to the T+2 trading mode, you will need to buy shares earlier) .

A tax of 13% will be withheld from dividends received, so in fact, not 20.57 rubles, but 17.89 will be credited to your account.

Dividend history for 2019

According to an open source, MTS paid ₽19.98 and ₽8.68 dividends in 2021 and ₽13.25 in 2021.

Dividend forecasts for 2020

Two sources predict a total dividend of ₽41.91 per MTS share*.

How much do you need to invest in MTS to receive ₽100,000 in dividends monthly?

Let's say we want to buy MTS shares at today's price of ₽324.3 and, based on open source data, the projected dividend in the new year (2020) will be ₽41.91 (div. yield - 12.92%)

Target:

- ₽100,000 per month or ₽1,200,000 per year.

Calculation:

- At ₽41.91 in dividends per share, we should have 28,633 shares in the portfolio. (₽1,200,000 / ₽41.91)

- At a price of ₽324.3 per share, the price of the portfolio is ₽9,285,682 (₽324.3 x 28,633)**

- Thus, a one-time dividend payment for 28,633 shares of MTS PJSC will be ₽1,200,000. Divided by the number of months in the year, we get ₽100,000 per month in passive income.

Bottom line: by investing RUB 9,285,682 in , you would receive approximately 28,633 shares, which would pay RUB 1,200,000 in dividends in 2021

Stock return

If we take the price of MTS shares in a wide range of 270–300 rubles, then the dividend is 28 rubles. per one joint stock company gives a dirty profitability of about 9.3–10.4% and a net (including personal income tax) profitability of about 8–9%.

You also need to take into account that MTS is conducting a share buyback and in the future plans to repay the purchased securities, which will have a positive effect on payments.

Is it worth taking MTS for dividends in 2021?

MTS has already released a report for the 1st quarter of 2021, so we can assess the consequences of the pandemic for the telecom. I would like to note that MTS survived the crisis quite well.

Firstly, all telecoms generally performed well, as more people began to spend time at home, communicating on the Internet and by phone.

Secondly, MTS has a fairly diversified business: it not only provides communication services, but also sells phones and accessories, MTS Bank issues loans, and Sistema Capital makes money on commissions through mutual funds. In general, there is not only telecom and digital, but also banking and investment activities.

Thus, for the 1st quarter of 2021, revenue amounted to 119.6 billion rubles, which is higher than the same period last year – then MTS earned 109.8 billion rubles. Net profit also increased – to 17.9 billion rubles against 17.8 billion rubles.

In general, if you look at the dynamics of financial results, you can see that the company’s revenue and net profit remain at approximately the same level from year to year (the exception is 2021, but there is a gigantic fine in the Uzbek case, and the payment of dividends is, basically had no effect).

MTS has a large margin of safety to pay dividends in the declared amount even with large expenses. In addition, AFK Sistema needs dividends from its subsidiaries, so MTS cannot help but pay dividends even if it wants to.

Looking at the statements, you might think that the company's debt load is growing. Thus, in 2021, long-term liabilities increased sharply from 270 billion to 542 billion rubles, and by the 1st quarter of 2021 they grew to 559.7 billion rubles. Now the majority of MTS capital consists of debts.

You might think this is bad, but it's not.

In fact, in 2021, MTS increased its stake in MTS Bank to a controlling stake and began to take into account all its assets, liabilities and results of its activities in the company’s general reporting.

What are liabilities for a bank? That's right - deposits of legal entities and individuals. For a bank, loans are assets and deposits are liabilities.

In fact, if you isolate from the reporting the results of the work of only the telecommunications company MTS, then there will be stable indicators.

By the way, due to the large share of bank liabilities in the consolidated statements of MTS, there is no point in calculating the P/S and P/B multipliers - they will be distorted. According to them, it turns out that MTS is fundamentally overvalued, although the valuation of the telecom itself, excluding the banking business, is quite average.

