In order to understand how profitable a particular investment is, you need to know how quickly the first dividends will begin to arrive. But how to make this calculation? For this purpose, the economy has a special system that includes two points:

— Return on investment

. A special procedure that includes certain formulas. It lets you know. How quickly income from invested funds will begin to appear.

— Discounted return on investment

. A more complex option, which includes in its calculation, in addition to the data from the first option, also currency instability.

Now about each of the calculations in more detail.

Settlement procedure

Calculation of the value of the discounted payback period (period) of the project is carried out using the DPP formula:

DP=i=1NIFi(R+1)i

Where:

- DP - discount profit for the total investment time;

- i is the number value of income receipt in months and years;

- N is the time period until the cost is reimbursed;

- IF is the size of the cash flow (net increase plus depreciation);

- R—barrier rate (discount factor).

In order for the calculation results to be as accurate as possible, the economic conditions during the implementation of a business project must be extremely stable. That is, during the accounting period, inflation, as well as other factors that directly affect purchasing power, must remain unchanged.

It is assumed that the DP value will necessarily exceed the volume of the initial investment. This will make it possible to return the funds invested in the project. Of course, this will require a longer time period than for a return that does not take into account inflationary growth and shortfalls in income.

In order to determine the discounted payback period of DPB, both graphical and speculation-based techniques can be used. This is especially true for specialists in economics who do not have a good command of algebra.

The formula presented above implies that computational manipulations will be performed for each analyzed time period separately. After which the results obtained are subject to summation. This event requires significant labor costs, especially if we are talking about a large number of financing elements.

The most rational solution in such a situation would be automation, carried out using available tools. To achieve the desired result, you should use a special online calculator.

What is DPP discounted payback period (period) and how to calculate it using the formula

The easiest way to understand the calculation procedure is with a clear example. Let’s say 2.2 million rubles are invested in a business project. Presumably, the annual volume of revenue in three tranches will be: 1, 2.5 and 4 million. And the discount coefficient (R) is 11%.

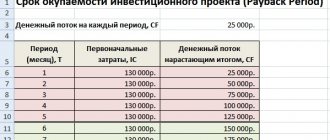

We calculate profit using the table:

| Number value i | Revenue (million rubles) | Discount profit | Total indicator (million rubles) |

| 1 | 1 | =1/ | 0,90 |

| 2 | 2,5 | =2,5/ | 1,62 |

| 3 | 4 | =4/ | 2,19 |

| Total: 4.71 | |||

We calculate the DPP indicator based on the average annual volume of financial flow:

DP сг=i-1NDPiN=4.713=1.57 (million rubles)

Where:

- DP сг - the totality of annual cash receipts (average);

- i is the number of the time period during which financing is made;

- DPi is the amount of incoming funds;

- N is the number of trenches.

When figuring out how to calculate and find the discounted payback period of DPP, how many years is the duration of the period, you should refer to the formula given in the previous paragraph:

investment amount discount income = 2.21.57 = 1.40 (years)

Which ultimately roughly equals 17 months. During this time, the entrepreneur will be able to return the invested money, taking into account the discount.

This calculation method has become widespread because it is easy to use. It is important to note that its accuracy is not too high.

Discounted calculation of DBPP payback period

As already mentioned, the main difference between the discounted calculation and the usual one is that the calculation takes into account the variable value of money. This method is best used for the following reasons:

- Unreliability of the national currency . In the modern economy, this factor is almost constant, which means that using the usual calculation means putting your savings at risk.

- Widespread use. In most cases, investors use this method. The advantage of such mass participation is that there will be an opportunity to compare your results with the results of colleagues or competitors.

- More accurate results. With a discount calculation, the readings are much more reliable. This makes the risk for the investor minimal. The usual procedure cannot boast of such a point. After all, the currency can fall in price several times. This means that the investor will not only receive nothing, but will also end up in debt.

- Visibility. By making calculations in this way, it is possible to make certain forecasts and understand what the purchasing power of money will be at the time of receipt.

The only disadvantage inherent in the discounted option is that it is more difficult to make such a calculation. But the result pays for the work.

Speaking about the discounted calculation period for the return on investment, one cannot fail to mention such an important term as the discount factor.

In simple terms, the discount factor is a rate that allows you to convert future income into a single, independent value.

In order to calculate this indicator, you must use the following formula:

Here:

- E is the discount rate. This indicator can be either the same or different at each stage of investment.

Now you can move on to studying the discounted calculation formula.