In general, MTS is a mature and stable company that has occupied a strong niche among telecoms and is developing its own ecosystem (read: secondary businesses) rather than its main direction. Most of the profit comes from subscription fees, i.e. In fact, a subscription business model is being implemented - this is the most sustainable model in a crisis, since people do not stop using subscriptions.

During quarantine, digital services SmartMed and Smart Education, cloud technologies, and big data were in high demand. This segment is the fastest growing in the MTS ecosystem. At the end of the quarter, it provided about 2.5 billion rubles. revenue growth. In the future, we can expect that the direction will continue to develop, ensuring further growth of the group’s business.

There are other growth points - the introduction of the 5G format, expansion into foreign markets, consolidation with other operators (or their absorption). And, of course, the development of related businesses – banking and investment. All this gives confidence in the stability of the company and the promised dividends.

So MTS can be conditionally considered a quasi-bond. Well, or a conservative dividend blue chip.

Another argument in favor of buying MTS in 2021 with dividends is an active buyback. The company plans to spend about 15 billion rubles on the buyout.

However, I will also note certain risks that must be taken into account when investing in MTS:

- Dependence on the AFK System. This seems to be a plus (you can safely expect big dividends + The system will support its daughter if something happens), but also a minus. There are risks that AFK Sistema will squeeze all the juice out of MTS, like Rosneft from Bashneft (although Yevtushenkov manages his business quite wisely). A developed business like MTS needs to invest more to achieve a breakthrough - and dividends remove capital from the company. On the other hand, MTS breakthroughs are of no particular use.

- Cancellation of roaming in Russia. This affected the commissions that MTS received as additional income from subscription fees.

- People began to travel less. Revenue from foreign roaming decreased, which was also reflected in the reporting. As a result, MTS does not receive part of its usual profit. When foreign travel resumes, this income item will return to its previous level.

- Strong competitors. The subscriber base is already divided between the main competitors - MTS, Beeline, Tele2 and Megafon. The same Tele2 was bought by Rostelecom and the provider will actively promote it. In short, there are simply no growth points in the domestic market, but there is fierce competition.

- Difficult situation in the banking sector. The crisis in the banking sector is still awaiting us, and the operating results of MTS Bank will affect the operating results of the entire Group.

- The MGTS subsidiary is in a rather difficult financial situation and has not paid dividends at all this year, and if MTS consolidates it, it will accumulate debt.

But in general, most of the disadvantages are due to the specifics of a developed business and are generally characteristic of a significant number of companies of this level. But the impact of the pandemic is temporary, and investors understand this. Perhaps this is why, after the March fall, MTS recovered faster than the market.

Financial results

MTS revenue in the fourth quarter of 2021 according to international financial reporting standards (IFRS) increased by 7.4% compared to the same period in 2021 and amounted to 133.7 billion rubles.

Adjusted OIBDA for the reporting period increased by 1.3%, to RUB 52.5 billion, including due to stable growth in revenue from core services. MTS's net profit in the fourth quarter of 2020 increased 2.4 times, to 13.1 billion rubles. The company explains this growth by stable performance of its core business and a decrease in net interest expenses, as well as the effect of changes in exchange rates.

At the end of 2021, MTS revenue increased by 5.2% and amounted to 494.9 billion rubles. Adjusted OIBDA increased by 1.7%, to RUB 215.2 billion, net profit - by 13.2%, to RUB 61.4 billion.

MTS capital expenditures at the end of 2021 amounted to 91.6 billion rubles, net debt - 317.6 billion rubles.

Annual meeting of MTS shareholders in 2021

The annual meeting of MTS PJSC took place on June 28 at the company's main office in Moscow. MTS shareholders and investors were given the opportunity to participate in resolving the following company issues:

- regulation of the 2021 annual meeting and possible changes thereto;

- review and approval of annual documentation (profit and loss statements, accounting documentation);

- comparison of the results of the current and last year;

- elections of members of the Board of Directors, Audit Commission;

- adoption of the edition of the Charter;

- regulations on financial payments to board members;

- reorganization of the company, attraction of subsidiaries.