Barrier rate

Or in other words, the discount factor is a parameter used to determine the volume of financial flow in the n-period to analyze the performance of a future business project. Essentially, it is a rate, expressed as a percentage, that is used to reduce disparate receipts to a common current value. The discount factor is calculated as follows:

r=1(1+E)(n-1)

Where:

- E - discount standard (can be general or variable);

- (n-1) — time period in years.

Thus, the barrier rate represents the smallest amount of income per 1 invested ruble. When investing in a project, an investor must understand that the implementation of an idea can not only bring profit, but also force one to take risks.

Calculation formula taking into account risks

Before the start of settlement manipulations, all possible factors (financial, production, commercial, currency, etc.) that can negatively affect efficiency are examined and assessed in detail. Only after this do we begin calculations using the appropriate formula:

r= r b+i=1nRi

Where:

- r—discount rate;

- r b - risk-free value;

- Ri—premium value for i-type;

- n is the number of risk premiums.

In the conditions of market development, which has an upward trend, this method of determining the payback period (period) of a project, taking into account discounting, is a good opportunity to achieve high accuracy in calculations.

Calculation and presentation system

In order to determine the current range of parameters for calculating the stepwise increase in payback and to indicate the timing of the actual return of funds, it is necessary to rely on two key selection points:

- Desire to prepare and analyze a mathematically accurate, meticulous project plan;

- A superficial or cost-effective justification of the main criteria that are most interesting from an investment perspective.

As soon as the choice becomes obvious, the accounting department, a focus group of economists or a management manager begin to physically perform their professional duties. The final product of inferences is presented in the form of a textual “manual” calculation using formulas or in the form of a computerized ready-made graph (compiled in Excel).

Initial Investment

They represent funds invested in a future business. After all, in order to get material benefits, you have to make a monetary investment. Those who are just starting to master entrepreneurial activity should limit themselves to low-budget ideas. Does not require large sums of money to sell. It is necessary to study business areas in which you can work for the first time without having large financial savings. This is the only way to learn how to manage business processes and minimize the likelihood of losses.

The initial investment is calculated using the formula:

I0=t=1nIt(1+r)t

Where:

- I0—volume of initial investment;

- n is the number of time intervals;

- t—numeric value of periods;

- r—discount factor;

- It is a financial flow.

How to make a calculation

In order to calculate simple payback, you need to resort to this formula:

In this formula:

- PP is the desired value, i.e. a simple calculation of payback.

- KO – total cash flow. This is the sum of all investments in an investment. For the entire investment period

- CFcr is a value reflecting stable dividends. It is possible only after the process, enterprise or production, begins to work stably, according to the planned plan.

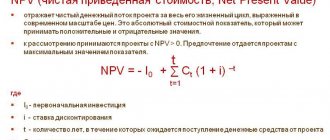

Discount payback period

This is the leading investment parameter, representing the time required to return the money spent, and also characterizing existing risks. In other words, this is the period (week, month, year) that, according to calculations, is necessary for a full revolution.

The main difference from the simple PP formula is the mandatory reduction of profit to the current moment.

Calculation formula

Looks like:

DPP=min n, at which t=1nCFt(1+r)t>IC

Where:

- IC - initial investment;

- CF - financial flow;

- r—discount rate;

- n is the implementation period.

Example of a settlement transaction

Let’s say an entrepreneur is going to open a pizzeria and invest 9 million rubles in his business project. I also took into account the possibility of losses during the first 3 months. In the process of work, he plans to reach a monthly profit of 250 thousand rubles. The result is 3,000,000 in 12 months.

The downtime in this case will be 3 years (9 million/3 million).

Taking these conditions as a sample, you can calculate the discount flow (take the rate to be 10%). For clarity, the information should be shown in the table:

| Temporary value | Computations | Final result (RUB) |

| 1 | 3 000 000 / (1+0,1) | 2 727 272 |

| 2 | 3 000 000 / (1+0,1)2 | 2 479 389 |

| 3 | 3 000 000 / (1+0,1)3 | 2 253 944 |

| Total: 7,460,605 | ||

As you can see, the total amount of cash receipts will not be enough to fully recoup the work of the pizzeria.

If we assume that the company will work in the same mode for another year and receive an income of 2,049,040, it will be possible to determine the DPP indicator. To do this, we first divide the uncovered share of investments (1,539,395) by the profit received in the last period of time. Then we add the periods taken into account.