Above are only the main issues that were discussed at the annual congress. The full list of questions can be found on the corresponding page of the official press release. The company's website also provides current news on this issue for public consumption. In accordance with the above events, today it is possible to approximately predict the cut-off and payment dates.

What dividends will be paid in 2021?

For how much MTS will pay in dividends per security in 2021, see the table above. And the total amount of dividends will be 56 billion rubles.

MTS adheres to the dividend accrual structure based on payments 2 times a year.

Question: if the dividend is constantly growing, then why are MTS shares falling? The point here is that the company devotes almost all of its cash flow to dividends.

The reason is the unstable financial condition of the main shareholder, the AFK Sistema holding company, which needs economic support. In accordance with this, MTS has the risk of insufficient investment, unfavorable transactions for the organization of transactions in favor of the main majority shareholder, and other issues that negatively affect the price of securities.

MTS shares and dividends in 2021

The acquisition of securities of MTS PJSC is attractive for small and large investors. The current level of profitability is set at 9.93% at the time of publication of the material, and the share of profit is 76.34%. The company guarantees stable payments and demonstrates positive growth dynamics. The payment for the previous period amounted to 23.40 rubles per share, and the total amount exceeded 46 billion rubles. These indicators are quite remarkable and have no competition among other telecommunications operators.

Dividend payment date

You can make a profit only in accordance with the official dates. This number will be announced immediately after the closure of the MTS register in 2021. The last date, current information on interest and other important information are published in the corresponding section of the official website. You can access the news section by subscribing to the free email newsletter by filling out the appropriate form. Meeting dates and other relevant information will be communicated in the event of any securities holding.

MTS dividends per share in 2021 - latest news

Actually, all the most important things about the size of MTS dividends in 2021 per share are said a little higher. But for a better understanding of the situation, it should be emphasized that:

- the exact amount of payments, including the amount of accruals to holders for each available share, is unknown;

- the minimum profit for each security will be guaranteed to be above 20 rubles;

- the document regulating the procedure for settlements with shareholders has not been adopted;

- its consideration and adoption is planned for the near future.

Considering the above, there is no reason for people who have invested in a mobile operator to worry. They just have to wait for news or, if they find a more profitable source of income, sell their existing portfolio and replace it with other promising investments.

How to buy MTS shares for an individual and receive dividends?

As stated earlier, all interested individuals and legal entities can gain access to securities trading. To do this, you initially need to have a certain amount that will be required to purchase a certain number of shares on the stock exchange or from official representatives. The larger the final package of securities, the higher your profit on the final deductions from dividends. If you have not previously encountered this issue, it is strongly recommended that you seek information in the relevant news sections, where you can read recommendations for the greatest efficiency from trading.

How to buy shares and receive dividends

MTS shares are listed on the Moscow Exchange, and it is best to use the services of a licensed broker to purchase them.

Best brokers

Here you can find a list of the best brokers on the Russian market.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Warning about Forex and BO

The Internet is replete with many offers for trading on Forex or binary options. The investor must understand that such pseudo-financial firms make their own income from the losses of their clients, so it is better not to mess with them. There are no shares or other exchange instruments on these platforms.

It is worth working only through licensed brokers, who actually allow you to buy MTS securities in the name of the investor and receive dividends on them.

Closing the register for dividends

The closing date of the register for dividends coincides with the cut-off numbers. After this action, the official payment date will be set, after which you will be able to receive the accumulated money for further use. As stated earlier, in 2021 the deadline is set at 09.10, in the case of the forecast for 2021, the payment will be made on August 03, 2021, and the profit percentage will be about 137%. If the above information is confirmed, investors will make significant profits over the given period.

Important

To get into the register, you need to buy securities two trading days before the closing date of the register. Then the date of delivery of shares under the concluded transaction will coincide with the date of registration of the register.

If the shareholders' meeting has not yet taken place, the table shows the amount of dividends per share recommended by the board of directors. A predicted value may also be provided. Dividend yield is calculated based on the closing quote of the previous trading day (if the closure of the register has not yet taken place) or two days before the cutoff.