1 539 395/2 049 040+3= 3,75

Thus, for the enterprise to fully work out the money invested in it, it will take 3.75 years.

The difference between ROI and DRR

DRR is the share of advertising costs or CRR (Cost Revenue Ratio). DRR is similar to ROAS and shows the ratio of advertising costs to advertising revenue.

Calculating the formula helps determine what percentage of the income received is the cost of spending on an advertising campaign.

The DRR indicator, in contrast to ROI, allows you to determine the share of advertising expenses from the revenue from them. Using this indicator, we can also draw conclusions about the profitability of a project or advertising campaign. The DRR should not be higher than 100%, otherwise the advertising company will be considered unprofitable.

What is the difference between discounted and simple terms?

First of all, one common similarity between DSO and PSO should be pointed out. Both of them differ in rather approximate calculation results. The difference lies in the characteristic features of taking into account inflation and other important factors at the time of calculation.

Long-term investments are subject to greater risk. It is impossible to protect yourself one hundred percent from losses due to unforeseen circumstances. Therefore, in terms of investment, short-term business projects are more preferable. But at the same time, it is the business with a long-term perspective that can ultimately bring the greatest benefit. By the way, in their regard, according to world economic statistics, it is possible to obtain the most accurate information.

What is a good ROI?

As noted above, ROI can vary, and even a high indicator in a certain situation does not indicate the rationality of the investment.

So let's find out what is considered good ROI

If there is a shortage of a particular product on the market, ROI may not be calculated, since rising prices will provide increased profits, cover all investments, and costs for marketing activities may be minimal. At the same time, you can safely increase production volumes. But when the market is already saturated and a lot of goods have accumulated in the company’s warehouses, sales volumes can only be increased by investing in marketing activities.

At the same time, even a relatively low ROI is also acceptable. Once sales correspond to production, it’s time to think about optimizing costs and increasing this indicator. A good or bad indicator, it all depends on the situation; in one case, even minimal ROI is good, in another, a low level of return on investment is unacceptable.

Pros and cons of DPP indicator

Among the expressed advantages, it is necessary to indicate the following points:

- High efficiency of the parameter in identifying high-risk projects. It is the DPO that makes it possible to predict the likely depreciation of money in the future, which is especially important for the dynamic markets of developing countries. Compared to the payback period without discounting, it identifies changes in the state of the currency, which allows you to calculate probable losses in advance.

- It can be used to calculate different discount rates for the corresponding time periods.

Now we should list the existing disadvantages, which in fact are more numerous than the advantages:

- The main disadvantage is that the discount method makes it impossible to fix profits and costs after the expiration of the period.

- In addition, it is highly susceptible to the actual length of the period between the initial investment and the moment of active implementation (receipt of income).

- It is unrealistic to calculate the required parameter in the presence of multidirectional financial flows.

- Presence of subjectivity.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

When to calculate ROI?

When determining when this needs to be done, it is necessary to take into account that this is a generalized indicator; it indicates the condition, but does not show what caused this situation.

Therefore, for clarity and to ensure the objectivity of the judgment and the effectiveness of the decisions made, its calculation is carried out during periods of stability, when there were no global changes.

At the same time, ROI is not calculated constantly, but only if it is necessary to make a management decision, and it is this indicator that can affect what global changes may occur in the future; priorities in marketing and advertising activities will be determined.

It will also be correct to calculate it after conducting an advertising campaign and performing a number of marketing activities.

How to calculate the discounted payback period of a DPP project: features of the method

Many entrepreneurs, when planning business ideas, use a simplified method for determining the time period during which they can return the invested funds. Their choice is explained quite simply:

- PP parameters reflect the situation more clearly. A finance specialist immediately sees how much money is required for implementation and makes forecasts for the return on investment.

- A simple technique gives results that are relevant for short-term enterprises. Discounting, in turn, implies an analysis of long-term patterns.

When conducting a study of “long-term” investments, all significant factors are taken into account: the cost of raw materials, energy and labor resources, the nuances of taxation, the economic and political situation in the country, etc. Among the main criteria influencing investors’ preferences regarding cash injections, VSA certainly plays a significant role, but not the most important one.

Therefore, having considered all the available advantages and disadvantages of the method, we should recommend the definition of discount CO:

- For those whose occupation involves high-risk investments.

- Organizations actively exploring new markets (especially relevant for countries with unstable economies).

- Specialists who carry out analysis in planning commercial work. Indeed, in a business plan, this parameter determines exactly the period of time when costs and profits must be calculated with great care.